Key Insights

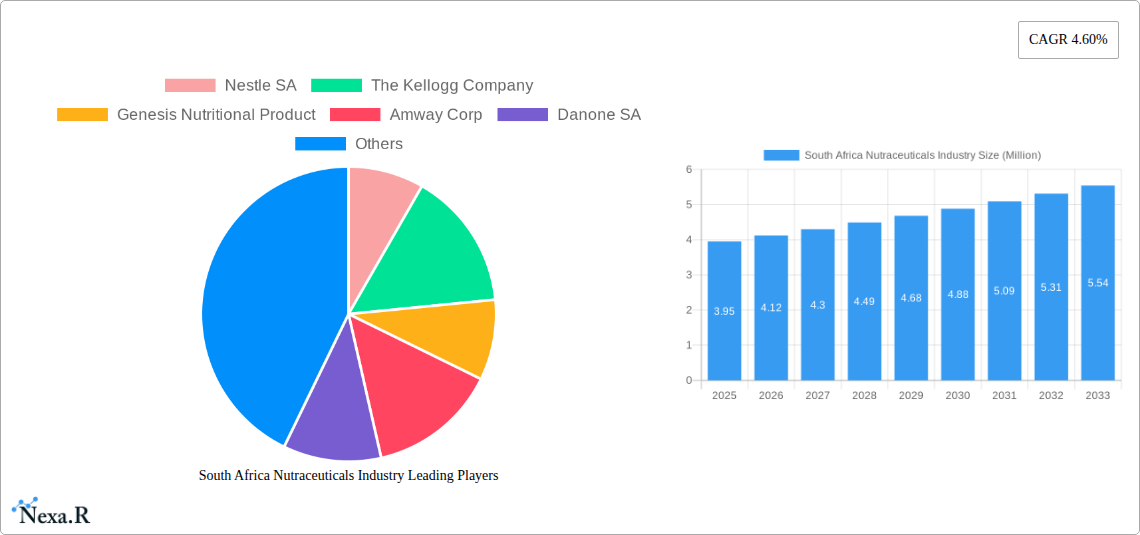

The South African nutraceuticals market is poised for substantial growth, with an estimated market size of $3.95 million in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of 4.60% through 2033. This robust expansion is underpinned by a confluence of powerful drivers, including a growing consumer consciousness regarding preventative healthcare and wellness. As South Africans become more proactive about their health, the demand for products that offer health benefits beyond basic nutrition continues to surge. This trend is further amplified by rising disposable incomes, allowing a larger segment of the population to invest in premium health-focused food and beverage options. The market's dynamism is also fueled by increasing product innovation and a wider availability of sophisticated nutraceutical offerings, catering to diverse health needs such as immune support, digestive health, and cognitive enhancement.

South Africa Nutraceuticals Industry Market Size (In Million)

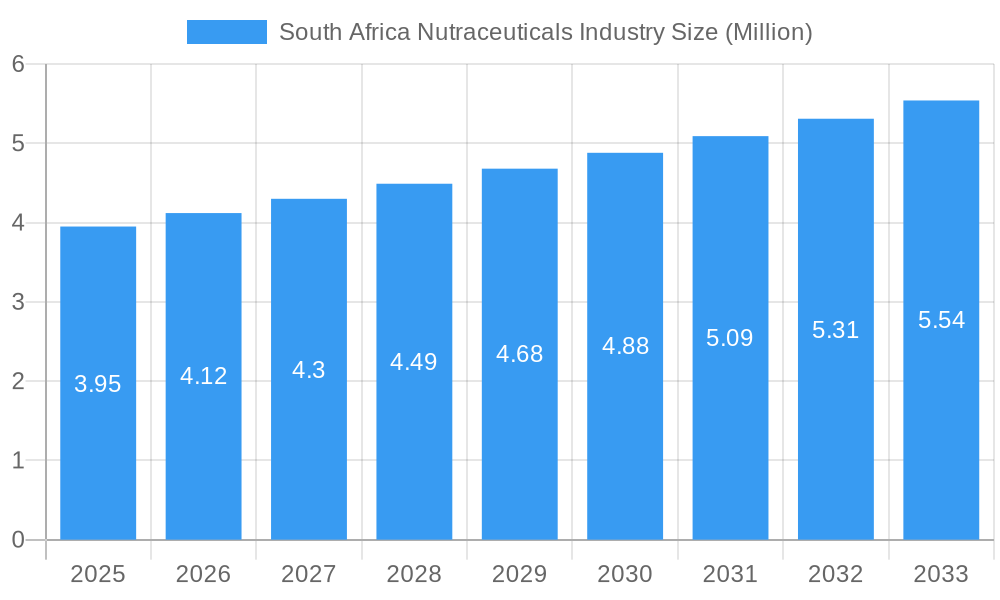

However, the market is not without its restraints. High production costs for specialized nutraceutical ingredients, coupled with potentially complex regulatory landscapes, can pose challenges to market accessibility and affordability. Price sensitivity among a portion of the consumer base also necessitates careful strategic pricing by manufacturers. Despite these hurdles, the outlook remains overwhelmingly positive. The market is segmented across various consumption patterns and product categories, including dietary supplements, functional foods and beverages, and other nutraceutical-based health products. Key players such as Nestle SA, The Kellogg Company, and Danone SA are actively shaping the market through strategic investments in research and development, product launches, and market penetration strategies across South Africa, indicating a competitive yet expanding landscape.

South Africa Nutraceuticals Industry Company Market Share

This comprehensive report provides an in-depth analysis of the South Africa nutraceuticals industry, a rapidly expanding sector driven by increasing health consciousness, rising disposable incomes, and a growing demand for preventative healthcare solutions. Covering the period from 2019 to 2033, with a base year of 2025, this report offers a detailed exploration of market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, opportunities, and the influential players shaping this dynamic market. We delve into the intricate workings of production, consumption, import, export, and price trends, offering invaluable insights for stakeholders seeking to navigate and capitalize on the South African nutraceuticals market.

South Africa Nutraceuticals Industry Market Dynamics & Structure

The South Africa nutraceuticals industry is characterized by a moderately concentrated market structure, with a blend of multinational corporations and emerging local players vying for market share. Technological innovation remains a significant driver, particularly in the development of scientifically backed functional foods and supplements. The regulatory framework, while evolving, plays a crucial role in ensuring product safety and efficacy, influencing market entry and product development strategies. Competitive product substitutes, ranging from traditional foods with inherent health benefits to prescription medications, present a dynamic competitive landscape. End-user demographics are increasingly skewed towards health-conscious millennials and aging populations seeking to manage chronic diseases and enhance overall well-being. Mergers and acquisitions (M&A) are becoming more prevalent as larger entities seek to consolidate their market position, expand their product portfolios, and acquire innovative technologies.

- Market Concentration: Dominated by key players, but with increasing opportunities for niche and specialized product manufacturers.

- Technological Innovation Drivers: Advancements in extraction, formulation, and bioavailability technologies.

- Regulatory Frameworks: Food and beverages act, medicines and related substances act, and specific health claim regulations.

- Competitive Product Substitutes: Functional foods, dietary supplements, fortified beverages, and over-the-counter health products.

- End-User Demographics: Growing demand from urbanized populations, middle-income earners, and individuals with chronic health conditions.

- M&A Trends: Strategic acquisitions to gain market access, R&D capabilities, and expand product offerings.

South Africa Nutraceuticals Industry Growth Trends & Insights

The South Africa nutraceuticals industry is poised for robust growth, projected to witness a significant increase in market size over the forecast period. This expansion is fueled by a confluence of factors, including a heightened awareness of preventive healthcare and the perceived benefits of natural and scientifically validated health solutions. Adoption rates for various nutraceutical categories, such as probiotics, omega-3 fatty acids, and vitamins, are steadily climbing as consumers actively seek to supplement their diets and address specific health concerns like cardiovascular health, digestive well-being, and immune support. Technological disruptions are emerging in areas like personalized nutrition and advanced delivery systems, promising to enhance product efficacy and consumer engagement. Consumer behavior is shifting towards a more proactive approach to health, with a growing preference for products that offer tangible health benefits beyond basic nutrition. The market penetration of fortified foods and dietary supplements is expected to deepen, indicating a broader acceptance and integration of nutraceuticals into daily lifestyles. The Compound Annual Growth Rate (CAGR) for the South African nutraceuticals market is estimated to be around xx%, a testament to its dynamic growth trajectory.

Dominant Regions, Countries, or Segments in South Africa Nutraceuticals Industry

The Consumption Analysis segment is currently the dominant driver of growth within the South Africa nutraceuticals industry. This dominance is primarily attributed to the increasing health consciousness across major urban centers, particularly in the Gauteng province, which represents a significant portion of the country's population and disposable income. Economic policies that encourage healthy living and the availability of diverse distribution channels further bolster consumption.

- Consumption Analysis:

- Market Share: Gauteng province accounts for approximately xx% of the total nutraceutical consumption.

- Key Drivers: Rising disposable incomes, increasing prevalence of lifestyle diseases (diabetes, cardiovascular conditions), and growing awareness of preventative health measures.

- Consumer Preferences: High demand for immune boosters, weight management supplements, and products for digestive health.

- Distribution Channels: Strong presence of supermarkets, pharmacies, and growing e-commerce platforms catering to urban consumers.

The Import Market Analysis (Value & Volume) also plays a crucial role, reflecting the reliance on specialized ingredients and finished products not yet extensively manufactured locally. South Africa's strategic location and established trade relationships facilitate significant imports, particularly of advanced formulations and high-value ingredients.

- Import Market Analysis (Value & Volume):

- Major Importing Countries: China, the United States, and European Union nations.

- Key Import Categories: Specialized vitamins, minerals, herbal extracts, and advanced protein supplements.

- Value Trends: Increasing import value driven by demand for premium and specialized nutraceuticals.

- Volume Trends: Steady volume growth, reflecting the expanding consumer base.

The Production Analysis is steadily growing, with an increasing number of local manufacturers focusing on leveraging indigenous botanicals and catering to specific local health needs. However, it still lags behind consumption and import levels, indicating room for significant local production expansion.

- Production Analysis:

- Growth Potential: Substantial opportunities for local manufacturing of popular nutraceutical categories.

- Focus Areas: Growing interest in plant-based proteins, immune support formulations, and traditional African medicinal plant extracts.

- Challenges: Access to advanced manufacturing technologies and consistent raw material sourcing can be limiting factors.

The Export Market Analysis is nascent but shows promising growth potential, especially for unique South African botanical extracts and ethically sourced natural products. International demand for these niche offerings is expected to rise.

- Export Market Analysis (Value & Volume):

- Emerging Markets: Sub-Saharan Africa, with potential for expansion into European and Asian markets.

- Key Export Products: Rooibos-derived products, specific herbal extracts, and ethically sourced natural ingredients.

- Growth Potential: Driven by global trends in natural and sustainable health products.

The Price Trend Analysis indicates a stable to slightly increasing trend, influenced by raw material costs, manufacturing expenses, and import duties. However, competitive pressures and the rise of private label brands are helping to moderate price increases in certain segments.

- Price Trend Analysis:

- Influencing Factors: Global commodity prices for key ingredients, currency fluctuations, and logistics costs.

- Segmental Variations: Premium products and specialized formulations tend to command higher prices.

South Africa Nutraceuticals Industry Product Landscape

The South Africa nutraceuticals product landscape is characterized by a diverse range of offerings, including vitamins and minerals, dietary supplements, functional foods and beverages, and specialized medical foods. Innovations are centered on enhancing bioavailability, developing targeted delivery systems, and incorporating scientifically validated ingredients for specific health benefits, such as improved cognitive function, enhanced athletic performance, and better joint health. The growing demand for plant-based and natural ingredients is also driving product development, with a focus on sustainably sourced and ethically produced nutraceuticals.

Key Drivers, Barriers & Challenges in South Africa Nutraceuticals Industry

Key Drivers:

- Rising Health Consciousness: An increasing awareness of preventive healthcare and the benefits of dietary supplements.

- Growing Disposable Income: Improved economic conditions leading to increased consumer spending on health and wellness products.

- Prevalence of Lifestyle Diseases: The high incidence of chronic conditions like diabetes and cardiovascular diseases drives demand for health-promoting solutions.

- Technological Advancements: Innovations in formulation, delivery systems, and scientific research enhancing product efficacy.

- Supportive Regulatory Environment: Evolving regulations that encourage product development and market entry for safe and effective nutraceuticals.

Key Barriers & Challenges:

- Consumer Education and Awareness: A need for greater understanding of the science behind nutraceuticals and their benefits.

- Regulatory Hurdles: Navigating complex and evolving regulatory frameworks for health claims and product approvals can be challenging.

- Supply Chain Disruptions: Reliance on imported raw materials can lead to vulnerabilities in the supply chain.

- Counterfeit Products: The presence of substandard and counterfeit products can erode consumer trust.

- Price Sensitivity: While demand is growing, a segment of the population remains price-sensitive, limiting access to premium products.

Emerging Opportunities in South Africa Nutraceuticals Industry

Emerging opportunities in the South Africa nutraceuticals industry lie in the burgeoning demand for personalized nutrition solutions tailored to individual genetic profiles and health needs. The growing popularity of plant-based diets presents a significant opportunity for the development of novel vegan and vegetarian nutraceuticals, including protein supplements and functional food ingredients. Furthermore, there is an untapped market for specialized nutraceuticals targeting specific age groups and health concerns, such as cognitive enhancement for students and seniors, and bone health for aging populations. The integration of technology, such as mobile health applications and wearable devices, offers a platform for delivering personalized dietary recommendations and tracking the efficacy of nutraceutical interventions.

Growth Accelerators in the South Africa Nutraceuticals Industry Industry

Several catalysts are accelerating the growth of the South Africa nutraceuticals industry. Technological breakthroughs in biotechnology and food science are enabling the development of novel ingredients with enhanced efficacy and bioavailability, such as encapsulated probiotics and bioavailable curcumin. Strategic partnerships between nutraceutical manufacturers, research institutions, and healthcare providers are fostering innovation and building consumer trust through scientific validation. Market expansion strategies, including increased penetration into rural areas and the development of more affordable product lines, are broadening the consumer base. The growing influence of e-commerce and digital marketing is also a significant growth accelerator, enabling companies to reach a wider audience and provide convenient purchasing options.

Key Players Shaping the South Africa Nutraceuticals Industry Market

- Nestle SA

- The Kellogg Company

- Genesis Nutritional Product

- Amway Corp

- Danone SA

- Red Bull GmbH

- Herbalife Nutrition

- The Coca-Cola Company

- Ascendis Health

- GlaxoSmithKline PLC

Notable Milestones in South Africa Nutraceuticals Industry Sector

- 2020: Increased consumer focus on immune health leads to a surge in demand for Vitamin C and Zinc supplements.

- 2021: Launch of several new plant-based protein powders catering to the growing vegan and vegetarian market.

- 2022: Ascendis Health announces strategic partnerships to expand its nutraceutical product portfolio.

- 2023: Growing adoption of e-commerce platforms for purchasing dietary supplements, indicating a shift in consumer buying habits.

- 2024: Increased investment in research and development for probiotics and prebiotics to support gut health.

- 2025 (Estimated): Further market penetration of functional foods and beverages with added health benefits.

In-Depth South Africa Nutraceuticals Industry Market Outlook

The future outlook for the South Africa nutraceuticals industry is exceptionally bright, driven by sustained consumer demand for health and wellness solutions. Growth accelerators such as personalized nutrition, continued innovation in plant-based ingredients, and the expanding reach of digital commerce will shape the market landscape. Strategic opportunities exist in developing affordable and accessible product lines for underserved populations, alongside the potential to export unique South African botanical extracts. The industry's ability to adapt to evolving regulatory landscapes and effectively educate consumers will be paramount to realizing its full growth potential in the coming years.

South Africa Nutraceuticals Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South Africa Nutraceuticals Industry Segmentation By Geography

- 1. South Africa

South Africa Nutraceuticals Industry Regional Market Share

Geographic Coverage of South Africa Nutraceuticals Industry

South Africa Nutraceuticals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing inclination towards fitness and sports participation; Increasing demand for fortified processed food products

- 3.3. Market Restrains

- 3.3.1. Extensive presence of alternative protein products sourced from plant based ingredients

- 3.4. Market Trends

- 3.4.1. Rising Healthcare Costs and Focus on Preventive Health Management

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Nutraceuticals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nestle SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Kellogg Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Genesis Nutritional Product

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amway Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Danone SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Red Bull GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Herbalife Nutrition

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Coca-Cola Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ascendis Health*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GlaxoSmithKline PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nestle SA

List of Figures

- Figure 1: South Africa Nutraceuticals Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa Nutraceuticals Industry Share (%) by Company 2025

List of Tables

- Table 1: South Africa Nutraceuticals Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: South Africa Nutraceuticals Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: South Africa Nutraceuticals Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: South Africa Nutraceuticals Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: South Africa Nutraceuticals Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: South Africa Nutraceuticals Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: South Africa Nutraceuticals Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: South Africa Nutraceuticals Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: South Africa Nutraceuticals Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: South Africa Nutraceuticals Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: South Africa Nutraceuticals Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: South Africa Nutraceuticals Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Nutraceuticals Industry?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the South Africa Nutraceuticals Industry?

Key companies in the market include Nestle SA, The Kellogg Company, Genesis Nutritional Product, Amway Corp, Danone SA, Red Bull GmbH, Herbalife Nutrition, The Coca-Cola Company, Ascendis Health*List Not Exhaustive, GlaxoSmithKline PLC.

3. What are the main segments of the South Africa Nutraceuticals Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing inclination towards fitness and sports participation; Increasing demand for fortified processed food products.

6. What are the notable trends driving market growth?

Rising Healthcare Costs and Focus on Preventive Health Management.

7. Are there any restraints impacting market growth?

Extensive presence of alternative protein products sourced from plant based ingredients.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Nutraceuticals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Nutraceuticals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Nutraceuticals Industry?

To stay informed about further developments, trends, and reports in the South Africa Nutraceuticals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence