Key Insights

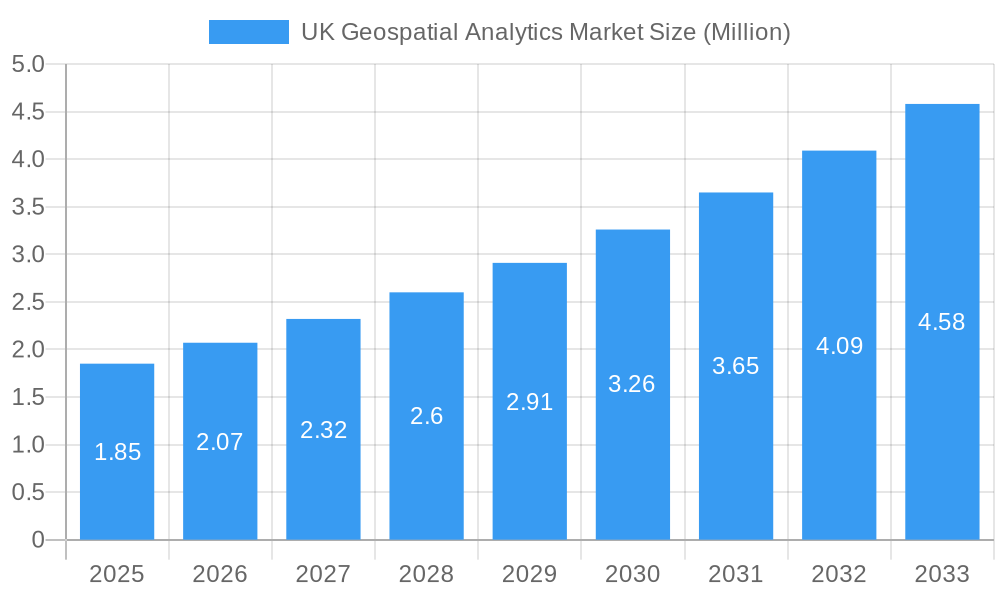

The UK Geospatial Analytics Market is poised for significant expansion, projected to reach an estimated $1.85 Million by 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 11.26% during the forecast period of 2025-2033. This impressive growth is fueled by a confluence of evolving technological capabilities and an increasing demand for data-driven decision-making across various sectors. Key drivers for this market include advancements in AI and machine learning integration, the proliferation of IoT devices generating vast amounts of location-based data, and the growing need for enhanced spatial intelligence to optimize operations, improve resource management, and mitigate risks. The market is segmented across diverse types of geospatial analytics, with Surface Analysis and Network Analysis expected to see substantial adoption. Furthermore, the integration of Geovisualization tools is making complex spatial data more accessible and understandable for a wider range of end-users.

UK Geospatial Analytics Market Market Size (In Million)

The expanding application of geospatial analytics in critical end-user verticals such as Defense and Intelligence, Government, and Utility and Communication underscores its strategic importance. These sectors leverage geospatial insights for everything from national security and urban planning to infrastructure management and disaster response. Emerging applications in sectors like Automotive and Transportation for smart mobility solutions, and in Real Estate and Construction for site selection and development, are further propelling market growth. While the market presents a promising outlook, potential restraints such as data privacy concerns and the need for specialized skill sets in data analysis might present challenges. However, with leading companies like ESRI Inc., Oracle Corporation, and Trimble investing heavily in R&D and solution development, the UK Geospatial Analytics Market is well-positioned to overcome these hurdles and realize its full growth potential.

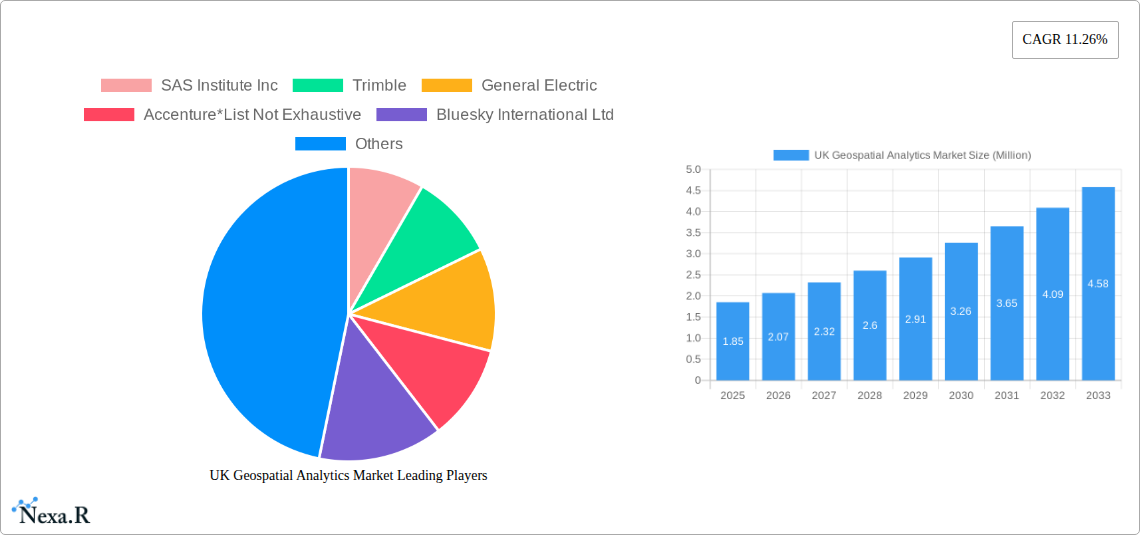

UK Geospatial Analytics Market Company Market Share

Unlock the Future of Spatial Intelligence: UK Geospatial Analytics Market Report 2024-2033

This comprehensive report provides an in-depth analysis of the UK Geospatial Analytics market, charting its evolution from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this research is meticulously designed to equip industry professionals, investors, and strategists with actionable insights. Our analysis covers critical segments including Surface Analysis, Network Analysis, and Geovisualization, and delves into diverse end-user verticals such as Agriculture, Utility and Communication, Defense and Intelligence, Government, Mining and Natural Resources, Automotive and Transportation, Healthcare, and Real Estate and Construction.

Discover the market's dynamic forces, driven by cutting-edge technologies and evolving spatial data applications. This report offers a detailed examination of market trends, key players, and emerging opportunities that will shape the UK Geospatial Analytics market size and UK Geospatial Analytics market share in the coming years.

UK Geospatial Analytics Market Market Dynamics & Structure

The UK Geospatial Analytics market exhibits a moderately concentrated structure, with established players like ESRI Inc., Hexagon, and Trimble holding significant sway. However, the landscape is dynamic, fueled by relentless technological innovation, particularly in areas like AI-powered spatial analysis and real-time data processing. Regulatory frameworks, such as data privacy laws and standards for geospatial data sharing, also play a crucial role in shaping market access and product development. Competitive product substitutes are emerging, offering specialized solutions that challenge broader GIS platforms. End-user demographics are diversifying, with increased adoption across non-traditional sectors. Mergers and acquisitions (M&A) remain a key strategy for market consolidation and expansion, with an estimated XX number of significant deals recorded in the historical period, aimed at acquiring specialized capabilities or expanding customer bases. Barriers to innovation include the high cost of sophisticated geospatial software and the need for skilled professionals capable of leveraging advanced analytics.

- Market Concentration: Moderately concentrated with a few key players and a growing number of specialized vendors.

- Technological Innovation Drivers: AI/ML integration, cloud-based solutions, IoT data fusion, real-time analytics.

- Regulatory Frameworks: Data Protection Act 2018, UK Geospatial Strategy, Open Data initiatives.

- Competitive Product Substitutes: Specialized vertical solutions, data visualization tools, niche analytics platforms.

- End-User Demographics: Broadening adoption across government, defense, utilities, urban planning, environmental science, and commercial sectors.

- M&A Trends: Focus on acquiring niche technologies, expanding service offerings, and consolidating market presence.

UK Geospatial Analytics Market Growth Trends & Insights

The UK Geospatial Analytics market is poised for substantial expansion, projected to reach a market value of over £10,000 Million by 2033. This robust growth is underpinned by increasing adoption rates across a multitude of sectors, driven by the inherent value of spatial intelligence in decision-making. Technological disruptions, such as the proliferation of high-resolution satellite imagery, drone technology, and advanced sensor networks, are providing richer datasets for analysis. Consumer behavior shifts are also contributing, with a growing demand for location-aware services and data-driven insights in both personal and professional contexts. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 15% during the forecast period. The penetration of geospatial analytics into everyday business operations is rapidly increasing, moving beyond specialized departments to become a core component of strategic planning and operational efficiency. This trend is further accelerated by the development of user-friendly, cloud-based platforms that democratize access to powerful spatial tools, enabling a wider array of professionals to derive actionable insights from geographic data. The integration of geospatial analytics with other advanced technologies like Artificial Intelligence and the Internet of Things is creating new possibilities for predictive modeling, real-time monitoring, and optimized resource allocation. The increasing availability of open geospatial data is also a significant catalyst, lowering entry barriers and fostering innovation. Furthermore, government initiatives aimed at digital transformation and smart city development are creating substantial demand for sophisticated geospatial solutions.

Dominant Regions, Countries, or Segments in UK Geospatial Analytics Market

Within the UK Geospatial Analytics market, the Government end-user vertical stands out as a primary driver of growth and adoption, closely followed by Defense and Intelligence and the Utility and Communication sectors. The government's extensive use of geospatial analytics spans urban planning, infrastructure management, environmental monitoring, public safety, and resource allocation, leading to significant investment in GIS technologies and analytical services. The defense sector leverages these capabilities for intelligence, surveillance, reconnaissance, and operational planning, often demanding highly sophisticated and secure geospatial solutions. The utility and communication industries rely on geospatial analytics for network planning, asset management, outage prediction, and customer service optimization, making it an indispensable tool for maintaining critical infrastructure. The Real Estate and Construction sector is also experiencing rapid growth, utilizing geospatial data for site selection, risk assessment, property valuation, and project management. The increasing complexity of construction projects, exemplified by initiatives like the Hinkley Point C nuclear power station, underscores the critical role of integrated geospatial platforms for collaboration and oversight. Furthermore, the increasing focus on sustainable development and smart city initiatives by local and national governments is creating a persistent demand for advanced geospatial solutions across various public services. The market share of these dominant segments is estimated to be over 60% of the total market value. Economic policies that encourage digital transformation and infrastructure development, coupled with strong governmental support for data sharing and open data initiatives, further solidify the dominance of these sectors. The inherent need for precise location-based data and analysis in these areas ensures their continued leadership in driving the UK geospatial analytics market forward.

- Dominant End-User Verticals: Government, Defense and Intelligence, Utility and Communication, Real Estate and Construction.

- Key Drivers for Dominance: Public sector investment, national security needs, critical infrastructure management, urban development initiatives, digital transformation mandates.

- Market Share Contribution: Estimated over 60% of the total market.

- Growth Potential: High, driven by ongoing government digitization efforts, infrastructure upgrades, and increasing demand for smart city solutions.

UK Geospatial Analytics Market Product Landscape

The UK Geospatial Analytics market is characterized by a rich and evolving product landscape. Companies are continuously innovating, offering advanced solutions that integrate AI and machine learning for predictive analytics, sophisticated 3D visualization tools for complex modeling, and cloud-based platforms for scalable data processing and accessibility. Key product innovations include real-time data integration from IoT devices for dynamic environmental monitoring and predictive maintenance in utilities. Advanced network analysis tools are enabling more efficient routing and logistics optimization for transportation and supply chains. Geovisualization capabilities are becoming increasingly immersive, with augmented and virtual reality applications emerging for urban planning and infrastructure inspection. These products are designed to deliver precise, actionable insights, enhancing operational efficiency, informing strategic decision-making, and driving significant ROI for end-users across various industries.

Key Drivers, Barriers & Challenges in UK Geospatial Analytics Market

Key Drivers: The UK Geospatial Analytics market is propelled by several potent drivers. Technological advancements in AI, cloud computing, and sensor technology provide enhanced data collection and analytical capabilities. Growing government initiatives promoting smart cities and digital infrastructure create a fertile ground for adoption. The increasing need for data-driven decision-making across industries like defense, utilities, and real estate also fuels demand. Furthermore, the rise of open data policies encourages wider access to geospatial information, fostering innovation and new application development.

Barriers & Challenges: Despite the strong growth trajectory, the market faces certain barriers and challenges. The high cost of sophisticated geospatial software and the need for specialized expertise can be a significant barrier for small and medium-sized enterprises. Data integration complexities, especially with disparate legacy systems, pose technical hurdles. Regulatory compliance regarding data privacy and security adds another layer of complexity. Intense competition from established players and emerging niche providers can also pressure pricing and market share. Supply chain disruptions for hardware components, while less prevalent now, can still impact project timelines.

Emerging Opportunities in UK Geospatial Analytics Market

Emerging opportunities in the UK Geospatial Analytics market are abundant and varied. The increasing demand for sustainable and green infrastructure is opening new avenues for environmental analytics, climate change modeling, and resource management. The healthcare sector presents a significant untapped market for geospatial analytics in public health, disease outbreak prediction, and optimizing healthcare facility locations. The burgeoning proptech (property technology) sector is actively integrating geospatial intelligence for advanced real estate analytics and smart building management. Furthermore, the ongoing digital transformation of the public sector, coupled with the drive towards autonomous systems in transportation and logistics, will create substantial demand for advanced spatial data solutions and real-time analytics.

Growth Accelerators in the UK Geospatial Analytics Market Industry

Several catalysts are accelerating growth within the UK Geospatial Analytics industry. Strategic partnerships between technology providers and end-user industries are crucial for co-developing tailored solutions and fostering wider adoption. Technological breakthroughs, such as the refinement of machine learning algorithms for spatial pattern recognition and the development of more powerful and cost-effective satellite imagery acquisition, are significantly enhancing analytical capabilities. Market expansion strategies, including the development of user-friendly, subscription-based SaaS models, are democratizing access to geospatial analytics, making it more accessible to a broader range of businesses. The continuous innovation in data fusion techniques, integrating diverse data sources like IoT, social media, and sensor data, is creating richer and more insightful analytical outputs, further solidifying the market's growth trajectory.

Key Players Shaping the UK Geospatial Analytics Market Market

- SAS Institute Inc

- Trimble

- General Electric

- Accenture

- Bluesky International Ltd

- ESRI Inc

- Oracle Corporation

- Bentley Systems Inc

- Hexagon

Notable Milestones in UK Geospatial Analytics Market Sector

- April 2023: EDF leveraged Esri UK's corporate GIS to establish a comprehensive geospatial site for the Hinkley Point C nuclear power station project. This initiative aimed to provide a unified view of this complex endeavor, fostering enhanced collaboration and enabling new digital workflows to improve safety and productivity. The portal has since expanded to include Tier-1 contractors, serving over 1,500 users.

- April 2021: Esri UK partnered with Tetra Tech, a global consulting and engineering firm, to elevate indoor mapping capabilities. This collaboration combined Esri UK's robust GIS system with interactive floor plans and location features, alongside Tetra Tech's 3D terrestrial laser scanning, data analytics, and CAD expertise. The joint effort aimed to deliver end-to-end indoor mapping solutions to meet the growing demand for facility management in commercial and institutional settings.

In-Depth UK Geospatial Analytics Market Market Outlook

The future of the UK Geospatial Analytics market is exceptionally promising, driven by an ever-increasing reliance on spatial intelligence. Growth accelerators such as the continued integration of AI and machine learning for predictive insights, coupled with the expansion of cloud-based geospatial platforms, will democratize access and foster wider adoption. Strategic partnerships and collaborations will continue to be vital in developing specialized solutions for emerging sectors like climate resilience and digital healthcare. The market is ripe for innovation in real-time data processing and advanced visualization techniques, supporting the development of smart cities and autonomous systems. Overall, the outlook points towards a dynamic and expanding market, offering significant opportunities for companies and professionals who can leverage the power of location-based data.

UK Geospatial Analytics Market Segmentation

-

1. Type

- 1.1. Surface Analysis

- 1.2. Network Analysis

- 1.3. Geovisualization

-

2. End-user Vertical

- 2.1. Agriculture

- 2.2. Utility and Communication

- 2.3. Defense and Intelligence

- 2.4. Government

- 2.5. Mining and Natural Resources

- 2.6. Automotive and Transportation

- 2.7. Healthcare

- 2.8. Real Estate and Construction

- 2.9. Other End-user Verticals

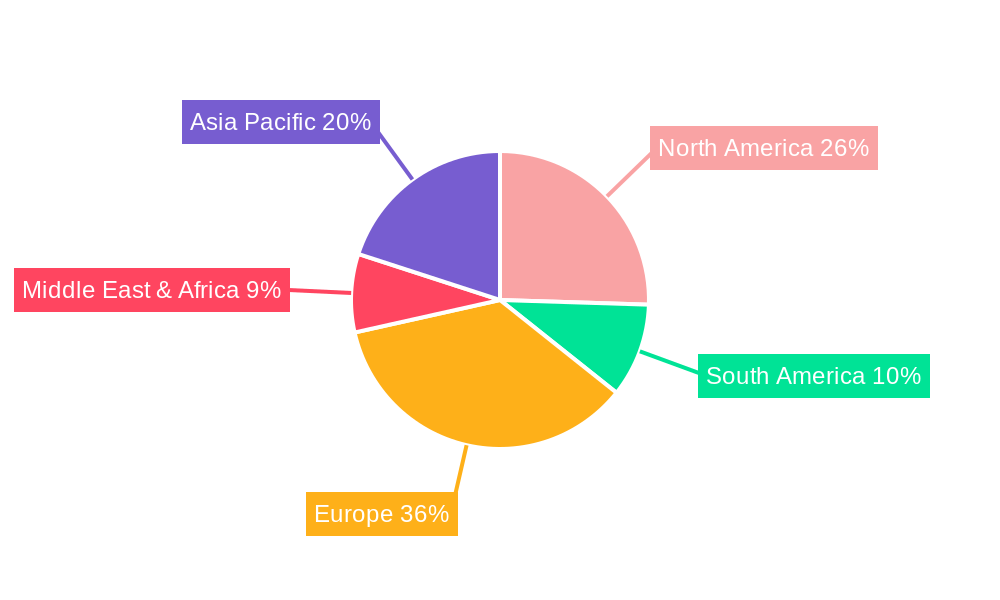

UK Geospatial Analytics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Geospatial Analytics Market Regional Market Share

Geographic Coverage of UK Geospatial Analytics Market

UK Geospatial Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing in Demand for Location Intelligence; Advancements of Big Data Analytics

- 3.3. Market Restrains

- 3.3.1. High Costs and Operational Concerns; Concerns related to Geoprivacy and Confidential Data

- 3.4. Market Trends

- 3.4.1. Location data will hold the significant share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Geospatial Analytics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface Analysis

- 5.1.2. Network Analysis

- 5.1.3. Geovisualization

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Agriculture

- 5.2.2. Utility and Communication

- 5.2.3. Defense and Intelligence

- 5.2.4. Government

- 5.2.5. Mining and Natural Resources

- 5.2.6. Automotive and Transportation

- 5.2.7. Healthcare

- 5.2.8. Real Estate and Construction

- 5.2.9. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UK Geospatial Analytics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Surface Analysis

- 6.1.2. Network Analysis

- 6.1.3. Geovisualization

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Agriculture

- 6.2.2. Utility and Communication

- 6.2.3. Defense and Intelligence

- 6.2.4. Government

- 6.2.5. Mining and Natural Resources

- 6.2.6. Automotive and Transportation

- 6.2.7. Healthcare

- 6.2.8. Real Estate and Construction

- 6.2.9. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UK Geospatial Analytics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Surface Analysis

- 7.1.2. Network Analysis

- 7.1.3. Geovisualization

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Agriculture

- 7.2.2. Utility and Communication

- 7.2.3. Defense and Intelligence

- 7.2.4. Government

- 7.2.5. Mining and Natural Resources

- 7.2.6. Automotive and Transportation

- 7.2.7. Healthcare

- 7.2.8. Real Estate and Construction

- 7.2.9. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UK Geospatial Analytics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Surface Analysis

- 8.1.2. Network Analysis

- 8.1.3. Geovisualization

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Agriculture

- 8.2.2. Utility and Communication

- 8.2.3. Defense and Intelligence

- 8.2.4. Government

- 8.2.5. Mining and Natural Resources

- 8.2.6. Automotive and Transportation

- 8.2.7. Healthcare

- 8.2.8. Real Estate and Construction

- 8.2.9. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UK Geospatial Analytics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Surface Analysis

- 9.1.2. Network Analysis

- 9.1.3. Geovisualization

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Agriculture

- 9.2.2. Utility and Communication

- 9.2.3. Defense and Intelligence

- 9.2.4. Government

- 9.2.5. Mining and Natural Resources

- 9.2.6. Automotive and Transportation

- 9.2.7. Healthcare

- 9.2.8. Real Estate and Construction

- 9.2.9. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UK Geospatial Analytics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Surface Analysis

- 10.1.2. Network Analysis

- 10.1.3. Geovisualization

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Agriculture

- 10.2.2. Utility and Communication

- 10.2.3. Defense and Intelligence

- 10.2.4. Government

- 10.2.5. Mining and Natural Resources

- 10.2.6. Automotive and Transportation

- 10.2.7. Healthcare

- 10.2.8. Real Estate and Construction

- 10.2.9. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SAS Institute Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Trimble

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Electric

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Accenture*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bluesky International Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ESRI Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Oracle Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bentley Systems Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hexagon

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 SAS Institute Inc

List of Figures

- Figure 1: Global UK Geospatial Analytics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UK Geospatial Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America UK Geospatial Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America UK Geospatial Analytics Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 5: North America UK Geospatial Analytics Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 6: North America UK Geospatial Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America UK Geospatial Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America UK Geospatial Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 9: South America UK Geospatial Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America UK Geospatial Analytics Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 11: South America UK Geospatial Analytics Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 12: South America UK Geospatial Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America UK Geospatial Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe UK Geospatial Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe UK Geospatial Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe UK Geospatial Analytics Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 17: Europe UK Geospatial Analytics Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 18: Europe UK Geospatial Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe UK Geospatial Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa UK Geospatial Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa UK Geospatial Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa UK Geospatial Analytics Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Middle East & Africa UK Geospatial Analytics Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Middle East & Africa UK Geospatial Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa UK Geospatial Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific UK Geospatial Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific UK Geospatial Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific UK Geospatial Analytics Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 29: Asia Pacific UK Geospatial Analytics Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 30: Asia Pacific UK Geospatial Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific UK Geospatial Analytics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Geospatial Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global UK Geospatial Analytics Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Global UK Geospatial Analytics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global UK Geospatial Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global UK Geospatial Analytics Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Global UK Geospatial Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global UK Geospatial Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global UK Geospatial Analytics Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global UK Geospatial Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global UK Geospatial Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global UK Geospatial Analytics Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 18: Global UK Geospatial Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global UK Geospatial Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global UK Geospatial Analytics Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 30: Global UK Geospatial Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global UK Geospatial Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global UK Geospatial Analytics Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 39: Global UK Geospatial Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific UK Geospatial Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Geospatial Analytics Market?

The projected CAGR is approximately 11.26%.

2. Which companies are prominent players in the UK Geospatial Analytics Market?

Key companies in the market include SAS Institute Inc, Trimble, General Electric, Accenture*List Not Exhaustive, Bluesky International Ltd, ESRI Inc, Oracle Corporation, Bentley Systems Inc, Hexagon.

3. What are the main segments of the UK Geospatial Analytics Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing in Demand for Location Intelligence; Advancements of Big Data Analytics.

6. What are the notable trends driving market growth?

Location data will hold the significant share.

7. Are there any restraints impacting market growth?

High Costs and Operational Concerns; Concerns related to Geoprivacy and Confidential Data.

8. Can you provide examples of recent developments in the market?

April 2023: EDF used Esri UK corporate GIS to build a geospatial site for the Hinkley Point C nuclear power station, one of Europe's most extensive and complicated building projects. The portal provides a single picture of the entire project. They are facilitating greater cooperation and enabling new digital workflows, Assisting employees and contractors in improving safety and productivity. When the building of the nuclear reactors began, the portal has recently been expanded to include Tier-1 contractors, and it presently has over 1,500 users.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Geospatial Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Geospatial Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Geospatial Analytics Market?

To stay informed about further developments, trends, and reports in the UK Geospatial Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence