Key Insights

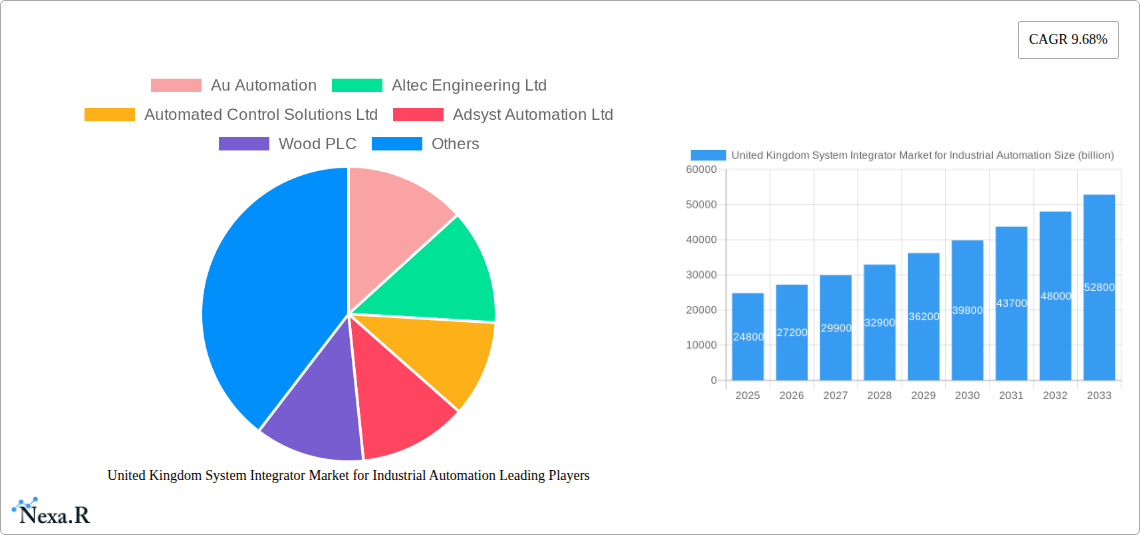

The United Kingdom's System Integrator Market for Industrial Automation is poised for substantial growth, reaching an estimated £24.8 billion in 2025. This robust expansion is driven by a projected Compound Annual Growth Rate (CAGR) of 9.68% throughout the forecast period of 2025-2033. Key catalysts for this upward trajectory include the increasing adoption of Industry 4.0 technologies, the relentless pursuit of operational efficiency and cost reduction across various sectors, and the growing demand for smart manufacturing solutions. The imperative to enhance productivity, improve quality control, and ensure regulatory compliance further fuels the need for sophisticated system integration services. The market is witnessing a significant surge in demand for Programmable Logic Controllers (PLCs), Distributed Control Systems (DCSs), Supervisory Control and Data Acquisition (SCADA) systems, Human-Machine Interfaces (HMIs), and industrial robotics. These technologies are instrumental in modernizing industrial processes, enabling greater automation, and providing real-time data insights for informed decision-making.

United Kingdom System Integrator Market for Industrial Automation Market Size (In Billion)

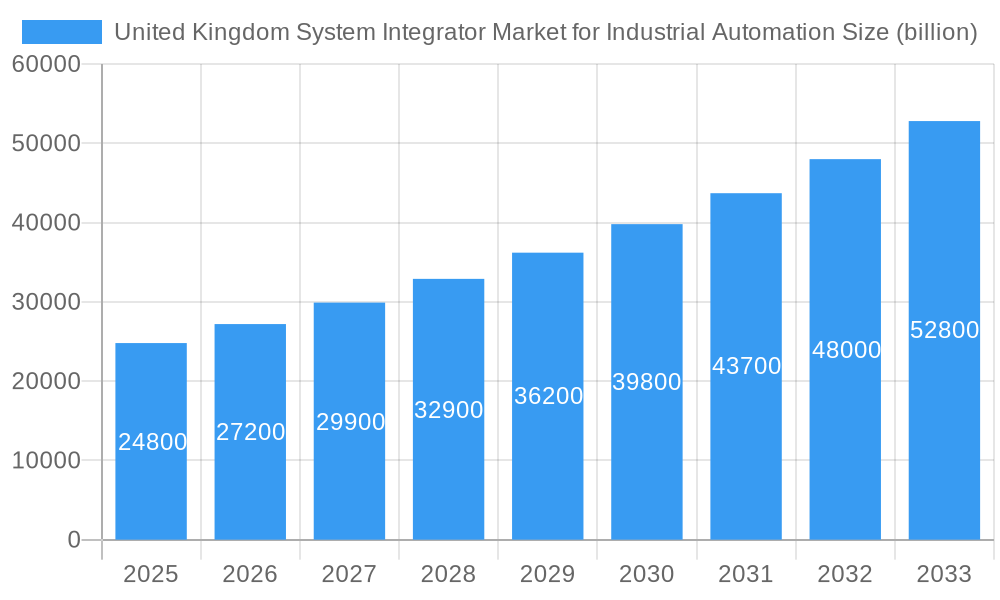

The industrial automation landscape in the UK is characterized by dynamic trends and evolving end-user needs. The manufacturing, automotive, food & beverage, and pharmaceuticals sectors are leading the charge in adopting advanced system integration solutions. These industries are increasingly investing in automation to stay competitive, optimize their supply chains, and meet stringent quality standards. While the market is experiencing strong growth, certain factors may present challenges. High initial investment costs for automation infrastructure and a potential shortage of skilled personnel capable of implementing and maintaining complex integrated systems could pose restraints. However, the overarching benefits of enhanced efficiency, improved safety, and greater agility are expected to outweigh these concerns, ensuring sustained market expansion. Prominent players like Au Automation, Altec Engineering Ltd, and Automated Control Solutions Ltd are actively shaping this market through their innovative offerings and comprehensive service portfolios, contributing to the UK's industrial modernization efforts.

United Kingdom System Integrator Market for Industrial Automation Company Market Share

Unlock the future of industrial efficiency with our in-depth report on the United Kingdom System Integrator Market for Industrial Automation. This definitive study provides granular insights into market dynamics, growth trajectories, and competitive landscapes, empowering stakeholders to make informed strategic decisions. We delve into the intricate web of industrial automation system integrators, exploring how leading firms are shaping the UK's manufacturing, automotive, food & beverage, and pharmaceutical sectors through advanced integration of PLCs, DCSs, SCADA systems, HMIs, and robotics. This report forecasts a robust market expansion, driven by the relentless pursuit of operational excellence and digital transformation.

United Kingdom System Integrator Market for Industrial Automation Market Dynamics & Structure

The United Kingdom system integrator market for industrial automation is characterized by a moderate to high degree of market concentration, with a few prominent players holding significant market share. Technological innovation acts as a primary driver, fueled by advancements in IoT, AI, and cloud computing, enabling smarter, more connected industrial environments. Regulatory frameworks, particularly those focusing on safety standards and cybersecurity within industrial control systems, play a crucial role in shaping integration strategies and compliance. Competitive product substitutes are evolving rapidly, with open-source solutions and modular architectures challenging traditional proprietary systems. End-user demographics are increasingly sophisticated, demanding tailored solutions that optimize efficiency, reduce operational costs, and enhance product quality. Merger and acquisition (M&A) trends are active, as larger integrators seek to expand their service portfolios, geographical reach, and technological capabilities.

- Market Concentration: Dominated by established players with specialized expertise and a growing number of agile, niche integrators.

- Technological Innovation: Driven by the integration of Industry 4.0 technologies like AI, machine learning, and IoT for predictive maintenance and real-time data analytics.

- Regulatory Frameworks: Stringent adherence to safety (e.g., IEC 61508) and cybersecurity standards (e.g., NIS Directive) is paramount.

- Competitive Substitutes: Rise of modular automation solutions and cloud-based platforms offering flexibility and scalability.

- End-User Demographics: Increasing demand for bespoke integration services across diverse manufacturing and processing industries.

- M&A Trends: Strategic acquisitions aimed at bolstering digital transformation capabilities and expanding service offerings.

United Kingdom System Integrator Market for Industrial Automation Growth Trends & Insights

The United Kingdom system integrator market for industrial automation is poised for significant growth, projected to expand from $xx billion in 2023 to an estimated $xx billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately xx%. This impressive trajectory is underpinned by the relentless drive for operational efficiency and the increasing adoption of Industry 4.0 technologies across various sectors. Companies are recognizing system integrators as critical partners in navigating the complexities of digital transformation, enabling seamless integration of advanced hardware and software solutions. The market size evolution is a testament to the growing realization that sophisticated automation is no longer a luxury but a necessity for maintaining global competitiveness. Adoption rates for integrated automation solutions are escalating, driven by the tangible benefits of increased productivity, reduced downtime, enhanced quality control, and improved safety. Technological disruptions, such as the proliferation of AI-powered analytics, advanced robotics, and the Industrial Internet of Things (IIoT), are not only creating new opportunities but also compelling established industries to re-evaluate their automation strategies. Consumer behavior shifts, particularly the demand for customized products and faster delivery times, are further pushing manufacturers to adopt more agile and responsive automation systems, with system integrators playing a pivotal role in realizing these transformations. Market penetration is expected to deepen across traditional manufacturing domains and expand into emerging areas like sustainable energy and advanced material processing. The demand for specialized integration services, from initial consultation and design to implementation and ongoing support, will continue to fuel market expansion. The shift towards smart factories and the need for data-driven decision-making processes are central to this growth narrative. System integrators are instrumental in bridging the gap between legacy systems and cutting-edge technologies, ensuring a smooth and efficient transition for businesses. The economic landscape, influenced by government initiatives promoting industrial modernization and investment in advanced manufacturing, further supports this optimistic outlook. The increasing complexity of supply chains and the need for real-time visibility and control are also significant growth catalysts.

Dominant Regions, Countries, or Segments in United Kingdom System Integrator Market for Industrial Automation

The dominance within the United Kingdom System Integrator Market for Industrial Automation is significantly influenced by the Manufacturing sector, which consistently represents the largest end-user industry. This segment's strong performance is driven by a confluence of factors, including substantial investment in modernizing production lines, the imperative to enhance productivity, and the adoption of advanced technologies like robotics and IoT to remain competitive on a global scale. The UK's manufacturing base, encompassing a wide array of sub-sectors from aerospace and automotive components to consumer goods and heavy machinery, provides a fertile ground for system integration services. Within this manufacturing landscape, PLCs (Programmable Logic Controllers) continue to be a cornerstone of industrial automation, forming the backbone of control systems for a vast range of machinery and processes. Their reliability, flexibility, and evolving capabilities make them indispensable. However, the growth of integrated solutions is increasingly seeing demand for SCADA systems for enhanced monitoring and control, and HMIs (Human-Machine Interfaces) for intuitive operator interaction. Robotics is another rapidly expanding segment, driven by advancements in collaborative robots (cobots) and their ability to work alongside human operators, improving safety and efficiency in repetitive or hazardous tasks.

Geographically, the Midlands region of the UK stands out as a significant hub for industrial automation system integration. This is largely attributable to its historical strength in manufacturing, particularly automotive and advanced engineering, which have a high concentration of factories and industrial complexes requiring sophisticated automation solutions. The presence of a skilled workforce and established supply chains further solidifies the Midlands' position. Government initiatives aimed at revitalizing industrial clusters and promoting advanced manufacturing also contribute to the region's dominance. Economic policies that encourage investment in automation and digital technologies, coupled with robust infrastructure that supports the deployment of complex integrated systems, are key drivers. The market share within manufacturing is substantial, with system integrators playing a crucial role in implementing solutions that deliver measurable improvements in output, quality, and cost-effectiveness. The growth potential in this segment remains high as businesses continue to upgrade legacy systems and embrace new automation paradigms.

United Kingdom System Integrator Market for Industrial Automation Product Landscape

The product landscape within the United Kingdom system integrator market for industrial automation is characterized by sophisticated offerings designed to enhance operational efficiency and drive digital transformation. Key product types include Programmable Logic Controllers (PLCs), Distributed Control Systems (DCSs), Supervisory Control and Data Acquisition (SCADA) systems, Human-Machine Interfaces (HMIs), and robotics. Innovations are focused on seamless integration, intelligent data processing, and enhanced connectivity through IoT platforms. Performance metrics are increasingly defined by real-time data analytics, predictive maintenance capabilities, and reduced energy consumption. Unique selling propositions revolve around tailored solutions that address specific industry challenges, such as supply chain optimization in food and beverage or precision control in pharmaceuticals. Technological advancements are leading to more powerful, compact, and user-friendly automation components.

Key Drivers, Barriers & Challenges in United Kingdom System Integrator Market for Industrial Automation

Key Drivers: The primary forces propelling the United Kingdom system integrator market for industrial automation are the escalating demand for enhanced operational efficiency and productivity across all industrial sectors. Technological advancements, particularly in Industry 4.0 technologies like IoT, AI, and robotics, are compelling businesses to invest in integrated automation solutions. Government initiatives promoting industrial modernization and digital transformation further act as significant catalysts. The need to reduce manufacturing costs, improve product quality, and maintain global competitiveness are also pivotal drivers.

Barriers & Challenges: Key challenges include the high initial investment cost associated with implementing advanced automation systems, which can be a significant barrier for Small and Medium-sized Enterprises (SMEs). A persistent skills gap in specialized automation and digital technologies can hinder adoption and implementation. Cybersecurity threats to connected industrial systems pose a considerable risk, demanding robust security integration. Supply chain disruptions and the availability of critical components can impact project timelines and costs. Furthermore, resistance to change within organizations and the complexity of integrating new technologies with legacy systems present ongoing hurdles.

Emerging Opportunities in United Kingdom System Integrator Market for Industrial Automation

Emerging opportunities within the United Kingdom system integrator market for industrial automation lie in the growing demand for sustainable automation solutions and the integration of AI for predictive analytics and autonomous decision-making. The expansion of automation into niche sectors such as advanced materials, renewable energy infrastructure, and specialized logistics presents untapped markets. Furthermore, the increasing focus on cybersecurity solutions specifically designed for industrial control systems offers a significant growth avenue. The development of more intuitive, low-code/no-code automation platforms also opens doors for wider adoption among businesses with limited in-house expertise.

Growth Accelerators in the United Kingdom System Integrator Market for Industrial Automation Industry

Catalysts driving long-term growth in the United Kingdom system integrator market for industrial automation include breakthroughs in artificial intelligence and machine learning that enable more intelligent and adaptive systems. Strategic partnerships between system integrators, technology providers, and end-users are fostering innovation and collaborative development. Market expansion into new industrial verticals and the increasing adoption of robotic process automation (RPA) for administrative tasks within industrial settings are also significant growth accelerators. The continuous evolution of cloud computing infrastructure is further enabling scalable and accessible automation solutions.

Key Players Shaping the United Kingdom System Integrator Market for Industrial Automation Market

- Au Automation

- Altec Engineering Ltd

- Automated Control Solutions Ltd

- Adsyst Automation Ltd

- Wood PLC

- Cully Automation

- Applied Automation

- Cougar Automation Ltd

- Core Control Solutions

- Adelphi Automation

Notable Milestones in United Kingdom System Integrator Market for Industrial Automation Sector

- March 2020: Adsyst Automation Ltd was certified to deliver Rockwell's ThinManager, enhancing their capability to provide secure and centralized software solutions for automation networks.

- February 2021: Wood PLC entered a new two-year partnership with the Resilient Cities Network, demonstrating the value of public-private collaboration in shaping impactful solutions for resilient infrastructure and cities.

In-Depth United Kingdom System Integrator Market for Industrial Automation Market Outlook

The outlook for the United Kingdom System Integrator Market for Industrial Automation remains exceptionally strong, driven by a confluence of technological advancements and strategic imperatives within industries. Growth accelerators such as the continued integration of AI for advanced analytics and autonomous operations, coupled with robust partnerships across the ecosystem, will fuel further market penetration. The increasing adoption of sustainable automation practices and the expansion into emerging sectors like green manufacturing and advanced logistics represent significant future growth potential. The market's ability to adapt to evolving consumer demands for customization and faster production cycles will be a key determinant of sustained success.

United Kingdom System Integrator Market for Industrial Automation Segmentation

-

1. Product Type

- 1.1. PLCs

- 1.2. DCSs

- 1.3. SCADA systems

- 1.4. HMIs

- 1.5. robotics

-

2. End-User Industry

- 2.1. Manufacturing

- 2.2. automotive

- 2.3. food & beverage

- 2.4. pharmaceuticals

United Kingdom System Integrator Market for Industrial Automation Segmentation By Geography

- 1. United Kingdom

United Kingdom System Integrator Market for Industrial Automation Regional Market Share

Geographic Coverage of United Kingdom System Integrator Market for Industrial Automation

United Kingdom System Integrator Market for Industrial Automation REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digital Transformation and Industry 4.0 initiatives

- 3.3. Market Restrains

- 3.3.1. Requirement of High Investments for Automation Implementation and Maintenance

- 3.4. Market Trends

- 3.4.1. Digital Transformation and Industry 4.0 Initiatives to Drive Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom System Integrator Market for Industrial Automation Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. PLCs

- 5.1.2. DCSs

- 5.1.3. SCADA systems

- 5.1.4. HMIs

- 5.1.5. robotics

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Manufacturing

- 5.2.2. automotive

- 5.2.3. food & beverage

- 5.2.4. pharmaceuticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Au Automation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Altec Engineering Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Automated Control Solutions Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Adsyst Automation Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wood PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cully Automation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Applied Automation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cougar Automation Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Core Control Solutions

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Adelphi Automatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Au Automation

List of Figures

- Figure 1: United Kingdom System Integrator Market for Industrial Automation Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom System Integrator Market for Industrial Automation Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom System Integrator Market for Industrial Automation Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: United Kingdom System Integrator Market for Industrial Automation Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: United Kingdom System Integrator Market for Industrial Automation Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 4: United Kingdom System Integrator Market for Industrial Automation Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 5: United Kingdom System Integrator Market for Industrial Automation Revenue billion Forecast, by Region 2020 & 2033

- Table 6: United Kingdom System Integrator Market for Industrial Automation Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: United Kingdom System Integrator Market for Industrial Automation Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: United Kingdom System Integrator Market for Industrial Automation Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 9: United Kingdom System Integrator Market for Industrial Automation Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 10: United Kingdom System Integrator Market for Industrial Automation Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 11: United Kingdom System Integrator Market for Industrial Automation Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom System Integrator Market for Industrial Automation Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom System Integrator Market for Industrial Automation?

The projected CAGR is approximately 9.68%.

2. Which companies are prominent players in the United Kingdom System Integrator Market for Industrial Automation?

Key companies in the market include Au Automation, Altec Engineering Ltd, Automated Control Solutions Ltd, Adsyst Automation Ltd, Wood PLC, Cully Automation, Applied Automation, Cougar Automation Ltd, Core Control Solutions, Adelphi Automatio.

3. What are the main segments of the United Kingdom System Integrator Market for Industrial Automation?

The market segments include Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Digital Transformation and Industry 4.0 initiatives.

6. What are the notable trends driving market growth?

Digital Transformation and Industry 4.0 Initiatives to Drive Market Growth.

7. Are there any restraints impacting market growth?

Requirement of High Investments for Automation Implementation and Maintenance.

8. Can you provide examples of recent developments in the market?

February 2021 - Wood PLC agreed to enter a new two-year partnership with Resilient Cities Network.This partnership between Wood and the Resilient Cities Network shows the value of the public and private sectors coming together to shape impactful solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom System Integrator Market for Industrial Automation," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom System Integrator Market for Industrial Automation report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom System Integrator Market for Industrial Automation?

To stay informed about further developments, trends, and reports in the United Kingdom System Integrator Market for Industrial Automation, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence