Key Insights

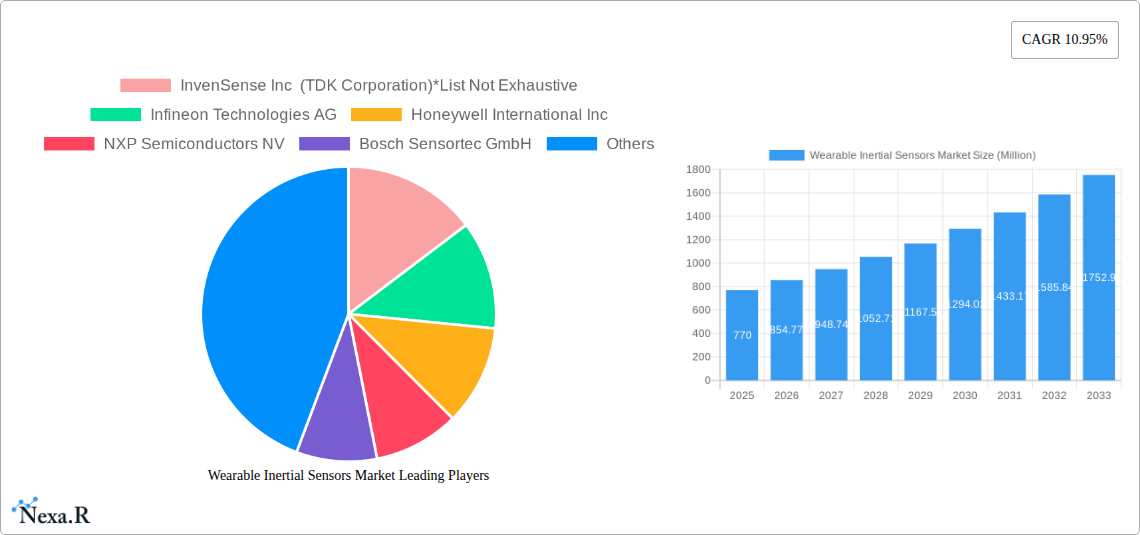

The Wearable Inertial Sensors Market is poised for significant expansion, projected to reach \$0.77 billion in 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 10.95% through 2033. This burgeoning market is primarily driven by the escalating demand for advanced consumer electronics, particularly smartwatches and fitness bands, which increasingly integrate inertial sensors for enhanced functionality like motion tracking, activity monitoring, and user interface control. The healthcare sector is also a major catalyst, with wearable inertial sensors enabling remote patient monitoring, rehabilitation tracking, and the development of sophisticated medical devices for diagnostics and therapeutic interventions. Furthermore, the burgeoning sports and fitness industry is leveraging these sensors for performance analysis, injury prevention, and personalized training programs, further fueling market growth. The continuous miniaturization and improved power efficiency of these sensors are making them indispensable components in a wider array of wearable devices.

Wearable Inertial Sensors Market Market Size (In Million)

The market's trajectory is further shaped by key trends such as the integration of AI and machine learning with wearable sensor data to offer predictive analytics and personalized insights. The development of novel sensor materials and fabrication techniques is also contributing to improved accuracy, reduced cost, and enhanced durability of wearable devices. While the market exhibits strong growth potential, certain restraints need to be addressed. These include the increasing complexity of data analysis and the need for robust data security and privacy measures, particularly in healthcare applications. Moreover, the high cost of research and development for cutting-edge inertial sensor technology can pose a barrier for smaller players. Despite these challenges, the widespread adoption of smart textiles, advanced sports gear, and government initiatives promoting digital health solutions are expected to create substantial opportunities for market expansion in the coming years.

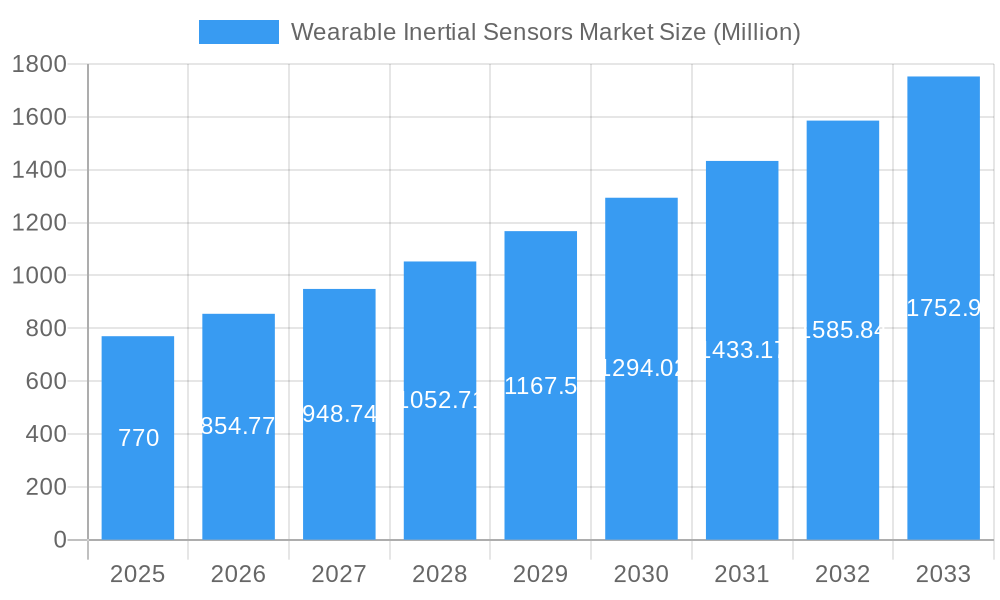

Wearable Inertial Sensors Market Company Market Share

This comprehensive report delves into the dynamic wearable inertial sensors market, projecting robust growth from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. We analyze the intricate market structure, key growth drivers, dominant segments, and the competitive landscape of inertial sensors for smartwatches, fitness trackers, smart clothing, and advanced healthcare applications. Gain critical insights into market trends, technological advancements, and emerging opportunities that are shaping the future of personalized technology and remote monitoring. This report quantifies market evolution in million units, offering unparalleled strategic intelligence for stakeholders.

Wearable Inertial Sensors Market Market Dynamics & Structure

The wearable inertial sensors market is characterized by a moderate to high degree of fragmentation, driven by continuous technological innovation and the increasing demand for sophisticated motion tracking and sensing capabilities in consumer electronics, healthcare, and sports. Key drivers include the miniaturization of sensors, advancements in Artificial Intelligence (AI) for data interpretation, and the growing emphasis on personalized health and fitness. Regulatory frameworks, particularly concerning data privacy and medical device certification, play a crucial role in shaping product development and market access. Competitive product substitutes, such as optical and magnetic sensors, exist but are often complemented by inertial sensors to achieve comprehensive motion analysis. End-user demographics are rapidly expanding beyond young, tech-savvy consumers to include an aging population seeking health monitoring solutions and professional athletes aiming for performance optimization. Mergers and acquisitions (M&A) activity remains a significant trend, with larger semiconductor companies acquiring innovative sensor technology providers to strengthen their portfolios.

- Market Concentration: Moderate to high fragmentation with a mix of large, established players and agile, specialized sensor manufacturers.

- Technological Innovation Drivers: Miniaturization, low power consumption, enhanced accuracy, AI integration for gesture recognition and activity classification, and improved sensor fusion capabilities.

- Regulatory Frameworks: Data privacy regulations (e.g., GDPR, CCPA), medical device compliance standards (e.g., FDA, CE marking) are critical for healthcare applications.

- Competitive Product Substitutes: Optical sensors, magnetic sensors, and other environmental sensors that can augment or, in specific use cases, partially replace inertial sensing.

- End-User Demographics: Broadening appeal across age groups, from fitness enthusiasts and gamers to elderly individuals and patients requiring remote monitoring.

- M&A Trends: Strategic acquisitions of specialized sensor IP and technology companies by larger semiconductor and electronics manufacturers to consolidate market position and expand product offerings.

Wearable Inertial Sensors Market Growth Trends & Insights

The wearable inertial sensors market is poised for significant expansion, driven by the escalating adoption of smart wearables across diverse consumer segments. Market size evolution is directly correlated with the increasing integration of inertial sensors into smartwatches, fitness bands, and the burgeoning smart clothing sector. Adoption rates are accelerating as consumers become more health-conscious and data-driven, seeking quantifiable insights into their physical activity, sleep patterns, and overall well-being. Technological disruptions, such as the development of highly accurate, low-power inertial measurement units (IMUs) and advancements in sensor fusion algorithms, are enabling more sophisticated applications, including advanced gesture recognition for touchless control and precise sports performance analysis. Consumer behavior shifts, characterized by a growing demand for personalized experiences and proactive health management, further fuel this growth. The increasing affordability and accessibility of wearable devices, coupled with their enhanced functionality, are democratizing access to advanced sensing technologies.

The projected CAGR for the wearable inertial sensors market is expected to be substantial, reflecting this confluence of technological innovation and escalating consumer demand. Market penetration is steadily increasing, moving beyond niche applications to become an integral component of everyday consumer electronics. The evolution from basic step counting to complex activity recognition, fall detection, and even subtle physiological monitoring showcases the transformative potential of inertial sensors. As manufacturers continue to embed these sensors into a wider array of devices, from children's educational toys to advanced industrial safety equipment, the market’s trajectory will be further amplified. The ability of these sensors to capture nuanced motion data is opening new avenues for virtual and augmented reality experiences, gaming, and rehabilitation therapies, all of which contribute to a robust and sustainable growth outlook.

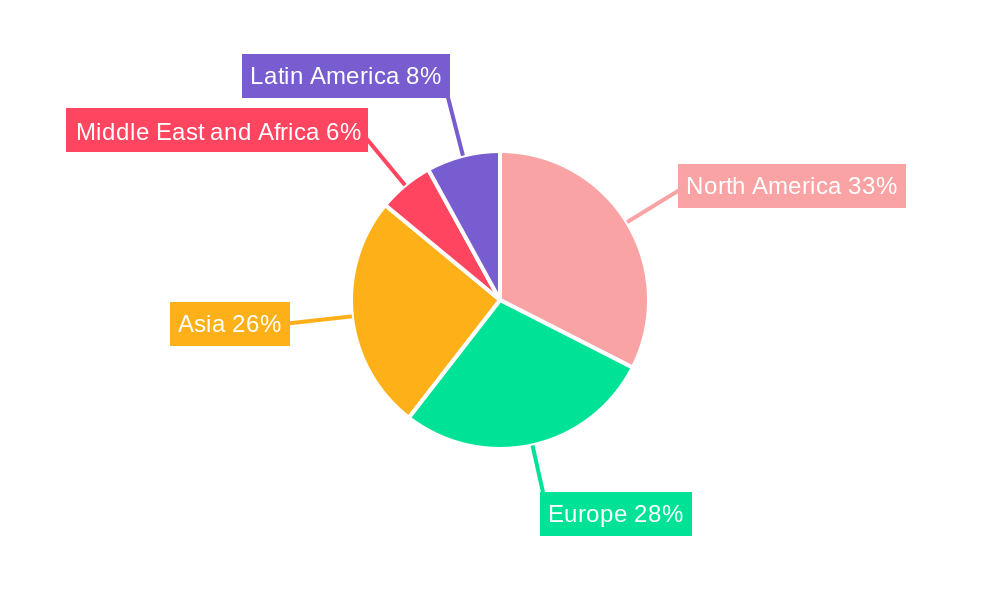

Dominant Regions, Countries, or Segments in Wearable Inertial Sensors Market

The North America region currently dominates the wearable inertial sensors market, driven by its high disposable income, early adoption of technology, and a strong emphasis on health and fitness trends. The United States, in particular, stands out due to its significant consumer electronics market, the presence of leading wearable device manufacturers, and robust research and development in the healthcare technology sector. Economic policies that encourage innovation and the widespread availability of advanced communication infrastructure further bolster North America's leading position. The Sports and Fitness end-user segment consistently drives demand, with a substantial portion of the market share attributed to fitness bands and smartwatches designed for activity tracking, training, and performance monitoring.

The Consumer Electronics segment also represents a major growth engine, fueled by the relentless innovation in smartwatches and other wearable gadgets that offer convenience, connectivity, and personalized experiences. Within the Product Type segment, Smart Watches and Fitness Bands/Activity Tracker collectively hold the largest market share. These devices rely heavily on inertial sensors for functionalities such as step counting, calorie estimation, sleep analysis, and various sports-specific metrics. The increasing integration of more advanced features, like fall detection and personalized coaching, further solidifies the dominance of these product categories.

Key drivers contributing to this regional and segment dominance include:

- High Consumer Spending Power: Enabling widespread adoption of premium wearable devices.

- Technological Savvy Population: Rapid embrace of new technologies and data-driven insights.

- Established Healthcare Infrastructure: Growing use of wearables for remote patient monitoring and chronic disease management.

- Strong Ecosystem of Manufacturers and Developers: Fostering continuous product innovation and market expansion.

- Aggressive Marketing and Awareness Campaigns: Educating consumers about the benefits of wearable technology.

Wearable Inertial Sensors Market Product Landscape

The product landscape of the wearable inertial sensors market is defined by a relentless pursuit of miniaturization, enhanced accuracy, and reduced power consumption. Innovations are centered around advanced Inertial Measurement Units (IMUs) that integrate accelerometers, gyroscopes, and sometimes magnetometers into single, compact packages. These sensors are crucial for enabling sophisticated applications like precise gesture recognition, advanced activity classification (e.g., distinguishing between running, cycling, and swimming), and fall detection in healthcare devices. The unique selling proposition of these advanced sensors lies in their ability to provide rich, nuanced motion data that can be leveraged for highly personalized user experiences and critical health monitoring. Technological advancements are also focusing on improving sensor fusion algorithms to combine data from multiple sensors for even greater accuracy and reliability.

Key Drivers, Barriers & Challenges in Wearable Inertial Sensors Market

Key Drivers:

- Growing Health Consciousness: Increasing consumer demand for personal health monitoring and fitness tracking.

- Technological Advancements: Miniaturization, lower power consumption, and improved accuracy of inertial sensors.

- Expanding Applications: Integration into smart clothing, sports equipment, and augmented reality (AR)/virtual reality (VR) devices.

- Rise of the IoT Ecosystem: Wearable inertial sensors are critical components of the interconnected Internet of Things.

- Demand for Gesture Control: Enabling touchless interaction with devices.

Barriers & Challenges:

- High Development Costs: Research and development for advanced sensor technology can be expensive.

- Battery Life Constraints: Power-hungry inertial sensors can impact overall device battery performance.

- Data Accuracy and Reliability: Ensuring consistent and accurate data collection across diverse environments and user activities.

- Privacy Concerns: Handling sensitive personal data collected by wearable devices.

- Supply Chain Disruptions: Global semiconductor shortages and manufacturing complexities can impact availability.

- Intense Competition: A crowded market with numerous players vying for market share.

Emerging Opportunities in Wearable Inertial Sensors Market

Emerging opportunities in the wearable inertial sensors market lie in the untapped potential of advanced healthcare applications and the burgeoning smart clothing sector. The increasing focus on remote patient monitoring for chronic diseases presents a significant avenue, where inertial sensors can track mobility, gait analysis, and even detect falls in elderly individuals, providing crucial data to caregivers and medical professionals. The integration of these sensors into smart textiles for continuous health tracking and performance analysis in sports is another promising frontier. Furthermore, advancements in AI-powered analytics are unlocking new possibilities for personalized coaching, predictive diagnostics, and immersive gaming experiences. Exploring niche markets such as industrial safety, where wearables can monitor worker movements and prevent accidents, also offers substantial growth potential.

Growth Accelerators in the Wearable Inertial Sensors Market Industry

Growth accelerators in the wearable inertial sensors market are primarily driven by transformative technological breakthroughs and strategic market expansion initiatives. The continuous innovation in miniaturization and power efficiency of Inertial Measurement Units (IMUs) is making them more viable for integration into a wider array of devices, including ultra-thin smart clothing and discreet medical patches. Furthermore, strategic partnerships between sensor manufacturers and leading wearable device brands are crucial for co-development and faster market penetration, ensuring that cutting-edge sensor technology is seamlessly integrated into user-friendly products. The growing trend of device convergence, where multiple functionalities are consolidated into single wearables, also acts as a significant accelerator, increasing the demand for sophisticated sensing capabilities.

Key Players Shaping the Wearable Inertial Sensors Market Market

- InvenSense Inc (TDK Corporation)

- Infineon Technologies AG

- Honeywell International Inc

- NXP Semiconductors NV

- Bosch Sensortec GmbH

- Knowles Electronics

- General Electric Co

- STMicroelectronics NV

- TE Connectivity Ltd

- Texas Instruments Incorporated

- Analog Devices Inc

- Panasonic Corporation

- AMS osram AG

Notable Milestones in Wearable Inertial Sensors Market Sector

- January 2023: Wearable Devices Ltd. established a partnership with a Fortune 500 communications equipment firm as an Independent Software Vendor ("ISV"). This collaboration aims to facilitate the integration of Mudra Neural Input technology into the partner's chipsets, offering a touchless input platform for wearable manufacturers powered by Mudra's sensors and AI.

- December 2022: Panasonic Industries introduced a new Grid-Eye sensor with a 90° lens, enhancing its field of vision (FoV) for improved people counting and tracking applications. This innovation reduces the number of sensors required and is praised for its privacy-conscious 64-pixel resolution.

In-Depth Wearable Inertial Sensors Market Market Outlook

The wearable inertial sensors market is poised for sustained growth, propelled by a confluence of technological advancements and evolving consumer demands. Future market potential is anchored in the continued integration of these sensors into emerging categories like smart clothing and advanced medical wearables. Strategic opportunities abound in developing highly specialized sensors for niche applications, such as rehabilitation therapy and industrial safety, where precision motion capture is paramount. The ongoing evolution of AI and machine learning algorithms will further enhance the value proposition of inertial sensors, enabling more sophisticated data interpretation and personalized user experiences. As the global population increasingly embraces health-conscious lifestyles and seeks convenient, data-driven solutions, the wearable inertial sensors market is set to witness significant expansion and innovation.

Wearable Inertial Sensors Market Segmentation

-

1. Product Type

- 1.1. Smart Watches

- 1.2. Fitness Bands/Activity Tracker

- 1.3. Smart Clothing

- 1.4. Sports Gear

- 1.5. Others

-

2. End-user Type

- 2.1. Healthcare

- 2.2. Sports and Fitness

- 2.3. Consumer electronics

- 2.4. Entertainment and Media

- 2.5. Government and Public Utilities

- 2.6. Others

Wearable Inertial Sensors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia and New Zealand

-

4. Middle East and Africa

- 4.1. United Arab Emirates

- 4.2. Saudi Arabia

- 4.3. Israel

-

5. Latin America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Mexico

Wearable Inertial Sensors Market Regional Market Share

Geographic Coverage of Wearable Inertial Sensors Market

Wearable Inertial Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing health awareness; Growing Demand for Wearable Fitness Monitors; Rapid Technology Advancements

- 3.3. Market Restrains

- 3.3.1. Security concerns; High cost of the devices

- 3.4. Market Trends

- 3.4.1. Consumer Electronics to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wearable Inertial Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Smart Watches

- 5.1.2. Fitness Bands/Activity Tracker

- 5.1.3. Smart Clothing

- 5.1.4. Sports Gear

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by End-user Type

- 5.2.1. Healthcare

- 5.2.2. Sports and Fitness

- 5.2.3. Consumer electronics

- 5.2.4. Entertainment and Media

- 5.2.5. Government and Public Utilities

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Middle East and Africa

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Wearable Inertial Sensors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Smart Watches

- 6.1.2. Fitness Bands/Activity Tracker

- 6.1.3. Smart Clothing

- 6.1.4. Sports Gear

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by End-user Type

- 6.2.1. Healthcare

- 6.2.2. Sports and Fitness

- 6.2.3. Consumer electronics

- 6.2.4. Entertainment and Media

- 6.2.5. Government and Public Utilities

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Wearable Inertial Sensors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Smart Watches

- 7.1.2. Fitness Bands/Activity Tracker

- 7.1.3. Smart Clothing

- 7.1.4. Sports Gear

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by End-user Type

- 7.2.1. Healthcare

- 7.2.2. Sports and Fitness

- 7.2.3. Consumer electronics

- 7.2.4. Entertainment and Media

- 7.2.5. Government and Public Utilities

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Wearable Inertial Sensors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Smart Watches

- 8.1.2. Fitness Bands/Activity Tracker

- 8.1.3. Smart Clothing

- 8.1.4. Sports Gear

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by End-user Type

- 8.2.1. Healthcare

- 8.2.2. Sports and Fitness

- 8.2.3. Consumer electronics

- 8.2.4. Entertainment and Media

- 8.2.5. Government and Public Utilities

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Wearable Inertial Sensors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Smart Watches

- 9.1.2. Fitness Bands/Activity Tracker

- 9.1.3. Smart Clothing

- 9.1.4. Sports Gear

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by End-user Type

- 9.2.1. Healthcare

- 9.2.2. Sports and Fitness

- 9.2.3. Consumer electronics

- 9.2.4. Entertainment and Media

- 9.2.5. Government and Public Utilities

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Latin America Wearable Inertial Sensors Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Smart Watches

- 10.1.2. Fitness Bands/Activity Tracker

- 10.1.3. Smart Clothing

- 10.1.4. Sports Gear

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by End-user Type

- 10.2.1. Healthcare

- 10.2.2. Sports and Fitness

- 10.2.3. Consumer electronics

- 10.2.4. Entertainment and Media

- 10.2.5. Government and Public Utilities

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 InvenSense Inc (TDK Corporation)*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Infineon Technologies AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Honeywell International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 NXP Semiconductors NV

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bosch Sensortec GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Knowles Electronics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 General Electric Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 STMicroelectronics NV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TE Connectivity Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Texas Instruments Incorporated

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Analog Devices Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Panasonic Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 AMS osram AG

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 InvenSense Inc (TDK Corporation)*List Not Exhaustive

List of Figures

- Figure 1: Global Wearable Inertial Sensors Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Wearable Inertial Sensors Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Wearable Inertial Sensors Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Wearable Inertial Sensors Market Revenue (Million), by End-user Type 2025 & 2033

- Figure 5: North America Wearable Inertial Sensors Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 6: North America Wearable Inertial Sensors Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Wearable Inertial Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Wearable Inertial Sensors Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Wearable Inertial Sensors Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Wearable Inertial Sensors Market Revenue (Million), by End-user Type 2025 & 2033

- Figure 11: Europe Wearable Inertial Sensors Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 12: Europe Wearable Inertial Sensors Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Wearable Inertial Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Wearable Inertial Sensors Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Wearable Inertial Sensors Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Wearable Inertial Sensors Market Revenue (Million), by End-user Type 2025 & 2033

- Figure 17: Asia Wearable Inertial Sensors Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 18: Asia Wearable Inertial Sensors Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Wearable Inertial Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Wearable Inertial Sensors Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Middle East and Africa Wearable Inertial Sensors Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East and Africa Wearable Inertial Sensors Market Revenue (Million), by End-user Type 2025 & 2033

- Figure 23: Middle East and Africa Wearable Inertial Sensors Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 24: Middle East and Africa Wearable Inertial Sensors Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Wearable Inertial Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Wearable Inertial Sensors Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Latin America Wearable Inertial Sensors Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Latin America Wearable Inertial Sensors Market Revenue (Million), by End-user Type 2025 & 2033

- Figure 29: Latin America Wearable Inertial Sensors Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 30: Latin America Wearable Inertial Sensors Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Wearable Inertial Sensors Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wearable Inertial Sensors Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Wearable Inertial Sensors Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 3: Global Wearable Inertial Sensors Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Wearable Inertial Sensors Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Wearable Inertial Sensors Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 6: Global Wearable Inertial Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Wearable Inertial Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Wearable Inertial Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Wearable Inertial Sensors Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Global Wearable Inertial Sensors Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 11: Global Wearable Inertial Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Wearable Inertial Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Wearable Inertial Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Wearable Inertial Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Wearable Inertial Sensors Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 16: Global Wearable Inertial Sensors Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 17: Global Wearable Inertial Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Wearable Inertial Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: India Wearable Inertial Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Wearable Inertial Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: South Korea Wearable Inertial Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Australia and New Zealand Wearable Inertial Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Wearable Inertial Sensors Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 24: Global Wearable Inertial Sensors Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 25: Global Wearable Inertial Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: United Arab Emirates Wearable Inertial Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Saudi Arabia Wearable Inertial Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Israel Wearable Inertial Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Wearable Inertial Sensors Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 30: Global Wearable Inertial Sensors Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 31: Global Wearable Inertial Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Wearable Inertial Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Wearable Inertial Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Mexico Wearable Inertial Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wearable Inertial Sensors Market?

The projected CAGR is approximately 10.95%.

2. Which companies are prominent players in the Wearable Inertial Sensors Market?

Key companies in the market include InvenSense Inc (TDK Corporation)*List Not Exhaustive, Infineon Technologies AG, Honeywell International Inc, NXP Semiconductors NV, Bosch Sensortec GmbH, Knowles Electronics, General Electric Co, STMicroelectronics NV, TE Connectivity Ltd, Texas Instruments Incorporated, Analog Devices Inc, Panasonic Corporation, AMS osram AG.

3. What are the main segments of the Wearable Inertial Sensors Market?

The market segments include Product Type, End-user Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing health awareness; Growing Demand for Wearable Fitness Monitors; Rapid Technology Advancements.

6. What are the notable trends driving market growth?

Consumer Electronics to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Security concerns; High cost of the devices.

8. Can you provide examples of recent developments in the market?

January 2023 - Wearable Devices Ltd. established a partnership with a Fortune 500 communications equipment firm (the partner) as an Independent Software Vendor ("ISV"). The partnership will make it easier for the partner's chipset to include the Mudra Neural Input technology. All of the partner's clients that manufacture wearables will be able to use a touchless input platform that is ready to deploy due to Mudra technology which combines its sensors and artificial intelligence (AI).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wearable Inertial Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wearable Inertial Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wearable Inertial Sensors Market?

To stay informed about further developments, trends, and reports in the Wearable Inertial Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence