Key Insights

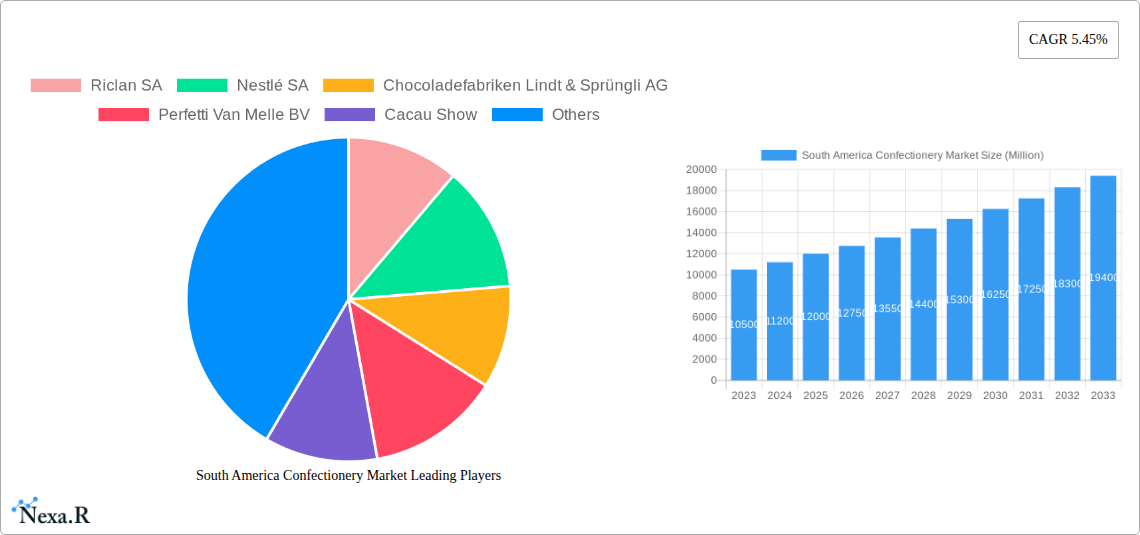

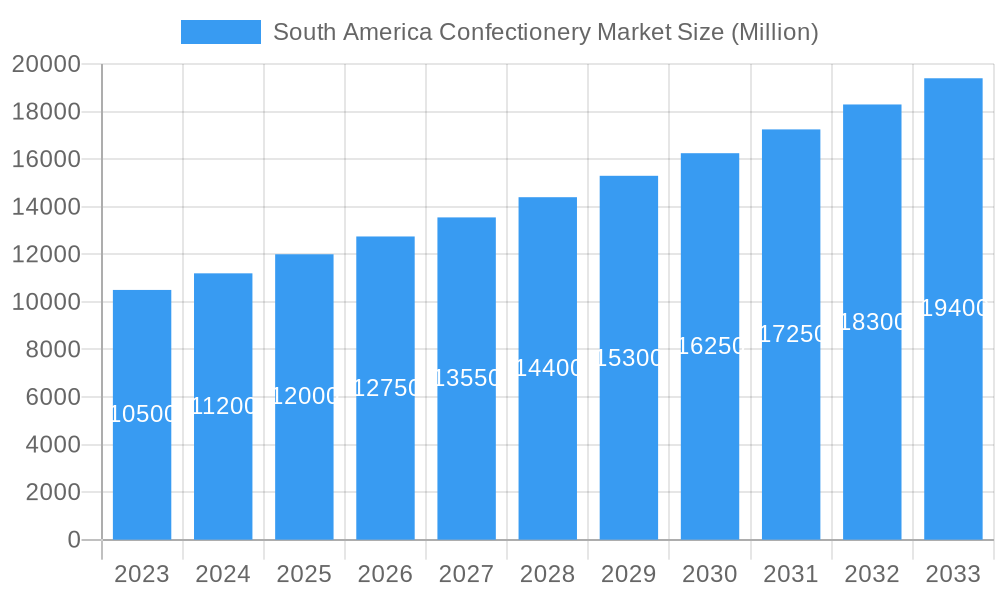

The South America confectionery market is poised for significant expansion, projected to reach a market size of $12,000 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 5.45% through 2033. This robust growth is propelled by several key drivers, including the increasing disposable income across the region, a growing young population with a higher propensity for confectionery consumption, and the rising popularity of premium and artisanal chocolate products. Furthermore, the expansion of modern retail formats like supermarkets and hypermarkets, alongside the burgeoning online retail sector, is enhancing product accessibility and driving sales. The market is segmented into Confections (including Chocolate, Gums, Snack Bars, and Sugar Confectionery), with chocolate holding a substantial share due to strong consumer preference and innovation in flavors and formats. The convenience and accessibility offered by convenience stores also play a crucial role in daily impulse purchases.

South America Confectionery Market Market Size (In Billion)

Despite the positive outlook, the market faces certain restraints. Fluctuations in raw material prices, particularly cocoa and sugar, can impact profit margins for manufacturers and potentially affect consumer pricing. Additionally, growing health consciousness among consumers, leading to a preference for healthier snack alternatives and sugar-free options, presents an ongoing challenge. However, manufacturers are actively innovating by introducing healthier confectionery options, including sugar-free variants and products with natural ingredients, to mitigate these restraints. The competitive landscape is dynamic, featuring major global players like Nestlé SA, Mars Incorporated, and Mondelēz International Inc., alongside strong regional players such as Riclan SA and Cacau Show, all vying for market share through product innovation, strategic partnerships, and extensive distribution networks across key South American nations like Brazil, Argentina, and Colombia.

South America Confectionery Market Company Market Share

South America Confectionery Market Analysis Report: Unlocking Growth in Chocolate, Sugar Confectionery, and Snack Bars

This comprehensive report delivers an in-depth analysis of the South American Confectionery Market, a dynamic sector poised for significant expansion. Spanning the historical period of 2019-2024, a base year of 2025, and a detailed forecast period from 2025-2033, this report provides actionable insights for industry stakeholders. We delve into parent and child market segments, analyzing key drivers, emerging opportunities, and competitive strategies. All quantitative data is presented in Million units for clarity and ease of comparison.

South America Confectionery Market Market Dynamics & Structure

The South American confectionery market is characterized by a moderate to high level of concentration, with key players like Nestlé SA, Mondelēz International Inc., and Arcor S A I C holding significant market shares. Technological innovation is driven by a growing consumer demand for healthier options, premium indulgence, and novel flavor profiles. Regulatory frameworks, particularly concerning sugar content and labeling, are evolving across the region, influencing product development and market access. Competitive product substitutes, ranging from healthier snack alternatives to home-baked goods, pose a constant challenge, pushing manufacturers to innovate and differentiate. End-user demographics reveal a growing middle class with increased disposable income, driving demand for both mass-market and premium confectionery. Mergers and acquisitions (M&A) are a prominent feature, with recent strategic moves aiming to consolidate market presence and expand product portfolios. For instance, the acquisition of Dori Alimentos by Ferrero's sister company, Ferrara Candy Co., in July 2023, highlights a trend of consolidation and a focus on the burgeoning Brazilian market.

- Market Concentration: Dominated by a few multinational corporations and strong regional players.

- Innovation Drivers: Health and wellness trends, premiumization, and unique flavor experiences.

- Regulatory Landscape: Evolving policies on sugar, artificial sweeteners, and ingredient transparency.

- Competitive Substitutes: Healthy snacks, fresh produce, and artisanal confectionery.

- End-User Demographics: Growing middle class, increasing disposable income, and evolving lifestyle choices.

- M&A Trends: Strategic acquisitions to enhance market share, access new technologies, and expand geographical reach. For example, the Dori Alimentos acquisition aimed to bolster Ferrero's presence in Brazil.

South America Confectionery Market Growth Trends & Insights

The South American confectionery market is experiencing robust growth, projected to expand significantly over the forecast period. This expansion is fueled by a confluence of factors, including rising disposable incomes in key economies, a growing young population with a penchant for sweet treats, and an increasing adoption of convenience-based consumption patterns. Market size evolution is evident in the consistent year-on-year growth observed across various sub-segments, from indulgent chocolates to healthier snack bars. Technological disruptions are playing a crucial role, with advancements in manufacturing processes enabling greater efficiency and the development of innovative product formats. For example, the integration of sophisticated flavoring technologies and the adoption of sustainable packaging solutions are becoming increasingly prevalent.

Consumer behavior shifts are profoundly impacting the market. There's a discernible trend towards conscious consumption, with a growing segment of consumers seeking confectionery products that align with their wellness goals. This includes a demand for sugar-free options, reduced-calorie formulations, and products with natural ingredients. The rise of online retail stores has further democratized access to a wider variety of confectionery products, allowing consumers to explore niche brands and international offerings. The CAGR for the South American confectionery market is estimated to be xx% over the forecast period. Market penetration for chocolate confectionery remains high, while snack bars, particularly protein and fruit & nut bars, are witnessing accelerated adoption rates driven by health-conscious consumers. Sugar confectionery continues to hold a substantial share, adapting to evolving preferences with a focus on unique textures and flavors.

Dominant Regions, Countries, or Segments in South America Confectionery Market

Brazil stands out as the dominant region within the South American confectionery market, driven by its large population, robust economy, and established manufacturing base. Its significant contribution is fueled by strong consumer demand across all confectionery segments, particularly chocolate and sugar confectionery. The country’s economic policies, which support domestic production and export, further bolster its market leadership. Supermarkets/Hypermarkets represent the leading distribution channel in Brazil and across much of South America, offering wide product assortments and competitive pricing, thereby driving significant sales volumes.

Within the confectionery segments, Chocolate emerges as a dominant category, with Milk and White Chocolate variants experiencing particularly high demand due to their widespread appeal. However, the growing health consciousness is also driving a steady rise in Dark Chocolate consumption. Sugar Confectionery also commands a substantial market share, with Gummies and Jellies, as well as Hard Candies, being popular choices. The Snack Bar segment, encompassing Cereal Bars, Fruit & Nut Bars, and Protein Bars, is experiencing the fastest growth, aligning with the global trend towards healthier snacking. This segment’s dominance is intrinsically linked to evolving consumer preferences for on-the-go, nutritious, and functional food options.

- Dominant Region: Brazil, due to its large consumer base and strong industrial infrastructure.

- Leading Distribution Channel: Supermarkets/Hypermarkets, offering convenience and variety.

- Dominant Confectionery Segment: Chocolate, with Milk and White variants leading, followed by growing Dark Chocolate.

- High-Growth Segment: Snack Bars (Cereal, Fruit & Nut, Protein), driven by health and wellness trends.

- Key Drivers for Dominance:

- Economic Policies: Supportive government initiatives and trade agreements.

- Infrastructure: Well-developed logistics and retail networks.

- Consumer Demographics: Large, young, and increasingly affluent populations.

- Market Penetration: High existing penetration for traditional segments, with significant untapped potential for newer segments.

South America Confectionery Market Product Landscape

The South American confectionery market is witnessing a surge in product innovation, driven by evolving consumer preferences and technological advancements. Manufacturers are increasingly focusing on developing healthier alternatives, such as sugar-free and low-calorie options, alongside indulgent, premium offerings. Product applications are broadening, with confectionery extending beyond traditional treats to functional foods like protein bars with added vitamins and minerals. Performance metrics highlight a demand for superior taste, texture, and convenient packaging. Unique selling propositions often revolve around natural ingredients, ethical sourcing, and novel flavor fusions, appealing to a more discerning consumer base. Technological advancements in encapsulation and flavor masking are enabling the creation of sophisticated sugar-free products without compromising on taste.

Key Drivers, Barriers & Challenges in South America Confectionery Market

Key Drivers:

- Growing Disposable Income: Rising incomes in key South American economies are boosting consumer spending on discretionary items like confectionery.

- Young and Growing Population: A significant youth demographic with a high consumption rate for sweet treats.

- Urbanization and Convenience: The shift towards urban living increases demand for on-the-go snacks and convenience confectionery.

- Product Innovation: Development of healthier, premium, and novel flavored confectionery appeals to diverse consumer tastes.

- E-commerce Growth: Expanding online retail channels provide greater accessibility and product variety.

Barriers & Challenges:

- Economic Volatility: Fluctuations in currency exchange rates and inflation can impact purchasing power and raw material costs.

- Supply Chain Disruptions: Dependence on imported raw materials and logistical challenges can lead to cost increases and availability issues.

- Health and Wellness Concerns: Increasing consumer awareness about sugar intake and its health implications can lead to reduced demand for traditional confectionery.

- Regulatory Hurdles: Evolving food safety regulations and labeling requirements can add complexity and cost to product development.

- Intense Competition: A crowded market with both multinational and local players necessitates continuous innovation and competitive pricing.

Emerging Opportunities in South America Confectionery Market

Emerging opportunities in the South American confectionery market lie in catering to the growing demand for health-conscious options, including plant-based, gluten-free, and functional confectionery. The premiumization trend presents a significant avenue, with consumers willing to pay more for high-quality, ethically sourced, and uniquely flavored products. Untapped markets in less developed regions within South America, coupled with innovative applications such as confectionery as ingredients in other food products, offer substantial growth potential. Furthermore, the increasing adoption of personalized nutrition could pave the way for customized confectionery offerings.

Growth Accelerators in the South America Confectionery Market Industry

Catalysts driving long-term growth in the South American confectionery market include continuous technological breakthroughs in ingredient science and processing, enabling the creation of healthier and more sustainable products. Strategic partnerships between local manufacturers and international players can facilitate market penetration and knowledge transfer. Moreover, market expansion strategies focusing on underserved demographics and geographical regions, alongside aggressive product development that anticipates evolving consumer needs, will be critical for sustained growth. The increasing focus on sustainability throughout the value chain will also act as a significant growth accelerator.

Key Players Shaping the South America Confectionery Market Market

- Riclan SA

- Nestlé SA

- Chocoladefabriken Lindt & Sprüngli AG

- Perfetti Van Melle BV

- Cacau Show

- Colombina SA

- Ferrero International SA

- Florestal Alimentos SA

- Mars Incorporated

- Barry Callebaut AG

- Arcor S A I C

- The Hershey Company

- Dori Alimentos SA

- Mondelēz International Inc

- Grupo de Inversiones Suramericana SA

- Kellogg Company

Notable Milestones in South America Confectionery Market Sector

- July 2023: Ferrero's sister company, Ferrara Candy Co., announced the acquisition of Brazilian snacks company Dori Alimentos, which sells a variety of chocolate and sugar confectionery brands, including Dori, Pettiz, and Jubes. This move significantly strengthens Ferrara's presence in the Brazilian market and broadens its product portfolio.

- April 2023: Under the ONE brand, The Hershey Company launched the Peanut Butter & Jelly Flavored Protein Bar. The ONE Limited Edition Peanut Butter & Jelly flavored bars are packed with 20 g of protein, 1 g of sugar, and the familiar taste of peanut butter and strawberry jelly flavors, aligning with the growing demand for functional and healthy snacks.

- January 2023: The Hershey Company launched caffeinated protein bars. The range is available in two flavors, which include Vanilla Latte and Caramel Macchiato. This product launch addresses the consumer desire for energy-boosting and functional confectionery options.

In-Depth South America Confectionery Market Market Outlook

The future outlook for the South American confectionery market is highly promising, driven by a dynamic interplay of accelerating growth factors. The continued rise in disposable incomes and a youthful, expanding population form a strong foundation for sustained demand. Furthermore, the increasing consumer preference for health and wellness-oriented products, coupled with an appetite for premium and innovative offerings, creates significant opportunities for differentiated products. Technological advancements in food science and sustainable manufacturing practices will enable companies to meet these evolving demands efficiently and responsibly. Strategic collaborations, targeted market expansions into emerging economies within the region, and a proactive approach to product development that aligns with global trends in personalized nutrition and functional foods will be key to capitalizing on the market's substantial future potential.

South America Confectionery Market Segmentation

-

1. Confections

-

1.1. Chocolate

-

1.1.1. By Confectionery Variant

- 1.1.1.1. Dark Chocolate

- 1.1.1.2. Milk and White Chocolate

-

1.1.1. By Confectionery Variant

-

1.2. Gums

- 1.2.1. Bubble Gum

-

1.2.2. Chewing Gum

-

1.2.2.1. By Sugar Content

- 1.2.2.1.1. Sugar Chewing Gum

- 1.2.2.1.2. Sugar-free Chewing Gum

-

1.2.2.1. By Sugar Content

-

1.3. Snack Bar

- 1.3.1. Cereal Bar

- 1.3.2. Fruit & Nut Bar

- 1.3.3. Protein Bar

-

1.4. Sugar Confectionery

- 1.4.1. Hard Candy

- 1.4.2. Lollipops

- 1.4.3. Mints

- 1.4.4. Pastilles, Gummies, and Jellies

- 1.4.5. Toffees and Nougats

- 1.4.6. Others

-

1.1. Chocolate

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

South America Confectionery Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Confectionery Market Regional Market Share

Geographic Coverage of South America Confectionery Market

South America Confectionery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for meat alternatives

- 3.3. Market Restrains

- 3.3.1. Presence of numerous alternatives in the plant proteins

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Confectionery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Confections

- 5.1.1. Chocolate

- 5.1.1.1. By Confectionery Variant

- 5.1.1.1.1. Dark Chocolate

- 5.1.1.1.2. Milk and White Chocolate

- 5.1.1.1. By Confectionery Variant

- 5.1.2. Gums

- 5.1.2.1. Bubble Gum

- 5.1.2.2. Chewing Gum

- 5.1.2.2.1. By Sugar Content

- 5.1.2.2.1.1. Sugar Chewing Gum

- 5.1.2.2.1.2. Sugar-free Chewing Gum

- 5.1.2.2.1. By Sugar Content

- 5.1.3. Snack Bar

- 5.1.3.1. Cereal Bar

- 5.1.3.2. Fruit & Nut Bar

- 5.1.3.3. Protein Bar

- 5.1.4. Sugar Confectionery

- 5.1.4.1. Hard Candy

- 5.1.4.2. Lollipops

- 5.1.4.3. Mints

- 5.1.4.4. Pastilles, Gummies, and Jellies

- 5.1.4.5. Toffees and Nougats

- 5.1.4.6. Others

- 5.1.1. Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Confections

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Riclan SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestlé SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chocoladefabriken Lindt & Sprüngli AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Perfetti Van Melle BV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cacau Show

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Colombina SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ferrero International SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Florestal Alimentos SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mars Incorporated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Barry Callebaut AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Arcor S A I C

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 The Hershey Compan

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Dori Alimentos SA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Mondelēz International Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Grupo de Inversiones Suramericana SA

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Kellogg Company

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Riclan SA

List of Figures

- Figure 1: South America Confectionery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Confectionery Market Share (%) by Company 2025

List of Tables

- Table 1: South America Confectionery Market Revenue Million Forecast, by Confections 2020 & 2033

- Table 2: South America Confectionery Market Volume K Tons Forecast, by Confections 2020 & 2033

- Table 3: South America Confectionery Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: South America Confectionery Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: South America Confectionery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South America Confectionery Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: South America Confectionery Market Revenue Million Forecast, by Confections 2020 & 2033

- Table 8: South America Confectionery Market Volume K Tons Forecast, by Confections 2020 & 2033

- Table 9: South America Confectionery Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: South America Confectionery Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 11: South America Confectionery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: South America Confectionery Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Brazil South America Confectionery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Brazil South America Confectionery Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Argentina South America Confectionery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Argentina South America Confectionery Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Chile South America Confectionery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Chile South America Confectionery Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Colombia South America Confectionery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Colombia South America Confectionery Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Peru South America Confectionery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Peru South America Confectionery Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Venezuela South America Confectionery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Venezuela South America Confectionery Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Ecuador South America Confectionery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Ecuador South America Confectionery Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Bolivia South America Confectionery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Bolivia South America Confectionery Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Paraguay South America Confectionery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Paraguay South America Confectionery Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Uruguay South America Confectionery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Uruguay South America Confectionery Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Confectionery Market?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the South America Confectionery Market?

Key companies in the market include Riclan SA, Nestlé SA, Chocoladefabriken Lindt & Sprüngli AG, Perfetti Van Melle BV, Cacau Show, Colombina SA, Ferrero International SA, Florestal Alimentos SA, Mars Incorporated, Barry Callebaut AG, Arcor S A I C, The Hershey Compan, Dori Alimentos SA, Mondelēz International Inc, Grupo de Inversiones Suramericana SA, Kellogg Company.

3. What are the main segments of the South America Confectionery Market?

The market segments include Confections, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 12000 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for meat alternatives.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of numerous alternatives in the plant proteins.

8. Can you provide examples of recent developments in the market?

July 2023: Ferrero's sister company, Ferrara Candy Co., announced the acquisition of Brazilian snacks company Dori Alimentos, which sells a variety of chocolate and sugar confectionery brands, including Dori, Pettiz, and Jubes.April 2023: Under the ONE brand, The Hershey Company launched the Peanut Butter & Jelly Flavored Protein Bar. The ONE Limited Edition Peanut Butter & Jelly flavored bars are packed with 20 g of protein, 1 g of sugar, and the familiar taste of peanut butter and strawberry jelly flavors.January 2023: The Hershey Company launched caffeinated protein bars. The range is available in two flavors, which include Vanilla Latte and Caramel Macchiato.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Confectionery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Confectionery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Confectionery Market?

To stay informed about further developments, trends, and reports in the South America Confectionery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence