Key Insights

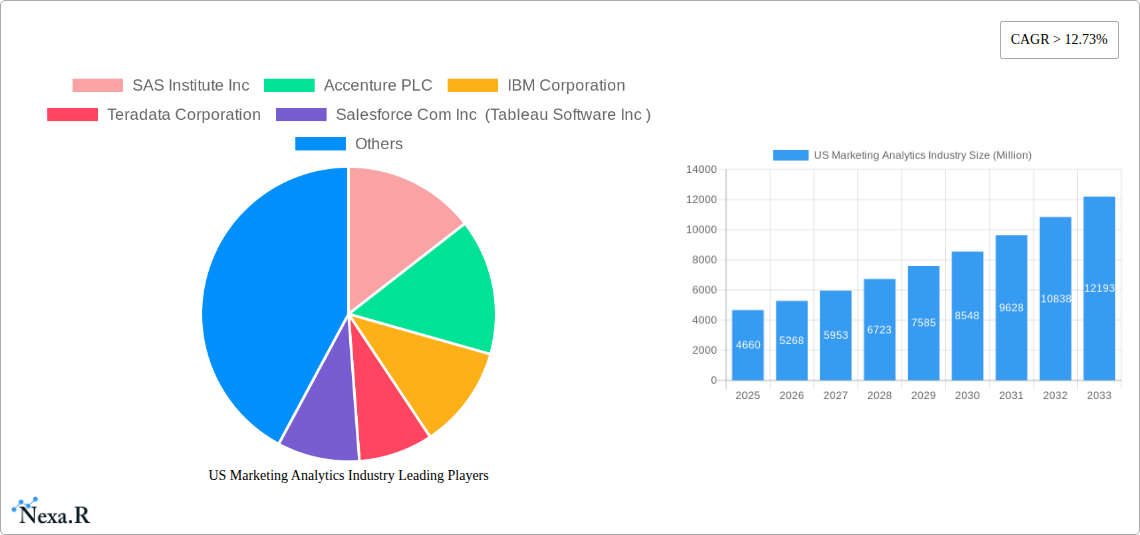

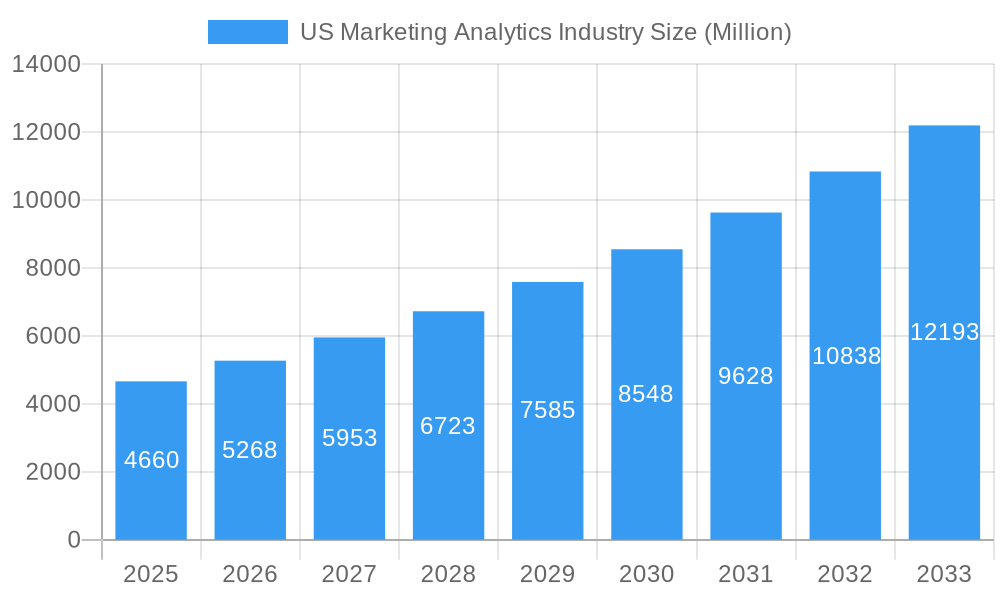

The US Marketing Analytics market is poised for significant expansion, projecting a market size of $4.66 billion by 2025. This growth is fueled by a robust CAGR exceeding 12.73%, indicating a dynamic and rapidly evolving landscape. The increasing adoption of digital marketing strategies across various sectors, coupled with the burgeoning volume of customer data, presents a substantial opportunity for marketing analytics solutions. Businesses are increasingly recognizing the critical role of data-driven insights in optimizing campaign performance, understanding customer behavior, and enhancing return on investment (ROI). Key drivers include the demand for personalized customer experiences, the need to measure and improve marketing campaign effectiveness, and the growing sophistication of analytics tools. The deployment of cloud-based solutions is expected to lead the market, offering scalability, flexibility, and cost-efficiency.

US Marketing Analytics Industry Market Size (In Billion)

The market's growth trajectory is further propelled by the widespread application of marketing analytics in online marketing, email marketing, content marketing, and social media marketing. Industries such as Retail, BFSI, Education, Healthcare, and Manufacturing are heavily investing in these solutions to gain a competitive edge. The forecast period from 2025 to 2033 anticipates sustained high growth, driven by emerging trends like the integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics, real-time campaign optimization, and advanced customer segmentation. While the market enjoys strong growth, potential restraints might include data privacy concerns, the scarcity of skilled analytics professionals, and the initial investment costs for some advanced solutions. However, the overarching demand for actionable marketing intelligence and the continuous innovation within the analytics space are expected to overcome these challenges, ensuring a prosperous future for the US Marketing Analytics industry.

US Marketing Analytics Industry Company Market Share

This comprehensive report offers an in-depth analysis of the US marketing analytics industry, a critical sector for businesses aiming to optimize marketing ROI, enhance customer engagement, and drive business intelligence. The US market, projected to reach $XX billion by 2025 and forecast to grow at a CAGR of XX% from 2025 to 2033, is characterized by rapid technological advancements and evolving consumer behaviors. This report delves into market dynamics, growth trends, dominant segments, product landscapes, key players, and emerging opportunities, providing actionable insights for marketers, data scientists, and business strategists.

US Marketing Analytics Industry Market Dynamics & Structure

The US marketing analytics market exhibits a moderately concentrated structure, with key players like SAS Institute Inc., Accenture PLC, IBM Corporation, Teradata Corporation, Salesforce.com Inc. (Tableau Software Inc.), Microsoft Corporation, Adobe Systems Incorporated, Pegasystems Inc., Neustar Inc., and Oracle Corporation dominating innovation and market share. Technological innovation, particularly in AI, machine learning, and predictive analytics, is a primary driver, enabling more sophisticated customer segmentation, campaign optimization, and performance measurement. Regulatory frameworks, including data privacy laws like CCPA, influence data handling practices and emphasize transparent data usage. Competitive product substitutes exist, ranging from in-house analytics solutions to specialized agency services, but the advanced capabilities of dedicated marketing analytics platforms offer a significant advantage. End-user demographics are diverse, with the Retail, BFSI, and Healthcare sectors showing strong adoption. Mergers and acquisitions (M&A) are a recurring trend, as seen with Vi Labs' acquisition of Motus Consumer Insights, indicating a drive towards consolidating specialized capabilities and expanding market reach. The market is segmented by deployment models, with Cloud solutions increasingly favored over On-premise for scalability and accessibility.

- Market Concentration: Moderately concentrated with a few dominant players.

- Technological Drivers: AI, Machine Learning, Predictive Analytics, Big Data.

- Regulatory Impact: Data privacy laws (e.g., CCPA) influencing data usage and compliance.

- Competitive Landscape: In-house solutions, agency services, and specialized platforms.

- M&A Trends: Consolidation for enhanced capabilities and market share.

- Deployment Preferences: Growing shift towards Cloud solutions.

US Marketing Analytics Industry Growth Trends & Insights

The US marketing analytics market has witnessed substantial growth throughout the historical period (2019-2024), driven by an increasing reliance on data-driven decision-making across industries. The base year of 2025 sees the market valued at an estimated $XX billion, with a robust projected CAGR of XX% through 2033. This growth is fueled by the imperative for businesses to understand customer behavior, personalize marketing messages, and measure campaign effectiveness with granular precision. Adoption rates for advanced analytics tools are accelerating, particularly among small and medium-sized enterprises (SMEs), as user-friendly platforms and cloud-based solutions become more accessible. Technological disruptions, such as the integration of natural language processing (NLP) for sentiment analysis and the application of AI for real-time campaign adjustments, are reshaping the market. Consumer behavior shifts towards hyper-personalization and seamless omnichannel experiences further propel the demand for sophisticated marketing analytics. The increasing volume and variety of data generated from digital interactions necessitate powerful analytics capabilities to derive actionable insights. The market penetration of marketing analytics solutions is expected to deepen, becoming an indispensable component of any successful marketing strategy.

- Market Size Evolution: Significant growth from historical data to 2033 projections.

- Adoption Rates: Increasing across all business sizes, especially SMEs.

- Technological Disruptions: NLP for sentiment analysis, AI for real-time optimization.

- Consumer Behavior Shifts: Demand for hyper-personalization and omnichannel experiences.

- Data Landscape: Growing volume and variety of digital interaction data.

- Market Penetration: Deepening across all industry verticals.

Dominant Regions, Countries, or Segments in US Marketing Analytics Industry

Within the US marketing analytics industry, the Cloud deployment segment is unequivocally dominant, capturing an estimated market share of XX% by 2025. This supremacy is driven by the inherent advantages of cloud infrastructure: scalability, flexibility, cost-effectiveness, and easier integration with other cloud-based marketing tools. Businesses can readily access cutting-edge analytics capabilities without the significant upfront investment and ongoing maintenance associated with on-premise solutions. The Online Marketing application segment also holds a commanding position, accounting for approximately XX% of the market. This is a direct reflection of the digital-first marketing strategies prevalent today, where tracking website traffic, social media engagement, search engine performance, and digital advertising effectiveness is paramount.

The Retail end-user industry stands out as a primary driver of growth, representing an estimated XX% of the market. Retailers leverage marketing analytics extensively to understand purchasing patterns, personalize customer journeys, manage inventory, and optimize promotional campaigns for maximum ROI. The ability to analyze vast amounts of transactional data, coupled with online browsing behavior, allows for highly targeted marketing efforts.

- Dominant Deployment: Cloud solutions lead due to scalability and cost-effectiveness.

- Market Share (2025 Estimate): XX%

- Dominant Application: Online Marketing is crucial for digital-centric strategies.

- Key Focus Areas: Website analytics, social media tracking, digital advertising performance.

- Dominant End User: Retail sector utilizes analytics for customer understanding and optimization.

- Key Applications: Personalization, inventory management, promotional effectiveness.

- Other Key Segments:

- On-premise: Declining but still relevant for highly regulated industries.

- E-mail Marketing: Essential for customer retention and direct communication.

- Content Marketing: Driving engagement and lead generation through data-backed content strategies.

- Social Media Marketing: Crucial for brand building and customer interaction.

- BFSI: High adoption for risk assessment, fraud detection, and customer lifecycle management.

- Healthcare: Increasing use for patient engagement, personalized treatment plans, and operational efficiency.

US Marketing Analytics Industry Product Landscape

The US marketing analytics industry is characterized by a dynamic product landscape featuring innovative solutions designed to extract actionable insights from complex datasets. Key product advancements include the integration of AI and machine learning algorithms for predictive modeling, natural language processing (NLP) for sentiment analysis from customer feedback, and advanced visualization tools for intuitive data interpretation. Unique selling propositions often revolve around real-time data processing, end-to-end campaign management capabilities, and seamless integration with CRM and marketing automation platforms. Performance metrics are increasingly focused on measurable business outcomes, such as improved conversion rates, reduced customer acquisition costs, and enhanced customer lifetime value. Technological advancements are enabling more sophisticated customer journey mapping, attribution modeling, and personalization at scale, making marketing analytics an indispensable tool for competitive advantage.

Key Drivers, Barriers & Challenges in US Marketing Analytics Industry

Key Drivers:

- Data Proliferation: The ever-increasing volume and variety of data generated by digital interactions.

- Demand for ROI Optimization: Businesses are under pressure to demonstrate clear returns on their marketing investments.

- Technological Advancements: Continuous innovation in AI, ML, and big data analytics.

- Personalization Imperative: Evolving consumer expectations for tailored experiences.

- Competitive Pressure: The need to gain a competitive edge through data-driven insights.

Barriers & Challenges:

- Data Silos: Difficulty in integrating data from disparate sources.

- Talent Shortage: Lack of skilled data scientists and analysts.

- Data Privacy and Security Concerns: Navigating complex regulations like CCPA.

- Implementation Complexity: Integrating new analytics solutions into existing IT infrastructures.

- Cost of Advanced Solutions: High investment required for enterprise-grade platforms.

- Measuring Intangible Benefits: Quantifying the impact of brand awareness and customer loyalty.

Emerging Opportunities in US Marketing Analytics Industry

Emerging opportunities in the US marketing analytics industry lie in the burgeoning areas of predictive customer churn analysis, hyper-personalized content recommendations, and the application of AI in generative marketing content creation. The growing adoption of IoT devices presents new avenues for collecting and analyzing real-time behavioral data. Furthermore, the demand for ethical AI and transparent data practices opens up opportunities for solutions that prioritize privacy and fairness. Untapped markets within the small and medium-sized business (SMB) sector, with tailored and affordable analytics solutions, represent significant growth potential. The evolution of augmented analytics, which automates data preparation and insight discovery, is also poised to democratize advanced analytics.

Growth Accelerators in the US Marketing Analytics Industry Industry

Several catalysts are accelerating the growth of the US marketing analytics industry. Strategic partnerships, such as the one between Moody's Corporation and Microsoft, are fostering innovation and expanding the reach of advanced analytics solutions across critical sectors like financial services. The continuous development and adoption of AI and machine learning capabilities are enabling more sophisticated and predictive analytics, driving efficiency and effectiveness. Cloud-native analytics platforms are lowering the barrier to entry and facilitating wider adoption. Furthermore, a growing understanding of the ROI of data-driven marketing is encouraging increased investment in analytics tools and talent. Market expansion strategies, including the development of industry-specific solutions and global outreach, are also contributing to sustained growth.

Key Players Shaping the US Marketing Analytics Industry Market

- SAS Institute Inc.

- Accenture PLC

- IBM Corporation

- Teradata Corporation

- Salesforce Com Inc (Tableau Software Inc )

- Microsoft Corporation

- Adobe Systems Incorporated

- Pegasystems Inc.

- Neustar Inc.

- Oracle Corporation

- Google LLC

Notable Milestones in US Marketing Analytics Industry Sector

- June 2023: Moody’s Corporation and Microsoft announced a new partnership to deliver next-generation data, analytics, research, collaboration, and risk solutions for financial services and global knowledge workers. This collaboration leverages Microsoft Azure OpenAI Service and Moody’s data, enhancing corporate intelligence and risk assessment with Microsoft AI.

- July 2022: Neustar, a TransUnion company, partnered with Adverity to enable marketers to connect all their data effortlessly, boosting marketing and brand effectiveness by improving ROI through a comprehensive data strategy.

- December 2022: Vi Labs acquired Motus Consumer Insights, an analytics firm specializing in member acquisition, site selection, and marketing BI. This acquisition aims to integrate Vi's AI-powered customer engagement solutions with Motus's customer acquisition and site selection platforms.

In-Depth US Marketing Analytics Industry Market Outlook

The future outlook for the US marketing analytics industry remains exceptionally strong, driven by the unwavering demand for data-driven decision-making. Growth accelerators such as advancements in AI, strategic industry partnerships, and the widespread adoption of cloud technologies will continue to propel market expansion. The increasing sophistication of customer journey analytics and predictive modeling will enable businesses to achieve unprecedented levels of personalization and campaign effectiveness. Strategic opportunities lie in the development of solutions for emerging industries and in addressing the growing need for privacy-preserving analytics. The market's trajectory indicates a future where marketing analytics is not just a tool, but an indispensable foundation for sustained business growth and competitive advantage in an increasingly complex digital landscape.

US Marketing Analytics Industry Segmentation

-

1. Deployment

- 1.1. Cloud

- 1.2. On-premise

-

2. Application

- 2.1. Online Marketing

- 2.2. E-mail Marketing

- 2.3. Content Marketing

- 2.4. Social Media Marketing

- 2.5. Other Applications

-

3. End User

- 3.1. Retail

- 3.2. BFSI

- 3.3. Education

- 3.4. Healthcare

- 3.5. Manufacturing

- 3.6. Travel and Hospitality

- 3.7. Other End Users

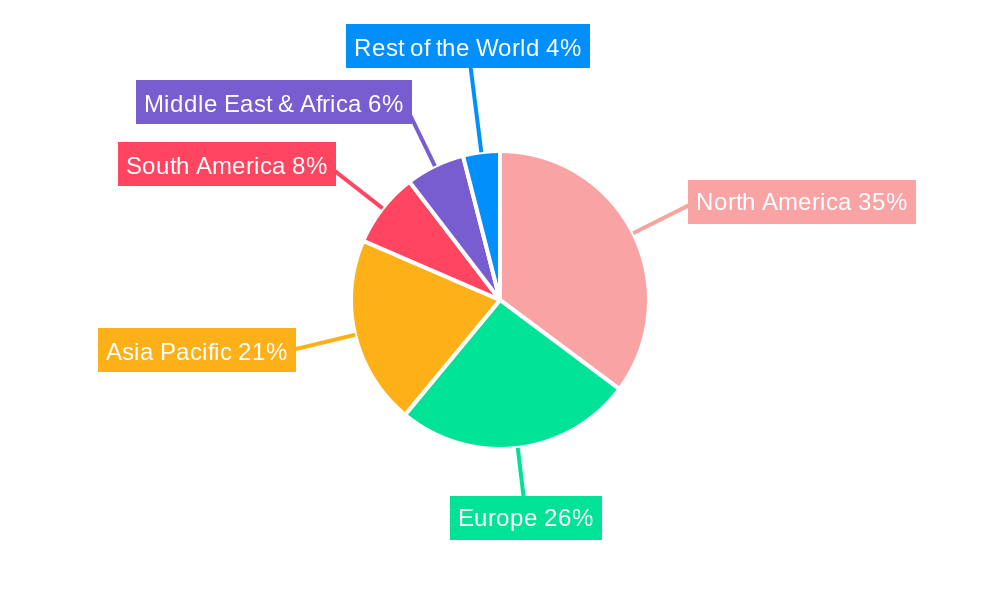

US Marketing Analytics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Marketing Analytics Industry Regional Market Share

Geographic Coverage of US Marketing Analytics Industry

US Marketing Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 12.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Social Media Channels; Increasing Need to Utilize Marketing Budgets for an Effective ROI; Adoption of Cloud Technology and Big Data

- 3.3. Market Restrains

- 3.3.1. High Cost of Implementation and System Integration Issues for Marketing Analytics Software; Availability of Many Free Open Source Software

- 3.4. Market Trends

- 3.4.1. Adoption of Cloud Technology and Big Data is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Marketing Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Cloud

- 5.1.2. On-premise

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Online Marketing

- 5.2.2. E-mail Marketing

- 5.2.3. Content Marketing

- 5.2.4. Social Media Marketing

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Retail

- 5.3.2. BFSI

- 5.3.3. Education

- 5.3.4. Healthcare

- 5.3.5. Manufacturing

- 5.3.6. Travel and Hospitality

- 5.3.7. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America US Marketing Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. Cloud

- 6.1.2. On-premise

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Online Marketing

- 6.2.2. E-mail Marketing

- 6.2.3. Content Marketing

- 6.2.4. Social Media Marketing

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Retail

- 6.3.2. BFSI

- 6.3.3. Education

- 6.3.4. Healthcare

- 6.3.5. Manufacturing

- 6.3.6. Travel and Hospitality

- 6.3.7. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. South America US Marketing Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. Cloud

- 7.1.2. On-premise

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Online Marketing

- 7.2.2. E-mail Marketing

- 7.2.3. Content Marketing

- 7.2.4. Social Media Marketing

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Retail

- 7.3.2. BFSI

- 7.3.3. Education

- 7.3.4. Healthcare

- 7.3.5. Manufacturing

- 7.3.6. Travel and Hospitality

- 7.3.7. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Europe US Marketing Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. Cloud

- 8.1.2. On-premise

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Online Marketing

- 8.2.2. E-mail Marketing

- 8.2.3. Content Marketing

- 8.2.4. Social Media Marketing

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Retail

- 8.3.2. BFSI

- 8.3.3. Education

- 8.3.4. Healthcare

- 8.3.5. Manufacturing

- 8.3.6. Travel and Hospitality

- 8.3.7. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Middle East & Africa US Marketing Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. Cloud

- 9.1.2. On-premise

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Online Marketing

- 9.2.2. E-mail Marketing

- 9.2.3. Content Marketing

- 9.2.4. Social Media Marketing

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Retail

- 9.3.2. BFSI

- 9.3.3. Education

- 9.3.4. Healthcare

- 9.3.5. Manufacturing

- 9.3.6. Travel and Hospitality

- 9.3.7. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Asia Pacific US Marketing Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. Cloud

- 10.1.2. On-premise

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Online Marketing

- 10.2.2. E-mail Marketing

- 10.2.3. Content Marketing

- 10.2.4. Social Media Marketing

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Retail

- 10.3.2. BFSI

- 10.3.3. Education

- 10.3.4. Healthcare

- 10.3.5. Manufacturing

- 10.3.6. Travel and Hospitality

- 10.3.7. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SAS Institute Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Accenture PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IBM Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Teradata Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Salesforce Com Inc (Tableau Software Inc )

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Microsoft Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Adobe Systems Incorporated

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pegasystems Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Neustar Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Oracle Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Google LLC*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 SAS Institute Inc

List of Figures

- Figure 1: Global US Marketing Analytics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Marketing Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 3: North America US Marketing Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America US Marketing Analytics Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America US Marketing Analytics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America US Marketing Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 7: North America US Marketing Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America US Marketing Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America US Marketing Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Marketing Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 11: South America US Marketing Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 12: South America US Marketing Analytics Industry Revenue (Million), by Application 2025 & 2033

- Figure 13: South America US Marketing Analytics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: South America US Marketing Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 15: South America US Marketing Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: South America US Marketing Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America US Marketing Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Marketing Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 19: Europe US Marketing Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 20: Europe US Marketing Analytics Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Europe US Marketing Analytics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe US Marketing Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Europe US Marketing Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Europe US Marketing Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe US Marketing Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Marketing Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 27: Middle East & Africa US Marketing Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Middle East & Africa US Marketing Analytics Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East & Africa US Marketing Analytics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East & Africa US Marketing Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 31: Middle East & Africa US Marketing Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East & Africa US Marketing Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Marketing Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Marketing Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 35: Asia Pacific US Marketing Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Asia Pacific US Marketing Analytics Industry Revenue (Million), by Application 2025 & 2033

- Figure 37: Asia Pacific US Marketing Analytics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Asia Pacific US Marketing Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 39: Asia Pacific US Marketing Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: Asia Pacific US Marketing Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific US Marketing Analytics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Marketing Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Global US Marketing Analytics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global US Marketing Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global US Marketing Analytics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global US Marketing Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 6: Global US Marketing Analytics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global US Marketing Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global US Marketing Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global US Marketing Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 13: Global US Marketing Analytics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global US Marketing Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global US Marketing Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global US Marketing Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 20: Global US Marketing Analytics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global US Marketing Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global US Marketing Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global US Marketing Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 33: Global US Marketing Analytics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global US Marketing Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global US Marketing Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global US Marketing Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 43: Global US Marketing Analytics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Global US Marketing Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 45: Global US Marketing Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Marketing Analytics Industry?

The projected CAGR is approximately > 12.73%.

2. Which companies are prominent players in the US Marketing Analytics Industry?

Key companies in the market include SAS Institute Inc, Accenture PLC, IBM Corporation, Teradata Corporation, Salesforce Com Inc (Tableau Software Inc ), Microsoft Corporation, Adobe Systems Incorporated, Pegasystems Inc, Neustar Inc, Oracle Corporation, Google LLC*List Not Exhaustive.

3. What are the main segments of the US Marketing Analytics Industry?

The market segments include Deployment, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Social Media Channels; Increasing Need to Utilize Marketing Budgets for an Effective ROI; Adoption of Cloud Technology and Big Data.

6. What are the notable trends driving market growth?

Adoption of Cloud Technology and Big Data is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Cost of Implementation and System Integration Issues for Marketing Analytics Software; Availability of Many Free Open Source Software.

8. Can you provide examples of recent developments in the market?

June 2023 - Moody’s Corporation and Microsoft have announced a new partnership to deliver next-generation data, analytics, research, collaboration, and risk solutions for financial services and global knowledge workers. Built on a combination of Moody’s robust data and analytical capabilities and the power and scale of Microsoft Azure OpenAI Service, the partnership creates innovative offerings that enhance insights into corporate intelligence and risk assessment, powered by Microsoft AI and anchored by Moody’s proprietary data, analytics, and research.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Marketing Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Marketing Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Marketing Analytics Industry?

To stay informed about further developments, trends, and reports in the US Marketing Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence