Key Insights

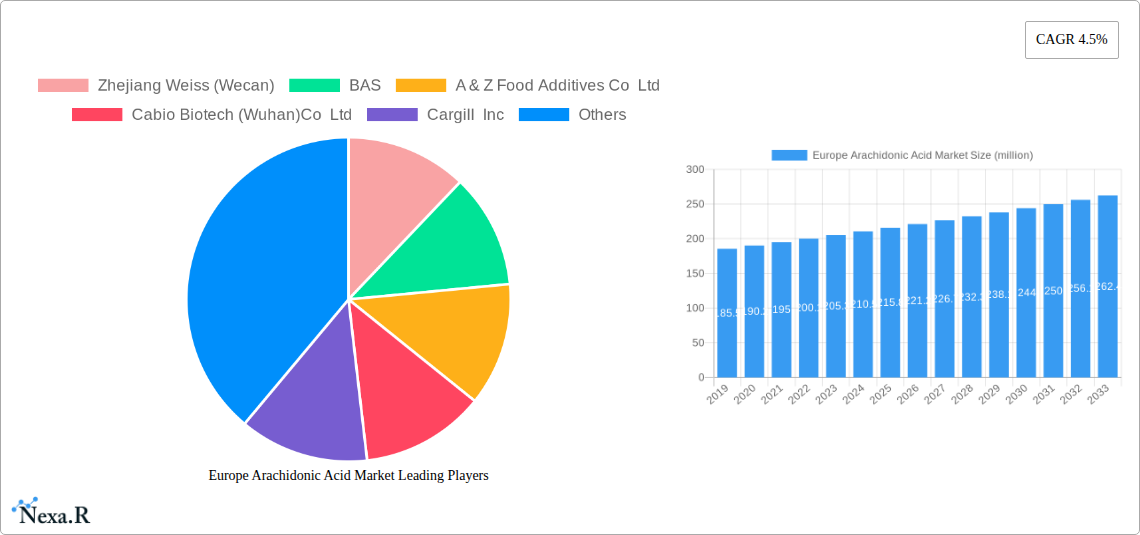

The European Arachidonic Acid (ARA) market is poised for significant expansion, driven by increasing consumer demand for health-conscious products and advancements in dietary supplement formulations. With an estimated market size of $220 million in 2024, the sector is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 4.5% through 2033. This upward trajectory is largely fueled by the rising awareness of ARA's crucial role in infant nutrition and cognitive development, leading to its widespread incorporation into infant formulas. Furthermore, the burgeoning dietary supplement sector, catering to individuals seeking enhanced brain health, immune support, and athletic performance, represents another substantial growth avenue. The pharmaceutical industry also contributes to this demand, utilizing ARA in research and the development of therapies for various health conditions. The technological advancements in extraction methods, particularly Solvent Extraction and Solid-Phase Extraction, are enhancing the purity and yield of ARA, making it more accessible and cost-effective for manufacturers.

Europe Arachidonic Acid Market Market Size (In Million)

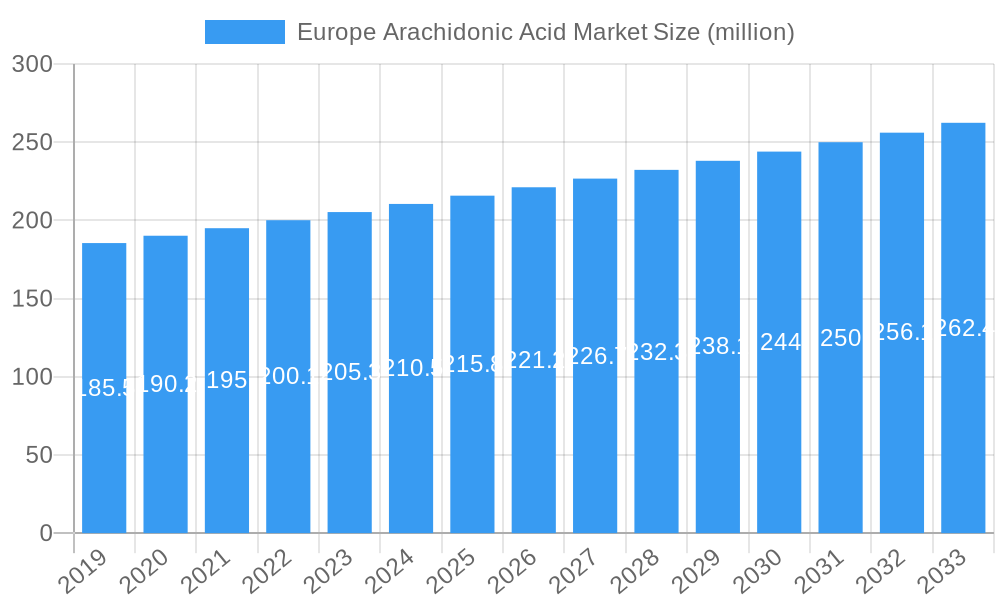

The European market for Arachidonic Acid is characterized by a strong presence of key players like Zhejiang Weiss (Wecan), BAS, and Cargill Inc., all actively innovating and expanding their product portfolios. While the demand from Germany, the United Kingdom, and France remains dominant, significant growth is anticipated in other European nations such as Spain, Italy, and Russia, as awareness and accessibility of ARA-enriched products increase. The market, however, faces certain restraints, including the complex regulatory landscape surrounding novel food ingredients and potential price volatility of raw materials. Nevertheless, the overarching trend towards preventative healthcare and the continuous discovery of ARA's health benefits are expected to overcome these challenges, solidifying its position as a vital component in the European health and wellness landscape. The forecast period from 2025 to 2033 anticipates sustained innovation and market penetration, further cementing ARA's importance.

Europe Arachidonic Acid Market Company Market Share

Europe Arachidonic Acid Market Report Description

This comprehensive report, Europe Arachidonic Acid Market: Size, Share, Trends, Analysis & Forecast 2025-2033, offers an in-depth analysis of the evolving European arachidonic acid market. Covering the historical period from 2019 to 2024 and projecting growth through 2033, this study provides critical insights for stakeholders navigating this dynamic sector. With a base year of 2025, the report leverages advanced analytical techniques to deliver actionable intelligence on market dynamics, growth trends, dominant segments, product innovations, and key challenges.

The report meticulously examines the parent market – Arachidonic Acid – and its crucial child markets, including specific applications like Infant Formula and Dietary Supplements within the Food and Beverage sector, alongside the Pharmaceutical segment. Utilizing high-traffic keywords such as "Arachidonic Acid Europe," "ARA Market," "Omega-6 Fatty Acids," "Infant Nutrition Ingredients," "Dietary Supplement APIs," and "Pharmaceutical Ingredients Europe," this report ensures maximum visibility for industry professionals and decision-makers.

Quantifiable data presented in million units for market size, historical growth, and future projections, alongside qualitative analyses of competitive landscapes and regulatory frameworks, makes this report an indispensable resource. This report is designed for immediate use, requiring no further modification.

Europe Arachidonic Acid Market Market Dynamics & Structure

The European Arachidonic Acid (ARA) market exhibits a moderately concentrated structure, characterized by the presence of established global players and emerging regional manufacturers. Technological innovation is a key driver, with advancements in extraction and purification techniques from microalgae and fungi continuously improving ARA yield and purity. Regulatory frameworks, particularly concerning food safety, infant nutrition, and pharmaceutical applications, play a significant role in shaping market access and product development. Competitive product substitutes, primarily other omega fatty acids and synthesized alternatives, pose a constant challenge, necessitating continuous product differentiation and clear articulation of ARA's unique benefits. End-user demographics are increasingly influenced by a growing health-conscious population seeking functional foods and dietary supplements, driving demand for ARA in these applications. Mergers and acquisitions (M&A) trends are observed, as larger companies seek to expand their portfolios and gain market share, further consolidating the competitive landscape.

- Market Concentration: Dominated by a few key players, but with increasing fragmentation due to new entrants and specialized manufacturers.

- Technological Innovation: Focus on sustainable sourcing (microalgae, fungi) and efficient extraction (e.g., advanced solvent and solid-phase extraction) to reduce costs and improve quality.

- Regulatory Frameworks: Strict adherence to EFSA (European Food Safety Authority) guidelines for food additives and novel foods; EMA (European Medicines Agency) regulations for pharmaceutical-grade ARA.

- Competitive Substitutes: Competition from EPA, DHA, and other omega-3 and omega-6 fatty acids; emergence of synthetic ARA in certain applications.

- End-User Demographics: Growing demand from aging populations, parents seeking optimal infant development, and athletes focused on performance and recovery.

- M&A Trends: Strategic acquisitions by major ingredient suppliers and food conglomerates to secure supply chains and expand product offerings.

Europe Arachidonic Acid Market Growth Trends & Insights

The Europe Arachidonic Acid (ARA) market is poised for significant expansion driven by a confluence of factors including rising consumer awareness of health and wellness, increasing adoption in infant nutrition, and expanding applications in pharmaceuticals and dietary supplements. The market size is projected to evolve from approximately $XXX million in 2025 to an estimated $XXX million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of XX.X%. This growth is underpinned by a notable increase in adoption rates across key segments.

Technological disruptions, particularly in microalgal cultivation and fermentation processes, are leading to more cost-effective and sustainable ARA production. This enhanced efficiency is crucial for meeting the escalating demand from the food and beverage industry, especially for infant formula fortification, where ARA is recognized for its critical role in brain and eye development. Dietary supplements are another major growth engine, with consumers increasingly seeking out ARA for its potential anti-inflammatory properties and benefits in sports nutrition. The pharmaceutical sector is also exploring ARA for therapeutic applications, further broadening its market penetration.

Consumer behavior shifts are playing a pivotal role. There's a discernible preference for natural and bio-based ingredients, which aligns perfectly with ARA derived from microbial sources. Furthermore, the growing trend of personalized nutrition and the proactive management of health conditions are driving demand for specialized ingredients like ARA. The "clean label" movement also favors naturally sourced ARA over synthetic alternatives. Market penetration is expected to deepen as awareness of ARA's specific benefits, beyond general omega-6 fatty acids, becomes more widespread. Projections indicate that the food and beverage segment, particularly infant formula, will continue to hold the largest market share, but the pharmaceutical and dietary supplement segments are expected to exhibit higher growth rates due to ongoing research and development and a rising demand for evidence-based health solutions. The overall market penetration for ARA in targeted applications is estimated to reach XX% by 2033.

Dominant Regions, Countries, or Segments in Europe Arachidonic Acid Market

Within the European Arachidonic Acid (ARA) market, the Food and Beverage segment, specifically Infant Formula, stands out as the dominant force driving market growth. This dominance is a direct consequence of the indispensable role ARA plays in infant cognitive and visual development. European regulatory bodies, such as the European Food Safety Authority (EFSA), have established guidelines that permit and even recommend the inclusion of ARA in infant formulas, creating a robust and consistent demand. Countries with high birth rates and advanced infant care practices, such as Germany, France, the UK, and the Nordic nations, represent key markets within this dominant segment. The economic policies in these regions, often prioritizing public health initiatives and parental support, further bolster the consumption of fortified infant nutrition products.

The Technology: Solvent Extraction method currently holds a significant share in ARA production within Europe. This is attributed to its established efficiency and scalability for commercial production, particularly when sourcing ARA from fungal and yeast biomass. However, the increasing emphasis on sustainability and cost-effectiveness is driving research and investment into alternative technologies like Solid-Phase Extraction and, more prominently, direct microbial fermentation and microalgal cultivation. These emerging technologies promise higher yields and reduced environmental impact, potentially shifting the technological landscape in the coming years.

The Application: Dietary Supplements segment is also experiencing substantial growth, driven by an aging European population increasingly focused on cognitive health, joint support, and managing inflammatory conditions. The "wellness" trend across Europe, coupled with rising disposable incomes, empowers consumers to invest in preventative healthcare solutions, making ARA-fortified supplements a popular choice. The pharmaceutical segment, while currently smaller in market share, presents significant future growth potential. Ongoing clinical trials and research into ARA's therapeutic applications for conditions ranging from cardiovascular health to neurodegenerative diseases are expected to drive its adoption as a pharmaceutical ingredient. The market share of Infant Formula within the total ARA market is estimated at approximately XX% in 2025, with Dietary Supplements at XX% and Pharmaceuticals at XX%. The growth potential for Dietary Supplements and Pharmaceuticals is projected to be higher than that of Infant Formula in the forecast period.

Europe Arachidonic Acid Market Product Landscape

The Europe Arachidonic Acid (ARA) product landscape is characterized by a focus on high purity and specialized formulations tailored for distinct applications. Leading companies are offering ARA in various forms, including oil dispersions and powders, to enhance stability and ease of incorporation into finished products. Innovations center on improving the bioavailability of ARA and ensuring its stability against oxidation, particularly critical for food and pharmaceutical applications. Product performance is measured by purity levels (often exceeding 90% for pharmaceutical grades), specific fatty acid profiles, and efficacy in target applications, such as promoting infant visual acuity or supporting cognitive function. Unique selling propositions include sourcing from sustainable and traceable origins, such as specific strains of microalgae or fungi, and demonstrating superior sensory profiles in food applications. Technological advancements are evident in the development of microencapsulation techniques for enhanced stability and controlled release.

Key Drivers, Barriers & Challenges in Europe Arachidonic Acid Market

Key Drivers:

- Growing Health and Wellness Consciousness: Increased consumer awareness of the health benefits of omega-6 fatty acids, particularly ARA, for cognitive function, vision, and anti-inflammatory responses.

- Demand in Infant Nutrition: ARA's critical role in infant development drives consistent demand for fortification in infant formulas across Europe.

- Expanding Dietary Supplement Market: Rising popularity of dietary supplements for proactive health management, sports nutrition, and age-related health concerns.

- Technological Advancements in Production: Improved extraction and fermentation techniques leading to higher yields, enhanced purity, and cost-effectiveness.

- Research and Development in Pharmaceuticals: Emerging therapeutic applications for ARA in treating various chronic diseases are spurring pharmaceutical interest and investment.

Key Barriers & Challenges:

- Regulatory Hurdles: Navigating evolving and stringent food and pharmaceutical regulations across different European countries can be complex and time-consuming, impacting market entry and product approval timelines.

- Supply Chain Volatility: Dependence on specific raw material sources (e.g., microalgae cultivation) can lead to supply chain disruptions due to environmental factors or geopolitical issues.

- Price Sensitivity and Competition: The presence of competing omega fatty acids and synthesized alternatives can create price pressures, especially in high-volume food applications.

- Consumer Education and Awareness: While awareness is growing, a significant portion of the consumer base may not fully understand the specific benefits of ARA compared to other omega fatty acids, requiring ongoing educational efforts.

- Oxidative Stability: ARA's susceptibility to oxidation necessitates advanced stabilization techniques, adding to production costs and product development complexities.

Emerging Opportunities in Europe Arachidonic Acid Market

Emerging opportunities in the Europe Arachidonic Acid (ARA) market lie in the burgeoning field of personalized nutrition and the development of functional foods targeting specific health outcomes. The increasing consumer demand for plant-based and sustainable ingredients presents a significant avenue for ARA derived from microalgae and fungi, moving away from traditional animal-based sources. Untapped markets exist in developing specialized ARA formulations for active aging populations, focusing on cognitive support and joint health. Furthermore, exploring novel applications in pet food fortification, leveraging ARA's benefits for animal health and well-being, represents an underserved niche. The growing interest in the gut-brain axis also opens doors for research and product development involving ARA.

Growth Accelerators in the Europe Arachidonic Acid Market Industry

Long-term growth in the Europe Arachidonic Acid (ARA) market will be significantly accelerated by continued investment in sustainable and efficient production technologies, particularly advanced microalgal cultivation and precision fermentation. Strategic partnerships between ingredient manufacturers, food and beverage companies, and pharmaceutical firms will be crucial for co-development and market penetration of innovative ARA-based products. Expansion into emerging European economies with growing disposable incomes and increasing health consciousness will unlock new demand centers. Furthermore, ongoing clinical research validating the therapeutic benefits of ARA will serve as a powerful catalyst, driving demand from the pharmaceutical sector and bolstering consumer confidence in its efficacy for dietary supplements. The focus on bio-based and natural ingredients by consumers will also act as a significant growth accelerator.

Key Players Shaping the Europe Arachidonic Acid Market Market

- Zhejiang Weiss (Wecan)

- BAS

- A & Z Food Additives Co Ltd

- Cabio Biotech (Wuhan)Co Ltd

- Cargill Inc

- Cayman Chemicals

- Xiamen Kingdomway

- Guangdong Runke Bioengineering Co Ltd

- Royal DSM

- Martek Bioscience

Notable Milestones in Europe Arachidonic Acid Market Sector

- 2019: Increased research publications highlighting ARA's role in immune system support.

- 2020: Expansion of microalgae cultivation facilities in Europe to meet growing demand for sustainable ARA.

- 2021: Introduction of new, highly stable ARA formulations for infant formula by major ingredient suppliers.

- 2022: Several European countries revise infant nutrition guidelines, emphasizing the importance of DHA and ARA.

- 2023: Launch of new dietary supplements targeting cognitive health and joint support featuring high-purity ARA.

- 2024: Increased investment in clinical trials investigating ARA for neurological disorders.

In-Depth Europe Arachidonic Acid Market Market Outlook

The Europe Arachidonic Acid (ARA) market outlook is exceptionally positive, fueled by sustained growth drivers and the continuous emergence of new opportunities. The increasing consumer demand for health-promoting ingredients, coupled with the indispensable role of ARA in infant nutrition and its expanding therapeutic potential in pharmaceuticals, provides a robust foundation for market expansion. Strategic advancements in production technologies, focusing on sustainability and cost-effectiveness, will further bolster supply and market accessibility. The trend towards bio-based and natural ingredients aligns perfectly with ARA's sourcing, enhancing its market appeal. The focus on personalized nutrition and the proactive management of health conditions will continue to drive demand for specialized ARA formulations. Consequently, the market is projected to witness robust growth, presenting significant strategic opportunities for stakeholders to innovate and capture market share within this vital nutritional ingredient sector.

Europe Arachidonic Acid Market Segmentation

-

1. Technology

- 1.1. Solvent Extraction

- 1.2. Solid-Phase Extraction

-

2. Application

-

2.1. Food and Beverage

- 2.1.1. Infant Formula

- 2.1.2. Dietary Supplements

- 2.2. Pharmaceuticals

-

2.1. Food and Beverage

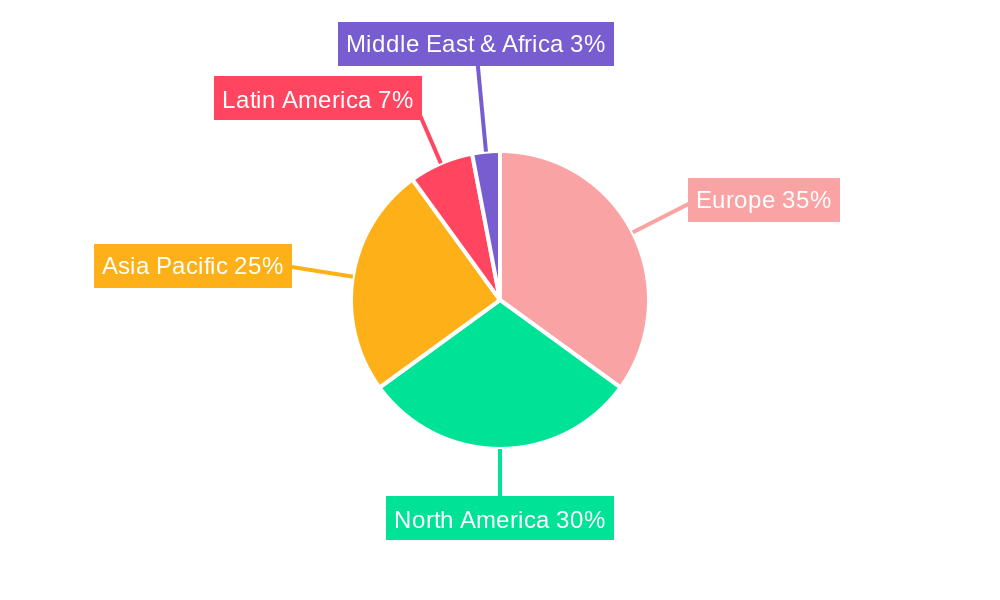

Europe Arachidonic Acid Market Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. United Kingdom

- 1.3. France

- 1.4. Russia

- 1.5. Spain

- 1.6. Italy

- 1.7. Rest of Europe

Europe Arachidonic Acid Market Regional Market Share

Geographic Coverage of Europe Arachidonic Acid Market

Europe Arachidonic Acid Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation

- 3.3. Market Restrains

- 3.3.1. ; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition

- 3.4. Market Trends

- 3.4.1. Infant Nutrition Holds The Dominant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Arachidonic Acid Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Solvent Extraction

- 5.1.2. Solid-Phase Extraction

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.1.1. Infant Formula

- 5.2.1.2. Dietary Supplements

- 5.2.2. Pharmaceuticals

- 5.2.1. Food and Beverage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zhejiang Weiss (Wecan)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BAS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 A & Z Food Additives Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cabio Biotech (Wuhan)Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cargill Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cayman Chemicals

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Xiamen Kingdomway

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Guangdong Runke Bioengineering Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Royal DSM

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Martek Bioscience

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Zhejiang Weiss (Wecan)

List of Figures

- Figure 1: Europe Arachidonic Acid Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Arachidonic Acid Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Arachidonic Acid Market Revenue million Forecast, by Technology 2020 & 2033

- Table 2: Europe Arachidonic Acid Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Europe Arachidonic Acid Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Arachidonic Acid Market Revenue million Forecast, by Technology 2020 & 2033

- Table 5: Europe Arachidonic Acid Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Europe Arachidonic Acid Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: Germany Europe Arachidonic Acid Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: United Kingdom Europe Arachidonic Acid Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Arachidonic Acid Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Russia Europe Arachidonic Acid Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Arachidonic Acid Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Arachidonic Acid Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Europe Arachidonic Acid Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Arachidonic Acid Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Europe Arachidonic Acid Market?

Key companies in the market include Zhejiang Weiss (Wecan), BAS, A & Z Food Additives Co Ltd, Cabio Biotech (Wuhan)Co Ltd, Cargill Inc, Cayman Chemicals, Xiamen Kingdomway, Guangdong Runke Bioengineering Co Ltd, Royal DSM, Martek Bioscience.

3. What are the main segments of the Europe Arachidonic Acid Market?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 220 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation.

6. What are the notable trends driving market growth?

Infant Nutrition Holds The Dominant Share.

7. Are there any restraints impacting market growth?

; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Arachidonic Acid Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Arachidonic Acid Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Arachidonic Acid Market?

To stay informed about further developments, trends, and reports in the Europe Arachidonic Acid Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence