Key Insights

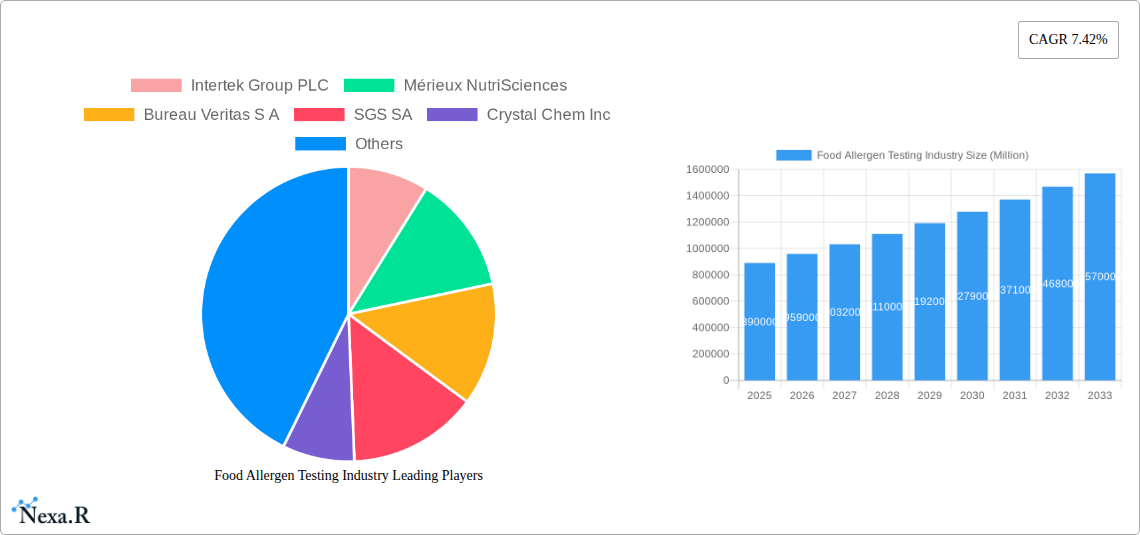

The global Food Allergen Testing market is projected to experience robust growth, reaching an estimated $0.89 million in the base year 2025 and expanding at a significant Compound Annual Growth Rate (CAGR) of 7.42% through 2033. This upward trajectory is fueled by increasing consumer awareness regarding food allergies, stringent government regulations mandating accurate allergen labeling, and a growing demand for safe and transparent food products. The rising prevalence of food allergies worldwide, coupled with the globalization of food supply chains, necessitates sophisticated testing methods to prevent cross-contamination and ensure product safety. Technological advancements in immunoassay-based and PCR-based testing platforms are enhancing sensitivity, speed, and accuracy, further driving market expansion. Key applications span across diverse food sectors, including seafood and meat products, dairy, beverages, bakery, confectionery, and crucially, baby food and infant formula, where the stakes for consumer safety are highest.

Food Allergen Testing Industry Market Size (In Billion)

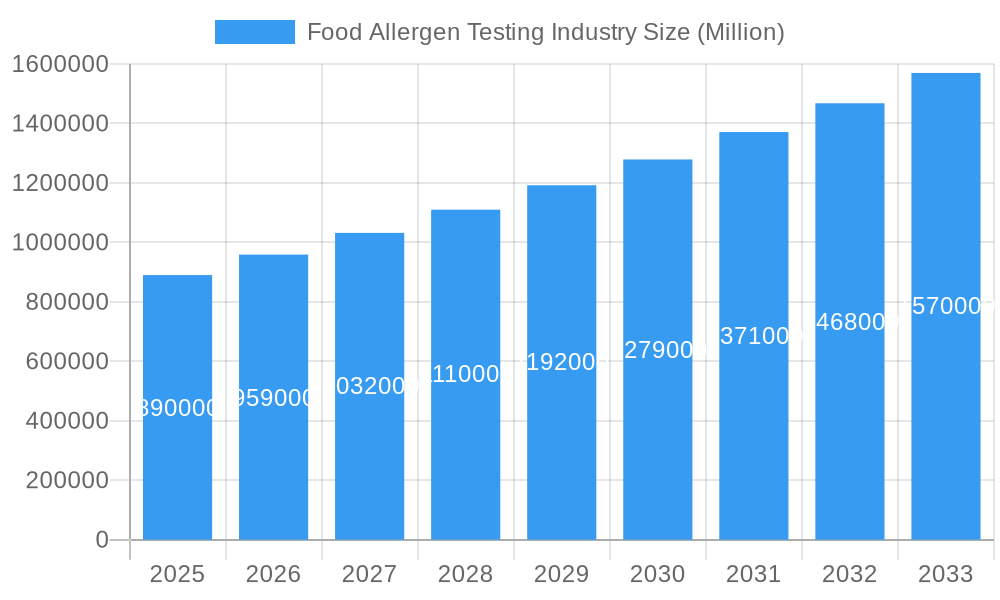

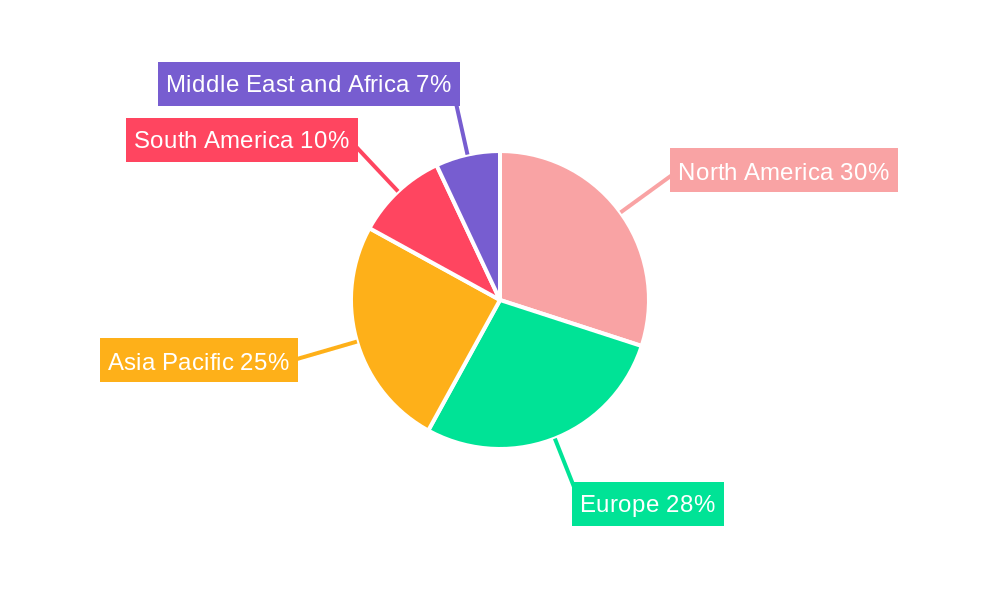

The market's expansion is supported by a competitive landscape featuring prominent global players like Intertek Group PLC, Mérieux NutriSciences, Bureau Veritas S.A., SGS SA, and Eurofins Scientific SE, among others. These companies are at the forefront of developing and offering advanced allergen detection solutions. While growth drivers are strong, potential restraints include the high cost of advanced testing equipment and the need for skilled personnel to operate them. However, the persistent emphasis on food safety and the continuous innovation in testing technologies are expected to outweigh these challenges. Geographically, North America and Europe are anticipated to remain dominant markets due to established regulatory frameworks and high consumer demand for allergen-free products. The Asia Pacific region, however, is poised for significant growth, driven by an expanding food processing industry, increasing disposable incomes, and rising awareness of food safety standards.

Food Allergen Testing Industry Company Market Share

Gain a comprehensive understanding of the global food allergen testing market, a critical sector driven by increasing consumer awareness, stringent regulatory mandates, and the growing prevalence of food allergies worldwide. This in-depth report provides an exhaustive analysis of market dynamics, growth trends, regional dominance, product landscape, key players, and emerging opportunities. With a focus on precise market estimations and future projections, this report is an indispensable resource for stakeholders looking to navigate and capitalize on the evolving food allergen testing industry.

Food Allergen Testing Industry Market Dynamics & Structure

The food allergen testing market exhibits a moderately concentrated structure, characterized by the strategic presence of established global players alongside a growing number of specialized niche providers. Technological innovation remains a primary driver, with significant investment channeled into developing more sensitive, rapid, and cost-effective detection methods. Regulatory frameworks, such as the FALCPA in the US and EU FIC, are continuously evolving, pushing for greater transparency and accuracy in allergen detection. Competitive product substitutes, primarily ranging from traditional laboratory-based assays to rapid on-site test kits, are readily available, forcing manufacturers to focus on differentiation through performance and price. End-user demographics span the entire food supply chain, from raw material suppliers and food manufacturers to retailers and contract testing laboratories, all seeking to ensure product safety and compliance. Mergers and acquisitions (M&A) are prevalent, with larger companies actively acquiring innovative technologies or expanding their geographical reach. For instance, the past few years have seen an average of 8-12 significant M&A deals annually, reflecting consolidation and strategic expansion within the food ingredient testing and food safety testing sectors. Barriers to innovation often stem from the complexity of food matrices, the need for method validation, and the high cost of developing and obtaining regulatory approvals for new testing platforms.

- Market Concentration: Dominated by a few large players, with increasing fragmentation in specific technological niches.

- Technological Innovation: Driven by demand for multiplexing capabilities, reduced detection limits, and faster turnaround times.

- Regulatory Frameworks: Key drivers for market growth, with evolving legislation mandating comprehensive allergen labeling.

- Competitive Landscape: Intense competition among providers of immunoassay-based, PCR-based, and other advanced allergen detection methods.

- End-User Demographics: Broad spectrum, from small food producers to multinational corporations requiring robust food pathogen and allergen control.

- M&A Trends: Active consolidation and strategic acquisitions to gain market share and technological advantage in food quality testing.

Food Allergen Testing Industry Growth Trends & Insights

The food allergen testing market is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. The base year market size is estimated at $2,150 million in 2025. This robust expansion is fueled by a confluence of factors, including heightened consumer awareness regarding food allergies and intolerances, leading to increased demand for accurate and reliable allergen testing services. Regulatory bodies worldwide are progressively tightening regulations concerning food labeling and allergen management, compelling food manufacturers to invest more heavily in allergen testing kits and analytical procedures. The rising incidence of foodborne illnesses and allergic reactions further accentuates the critical need for comprehensive food contaminant testing. Technological advancements are also playing a pivotal role, with the development of more sensitive, faster, and user-friendly testing methods, such as PCR-based and immunoassay-based technologies, driving higher adoption rates. The increasing globalization of the food supply chain necessitates rigorous food supply chain testing to ensure safety and compliance across different regions. Consumer behavior is shifting towards demanding transparency and verifiable safety claims for food products, pushing companies to implement proactive food safety testing protocols. The dairy product allergen testing segment, for instance, is experiencing sustained demand due to common allergens like milk and lactose. Similarly, the bakery and confectionery sector, often dealing with multiple potential allergens, contributes significantly to market volume. The estimated market penetration for advanced allergen testing technologies is expected to reach 75% by 2030. Disruptions in the market are often triggered by new product launches offering enhanced specificity and reduced false positives, as well as by shifts in consumer perception influenced by high-profile recall incidents. The overall market size is projected to reach approximately $3,800 million by 2033.

Dominant Regions, Countries, or Segments in Food Allergen Testing Industry

North America, led by the United States, currently holds a dominant position in the global food allergen testing market, accounting for an estimated 35% of the total market share in 2025. This dominance is attributed to several key factors, including a highly developed food industry with stringent regulatory oversight, high consumer demand for safe and clearly labeled food products, and significant investment in research and development for advanced allergen detection technologies. The presence of major food manufacturers and a robust network of third-party testing laboratories further bolsters its market leadership. Following closely, Europe, with countries like Germany, France, and the UK leading the charge, represents another substantial market, driven by the EU's comprehensive food safety legislation and a growing consumer base concerned about allergens.

Among the technology segments, immunoassay-based / ELISA methods continue to hold the largest market share, estimated at 45% in 2025, due to their established reliability, cost-effectiveness, and widespread adoption for detecting specific allergens in various food matrices. However, PCR (Polymerase Chain Reaction)-based testing is experiencing rapid growth, projected at a CAGR of 8.2%, driven by its high specificity, sensitivity, and ability to detect multiple allergens simultaneously, particularly in complex samples and for trace contamination.

In terms of applications, Seafood and Meat Products and Dairy Products segments are the largest contributors, estimated to capture 20% and 18% of the market share respectively in 2025. This is largely due to the prevalence of common allergens such as fish, shellfish, milk, and lactose, and the critical need for accurate allergen control in these high-risk categories. The Bakery and Confectionery segment also represents a significant application area, given the frequent use of wheat, soy, and nuts. The increasing demand for baby food and infant formula, coupled with heightened concerns about allergens in these sensitive products, is driving the growth of the Baby Food and Infant Formula segment, projected to grow at a CAGR of 7.8%.

- Dominant Region: North America (US) - High regulatory standards, consumer awareness, strong R&D.

- Key European Markets: Germany, France, UK - Driven by EU regulations and consumer demand.

- Leading Technology Segment: Immunoassay-based / ELISA - Established, cost-effective, widely adopted.

- Fastest Growing Technology Segment: PCR (Polymerase Chain Reaction)-based - High specificity, sensitivity, multiplexing capabilities.

- Dominant Application Segments: Seafood and Meat Products, Dairy Products - Prevalence of common allergens, critical safety concerns.

- High Growth Application Segment: Baby Food and Infant Formula - Increased consumer focus on safety for vulnerable populations.

Food Allergen Testing Industry Product Landscape

The food allergen testing industry is characterized by a dynamic product landscape featuring innovative solutions designed for enhanced accuracy, speed, and ease of use. Manufacturers are continuously launching advanced test kits and laboratory services that offer lower detection limits, improved specificity, and the ability to screen for multiple allergens simultaneously. Unique selling propositions often revolve around rapid results, minimal sample preparation, and compatibility with various food matrices, including processed foods, raw ingredients, and environmental swabs. Technological advancements include the development of lateral flow devices with increased sensitivity, multiplex PCR assays capable of identifying a panel of allergens in a single run, and sophisticated ELISA kits with improved monoclonal antibody performance. The trend towards portable and field-deployable testing solutions is also shaping the product offerings, empowering on-site food quality assurance and allergen risk management.

Key Drivers, Barriers & Challenges in Food Allergen Testing Industry

The food allergen testing industry is propelled by several key drivers, including increasingly stringent global regulations on allergen labeling, heightened consumer awareness and demand for allergen-free products, and the rising incidence of food allergies worldwide. Technological advancements in detection methods, such as improved PCR and immunoassay techniques, are also significant catalysts.

Conversely, challenges include the high cost of advanced testing equipment and reagents, the complexity of validating new methods across diverse food matrices, and potential supply chain disruptions for critical testing components. Regulatory hurdles, such as differing international standards for allergen thresholds, can also pose significant barriers. Competitive pressures from both established players and emerging innovators, coupled with the need for continuous method improvement to keep pace with evolving scientific understanding, present ongoing challenges. The estimated impact of these challenges can lead to a 5-8% increase in operational costs for smaller manufacturers.

Emerging Opportunities in Food Allergen Testing Industry

Emerging opportunities in the food allergen testing industry lie in the development of more comprehensive and integrated food safety solutions, including the testing for undeclared allergens through advanced DNA and protein-based methods. The growing demand for plant-based and alternative protein products presents a new frontier for allergen testing, requiring novel approaches to identify cross-contamination from traditional allergens. Untapped markets in developing economies, where food safety regulations are evolving, offer significant growth potential. Furthermore, the integration of artificial intelligence and machine learning in data analysis from testing platforms can lead to predictive insights for allergen risk management, creating a unique value proposition for service providers. The expansion of rapid, point-of-use testing devices for small and medium-sized enterprises (SMEs) is another significant opportunity.

Growth Accelerators in the Food Allergen Testing Industry Industry

Key growth accelerators for the food allergen testing industry include continuous technological breakthroughs in sensitivity and specificity, such as the development of CRISPR-based diagnostic tools for allergen detection. Strategic partnerships between testing laboratories, food manufacturers, and technology providers are fostering innovation and market expansion. The increasing focus on supply chain traceability and transparency is driving demand for robust food provenance testing solutions that integrate allergen data. Furthermore, the expansion of services for emerging dietary trends, like gluten-free and vegan, is creating new revenue streams. Government initiatives promoting food safety and consumer protection also act as significant growth catalysts, encouraging greater adoption of advanced food analysis techniques.

Key Players Shaping the Food Allergen Testing Industry Market

- Intertek Group PLC

- Mérieux NutriSciences

- Bureau Veritas S A

- SGS SA

- Crystal Chem Inc

- Lifeasible

- ALS Limited

- Microbac Laboratories Inc

- Eurofins Scientific SE

- Neogen Corporation

Notable Milestones in Food Allergen Testing Industry Sector

- March 2024: Gold Standard Diagnostics launched the first product of the new allergen PowerLine tests: the SENSIStrip Gluten PowerLine Lateral Flow Device. The product comprises a sensitive detection system based on a monoclonal antibody and can detect gluten residues in food matrices, rinse water, and swabs, enhancing rapid gluten detection capabilities.

- March 2024: ALS strategically expanded and strengthened its European and USA Life Sciences presence by acquiring Northeast USA-based York Analytical Laboratories (York) and Western Europe-based Wessling Holding GmbH & Co. This expansion significantly broadens ALS's food testing laboratory network and service offerings.

- February 2024: Mérieux NutriSciences opened a new and well-equipped laboratory for food analysis in Maringá, Brazil. The new facility, accredited according to NBR ISO/IEC 17025 requirements, will bolster support for the South American food industry quality control and allergen testing needs.

In-Depth Food Allergen Testing Industry Market Outlook

The food allergen testing industry is on a trajectory for sustained and accelerated growth, driven by an imperative for enhanced food safety and consumer confidence. Future market potential is significantly amplified by the increasing demand for highly sensitive and specific testing methodologies, particularly for trace allergens and emerging food allergens. Strategic opportunities lie in the global expansion of accredited testing services, catering to the evolving needs of a diverse food manufacturing landscape. The continuous development of cost-effective, rapid, and user-friendly testing solutions will further democratize access to critical food safety testing for businesses of all sizes, ultimately contributing to a safer global food supply.

Food Allergen Testing Industry Segmentation

-

1. Technology

- 1.1. Immunoassay-based /ELISA

- 1.2. PCR (Polymerase Chain Reaction)-based

- 1.3. Other Technologies

-

2. Application

- 2.1. Seafood and Meat Products

- 2.2. Dairy Products

- 2.3. Beverages

- 2.4. Bakery and Confectionery

- 2.5. Baby Food and Infant Formula

- 2.6. Other Applications

Food Allergen Testing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Food Allergen Testing Industry Regional Market Share

Geographic Coverage of Food Allergen Testing Industry

Food Allergen Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety

- 3.3. Market Restrains

- 3.3.1. Inconsistencies Involved in Food Allergen Declarations

- 3.4. Market Trends

- 3.4.1. Increasing Prevalence of Food Allergies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food Allergen Testing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Immunoassay-based /ELISA

- 5.1.2. PCR (Polymerase Chain Reaction)-based

- 5.1.3. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Seafood and Meat Products

- 5.2.2. Dairy Products

- 5.2.3. Beverages

- 5.2.4. Bakery and Confectionery

- 5.2.5. Baby Food and Infant Formula

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Food Allergen Testing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Immunoassay-based /ELISA

- 6.1.2. PCR (Polymerase Chain Reaction)-based

- 6.1.3. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Seafood and Meat Products

- 6.2.2. Dairy Products

- 6.2.3. Beverages

- 6.2.4. Bakery and Confectionery

- 6.2.5. Baby Food and Infant Formula

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Food Allergen Testing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Immunoassay-based /ELISA

- 7.1.2. PCR (Polymerase Chain Reaction)-based

- 7.1.3. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Seafood and Meat Products

- 7.2.2. Dairy Products

- 7.2.3. Beverages

- 7.2.4. Bakery and Confectionery

- 7.2.5. Baby Food and Infant Formula

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Food Allergen Testing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Immunoassay-based /ELISA

- 8.1.2. PCR (Polymerase Chain Reaction)-based

- 8.1.3. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Seafood and Meat Products

- 8.2.2. Dairy Products

- 8.2.3. Beverages

- 8.2.4. Bakery and Confectionery

- 8.2.5. Baby Food and Infant Formula

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America Food Allergen Testing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Immunoassay-based /ELISA

- 9.1.2. PCR (Polymerase Chain Reaction)-based

- 9.1.3. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Seafood and Meat Products

- 9.2.2. Dairy Products

- 9.2.3. Beverages

- 9.2.4. Bakery and Confectionery

- 9.2.5. Baby Food and Infant Formula

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Food Allergen Testing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Immunoassay-based /ELISA

- 10.1.2. PCR (Polymerase Chain Reaction)-based

- 10.1.3. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Seafood and Meat Products

- 10.2.2. Dairy Products

- 10.2.3. Beverages

- 10.2.4. Bakery and Confectionery

- 10.2.5. Baby Food and Infant Formula

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Intertek Group PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mérieux NutriSciences

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bureau Veritas S A

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SGS SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Crystal Chem Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lifeasible

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ALS Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Microbac Laboratories Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Eurofins Scientific SE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Neogen Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Intertek Group PLC

List of Figures

- Figure 1: Global Food Allergen Testing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Food Allergen Testing Industry Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Food Allergen Testing Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Food Allergen Testing Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Food Allergen Testing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Food Allergen Testing Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Food Allergen Testing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Food Allergen Testing Industry Revenue (Million), by Technology 2025 & 2033

- Figure 9: Europe Food Allergen Testing Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Food Allergen Testing Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Food Allergen Testing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Food Allergen Testing Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Food Allergen Testing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Food Allergen Testing Industry Revenue (Million), by Technology 2025 & 2033

- Figure 15: Asia Pacific Food Allergen Testing Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Food Allergen Testing Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Food Allergen Testing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Food Allergen Testing Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Food Allergen Testing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Food Allergen Testing Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: South America Food Allergen Testing Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: South America Food Allergen Testing Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Food Allergen Testing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Food Allergen Testing Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Food Allergen Testing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Food Allergen Testing Industry Revenue (Million), by Technology 2025 & 2033

- Figure 27: Middle East and Africa Food Allergen Testing Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East and Africa Food Allergen Testing Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Food Allergen Testing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Food Allergen Testing Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Food Allergen Testing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Food Allergen Testing Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Food Allergen Testing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Food Allergen Testing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Food Allergen Testing Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 5: Global Food Allergen Testing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Food Allergen Testing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Food Allergen Testing Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: Global Food Allergen Testing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Food Allergen Testing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Food Allergen Testing Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 22: Global Food Allergen Testing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Food Allergen Testing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: India Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: China Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Food Allergen Testing Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 30: Global Food Allergen Testing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Food Allergen Testing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Food Allergen Testing Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 36: Global Food Allergen Testing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 37: Global Food Allergen Testing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Food Allergen Testing Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Allergen Testing Industry?

The projected CAGR is approximately 7.42%.

2. Which companies are prominent players in the Food Allergen Testing Industry?

Key companies in the market include Intertek Group PLC, Mérieux NutriSciences, Bureau Veritas S A, SGS SA, Crystal Chem Inc , Lifeasible, ALS Limited, Microbac Laboratories Inc, Eurofins Scientific SE, Neogen Corporation.

3. What are the main segments of the Food Allergen Testing Industry?

The market segments include Technology, Application .

4. Can you provide details about the market size?

The market size is estimated to be USD 0.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety.

6. What are the notable trends driving market growth?

Increasing Prevalence of Food Allergies.

7. Are there any restraints impacting market growth?

Inconsistencies Involved in Food Allergen Declarations.

8. Can you provide examples of recent developments in the market?

March 2024: Gold Standard Diagnostics launched the first product of the new allergen PowerLine tests: the SENSIStrip Gluten PowerLine Lateral Flow Device. The product comprises a sensitive detection system based on a monoclonal antibody and can detect gluten residues in food matrices, rinse water, and swabs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food Allergen Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food Allergen Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food Allergen Testing Industry?

To stay informed about further developments, trends, and reports in the Food Allergen Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence