Key Insights

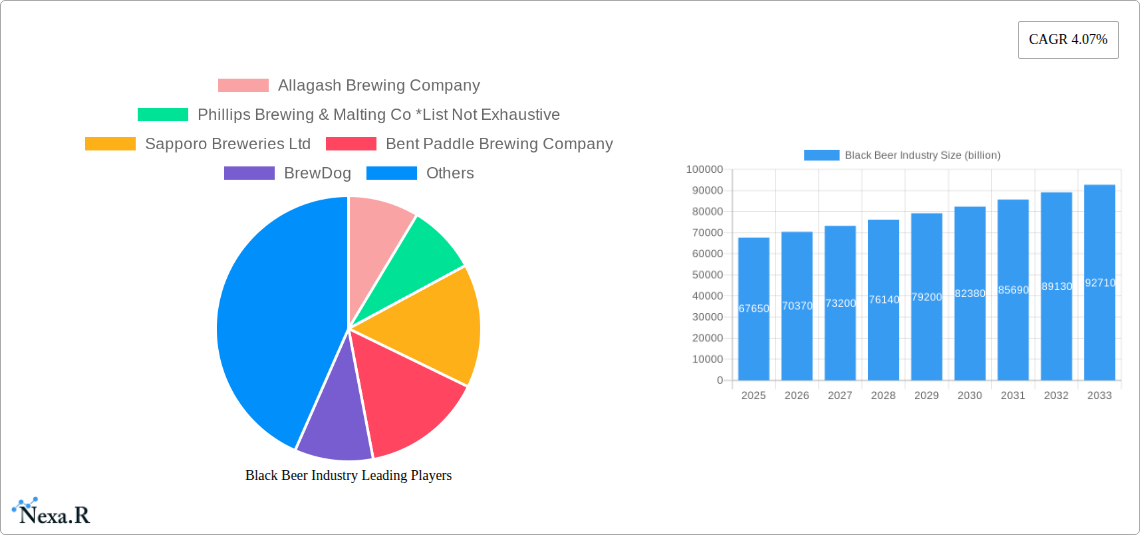

The global Black Beer market is poised for robust expansion, with a projected market size of USD 67.65 billion in 2025. This growth is fueled by a confluence of factors, including an increasing consumer preference for darker, richer beer profiles, and the rising popularity of craft brewing. The market is expected to experience a compound annual growth rate (CAGR) of 4.07% from 2025 to 2033, indicating sustained and healthy expansion. Key drivers for this growth include evolving consumer tastes, a wider availability of diverse black beer varieties, and aggressive marketing by established and emerging breweries. The on-trade segment, encompassing bars, pubs, and restaurants, is anticipated to remain a significant channel, driven by the social nature of beer consumption. Simultaneously, the off-trade segment, including retail stores and supermarkets, is expected to witness steady growth as consumers increasingly purchase black beer for home consumption, encouraged by innovative packaging and promotional activities. The influence of the craft beer revolution cannot be overstated, as it has introduced a plethora of artisanal black beer styles, appealing to a discerning and adventurous consumer base.

Black Beer Industry Market Size (In Billion)

The market's trajectory is also shaped by emerging trends such as the integration of novel ingredients and brewing techniques to create unique black beer experiences, and a growing emphasis on sustainability in brewing operations. For instance, the exploration of specialty malts and adjuncts is leading to a wider spectrum of flavor profiles within the black beer category, from intensely roasted to subtly sweet. Furthermore, conscious consumerism is driving demand for ethically sourced ingredients and environmentally friendly production methods, prompting breweries to adopt greener practices. Despite this promising outlook, certain restraints could impact market penetration, such as fluctuating raw material costs, particularly for premium malts and hops, and evolving regulatory landscapes concerning alcohol production and distribution in various regions. However, the overall positive sentiment driven by product innovation and shifting consumer preferences suggests that the black beer market will continue its upward climb, offering significant opportunities for stakeholders across the value chain.

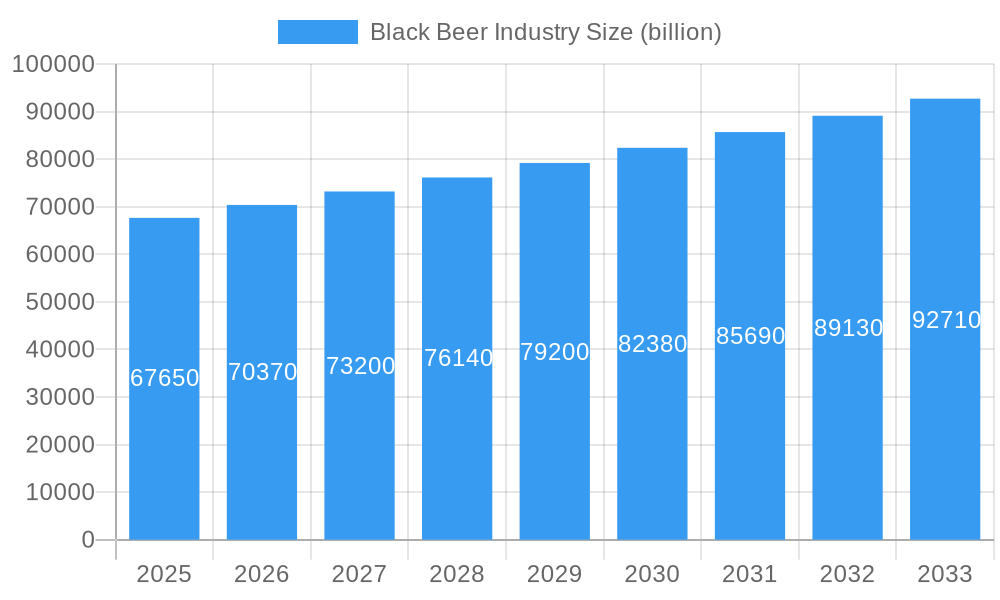

Black Beer Industry Company Market Share

Black Beer Industry Market Dynamics & Structure

The global black beer market exhibits a moderate concentration, driven by a blend of established craft breweries and larger multinational corporations. Technological innovation, particularly in brewing processes and ingredient sourcing, plays a crucial role in differentiating products and appealing to evolving consumer tastes. Regulatory frameworks, encompassing alcohol production, taxation, and labeling, influence market entry and operational costs. The competitive landscape features a range of product substitutes, including other dark beer styles (stouts, porters) and non-alcoholic beverages, necessitating continuous product development and marketing efforts. End-user demographics are expanding beyond traditional beer enthusiasts to include younger consumers and those seeking premium, artisanal beverage experiences. Mergers and acquisitions (M&A) activity, though not as intense as in some other beverage sectors, is observed as companies seek to expand their portfolios and market reach.

- Market Concentration: Characterized by a mix of large players and numerous craft breweries.

- Technological Innovation: Focus on advanced brewing techniques, yeast strains, and flavor profiles.

- Regulatory Impact: Stringent regulations impacting production, distribution, and marketing.

- Product Substitutes: Competition from stouts, porters, and other dark ales.

- End-User Demographics: Growing appeal among younger adults and premium beverage seekers.

- M&A Trends: Strategic acquisitions for portfolio diversification and market penetration.

Black Beer Industry Growth Trends & Insights

The black beer industry is poised for robust growth, fueled by evolving consumer preferences for complex flavor profiles and premium craft beverages. The global market size is projected to reach an estimated $65.3 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2019 to 2033. This expansion is underpinned by increasing adoption rates of craft beers, with black beer styles gaining significant traction due to their rich, malty characteristics and versatility. Technological disruptions in brewing, such as advanced fermentation control and barrel-aging innovations, are enhancing product quality and expanding the range of available black beer styles. Consumer behavior shifts are characterized by a growing demand for locally sourced ingredients, artisanal production methods, and unique flavor experiences. This translates into higher market penetration for specialty black beers, moving beyond traditional dark lagers and ales to encompass more niche and experimental offerings. The parent market, encompassing the broader beer industry, provides a substantial foundation for black beer’s growth, with black beer representing a key premium segment within it. The child market, focusing on specific sub-styles of black beer, is also demonstrating impressive growth as consumers become more educated and adventurous in their choices.

- Market Size Evolution: Projected to reach $65.3 billion by 2025, with continued growth through 2033.

- CAGR: Estimated at 5.8% over the forecast period (2025-2033).

- Adoption Rates: Increasing preference for craft and specialty beer styles.

- Technological Disruptions: Advancements in brewing, fermentation, and barrel-aging.

- Consumer Behavior Shifts: Demand for artisanal, local, and unique flavor experiences.

- Market Penetration: Growing share for specialty black beers within the broader beer market.

- Parent Market Influence: Black beer benefits from the overall growth and established distribution of the beer industry.

- Child Market Dynamics: Emerging sub-segments within black beer experiencing significant interest.

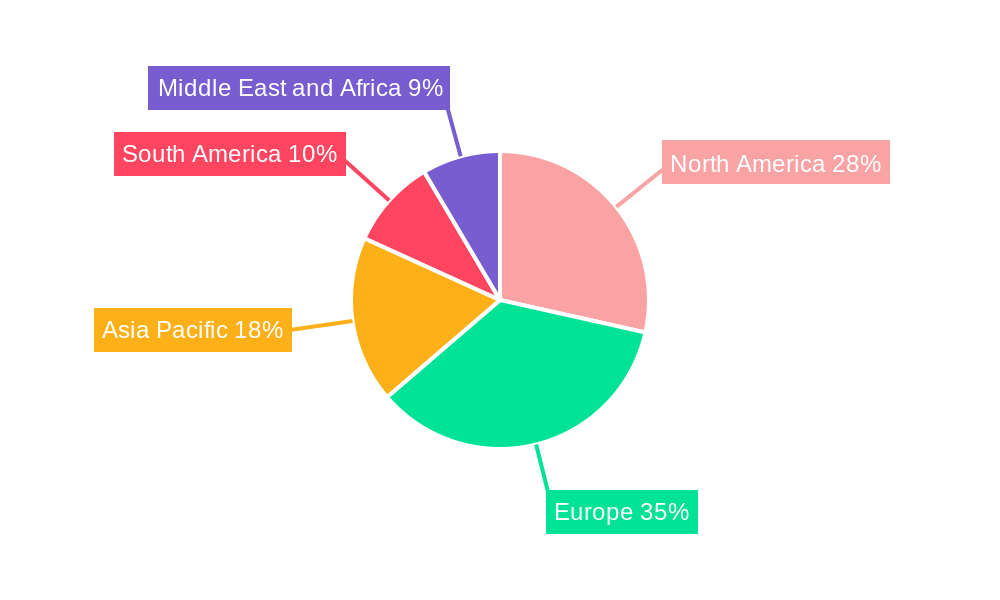

Dominant Regions, Countries, or Segments in Black Beer Industry

The black beer industry's growth is significantly driven by Europe, particularly countries with strong craft beer cultures and a long history of dark beer consumption. Germany, Belgium, the United Kingdom, and Poland stand out as dominant regional markets, contributing substantially to the overall market size. The Ale product type within the black beer segment is currently leading the market due to its diverse sub-styles, including various black ales and darker interpretations of traditional ales, which appeal to a wide spectrum of palates. In terms of sales channels, Off-Trade sales are experiencing robust growth, driven by the increasing popularity of at-home consumption and the proliferation of specialty liquor stores and online beer retailers. Economic policies in these European nations, which often support small and medium-sized enterprises (SMEs) and craft brewing initiatives, foster innovation and market entry. Strong retail infrastructure and established distribution networks for alcoholic beverages further solidify the dominance of these regions. Market share within the Ale segment is estimated at 55%, with significant growth potential stemming from new product development and an expanding consumer base seeking richer flavor profiles. The historical period (2019-2024) saw a steady rise in the popularity of craft ales, setting the stage for continued expansion.

- Dominant Region: Europe (Germany, Belgium, UK, Poland).

- Leading Product Type: Ale (accounting for an estimated 55% market share).

- Leading Sales Channel: Off-Trade (driven by retail and online sales).

- Key Drivers in Europe: Supportive economic policies for craft breweries, established distribution networks, strong consumer appreciation for dark beer heritage.

- Ale Dominance Factors: Versatility of sub-styles, rich flavor profiles, growing craft beer culture.

- Off-Trade Growth Catalysts: Convenience, wider product availability, increasing preference for home consumption.

- Market Share (Ale): Estimated 55%.

- Growth Potential: High, fueled by innovation and consumer education.

Black Beer Industry Product Landscape

The black beer product landscape is characterized by continuous innovation, with brewers exploring unique flavor profiles, ingredient combinations, and brewing techniques. Beyond traditional black lagers and dark ales, there's a growing interest in specialty offerings such as barrel-aged black ales, coffee-infused black beers, and those incorporating exotic adjuncts. These innovations cater to the discerning palate of the modern beer consumer seeking novel and complex taste experiences. Performance metrics are often measured by consumer reviews, awards at brewing competitions, and sales volume within niche markets. Unique selling propositions include the depth of flavor, the visual appeal of the dark hue, and the craftsmanship involved in their creation. Technological advancements in malting, roasting, and fermentation processes are enabling brewers to achieve a wider spectrum of dark beer characteristics, from subtle roast notes to intense coffee and chocolate undertones. The estimated market size for specialty black beers is projected to grow by XX% within the forecast period.

Key Drivers, Barriers & Challenges in Black Beer Industry

Key Drivers:

- Growing Consumer Preference for Craft and Specialty Beverages: Increasing demand for premium, artisanal beers with complex flavor profiles is a primary growth driver.

- Innovation in Brewing Techniques: Advancements in roasting, malting, and fermentation unlock new flavor possibilities, attracting a wider consumer base.

- Rising Disposable Incomes and Premiumization Trends: Consumers are willing to spend more on higher-quality, niche beverage experiences.

- Evolving Distribution Channels: Expansion of online retail and specialty liquor stores makes black beer more accessible.

Barriers & Challenges:

- Intense Competition: The broader beer market is highly competitive, with numerous established brands and emerging craft players vying for consumer attention.

- Regulatory Hurdles: Strict regulations surrounding alcohol production, distribution, and marketing can pose challenges, particularly for smaller breweries.

- Supply Chain Volatility: Fluctuations in the availability and cost of key ingredients like malts and hops can impact production and profitability.

- Consumer Perception and Education: Educating consumers about the nuances of different black beer styles and overcoming potential perceptions of being too heavy or bitter is an ongoing challenge. The estimated cost impact of supply chain disruptions is projected at $XXX million annually.

Emerging Opportunities in Black Beer Industry

Emerging opportunities in the black beer industry lie in further segmenting the market with highly specialized offerings and expanding into underdeveloped geographic regions. There's a significant opportunity in the non-alcoholic black beer segment, catering to health-conscious consumers and those seeking sophisticated beverage options without alcohol. Furthermore, exploring collaborations with the food industry for unique food and beer pairings, particularly with desserts and savory dishes, can unlock new consumer engagement avenues. The growing trend of limited-edition releases and experimental brews also presents a lucrative avenue for craft breweries to drive consumer excitement and loyalty. The estimated market penetration of non-alcoholic black beer is projected to reach XX% by 2033.

Growth Accelerators in the Black Beer Industry Industry

Several key catalysts are accelerating long-term growth in the black beer industry. Technological breakthroughs in yeast cultivation and enzyme technology are enabling the creation of smoother, more complex dark beer profiles, appealing to a broader audience. Strategic partnerships between craft breweries and larger beverage corporations can facilitate wider distribution and increased brand visibility. Furthermore, market expansion strategies targeting emerging economies with a growing middle class and an increasing appetite for premium beverages will be crucial for sustained growth. The development of innovative packaging solutions that enhance shelf life and consumer appeal will also contribute significantly to market acceleration.

Key Players Shaping the Black Beer Industry Market

- Allagash Brewing Company

- Phillips Brewing & Malting Co

- Sapporo Breweries Ltd

- Bent Paddle Brewing Company

- BrewDog

- Hill Farmstead Brewery

- New Belgium Brewing Company

- St Killian Importing Co

Notable Milestones in Black Beer Industry Sector

- 2019: Increased focus on barrel-aging techniques for dark beers, leading to enhanced flavor complexity.

- 2020: Rise in home brewing and at-home consumption, boosting off-trade sales of black beer.

- 2021: Growing demand for ethically sourced and sustainable ingredients in craft beer production.

- 2022: Introduction of new cold-brewed coffee black beer variants gaining popularity.

- 2023: Expansion of online beer marketplaces and direct-to-consumer sales models.

- 2024: Increased investment in research and development for low-alcohol and non-alcoholic dark beer options.

In-Depth Black Beer Industry Market Outlook

The black beer industry's future outlook is exceptionally promising, driven by sustained consumer demand for premium and artisanal beverage experiences. Growth accelerators such as technological innovation in brewing, strategic market expansions into developing economies, and an increasing consumer appreciation for complex flavor profiles will propel the market forward. The ongoing trend of premiumization within the beverage sector ensures that black beer, with its inherent richness and versatility, will continue to capture a significant share of the market. Further development of niche segments, including non-alcoholic options and unique ingredient fusions, will unlock new avenues for growth and cater to an ever-evolving consumer palate. The projected market value for 2033 is estimated at $XX billion.

Black Beer Industry Segmentation

-

1. Product Type

- 1.1. Lager

- 1.2. Ale

- 1.3. Others

-

2. Sales Channel

- 2.1. On-Trade

- 2.2. Off-Trade

Black Beer Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Black Beer Industry Regional Market Share

Geographic Coverage of Black Beer Industry

Black Beer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Escalating Consumer Investment in Preventive Healthcare Products; Increasing Algal Protein Applications Among Various Supplements

- 3.3. Market Restrains

- 3.3.1. Availability of Alternative Protein Sources

- 3.4. Market Trends

- 3.4.1. Increased Demand For Craft Beer

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Black Beer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Lager

- 5.1.2. Ale

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Black Beer Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Lager

- 6.1.2. Ale

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Sales Channel

- 6.2.1. On-Trade

- 6.2.2. Off-Trade

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Black Beer Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Lager

- 7.1.2. Ale

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Sales Channel

- 7.2.1. On-Trade

- 7.2.2. Off-Trade

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Black Beer Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Lager

- 8.1.2. Ale

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Sales Channel

- 8.2.1. On-Trade

- 8.2.2. Off-Trade

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Black Beer Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Lager

- 9.1.2. Ale

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Sales Channel

- 9.2.1. On-Trade

- 9.2.2. Off-Trade

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Black Beer Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Lager

- 10.1.2. Ale

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Sales Channel

- 10.2.1. On-Trade

- 10.2.2. Off-Trade

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Allagash Brewing Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Phillips Brewing & Malting Co *List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sapporo Breweries Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bent Paddle Brewing Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BrewDog

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hill Farmstead Brewery

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 New Belgium Brewing Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 St Killian Importing Co

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Allagash Brewing Company

List of Figures

- Figure 1: Global Black Beer Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Black Beer Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Black Beer Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Black Beer Industry Revenue (billion), by Sales Channel 2025 & 2033

- Figure 5: North America Black Beer Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 6: North America Black Beer Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Black Beer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Black Beer Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Black Beer Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Black Beer Industry Revenue (billion), by Sales Channel 2025 & 2033

- Figure 11: Europe Black Beer Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 12: Europe Black Beer Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Black Beer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Black Beer Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Black Beer Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Black Beer Industry Revenue (billion), by Sales Channel 2025 & 2033

- Figure 17: Asia Pacific Black Beer Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 18: Asia Pacific Black Beer Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Black Beer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Black Beer Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: South America Black Beer Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Black Beer Industry Revenue (billion), by Sales Channel 2025 & 2033

- Figure 23: South America Black Beer Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 24: South America Black Beer Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Black Beer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Black Beer Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Black Beer Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Black Beer Industry Revenue (billion), by Sales Channel 2025 & 2033

- Figure 29: Middle East and Africa Black Beer Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 30: Middle East and Africa Black Beer Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Black Beer Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Black Beer Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Black Beer Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 3: Global Black Beer Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Black Beer Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Black Beer Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 6: Global Black Beer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Black Beer Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global Black Beer Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 13: Global Black Beer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 14: Spain Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Russia Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Black Beer Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Black Beer Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 23: Global Black Beer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: China Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Black Beer Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Global Black Beer Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 31: Global Black Beer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Black Beer Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 36: Global Black Beer Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 37: Global Black Beer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 38: South Africa Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Black Beer Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Black Beer Industry?

The projected CAGR is approximately 4.07%.

2. Which companies are prominent players in the Black Beer Industry?

Key companies in the market include Allagash Brewing Company, Phillips Brewing & Malting Co *List Not Exhaustive, Sapporo Breweries Ltd, Bent Paddle Brewing Company, BrewDog, Hill Farmstead Brewery, New Belgium Brewing Company, St Killian Importing Co.

3. What are the main segments of the Black Beer Industry?

The market segments include Product Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 67.65 billion as of 2022.

5. What are some drivers contributing to market growth?

Escalating Consumer Investment in Preventive Healthcare Products; Increasing Algal Protein Applications Among Various Supplements.

6. What are the notable trends driving market growth?

Increased Demand For Craft Beer.

7. Are there any restraints impacting market growth?

Availability of Alternative Protein Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Black Beer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Black Beer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Black Beer Industry?

To stay informed about further developments, trends, and reports in the Black Beer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence