Key Insights

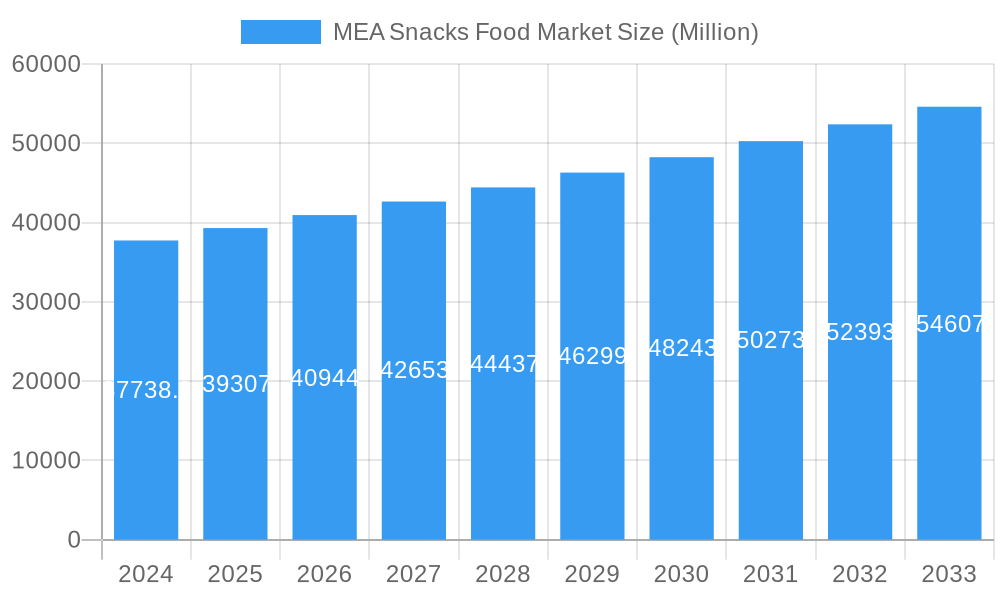

The Middle East & Africa (MEA) Snacks Food Market is poised for substantial growth, currently estimated at $37,738.2 million in 2024. This upward trajectory is driven by a confluence of factors, including rising disposable incomes, increasing urbanization, and a growing consumer preference for convenient and on-the-go food options. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of 4.4% from 2025 to 2033, indicating a robust and sustained expansion. Key growth drivers include the burgeoning young population across the region, who are increasingly exposed to global snacking trends and demand a wider variety of innovative and health-conscious products. The expanding retail infrastructure, particularly the rise of organized retail channels like supermarkets and hypermarkets, alongside the rapid adoption of online retail, is further facilitating market accessibility and consumer reach. Emerging economies within the MEA region are witnessing a significant surge in demand for both traditional and novel snack varieties, contributing to the overall market dynamism.

MEA Snacks Food Market Market Size (In Billion)

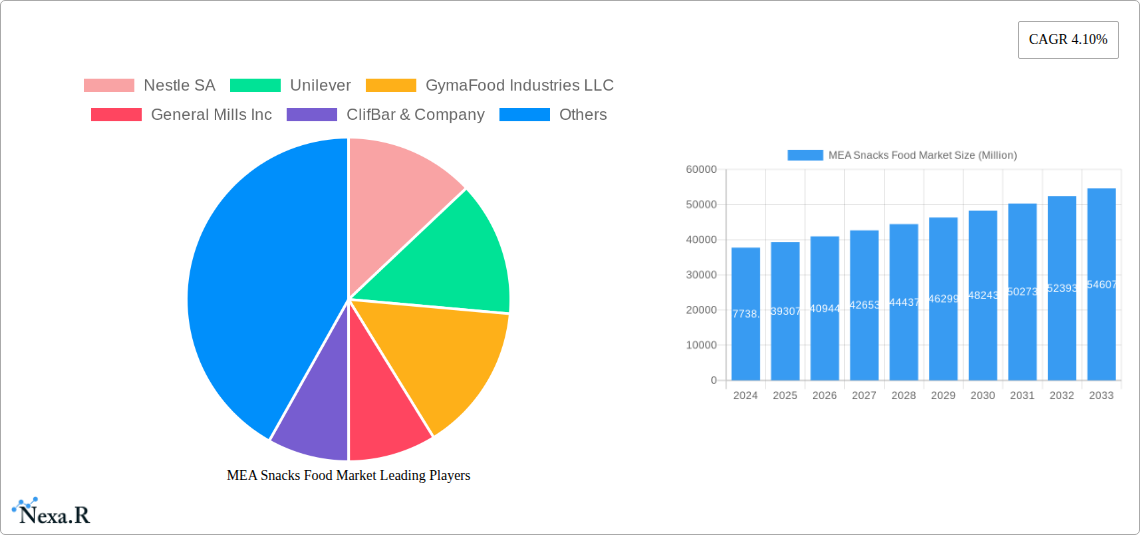

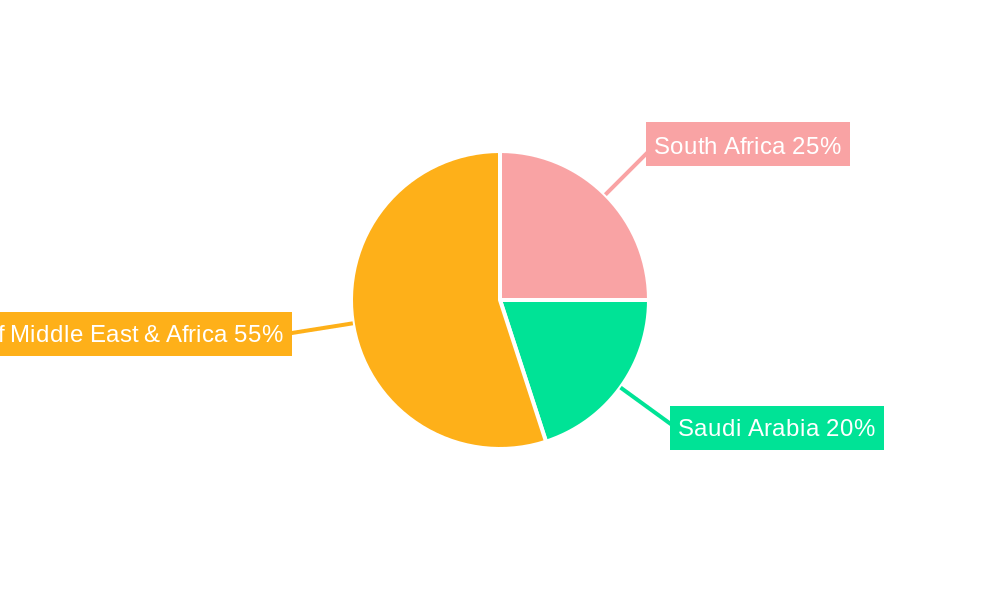

The MEA Snacks Food Market is characterized by a diverse range of product segments, with Savory Snacks and Confectionery Snacks holding dominant positions due to their widespread appeal and established market presence. However, significant growth potential is also observed in the Fruit Snacks and Bakery Snacks segments, fueled by a growing consumer awareness regarding healthier snacking alternatives. The distribution landscape is evolving, with Supermarkets & Hypermarkets remaining a key channel, complemented by the aggressive expansion of Convenience Stores and the burgeoning Online Retail Stores, which are proving instrumental in reaching a wider consumer base, especially in remote areas. Geographically, South Africa and Saudi Arabia are anticipated to be major growth contributors, alongside the broader Rest of the Middle East & Africa region, which presents untapped potential for market players. Companies like Nestle SA, Unilever, and Mondelez International are strategically investing in product innovation, market penetration, and expanding their distribution networks to capitalize on these evolving market dynamics and cater to the diverse preferences of consumers across the MEA region.

MEA Snacks Food Market Company Market Share

MEA Snacks Food Market: Comprehensive Growth Analysis and Future Outlook (2019-2033)

Unlock lucrative growth opportunities within the dynamic MEA Snacks Food Market. This in-depth report provides an indispensable resource for industry professionals, offering a granular analysis of market size, trends, and competitive landscapes from 2019 to 2033. Leveraging critical data and expert insights, we dissect the parent and child market segments, identifying key drivers, emerging trends, and strategic imperatives for success. The MEA Snacks Food Market is projected to experience significant expansion, driven by evolving consumer preferences, increasing disposable incomes, and a growing demand for convenient and healthier snack options. This report details projections for the base year (2025) and the extensive forecast period (2025-2033), alongside historical context from 2019-2024. All values are presented in million units for clarity and precision.

MEA Snacks Food Market Market Dynamics & Structure

The MEA Snacks Food Market is characterized by a moderately concentrated structure, with a mix of large multinational corporations and agile regional players vying for market share. Technological innovation is a significant driver, particularly in the development of healthier, more convenient, and sustainably packaged snack options. Regulatory frameworks, while evolving, generally favor food safety and quality standards, influencing product formulations and market entry strategies. Competitive product substitutes are abundant, ranging from traditional confectionery to emerging healthy alternatives, intensifying the need for differentiation. End-user demographics are diverse, with a growing young population in many MEA countries driving demand for impulse purchases and on-the-go snacking solutions. Mergers and acquisitions (M&A) trends are moderately active, as key players seek to consolidate their market positions, expand their product portfolios, and gain access to new geographies or distribution channels.

- Market Concentration: Dominated by a few key international players, with increasing participation from local and regional manufacturers.

- Technological Innovation Drivers: Focus on healthier ingredients, reduced sugar/fat content, plant-based options, and sustainable packaging.

- Regulatory Frameworks: Emphasis on food safety, labeling, and import/export regulations influencing market access and product development.

- Competitive Product Substitutes: Wide array of options including chips, biscuits, chocolates, fruit snacks, and protein bars.

- End-User Demographics: Growing youth population, urbanization, and rising disposable incomes fueling demand.

- M&A Trends: Strategic acquisitions to enhance market reach, diversify product offerings, and gain competitive advantages.

MEA Snacks Food Market Growth Trends & Insights

The MEA Snacks Food Market is on an upward trajectory, fueled by a confluence of socioeconomic and behavioral shifts. The market size is projected to witness substantial growth, underpinned by increasing urbanization and a burgeoning middle class across the region. Adoption rates for convenience-focused and health-conscious snacks are rapidly accelerating, mirroring global trends. Technological disruptions, such as advancements in food processing and the rise of e-commerce platforms, are reshaping how snacks are produced, marketed, and consumed. Consumer behavior is undergoing a significant transformation, with a discernible shift towards mindful eating, a preference for natural ingredients, and a growing interest in functional snacks that offer added health benefits. The market penetration of premium and niche snack products is also on the rise, indicating a more discerning consumer base.

The market's expansion is further propelled by the inherent demand for quick, convenient, and palatable food options in busy urban lifestyles prevalent across the Middle East and Africa. As disposable incomes rise, consumers are increasingly willing to spend on premium and specialty snacks, moving beyond basic sustenance to seek enjoyable and sometimes indulgent experiences. The proliferation of online retail stores and rapid delivery services has democratized access to a wider variety of snack products, including international brands and niche offerings, thereby broadening consumer choice and driving sales. Furthermore, the influence of social media and global food trends is shaping local preferences, encouraging the trial of new flavors, formats, and ingredient profiles. This dynamic environment demands continuous innovation from manufacturers to stay ahead of evolving consumer demands.

The integration of healthier ingredients and formulations is a dominant trend, with a noticeable increase in demand for snacks that are low in sugar, salt, and unhealthy fats, while being high in protein, fiber, and essential nutrients. This aligns with a growing awareness of health and wellness issues across the region. The “free-from” category, encompassing gluten-free, dairy-free, and vegan snacks, is experiencing remarkable growth as consumers seek to address dietary restrictions and lifestyle choices. Innovations in packaging, including the use of recyclable and biodegradable materials, are also gaining traction, appealing to environmentally conscious consumers. The convenience factor remains paramount, with single-serve portions and ready-to-eat formats being highly popular, particularly among working professionals and students.

- Market Size Evolution: Experiencing robust growth driven by population expansion and economic development.

- Adoption Rates: High adoption of convenience and health-oriented snacks.

- Technological Disruptions: Impact of e-commerce, advanced processing, and personalized nutrition.

- Consumer Behavior Shifts: Growing preference for healthier ingredients, natural products, and functional benefits.

- Market Penetration: Increasing penetration of premium and niche snack categories.

- CAGR: (Projected CAGR to be provided in the full report – placeholder used for description).

- Market Penetration: (Specific penetration rates for key segments to be detailed in the full report).

Dominant Regions, Countries, or Segments in MEA Snacks Food Market

The MEA Snacks Food Market is witnessing robust growth driven by a convergence of factors. Within the Geography segment, the Rest of Middle East & Africa is emerging as a dominant force, showcasing rapid expansion due to its large and young population, increasing urbanization, and a rapidly growing middle class with rising disposable incomes. Countries within this vast segment are experiencing a surge in demand for convenient and on-the-go snacking options. This region's economic development, coupled with significant investments in retail infrastructure, is creating fertile ground for snack manufacturers.

In terms of Type, Savory Snacks hold a significant lead and are expected to continue their dominance. This segment encompasses a wide variety of products like potato chips, extruded snacks, and savory biscuits, which are deeply ingrained in the snacking habits of consumers across the MEA region. The inherent appeal of savory flavors and the vast array of product innovations within this category contribute to its strong market presence.

Regarding Distribution, Supermarkets & Hypermarkets remain the primary channel for snack sales, owing to their extensive reach, product variety, and the shopping habits of a significant portion of the population. However, Online retail Stores are exhibiting the fastest growth rate, driven by increasing internet penetration, smartphone usage, and the convenience of home delivery. This channel is proving to be particularly effective in reaching younger demographics and urban consumers.

Key drivers for dominance in the Rest of Middle East & Africa include:

- Favorable Demographics: A large, young, and growing population eager for new and convenient food options.

- Economic Growth: Increasing disposable incomes leading to higher consumer spending on discretionary items like snacks.

- Urbanization: Rapid urbanization driving demand for on-the-go and ready-to-eat food products.

- Retail Infrastructure Development: Expansion of modern retail formats and e-commerce platforms facilitating wider product accessibility.

The dominance of Savory Snacks is attributed to:

- Cultural Preferences: Traditional snacking habits often favor savory items.

- Product Variety: An extensive range of flavors, textures, and formats catering to diverse tastes.

- Affordability and Accessibility: Savory snacks are generally perceived as affordable and readily available.

The strength of Supermarkets & Hypermarkets as a distribution channel is due to:

- One-Stop Shopping: Consumers prefer to purchase groceries and snacks from a single location.

- Promotional Activities: Frequent in-store promotions and discounts drive impulse purchases.

- Brand Visibility: Prime shelf placement in these outlets enhances brand visibility.

The rapid rise of Online Retail Stores is fueled by:

- Convenience: The ease of ordering from home or office.

- Wider Selection: Access to a broader range of products than typically found in physical stores.

- Targeted Marketing: Online platforms allow for personalized recommendations and promotions.

The market share and growth potential within these dominant segments underscore the strategic importance for manufacturers to focus their efforts and resources on these areas to maximize their return on investment in the MEA Snacks Food Market.

MEA Snacks Food Market Product Landscape

The MEA Snacks Food Market is characterized by a dynamic product landscape driven by innovation and evolving consumer demands. Product innovations are increasingly focused on catering to health-conscious consumers, with a surge in offerings that are low in sugar, high in protein, and made with natural ingredients. The fruit snacks segment, for instance, is witnessing new product launches featuring exotic flavors and fortified options. Confectionery snacks are seeing a trend towards premiumization and the incorporation of healthier alternatives, such as dark chocolate and reduced-sugar variants. Bakery snacks are expanding to include gluten-free and whole-grain options, appealing to a wider consumer base.

Unique selling propositions often revolve around ingredient transparency, ethical sourcing, and functional benefits, such as energy-boosting or digestive health properties. Technological advancements in food processing enable the creation of novel textures and shelf-stable products that meet consumer expectations for convenience and quality. The product landscape is a testament to the market's responsiveness to global health trends and local preferences, ensuring a diverse and appealing range of snacks for the MEA consumer.

Key Drivers, Barriers & Challenges in MEA Snacks Food Market

The MEA Snacks Food Market is propelled by several key drivers that foster robust growth. The expanding young population and increasing disposable incomes are paramount, driving higher consumption of convenient and impulse-buy snack products. Growing health consciousness among consumers is a significant catalyst, fueling demand for healthier snack options, including low-sugar, high-protein, and plant-based alternatives. The rapid pace of urbanization and busy lifestyles further necessitate on-the-go, convenient snacking solutions. Technological advancements in food production and a burgeoning e-commerce landscape are expanding accessibility and consumer choice.

However, the market also faces significant barriers and challenges. Intense competition from both local and international players can lead to price wars and squeezed profit margins. Evolving regulatory landscapes in different countries can create complexities in market entry and product compliance. Supply chain disruptions, particularly in logistics and raw material sourcing, can impact product availability and cost. Fluctuations in raw material prices, such as those for key ingredients like grains, sugar, and oils, pose a considerable challenge to cost management and pricing strategies. Economic volatility and currency fluctuations in certain MEA markets can also affect consumer purchasing power and import costs.

- Drivers: Young demographics, rising disposable incomes, health consciousness, urbanization, e-commerce growth.

- Barriers: Intense competition, evolving regulations, supply chain disruptions, raw material price volatility, economic instability.

Emerging Opportunities in MEA Snacks Food Market

Emerging opportunities in the MEA Snacks Food Market lie in tapping into the burgeoning demand for functional and personalized nutrition. The "free-from" category (gluten-free, dairy-free, vegan) continues to expand, offering significant potential for product innovation and market penetration. There is a growing interest in premium and artisanal snacks, allowing for differentiation through unique flavors, high-quality ingredients, and appealing packaging. The untapped potential in specific geographical pockets within the Rest of Middle East & Africa presents an avenue for market expansion, particularly through strategic partnerships with local distributors. Furthermore, the increasing adoption of online grocery shopping opens doors for direct-to-consumer models and targeted digital marketing campaigns.

Growth Accelerators in the MEA Snacks Food Market Industry

Several catalysts are accelerating the growth of the MEA Snacks Food Market industry. Strategic partnerships between international snack manufacturers and local distributors are proving instrumental in navigating complex regional markets and expanding reach. Technological breakthroughs in food processing are enabling the creation of innovative, healthier, and more appealing snack products, meeting the evolving demands of health-conscious consumers. Market expansion strategies, including the introduction of localized product variants and tailored marketing campaigns, are crucial for capturing market share in diverse cultural contexts. Investments in research and development focused on sustainable packaging and clean label ingredients are further enhancing brand appeal and long-term market viability.

Key Players Shaping the MEA Snacks Food Market Market

- Nestle SA

- Unilever

- GymaFood Industries LLC

- General Mills Inc

- ClifBar & Company

- Gellatas Gullon

- BestfoodCo LLC

- Britannia Industries

- Kellogg Company

- Mondelez International

Notable Milestones in MEA Snacks Food Market Sector

- October 2021: TNF Pure Fruit Bar brand launched in the United Arab Emirates, offering vegan, vegetarian, gluten-free, dairy-free, and nut-free options in Strawberry, Apricot, and Raspberry variants, with no preservatives, additives, or colorants.

- July 2021: Khabib Nurmagomedov launched Fitroo, a premium protein bar brand in the United Arab Emirates, available in chocolate, banana, vanilla, and cookies flavors, promoting a healthy diet.

- January 2020: PepsiCo acquired a majority shareholding of Senselet Food Processing, an Ethiopian potato crisps company, strengthening its position in the region with the popular Sun Chips brand.

In-Depth MEA Snacks Food Market Market Outlook

The MEA Snacks Food Market is poised for sustained and significant growth in the coming years. The confluence of a young, growing population, rising disposable incomes, and an increasing emphasis on health and wellness are powerful growth accelerators. Strategic opportunities lie in capitalizing on the burgeoning demand for healthier alternatives, including plant-based and "free-from" options. Investments in e-commerce infrastructure and direct-to-consumer strategies will be crucial for expanding market reach and enhancing consumer engagement. The market's future outlook is bright, with continued innovation in product development, sustainable practices, and targeted marketing expected to drive significant expansion and profitability for industry players.

MEA Snacks Food Market Segmentation

-

1. Type

- 1.1. Frozen Snacks

- 1.2. Savory Snacks

- 1.3. Fruit Snacks

- 1.4. Confectionery Snacks

- 1.5. Bakery Snacks

- 1.6. Others

-

2. Distribution

- 2.1. Supermarket & Hypermarkets

- 2.2. Convenience stores

- 2.3. Online retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. South Africa

- 3.2. Saudi Arabia

- 3.3. Rest of Middle East & Africa

MEA Snacks Food Market Segmentation By Geography

- 1. South Africa

- 2. Saudi Arabia

- 3. Rest of Middle East

MEA Snacks Food Market Regional Market Share

Geographic Coverage of MEA Snacks Food Market

MEA Snacks Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid urbanization and busy lifestyles in the MEA region lead to higher consumption of convenient snack foods as part of on-the-go eating habits.

- 3.3. Market Restrains

- 3.3.1 Increasing awareness of health issues related to high sugar

- 3.3.2 salt

- 3.3.3 and fat content in traditional snacks can limit consumption and push consumers towards healthier alternatives.

- 3.4. Market Trends

- 3.4.1. Surging demand for clean-label and free-from snacks

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Snacks Food Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Frozen Snacks

- 5.1.2. Savory Snacks

- 5.1.3. Fruit Snacks

- 5.1.4. Confectionery Snacks

- 5.1.5. Bakery Snacks

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution

- 5.2.1. Supermarket & Hypermarkets

- 5.2.2. Convenience stores

- 5.2.3. Online retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Saudi Arabia

- 5.3.3. Rest of Middle East & Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Saudi Arabia

- 5.4.3. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa MEA Snacks Food Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Frozen Snacks

- 6.1.2. Savory Snacks

- 6.1.3. Fruit Snacks

- 6.1.4. Confectionery Snacks

- 6.1.5. Bakery Snacks

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution

- 6.2.1. Supermarket & Hypermarkets

- 6.2.2. Convenience stores

- 6.2.3. Online retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Saudi Arabia

- 6.3.3. Rest of Middle East & Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Saudi Arabia MEA Snacks Food Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Frozen Snacks

- 7.1.2. Savory Snacks

- 7.1.3. Fruit Snacks

- 7.1.4. Confectionery Snacks

- 7.1.5. Bakery Snacks

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution

- 7.2.1. Supermarket & Hypermarkets

- 7.2.2. Convenience stores

- 7.2.3. Online retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Saudi Arabia

- 7.3.3. Rest of Middle East & Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of Middle East MEA Snacks Food Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Frozen Snacks

- 8.1.2. Savory Snacks

- 8.1.3. Fruit Snacks

- 8.1.4. Confectionery Snacks

- 8.1.5. Bakery Snacks

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution

- 8.2.1. Supermarket & Hypermarkets

- 8.2.2. Convenience stores

- 8.2.3. Online retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Saudi Arabia

- 8.3.3. Rest of Middle East & Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Nestle SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Unilever

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 GymaFood Industries LLC

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 General Mills Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 ClifBar & Company

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Gellatas Gullon

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 BestfoodCo LLC

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Britannia Industries

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Kellogg Company

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Mondelez International

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Nestle SA

List of Figures

- Figure 1: Global MEA Snacks Food Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: South Africa MEA Snacks Food Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: South Africa MEA Snacks Food Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: South Africa MEA Snacks Food Market Revenue (undefined), by Distribution 2025 & 2033

- Figure 5: South Africa MEA Snacks Food Market Revenue Share (%), by Distribution 2025 & 2033

- Figure 6: South Africa MEA Snacks Food Market Revenue (undefined), by Geography 2025 & 2033

- Figure 7: South Africa MEA Snacks Food Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: South Africa MEA Snacks Food Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: South Africa MEA Snacks Food Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Saudi Arabia MEA Snacks Food Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: Saudi Arabia MEA Snacks Food Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Saudi Arabia MEA Snacks Food Market Revenue (undefined), by Distribution 2025 & 2033

- Figure 13: Saudi Arabia MEA Snacks Food Market Revenue Share (%), by Distribution 2025 & 2033

- Figure 14: Saudi Arabia MEA Snacks Food Market Revenue (undefined), by Geography 2025 & 2033

- Figure 15: Saudi Arabia MEA Snacks Food Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Saudi Arabia MEA Snacks Food Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Saudi Arabia MEA Snacks Food Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Rest of Middle East MEA Snacks Food Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: Rest of Middle East MEA Snacks Food Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Rest of Middle East MEA Snacks Food Market Revenue (undefined), by Distribution 2025 & 2033

- Figure 21: Rest of Middle East MEA Snacks Food Market Revenue Share (%), by Distribution 2025 & 2033

- Figure 22: Rest of Middle East MEA Snacks Food Market Revenue (undefined), by Geography 2025 & 2033

- Figure 23: Rest of Middle East MEA Snacks Food Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Rest of Middle East MEA Snacks Food Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of Middle East MEA Snacks Food Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Snacks Food Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global MEA Snacks Food Market Revenue undefined Forecast, by Distribution 2020 & 2033

- Table 3: Global MEA Snacks Food Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global MEA Snacks Food Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global MEA Snacks Food Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global MEA Snacks Food Market Revenue undefined Forecast, by Distribution 2020 & 2033

- Table 7: Global MEA Snacks Food Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Global MEA Snacks Food Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global MEA Snacks Food Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global MEA Snacks Food Market Revenue undefined Forecast, by Distribution 2020 & 2033

- Table 11: Global MEA Snacks Food Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global MEA Snacks Food Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global MEA Snacks Food Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global MEA Snacks Food Market Revenue undefined Forecast, by Distribution 2020 & 2033

- Table 15: Global MEA Snacks Food Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Global MEA Snacks Food Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Snacks Food Market?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the MEA Snacks Food Market?

Key companies in the market include Nestle SA, Unilever, GymaFood Industries LLC, General Mills Inc, ClifBar & Company, Gellatas Gullon, BestfoodCo LLC, Britannia Industries, Kellogg Company, Mondelez International.

3. What are the main segments of the MEA Snacks Food Market?

The market segments include Type, Distribution, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rapid urbanization and busy lifestyles in the MEA region lead to higher consumption of convenient snack foods as part of on-the-go eating habits..

6. What are the notable trends driving market growth?

Surging demand for clean-label and free-from snacks.

7. Are there any restraints impacting market growth?

Increasing awareness of health issues related to high sugar. salt. and fat content in traditional snacks can limit consumption and push consumers towards healthier alternatives..

8. Can you provide examples of recent developments in the market?

In October 2021, the TNF Pure Fruit Bar brand launched in the United Arab Emirates. The fruit bars are vegan and vegetarian, gluten-free, dairy-free, and nut-free, and have no preservatives, additives, or colorants. The bars are available in three variants Strawberry, Apricot, and Raspberry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Snacks Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Snacks Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Snacks Food Market?

To stay informed about further developments, trends, and reports in the MEA Snacks Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence