Key Insights

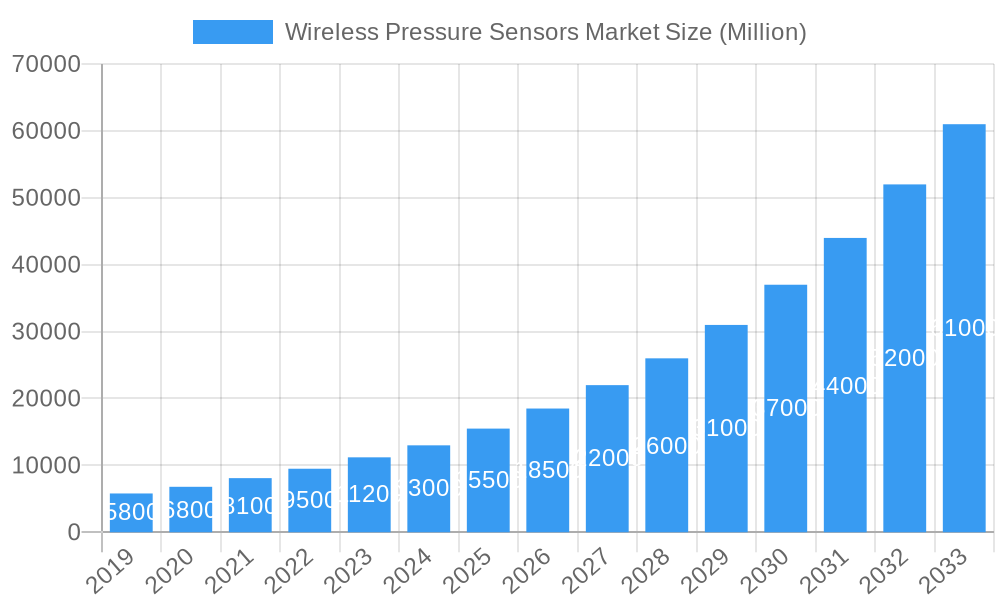

The global Wireless Pressure Sensors Market is projected to experience significant expansion. Forecasted to reach a market size of $13.07 billion by 2025, the market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 6.2% through 2033. This robust growth is driven by increasing demand for automation and smart technologies, the cost and flexibility advantages of wireless solutions, and the growing adoption of the Industrial Internet of Things (IIoT) for real-time monitoring and predictive maintenance. Key sectors such as healthcare (remote patient monitoring, implantable devices), automotive (vehicle safety, ADAS), and Oil & Gas (exploration, production, pipeline monitoring) are significant contributors to this demand.

Wireless Pressure Sensors Market Market Size (In Billion)

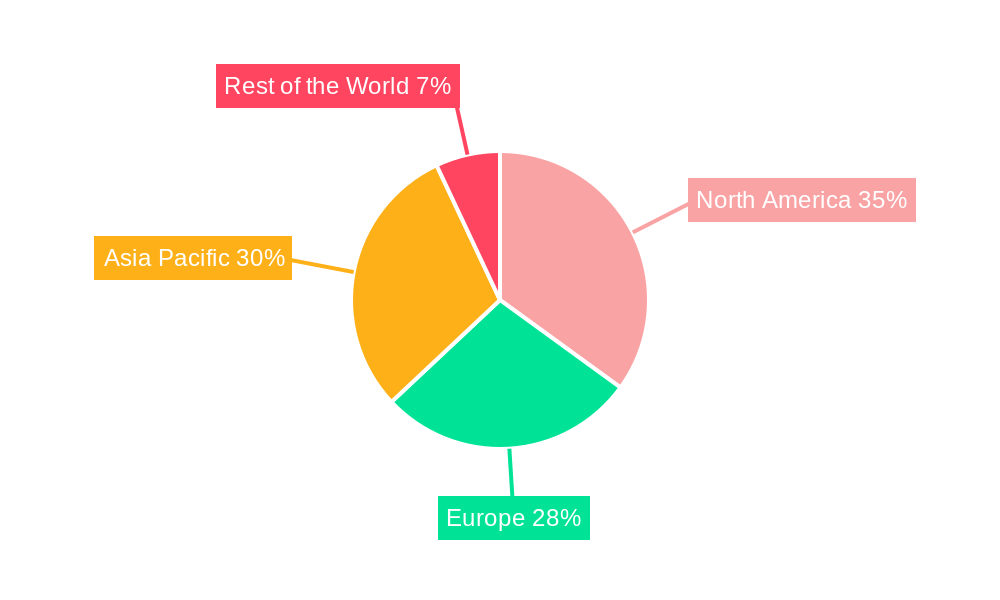

Market trends include sensor miniaturization for improved energy efficiency and advancements in communication protocols (LoRaWAN, NB-IoT) enhancing deployment and data transmission. The integration of AI and ML with sensor data is enabling intelligent decision-making. Challenges include initial implementation costs, cybersecurity concerns, and the need for standardization. Despite these, continuous innovation in sensing technologies (Piezoresistive, CMOS, Capacitive, Optical) and expanding applications across industries indicate a dynamic market future. North America and Asia Pacific are expected to lead market size and growth due to strong industrial bases and rapid technological adoption.

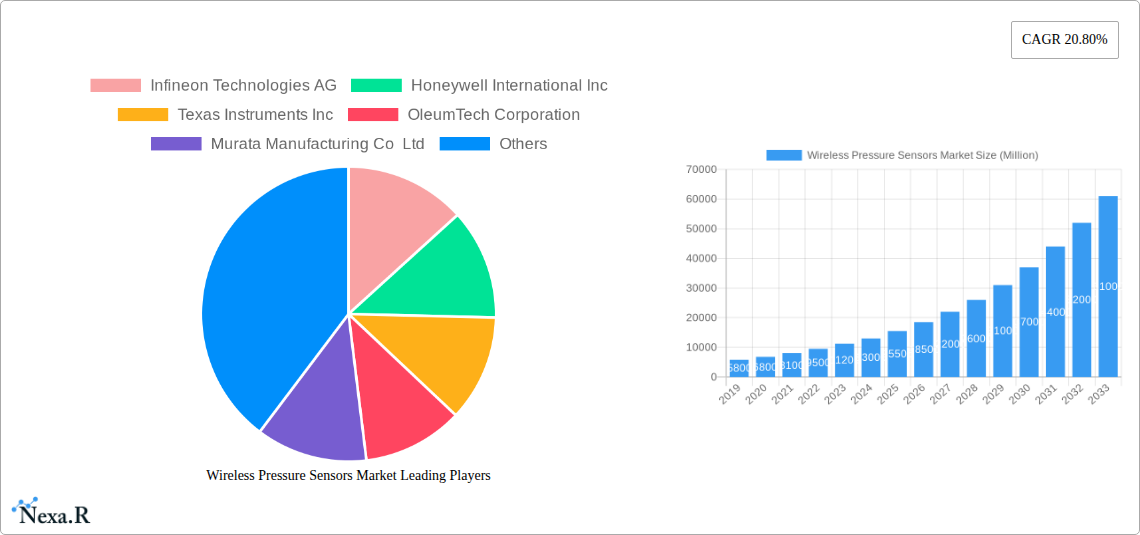

Wireless Pressure Sensors Market Company Market Share

Global Wireless Pressure Sensors Market: Dynamics, Trends, and Outlook (2019-2033)

This report provides an in-depth analysis of the global Wireless Pressure Sensors Market, covering its structure, growth trajectory, and future potential. Analyzing the historical period 2019-2024, with a base year of 2025 and a forecast period to 2033, this report offers insights into key market segments, emerging technologies, and competitive landscapes, providing actionable intelligence for stakeholders.

Wireless Pressure Sensors Market Market Dynamics & Structure

The global Wireless Pressure Sensors Market is characterized by a moderately concentrated landscape, with key players like Infineon Technologies AG, Honeywell International Inc, Texas Instruments Inc, OleumTech Corporation, Murata Manufacturing Co Ltd, ESI Inc, Siemens AG, ABB Group, TE Connectivity Ltd, Acuity Incorporated, Rockwell Automation Inc, Phoenix Sensors LLC, Analog Devices Inc, and Emerson Electric Company holding significant market share. Technological innovation serves as a primary driver, with continuous advancements in miniaturization, power efficiency, and data transmission capabilities shaping product development. For instance, the increasing adoption of IoT devices fuels the demand for sophisticated wireless pressure sensing solutions across various industries. Regulatory frameworks, particularly concerning safety and data security in critical applications like healthcare and oil & gas, also influence market dynamics. Competitive product substitutes, such as wired pressure sensors and alternative monitoring solutions, present a challenge, but the inherent flexibility and cost-effectiveness of wireless technology are increasingly favored. End-user demographics are shifting towards a greater demand for real-time monitoring and predictive maintenance, especially in the industrial and automotive sectors. Mergers and acquisitions (M&A) are a recurring trend, with companies seeking to expand their product portfolios, technological expertise, and geographical reach. For example, the period 2019-2024 saw approximately 15 M&A deals, indicating a consolidated approach to market growth. Barriers to innovation include high R&D costs and the need for robust cybersecurity protocols to ensure data integrity.

Wireless Pressure Sensors Market Growth Trends & Insights

The global Wireless Pressure Sensors Market is poised for significant expansion, projected to grow from an estimated xx Million units in 2025 to xx Million units by 2033, exhibiting a compound annual growth rate (CAGR) of approximately xx%. This robust growth trajectory is underpinned by several key factors. The escalating adoption of the Internet of Things (IoT) across diverse industries is a primary catalyst, driving the demand for connected devices that rely on accurate, real-time pressure monitoring. In the Oil & Gas sector, for instance, wireless pressure sensors are indispensable for pipeline integrity monitoring, wellhead pressure management, and flow control, contributing an estimated xx% to the market in 2025. Similarly, the Automotive industry is witnessing a surge in demand for tire pressure monitoring systems (TPMS) and engine pressure sensors, driven by safety regulations and the pursuit of fuel efficiency. The Healthcare industry is also a significant contributor, with wireless pressure sensors finding applications in medical devices, patient monitoring systems, and infusion pumps, ensuring patient safety and operational efficiency. The market penetration of wireless pressure sensors is steadily increasing, moving beyond traditional industrial applications into consumer electronics and smart infrastructure projects. Technological disruptions, such as advancements in MEMS (Micro-Electro-Mechanical Systems) technology and low-power wireless communication protocols, are making these sensors more affordable, precise, and energy-efficient, thereby expanding their applicability. Consumer behavior is increasingly favoring smart, connected solutions that offer convenience, enhanced safety, and operational insights. This shift is fueling the adoption of wireless pressure sensors in smart homes, wearable technology, and advanced environmental monitoring systems. The evolving industrial landscape, marked by the rise of Industry 4.0, further amplifies the need for integrated, data-driven solutions, with wireless pressure sensors playing a pivotal role in enabling this transformation.

Dominant Regions, Countries, or Segments in Wireless Pressure Sensors Market

The Capacitive technology segment is currently the most dominant force within the global Wireless Pressure Sensors Market, accounting for an estimated xx% of the market in 2025. This dominance is attributed to the inherent advantages of capacitive sensors, including their excellent accuracy, long-term stability, and ability to operate effectively in harsh environments, making them a preferred choice across numerous demanding applications. Following closely are Piezoresistive and CMOS technologies, which are also experiencing substantial growth due to their cost-effectiveness and widespread availability, particularly in consumer electronics and automotive sectors.

Geographically, North America is the leading region in the Wireless Pressure Sensors Market, driven by robust government initiatives promoting industrial automation, significant investments in smart infrastructure, and a high adoption rate of IoT technologies. The presence of major players like Honeywell International Inc. and Emerson Electric Company, coupled with a strong demand from the Oil & Gas and Automotive sectors, further bolsters North America's market leadership. The United States, in particular, plays a crucial role due to its advanced technological ecosystem and substantial end-user industry base.

Within the end-user industry, the Oil & Gas sector remains a primary driver of market growth. The increasing need for enhanced safety, environmental compliance, and operational efficiency in exploration, production, and transportation necessitates the deployment of sophisticated wireless pressure monitoring systems. This sector is projected to contribute an estimated xx% to the global market in 2025.

The Automotive industry is another significant growth engine, propelled by stringent safety regulations mandating the use of tire pressure monitoring systems (TPMS) and the increasing integration of advanced driver-assistance systems (ADAS) that rely on accurate pressure data.

Furthermore, the Power & Energy sector is witnessing accelerated adoption of wireless pressure sensors for grid management, renewable energy infrastructure monitoring, and predictive maintenance of power plants, contributing to the overall market expansion. The increasing focus on smart grid technologies and the demand for reliable energy supply are key factors driving this segment.

Wireless Pressure Sensors Market Product Landscape

The Wireless Pressure Sensors Market is witnessing a wave of innovation focused on enhancing performance, expanding applications, and improving user experience. Key product advancements include the development of ultra-low power consumption sensors that enable extended battery life for remote deployments, and miniaturized sensors suitable for integration into compact devices. Novel materials and manufacturing techniques are contributing to increased durability and resistance to extreme temperatures and corrosive environments. Applications are diversifying rapidly, from traditional industrial monitoring in Oil & Gas and Power & Energy to burgeoning areas like smart agriculture, building automation, and wearable health trackers. Performance metrics such as improved accuracy (e.g., ±0.1% full scale), wider operating temperature ranges (e.g., -40°C to +125°C), and enhanced wireless connectivity (e.g., LoRaWAN, NB-IoT) are key differentiators for manufacturers like Texas Instruments Inc. and Murata Manufacturing Co Ltd.

Key Drivers, Barriers & Challenges in Wireless Pressure Sensors Market

The Wireless Pressure Sensors Market is propelled by several key drivers, including the accelerating adoption of IoT and Industry 4.0, the increasing demand for real-time data for predictive maintenance and operational efficiency, stringent safety regulations in sectors like automotive and healthcare, and the inherent cost-effectiveness and flexibility of wireless solutions. Technological advancements in sensor miniaturization, power management, and wireless communication protocols are further fueling market growth.

However, the market also faces significant challenges and restraints. Cybersecurity concerns regarding data breaches and unauthorized access to sensitive information remain a paramount issue. The complexity of integrating wireless sensors into existing infrastructure and the need for specialized technical expertise can act as a barrier. Furthermore, the initial cost of deployment, though declining, can still be a deterrent for smaller enterprises. Supply chain disruptions, geopolitical uncertainties, and fluctuating raw material prices can impact manufacturing and availability. Intense competition among established players and emerging startups also puts pressure on profit margins.

Emerging Opportunities in Wireless Pressure Sensors Market

Emerging opportunities within the Wireless Pressure Sensors Market are abundant and span across several promising domains. The rapid expansion of smart city initiatives presents a significant untapped market for sensors used in traffic management, environmental monitoring, and utility infrastructure. The growing demand for remote patient monitoring and smart healthcare devices opens avenues for advanced, miniaturized wireless pressure sensors. Furthermore, the increasing adoption of precision agriculture techniques, requiring real-time soil and water pressure monitoring, offers another substantial growth area. The development of specialized sensors for niche applications within the industrial sector, such as submersible pressure monitoring in deep-sea exploration or high-temperature applications in advanced manufacturing, also presents lucrative opportunities for innovation and market penetration.

Growth Accelerators in the Wireless Pressure Sensors Market Industry

Several catalysts are accelerating the long-term growth of the Wireless Pressure Sensors Market. Continuous technological breakthroughs in areas like AI-powered data analytics for predictive maintenance, advanced material science for enhanced sensor durability, and low-power wide-area network (LPWAN) technologies are expanding the applicability and reducing the cost of wireless pressure sensing solutions. Strategic partnerships between sensor manufacturers and IoT platform providers are creating integrated ecosystems that simplify deployment and data management. Furthermore, ongoing market expansion strategies by key players, focusing on emerging economies and underserved industrial sectors, are driving wider adoption and market penetration, solidifying the foundational growth of this dynamic industry.

Key Players Shaping the Wireless Pressure Sensors Market Market

- Infineon Technologies AG

- Honeywell International Inc

- Texas Instruments Inc

- OleumTech Corporation

- Murata Manufacturing Co Ltd

- ESI Inc

- Siemens AG

- ABB Group

- TE Connectivity Ltd

- Acuity Incorporated

- Rockwell Automation Inc

- Phoenix Sensors LLC

- Analog Devices Inc

- Emerson Electric Company

Notable Milestones in Wireless Pressure Sensors Market Sector

- 2023, Q4: Introduction of self-powered wireless pressure sensors with significantly extended battery life by Infineon Technologies AG.

- 2023, Q2: Honeywell International Inc. launches a new series of intrinsically safe wireless pressure transmitters for hazardous industrial environments.

- 2022, Q3: Texas Instruments Inc. releases a new low-power wireless microcontroller optimized for IoT pressure sensing applications.

- 2022, Q1: OleumTech Corporation announces strategic partnership with an industrial automation solutions provider to expand its remote monitoring capabilities.

- 2021, Q4: Murata Manufacturing Co Ltd introduces a compact, high-accuracy capacitive wireless pressure sensor for consumer electronics.

- 2021, Q2: ESI Inc. acquires a smaller competitor to expand its product portfolio in the medical device segment.

- 2020, Q3: Siemens AG showcases its integrated wireless pressure sensing solutions at a major industrial automation exhibition.

- 2020, Q1: ABB Group expands its smart sensor offerings, including advanced wireless pressure monitoring, for the power and energy sector.

- 2019, Q4: TE Connectivity Ltd. introduces enhanced sealing and durability features in its wireless pressure sensor line for harsh environments.

In-Depth Wireless Pressure Sensors Market Market Outlook

The future of the Wireless Pressure Sensors Market is exceptionally bright, fueled by a confluence of technological advancements and expanding industrial demands. Growth accelerators such as the pervasive integration of AI for smarter data analytics, the development of novel sensing materials for enhanced performance in extreme conditions, and the continued evolution of low-power, long-range communication technologies will propel market expansion. Strategic partnerships between sensor manufacturers and cloud-based IoT platforms will simplify integration and unlock new service-based revenue streams. The increasing focus on sustainability and efficiency across all industries will further drive the adoption of wireless pressure monitoring for optimized resource management and reduced operational costs, presenting substantial future market potential and compelling strategic opportunities for market participants.

Wireless Pressure Sensors Market Segmentation

-

1. Technology

- 1.1. Piezoresistive

- 1.2. CMOS

- 1.3. Capacitive

- 1.4. Optical Sensing

- 1.5. Piezoelectric

- 1.6. Other Technologies

-

2. End-user Industry

- 2.1. Oil & Gas

- 2.2. Automotive

- 2.3. Healthcare

- 2.4. Consumer Electronics

- 2.5. IT and Telecom

- 2.6. Power & Energy

- 2.7. Entertainment & Media

- 2.8. Other End-user Industries

Wireless Pressure Sensors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East

Wireless Pressure Sensors Market Regional Market Share

Geographic Coverage of Wireless Pressure Sensors Market

Wireless Pressure Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Automotive and Health Care Industries; Increasing Adoption of Wireless Systems Due to Industry 4.0

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with Sensing Products; Low Product Differentiation

- 3.4. Market Trends

- 3.4.1. Wireless Pressure Sensors to Witness an Increased Demand from the Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wireless Pressure Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Piezoresistive

- 5.1.2. CMOS

- 5.1.3. Capacitive

- 5.1.4. Optical Sensing

- 5.1.5. Piezoelectric

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil & Gas

- 5.2.2. Automotive

- 5.2.3. Healthcare

- 5.2.4. Consumer Electronics

- 5.2.5. IT and Telecom

- 5.2.6. Power & Energy

- 5.2.7. Entertainment & Media

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Wireless Pressure Sensors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Piezoresistive

- 6.1.2. CMOS

- 6.1.3. Capacitive

- 6.1.4. Optical Sensing

- 6.1.5. Piezoelectric

- 6.1.6. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil & Gas

- 6.2.2. Automotive

- 6.2.3. Healthcare

- 6.2.4. Consumer Electronics

- 6.2.5. IT and Telecom

- 6.2.6. Power & Energy

- 6.2.7. Entertainment & Media

- 6.2.8. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Wireless Pressure Sensors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Piezoresistive

- 7.1.2. CMOS

- 7.1.3. Capacitive

- 7.1.4. Optical Sensing

- 7.1.5. Piezoelectric

- 7.1.6. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil & Gas

- 7.2.2. Automotive

- 7.2.3. Healthcare

- 7.2.4. Consumer Electronics

- 7.2.5. IT and Telecom

- 7.2.6. Power & Energy

- 7.2.7. Entertainment & Media

- 7.2.8. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Wireless Pressure Sensors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Piezoresistive

- 8.1.2. CMOS

- 8.1.3. Capacitive

- 8.1.4. Optical Sensing

- 8.1.5. Piezoelectric

- 8.1.6. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil & Gas

- 8.2.2. Automotive

- 8.2.3. Healthcare

- 8.2.4. Consumer Electronics

- 8.2.5. IT and Telecom

- 8.2.6. Power & Energy

- 8.2.7. Entertainment & Media

- 8.2.8. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of the World Wireless Pressure Sensors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Piezoresistive

- 9.1.2. CMOS

- 9.1.3. Capacitive

- 9.1.4. Optical Sensing

- 9.1.5. Piezoelectric

- 9.1.6. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil & Gas

- 9.2.2. Automotive

- 9.2.3. Healthcare

- 9.2.4. Consumer Electronics

- 9.2.5. IT and Telecom

- 9.2.6. Power & Energy

- 9.2.7. Entertainment & Media

- 9.2.8. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Infineon Technologies AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Honeywell International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Texas Instruments Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 OleumTech Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Murata Manufacturing Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ESI Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Siemens AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 ABB Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 TE Connectivity Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Acuity Incorporated

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Rockwell Automation Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Phoenix Sensors LLC

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Analog Devices Inc

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Emerson Electric Company

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global Wireless Pressure Sensors Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Wireless Pressure Sensors Market Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Wireless Pressure Sensors Market Revenue (billion), by Technology 2025 & 2033

- Figure 4: North America Wireless Pressure Sensors Market Volume (K Units), by Technology 2025 & 2033

- Figure 5: North America Wireless Pressure Sensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Wireless Pressure Sensors Market Volume Share (%), by Technology 2025 & 2033

- Figure 7: North America Wireless Pressure Sensors Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 8: North America Wireless Pressure Sensors Market Volume (K Units), by End-user Industry 2025 & 2033

- Figure 9: North America Wireless Pressure Sensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America Wireless Pressure Sensors Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: North America Wireless Pressure Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Wireless Pressure Sensors Market Volume (K Units), by Country 2025 & 2033

- Figure 13: North America Wireless Pressure Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Wireless Pressure Sensors Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Wireless Pressure Sensors Market Revenue (billion), by Technology 2025 & 2033

- Figure 16: Europe Wireless Pressure Sensors Market Volume (K Units), by Technology 2025 & 2033

- Figure 17: Europe Wireless Pressure Sensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 18: Europe Wireless Pressure Sensors Market Volume Share (%), by Technology 2025 & 2033

- Figure 19: Europe Wireless Pressure Sensors Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 20: Europe Wireless Pressure Sensors Market Volume (K Units), by End-user Industry 2025 & 2033

- Figure 21: Europe Wireless Pressure Sensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Europe Wireless Pressure Sensors Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: Europe Wireless Pressure Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Wireless Pressure Sensors Market Volume (K Units), by Country 2025 & 2033

- Figure 25: Europe Wireless Pressure Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Wireless Pressure Sensors Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Wireless Pressure Sensors Market Revenue (billion), by Technology 2025 & 2033

- Figure 28: Asia Pacific Wireless Pressure Sensors Market Volume (K Units), by Technology 2025 & 2033

- Figure 29: Asia Pacific Wireless Pressure Sensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Asia Pacific Wireless Pressure Sensors Market Volume Share (%), by Technology 2025 & 2033

- Figure 31: Asia Pacific Wireless Pressure Sensors Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 32: Asia Pacific Wireless Pressure Sensors Market Volume (K Units), by End-user Industry 2025 & 2033

- Figure 33: Asia Pacific Wireless Pressure Sensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: Asia Pacific Wireless Pressure Sensors Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 35: Asia Pacific Wireless Pressure Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Wireless Pressure Sensors Market Volume (K Units), by Country 2025 & 2033

- Figure 37: Asia Pacific Wireless Pressure Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Wireless Pressure Sensors Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Rest of the World Wireless Pressure Sensors Market Revenue (billion), by Technology 2025 & 2033

- Figure 40: Rest of the World Wireless Pressure Sensors Market Volume (K Units), by Technology 2025 & 2033

- Figure 41: Rest of the World Wireless Pressure Sensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 42: Rest of the World Wireless Pressure Sensors Market Volume Share (%), by Technology 2025 & 2033

- Figure 43: Rest of the World Wireless Pressure Sensors Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 44: Rest of the World Wireless Pressure Sensors Market Volume (K Units), by End-user Industry 2025 & 2033

- Figure 45: Rest of the World Wireless Pressure Sensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Rest of the World Wireless Pressure Sensors Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Rest of the World Wireless Pressure Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Rest of the World Wireless Pressure Sensors Market Volume (K Units), by Country 2025 & 2033

- Figure 49: Rest of the World Wireless Pressure Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of the World Wireless Pressure Sensors Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wireless Pressure Sensors Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Global Wireless Pressure Sensors Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 3: Global Wireless Pressure Sensors Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Wireless Pressure Sensors Market Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Wireless Pressure Sensors Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Wireless Pressure Sensors Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global Wireless Pressure Sensors Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 8: Global Wireless Pressure Sensors Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 9: Global Wireless Pressure Sensors Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Wireless Pressure Sensors Market Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Wireless Pressure Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Wireless Pressure Sensors Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States Wireless Pressure Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Wireless Pressure Sensors Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada Wireless Pressure Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Wireless Pressure Sensors Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Global Wireless Pressure Sensors Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 18: Global Wireless Pressure Sensors Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 19: Global Wireless Pressure Sensors Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Wireless Pressure Sensors Market Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Wireless Pressure Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Global Wireless Pressure Sensors Market Volume K Units Forecast, by Country 2020 & 2033

- Table 23: Germany Wireless Pressure Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany Wireless Pressure Sensors Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 25: United Kingdom Wireless Pressure Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Wireless Pressure Sensors Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 27: France Wireless Pressure Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: France Wireless Pressure Sensors Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Wireless Pressure Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of Europe Wireless Pressure Sensors Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Global Wireless Pressure Sensors Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 32: Global Wireless Pressure Sensors Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 33: Global Wireless Pressure Sensors Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Wireless Pressure Sensors Market Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Wireless Pressure Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global Wireless Pressure Sensors Market Volume K Units Forecast, by Country 2020 & 2033

- Table 37: China Wireless Pressure Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: China Wireless Pressure Sensors Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Japan Wireless Pressure Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Japan Wireless Pressure Sensors Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: India Wireless Pressure Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: India Wireless Pressure Sensors Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 43: Rest of Asia Pacific Wireless Pressure Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Rest of Asia Pacific Wireless Pressure Sensors Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 45: Global Wireless Pressure Sensors Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 46: Global Wireless Pressure Sensors Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 47: Global Wireless Pressure Sensors Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 48: Global Wireless Pressure Sensors Market Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 49: Global Wireless Pressure Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Global Wireless Pressure Sensors Market Volume K Units Forecast, by Country 2020 & 2033

- Table 51: Latin America Wireless Pressure Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Latin America Wireless Pressure Sensors Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Middle East Wireless Pressure Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Middle East Wireless Pressure Sensors Market Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wireless Pressure Sensors Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Wireless Pressure Sensors Market?

Key companies in the market include Infineon Technologies AG, Honeywell International Inc, Texas Instruments Inc, OleumTech Corporation, Murata Manufacturing Co Ltd, ESI Inc, Siemens AG, ABB Group, TE Connectivity Ltd, Acuity Incorporated, Rockwell Automation Inc, Phoenix Sensors LLC, Analog Devices Inc, Emerson Electric Company.

3. What are the main segments of the Wireless Pressure Sensors Market?

The market segments include Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in Automotive and Health Care Industries; Increasing Adoption of Wireless Systems Due to Industry 4.0.

6. What are the notable trends driving market growth?

Wireless Pressure Sensors to Witness an Increased Demand from the Automotive Industry.

7. Are there any restraints impacting market growth?

High Cost Associated with Sensing Products; Low Product Differentiation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wireless Pressure Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wireless Pressure Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wireless Pressure Sensors Market?

To stay informed about further developments, trends, and reports in the Wireless Pressure Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence