Key Insights

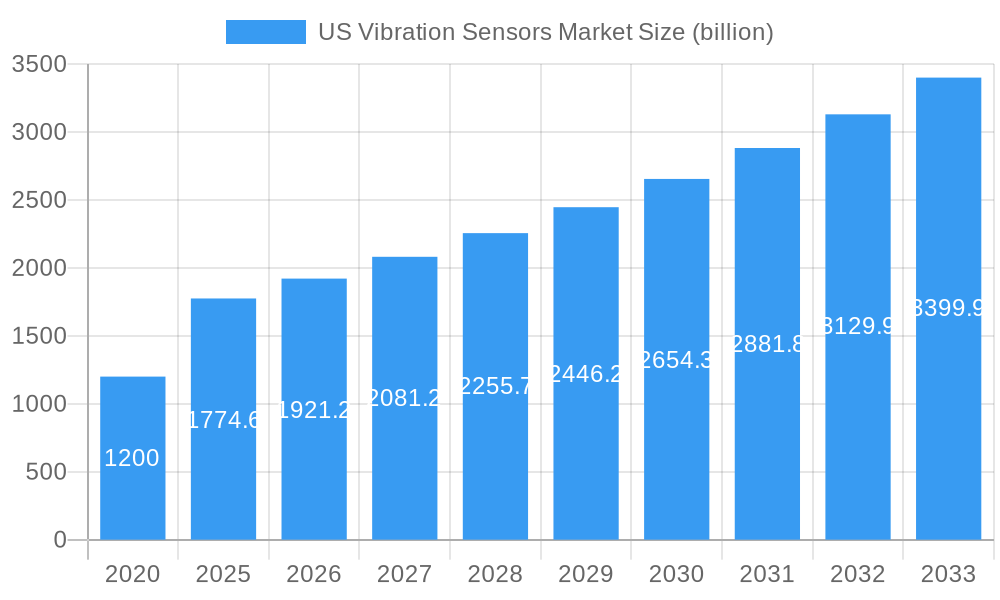

The US vibration sensors market is poised for significant expansion, driven by escalating demand across critical industries such as automotive, aerospace & defense, and industrial automation. With an estimated market size of approximately $1.2 billion in 2020, the market is projected to grow at a robust CAGR of 8.2% through 2033. This growth is primarily fueled by the increasing adoption of predictive maintenance strategies, where vibration sensors play a crucial role in monitoring equipment health, detecting anomalies early, and preventing costly downtime. The burgeoning industrial IoT (IIoT) ecosystem further accelerates this trend, enabling real-time data analysis and remote monitoring capabilities. Technological advancements, including miniaturization, enhanced accuracy, and the integration of wireless communication, are also contributing to the market's upward trajectory.

US Vibration Sensors Market Market Size (In Billion)

The US vibration sensors market is characterized by its diverse segmentation, with accelerometers dominating the product landscape due to their versatility and widespread application. However, proximity probes and tachometers are also witnessing steady growth, particularly in specialized industrial environments. Beyond traditional sectors, the healthcare industry is emerging as a notable growth area, leveraging vibration sensing for patient monitoring and diagnostic tools. While the market benefits from strong growth drivers, potential restraints include high initial investment costs for advanced sensor systems and the need for skilled personnel for installation and data interpretation. Nevertheless, the overarching trend towards smarter manufacturing, enhanced safety regulations, and the continuous innovation by leading companies like Honeywell, Bosch Sensortec, and National Instruments are expected to propel the US vibration sensors market to new heights.

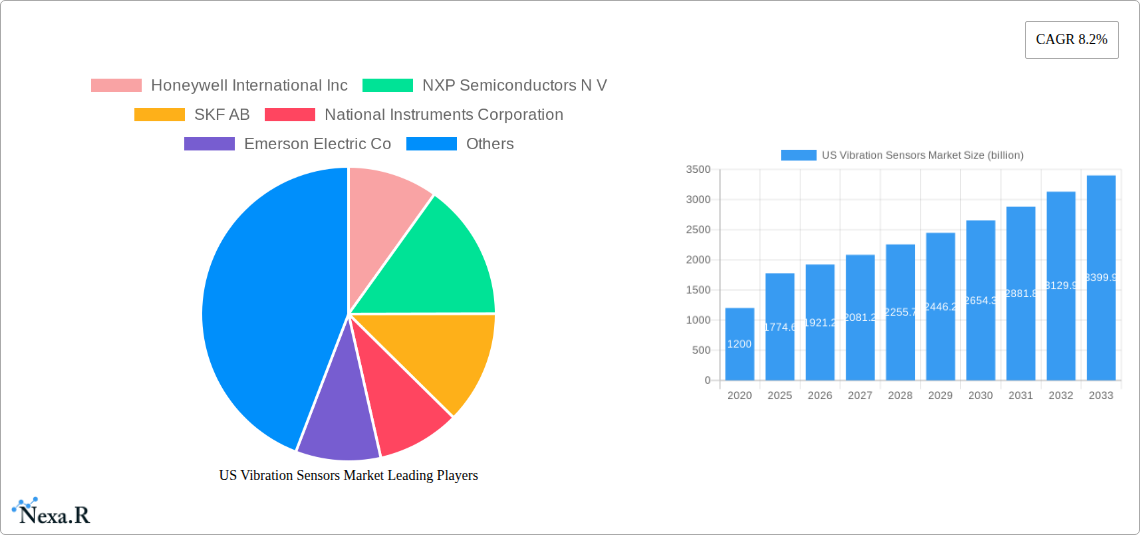

US Vibration Sensors Market Company Market Share

US Vibration Sensors Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the US vibration sensors market, a critical component of industrial automation, predictive maintenance, and safety monitoring across diverse sectors. Leveraging high-impact keywords such as "vibration sensors," "accelerometers," "proximity probes," "tachometers," "industrial IoT," "predictive maintenance," and "condition monitoring," this study offers unparalleled insights into market dynamics, growth trends, and future opportunities. We meticulously examine the parent market encompassing all vibration sensing technologies and its intricate child markets segmented by product type and end-user industry. With a study period spanning from 2019 to 2033, including a base year of 2025 and a detailed forecast period, this report is your essential guide to navigating the evolving landscape of US vibration sensing solutions, with projected market values in billions of US dollars.

US Vibration Sensors Market Market Dynamics & Structure

The US vibration sensors market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and robust end-user demand. Market concentration is moderately fragmented, with key players continuously investing in R&D to enhance product performance and expand application reach. Technological innovation is a primary driver, fueled by advancements in MEMS technology, miniaturization, and wireless connectivity, enabling smarter and more integrated condition monitoring solutions. Regulatory frameworks, particularly those concerning industrial safety and environmental standards, indirectly bolster the demand for reliable vibration monitoring systems. Competitive product substitutes, such as acoustic emission sensors and thermal imaging, exist but are often complementary rather than direct replacements for vibration sensing capabilities. End-user demographics are increasingly sophisticated, demanding real-time data, advanced analytics, and seamless integration with existing industrial control systems and IIoT platforms. Mergers and acquisitions (M&A) trends indicate strategic consolidation and expansion of capabilities within the market, with several key players actively pursuing acquisitions to broaden their product portfolios and geographical reach. The market's structure is shaped by both established players and emerging innovators, creating a competitive yet collaborative environment.

- Market Concentration: Moderately fragmented with a mix of large multinational corporations and specialized sensor manufacturers.

- Technological Innovation Drivers: Miniaturization, MEMS advancements, wireless communication protocols (LoRaWAN, NB-IoT), AI-powered analytics, and edge computing.

- Regulatory Frameworks: OSHA, EPA, and industry-specific safety standards indirectly drive adoption for compliance and risk mitigation.

- Competitive Product Substitutes: Acoustic emission sensors, thermal imaging, ultrasonic testing, though often used in conjunction with vibration analysis.

- End-User Demographics: Increasing demand for real-time data, predictive maintenance capabilities, IIoT integration, and customized solutions.

- M&A Trends: Strategic acquisitions focused on technology integration, market expansion, and portfolio diversification.

US Vibration Sensors Market Growth Trends & Insights

The US vibration sensors market is poised for substantial growth, driven by an escalating need for predictive maintenance, enhanced operational efficiency, and stringent safety regulations across various industries. The market size is projected to witness a compound annual growth rate (CAGR) of approximately 9.2% from $2.8 billion in 2025 to an estimated $5.9 billion by 2033. This growth is underpinned by a rising adoption rate of condition monitoring technologies, moving beyond reactive repair to proactive fault detection. Technological disruptions, particularly the integration of Artificial Intelligence (AI) and Machine Learning (ML) with vibration data analytics, are revolutionizing fault prediction accuracy and enabling more sophisticated insights. Consumer behavior shifts are evident, with industrial end-users increasingly prioritizing solutions that offer seamless data integration, cloud connectivity, and edge computing capabilities for localized processing. The adoption of wireless vibration sensors is rapidly increasing, reducing installation costs and complexity, and expanding deployment in hard-to-reach or hazardous environments. Furthermore, the increasing complexity of industrial machinery and the need to minimize downtime are compelling factors driving the demand for advanced vibration monitoring systems. The transition towards Industry 4.0 and the widespread implementation of the Industrial Internet of Things (IIoT) are creating fertile ground for the widespread adoption of sophisticated vibration sensing technologies.

Dominant Regions, Countries, or Segments in US Vibration Sensors Market

Within the US vibration sensors market, the Automotive industry stands out as a dominant segment driving significant growth and adoption of advanced sensing technologies. This sector's relentless pursuit of improved vehicle safety, performance, and fuel efficiency necessitates sophisticated monitoring of engine components, transmissions, and chassis systems. The increasing prevalence of electric vehicles (EVs) also introduces new vibration challenges and opportunities for sensor manufacturers. The Aerospace & Defence sector also represents a critical and high-value market, driven by stringent safety requirements and the need for continuous monitoring of critical aircraft components to ensure airworthiness and prevent catastrophic failures. The growing defense spending and modernization efforts further amplify demand.

The Oil and Gas industry continues to be a substantial contributor, particularly in the upstream and midstream segments, where the continuous operation of heavy machinery, pipelines, and drilling equipment is paramount. Predictive maintenance enabled by vibration sensors helps mitigate risks associated with equipment failure in harsh and remote environments. The Metals and Mining industry also relies heavily on vibration analysis for monitoring large-scale crushing and grinding equipment, conveyor systems, and heavy-duty vehicles, directly impacting operational efficiency and safety.

- Automotive Industry:

- Key Drivers: Increased focus on vehicle safety, performance optimization, autonomous driving technology development, and the growth of the EV market.

- Market Share: Estimated to account for over 25% of the total US vibration sensors market revenue by 2025.

- Growth Potential: High, driven by continuous innovation in powertrain and chassis monitoring.

- Aerospace & Defence:

- Key Drivers: Strict safety regulations, demand for robust and reliable components, advancements in aircraft technology, and national security imperatives.

- Market Share: Significant contribution, particularly in high-end sensor applications.

- Growth Potential: Strong, with consistent demand for critical component monitoring.

- Oil and Gas:

- Key Drivers: Need for uninterrupted operations, risk mitigation in hazardous environments, and optimization of exploration and production activities.

- Market Share: Substantial, especially in upstream and midstream operations.

- Growth Potential: Steady, influenced by global energy demand.

- Metals and Mining:

- Key Drivers: Optimization of heavy machinery performance, reduction of downtime, and enhancement of worker safety.

- Market Share: Significant, particularly for large-scale industrial equipment monitoring.

- Growth Potential: Moderate to strong, tied to commodity prices and infrastructure development.

US Vibration Sensors Market Product Landscape

The US vibration sensors market product landscape is dominated by high-performance Accelerometers, which account for the largest market share due to their versatility and wide range of applications, from automotive and industrial machinery to consumer electronics and aerospace. Proximity Probes are crucial for non-contact monitoring of rotating machinery like turbines and compressors, ensuring early detection of bearing wear and shaft misalignment. Tachometers are essential for measuring rotational speed, a critical parameter in various industrial processes and vehicle systems. The "Others" category includes specialized sensors like velocity sensors and displacement sensors, catering to niche applications requiring specific measurement capabilities. Continuous product innovations focus on enhanced sensitivity, wider frequency response, improved durability for harsh environments, and seamless integration with wireless communication and data analytics platforms.

Key Drivers, Barriers & Challenges in US Vibration Sensors Market

The US vibration sensors market is propelled by several key drivers, including the escalating demand for predictive maintenance to minimize costly downtime, the growing implementation of Industry 4.0 and IIoT technologies for enhanced operational efficiency, and increasingly stringent safety regulations across industries. Technological advancements in MEMS and wireless communication are further enabling more affordable and accessible vibration monitoring solutions.

- Key Drivers:

- Predictive Maintenance: Cost savings and reduced downtime through early fault detection.

- Industry 4.0/IIoT Adoption: Seamless integration with smart manufacturing ecosystems.

- Safety Regulations: Compliance and risk mitigation for critical assets.

- Technological Advancements: Miniaturization, wireless connectivity, AI integration.

However, the market faces certain barriers and challenges. The initial cost of implementing advanced vibration monitoring systems can be a deterrent for small and medium-sized enterprises. A shortage of skilled personnel capable of interpreting complex vibration data and maintaining sophisticated systems can also hinder widespread adoption. Supply chain disruptions, as witnessed in recent years, can impact component availability and lead times, while the threat of cybersecurity breaches in connected systems requires robust security measures. Competitive pressures from alternative monitoring technologies and the need for continuous R&D to stay ahead of the curve also present ongoing challenges.

- Barriers & Challenges:

- High Initial Investment: Cost of sensors, data acquisition systems, and software.

- Skilled Workforce Shortage: Lack of trained personnel for data analysis and system maintenance.

- Supply Chain Volatility: Potential for component shortages and price fluctuations.

- Cybersecurity Concerns: Protecting connected systems from data breaches.

- Technological Obsolescence: Rapid pace of innovation requiring continuous upgrades.

Emerging Opportunities in US Vibration Sensors Market

Emerging opportunities in the US vibration sensors market lie in the burgeoning demand for smart, connected sensors that offer advanced analytics and AI-driven insights. The integration of vibration sensors with other IIoT devices, such as temperature and pressure sensors, to create comprehensive condition monitoring solutions presents a significant growth avenue. The expansion of vibration sensing into new application areas, including healthcare (e.g., monitoring medical equipment, patient mobility), and smart infrastructure (e.g., bridge health monitoring, building structural integrity), offers untapped market potential. Furthermore, the development of ultra-low-power, long-range wireless vibration sensors for remote asset monitoring in sectors like agriculture and utilities is an evolving opportunity.

Growth Accelerators in the US Vibration Sensors Market Industry

Several catalysts are accelerating the growth of the US vibration sensors market industry. Technological breakthroughs in sensor miniaturization and sensitivity are enabling more precise and widespread deployment. Strategic partnerships between sensor manufacturers, IIoT platform providers, and data analytics companies are creating integrated solutions that offer greater value to end-users. Market expansion strategies by key players, including entering new geographical regions and targeting underserved industry verticals, are also driving growth. The increasing focus on sustainability and energy efficiency in industrial operations further boosts the adoption of vibration monitoring for optimizing machinery performance and reducing energy consumption.

Key Players Shaping the US Vibration Sensors Market Market

- Honeywell International Inc

- NXP Semiconductors N V

- SKF AB

- National Instruments Corporation

- Emerson Electric Co

- TE Connectivity Ltd

- Bosch Sensortec GmbH (Robert Bosch GmbH)

- Hansford Sensors Ltd

- Texas Instruments Incorporated

- Rockwell Automation Inc

- Analog Devices Inc

Notable Milestones in US Vibration Sensors Market Sector

- May 2021: Yokogava introduced the new wireless vibration sensor module XS770A, designed for hazardous locations and capable of transmitting data up to 6 miles/10 km. Its battery-powered design and smartphone NFC interface offer versatile application configuration.

- September 2021: Advantech partnered with RAD to simplify IoT solutions deployment on LoRaWAN networks. This collaboration led to the launch of Advantech's WISE-2410 LoRaWAN smart vibration sensor, fully integrated into Actility's ThingPark Enterprise IoT Platform, catering to industrial automation needs across continents.

In-Depth US Vibration Sensors Market Market Outlook

The US vibration sensors market is set for robust expansion, driven by the pervasive adoption of Industry 4.0 principles and the critical need for proactive asset management. Future growth will be significantly shaped by advancements in AI and machine learning algorithms that enhance the predictive capabilities of vibration analysis, enabling earlier and more accurate fault detection. The trend towards wireless and embedded sensor solutions will continue to lower implementation barriers, driving wider adoption across diverse industrial and commercial applications. Strategic collaborations and the integration of vibration sensing into comprehensive IIoT ecosystems will unlock new service-based revenue streams. The market's outlook is bright, with substantial opportunities for innovation in sensor technology, data analytics, and end-to-end condition monitoring solutions, promising enhanced operational reliability and significant cost savings for businesses across the US.

US Vibration Sensors Market Segmentation

-

1. Product

- 1.1. Accelerometers

- 1.2. Proximity Probes

- 1.3. Tachometers

- 1.4. Others

-

2. Industry

- 2.1. Automotive

- 2.2. Helathcare

- 2.3. Aerospace & Defence

- 2.4. Consumer Electronics

- 2.5. Oil And Gas

- 2.6. Metals and Mining

- 2.7. Others

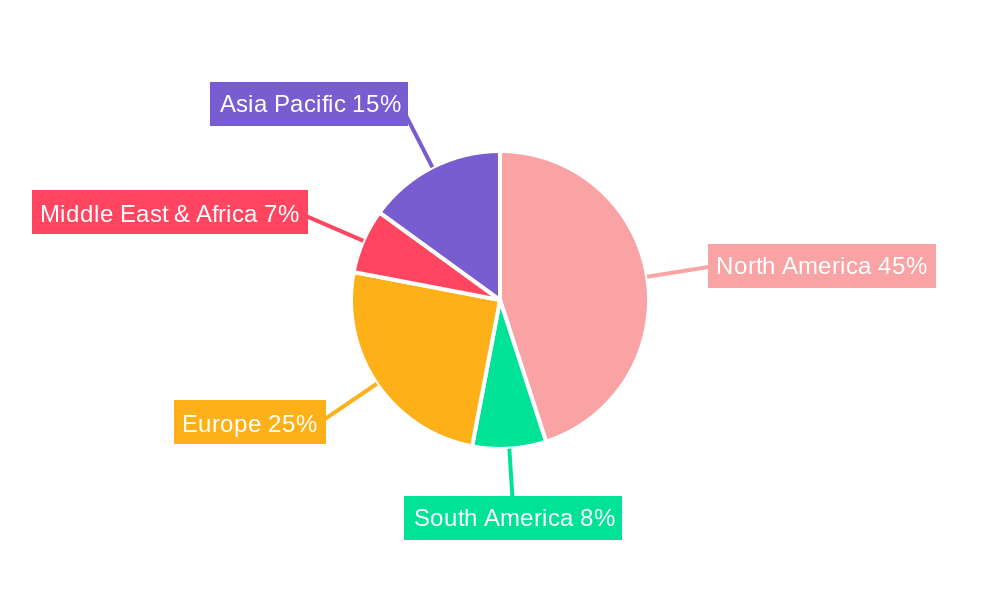

US Vibration Sensors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Vibration Sensors Market Regional Market Share

Geographic Coverage of US Vibration Sensors Market

US Vibration Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Need for Machine Monitoring and Maintenance; Longer Service Life

- 3.2.2 Self Generating Capability and Wide Range of Frequency of Vibration Sensors

- 3.3. Market Restrains

- 3.3.1. Compatibility With Old Machinery; Critical and Hazardous Implication on the Environment

- 3.4. Market Trends

- 3.4.1. Aerospace & Defense End User to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Vibration Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Accelerometers

- 5.1.2. Proximity Probes

- 5.1.3. Tachometers

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Automotive

- 5.2.2. Helathcare

- 5.2.3. Aerospace & Defence

- 5.2.4. Consumer Electronics

- 5.2.5. Oil And Gas

- 5.2.6. Metals and Mining

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America US Vibration Sensors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Accelerometers

- 6.1.2. Proximity Probes

- 6.1.3. Tachometers

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Industry

- 6.2.1. Automotive

- 6.2.2. Helathcare

- 6.2.3. Aerospace & Defence

- 6.2.4. Consumer Electronics

- 6.2.5. Oil And Gas

- 6.2.6. Metals and Mining

- 6.2.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America US Vibration Sensors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Accelerometers

- 7.1.2. Proximity Probes

- 7.1.3. Tachometers

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Industry

- 7.2.1. Automotive

- 7.2.2. Helathcare

- 7.2.3. Aerospace & Defence

- 7.2.4. Consumer Electronics

- 7.2.5. Oil And Gas

- 7.2.6. Metals and Mining

- 7.2.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe US Vibration Sensors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Accelerometers

- 8.1.2. Proximity Probes

- 8.1.3. Tachometers

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Industry

- 8.2.1. Automotive

- 8.2.2. Helathcare

- 8.2.3. Aerospace & Defence

- 8.2.4. Consumer Electronics

- 8.2.5. Oil And Gas

- 8.2.6. Metals and Mining

- 8.2.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa US Vibration Sensors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Accelerometers

- 9.1.2. Proximity Probes

- 9.1.3. Tachometers

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Industry

- 9.2.1. Automotive

- 9.2.2. Helathcare

- 9.2.3. Aerospace & Defence

- 9.2.4. Consumer Electronics

- 9.2.5. Oil And Gas

- 9.2.6. Metals and Mining

- 9.2.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific US Vibration Sensors Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Accelerometers

- 10.1.2. Proximity Probes

- 10.1.3. Tachometers

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Industry

- 10.2.1. Automotive

- 10.2.2. Helathcare

- 10.2.3. Aerospace & Defence

- 10.2.4. Consumer Electronics

- 10.2.5. Oil And Gas

- 10.2.6. Metals and Mining

- 10.2.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NXP Semiconductors N V

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SKF AB

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 National Instruments Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Emerson Electric Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TE Connectivity Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bosch Sensortec GmbH (Robert Bosch GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hansford Sensors Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Texas Instruments Incorporated

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rockwell Automation Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Analog Devices Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global US Vibration Sensors Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Vibration Sensors Market Revenue (billion), by Product 2025 & 2033

- Figure 3: North America US Vibration Sensors Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America US Vibration Sensors Market Revenue (billion), by Industry 2025 & 2033

- Figure 5: North America US Vibration Sensors Market Revenue Share (%), by Industry 2025 & 2033

- Figure 6: North America US Vibration Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America US Vibration Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America US Vibration Sensors Market Revenue (billion), by Product 2025 & 2033

- Figure 9: South America US Vibration Sensors Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: South America US Vibration Sensors Market Revenue (billion), by Industry 2025 & 2033

- Figure 11: South America US Vibration Sensors Market Revenue Share (%), by Industry 2025 & 2033

- Figure 12: South America US Vibration Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America US Vibration Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe US Vibration Sensors Market Revenue (billion), by Product 2025 & 2033

- Figure 15: Europe US Vibration Sensors Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe US Vibration Sensors Market Revenue (billion), by Industry 2025 & 2033

- Figure 17: Europe US Vibration Sensors Market Revenue Share (%), by Industry 2025 & 2033

- Figure 18: Europe US Vibration Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe US Vibration Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa US Vibration Sensors Market Revenue (billion), by Product 2025 & 2033

- Figure 21: Middle East & Africa US Vibration Sensors Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East & Africa US Vibration Sensors Market Revenue (billion), by Industry 2025 & 2033

- Figure 23: Middle East & Africa US Vibration Sensors Market Revenue Share (%), by Industry 2025 & 2033

- Figure 24: Middle East & Africa US Vibration Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa US Vibration Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific US Vibration Sensors Market Revenue (billion), by Product 2025 & 2033

- Figure 27: Asia Pacific US Vibration Sensors Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Asia Pacific US Vibration Sensors Market Revenue (billion), by Industry 2025 & 2033

- Figure 29: Asia Pacific US Vibration Sensors Market Revenue Share (%), by Industry 2025 & 2033

- Figure 30: Asia Pacific US Vibration Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific US Vibration Sensors Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Vibration Sensors Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global US Vibration Sensors Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 3: Global US Vibration Sensors Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global US Vibration Sensors Market Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Global US Vibration Sensors Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 6: Global US Vibration Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global US Vibration Sensors Market Revenue billion Forecast, by Product 2020 & 2033

- Table 11: Global US Vibration Sensors Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 12: Global US Vibration Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global US Vibration Sensors Market Revenue billion Forecast, by Product 2020 & 2033

- Table 17: Global US Vibration Sensors Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 18: Global US Vibration Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global US Vibration Sensors Market Revenue billion Forecast, by Product 2020 & 2033

- Table 29: Global US Vibration Sensors Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 30: Global US Vibration Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global US Vibration Sensors Market Revenue billion Forecast, by Product 2020 & 2033

- Table 38: Global US Vibration Sensors Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 39: Global US Vibration Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific US Vibration Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Vibration Sensors Market?

The projected CAGR is approximately 8.2%.

2. Which companies are prominent players in the US Vibration Sensors Market?

Key companies in the market include Honeywell International Inc, NXP Semiconductors N V, SKF AB, National Instruments Corporation, Emerson Electric Co, TE Connectivity Ltd, Bosch Sensortec GmbH (Robert Bosch GmbH, Hansford Sensors Ltd, Texas Instruments Incorporated, Rockwell Automation Inc, Analog Devices Inc.

3. What are the main segments of the US Vibration Sensors Market?

The market segments include Product, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Machine Monitoring and Maintenance; Longer Service Life. Self Generating Capability and Wide Range of Frequency of Vibration Sensors.

6. What are the notable trends driving market growth?

Aerospace & Defense End User to Hold Significant Share.

7. Are there any restraints impacting market growth?

Compatibility With Old Machinery; Critical and Hazardous Implication on the Environment.

8. Can you provide examples of recent developments in the market?

May 2021 - Yokogava introduced a new wireless vibration sensor module XS770A, Durable enough for hazardous locations and powerful enough to transmit data up to 6 miles/10 km, the battery-powered XS770A can configure multiple applications via a single smartphone Near Field Communication (NFC) interface.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Vibration Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Vibration Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Vibration Sensors Market?

To stay informed about further developments, trends, and reports in the US Vibration Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence