Key Insights

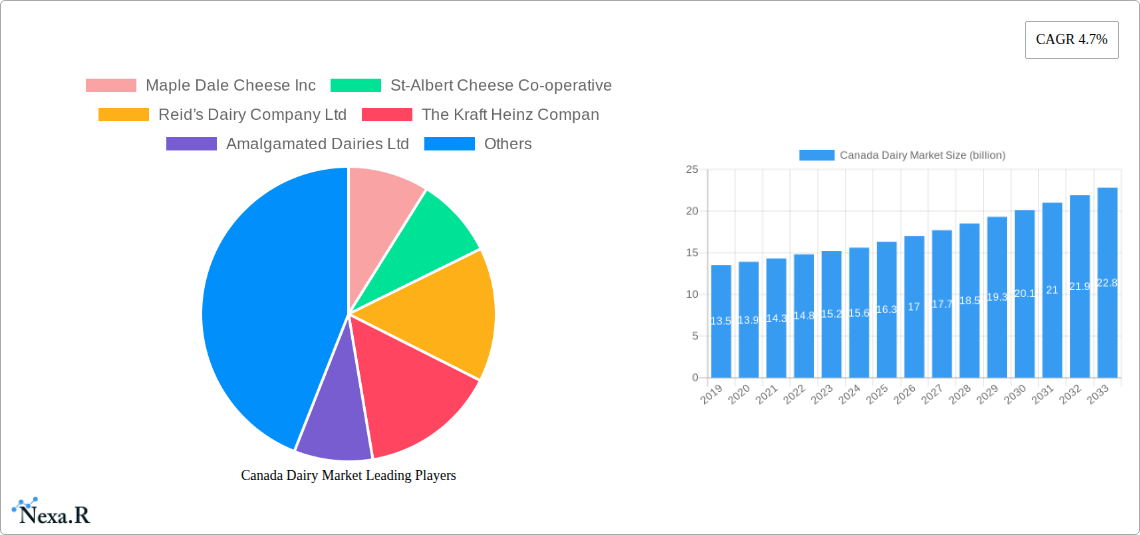

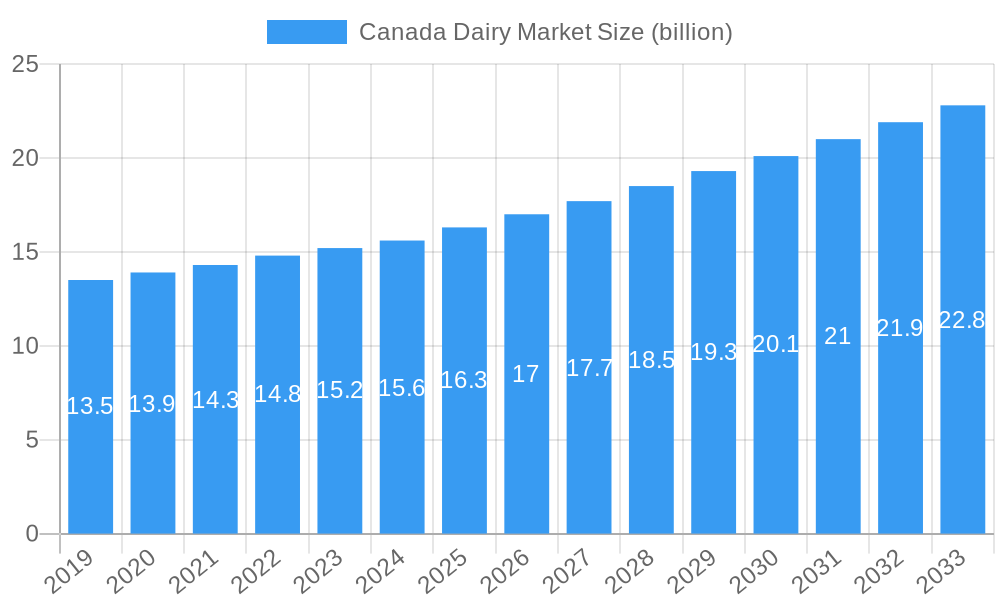

The Canadian dairy market is poised for steady expansion, with an estimated market size of CAD 15.4 billion in 2024 and a projected Compound Annual Growth Rate (CAGR) of 4.7%. This growth is primarily fueled by evolving consumer preferences towards healthier and more premium dairy products, alongside a rising demand for convenience. Key drivers include the increasing popularity of specialized dairy items like cultured butter and artisanal cheeses, which cater to a more discerning palate. Furthermore, the burgeoning online retail sector is significantly influencing distribution, making a wider array of dairy products more accessible to consumers across the nation. The expanding on-trade sector, encompassing restaurants and food services, also contributes to market momentum as dining out becomes more prevalent.

Canada Dairy Market Market Size (In Million)

Despite a robust growth trajectory, the market faces certain restraints. Fluctuations in raw milk prices and increasing operational costs for dairy producers can impact profitability and pricing strategies. Additionally, the growing awareness and adoption of plant-based alternatives present a competitive challenge. However, the inherent nutritional benefits and established consumer loyalty towards traditional dairy products are expected to mitigate these challenges. The market is segmented across various product categories including milk, cheese, yogurt, butter, cream, and dairy desserts, with each segment exhibiting unique growth dynamics influenced by consumer trends and innovation in product development and packaging. Distribution channels, particularly off-trade options like supermarkets and online retailers, are crucial for market penetration and expansion.

Canada Dairy Market Company Market Share

Canada Dairy Market: Comprehensive Report & Forecast (2019-2033)

This in-depth report delivers a detailed analysis of the Canada dairy market, encompassing its intricate structure, dynamic growth trends, dominant regional influences, evolving product landscape, and the key players shaping its future. With a focus on both parent and child market segments, this study offers unparalleled insights for industry professionals, investors, and stakeholders. The report leverages high-traffic keywords and presents all values in billion units, offering a clear and actionable understanding of this vital sector.

Canada Dairy Market Market Dynamics & Structure

The Canada dairy market is characterized by a moderately concentrated structure, with a few major cooperatives and international players holding significant market share. Technological innovation is primarily driven by advancements in processing technologies, packaging solutions, and the development of value-added dairy products. Regulatory frameworks, overseen by bodies like Dairy Farmers of Canada and provincial milk marketing boards, play a crucial role in managing supply, pricing, and quality standards, influencing competitive dynamics. While direct substitutes like plant-based alternatives are gaining traction, the inherent nutritional benefits and established consumer preferences for dairy products create strong brand loyalty, limiting their immediate disruptive impact. End-user demographics, including a growing health-conscious population and evolving household sizes, are influencing product demand. Mergers and acquisitions (M&A) are a consistent feature, aimed at expanding product portfolios, enhancing distribution networks, and achieving economies of scale.

- Market Concentration: Dominated by key players like Saputo Inc., Agropur Dairy Cooperative, and Groupe Lactalis, alongside emerging regional cooperatives.

- Technological Drivers: Focus on enhanced shelf-life, improved nutritional profiles, and sustainable production methods.

- Regulatory Landscape: Strict supply management systems and quality control measures influence market entry and product development.

- Competitive Substitutes: Growing influence of plant-based milk and dairy alternatives, though traditional dairy retains strong market position.

- End-User Demographics: Shifting preferences towards convenience, health benefits, and sustainably sourced products.

- M&A Activity: Strategic acquisitions to broaden product offerings and market reach, as exemplified by Lactalis Canada's recent acquisition.

Canada Dairy Market Growth Trends & Insights

The Canada dairy market is projected for steady growth throughout the forecast period (2025-2033), propelled by increasing consumer demand for nutritious and convenient dairy products. The market size is expected to expand from approximately $XX billion in the base year 2025 to $XX billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX%. Adoption rates for specialized dairy products, such as lactose-free milk and high-protein yogurts, are on the rise, reflecting a growing awareness of health and wellness benefits among Canadian consumers. Technological disruptions, including the adoption of advanced processing techniques that enhance texture and flavor, and innovations in smart packaging for improved traceability and freshness, are further stimulating market evolution. Consumer behavior shifts are evident, with a notable increase in online grocery shopping for dairy items and a growing preference for ethically and sustainably produced goods. The demand for premium and artisanal dairy products is also contributing to market expansion.

Dominant Regions, Countries, or Segments in Canada Dairy Market

Within the Canadian dairy landscape, Milk stands out as the dominant segment, encompassing a broad spectrum of products that cater to diverse consumer needs and applications. This category's dominance is fueled by its fundamental role in Canadian diets, serving as a staple for both direct consumption and as a key ingredient in numerous culinary preparations. Within the milk segment, Fresh Milk continues to hold the largest market share due to consistent daily demand across households. However, UHT Milk is experiencing significant growth, particularly in regions with longer supply chains or for consumers seeking extended shelf-life options. The strong performance of the milk segment is further bolstered by its presence across all distribution channels, from large supermarkets to smaller convenience stores, and its penetration into both off-trade and on-trade sectors. Economic factors, such as stable domestic production supported by supply management, and robust infrastructure for milk collection and processing, are critical drivers of this segment's dominance. Furthermore, ongoing innovation in milk fortification and specialized milk formulations (e.g., organic, A2) are expanding its appeal and market penetration. The growth potential for milk products remains substantial, driven by their perceived health benefits and versatility.

- Dominant Segment: Milk

- Sub-Segments Driving Growth: Fresh Milk, UHT Milk.

- Key Drivers: Ubiquitous consumption, versatility in cooking and beverages, strong supply chain infrastructure, perceived health benefits.

- Market Share: Holds the largest share within the overall dairy market.

- Growth Potential: Continues to be a foundational product with opportunities in niche and functional formulations.

- Key Distribution Channels: Off-Trade (Supermarkets and Hypermarkets, Convenience Stores), On-Trade.

- Regional Influence: Widespread demand across all Canadian provinces, with strong consumption patterns in urban centers.

Canada Dairy Market Product Landscape

The Canada dairy market is witnessing a surge in product innovation, with a strong emphasis on enhanced nutritional profiles and convenient formats. Key innovations include the development of lactose-free and plant-based hybrid dairy products, catering to evolving dietary needs and preferences. Functional dairy beverages, fortified with vitamins and probiotics for improved gut health and immunity, are gaining significant traction. Product applications extend from traditional consumption as beverages and ingredients to sophisticated use in gourmet desserts and specialized culinary applications. Performance metrics are increasingly focused on ingredient quality, natural sourcing, and sustainability.

Key Drivers, Barriers & Challenges in Canada Dairy Market

Key Drivers: The Canada dairy market is propelled by robust consumer demand for protein-rich and calcium-fortified products, driven by increasing health consciousness. Technological advancements in processing, such as ultra-filtration and aseptic packaging, are enabling the development of innovative and convenient dairy offerings. Favorable government policies supporting domestic production and marketing initiatives further bolster the sector. The growing popularity of premium and artisanal dairy products also acts as a significant growth accelerator.

Barriers & Challenges: The primary challenges facing the Canada dairy market include the rising competition from plant-based alternatives, which are gaining market share due to perceived health and environmental benefits. Fluctuations in raw milk prices and production costs can impact profitability and consumer pricing. Stringent regulatory frameworks, while ensuring quality, can sometimes create barriers to entry for new products and players. Supply chain disruptions, particularly those related to logistics and labor, can also pose significant hurdles.

Emerging Opportunities in Canada Dairy Market

Emerging opportunities in the Canada dairy market lie in the continued expansion of the functional foods and beverages segment, with a focus on probiotics, prebiotics, and added nutrients. The growing demand for sustainable and ethically sourced dairy products presents a significant opportunity for brands emphasizing transparency in their supply chains and environmental stewardship. The untapped potential in niche product categories, such as artisanal cheeses and specialized dairy desserts, offers avenues for premiumization and increased profitability. Furthermore, the increasing adoption of e-commerce for grocery shopping creates new avenues for direct-to-consumer dairy product sales and personalized subscription models.

Growth Accelerators in the Canada Dairy Market Industry

Long-term growth in the Canada dairy market will be significantly accelerated by ongoing technological breakthroughs in dairy processing, leading to enhanced product quality, extended shelf-life, and reduced waste. Strategic partnerships between dairy producers, ingredient suppliers, and food manufacturers will foster the development of innovative products that meet evolving consumer demands. Market expansion strategies, including the exploration of export markets and the development of new product applications in the food service and industrial sectors, will also be crucial for sustained growth. Investments in research and development focused on novel dairy ingredients and health benefits will further solidify the market's trajectory.

Key Players Shaping the Canada Dairy Market Market

- Maple Dale Cheese Inc.

- St-Albert Cheese Co-operative

- Reid’s Dairy Company Ltd

- The Kraft Heinz Company

- Amalgamated Dairies Ltd

- Gay Lea Foods Co-operative Limited

- Danone SA

- Organic Meadow Limited Partnership

- Agropur Dairy Cooperative

- Saputo Inc.

- Groupe Lactalis

Notable Milestones in Canada Dairy Market Sector

- December 2022: Lactalis Canada acquired Kraft Heinz's Grated Cheese business in Canada, marking its entry into the ambient category.

- November 2022: The Kraft Heinz Company launched the cheesecake kit Philly Handbag.

- June 2022: Danone North America partnered with White Plains, Boulder, and Colo and launched Activia+ Multi-Benefit Probiotic Yogurt Drinks.

In-Depth Canada Dairy Market Market Outlook

The outlook for the Canada dairy market remains highly positive, driven by a confluence of growth accelerators. Innovations in functional dairy, sustainable sourcing, and the expansion of e-commerce channels are poised to redefine consumer engagement and market reach. Strategic collaborations and continued investment in research and development will be pivotal in unlocking new product categories and fortifying the market's competitive edge. The industry is well-positioned for sustained expansion, adapting to evolving consumer preferences and technological advancements to secure a strong future.

Canada Dairy Market Segmentation

-

1. Category

-

1.1. Butter

-

1.1.1. By Product Type

- 1.1.1.1. Cultured Butter

- 1.1.1.2. Uncultured Butter

-

1.1.1. By Product Type

-

1.2. Cheese

- 1.2.1. Natural Cheese

- 1.2.2. Processed Cheese

-

1.3. Cream

- 1.3.1. Double Cream

- 1.3.2. Single Cream

- 1.3.3. Whipping Cream

- 1.3.4. Others

-

1.4. Dairy Desserts

- 1.4.1. Cheesecakes

- 1.4.2. Frozen Desserts

- 1.4.3. Ice Cream

- 1.4.4. Mousses

-

1.5. Milk

- 1.5.1. Condensed milk

- 1.5.2. Flavored Milk

- 1.5.3. Fresh Milk

- 1.5.4. Powdered Milk

- 1.5.5. UHT Milk

- 1.6. Sour Milk Drinks

-

1.7. Yogurt

- 1.7.1. Flavored Yogurt

- 1.7.2. Unflavored Yogurt

-

1.1. Butter

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

Canada Dairy Market Segmentation By Geography

- 1. Canada

Canada Dairy Market Regional Market Share

Geographic Coverage of Canada Dairy Market

Canada Dairy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumer health conciousness; Growing consumer inclination toward Vegan/Plant-Based Proteins

- 3.3. Market Restrains

- 3.3.1. Stringent government regulation of food labels/claims

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Dairy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Butter

- 5.1.1.1. By Product Type

- 5.1.1.1.1. Cultured Butter

- 5.1.1.1.2. Uncultured Butter

- 5.1.1.1. By Product Type

- 5.1.2. Cheese

- 5.1.2.1. Natural Cheese

- 5.1.2.2. Processed Cheese

- 5.1.3. Cream

- 5.1.3.1. Double Cream

- 5.1.3.2. Single Cream

- 5.1.3.3. Whipping Cream

- 5.1.3.4. Others

- 5.1.4. Dairy Desserts

- 5.1.4.1. Cheesecakes

- 5.1.4.2. Frozen Desserts

- 5.1.4.3. Ice Cream

- 5.1.4.4. Mousses

- 5.1.5. Milk

- 5.1.5.1. Condensed milk

- 5.1.5.2. Flavored Milk

- 5.1.5.3. Fresh Milk

- 5.1.5.4. Powdered Milk

- 5.1.5.5. UHT Milk

- 5.1.6. Sour Milk Drinks

- 5.1.7. Yogurt

- 5.1.7.1. Flavored Yogurt

- 5.1.7.2. Unflavored Yogurt

- 5.1.1. Butter

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Maple Dale Cheese Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 St-Albert Cheese Co-operative

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Reid’s Dairy Company Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Kraft Heinz Compan

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amalgamated Dairies Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gay Lea Foods Co-operative Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Danone SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Organic Meadow Limited Partnership

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Agropur Dairy Cooperative

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Saputo Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Groupe Lactalis

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Maple Dale Cheese Inc

List of Figures

- Figure 1: Canada Dairy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Dairy Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Dairy Market Revenue billion Forecast, by Category 2020 & 2033

- Table 2: Canada Dairy Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Canada Dairy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Canada Dairy Market Revenue billion Forecast, by Category 2020 & 2033

- Table 5: Canada Dairy Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Canada Dairy Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Dairy Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Canada Dairy Market?

Key companies in the market include Maple Dale Cheese Inc, St-Albert Cheese Co-operative, Reid’s Dairy Company Ltd, The Kraft Heinz Compan, Amalgamated Dairies Ltd, Gay Lea Foods Co-operative Limited, Danone SA, Organic Meadow Limited Partnership, Agropur Dairy Cooperative, Saputo Inc, Groupe Lactalis.

3. What are the main segments of the Canada Dairy Market?

The market segments include Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumer health conciousness; Growing consumer inclination toward Vegan/Plant-Based Proteins.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Stringent government regulation of food labels/claims.

8. Can you provide examples of recent developments in the market?

December 2022: Lactalis Canada acquired Kraft Heinz's Grated Cheese business in Canada, marking its entry into the ambient category.November 2022: The Kraft Heinz Company launched the cheesecake kit Philly Handbag.June 2022: Danone North America partnered with White Plains, Boulder, and Colo and launched Activia+ Multi-Benefit Probiotic Yogurt Drinks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Dairy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Dairy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Dairy Market?

To stay informed about further developments, trends, and reports in the Canada Dairy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence