Key Insights

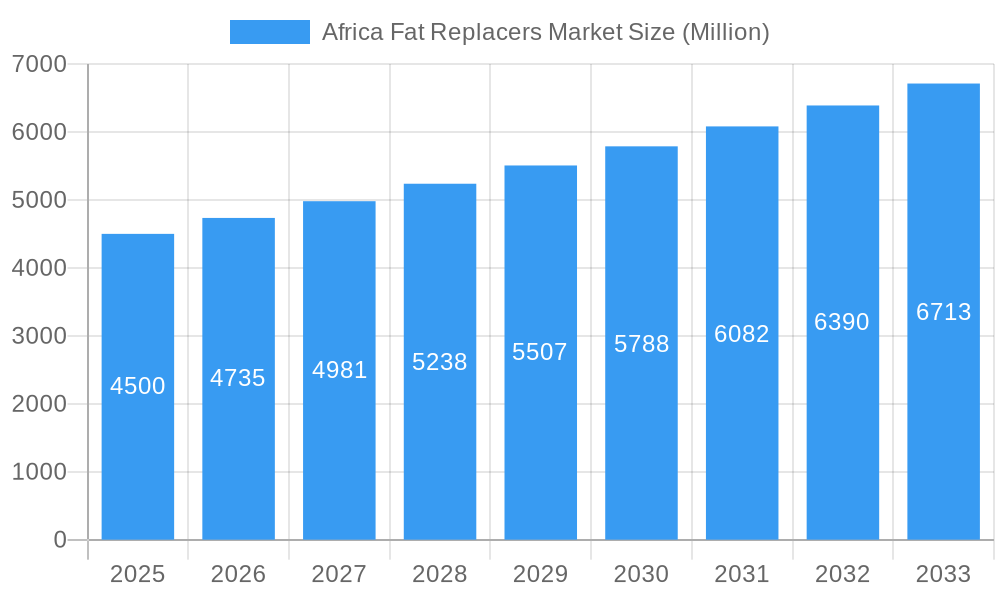

The African fat replacers market is projected for substantial growth, expected to reach an estimated USD 49.9 million by 2024, exhibiting a Compound Annual Growth Rate (CAGR) of 6.2% from 2024 to 2033. This expansion is driven by increasing consumer demand for healthier food options and heightened awareness of the health risks linked to high fat intake. Growing African populations and accelerating urbanization are increasing the demand for processed foods, often utilizing fat replacers to enhance nutritional content and extend shelf life. The rising incidence of lifestyle diseases such as obesity, diabetes, and cardiovascular conditions further promotes the adoption of reduced-fat products, establishing fat replacers as essential for food manufacturers continent-wide.

Africa Fat Replacers Market Market Size (In Million)

Key market drivers include the expanding processed food industry, particularly in bakery, confectionery, dairy, and beverage sectors, which are actively seeking innovative reformulation solutions. The versatility of fat replacers, sourced from plant and animal origins and categorized as carbohydrate-based, protein-based, and lipid-based, enables their integration into a diverse range of food products, meeting varied consumer preferences. The growing emphasis on clean-label and natural ingredients also influences product development, encouraging the exploration of novel fat replacers. However, addressing challenges related to the cost-effectiveness of advanced fat replacers and consumer perceptions of taste and texture in reduced-fat items is crucial for sustained market penetration and growth in key African economies including South Africa, Nigeria, and Kenya.

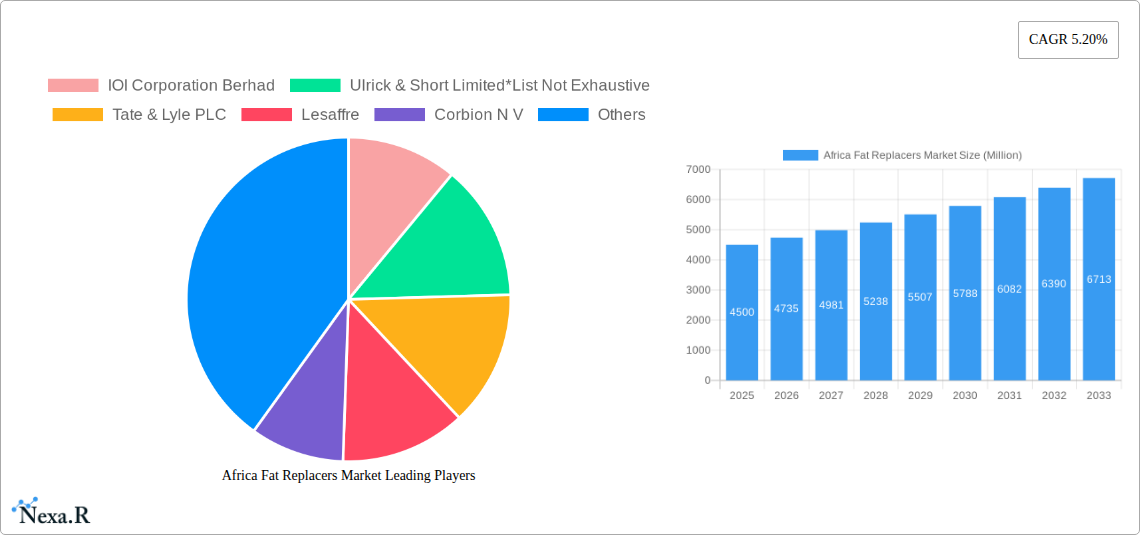

Africa Fat Replacers Market Company Market Share

Africa Fat Replacers Market: Comprehensive Market Analysis and Future Outlook (2019-2033)

Unlock critical insights into the burgeoning Africa Fat Replacers Market with our in-depth report. This comprehensive study navigates the dynamic landscape of fat reduction solutions across the continent, from plant-based innovations to animal-derived alternatives. Essential for food manufacturers, ingredient suppliers, market analysts, and strategic planners, this report provides a granular view of market size evolution, key growth drivers, competitive dynamics, and emerging opportunities. Our analysis spans the historical period (2019-2024), base year (2025), estimated year (2025), and a robust forecast period (2025-2033), delivering actionable intelligence for strategic decision-making. Explore the impact of health-conscious consumerism, evolving dietary trends, and technological advancements on the future of fat replacers in Africa.

Africa Fat Replacers Market Market Dynamics & Structure

The Africa Fat Replacers Market is characterized by a moderately concentrated landscape, with key players like Tate & Lyle PLC, Ingredion Incorporated, and Corbion N V holding significant influence. Technological innovation is a pivotal driver, with ongoing research focused on developing novel fat replacers that offer superior texture, mouthfeel, and taste profiles, while also meeting stringent nutritional standards. Regulatory frameworks, while still evolving in some African nations, are increasingly emphasizing food safety and labeling transparency, influencing product development and market entry strategies. Competitive product substitutes include traditional low-fat ingredients and whole food alternatives, requiring fat replacer manufacturers to constantly innovate and demonstrate clear value propositions. End-user demographics are shifting towards a more health-conscious population, particularly in urban centers, driving demand for reduced-fat food options. Mergers and acquisitions (M&A) are anticipated to play a role in consolidating market share and expanding geographical reach, though the volume of such deals is expected to be moderate in the initial forecast years. Innovation barriers include the cost of research and development, the need for extensive product testing, and navigating diverse regulatory landscapes across different African countries.

- Market Concentration: Moderately concentrated, with established global players and a growing number of regional suppliers.

- Technological Innovation: Focus on improved sensory properties, cost-effectiveness, and functional benefits.

- Regulatory Frameworks: Increasing emphasis on food safety, labeling, and health claims.

- Competitive Substitutes: Traditional low-fat ingredients, whole foods, and emerging alternative technologies.

- End-User Demographics: Growing health awareness, demand for convenience, and evolving dietary preferences.

- M&A Trends: Expected to drive consolidation and market expansion, though initial volumes may be moderate.

- Innovation Barriers: R&D costs, product validation, and regulatory complexities.

Africa Fat Replacers Market Growth Trends & Insights

The Africa Fat Replacers Market is poised for substantial growth, driven by a confluence of socio-economic and health-related factors. Increasing consumer awareness regarding the health implications of high fat intake, coupled with a rising prevalence of lifestyle diseases such as obesity and cardiovascular conditions, is a primary catalyst. This health consciousness translates directly into a growing demand for low-fat food products across various categories. The market's evolution is further shaped by evolving dietary habits, with a shift towards healthier eating patterns gaining traction, especially among the burgeoning middle class in key African economies. Technological disruptions, including advancements in enzyme technology, fermentation processes, and ingredient encapsulation, are enabling the development of more sophisticated and effective fat replacers. These innovations allow for the replication of fat's desirable sensory attributes – such as richness, mouthfeel, and flavor enhancement – with reduced calorie content. Market penetration of fat replacers is expected to increase significantly as food manufacturers increasingly incorporate these ingredients to cater to consumer demand and reformulate products to meet health guidelines. The projected Compound Annual Growth Rate (CAGR) for the Africa Fat Replacers Market is robust, indicating a strong upward trajectory in market size over the forecast period. This growth is underpinned by the increasing affordability and accessibility of these ingredients, as well as strategic investments in local production and distribution networks. Consumer behavior shifts, favoring natural and functional ingredients, will also influence the types of fat replacers that gain prominence, with plant-based options expected to see accelerated adoption. The base year of 2025 marks a pivotal point, with estimated market size reflecting initial widespread adoption, paving the way for accelerated expansion in the subsequent forecast years. The estimated market size for fat replacers in Africa is projected to reach approximately 550 million units in 2025, with significant growth anticipated throughout the forecast period up to 2033. This upward trend is supported by continuous research and development efforts focused on enhancing the performance and cost-effectiveness of fat replacers, making them more viable for a wider range of applications and price points across the African continent. The market is also witnessing a growing emphasis on clean-label ingredients and sustainable sourcing, which are expected to further influence product development and consumer preference.

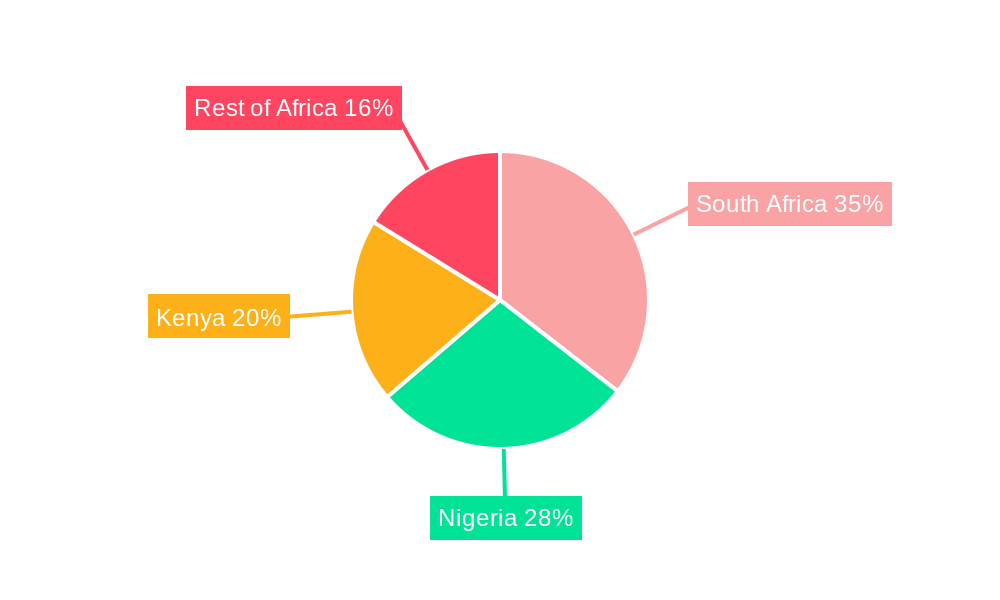

Dominant Regions, Countries, or Segments in Africa Fat Replacers Market

Within the Africa Fat Replacers Market, South Africa consistently emerges as a dominant region, driven by its relatively developed food processing industry, higher disposable incomes, and a more established consumer awareness regarding health and nutrition. The country's robust regulatory framework for food safety and labeling further supports the adoption of advanced food ingredients like fat replacers. Nigeria, with its vast population and rapidly growing economy, presents a significant and rapidly expanding market, particularly in the Bakery and Confectionery and Processed Meat segments. Increasing urbanization and a burgeoning middle class in Nigeria are fueling the demand for convenient, healthier food options. Kenya, while a smaller market compared to South Africa and Nigeria, exhibits strong growth potential, especially in the Dairy Products and Beverages sectors, as health consciousness gains momentum.

From a segmentation perspective, Carbohydrate-Based Fat Replacers are projected to dominate the market in the near to medium term. This is attributed to their versatility, cost-effectiveness, and wide range of applications across various food products, including baked goods, dairy alternatives, and processed meats. Their ability to mimic fat's texture and mouthfeel without significant calorie addition makes them highly attractive to manufacturers.

The Bakery and Confectionery application segment is a primary driver of growth for fat replacers across Africa. Consumers are increasingly seeking reduced-fat versions of popular treats like cakes, cookies, and chocolates, prompting manufacturers to integrate fat replacers. The Processed Meat segment also shows significant potential, with a growing demand for leaner sausages, burgers, and other meat products.

- Dominant Region: South Africa leads due to its advanced infrastructure, consumer awareness, and regulatory maturity.

- High-Growth Market: Nigeria showcases immense potential due to its large population and expanding middle class.

- Emerging Market: Kenya demonstrates strong growth prospects in specific food categories.

- Dominant Segment (Type): Carbohydrate-Based Fat Replacers, due to their cost-effectiveness and versatility.

- Dominant Segment (Application): Bakery and Confectionery, driven by consumer demand for healthier indulgence.

- Secondary Growth Segment (Application): Processed Meat, catering to the demand for leaner protein options.

- Key Drivers for Dominance:

- Economic Development and Disposable Income

- Consumer Health Awareness and Dietary Trends

- Food Processing Industry Infrastructure

- Regulatory Landscape and Food Safety Standards

- Urbanization and Changing Lifestyles

Africa Fat Replacers Market Product Landscape

The Africa Fat Replacers Market is witnessing a wave of innovative product development, with a strong emphasis on enhancing sensory attributes and nutritional profiles. Manufacturers are actively developing carbohydrate-based fat replacers, such as modified starches and fibers, that effectively mimic the creamy texture and mouthfeel of fat in applications like yogurts, dressings, and baked goods. Protein-based fat replacers, derived from sources like whey and soy, are gaining traction for their emulsifying properties and ability to add richness to products without significantly increasing calories. Innovations in lipid-based fat replacers, including structured lipids and esterified fats, are also contributing to product advancements, offering improved stability and functionality. Unique selling propositions often revolve around clean-label formulations, allergen-free options, and the ability to reduce fat content by up to 50% while maintaining desirable product quality. Technological advancements are enabling cost-effective production of these ingredients, making them more accessible for the African market.

Key Drivers, Barriers & Challenges in Africa Fat Replacers Market

The Africa Fat Replacers Market is propelled by several key drivers, including the escalating global and regional health consciousness surrounding obesity and related chronic diseases, which is directly fueling demand for reduced-fat food options. Furthermore, the growing middle class across the continent, with increased disposable incomes and a greater inclination towards healthier lifestyles, acts as a significant economic driver. Favorable government initiatives promoting healthier food consumption and stringent regulations on food product formulations also contribute to market expansion.

However, the market faces notable barriers and challenges. Supply chain complexities, including inadequate cold chain infrastructure and logistical challenges in remote regions, can impact the availability and cost-effectiveness of fat replacers. Regulatory hurdles and inconsistent food standards across different African nations can create complexities for manufacturers aiming for wider market penetration. High production costs for some advanced fat replacers can limit their adoption by smaller food manufacturers. Consumer perception and acceptance of processed foods containing fat replacers, often influenced by misconceptions about artificial ingredients, pose a significant challenge. Intense competition from established food ingredient suppliers and the availability of cheaper, albeit less functional, alternatives also present competitive pressures. Limited awareness about the benefits and functionality of various fat replacer types among local food producers can also hinder market growth.

Emerging Opportunities in Africa Fat Replacers Market

Emerging opportunities within the Africa Fat Replacers Market lie in the untapped potential of less developed countries and the growing demand for plant-based and natural fat replacers. As awareness of health and wellness continues to spread, there is an increasing preference for ingredients derived from sustainable and recognizable sources. This opens doors for innovations in fat replacers made from fruits, vegetables, and other natural sources. Furthermore, the expansion of the food processing industry in countries beyond the major hubs presents significant untapped markets. Developing region-specific fat replacer solutions tailored to local taste preferences and culinary traditions can unlock substantial growth. Opportunities also exist in the development of functional fat replacers that not only reduce fat content but also offer additional health benefits, such as increased fiber or improved nutrient absorption. The increasing demand for convenient, ready-to-eat meals and snacks in urbanized areas also presents a fertile ground for fat replacer adoption.

Growth Accelerators in the Africa Fat Replacers Market Industry

Several catalysts are accelerating the growth of the Africa Fat Replacers Market. Technological breakthroughs in ingredient processing and formulation are continuously improving the performance and cost-effectiveness of fat replacers, making them more accessible to a wider range of manufacturers. Strategic partnerships between international ingredient suppliers and local African food companies are crucial for market penetration, knowledge transfer, and customized product development. Market expansion strategies focusing on educating local food producers about the benefits and applications of fat replacers will also drive adoption. Investments in research and development tailored to African dietary habits and ingredient availability will foster innovation and create competitive advantages. The increasing global focus on sustainable food systems also presents an opportunity for growth, as fat replacers can contribute to reducing the environmental footprint of food production by optimizing ingredient usage.

Key Players Shaping the Africa Fat Replacers Market Market

- IOI Corporation Berhad

- Ulrick & Short Limited

- Tate & Lyle PLC

- Lesaffre

- Corbion N V

- Ingredion Incorporated

Notable Milestones in Africa Fat Replacers Market Sector

- 2019: Increased consumer focus on health and wellness trends, driving early adoption of low-fat products in major African cities.

- 2020: Growing interest in plant-based diets, boosting research and development into plant-derived fat replacers.

- 2021: Significant investment in food processing infrastructure across several African nations, creating a more conducive environment for ingredient innovation.

- 2022: Launch of new modified starch-based fat replacers offering improved texture and mouthfeel in dairy and bakery applications.

- 2023: Expansion of distribution networks by key players to reach tier-2 and tier-3 cities, broadening market access.

- 2024: Increased regulatory discussions and potential for harmonization of food standards, offering greater clarity for market entrants.

In-Depth Africa Fat Replacers Market Market Outlook

The Africa Fat Replacers Market is set to witness robust and sustained growth, driven by the convergence of health consciousness, evolving consumer preferences, and technological advancements. Growth accelerators such as ongoing innovation in ingredient functionality, strategic collaborations between global and local entities, and targeted market expansion initiatives will continue to shape the landscape. The increasing emphasis on sustainable and clean-label solutions presents a significant avenue for strategic opportunities, potentially leading to the development of novel, Africa-centric fat replacer formulations. The outlook remains highly positive, with the market poised to play a crucial role in the region's food industry evolution towards healthier and more sustainable offerings.

Africa Fat Replacers Market Segmentation

-

1. Source

- 1.1. Plant

- 1.2. Animal

-

2. Type

- 2.1. Carbohydrate-Based

- 2.2. Protein-Based

- 2.3. Lipid-Based

-

3. Application

- 3.1. Bakery and Confectionery

- 3.2. Beverages

- 3.3. Processed Meat

- 3.4. Dairy Products

- 3.5. Others

-

4. Geography

-

4.1. Africa

- 4.1.1. South Africa

- 4.1.2. Nigeria

- 4.1.3. Kenya

- 4.1.4. Rest of Africa

-

4.1. Africa

Africa Fat Replacers Market Segmentation By Geography

-

1. Africa

- 1.1. South Africa

- 1.2. Nigeria

- 1.3. Kenya

- 1.4. Rest of Africa

Africa Fat Replacers Market Regional Market Share

Geographic Coverage of Africa Fat Replacers Market

Africa Fat Replacers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health Benefits Promoting Apple Cider Vinegar Demand; Unfiltered Apple Cider Vinegar Being Popular

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Other Vinegar Types

- 3.4. Market Trends

- 3.4.1. Protein-Based Fat Replacers are the Fastest Growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Fat Replacers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Plant

- 5.1.2. Animal

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Carbohydrate-Based

- 5.2.2. Protein-Based

- 5.2.3. Lipid-Based

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Bakery and Confectionery

- 5.3.2. Beverages

- 5.3.3. Processed Meat

- 5.3.4. Dairy Products

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Africa

- 5.4.1.1. South Africa

- 5.4.1.2. Nigeria

- 5.4.1.3. Kenya

- 5.4.1.4. Rest of Africa

- 5.4.1. Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IOI Corporation Berhad

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ulrick & Short Limited*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tate & Lyle PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lesaffre

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Corbion N V

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ingredion Incorporated

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 IOI Corporation Berhad

List of Figures

- Figure 1: Africa Fat Replacers Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Africa Fat Replacers Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Fat Replacers Market Revenue million Forecast, by Source 2020 & 2033

- Table 2: Africa Fat Replacers Market Revenue million Forecast, by Type 2020 & 2033

- Table 3: Africa Fat Replacers Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: Africa Fat Replacers Market Revenue million Forecast, by Geography 2020 & 2033

- Table 5: Africa Fat Replacers Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Africa Fat Replacers Market Revenue million Forecast, by Source 2020 & 2033

- Table 7: Africa Fat Replacers Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: Africa Fat Replacers Market Revenue million Forecast, by Application 2020 & 2033

- Table 9: Africa Fat Replacers Market Revenue million Forecast, by Geography 2020 & 2033

- Table 10: Africa Fat Replacers Market Revenue million Forecast, by Country 2020 & 2033

- Table 11: South Africa Africa Fat Replacers Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Nigeria Africa Fat Replacers Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Kenya Africa Fat Replacers Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Rest of Africa Africa Fat Replacers Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Fat Replacers Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Africa Fat Replacers Market?

Key companies in the market include IOI Corporation Berhad, Ulrick & Short Limited*List Not Exhaustive, Tate & Lyle PLC, Lesaffre, Corbion N V, Ingredion Incorporated.

3. What are the main segments of the Africa Fat Replacers Market?

The market segments include Source, Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 49.9 million as of 2022.

5. What are some drivers contributing to market growth?

Health Benefits Promoting Apple Cider Vinegar Demand; Unfiltered Apple Cider Vinegar Being Popular.

6. What are the notable trends driving market growth?

Protein-Based Fat Replacers are the Fastest Growing Segment.

7. Are there any restraints impacting market growth?

Rising Demand for Other Vinegar Types.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Fat Replacers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Fat Replacers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Fat Replacers Market?

To stay informed about further developments, trends, and reports in the Africa Fat Replacers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence