Key Insights

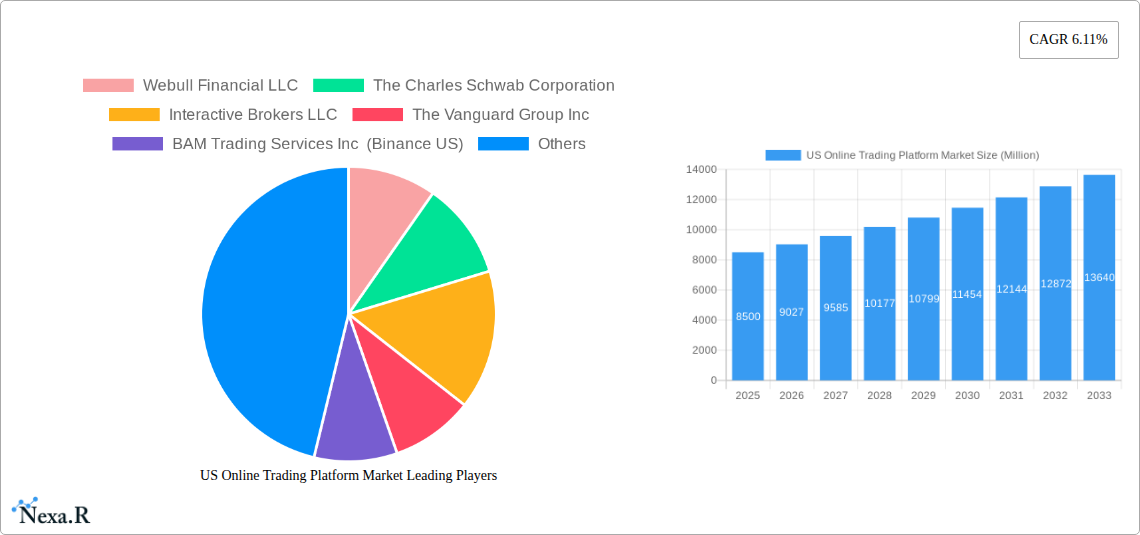

The US Online Trading Platform Market is projected for substantial expansion, expected to reach approximately $13,900 million by 2033. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 6.11% from an estimated $3.48 billion in the 2025 base year. Key growth drivers include a burgeoning retail investor base, enhanced financial literacy, and the widespread adoption of intuitive trading applications. The increasing availability of digital platforms for both novice and experienced traders, coupled with advancements in AI-driven analytics and seamless mobile integration, are significant market catalysts. Furthermore, rising interest in diverse asset classes, such as cryptocurrencies and alternative investments, is broadening the market's scope. Demand for secure, feature-rich platforms offering real-time data, advanced charting, and educational resources is escalating, compelling market participants to innovate and expand their offerings.

US Online Trading Platform Market Market Size (In Billion)

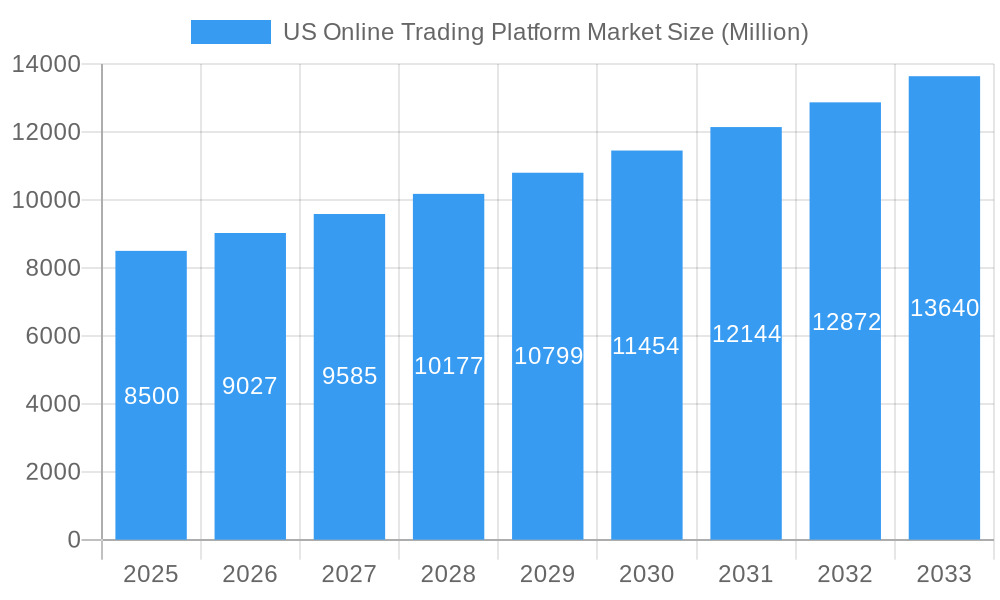

The competitive landscape of the US Online Trading Platform Market is characterized by dynamic interactions between established financial institutions and emerging fintech companies. Platforms are increasingly diversifying their offerings, with a notable shift towards cloud-based solutions for enhanced scalability and flexibility, while on-premises solutions remain relevant for institutional clients. The market is segmented by user type, catering to both beginner and advanced traders with distinct needs. Institutional investors, managing significant capital and employing complex strategies, and retail investors, seeking accessible trading experiences, represent primary end-user segments. Leading players like Webull Financial LLC, The Charles Schwab Corporation, Interactive Brokers LLC, and Robinhood Markets Inc. intensify competition, driving innovation in user experience, fee structures, and product variety. Regulatory changes and cybersecurity considerations will also critically influence market dynamics and investor confidence.

US Online Trading Platform Market Company Market Share

US Online Trading Platform Market: Key Growth Drivers, Trends, and Opportunities (2025-2033)

This comprehensive analysis delves into the US Online Trading Platform Market, forecasting significant growth from the 2025 base year through 2033. Examine the evolving digital financial services sector, from user-friendly beginner platforms to sophisticated trading tools for advanced users. Understand the critical role of cloud deployment and the growing influence of both retail and institutional investors. This report is an indispensable resource for financial institutions, technology providers, investors, and stakeholders aiming to leverage the dynamic US online trading ecosystem. All market size figures are in billion units.

US Online Trading Platform Market Market Dynamics & Structure

The US Online Trading Platform Market exhibits a dynamic and evolving structure, characterized by a blend of intense competition and strategic consolidation. Market concentration is moderately high, with established giants like The Charles Schwab Corporation, Interactive Brokers LLC, and Fidelity Investments Institutional Operations Company Inc holding significant sway. However, the emergence of innovative disruptors such as Robinhood Markets Inc and Webull Financial LLC has intensified competition, particularly for retail investor acquisition. Technological innovation is a primary driver, fueled by advancements in AI, machine learning for personalized trading insights, and the integration of seamless mobile user experiences. Regulatory frameworks, overseen by bodies like the SEC, play a crucial role in shaping market conduct, investor protection, and the introduction of new financial products. Competitive product substitutes are abundant, ranging from traditional brokerage accounts to decentralized finance (DeFi) platforms, forcing market participants to continuously innovate and offer differentiated value propositions. End-user demographics are shifting, with a significant influx of younger, tech-savvy retail investors alongside traditional institutional investors seeking efficiency and cost-effectiveness. Mergers and acquisitions (M&A) trends are notable, as larger firms acquire innovative startups to expand their technological capabilities and market reach, thereby consolidating market share.

- Market Concentration: Moderately high, with key players holding substantial market share.

- Technological Innovation Drivers: AI, ML, mobile-first design, enhanced user experience.

- Regulatory Frameworks: SEC oversight, FINRA regulations, driving investor protection and compliance.

- Competitive Product Substitutes: Traditional brokerages, neo-brokers, DeFi platforms.

- End-User Demographics: Growing retail investor base, evolving institutional needs.

- M&A Trends: Strategic acquisitions to gain technological edge and market share.

US Online Trading Platform Market Growth Trends & Insights

The US Online Trading Platform Market is poised for significant expansion, driven by a confluence of technological advancements, shifting consumer preferences, and increasing financial literacy. The market size has experienced a consistent upward trend throughout the historical period (2019-2024) and is projected to continue this trajectory throughout the forecast period (2025-2033). This growth is underpinned by rising adoption rates of online trading platforms, particularly among younger demographics who are more comfortable with digital interfaces and seeking accessible avenues for wealth creation. Technological disruptions, including the integration of AI-powered trading tools, personalized financial advice, and fractional share trading, are democratizing access to investment opportunities and making trading more appealing to a broader audience. Consumer behavior shifts are evident, with a growing demand for user-friendly, intuitive platforms that offer a comprehensive suite of tools, educational resources, and low-cost trading options. The ease of access through mobile applications has further accelerated this trend, allowing individuals to manage their investments anytime, anywhere. The penetration of online trading platforms is expected to deepen, moving beyond traditional stock and bond trading to encompass a wider range of asset classes, including cryptocurrencies and alternative investments. This evolution is fostering a more engaged and active investor community.

The estimated CAGR for the US Online Trading Platform Market during the forecast period is projected to be approximately 12.5%. This robust growth is fueled by several key factors. Firstly, the ongoing digitalization of financial services continues to push more traditional investors towards online solutions. Secondly, the increasing availability of educational resources and accessible trading tools is empowering novice investors to enter the market, contributing to higher adoption rates. Thirdly, innovations in platform features, such as advanced charting tools, real-time market data, and social trading capabilities, are enhancing the overall trading experience and attracting a wider user base. The market penetration is expected to reach 65% of the adult population by 2033, indicating a substantial increase from current levels. This surge in adoption is also driven by a greater awareness of financial planning and investment as a means to achieve long-term financial goals. The competitive landscape, while robust, is also driving innovation, with companies constantly striving to offer superior user experiences and competitive fee structures to capture market share. This competitive pressure, in turn, benefits consumers by providing them with more choices and better services. The integration of ESG (Environmental, Social, and Governance) investing options within trading platforms is also emerging as a significant trend, attracting a growing segment of socially conscious investors. The market's resilience, even amidst economic fluctuations, highlights the fundamental shift towards digital and accessible investment avenues.

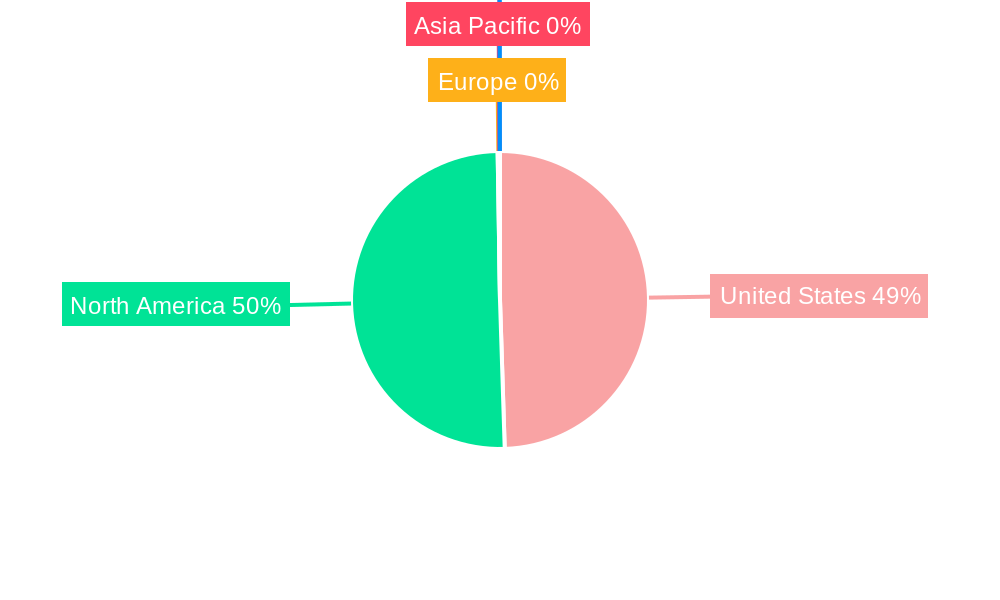

Dominant Regions, Countries, or Segments in US Online Trading Platform Market

The US Online Trading Platform Market is predominantly driven by the United States as a country, with specific segments exhibiting exceptional growth and market share. Within the Offerings segment, Platforms command the largest share, encompassing the core trading functionalities, user interfaces, and analytical tools that attract and retain users. These platforms are crucial for both beginner and advanced traders, offering functionalities ranging from simple order execution to complex algorithmic trading strategies. The Services segment, including research, financial advice, and customer support, is also a significant contributor to market dominance, acting as a key differentiator for platform providers.

In terms of Deployment Mode, Cloud deployment is rapidly becoming the dominant model. Cloud-based platforms offer scalability, flexibility, and cost-efficiency, making them attractive for both startups and established players. This allows for continuous updates, enhanced security, and seamless accessibility across various devices. The On-Premises model, while still present, is steadily declining as organizations embrace the advantages of cloud infrastructure.

The Type of platform most significantly driving growth is arguably the Beginner segment. The democratization of investing, fueled by user-friendly interfaces and educational resources, has opened the market to a vast new cohort of retail investors. These platforms are designed for ease of use, often featuring simplified navigation and guidance, thereby lowering the barrier to entry. However, the Advanced segment also plays a crucial role, catering to experienced traders who require sophisticated tools, real-time data, and specialized trading capabilities, such as options and futures trading.

The End-user segment that exerts the most influence is Retail Investors. Their sheer volume and increasing engagement with financial markets are reshaping the industry. Online trading platforms are increasingly tailored to meet the needs of individual investors, offering commission-free trading, fractional shares, and intuitive mobile applications. While Institutional Investors continue to be a significant market segment, their growth is often more measured and focused on specialized institutional trading solutions and robust API integrations for high-frequency trading and portfolio management.

Key drivers of dominance in the US market include strong economic policies that support investment, a highly developed technological infrastructure, and a culture of financial innovation. The presence of major financial hubs and a significant pool of potential investors further contribute to the market's growth. Market share within the US is substantial, with leading platforms capturing millions of active users. The growth potential within the retail investor segment remains immense, as financial literacy and investment aspirations continue to rise. The increasing adoption of mobile trading further solidifies the dominance of platforms that excel in this area.

US Online Trading Platform Market Product Landscape

The US Online Trading Platform Market product landscape is characterized by rapid innovation and a focus on enhancing user experience and accessibility. Key product innovations include the integration of AI-powered tools for personalized investment recommendations and risk management, advanced charting capabilities with real-time data feeds, and seamless execution of trades across a wide array of asset classes. Platforms are increasingly offering fractional share trading, allowing retail investors to participate in higher-priced stocks with smaller capital. The performance metrics of these products are measured by trading volume, user engagement, account growth, and customer satisfaction. Unique selling propositions often revolve around low trading fees, intuitive user interfaces, comprehensive educational resources, and robust mobile application functionality. Technological advancements are also extending to areas like social trading, where users can follow and replicate trades of experienced investors, and the integration of cryptocurrency trading capabilities.

Key Drivers, Barriers & Challenges in US Online Trading Platform Market

Key Drivers:

The US Online Trading Platform Market is propelled by several significant forces. Technologically, the widespread adoption of smartphones and the continuous evolution of mobile app development have made trading more accessible than ever before. AI and machine learning are enhancing platform functionalities, offering personalized insights and predictive analytics. Economically, low interest rate environments have historically encouraged investment in equities, and a growing awareness of the importance of long-term financial planning is driving individuals to seek investment avenues. Policy-driven factors, such as regulatory initiatives aimed at increasing transparency and investor protection, can also foster confidence and market growth. The increasing availability of low-cost or commission-free trading models has significantly reduced barriers to entry for retail investors.

Barriers & Challenges:

Despite the growth drivers, the market faces substantial barriers and challenges. Supply chain issues are less of a direct concern for digital platforms, but the underlying infrastructure and technological advancements rely on the broader tech supply chain. Regulatory hurdles remain a significant challenge, with evolving compliance requirements and the need to adhere to strict investor protection laws. Competitive pressures are intense, with numerous platforms vying for market share, leading to price wars and the constant need for differentiation. Cybersecurity threats pose a continuous risk, requiring substantial investment in robust security measures to protect user data and assets. Market volatility can also deter new investors, and the complexity of financial markets can be overwhelming for beginners, necessitating ongoing educational efforts from platform providers.

Emerging Opportunities in US Online Trading Platform Market

Emerging opportunities in the US Online Trading Platform Market are abundant and diverse. There is significant untapped potential in developing highly specialized platforms catering to niche investment interests, such as impact investing, ESG-focused portfolios, or alternative asset classes like private equity and venture capital for accredited investors. The continued evolution of AI and blockchain technology presents opportunities for developing more sophisticated and transparent trading mechanisms, including decentralized finance (DeFi) integrations and smart contract-based investment products. Evolving consumer preferences are also creating opportunities for platforms that offer integrated financial wellness tools, gamified learning experiences, and personalized financial planning advisory services. Furthermore, the increasing global connectivity suggests opportunities for cross-border trading functionalities and platforms that cater to diverse international investor bases.

Growth Accelerators in the US Online Trading Platform Market Industry

Several catalysts are accelerating long-term growth in the US Online Trading Platform Market. Technological breakthroughs in areas like quantum computing and advanced AI are expected to revolutionize trading analytics and predictive capabilities, offering unprecedented advantages to platform users. Strategic partnerships between fintech companies, traditional financial institutions, and even social media platforms are creating new distribution channels and enhancing user acquisition strategies. For example, the partnership between Twitter and eToro exemplifies this trend, opening up new revenue streams and expanding the reach of online trading. Market expansion strategies, including targeted marketing campaigns focusing on financial literacy and wealth creation, are continually bringing new investors into the ecosystem. The ongoing development of sophisticated APIs for institutional clients and the increasing integration of wealth management services within trading platforms are also significant growth accelerators, fostering deeper client relationships and higher customer lifetime value.

Key Players Shaping the US Online Trading Platform Market Market

- Webull Financial LLC

- The Charles Schwab Corporation

- Interactive Brokers LLC

- The Vanguard Group Inc

- BAM Trading Services Inc (Binance US)

- Merrill Lynch Pierce Fenner & Smith Incorporated (Bank of America Corporation)

- ETrade (Morgan Stanley)

- Fidelity Investments Institutional Operations Company Inc

- Robinhood Markets Inc

- Coinbase Global Inc

- eToro

- Tradestation Group Inc

- Trading Technologies International Inc

Notable Milestones in US Online Trading Platform Market Sector

- May 2023 - Etoro announced the launch of InsuranceWorld, a portfolio offering retail investors long-term exposure to the insurance sector. InsuranceWorld is a new addition to eToro's existing offering of portfolios, which already provides exposure to traditional financial sectors, such as private equity, big banks, and real estate trusts.

- April 2023 - Twitter, a US-based company, partnered with the cryptocurrency exchange eToro to allow users to trade stocks, cryptocurrencies, and other assets on the social network's platform by using the online platform services offered by eToro, which would generate new revenue streams for the market vendors.

In-Depth US Online Trading Platform Market Market Outlook

The US Online Trading Platform Market is set for sustained and accelerated growth, driven by continued technological innovation and an increasing appetite for investment opportunities among a broad demographic spectrum. Future market potential is immense, particularly with the further integration of AI for hyper-personalized trading experiences and advanced risk management tools. Strategic opportunities lie in the expansion of offerings to include a wider array of alternative investments and the development of robust educational resources that cater to all investor levels. The market is expected to witness continued consolidation through M&A activities, as larger players acquire innovative startups to enhance their technological capabilities and expand their service portfolios. The growing interest in sustainable and impact investing presents a significant avenue for differentiation and growth. Overall, the outlook is highly positive, with online trading platforms poised to remain a central pillar of the modern financial landscape.

US Online Trading Platform Market Segmentation

-

1. Offerings

- 1.1. Platforms

- 1.2. Services

-

2. Deployment Mode

- 2.1. On-Premises

- 2.2. Cloud

-

3. Type

- 3.1. Beginner

- 3.2. Advanced

-

4. End-user

- 4.1. Institutional Investors

- 4.2. Retail Investors

US Online Trading Platform Market Segmentation By Geography

- 1. United States

US Online Trading Platform Market Regional Market Share

Geographic Coverage of US Online Trading Platform Market

US Online Trading Platform Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Accessibility and the Rise in the Adoption of Smartphones; Integration of AI Technology and Robo Advisors to Update on Real-Time Updates; Capabilities Such as Trade Order and Investment Management Integrated into a Single Platform

- 3.3. Market Restrains

- 3.3.1. Increasing Risk of Counterfeits

- 3.4. Market Trends

- 3.4.1. Increasing Accessibility and the Rise in the Adoption of Smartphones is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. US Online Trading Platform Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offerings

- 5.1.1. Platforms

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.2.1. On-Premises

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Beginner

- 5.3.2. Advanced

- 5.4. Market Analysis, Insights and Forecast - by End-user

- 5.4.1. Institutional Investors

- 5.4.2. Retail Investors

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Offerings

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Webull Financial LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Charles Schwab Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Interactive Brokers LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Vanguard Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BAM Trading Services Inc (Binance US)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Merrill Lynch Pierce Fenner & Smith Incorporated (Bank of America Corporation)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ETrade (Morgan Stanley)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fidelity Investments Institutional Operations Company Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Robinhood Markets Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Coinbase Global Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 eToro

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Tradestation Group Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Trading Technologies International Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Webull Financial LLC

List of Figures

- Figure 1: US Online Trading Platform Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: US Online Trading Platform Market Share (%) by Company 2025

List of Tables

- Table 1: US Online Trading Platform Market Revenue billion Forecast, by Offerings 2020 & 2033

- Table 2: US Online Trading Platform Market Revenue billion Forecast, by Deployment Mode 2020 & 2033

- Table 3: US Online Trading Platform Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: US Online Trading Platform Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 5: US Online Trading Platform Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: US Online Trading Platform Market Revenue billion Forecast, by Offerings 2020 & 2033

- Table 7: US Online Trading Platform Market Revenue billion Forecast, by Deployment Mode 2020 & 2033

- Table 8: US Online Trading Platform Market Revenue billion Forecast, by Type 2020 & 2033

- Table 9: US Online Trading Platform Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 10: US Online Trading Platform Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Online Trading Platform Market?

The projected CAGR is approximately 6.11%.

2. Which companies are prominent players in the US Online Trading Platform Market?

Key companies in the market include Webull Financial LLC, The Charles Schwab Corporation, Interactive Brokers LLC, The Vanguard Group Inc, BAM Trading Services Inc (Binance US), Merrill Lynch Pierce Fenner & Smith Incorporated (Bank of America Corporation), ETrade (Morgan Stanley), Fidelity Investments Institutional Operations Company Inc, Robinhood Markets Inc, Coinbase Global Inc, eToro, Tradestation Group Inc, Trading Technologies International Inc .

3. What are the main segments of the US Online Trading Platform Market?

The market segments include Offerings, Deployment Mode, Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.48 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Accessibility and the Rise in the Adoption of Smartphones; Integration of AI Technology and Robo Advisors to Update on Real-Time Updates; Capabilities Such as Trade Order and Investment Management Integrated into a Single Platform.

6. What are the notable trends driving market growth?

Increasing Accessibility and the Rise in the Adoption of Smartphones is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Increasing Risk of Counterfeits.

8. Can you provide examples of recent developments in the market?

May 2023 - Etoro announced the launch of InsuranceWorld, a portfolio offering retail investors long-term exposure to the insurance sector. InsuranceWorld is a new addition to eToro's existing offering of portfolios, which already provides exposure to traditional financial sectors, such as private equity, big banks, and real estate trusts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Online Trading Platform Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Online Trading Platform Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Online Trading Platform Market?

To stay informed about further developments, trends, and reports in the US Online Trading Platform Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence