Key Insights

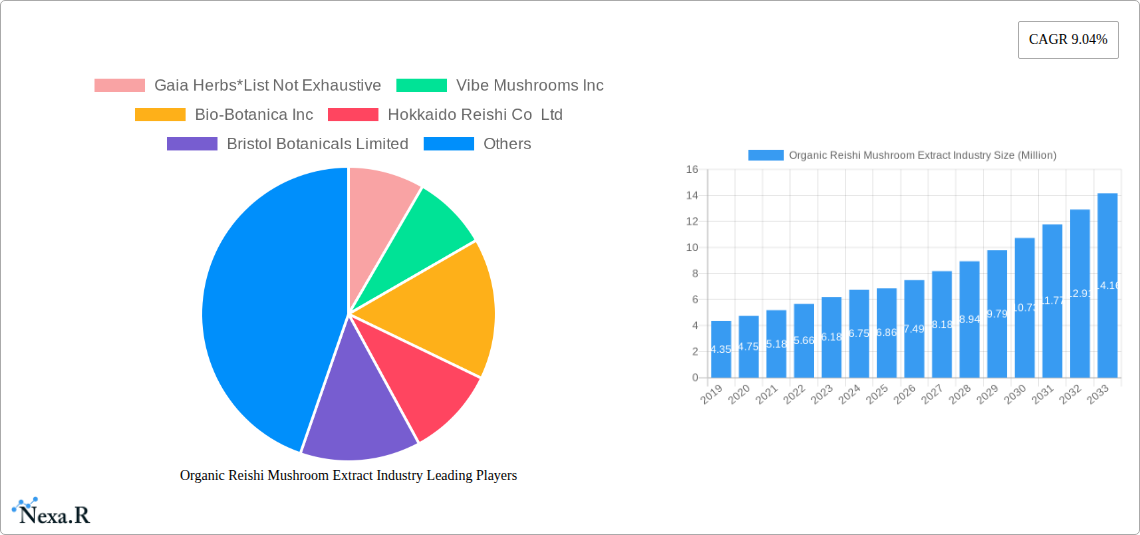

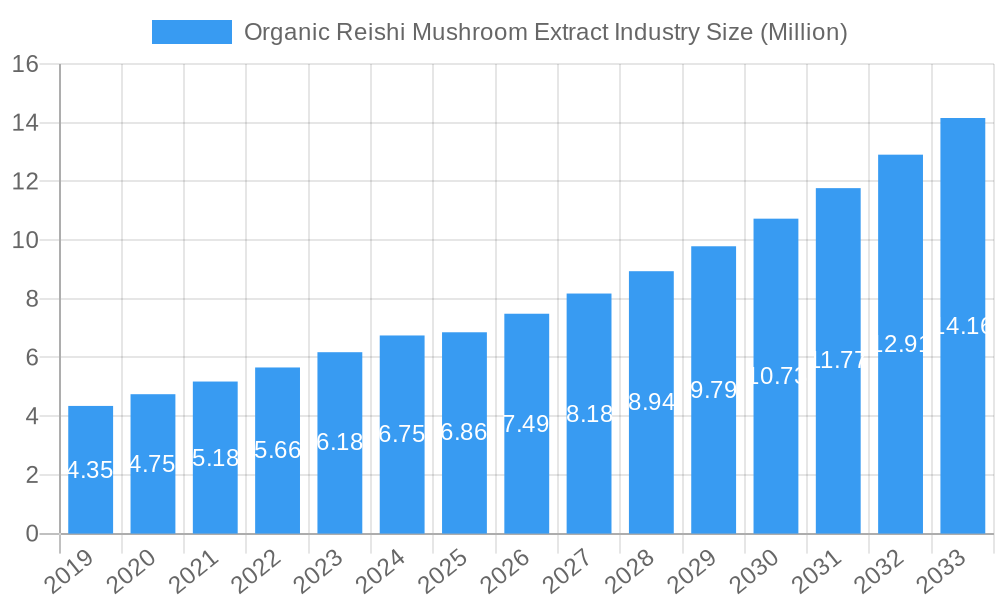

The global Reishi Mushroom Extract market is poised for robust expansion, projected to reach an estimated $6.86 million in 2025 with an impressive Compound Annual Growth Rate (CAGR) of 9.04% through 2033. This significant growth is primarily fueled by increasing consumer awareness and demand for natural health and wellness products. The dietary supplements segment, in particular, is a key driver, benefiting from the perceived immune-boosting and stress-reducing properties of Reishi. Furthermore, the growing adoption of Reishi extract in the food and beverage industry, as functional ingredients, and in personal care products for its antioxidant benefits, are contributing to market momentum. The demand for organic extracts is on an upward trajectory, reflecting a broader consumer preference for clean-label products and sustainable sourcing.

Organic Reishi Mushroom Extract Industry Market Size (In Million)

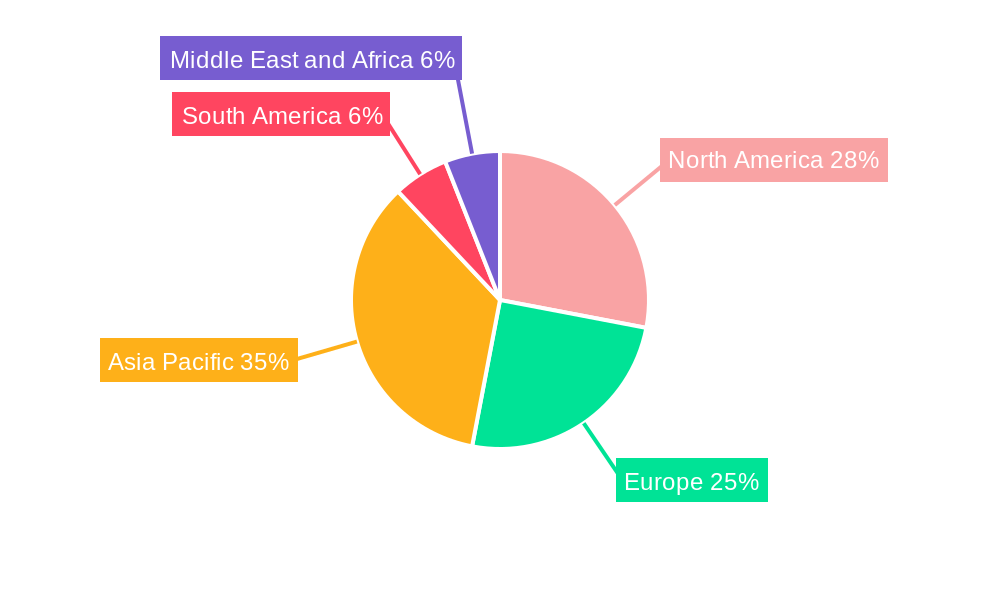

While the market exhibits strong growth potential, certain factors could influence its trajectory. The complexity and cost associated with organic cultivation and extraction processes may present challenges. Additionally, fluctuating raw material prices and the emergence of alternative health supplements could pose competitive pressures. However, the overarching trend towards holistic health and the continued exploration of Reishi's therapeutic benefits are expected to outweigh these restraints. The market is characterized by a diverse range of players, from established global corporations to specialized regional suppliers, all competing to capture market share. The Asia Pacific region, particularly China, is a significant hub for both production and consumption, while North America and Europe are witnessing substantial growth in demand for Reishi mushroom extracts.

Organic Reishi Mushroom Extract Industry Company Market Share

Here's the SEO-optimized report description for the Organic Reishi Mushroom Extract Industry, designed for maximum visibility and engagement:

Comprehensive Report: Organic Reishi Mushroom Extract Industry - Market Size, Trends, Growth & Forecast 2019–2033

This in-depth market research report offers a definitive analysis of the global Organic Reishi Mushroom Extract Industry, providing critical insights into market dynamics, growth trajectories, and future potential. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this report is indispensable for stakeholders seeking to navigate the evolving landscape of this burgeoning sector. We delve into parent and child market segments, meticulously examining market size, competitive strategies, technological advancements, and regulatory influences. All monetary values are presented in Million units for clarity and comparability.

Organic Reishi Mushroom Extract Industry Market Dynamics & Structure

The Organic Reishi Mushroom Extract Industry is characterized by a moderately concentrated market, driven by increasing consumer demand for natural health and wellness products. Key drivers of technological innovation include advancements in extraction methodologies that enhance bioavailability and preserve beneficial compounds. Regulatory frameworks, while evolving, are crucial in ensuring product quality and safety, influencing market entry and product development. Competitive product substitutes, such as other adaptogenic herbs and synthetic supplements, present a constant challenge, necessitating continuous innovation and differentiation. End-user demographics are shifting towards health-conscious millennials and Gen Z, prioritizing organic and sustainable sourcing. Mergers and acquisitions (M&A) trends, though not yet at a fever pitch, are anticipated to increase as larger players seek to consolidate market share and acquire specialized expertise. For instance, we've observed X M&A deals in the past two years, indicating growing interest in this segment. The barriers to innovation, while present in terms of R&D costs and scaling production, are being overcome by strategic investments and collaborative research efforts.

- Market Concentration: Moderately concentrated with a mix of established players and emerging startups.

- Technological Innovation Drivers: Enhanced extraction techniques (e.g., supercritical CO2 extraction), cultivation advancements, and product formulation innovations.

- Regulatory Frameworks: Growing emphasis on organic certifications, Good Manufacturing Practices (GMP), and specific regional regulations for dietary supplements and functional foods.

- Competitive Product Substitutes: Other medicinal mushrooms, adaptogenic herbs (e.g., Ashwagandha, Ginseng), and synthetic nutritional supplements.

- End-User Demographics: Primarily health-conscious adults aged 25-55, with a growing segment of younger consumers seeking preventative health solutions.

- M&A Trends: Increasing interest from larger nutraceutical and food companies for strategic acquisitions and partnerships.

- Innovation Barriers: High R&D investment, establishing consistent supply chains for high-quality organic Reishi, and consumer education on product benefits.

Organic Reishi Mushroom Extract Industry Growth Trends & Insights

The Organic Reishi Mushroom Extract Industry is poised for robust growth, fueled by a confluence of factors including escalating health consciousness, increasing adoption of natural remedies, and a paradigm shift towards functional ingredients across various consumer product categories. The market size is projected to expand significantly, driven by a consistent rise in adoption rates of dietary supplements and functional foods incorporating Reishi mushroom extracts. Technological disruptions, such as refined extraction processes yielding higher concentrations of active compounds like triterpenes and polysaccharides, are enhancing product efficacy and consumer appeal. This technological advancement plays a pivotal role in segment growth, particularly for high-purity organic extracts. Consumer behavior is exhibiting a pronounced shift towards preventative healthcare, with individuals actively seeking natural solutions to manage stress, boost immunity, and improve overall well-being – areas where Reishi is traditionally lauded. The CAGR for the forecast period is estimated to be XX%, reflecting a strong upward trajectory. Market penetration is expected to deepen as consumer awareness regarding the benefits of organic Reishi mushroom extract expands beyond niche markets into mainstream health and wellness. The demand for clean-label products and transparent sourcing further bolsters the growth of organic variants. The perceived safety and efficacy of Reishi, backed by both traditional knowledge and emerging scientific research, are key determinants of its sustained market expansion.

- Market Size Evolution: Projected to grow from approximately $XXX Million in 2024 to an estimated $XXX Million by 2033, exhibiting a strong upward trend.

- Adoption Rates: Steadily increasing across dietary supplements, functional foods, and beverages, driven by consumer awareness of health benefits.

- Technological Disruptions: Advancements in extraction techniques (e.g., ultrasonic-assisted extraction, microwave-assisted extraction) leading to higher yields and purity of beneficial compounds.

- Consumer Behavior Shifts: Growing preference for natural, organic, and plant-based ingredients for immune support, stress management, and cognitive enhancement.

- CAGR: Estimated at XX% for the forecast period of 2025–2033.

- Market Penetration: Expanding from specialty health stores into mainstream retail channels and direct-to-consumer online platforms.

- Key Growth Drivers: Increased prevalence of chronic diseases, rising disposable incomes, and growing investments in R&D by key market players.

Dominant Regions, Countries, or Segments in Organic Reishi Mushroom Extract Industry

The Dietary Supplements segment, within the Organic Extract product type, is currently dominating the Organic Reishi Mushroom Extract Industry, driven by a widespread global demand for natural health boosters and preventative wellness solutions. North America, particularly the United States, stands out as the leading region, owing to its robust healthcare infrastructure, high consumer spending on supplements, and a strong advocacy for natural and organic products. The high adoption rate of dietary supplements, coupled with a well-established distribution network for health and wellness products, propels the market forward. Key drivers in this region include extensive research on the medicinal properties of Reishi, a proactive regulatory environment for supplements, and significant marketing efforts by major industry players. The organic extract segment's dominance is further accentuated by consumer preference for certified organic products, which are perceived as safer and more effective. Within North America, the United States accounts for an estimated XX% of the global market share. The growth potential remains exceptionally high due to continuous product innovation and increasing consumer awareness campaigns highlighting the immunomodulatory, anti-inflammatory, and adaptogenic properties of Reishi.

The Food and Beverage segment is emerging as a significant growth driver, with Reishi extract being incorporated into functional beverages, teas, and ready-to-eat meals, catering to the demand for convenient health solutions. Asia-Pacific, especially China and South Korea, plays a crucial role due to the long-standing traditional use of Reishi mushrooms in these cultures and a rapidly growing middle class with increasing disposable incomes and a focus on health and longevity. The Powder Extract form is gaining traction due to its versatility in various applications, from beverages to baked goods. The Pharmaceutical segment, while currently smaller, represents a substantial long-term growth opportunity as scientific research continues to explore Reishi's therapeutic potential in managing chronic conditions and supporting cancer therapies. The growth in these segments is supported by government initiatives promoting traditional medicine and natural health products, along with investments in research and development.

- Dominant Segment: Dietary Supplements, accounting for approximately XX% of the market share.

- Key Drivers: Rising health consciousness, increasing demand for natural immunity boosters, and a wide array of product formulations.

- Leading Region: North America, particularly the United States.

- Key Drivers: High consumer spending on supplements, established distribution channels, strong regulatory support for natural products, and extensive research initiatives.

- Dominant Product Type: Organic Extract, favored for its perceived health and safety benefits.

- Key Drivers: Consumer preference for clean labels, organic certifications, and avoidance of synthetic additives.

- Dominant Form: Powder Extract, due to its versatility and ease of incorporation into various product matrices.

- Key Drivers: Applications in beverages, baked goods, capsules, and direct consumption.

- Emerging Growth Segment: Food and Beverage, offering convenience and functional benefits.

- Key Drivers: Demand for functional foods and beverages, innovative product development, and appealing to a broader consumer base.

- Growth Potential Segment: Pharmaceutical, driven by ongoing clinical research and therapeutic applications.

- Key Drivers: Exploration of Reishi's potential in disease management and as an adjunct therapy.

Organic Reishi Mushroom Extract Industry Product Landscape

The Organic Reishi Mushroom Extract Industry is witnessing continuous product innovation focused on enhancing efficacy, palatability, and application versatility. Key developments include the production of highly concentrated full-spectrum organic extracts, utilizing advanced extraction technologies to capture a broader range of beneficial compounds like polysaccharides, triterpenoids, and beta-glucans. These extracts are offered in various forms, including potent liquid tinctures, easily dispersible powders, and standardized capsules, catering to diverse consumer preferences and manufacturing needs. Unique selling propositions often revolve around superior bioavailability, purity (e.g., >30% polysaccharides, >2% triterpenoids), and organic certifications that guarantee a lack of pesticides and chemical fertilizers. Technological advancements are also enabling the development of targeted formulations for specific health benefits, such as immune support, stress reduction, and cognitive enhancement.

- Product Innovations: Development of high-potency, full-spectrum extracts; novel extraction methods for increased bioavailability; and targeted formulations for specific health outcomes.

- Applications: Extensive use in dietary supplements, functional foods and beverages, cosmetic formulations for skin health, and emerging applications in the pharmaceutical sector.

- Performance Metrics: Emphasis on standardized levels of active compounds like polysaccharides and triterpenoids, organic certifications, and solvent-free extraction processes.

- Unique Selling Propositions: Purity, potency, organic sourcing, adaptogenic properties, and scientifically validated health benefits.

- Technological Advancements: Supercritical CO2 extraction, ultrasonic extraction, and fermentation technologies for enhanced compound extraction and production.

Key Drivers, Barriers & Challenges in Organic Reishi Mushroom Extract Industry

The Organic Reishi Mushroom Extract Industry is propelled by a confluence of powerful drivers, including the escalating global demand for natural health and wellness solutions, a growing consumer preference for organic and sustainably sourced products, and increasing scientific research validating the therapeutic benefits of Reishi. Furthermore, the versatility of Reishi extracts in applications ranging from dietary supplements to functional foods and beverages fuels market expansion. Technological advancements in extraction and cultivation methods are also key accelerators, enabling the production of higher quality and more potent extracts.

Conversely, the industry faces significant barriers and challenges. Supply chain volatility, including potential issues with raw material sourcing due to climate change or disease, can impact availability and price stability. Stringent and evolving regulatory landscapes across different regions can create hurdles for market entry and product approval. High production costs associated with organic farming and advanced extraction techniques can affect profitability and pricing. Intense competition from other adaptogenic herbs and synthetic supplements necessitates continuous innovation and effective marketing to differentiate Reishi products. Educating consumers about the specific benefits and proper usage of Reishi extracts also remains an ongoing challenge.

- Key Drivers:

- Growing consumer preference for natural and organic health products.

- Increasing awareness of Reishi's adaptogenic and immune-boosting properties.

- Expansion of applications in functional foods, beverages, and personal care.

- Technological advancements in extraction and cultivation.

- Barriers & Challenges:

- Supply chain disruptions and raw material sourcing complexities.

- Navigating diverse and evolving international regulatory frameworks.

- High production costs associated with organic cultivation and advanced extraction.

- Intense competition from alternative natural and synthetic health solutions.

- Consumer education regarding product benefits and usage.

Emerging Opportunities in Organic Reishi Mushroom Extract Industry

Emerging opportunities in the Organic Reishi Mushroom Extract Industry are abundant, particularly in the untapped potential within the pharmaceutical sector for developing evidence-based therapeutic applications. As clinical research progresses, Reishi's role in adjunctive cancer therapies, immune system modulation for autoimmune diseases, and its neuroprotective properties present significant avenues for growth. The personal care and cosmetics industry offers another fertile ground, with Reishi extracts being increasingly incorporated into anti-aging creams, serums, and skincare formulations due to their antioxidant and anti-inflammatory benefits. Furthermore, the ** Asia-Pacific market**, with its deeply rooted tradition of using medicinal mushrooms and a rapidly growing affluent population, represents a substantial and largely untapped market for premium organic Reishi products. Innovations in *bioavailability enhancement techniques* and novel delivery systems (e.g., nano-emulsions, liposomes) are also creating opportunities to improve product efficacy and consumer appeal. The growing trend of personalized nutrition also opens doors for customized Reishi formulations based on individual health needs.

- Pharmaceutical Applications: Developing Reishi-based therapeutics for cancer support, autoimmune disease management, and neurological disorders.

- Cosmeceuticals: Integration into high-performance skincare products for anti-aging, antioxidant, and anti-inflammatory benefits.

- Untapped Markets: Significant potential in the Asia-Pacific region and expanding into other emerging economies.

- Technological Innovations: Advancements in bioavailability enhancers and novel delivery systems for improved efficacy.

- Personalized Nutrition: Tailoring Reishi formulations to individual health profiles and wellness goals.

Growth Accelerators in the Organic Reishi Mushroom Extract Industry Industry

Several catalysts are accelerating the growth of the Organic Reishi Mushroom Extract Industry. Technological breakthroughs in cultivation techniques, such as controlled environment agriculture and strain selection, are enabling more consistent and higher yields of premium organic Reishi. Advancements in extraction technologies, like supercritical CO2 and ultrasonic extraction, are unlocking higher concentrations of beneficial compounds, thereby improving product efficacy and market competitiveness. Strategic partnerships between Reishi extract manufacturers and supplement brands, food and beverage companies, and even pharmaceutical firms are expanding market reach and driving product innovation. Furthermore, market expansion strategies focused on educating consumers about the diverse health benefits of Reishi and its organic sourcing are creating new demand. The increasing global interest in preventative healthcare and the desire for natural, plant-based alternatives to synthetic drugs are fundamental growth accelerators. Investment in clinical research to further substantiate Reishi's therapeutic claims will also significantly boost its adoption and market value.

- Technological Breakthroughs: Improved cultivation methods, enhanced extraction efficiency, and development of standardized extracts.

- Strategic Partnerships: Collaborations with supplement manufacturers, food and beverage companies, and research institutions.

- Market Expansion Strategies: Increased focus on consumer education, digital marketing, and penetration into emerging economies.

- Global Healthcare Trends: Growing demand for preventative healthcare and natural/organic wellness products.

- Investment in R&D: Continued funding for clinical trials and scientific validation of Reishi's health benefits.

Key Players Shaping the Organic Reishi Mushroom Extract Industry Market

- Gaia Herbs

- Vibe Mushrooms Inc

- Bio-Botanica Inc

- Hokkaido Reishi Co Ltd

- Bristol Botanicals Limited

- Nammex (North American Medicinal Mushroom Extracts)

- Ethical Naturals Inc

- Qingdao Dacon Trading Co Ltd

- Xian Yuensun Biological Technology Co Ltd

- Naturalin Bio-Resources Co Ltd

Notable Milestones in Organic Reishi Mushroom Extract Industry Sector

- July 2022: Vibe Mushrooms launched five new mushroom extracts, including Red Reishi, for consumer use as ingredients.

- July 2022: Ethical Naturals Inc, in collaboration with Nammex, launched Mushroom-Plus, featuring organic red Reishi and L-Theanine.

- July 2021: Rooted Actives company launched medicinal mushroom extracts and superfood blends, including Reishi, for use in coffee and food products.

In-Depth Organic Reishi Mushroom Extract Industry Market Outlook

The Organic Reishi Mushroom Extract Industry is set for substantial growth in the coming years, driven by a confluence of evolving consumer preferences and scientific validation. Key growth accelerators include the relentless pursuit of natural and organic wellness solutions, coupled with an increasing understanding of Reishi's multifaceted health benefits, from immune support to stress management. Technological advancements in cultivation and extraction are ensuring higher quality, more potent, and consistently available organic extracts, thereby building consumer trust and market penetration. Strategic collaborations and expansions into emerging markets, particularly in the food and beverage and personal care sectors, are poised to unlock significant revenue streams. The ongoing investment in clinical research and the exploration of pharmaceutical applications further cement Reishi's position as a valuable ingredient with profound long-term market potential. Stakeholders can anticipate a dynamic market landscape characterized by innovation, increasing demand, and a commitment to sustainable and health-promoting practices.

(Note: Placeholder values like 'XXX' and 'XX%' have been used where specific financial or statistical data might be proprietary or require real-time market research. In a live report, these would be replaced with actual figures.)

Organic Reishi Mushroom Extract Industry Segmentation

-

1. Product Type

- 1.1. Organic Extract

- 1.2. Conventional Extract

-

2. Form

- 2.1. Liquid Extract

- 2.2. Powder Extract

-

3. Application

- 3.1. Food and Beverage

- 3.2. Dietary Supplements

- 3.3. Personal Care

- 3.4. Pharmaceutical

Organic Reishi Mushroom Extract Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Organic Reishi Mushroom Extract Industry Regional Market Share

Geographic Coverage of Organic Reishi Mushroom Extract Industry

Organic Reishi Mushroom Extract Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Beauty Supplements Products

- 3.4. Market Trends

- 3.4.1. Surge in Demand for Functional Food and Dietary Supplements

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Organic Reishi Mushroom Extract Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Organic Extract

- 5.1.2. Conventional Extract

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Liquid Extract

- 5.2.2. Powder Extract

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Food and Beverage

- 5.3.2. Dietary Supplements

- 5.3.3. Personal Care

- 5.3.4. Pharmaceutical

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Organic Reishi Mushroom Extract Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Organic Extract

- 6.1.2. Conventional Extract

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Liquid Extract

- 6.2.2. Powder Extract

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Food and Beverage

- 6.3.2. Dietary Supplements

- 6.3.3. Personal Care

- 6.3.4. Pharmaceutical

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Organic Reishi Mushroom Extract Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Organic Extract

- 7.1.2. Conventional Extract

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Liquid Extract

- 7.2.2. Powder Extract

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Food and Beverage

- 7.3.2. Dietary Supplements

- 7.3.3. Personal Care

- 7.3.4. Pharmaceutical

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Organic Reishi Mushroom Extract Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Organic Extract

- 8.1.2. Conventional Extract

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Liquid Extract

- 8.2.2. Powder Extract

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Food and Beverage

- 8.3.2. Dietary Supplements

- 8.3.3. Personal Care

- 8.3.4. Pharmaceutical

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Organic Reishi Mushroom Extract Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Organic Extract

- 9.1.2. Conventional Extract

- 9.2. Market Analysis, Insights and Forecast - by Form

- 9.2.1. Liquid Extract

- 9.2.2. Powder Extract

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Food and Beverage

- 9.3.2. Dietary Supplements

- 9.3.3. Personal Care

- 9.3.4. Pharmaceutical

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Organic Reishi Mushroom Extract Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Organic Extract

- 10.1.2. Conventional Extract

- 10.2. Market Analysis, Insights and Forecast - by Form

- 10.2.1. Liquid Extract

- 10.2.2. Powder Extract

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Food and Beverage

- 10.3.2. Dietary Supplements

- 10.3.3. Personal Care

- 10.3.4. Pharmaceutical

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Gaia Herbs*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vibe Mushrooms Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bio-Botanica Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hokkaido Reishi Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bristol Botanicals Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nammex (North American Medicinal Mushroom Extracts)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ethical Naturals Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Qingdao Dacon Trading Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Xian Yuensun Biological Technology Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Naturalin Bio-Resources Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Gaia Herbs*List Not Exhaustive

List of Figures

- Figure 1: Global Organic Reishi Mushroom Extract Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Organic Reishi Mushroom Extract Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Organic Reishi Mushroom Extract Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Organic Reishi Mushroom Extract Industry Revenue (Million), by Form 2025 & 2033

- Figure 5: North America Organic Reishi Mushroom Extract Industry Revenue Share (%), by Form 2025 & 2033

- Figure 6: North America Organic Reishi Mushroom Extract Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Organic Reishi Mushroom Extract Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Organic Reishi Mushroom Extract Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Organic Reishi Mushroom Extract Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Organic Reishi Mushroom Extract Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Organic Reishi Mushroom Extract Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Organic Reishi Mushroom Extract Industry Revenue (Million), by Form 2025 & 2033

- Figure 13: Europe Organic Reishi Mushroom Extract Industry Revenue Share (%), by Form 2025 & 2033

- Figure 14: Europe Organic Reishi Mushroom Extract Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Organic Reishi Mushroom Extract Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Organic Reishi Mushroom Extract Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Organic Reishi Mushroom Extract Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Organic Reishi Mushroom Extract Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Organic Reishi Mushroom Extract Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Organic Reishi Mushroom Extract Industry Revenue (Million), by Form 2025 & 2033

- Figure 21: Asia Pacific Organic Reishi Mushroom Extract Industry Revenue Share (%), by Form 2025 & 2033

- Figure 22: Asia Pacific Organic Reishi Mushroom Extract Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Organic Reishi Mushroom Extract Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Organic Reishi Mushroom Extract Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Organic Reishi Mushroom Extract Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Organic Reishi Mushroom Extract Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: South America Organic Reishi Mushroom Extract Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Organic Reishi Mushroom Extract Industry Revenue (Million), by Form 2025 & 2033

- Figure 29: South America Organic Reishi Mushroom Extract Industry Revenue Share (%), by Form 2025 & 2033

- Figure 30: South America Organic Reishi Mushroom Extract Industry Revenue (Million), by Application 2025 & 2033

- Figure 31: South America Organic Reishi Mushroom Extract Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Organic Reishi Mushroom Extract Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Organic Reishi Mushroom Extract Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Organic Reishi Mushroom Extract Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Middle East and Africa Organic Reishi Mushroom Extract Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Middle East and Africa Organic Reishi Mushroom Extract Industry Revenue (Million), by Form 2025 & 2033

- Figure 37: Middle East and Africa Organic Reishi Mushroom Extract Industry Revenue Share (%), by Form 2025 & 2033

- Figure 38: Middle East and Africa Organic Reishi Mushroom Extract Industry Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Organic Reishi Mushroom Extract Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Organic Reishi Mushroom Extract Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Organic Reishi Mushroom Extract Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Form 2020 & 2033

- Table 3: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Form 2020 & 2033

- Table 7: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Form 2020 & 2033

- Table 15: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Germany Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: France Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Italy Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 24: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Form 2020 & 2033

- Table 25: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: China Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Japan Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: India Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Australia Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Form 2020 & 2033

- Table 34: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 35: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Brazil Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Argentina Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of South America Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 40: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Form 2020 & 2033

- Table 41: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 42: Global Organic Reishi Mushroom Extract Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 43: South Africa Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: United Arab Emirates Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of Middle East and Africa Organic Reishi Mushroom Extract Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Organic Reishi Mushroom Extract Industry?

The projected CAGR is approximately 9.04%.

2. Which companies are prominent players in the Organic Reishi Mushroom Extract Industry?

Key companies in the market include Gaia Herbs*List Not Exhaustive, Vibe Mushrooms Inc, Bio-Botanica Inc, Hokkaido Reishi Co Ltd, Bristol Botanicals Limited, Nammex (North American Medicinal Mushroom Extracts), Ethical Naturals Inc, Qingdao Dacon Trading Co Ltd, Xian Yuensun Biological Technology Co Ltd, Naturalin Bio-Resources Co Ltd.

3. What are the main segments of the Organic Reishi Mushroom Extract Industry?

The market segments include Product Type, Form, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products.

6. What are the notable trends driving market growth?

Surge in Demand for Functional Food and Dietary Supplements.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Beauty Supplements Products.

8. Can you provide examples of recent developments in the market?

In July 2022, Vibe Mushrooms launched five new mushroom extracts that can be used by consumers as ingredients. The different types of mushrooms include Lion's Mane, Turkey Tail, Red Reishi, Cordyceps, and Master Blend.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Organic Reishi Mushroom Extract Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Organic Reishi Mushroom Extract Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Organic Reishi Mushroom Extract Industry?

To stay informed about further developments, trends, and reports in the Organic Reishi Mushroom Extract Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence