Key Insights

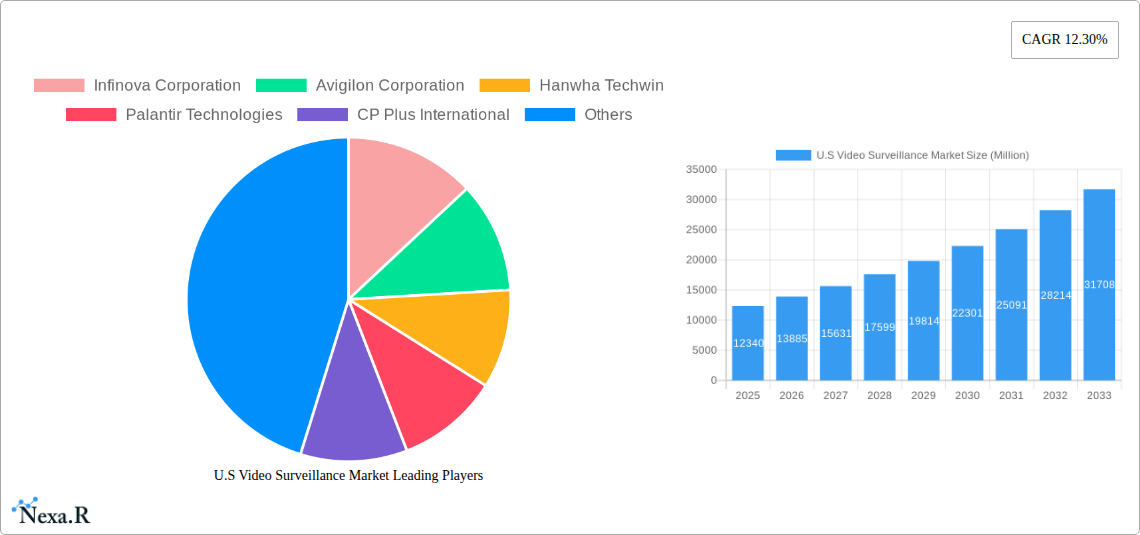

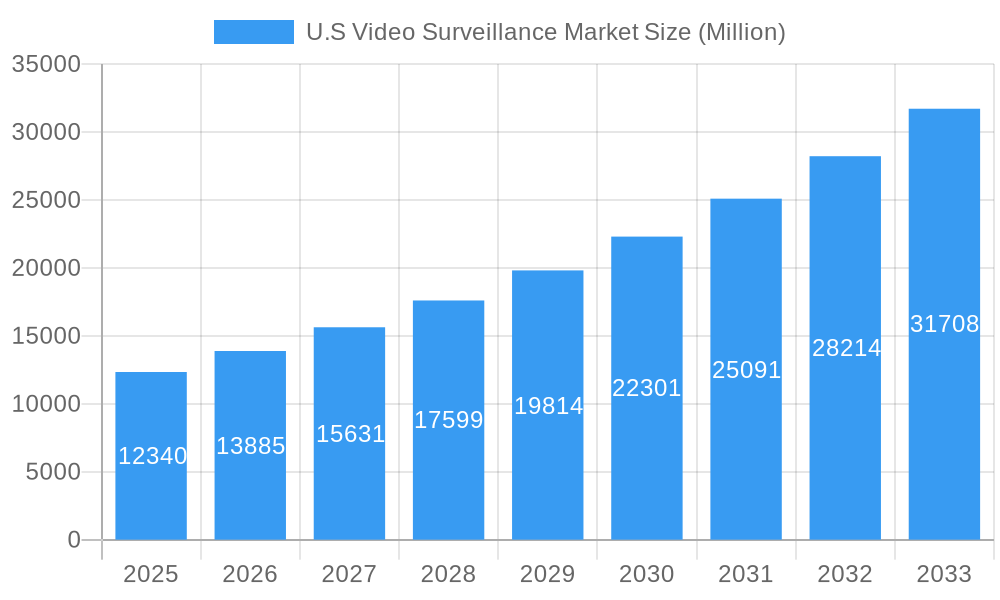

The U.S. video surveillance market is poised for robust expansion, projected to reach a significant valuation of $12.34 billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 12.30% anticipated to continue through 2033. This sustained growth is fueled by a confluence of critical factors, including escalating security concerns across both commercial and public sectors, the increasing adoption of advanced technologies like AI-powered video analytics, and the growing demand for comprehensive surveillance solutions in sectors such as retail, transportation, and national infrastructure. The integration of sophisticated video management systems and high-capacity storage is becoming standard, enabling more efficient data handling and real-time threat detection. Furthermore, the evolving landscape of smart cities and the continuous need for enhanced public safety are driving substantial investments in surveillance infrastructure, creating a dynamic and expanding market.

U.S Video Surveillance Market Market Size (In Billion)

The market is characterized by a strong trend towards intelligent surveillance, where video analytics are transforming raw footage into actionable insights. This shift is enabling proactive security measures, crime prevention, and operational efficiency improvements for end-users. While the market demonstrates significant growth potential, certain restraints such as high initial investment costs for advanced systems and concerns regarding data privacy and regulatory compliance may temper adoption rates in specific segments. However, the overwhelming benefits of enhanced security, operational oversight, and data-driven decision-making are expected to outweigh these challenges, ensuring a trajectory of continuous innovation and market penetration for video surveillance solutions in the U.S. over the forecast period. The competitive landscape features a mix of established global players and emerging innovators, all vying to capture market share through technological advancements and strategic partnerships.

U.S Video Surveillance Market Company Market Share

Comprehensive U.S. Video Surveillance Market Report: Trends, Drivers, and Future Outlook (2019-2033)

This in-depth report provides a detailed analysis of the U.S. Video Surveillance Market, encompassing its current state, historical performance, and projected future growth. Covering the period from 2019 to 2033, with a base year of 2025, this report is an essential resource for industry professionals seeking to understand market dynamics, identify growth opportunities, and strategize for success in the rapidly evolving video surveillance landscape. The report segments the market by Type (Cameras, Video Management Systems and Storage, Video Analytics) and End User (Commercial, Retail, National Infrastructure and City Surveillance, Transportation, Residential, Other End Users), offering granular insights into each segment's performance and potential.

U.S Video Surveillance Market Market Dynamics & Structure

The U.S. video surveillance market exhibits a moderate level of concentration, with a mix of large, established players and emerging innovators. Technological innovation remains a primary driver, fueled by advancements in AI, IoT integration, and cloud-based solutions, enabling sophisticated video analytics and remote monitoring capabilities. Regulatory frameworks, particularly concerning data privacy and facial recognition, are evolving and influencing deployment strategies. Competitive product substitutes, such as integrated security systems and advanced access control, present a dynamic landscape. End-user demographics are shifting towards a greater demand for integrated, intelligent, and user-friendly solutions across all sectors. Mergers and acquisitions (M&A) trends indicate consolidation, with larger companies acquiring smaller, specialized firms to expand their technology portfolios and market reach.

- Market Concentration: Moderate, with key players like Hikvision, Dahua, Honeywell, and Axis Communications holding significant shares.

- Technological Innovation Drivers: AI-powered analytics, cloud storage, edge computing, and cybersecurity advancements.

- Regulatory Frameworks: Evolving data privacy laws, ethical AI guidelines, and state-specific surveillance regulations.

- Competitive Product Substitutes: Integrated security platforms, smart home devices with video capabilities, and advanced alarm systems.

- End-User Demographics: Increasing adoption in commercial and retail sectors for loss prevention and operational efficiency; growing demand for smart city initiatives and national security applications.

- M&A Trends: Strategic acquisitions to gain access to new technologies, customer bases, and geographical markets. For example, Axis Communications' acquisition by Canon, or the ongoing consolidation within the VMS and analytics space.

U.S Video Surveillance Market Growth Trends & Insights

The U.S. Video Surveillance Market is poised for significant growth, driven by an increasing emphasis on security and safety across various sectors. The adoption rate of advanced surveillance technologies, including AI-powered video analytics and cloud-based solutions, is accelerating. This trend is reshaping consumer behavior and organizational strategies, moving beyond mere recording to intelligent monitoring and proactive threat detection. Technological disruptions, such as the miniaturization of sensors, enhanced low-light performance in cameras, and the integration of machine learning for real-time anomaly detection, are key contributors to this evolution.

The market size is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period of 2025–2033. This expansion is fueled by a burgeoning demand for integrated security solutions in the commercial and retail sectors, where businesses are investing heavily in loss prevention, customer analytics, and operational efficiency. The national infrastructure and city surveillance segment is also a major growth engine, with governments worldwide prioritizing public safety and smart city initiatives that heavily rely on advanced video surveillance systems.

Furthermore, the transportation sector, including airports, railways, and public transit, is seeing increased deployment of surveillance for security and passenger flow management. Even the residential segment is experiencing growth, albeit at a slower pace, as smart home technology becomes more accessible and integrated with security features. The overall market penetration of video surveillance systems continues to deepen, with businesses and individuals alike recognizing the value proposition of enhanced security and actionable insights derived from video data.

- Market Size Evolution: From approximately \$15,500 Million units in 2019 to an estimated \$30,000 Million units by 2025, with projections to exceed \$75,000 Million units by 2033.

- Adoption Rates: Rapid adoption of AI-powered analytics and cloud-based VMS across commercial and public sectors.

- Technological Disruptions: Introduction of 8K cameras, advanced thermal imaging, facial recognition with enhanced accuracy, and edge AI processing.

- Consumer Behavior Shifts: Increased demand for remote access, mobile surveillance capabilities, and proactive security alerts.

- Market Penetration: Growing deeper into small and medium-sized businesses (SMBs) and the residential sector due to declining costs and user-friendly interfaces.

Dominant Regions, Countries, or Segments in U.S Video Surveillance Market

Within the U.S. Video Surveillance Market, the Commercial end-user segment stands out as the dominant force, consistently driving market growth. This dominance is attributed to the pervasive need for enhanced security, operational efficiency, and data-driven insights across a wide array of industries, including finance, healthcare, education, and corporate offices. The adoption of advanced video surveillance solutions in this segment is propelled by significant investments in loss prevention, employee monitoring, customer behavior analysis, and compliance with stringent safety regulations.

The Cameras segment within the "Type" classification also plays a pivotal role in market expansion. The continuous innovation in camera technology, such as higher resolutions, improved low-light performance, wider dynamic range (WDR), and integrated AI capabilities, makes them the foundational component of any surveillance system.

Key Drivers for Commercial Segment Dominance:

- High Return on Investment (ROI): Businesses leverage video surveillance for tangible benefits like reduced shrinkage, improved workplace safety, and optimized operational workflows.

- Increasing Sophistication of Threats: Growing awareness of security threats, from petty theft to sophisticated corporate espionage, necessitates robust surveillance.

- Regulatory Compliance: Many industries are mandated to maintain surveillance for safety and compliance purposes, driving continuous upgrades.

- Technological Advancements: The integration of AI in cameras and VMS allows for predictive analytics and faster incident response, making them indispensable.

Market Share and Growth Potential: The Commercial segment is estimated to account for over 35% of the total U.S. Video Surveillance Market share in 2025, with a projected CAGR of 13.2% through 2033.

Dominant Role of Cameras: The Cameras segment represents approximately 45% of the total market value in 2025, with significant contributions from IP cameras, PTZ cameras, and specialized cameras (e.g., thermal, explosion-proof).

National Infrastructure and City Surveillance is another rapidly growing segment, driven by smart city initiatives and the need for public safety. Investments in intelligent traffic management, public space monitoring, and critical infrastructure protection are fueling demand. This segment is expected to grow at a CAGR of 14.5% during the forecast period.

Retail segment continues to be a strong adopter, focusing on loss prevention, customer experience enhancement, and staff monitoring. The integration of video analytics with point-of-sale (POS) systems provides valuable insights for inventory management and marketing strategies. This segment is projected to grow at a CAGR of 11.8%.

Transportation is a critical area for surveillance, encompassing airports, ports, railways, and public transit. The focus here is on passenger safety, security, and operational efficiency. AI-powered analytics for crowd management and anomaly detection are key growth factors, with an estimated CAGR of 13.5%.

U.S Video Surveillance Market Product Landscape

The U.S. Video Surveillance Market is characterized by a dynamic product landscape driven by relentless innovation. Advanced IP cameras now offer resolutions exceeding 4K, coupled with enhanced low-light performance and Wide Dynamic Range (WDR) capabilities, ensuring clear imagery in diverse conditions. Video Management Systems (VMS) are evolving into intelligent platforms, integrating AI for sophisticated video analytics such as facial recognition, object detection, and behavioral analysis. Storage solutions are shifting towards scalable, cloud-based options and efficient on-premise network-attached storage (NAS) devices, catering to growing data demands. The key selling proposition lies in the seamless integration of these components, providing end-to-end security solutions that offer not just recording but actionable insights and proactive threat mitigation.

Key Drivers, Barriers & Challenges in U.S Video Surveillance Market

The U.S. Video Surveillance Market is propelled by several key drivers, including the escalating need for enhanced public and private security, coupled with the growing adoption of smart city initiatives. Technological advancements, particularly in AI and IoT, are enabling more intelligent and integrated surveillance solutions. The declining cost of advanced hardware and the increasing demand for data-driven insights further fuel market expansion.

- Key Drivers:

- Rising crime rates and security concerns.

- Government investments in national security and smart cities.

- Technological innovations in AI, IoT, and cloud computing.

- Increasing demand for data analytics and business intelligence from video feeds.

- Cost-effectiveness of advanced surveillance systems.

However, the market faces significant barriers and challenges. Stringent data privacy regulations and concerns over the ethical use of facial recognition technology can lead to implementation hurdles and potential backlash. Cybersecurity threats to surveillance systems, including data breaches and system tampering, pose a constant risk. The high initial investment cost for sophisticated systems, particularly for small and medium-sized businesses, can also be a restraint.

- Key Barriers & Challenges:

- Evolving data privacy laws and ethical concerns (e.g., GDPR, CCPA implications).

- Cybersecurity vulnerabilities and the risk of data breaches.

- High initial capital expenditure for comprehensive systems.

- Lack of skilled personnel for installation, maintenance, and data analysis.

- Interoperability issues between different vendor systems.

- Public perception and potential for misuse of surveillance technology.

Emerging Opportunities in U.S Video Surveillance Market

Emerging opportunities in the U.S. Video Surveillance Market lie in the further integration of AI for predictive analytics and proactive threat identification. The expansion of edge computing allows for real-time processing of video data closer to the source, reducing latency and bandwidth requirements. The growing demand for privacy-preserving surveillance solutions, such as anonymization techniques and federated learning, presents a significant untapped market. Furthermore, the increasing adoption of video surveillance in niche sectors like agriculture for crop monitoring and livestock management, and in smart healthcare for patient monitoring and facility security, offers new avenues for growth.

Growth Accelerators in the U.S Video Surveillance Market Industry

Several factors are accelerating long-term growth in the U.S. Video Surveillance Market industry. The continuous evolution of Artificial Intelligence and Machine Learning algorithms is a major catalyst, enabling more sophisticated and accurate video analytics for applications beyond simple security. Strategic partnerships between hardware manufacturers, software developers, and cloud service providers are creating more integrated and comprehensive solutions. The ongoing development and deployment of 5G networks are facilitating higher bandwidth and lower latency, enabling real-time video streaming and advanced remote monitoring capabilities across the nation. Government initiatives promoting smart cities and public safety infrastructure also significantly boost market expansion.

Key Players Shaping the U.S Video Surveillance Market Market

- Axis Communications AB (Canon)

- Dahua Technology Co Ltd

- Hikvision Digital Technology Co Ltd

- Hanwha Techwin

- Honeywell Security Group

- Robert Bosch GmbH

- Schneider Electric SE

- Cisco Systems Inc

- Genetec Inc

- Verint Systems Inc

- NEC Corporation

- Panasonic Corporation

- FLIR Systems Inc

- Avigilon Corporation

- CP Plus International

- Qognify Inc

- Infinova Corporation

- Palantir Technologies

- Agent Video Intelligence Ltd

- Allied Telesis Inc

Notable Milestones in U.S Video Surveillance Market Sector

- July 2022: Konica Minolta Business Systems U.S.A., Inc. (Konica Minolta) developed a new promotion to raise understanding of its innovative security camera technologies. Its superhero concept echoes the hero/villain dynamic, urging company owners and physical security teams to consider their businesses as communities for which they serve as superheroes and protectors.

- April 2022: Qognify introduced Qognify VMS, a modern video management framework. It is designed to meet the particular physical security needs of companies all around the globe. Furthermore, it is based on the proven functionality of Qognify's famous video monitoring system Cayuga, which is used in thousands of surveillance systems worldwide.

In-Depth U.S Video Surveillance Market Market Outlook

The U.S. Video Surveillance Market is on a trajectory of sustained and robust growth, underpinned by several powerful growth accelerators. The relentless advancement in AI-powered video analytics, moving beyond mere detection to prediction and prevention of incidents, is a primary driver. The increasing demand for integrated, end-to-end security solutions that seamlessly combine cameras, VMS, and advanced analytics is fostering strategic alliances and product development. The widespread deployment of 5G networks is set to revolutionize real-time data transmission, enabling more efficient and responsive surveillance systems, especially for mobile and distributed applications. The ongoing digitalization of industries and smart city initiatives will continue to create new demand centers, making the U.S. video surveillance market a highly dynamic and lucrative sector for the foreseeable future.

U.S Video Surveillance Market Segmentation

-

1. Type

- 1.1. Cameras

- 1.2. Video Management Systems and Storage

- 1.3. Video Analytics

-

2. End User

- 2.1. Commercial

- 2.2. Retail

- 2.3. National Infrastructure and City Surveillance

- 2.4. Transportation

- 2.5. Residential

- 2.6. Other End Users

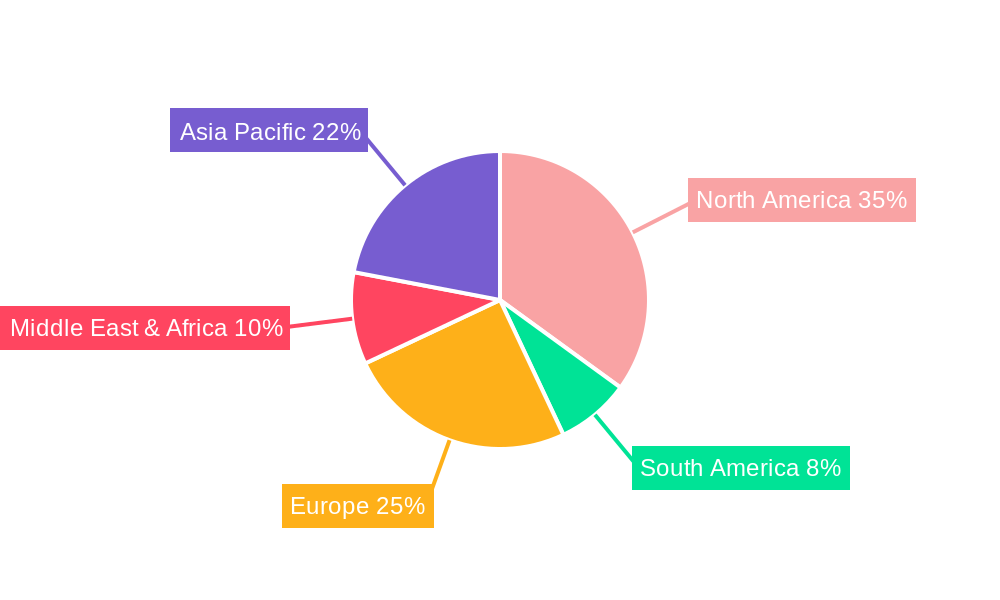

U.S Video Surveillance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

U.S Video Surveillance Market Regional Market Share

Geographic Coverage of U.S Video Surveillance Market

U.S Video Surveillance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Diminishing IP Camera Prices

- 3.2.2 Coupled with Technological Advancements in Analytics and Software; Emergence of Video Surveillance-as-a-Service (VSaaS) as a Viable Commercial Model

- 3.3. Market Restrains

- 3.3.1. High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity

- 3.4. Market Trends

- 3.4.1. Video Analytics to Witness Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global U.S Video Surveillance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cameras

- 5.1.2. Video Management Systems and Storage

- 5.1.3. Video Analytics

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Commercial

- 5.2.2. Retail

- 5.2.3. National Infrastructure and City Surveillance

- 5.2.4. Transportation

- 5.2.5. Residential

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America U.S Video Surveillance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cameras

- 6.1.2. Video Management Systems and Storage

- 6.1.3. Video Analytics

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Commercial

- 6.2.2. Retail

- 6.2.3. National Infrastructure and City Surveillance

- 6.2.4. Transportation

- 6.2.5. Residential

- 6.2.6. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America U.S Video Surveillance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cameras

- 7.1.2. Video Management Systems and Storage

- 7.1.3. Video Analytics

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Commercial

- 7.2.2. Retail

- 7.2.3. National Infrastructure and City Surveillance

- 7.2.4. Transportation

- 7.2.5. Residential

- 7.2.6. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe U.S Video Surveillance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cameras

- 8.1.2. Video Management Systems and Storage

- 8.1.3. Video Analytics

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Commercial

- 8.2.2. Retail

- 8.2.3. National Infrastructure and City Surveillance

- 8.2.4. Transportation

- 8.2.5. Residential

- 8.2.6. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa U.S Video Surveillance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cameras

- 9.1.2. Video Management Systems and Storage

- 9.1.3. Video Analytics

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Commercial

- 9.2.2. Retail

- 9.2.3. National Infrastructure and City Surveillance

- 9.2.4. Transportation

- 9.2.5. Residential

- 9.2.6. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific U.S Video Surveillance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cameras

- 10.1.2. Video Management Systems and Storage

- 10.1.3. Video Analytics

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Commercial

- 10.2.2. Retail

- 10.2.3. National Infrastructure and City Surveillance

- 10.2.4. Transportation

- 10.2.5. Residential

- 10.2.6. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Infinova Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Avigilon Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hanwha Techwin

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Palantir Technologies

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CP Plus International

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Qognify Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Honeywell Security Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cisco Systems Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schneider Electric SE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Genetec Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Verint Systems Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 NEC Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Axis Communications AB (Canon)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Robert Bosch GmbH

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Agent Video Intelligence Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Allied Telesis Inc

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Hikvision Digital Technology Co Ltd

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Dahua Technology Co Ltd

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 FLIR Systems Inc

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Panasonic Corporation

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Infinova Corporation

List of Figures

- Figure 1: Global U.S Video Surveillance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America U.S Video Surveillance Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America U.S Video Surveillance Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America U.S Video Surveillance Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America U.S Video Surveillance Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America U.S Video Surveillance Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America U.S Video Surveillance Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America U.S Video Surveillance Market Revenue (Million), by Type 2025 & 2033

- Figure 9: South America U.S Video Surveillance Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America U.S Video Surveillance Market Revenue (Million), by End User 2025 & 2033

- Figure 11: South America U.S Video Surveillance Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: South America U.S Video Surveillance Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America U.S Video Surveillance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe U.S Video Surveillance Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe U.S Video Surveillance Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe U.S Video Surveillance Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Europe U.S Video Surveillance Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe U.S Video Surveillance Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe U.S Video Surveillance Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa U.S Video Surveillance Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa U.S Video Surveillance Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa U.S Video Surveillance Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Middle East & Africa U.S Video Surveillance Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East & Africa U.S Video Surveillance Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa U.S Video Surveillance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific U.S Video Surveillance Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific U.S Video Surveillance Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific U.S Video Surveillance Market Revenue (Million), by End User 2025 & 2033

- Figure 29: Asia Pacific U.S Video Surveillance Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Asia Pacific U.S Video Surveillance Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific U.S Video Surveillance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global U.S Video Surveillance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global U.S Video Surveillance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global U.S Video Surveillance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global U.S Video Surveillance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global U.S Video Surveillance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global U.S Video Surveillance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global U.S Video Surveillance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global U.S Video Surveillance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global U.S Video Surveillance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global U.S Video Surveillance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global U.S Video Surveillance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Global U.S Video Surveillance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global U.S Video Surveillance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global U.S Video Surveillance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 30: Global U.S Video Surveillance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global U.S Video Surveillance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global U.S Video Surveillance Market Revenue Million Forecast, by End User 2020 & 2033

- Table 39: Global U.S Video Surveillance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific U.S Video Surveillance Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.S Video Surveillance Market?

The projected CAGR is approximately 12.30%.

2. Which companies are prominent players in the U.S Video Surveillance Market?

Key companies in the market include Infinova Corporation, Avigilon Corporation, Hanwha Techwin, Palantir Technologies, CP Plus International, Qognify Inc , Honeywell Security Group, Cisco Systems Inc, Schneider Electric SE, Genetec Inc, Verint Systems Inc, NEC Corporation, Axis Communications AB (Canon), Robert Bosch GmbH, Agent Video Intelligence Ltd, Allied Telesis Inc, Hikvision Digital Technology Co Ltd, Dahua Technology Co Ltd, FLIR Systems Inc, Panasonic Corporation.

3. What are the main segments of the U.S Video Surveillance Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Diminishing IP Camera Prices. Coupled with Technological Advancements in Analytics and Software; Emergence of Video Surveillance-as-a-Service (VSaaS) as a Viable Commercial Model.

6. What are the notable trends driving market growth?

Video Analytics to Witness Significant Market Growth.

7. Are there any restraints impacting market growth?

High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity.

8. Can you provide examples of recent developments in the market?

July 2022: Konica Minolta Business Systems U.S.A., Inc. (Konica Minolta) developed a new promotion to raise understanding of its innovative security camera technologies. Its superhero concept echoes the hero/villain dynamic, urging company owners and physical security teams to consider their businesses as communities for which they serve as superheroes and protectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.S Video Surveillance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.S Video Surveillance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.S Video Surveillance Market?

To stay informed about further developments, trends, and reports in the U.S Video Surveillance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence