Key Insights

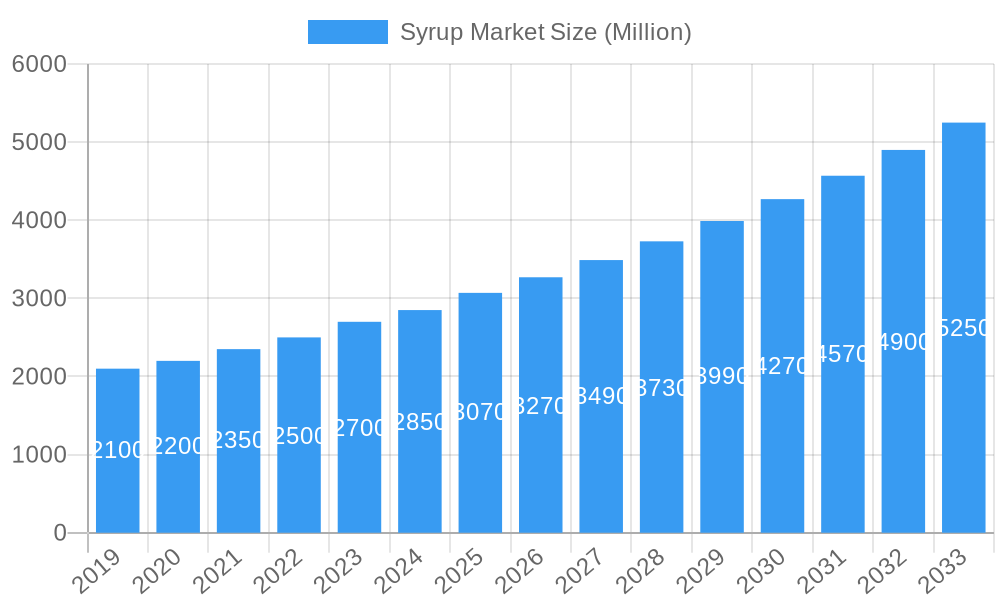

The global Syrup Market is poised for significant expansion, projected to reach USD 3.07 Billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.83% over the forecast period of 2025-2033. This growth is primarily fueled by the increasing demand for diverse syrup types, driven by evolving consumer preferences for both indulgent and healthier sweetening options. Chocolate and maple syrups continue to hold strong consumer appeal, while the rising popularity of natural and organic sweeteners like honey and fruit syrups indicates a significant market shift. Furthermore, the expanding use of syrups as versatile ingredients in a wide array of food and beverage applications, from breakfast toppings and baked goods to beverages and confectioneries, is a key market driver. The growing convenience food sector and the increasing adoption of e-commerce for grocery shopping are also contributing to the market's upward trajectory, making syrups more accessible to a wider consumer base.

Syrup Market Market Size (In Billion)

However, certain factors present potential challenges. Fluctuations in the prices of raw materials, such as sugar and cocoa, can impact manufacturing costs and influence syrup pricing. Additionally, increasing health consciousness among consumers and the ongoing scrutiny of high-sugar content in food products may lead to a preference for lower-calorie or sugar-free alternatives, potentially restraining the growth of traditional syrup segments. Despite these headwinds, innovation in product development, including the introduction of functional syrups with added health benefits and the exploration of novel flavor profiles, is expected to mitigate these restraints and further propel market growth. The strategic expansion of distribution channels, particularly online retail, is also crucial for capitalizing on the market's potential and reaching a diverse global audience.

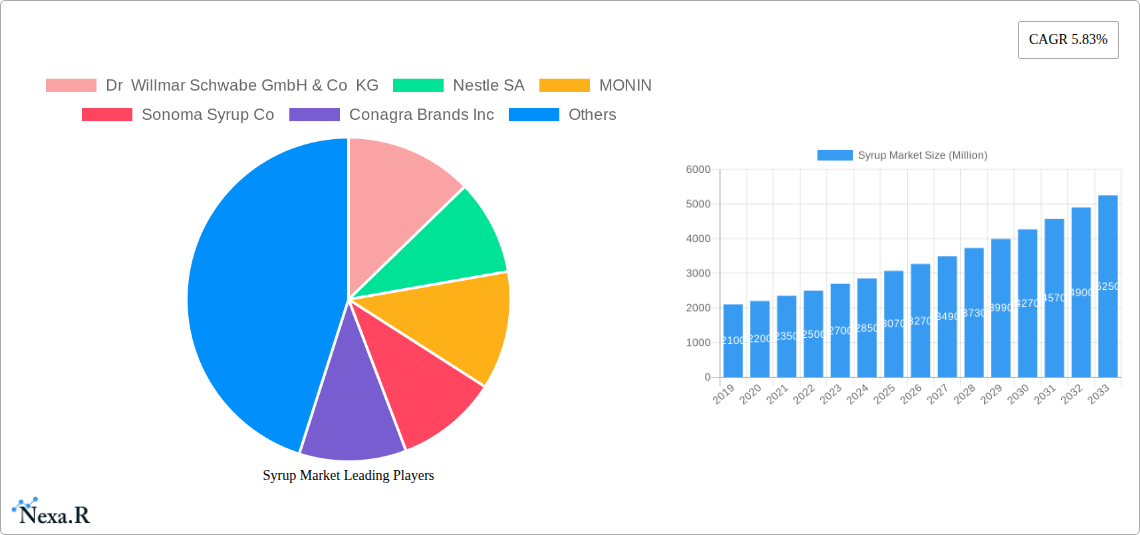

Syrup Market Company Market Share

Comprehensive Syrup Market Report: Trends, Drivers, and Future Outlook (2019-2033)

This in-depth report provides a thorough analysis of the global Syrup Market, encompassing its current dynamics, historical performance, and projected growth trajectory through 2033. We delve into parent and child market segments, offering granular insights into product types, distribution channels, and regional dominance. With a focus on high-traffic keywords, this report is optimized for maximum search engine visibility, making it an indispensable resource for industry professionals seeking to understand the evolving syrup landscape. The study period covers 2019–2033, with 2025 as the base and estimated year, and 2025–2033 as the forecast period, built upon historical data from 2019–2024. All quantitative values are presented in Million units.

Syrup Market Dynamics & Structure

The global Syrup Market is characterized by a dynamic interplay of factors shaping its structure and competitive landscape. Market concentration varies across segments, with some niche areas exhibiting higher consolidation, while broader categories like High-fructose Corn Syrup remain highly competitive. Technological innovation is a significant driver, particularly in developing novel sweeteners, functional syrups, and sustainable production methods. Regulatory frameworks, including food safety standards and labeling requirements, exert considerable influence on product development and market entry. Competitive product substitutes, such as artificial sweeteners and alternative flavorings, continuously challenge established syrup products. Understanding end-user demographics is crucial, as consumer preferences for natural, organic, and functional syrups are on the rise. Mergers and acquisitions (M&A) trends indicate strategic moves by key players to expand their product portfolios and market reach, often targeting innovative startups or companies with strong regional presence. For instance, the increasing demand for natural sweeteners has fueled acquisitions of companies specializing in maple and honey syrups.

- Market Concentration: Moderate to high in specialized segments like gourmet fruit syrups; fragmented in commodity syrups.

- Technological Innovation Drivers: Development of low-calorie syrups, enhanced flavor profiles, and plant-based alternatives.

- Regulatory Frameworks: Strict adherence to food safety and quality standards globally, with varying regional regulations.

- Competitive Product Substitutes: Artificial sweeteners, natural fruit juices, and other sweetening agents.

- End-User Demographics: Growing demand from health-conscious consumers, food service industries, and home bakers.

- M&A Trends: Strategic acquisitions by large food conglomerates to enter emerging syrup markets and acquire innovative technologies.

Syrup Market Growth Trends & Insights

The Syrup Market is poised for substantial growth, driven by evolving consumer preferences and expanding applications across various industries. Market size evolution has been marked by a steady upward trend, fueled by the increasing consumption of processed foods and beverages, as well as a growing appreciation for natural and specialty syrups. Adoption rates for healthier syrup options, such as organic and low-sugar variants, are accelerating significantly, indicating a shift in consumer behavior towards wellness. Technological disruptions are playing a pivotal role, with advancements in extraction and processing techniques leading to higher quality and more diverse syrup offerings. This includes innovations in creating syrups with enhanced nutritional profiles and extended shelf lives. Consumer behavior shifts are profoundly impacting the market, with a rising demand for transparency in ingredients and a preference for products with simple, recognizable components. The convenience of syrups in both home cooking and food service applications continues to be a significant growth catalyst.

The market penetration of specialty syrups, like artisanal maple syrup and exotic fruit syrups, is expanding as consumers seek unique culinary experiences. The global syrup market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 4.5% from 2025 to 2033, reaching an estimated market size of $XX Billion units. This growth is underpinned by the expanding food and beverage industry, particularly in emerging economies, and the increasing use of syrups in confectionery, dairy products, and baked goods. The convenience factor associated with syrups, coupled with their versatility in adding flavor and texture to a wide array of dishes and beverages, will continue to be a primary growth driver. Furthermore, the growing trend of home baking and cooking, amplified by social media's influence, is creating sustained demand for syrups as essential ingredients. The health and wellness trend is also indirectly benefiting the syrup market, as consumers are increasingly opting for natural sweeteners like maple syrup and honey over highly processed alternatives. The expansion of online retail channels has also made a wider variety of syrups accessible to consumers globally, further contributing to market growth. The strategic product development by key players, focusing on premiumization and niche market segments, will also be instrumental in driving the market forward.

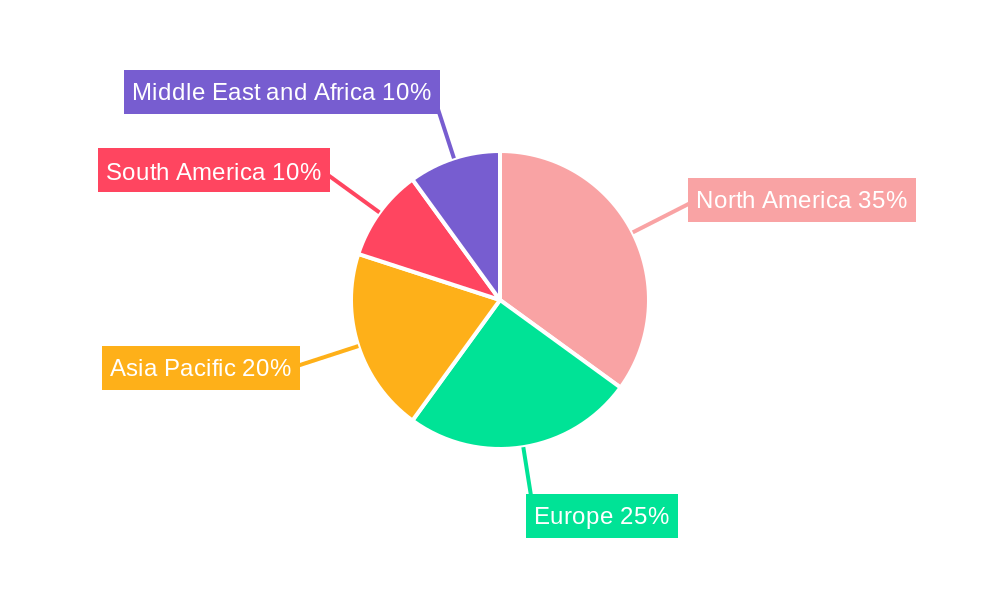

Dominant Regions, Countries, or Segments in Syrup Market

The global Syrup Market's growth is significantly influenced by regional economic factors, consumer preferences, and distribution infrastructure. North America, particularly the United States and Canada, consistently emerges as a dominant region, driven by a high per capita consumption of maple syrup and a well-established baking and confectionery industry. The demand for High-fructose Corn Syrup (HFCS) also remains substantial, though its market share is facing scrutiny due to health concerns, prompting innovation in alternative sweeteners. In Europe, countries like Germany, France, and the UK exhibit strong demand for specialty syrups, including fruit and gourmet varieties, with a growing emphasis on organic and natural ingredients. Asia-Pacific is a rapidly expanding market, with countries like China and India showing immense growth potential due to their large populations, rising disposable incomes, and increasing adoption of Western food habits. The demand for Chocolate Syrup and fruit-based syrups is particularly robust in this region.

Among the different Types of syrups, High-fructose Corn Syrup currently holds a significant market share due to its widespread use as a sweetener in processed foods and beverages. However, the Maple Syrup segment is experiencing robust growth, driven by consumer preference for natural and premium sweeteners, and its perceived health benefits. Chocolate Syrup remains a perennial favorite, especially in confectionery and dairy applications. The Honey segment is also poised for steady growth, fueled by its natural appeal and perceived health properties. The Distribution Channel analysis reveals that Supermarkets/Hypermarkets are the primary channel for syrup sales globally, owing to their extensive reach and product variety. Online Retail Stores are rapidly gaining traction, especially for specialty and gourmet syrups, offering convenience and wider selection to consumers.

- Dominant Region: North America, driven by established consumption patterns and a strong food industry.

- Key Country Drivers: United States (high consumption, innovation), Canada (maple syrup production), China (growing processed food market).

- Dominant Segment (Type): High-fructose Corn Syrup (volume), with Maple Syrup and Chocolate Syrup showing strong growth.

- Dominant Segment (Distribution Channel): Supermarkets/Hypermarkets, with Online Retail Stores experiencing rapid expansion.

- Growth Potential: Asia-Pacific region, particularly India and China, due to expanding middle class and evolving dietary habits.

- Economic Policies: Favorable agricultural policies supporting sweetener production and trade agreements influencing import/export dynamics.

- Infrastructure: Well-developed logistics and cold chain infrastructure in developed economies facilitating efficient distribution.

Syrup Market Product Landscape

The syrup market is witnessing a surge in product innovation, focusing on enhancing flavor profiles, nutritional content, and appealing to health-conscious consumers. Product developments range from organic and naturally sourced syrups to those fortified with functional ingredients. Unique selling propositions often revolve around gourmet flavors, artisanal production methods, and sustainable sourcing. For instance, the launch of premium fruit syrups made from exotic fruits offers a distinct taste experience. Technological advancements in extraction and purification processes are enabling the creation of syrups with cleaner labels and reduced sugar content.

- Product Innovations: Organic and natural sweeteners, low-calorie variants, functional syrups with added vitamins or probiotics, and novel flavor combinations.

- Applications: Extensive use in baked goods, confectionery, dairy products, beverages (coffees, teas, cocktails), breakfast cereals, and as table syrups.

- Performance Metrics: Focus on taste, texture, nutritional value (low sugar, high fiber), shelf stability, and ease of use.

- Unique Selling Propositions: Artisanal production, single-origin sourcing, specific dietary compliance (e.g., vegan, gluten-free).

- Technological Advancements: Improved extraction techniques for natural flavors, enzyme modifications for reduced sugar content, and advanced preservation methods.

Key Drivers, Barriers & Challenges in Syrup Market

Several key factors are propelling the global syrup market forward. The growing demand for natural and organic products is a significant driver, as consumers increasingly seek healthier alternatives to artificial sweeteners. The expanding food and beverage industry, coupled with the rise of the convenience food sector, also contributes to sustained demand. Technological advancements in syrup production, leading to improved quality, diverse flavors, and enhanced nutritional profiles, further bolster market growth.

- Technological Drivers: Innovations in sweetener extraction, flavor encapsulation, and low-calorie formulations.

- Economic Drivers: Increasing disposable incomes in emerging economies, leading to higher consumption of processed foods and premium syrups.

- Policy-Driven Factors: Government initiatives promoting healthy eating and sustainable agriculture can indirectly influence syrup market growth.

However, the market also faces significant barriers and challenges. Fluctuations in raw material prices, such as sugar and fruits, can impact production costs and profitability. Stringent regulatory requirements regarding food safety and labeling in different countries can pose challenges for market entry and expansion. Intense competition from established players and the emergence of new substitute products also present hurdles.

- Supply Chain Issues: Volatility in agricultural yields and the availability of key raw materials like sugarcane, corn, and fruits.

- Regulatory Hurdles: Navigating diverse food safety standards, labeling laws (e.g., sugar content disclosures), and import/export regulations across different nations.

- Competitive Pressures: Intense price competition in commodity syrup segments and the need for continuous product differentiation in specialty markets.

- Health Concerns: Negative consumer perceptions surrounding high-fructose corn syrup and overall sugar intake can impact demand for certain syrup types.

Emerging Opportunities in Syrup Market

The syrup market is ripe with emerging opportunities, driven by evolving consumer preferences and innovative applications. The rising demand for plant-based and vegan products presents a significant opening for syrups derived from natural sources like agave, dates, and coconut. The "free-from" trend also creates opportunities for syrups catering to specific dietary needs, such as gluten-free and low-FODMAP options. Furthermore, the burgeoning functional food and beverage sector offers a platform for syrups enriched with probiotics, vitamins, and other health-enhancing ingredients. The growing popularity of artisanal and craft beverages also fuels demand for premium and specialty syrups used in cocktails, mocktails, and specialty coffees.

- Untapped Markets: Expansion into developing economies with rising disposable incomes and increasing adoption of processed foods.

- Innovative Applications: Development of syrups for niche culinary uses, health supplements, and cosmetic products.

- Evolving Consumer Preferences: Focus on natural, organic, sustainable, and ethically sourced syrup options.

- Functional Syrups: Development of syrups with added health benefits, such as immunity boosters or digestive aids.

Growth Accelerators in the Syrup Market Industry

Several catalysts are driving long-term growth in the syrup market industry. Technological breakthroughs in sustainable sourcing and processing are not only reducing environmental impact but also leading to cost efficiencies. Strategic partnerships between syrup manufacturers and food & beverage companies are facilitating product innovation and market penetration. For instance, collaborations to develop new beverage formulations incorporating unique syrup flavors are on the rise. Market expansion strategies, including entering new geographical regions and targeting underserved consumer segments, are also critical growth accelerators. The increasing popularity of DIY food trends and home cooking, amplified by digital content, continues to fuel demand for a wide variety of syrups.

Key Players Shaping the Syrup Market Market

The global syrup market is shaped by a competitive landscape featuring established food conglomerates and specialized syrup manufacturers. These key players are actively engaged in product development, market expansion, and strategic alliances to maintain and enhance their market positions.

- Dr Willmar Schwabe GmbH & Co KG

- Nestle SA

- MONIN

- Sonoma Syrup Co

- Conagra Brands Inc

- The J M Smucker Company

- The Kraft Heinz Company

- The Quaker Oats Company

- Amorett

- The Hershey Company

Notable Milestones in Syrup Market Sector

The syrup market has witnessed significant developments, reflecting its dynamic nature and the industry's responsiveness to consumer trends and innovation.

- August 2022: Singing Dog Vanilla launched an organic vanilla syrup in the US market, designed to add pure and complex flavor to tea, lattes, iced coffee, and other beverage products.

- February 2022: Daysie introduced a line of simple syrups, including Madagascar vanilla, coconut almond, salted caramel, and a trio for coffee.

- September 2021: Bateel, a leader in the gourmet date industry, launched a range of organic date syrups in four flavors: classic, vanilla, cardamom, and passion fruit.

- July 2021: Dabur, a leading FMCG brand in India, entered the syrup and spreads segment with the launch of Dabur Honey Tasties in strawberry and chocolate flavors.

In-Depth Syrup Market Market Outlook

The future outlook for the syrup market is exceptionally promising, driven by a confluence of accelerating growth factors. The sustained consumer preference for natural and healthier sweetener options will continue to propel the growth of segments like maple syrup and honey. Innovations in low-calorie and functional syrups are expected to unlock new market opportunities, particularly among health-conscious demographics. The increasing penetration of e-commerce platforms will further broaden consumer access to a diverse range of specialty and artisanal syrups, fostering market expansion. Strategic partnerships, focused on product development and market penetration, along with the exploration of untapped geographical markets, will be instrumental in capitalizing on the market's considerable potential. The evolving culinary landscape, embracing global flavors and novel ingredients, will also continue to fuel demand for diverse syrup offerings, positioning the market for robust and sustained growth in the coming years.

Syrup Market Segmentation

-

1. Type

- 1.1. Chocolate Syrup

- 1.2. Maple Syrup

- 1.3. High-fructose Corn Syrup

- 1.4. Rice Syrup

- 1.5. Malt Syrup

- 1.6. Tapioca Syrup

- 1.7. Honey

- 1.8. Fruit Syrup

- 1.9. Other Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Syrup Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Syrup Market Regional Market Share

Geographic Coverage of Syrup Market

Syrup Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Convenient Snacking Options; Increase in Demand for New and Innovative Flavored Meat Snacks

- 3.3. Market Restrains

- 3.3.1. Fluctuations in the Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. Increasing Inclination Toward Organic/Natural Syrups

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Syrup Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chocolate Syrup

- 5.1.2. Maple Syrup

- 5.1.3. High-fructose Corn Syrup

- 5.1.4. Rice Syrup

- 5.1.5. Malt Syrup

- 5.1.6. Tapioca Syrup

- 5.1.7. Honey

- 5.1.8. Fruit Syrup

- 5.1.9. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Syrup Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chocolate Syrup

- 6.1.2. Maple Syrup

- 6.1.3. High-fructose Corn Syrup

- 6.1.4. Rice Syrup

- 6.1.5. Malt Syrup

- 6.1.6. Tapioca Syrup

- 6.1.7. Honey

- 6.1.8. Fruit Syrup

- 6.1.9. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Syrup Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chocolate Syrup

- 7.1.2. Maple Syrup

- 7.1.3. High-fructose Corn Syrup

- 7.1.4. Rice Syrup

- 7.1.5. Malt Syrup

- 7.1.6. Tapioca Syrup

- 7.1.7. Honey

- 7.1.8. Fruit Syrup

- 7.1.9. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Syrup Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chocolate Syrup

- 8.1.2. Maple Syrup

- 8.1.3. High-fructose Corn Syrup

- 8.1.4. Rice Syrup

- 8.1.5. Malt Syrup

- 8.1.6. Tapioca Syrup

- 8.1.7. Honey

- 8.1.8. Fruit Syrup

- 8.1.9. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Syrup Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chocolate Syrup

- 9.1.2. Maple Syrup

- 9.1.3. High-fructose Corn Syrup

- 9.1.4. Rice Syrup

- 9.1.5. Malt Syrup

- 9.1.6. Tapioca Syrup

- 9.1.7. Honey

- 9.1.8. Fruit Syrup

- 9.1.9. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Syrup Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chocolate Syrup

- 10.1.2. Maple Syrup

- 10.1.3. High-fructose Corn Syrup

- 10.1.4. Rice Syrup

- 10.1.5. Malt Syrup

- 10.1.6. Tapioca Syrup

- 10.1.7. Honey

- 10.1.8. Fruit Syrup

- 10.1.9. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dr Willmar Schwabe GmbH & Co KG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nestle SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MONIN

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sonoma Syrup Co

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Conagra Brands Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The J M Smucker Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 The Kraft Heinz Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Quaker Oats Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Amorett

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Hershey Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dr Willmar Schwabe GmbH & Co KG

List of Figures

- Figure 1: Global Syrup Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Syrup Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Syrup Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Syrup Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Syrup Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Syrup Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Syrup Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Syrup Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Syrup Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Syrup Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Syrup Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Syrup Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Syrup Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Syrup Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Syrup Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Syrup Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Syrup Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Syrup Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Syrup Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Syrup Market Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Syrup Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Syrup Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Syrup Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Syrup Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Syrup Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Syrup Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Syrup Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Syrup Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Syrup Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Syrup Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Syrup Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Syrup Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Syrup Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Syrup Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Syrup Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Syrup Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Syrup Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Syrup Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Syrup Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Syrup Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Spain Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Russia Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Syrup Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Syrup Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Syrup Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Syrup Market Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global Syrup Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Syrup Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Syrup Market Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Syrup Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Syrup Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Syrup Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Syrup Market?

The projected CAGR is approximately 5.83%.

2. Which companies are prominent players in the Syrup Market?

Key companies in the market include Dr Willmar Schwabe GmbH & Co KG, Nestle SA, MONIN, Sonoma Syrup Co, Conagra Brands Inc, The J M Smucker Company, The Kraft Heinz Company, The Quaker Oats Company, Amorett, The Hershey Company.

3. What are the main segments of the Syrup Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Convenient Snacking Options; Increase in Demand for New and Innovative Flavored Meat Snacks.

6. What are the notable trends driving market growth?

Increasing Inclination Toward Organic/Natural Syrups.

7. Are there any restraints impacting market growth?

Fluctuations in the Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

In August 2022, Singing Dog Vanilla launched an organic vanilla syrup in the US market. The company claims that the vanilla organic syrup will add pure and complex flavor to tea, lattes, iced coffee, and other beverage products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Syrup Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Syrup Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Syrup Market?

To stay informed about further developments, trends, and reports in the Syrup Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence