Key Insights

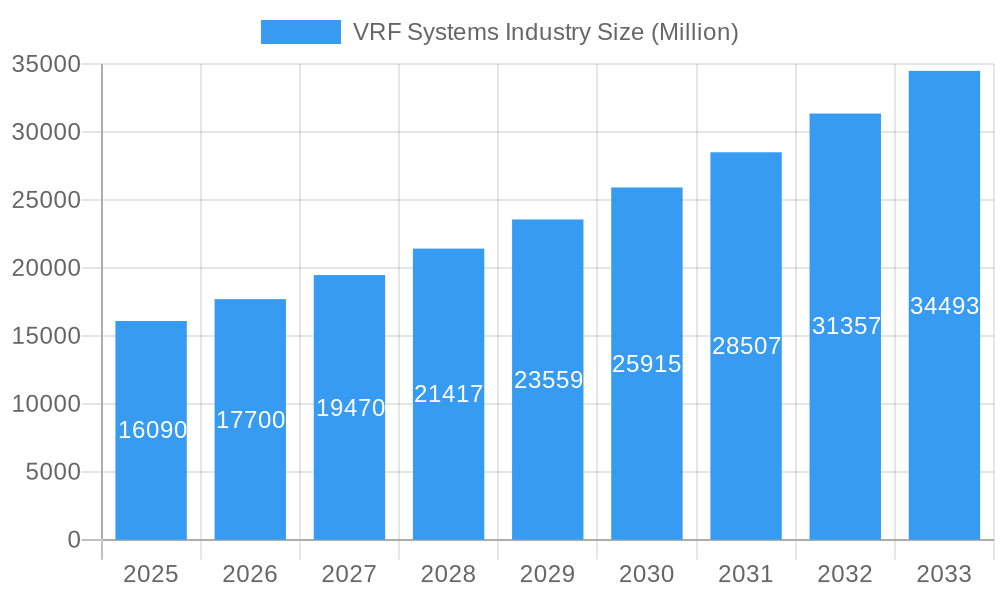

The Variable Refrigerant Flow (VRF) Systems market is poised for significant expansion, with a projected market size of USD 16.09 billion in 2025. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 11%, indicating sustained demand and innovation within the sector. Key drivers fueling this surge include the escalating need for energy-efficient HVAC solutions across residential, commercial, and industrial applications. The inherent flexibility, zoning capabilities, and simultaneous heating and cooling functionalities of VRF systems make them an increasingly attractive alternative to traditional HVAC setups. Furthermore, growing awareness of environmental regulations and the demand for reduced carbon footprints are propelling the adoption of advanced VRF technologies. The market is witnessing a clear trend towards smart and connected VRF systems, integrating IoT capabilities for enhanced control, diagnostics, and energy management. This technological evolution, coupled with increasing urbanization and construction activities globally, will continue to shape the market landscape.

VRF Systems Industry Market Size (In Billion)

Despite the strong growth prospects, certain restraints could influence market dynamics. The initial high upfront cost of VRF systems, compared to some conventional HVAC options, might pose a barrier for smaller businesses or budget-conscious residential projects. Additionally, the complexity of installation and the requirement for specialized technicians could present challenges in certain regions. However, the long-term operational cost savings and superior performance are increasingly outweighing these initial concerns. The market is segmented by components such as outdoor units and indoor units, with the ongoing development and optimization of both playing a crucial role. End-user segments—Industrial, Commercial, and Residential—are all contributing to the market's expansion, with commercial and industrial sectors often leading in adoption due to their larger scale and higher energy consumption needs. Major industry players like Panasonic, Daikin, Midea Group, Lennox, Carrier, Fujitsu, Mitsubishi Electric, LG Electronics, and Samsung Electronics are actively investing in research and development to introduce more sophisticated and sustainable VRF solutions, further solidifying the market's positive outlook.

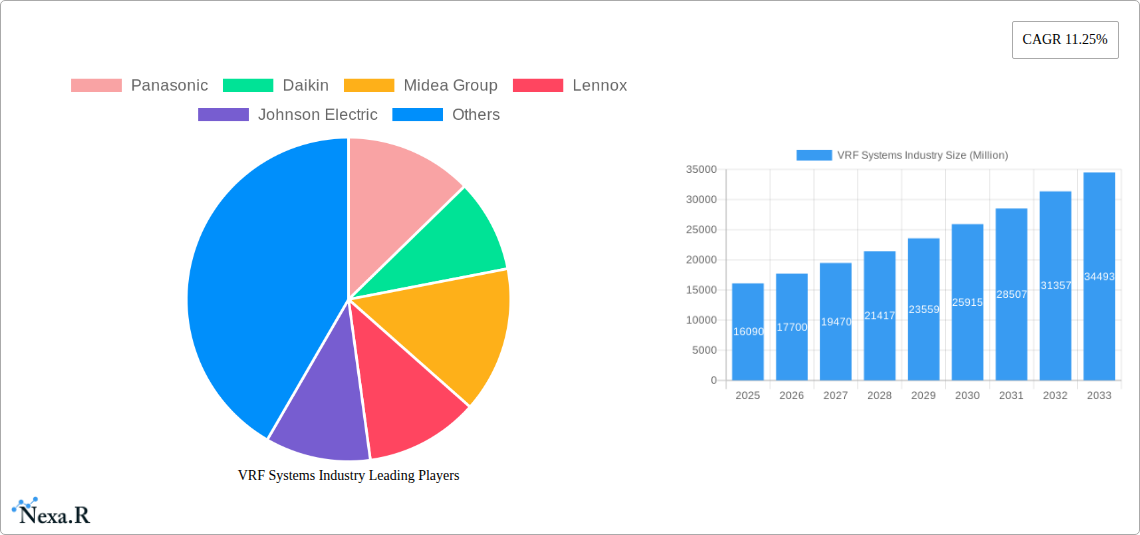

VRF Systems Industry Company Market Share

Comprehensive VRF Systems Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This in-depth report provides an exhaustive analysis of the Variable Refrigerant Flow (VRF) Systems industry, charting its evolution from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study offers unparalleled insights into market dynamics, key growth drivers, dominant regions, technological advancements, and the competitive landscape. We delve into both parent and child market segments, examining the intricate interplay of components like outdoor and indoor units, and end-user segments including industrial, commercial, and residential applications. This report is an essential resource for industry professionals, investors, and stakeholders seeking to understand and capitalize on the burgeoning VRF market.

VRF Systems Industry Market Dynamics & Structure

The VRF systems industry exhibits a moderately concentrated market structure, characterized by the significant presence of a few major global players, including Panasonic, Daikin, Midea Group, Lennox, Johnson Electric, Carrier, Fujitsu, Mitsubishi Electric, LG Electronics, and Samsung Electronics. These companies collectively hold a substantial market share, driving innovation and setting industry benchmarks. Technological innovation is a paramount driver, with ongoing advancements in energy efficiency, smart controls, and system scalability continually pushing the boundaries of VRF technology. The integration of IoT and AI for enhanced building management and predictive maintenance represents a key area of R&D investment. Regulatory frameworks, particularly those focusing on energy conservation and refrigerant emissions reduction, play a crucial role in shaping market demand and product development. Stricter environmental regulations are accelerating the adoption of highly efficient VRF solutions. Competitive product substitutes, such as traditional split systems and central HVAC, are present but increasingly challenged by the superior performance and flexibility of VRF in diverse applications. End-user demographics are shifting, with a growing demand for customized and energy-efficient climate control solutions across all sectors. The residential segment, in particular, is witnessing increased adoption due to rising disposable incomes and a greater awareness of energy costs. Mergers and acquisitions (M&A) activity, while not as prolific as in more mature industries, is present, often focused on acquiring specialized technologies or expanding geographical reach. For instance, strategic acquisitions of smart building technology firms can significantly enhance the offerings of VRF manufacturers. Barriers to innovation include the high cost of advanced R&D, the need for skilled installation and maintenance personnel, and the complexity of system integration in large-scale projects.

VRF Systems Industry Growth Trends & Insights

The VRF systems industry is poised for robust growth, projected to expand significantly from an estimated $XX billion in 2025 to $XX billion by 2033. This expansion is underpinned by a compound annual growth rate (CAGR) of approximately XX% during the forecast period (2025-2033). The increasing adoption rates, particularly in emerging economies and in sectors demanding high energy efficiency, are key contributors to this upward trajectory. Technological disruptions are profoundly impacting the market, with the integration of advanced control systems, IoT capabilities, and AI-driven analytics enhancing system performance, energy savings, and user experience. These innovations are not only improving operational efficiency but also driving new revenue streams through value-added services like remote diagnostics and predictive maintenance. Consumer behavior shifts are also playing a pivotal role. There is a discernible trend towards greater environmental consciousness and a desire for optimized indoor comfort, leading building owners and developers to favor energy-efficient and flexible HVAC solutions like VRF. The escalating cost of energy globally further amplifies the appeal of VRF systems, which offer substantial operational cost savings compared to conventional HVAC technologies. Market penetration is steadily increasing across all end-user segments, with commercial and industrial sectors leading the charge due to their larger-scale requirements and significant energy consumption. However, the residential segment is rapidly gaining traction as homeowners become more aware of VRF's benefits. The study period of 2019-2033, with a deep dive into the historical performance from 2019-2024 and a strong focus on the forecast period of 2025-2033, allows for a comprehensive understanding of the forces shaping market evolution. This includes analyzing the impact of global events on supply chains and demand, and the subsequent recovery and growth trajectories observed. The market is also being influenced by evolving building codes and standards that increasingly mandate energy-efficient HVAC solutions, making VRF systems a preferred choice for new constructions and retrofits. The continuous development of inverter technology, allowing for precise temperature control and reduced energy wastage, remains a cornerstone of VRF system efficiency and a key selling proposition driving sustained demand.

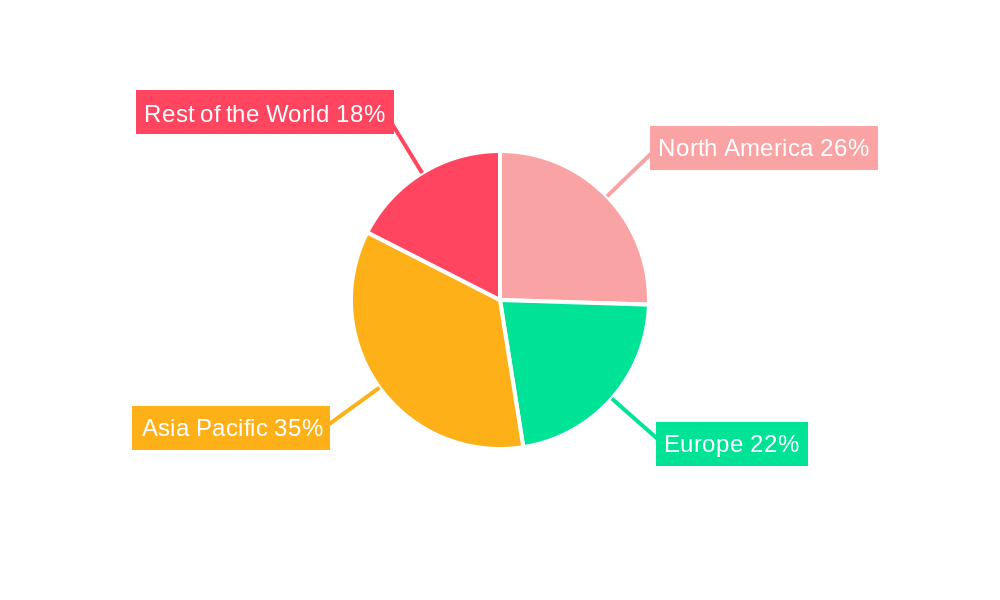

Dominant Regions, Countries, or Segments in VRF Systems Industry

Asia Pacific is emerging as the dominant region in the VRF systems industry, driven by rapid industrialization, urbanization, and increasing disposable incomes across countries like China, India, and Southeast Asian nations. The region's robust economic policies and substantial infrastructure development initiatives are creating a fertile ground for the adoption of advanced HVAC solutions. China, in particular, is a powerhouse in both manufacturing and consumption of VRF systems, accounting for a significant portion of the global market share. The country's strong emphasis on energy efficiency and the development of smart cities are further propelling VRF sales.

In terms of end-user segments, the Commercial sector currently holds the largest market share and is expected to continue its dominance throughout the forecast period. This is attributed to the widespread application of VRF systems in office buildings, hotels, retail spaces, and hospitals, where precise temperature control, energy efficiency, and zoning capabilities are paramount. The ability of VRF systems to cater to diverse occupancy schedules and cooling/heating demands in large commercial complexes makes them an ideal choice.

Within the Component market, Outdoor Units represent a critical segment, often dictating the overall capacity and efficiency of a VRF system. The demand for advanced, high-efficiency outdoor units with improved refrigerants and robust designs is a key driver of growth in this segment.

Key drivers fueling the dominance of Asia Pacific and the commercial segment include:

- Economic Growth and Urbanization: Rapid economic development in Asia Pacific fuels construction of commercial buildings and infrastructure, directly increasing demand for HVAC solutions.

- Energy Efficiency Mandates: Governments worldwide, especially in developed and developing Asian economies, are implementing stringent energy efficiency regulations, making VRF systems the preferred choice for compliance.

- Technological Advancements: Manufacturers are continually innovating, offering VRF systems with enhanced features like smart connectivity, improved heat recovery, and quieter operation, which are highly sought after in the commercial sector.

- Government Incentives and Subsidies: In many regions, governments offer incentives for adopting energy-efficient technologies, further stimulating VRF market growth.

- Growth Potential: The relatively lower market penetration of VRF systems in many developing countries within Asia Pacific presents significant untapped growth potential.

The Industrial segment is also witnessing substantial growth, driven by the need for precise temperature and humidity control in manufacturing processes, data centers, and warehouses. The Residential segment, while historically smaller, is projected to experience the highest growth rate as consumer awareness of VRF benefits, such as individual zone control and energy savings, increases. The ongoing evolution of product offerings, including compact and aesthetically pleasing indoor units, is making VRF systems more accessible and attractive for residential applications.

VRF Systems Industry Product Landscape

The VRF systems industry is defined by a relentless pursuit of innovation in product design and functionality. Manufacturers are actively developing VRF systems with enhanced energy efficiency ratings, often exceeding traditional HVAC systems by significant margins. Advanced inverter compressor technology is a cornerstone, allowing for precise load matching and substantial energy savings. Unique selling propositions include the modularity of systems, enabling scalability for buildings of varying sizes, and the sophisticated zoning capabilities that provide individualized climate control for different areas, optimizing comfort and reducing energy waste. Innovations in heat recovery VRF (HR-VRF) systems are gaining traction, enabling simultaneous heating and cooling with a high degree of energy efficiency by transferring heat between zones. Furthermore, the integration of smart controls and connectivity features, allowing for remote monitoring, diagnostics, and integration with Building Management Systems (BMS), is transforming the operational performance and user experience of VRF systems. The development of refrigerants with lower Global Warming Potential (GWP) is also a key focus area, addressing environmental concerns and meeting evolving regulatory requirements.

Key Drivers, Barriers & Challenges in VRF Systems Industry

Key Drivers:

- Growing Demand for Energy Efficiency: Escalating energy costs and stringent environmental regulations are major catalysts, pushing consumers and businesses towards energy-saving VRF solutions.

- Technological Advancements: Continuous innovation in inverter technology, smart controls, and heat recovery systems enhances performance and appeal.

- Increasing Urbanization and Construction: Rapid urban development globally fuels demand for advanced HVAC systems in commercial and residential buildings.

- Versatility and Flexibility: VRF systems offer superior zoning capabilities and suitability for diverse building types, from high-rises to individual homes.

- Government Initiatives: Favorable policies, incentives, and building codes promoting energy-efficient technologies accelerate market adoption.

Barriers & Challenges:

- High Initial Cost: The upfront investment for VRF systems can be higher compared to traditional HVAC solutions, posing a barrier for some segments.

- Skilled Labor Requirement: Installation, maintenance, and servicing of VRF systems require specialized training and expertise, leading to a shortage of qualified technicians.

- Complexity of Installation: Larger and more complex VRF installations require meticulous planning and execution, increasing project timelines and costs.

- Refrigerant Management: Evolving regulations regarding refrigerants and the need for environmentally friendly alternatives present ongoing research and development challenges.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of key components, affecting project timelines and profitability.

Emerging Opportunities in VRF Systems Industry

Emerging opportunities in the VRF systems industry lie in the expansion into developing economies with a growing middle class and increasing construction activities. Smart building integration presents a significant avenue, with VRF systems becoming central to holistic building management, offering advanced analytics and predictive maintenance. The development and adoption of VRF systems utilizing next-generation, low-GWP refrigerants represent a crucial opportunity to align with environmental goals and capture market share. Furthermore, the increasing demand for decentralized HVAC solutions in specific industrial applications, such as clean rooms and specialized manufacturing environments requiring precise climate control, offers niche market potential. Innovative financing models and "as-a-service" offerings for VRF systems could also unlock new customer segments, particularly for smaller businesses and residential property owners.

Growth Accelerators in the VRF Systems Industry Industry

Long-term growth in the VRF systems industry is being significantly accelerated by several key factors. Continuous technological breakthroughs in areas like AI-powered predictive maintenance, enhanced energy recovery efficiencies, and the development of more compact and aesthetically pleasing indoor units are making VRF systems more competitive and desirable. Strategic partnerships between VRF manufacturers and smart home technology providers, as well as building management system developers, are creating integrated solutions that offer unparalleled convenience and control. Furthermore, market expansion strategies focused on educating consumers and specifiers about the long-term cost savings and performance benefits of VRF are driving adoption, particularly in regions where the technology is less established. The ongoing push towards net-zero energy buildings and sustainable construction practices also acts as a powerful accelerator, positioning VRF systems as a key component of future building design.

Key Players Shaping the VRF Systems Industry Market

- Panasonic

- Daikin

- Midea Group

- Lennox

- Johnson Electric

- Carrier

- Fujitsu

- Mitsubishi Electric

- LG Electronics

- Samsung Electronics

Notable Milestones in VRF Systems Industry Sector

- 2019: Introduction of VRF systems with significantly lower Global Warming Potential (GWP) refrigerants by leading manufacturers, aligning with evolving environmental regulations.

- 2020: Widespread adoption of IoT and AI-enabled controls in VRF systems, enabling remote diagnostics, predictive maintenance, and enhanced energy management.

- 2021: Significant growth in heat recovery VRF (HR-VRF) system adoption, maximizing energy efficiency through simultaneous heating and cooling.

- 2022: Major manufacturers expand their product portfolios with more compact and aesthetically integrated indoor units to cater to the residential market.

- 2023: Increased investment in research and development for VRF systems designed for data centers and other specialized industrial applications requiring precise climate control.

- 2024: Enhanced focus on cybersecurity features for connected VRF systems to protect against potential network threats.

- 2025 (Projected): Launch of VRF systems with advanced features for integration into smart grid technologies, contributing to overall energy management.

In-Depth VRF Systems Industry Market Outlook

The future outlook for the VRF systems industry is exceptionally promising, driven by a confluence of strong growth accelerators. The market is set to benefit from continued technological innovation, particularly in the realm of intelligent control systems and sustainable refrigerant development. Strategic alliances and market expansion initiatives are crucial for penetrating new geographical territories and end-user segments. The increasing global commitment to energy efficiency and carbon emission reduction will continue to favor VRF systems, positioning them as a critical solution for sustainable building practices. Opportunities abound in untapped markets and in the development of specialized VRF solutions for niche applications, further solidifying the industry's growth trajectory and its importance in shaping the future of climate control.

VRF Systems Industry Segmentation

-

1. Component

- 1.1. Outdoor Units

- 1.2. Indoor Units

-

2. End User

- 2.1. Industrial

- 2.2. Commercial

- 2.3. Residential

VRF Systems Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

VRF Systems Industry Regional Market Share

Geographic Coverage of VRF Systems Industry

VRF Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Attractive Economic & Environmental Benefits of HVAC VRF Systems to Foster Growth; VRF systems have a high potential for energy savings and need little to no maintenance

- 3.3. Market Restrains

- 3.3.1. High Initial Costs; Growing Competition to Limit Margin

- 3.4. Market Trends

- 3.4.1. Residential Segments Plays a Prominent role in Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global VRF Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Outdoor Units

- 5.1.2. Indoor Units

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Industrial

- 5.2.2. Commercial

- 5.2.3. Residential

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America VRF Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Outdoor Units

- 6.1.2. Indoor Units

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Industrial

- 6.2.2. Commercial

- 6.2.3. Residential

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe VRF Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Outdoor Units

- 7.1.2. Indoor Units

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Industrial

- 7.2.2. Commercial

- 7.2.3. Residential

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific VRF Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Outdoor Units

- 8.1.2. Indoor Units

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Industrial

- 8.2.2. Commercial

- 8.2.3. Residential

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Rest of the World VRF Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Outdoor Units

- 9.1.2. Indoor Units

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Industrial

- 9.2.2. Commercial

- 9.2.3. Residential

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Panasonic

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Daikin

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Midea Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Lennox

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Johnson Electric

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Carrier

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Fujitsu

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Mitsubishi Electric

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 LG Electronics

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Samsung Electronics

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Panasonic

List of Figures

- Figure 1: Global VRF Systems Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America VRF Systems Industry Revenue (undefined), by Component 2025 & 2033

- Figure 3: North America VRF Systems Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America VRF Systems Industry Revenue (undefined), by End User 2025 & 2033

- Figure 5: North America VRF Systems Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America VRF Systems Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America VRF Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe VRF Systems Industry Revenue (undefined), by Component 2025 & 2033

- Figure 9: Europe VRF Systems Industry Revenue Share (%), by Component 2025 & 2033

- Figure 10: Europe VRF Systems Industry Revenue (undefined), by End User 2025 & 2033

- Figure 11: Europe VRF Systems Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe VRF Systems Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe VRF Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific VRF Systems Industry Revenue (undefined), by Component 2025 & 2033

- Figure 15: Asia Pacific VRF Systems Industry Revenue Share (%), by Component 2025 & 2033

- Figure 16: Asia Pacific VRF Systems Industry Revenue (undefined), by End User 2025 & 2033

- Figure 17: Asia Pacific VRF Systems Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific VRF Systems Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific VRF Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World VRF Systems Industry Revenue (undefined), by Component 2025 & 2033

- Figure 21: Rest of the World VRF Systems Industry Revenue Share (%), by Component 2025 & 2033

- Figure 22: Rest of the World VRF Systems Industry Revenue (undefined), by End User 2025 & 2033

- Figure 23: Rest of the World VRF Systems Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Rest of the World VRF Systems Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World VRF Systems Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global VRF Systems Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 2: Global VRF Systems Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global VRF Systems Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global VRF Systems Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 5: Global VRF Systems Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global VRF Systems Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global VRF Systems Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 8: Global VRF Systems Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 9: Global VRF Systems Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global VRF Systems Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 11: Global VRF Systems Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: Global VRF Systems Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global VRF Systems Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 14: Global VRF Systems Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Global VRF Systems Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the VRF Systems Industry?

The projected CAGR is approximately 11%.

2. Which companies are prominent players in the VRF Systems Industry?

Key companies in the market include Panasonic, Daikin, Midea Group, Lennox, Johnson Electric, Carrier, Fujitsu, Mitsubishi Electric, LG Electronics, Samsung Electronics.

3. What are the main segments of the VRF Systems Industry?

The market segments include Component, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Attractive Economic & Environmental Benefits of HVAC VRF Systems to Foster Growth; VRF systems have a high potential for energy savings and need little to no maintenance.

6. What are the notable trends driving market growth?

Residential Segments Plays a Prominent role in Market Growth.

7. Are there any restraints impacting market growth?

High Initial Costs; Growing Competition to Limit Margin.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "VRF Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the VRF Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the VRF Systems Industry?

To stay informed about further developments, trends, and reports in the VRF Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence