Key Insights

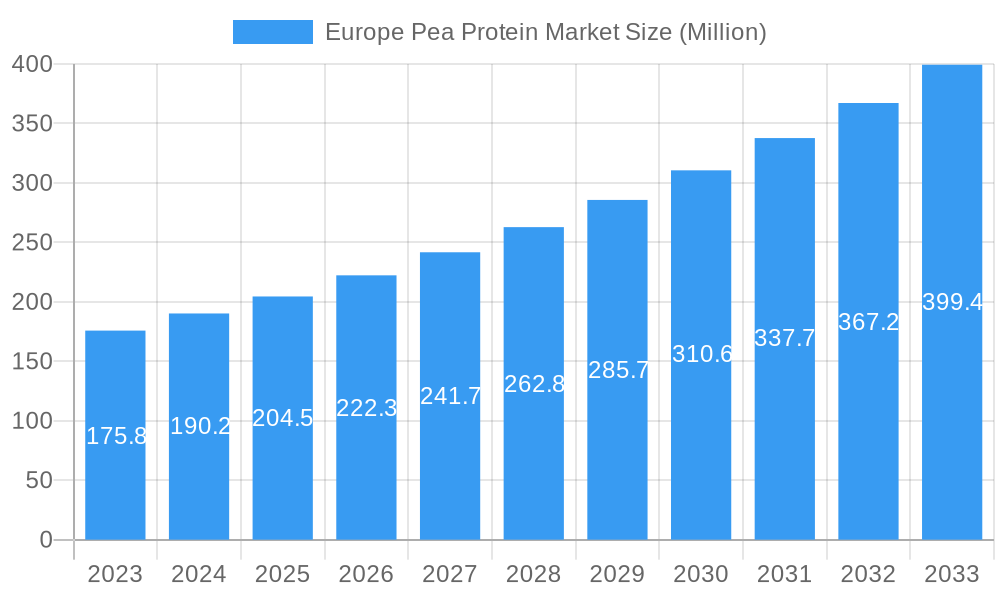

The Europe pea protein market is poised for significant expansion, with a current estimated market size of $204.5 million. This robust growth is projected to continue at a CAGR of 9.20% throughout the forecast period. This upward trajectory is largely fueled by increasing consumer demand for plant-based diets, driven by health consciousness, ethical considerations, and environmental sustainability concerns. The versatility of pea protein as a protein source, offering a complete amino acid profile, has led to its widespread adoption across various applications. Key drivers include the growing popularity of vegan and vegetarian lifestyles, the rising prevalence of food allergies and intolerances to dairy and soy, and the continuous innovation in food and beverage formulations to incorporate pea protein. The market's dynamism is further supported by advancements in processing technologies that enhance the taste, texture, and functionality of pea protein ingredients, making them more appealing for mainstream consumption.

Europe Pea Protein Market Market Size (In Million)

The market segments are characterized by diverse applications and forms, reflecting the broad utility of pea protein. In terms of form, Protein Isolate and Protein Concentrate are the leading categories, owing to their high protein content and purity, making them ideal for nutritional supplements and functional foods. Textured Protein is gaining traction as a meat substitute, catering to the burgeoning plant-based meat industry. Applications in Bakery, Meat Extender and Substitute, Nutritional Supplement, Beverage, and Snacks are experiencing substantial growth. Key players like Cargill Incorporated, Roquette Freres SA, and Archer Daniels Midland Company (ADM) are actively investing in research and development, expanding production capacities, and forging strategic partnerships to capitalize on market opportunities. Europe's strong emphasis on sustainable food systems and its developed food processing industry provide a fertile ground for the continued dominance of pea protein in the region's plant-based protein landscape.

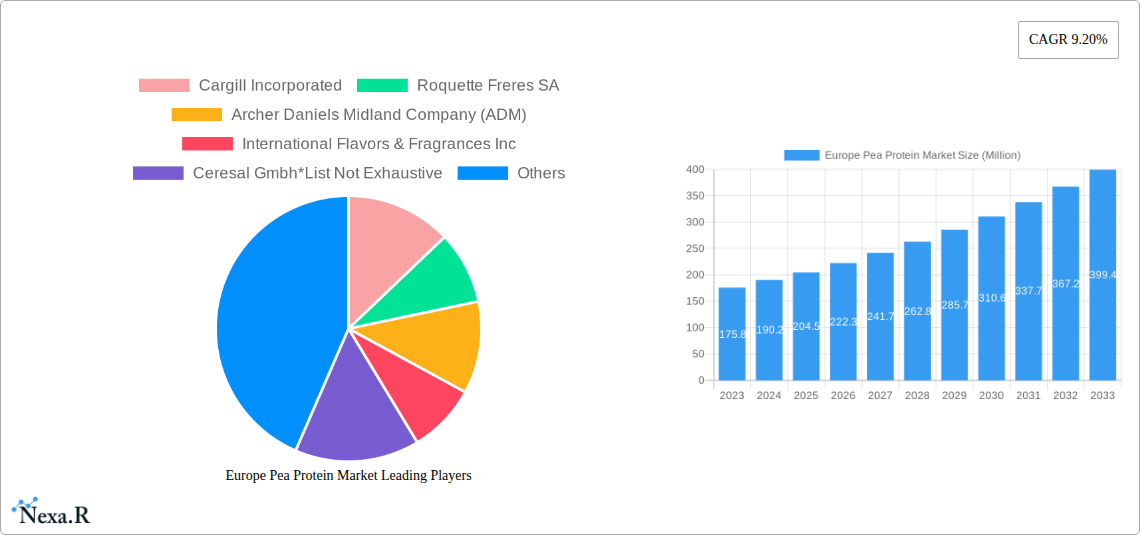

Europe Pea Protein Market Company Market Share

Europe Pea Protein Market Report: Unveiling Growth, Innovation, and Strategic Opportunities (2019–2033)

Unlock the dynamic landscape of the Europe Pea Protein Market with this comprehensive, SEO-optimized report. Delve into detailed market segmentation, understand key growth drivers, and identify emerging opportunities within the rapidly expanding plant-based protein sector. This report provides critical insights for stakeholders seeking to capitalize on the surging demand for sustainable and healthy protein alternatives across Europe. Explore parent and child market analyses, market dynamics, and future trends, all presented with actionable data and expert analysis.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Europe Pea Protein Market Market Dynamics & Structure

The Europe pea protein market is characterized by a moderate to high concentration of key players, driven by significant capital investment requirements and proprietary processing technologies. Cargill Incorporated, Roquette Freres SA, and Archer Daniels Midland Company (ADM) are prominent innovators, continually investing in research and development to enhance protein functionality, taste, and texture. Technological innovation remains a primary driver, with advancements in extraction and processing methods yielding higher purity isolates and novel textured proteins. Regulatory frameworks, particularly concerning food safety and novel food ingredients, play a crucial role in shaping market entry and product development. Competitive product substitutes, such as soy protein, whey protein, and other plant-based proteins, exert pressure but are increasingly differentiated by specific functional benefits and consumer perceptions of health and sustainability. End-user demographics are shifting rapidly, with a growing segment of health-conscious consumers, flexitarians, and vegans actively seeking plant-based protein sources. Mergers and acquisitions (M&A) trends are evident as larger players aim to consolidate market share and expand their portfolios. For instance, recent M&A activities indicate a strategic push towards integrating ingredient suppliers and technology providers. The market's growth is also influenced by evolving dietary guidelines and a societal push towards sustainable food systems.

- Market Concentration: Dominated by a few large, established players with significant R&D capabilities.

- Technological Innovation: Focus on improving taste, texture, digestibility, and expanding applications of pea protein.

- Regulatory Landscape: Stringent food safety regulations and evolving novel food approvals shape product launches.

- Competitive Landscape: Intense competition from other plant-based proteins (soy, fava bean, rice) and animal-based proteins.

- End-User Demographics: Growing demand from flexitarians, vegans, vegetarians, and health-conscious consumers.

- M&A Trends: Strategic acquisitions to gain market share, secure supply chains, and acquire advanced technologies.

- Sustainability Focus: Increasing consumer preference for eco-friendly and ethically sourced ingredients.

Europe Pea Protein Market Growth Trends & Insights

The Europe pea protein market is poised for substantial growth, projecting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This expansion is fueled by a confluence of robust market size evolution, accelerating adoption rates across various food and beverage sectors, and significant technological disruptions. The market is currently valued at an estimated $xx Million in 2025, with projections reaching $xx Million by 2033. Consumer behavior shifts are at the forefront of this growth trajectory; a discernible increase in plant-based diets, driven by health consciousness, ethical considerations, and environmental concerns, is a primary catalyst. The "flexitarian" movement, in particular, has opened up a vast new consumer base eager to incorporate more plant-based options without completely abandoning animal products. This translates into a significant market penetration for pea protein in mainstream food products. Technological advancements in processing techniques have been instrumental in overcoming historical limitations associated with pea protein, such as off-flavors and gritty textures. Innovations have led to the development of highly functional pea protein isolates and concentrates that can seamlessly integrate into a wide array of applications, from plant-based meats and dairy alternatives to nutritional supplements and baked goods. This improved functionality, coupled with rising awareness of pea protein's nutritional benefits, including its high protein content, essential amino acid profile, and allergen-friendliness compared to soy, is driving increased demand. Furthermore, government initiatives promoting sustainable agriculture and healthier food choices indirectly support the pea protein market by fostering a favorable ecosystem for plant-based ingredients. The increasing investment from major food manufacturers in developing and marketing alternative protein products underscores the significant market opportunities. The historical period from 2019–2024 witnessed a steady upward trend, laying the groundwork for the accelerated growth anticipated in the coming decade. The market's trajectory is further influenced by the growing emphasis on clean-label products, where pea protein, derived from a relatively simple legume, aligns well with consumer preferences for natural and recognizable ingredients.

Dominant Regions, Countries, or Segments in Europe Pea Protein Market

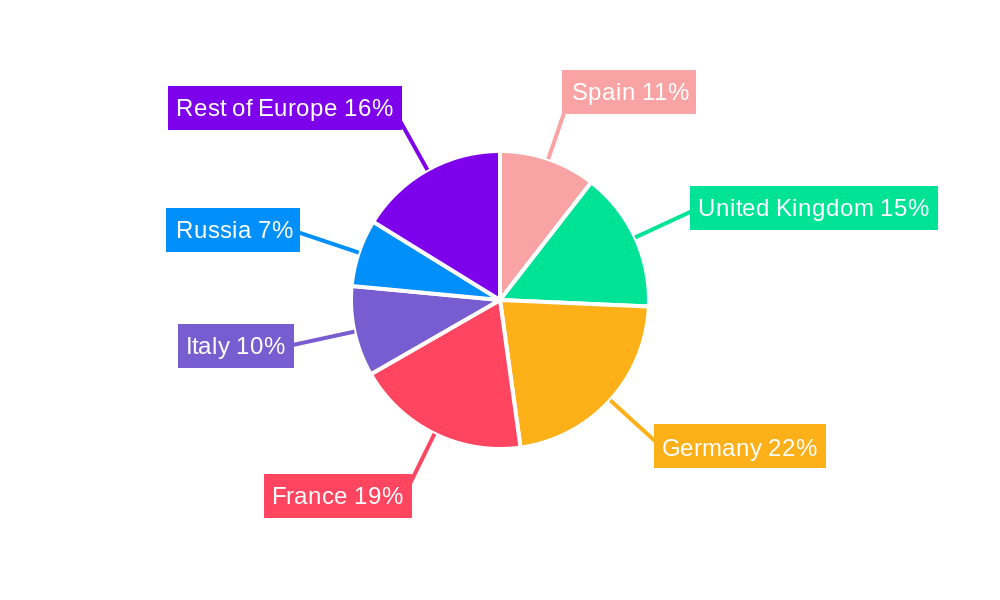

Within the Europe pea protein market, Germany consistently emerges as a dominant country, showcasing significant growth potential and market penetration across various segments. This leadership is attributed to a combination of strong economic policies supporting innovation and sustainability, well-developed infrastructure for food manufacturing and distribution, and a highly engaged consumer base with a growing appetite for plant-based alternatives. German consumers are increasingly health-conscious and environmentally aware, actively seeking protein sources that align with these values. This has led to a high adoption rate of pea protein in nutritional supplements and meat alternatives.

The Protein Isolate segment, within the Form category, is another key driver of market dominance. Pea protein isolates, characterized by their high protein content (typically >85%) and excellent solubility, are highly sought after for applications where purity and functionality are paramount. This segment is projected to hold the largest market share due to its versatility in creating high-protein food products with superior texture and taste.

In terms of Application, Meat Extender and Substitute stands out as a primary growth engine and a dominant segment. The burgeoning plant-based meat industry in Europe, driven by both consumer demand and ethical considerations, relies heavily on the functional properties of pea protein to mimic the texture, mouthfeel, and nutritional profile of traditional meat products. The increasing number of new product launches in this category further solidifies its dominant position.

- Dominant Country: Germany, due to strong consumer demand, supportive policies, and established food industry.

- Dominant Form: Protein Isolate, driven by its high purity and versatile functionality in premium food applications.

- Dominant Application: Meat Extender and Substitute, fueled by the rapid growth of the plant-based meat market.

- Key Drivers in Germany: High consumer awareness of health and sustainability, government support for alternative proteins, and robust food processing infrastructure.

- Growth Potential in Protein Isolate: Continued innovation in processing to enhance functionality and reduce costs.

- Expansion of Meat Extender & Substitute: Increasing product variety, improved taste and texture profiles, and greater consumer acceptance.

- Emerging Applications: Growing traction in bakery and beverage sectors, offering opportunities for diversification.

Europe Pea Protein Market Product Landscape

The Europe pea protein market is witnessing a surge in innovative product development, focusing on enhanced functionality and broader application ranges. Roquette Freres SA's recent launch of four multi-functional pea proteins – NUTRALYS® Pea F853M (isolate), NUTRALYS® H85 (hydrolysate), NUTRALYS® T Pea 700FL (textured), and NUTRALYS® T Pea 700M (textured) – exemplifies this trend. These ingredients are specifically designed to address taste and texture challenges in plant-based foods and high-protein nutritional products, offering solutions for improved palatability and consumer acceptance. The product landscape is increasingly segmented by protein content, with isolates catering to high-protein demands and concentrates serving a wider range of functional needs. Textured pea proteins are gaining significant traction for their ability to replicate the fibrous texture of meat, expanding their use in meat analogues. Performance metrics such as solubility, emulsification, gelation, and water-holding capacity are key differentiators, driving innovation in processing technologies to optimize these attributes.

Key Drivers, Barriers & Challenges in Europe Pea Protein Market

Key Drivers: The Europe pea protein market is propelled by several interconnected drivers. A significant catalyst is the escalating consumer demand for plant-based and sustainable protein sources, driven by health consciousness, environmental concerns, and ethical considerations. Technological advancements in extraction and processing are crucial, leading to improved flavor, texture, and functionality of pea protein ingredients. Government initiatives promoting healthy eating and sustainable agriculture also play a supportive role. The versatility of pea protein in various food and beverage applications, from meat substitutes to nutritional supplements, further fuels its market expansion.

Barriers & Challenges: Despite the robust growth, the market faces certain challenges. Supply chain volatility and the availability of raw materials can impact pricing and consistency. Regulatory hurdles related to novel food approvals and labeling can sometimes slow down product launches. While improving, off-flavors and gritty textures remain a concern for some applications, necessitating continuous innovation. Intense competition from other plant-based protein sources and established animal protein markets presents a significant challenge. Furthermore, the cost-competitiveness of pea protein compared to conventional protein sources remains a factor for price-sensitive consumers and manufacturers.

Emerging Opportunities in Europe Pea Protein Market

Emerging opportunities within the Europe pea protein market are manifold, driven by evolving consumer preferences and technological innovation. The demand for clean-label and minimally processed ingredients presents a significant avenue, as pea protein naturally aligns with these trends. Untapped markets within specialty nutrition, such as infant formula and medical foods, offer considerable potential due to pea protein's hypoallergenic properties. Innovative applications in dairy alternatives, beyond milk, including yogurts and cheeses, are gaining traction. The development of flavor masking technologies and novel texturization methods will unlock further possibilities in a wider range of food products. Furthermore, increasing consumer interest in functional foods with added health benefits, where pea protein can be combined with other beneficial ingredients, represents a growth frontier.

Growth Accelerators in the Europe Pea Protein Market Industry

Several catalysts are accelerating the long-term growth of the Europe pea protein market. Technological breakthroughs in processing, particularly in achieving superior protein isolates and textured proteins with enhanced sensory profiles, are fundamental. Strategic partnerships and collaborations between ingredient suppliers, food manufacturers, and research institutions are vital for innovation and market penetration. The increasing focus on market expansion into new product categories and geographical regions within Europe is a key accelerator. Moreover, the growing trend of product diversification by manufacturers, offering a wider array of pea protein-based products catering to diverse consumer needs and preferences, is significantly boosting market momentum.

Key Players Shaping the Europe Pea Protein Market Market

- Cargill Incorporated

- Roquette Freres SA

- Archer Daniels Midland Company (ADM)

- International Flavors & Fragrances Inc

- Ceresal Gmbh

- Koninklijke DSM N V

- Kerry Group PLC

- Emsland Food GmbH

- Cosucra Groupe Warcoing SA

- Ingredion Incorporated

Notable Milestones in Europe Pea Protein Market Sector

- February 2024: Roquette Freres SA launched four multi-functional pea proteins (NUTRALYS® Pea F853M, NUTRALYS® H85, NUTRALYS® T Pea 700FL, NUTRALYS® T Pea 700M) to enhance taste, texture, and creativity in plant-based and high-protein products.

- July 2023: ADM and Marel established an innovation center in the Netherlands to accelerate alternative protein capabilities, focusing on manufacturing, marketing, and novel processing techniques.

- June 2023: Cosucra secured EUR 45 million in funding from Sofiprotéol, Wallonie Entreprendre, and SFPIM to expand production capacity and operations.

In-Depth Europe Pea Protein Market Market Outlook

The future outlook for the Europe pea protein market is exceptionally strong, driven by enduring trends towards healthier and more sustainable eating habits. Growth accelerators, including continuous technological innovation in protein functionality and a growing consumer demand for clean-label ingredients, are set to propel the market forward. Strategic partnerships and an increasing focus on market expansion into novel applications like advanced dairy alternatives and specialized nutritional products will further bolster growth. The market is poised to witness significant expansion as manufacturers increasingly leverage pea protein’s hypoallergenic and environmentally friendly attributes to cater to a widening consumer base. The inherent potential for high protein content and versatility ensures pea protein's continued dominance in the plant-based protein landscape, offering substantial future market potential and strategic opportunities for stakeholders.

Europe Pea Protein Market Segmentation

-

1. Form

- 1.1. Protein Isolate

- 1.2. Protein Concentrate

- 1.3. Textured Protein

-

2. Application

- 2.1. Bakery

- 2.2. Meat Extender and Substitute

- 2.3. Nutritional Supplement

- 2.4. Beverage

- 2.5. Snacks

- 2.6. Other Applications

Europe Pea Protein Market Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. Germany

- 4. France

- 5. Italy

- 6. Russia

- 7. Rest of Europe

Europe Pea Protein Market Regional Market Share

Geographic Coverage of Europe Pea Protein Market

Europe Pea Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Plant Based Alternatives; Expanding Application of Pea Protein Toward Food Fortification

- 3.3. Market Restrains

- 3.3.1. Low Awareness and Application of the Additive

- 3.4. Market Trends

- 3.4.1. Growing Demand for Plant Based Alternatives

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pea Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Protein Isolate

- 5.1.2. Protein Concentrate

- 5.1.3. Textured Protein

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Meat Extender and Substitute

- 5.2.3. Nutritional Supplement

- 5.2.4. Beverage

- 5.2.5. Snacks

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.3.2. United Kingdom

- 5.3.3. Germany

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Spain Europe Pea Protein Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Protein Isolate

- 6.1.2. Protein Concentrate

- 6.1.3. Textured Protein

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bakery

- 6.2.2. Meat Extender and Substitute

- 6.2.3. Nutritional Supplement

- 6.2.4. Beverage

- 6.2.5. Snacks

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. United Kingdom Europe Pea Protein Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Protein Isolate

- 7.1.2. Protein Concentrate

- 7.1.3. Textured Protein

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bakery

- 7.2.2. Meat Extender and Substitute

- 7.2.3. Nutritional Supplement

- 7.2.4. Beverage

- 7.2.5. Snacks

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Germany Europe Pea Protein Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Protein Isolate

- 8.1.2. Protein Concentrate

- 8.1.3. Textured Protein

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bakery

- 8.2.2. Meat Extender and Substitute

- 8.2.3. Nutritional Supplement

- 8.2.4. Beverage

- 8.2.5. Snacks

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. France Europe Pea Protein Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Form

- 9.1.1. Protein Isolate

- 9.1.2. Protein Concentrate

- 9.1.3. Textured Protein

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bakery

- 9.2.2. Meat Extender and Substitute

- 9.2.3. Nutritional Supplement

- 9.2.4. Beverage

- 9.2.5. Snacks

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Form

- 10. Italy Europe Pea Protein Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Form

- 10.1.1. Protein Isolate

- 10.1.2. Protein Concentrate

- 10.1.3. Textured Protein

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Bakery

- 10.2.2. Meat Extender and Substitute

- 10.2.3. Nutritional Supplement

- 10.2.4. Beverage

- 10.2.5. Snacks

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Form

- 11. Russia Europe Pea Protein Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Form

- 11.1.1. Protein Isolate

- 11.1.2. Protein Concentrate

- 11.1.3. Textured Protein

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Bakery

- 11.2.2. Meat Extender and Substitute

- 11.2.3. Nutritional Supplement

- 11.2.4. Beverage

- 11.2.5. Snacks

- 11.2.6. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Form

- 12. Rest of Europe Europe Pea Protein Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Form

- 12.1.1. Protein Isolate

- 12.1.2. Protein Concentrate

- 12.1.3. Textured Protein

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Bakery

- 12.2.2. Meat Extender and Substitute

- 12.2.3. Nutritional Supplement

- 12.2.4. Beverage

- 12.2.5. Snacks

- 12.2.6. Other Applications

- 12.1. Market Analysis, Insights and Forecast - by Form

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Cargill Incorporated

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Roquette Freres SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Archer Daniels Midland Company (ADM)

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 International Flavors & Fragrances Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Ceresal Gmbh*List Not Exhaustive

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Koninklijke DSM N V

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Kerry Group PLC

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Emsland Food GmbH

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Cosucra Groupe Warcoing SA

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Ingredion Incorporated

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Cargill Incorporated

List of Figures

- Figure 1: Europe Pea Protein Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Pea Protein Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Pea Protein Market Revenue Million Forecast, by Form 2020 & 2033

- Table 2: Europe Pea Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Europe Pea Protein Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Pea Protein Market Revenue Million Forecast, by Form 2020 & 2033

- Table 5: Europe Pea Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Europe Pea Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Europe Pea Protein Market Revenue Million Forecast, by Form 2020 & 2033

- Table 8: Europe Pea Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Europe Pea Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Europe Pea Protein Market Revenue Million Forecast, by Form 2020 & 2033

- Table 11: Europe Pea Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Europe Pea Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Europe Pea Protein Market Revenue Million Forecast, by Form 2020 & 2033

- Table 14: Europe Pea Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Europe Pea Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Pea Protein Market Revenue Million Forecast, by Form 2020 & 2033

- Table 17: Europe Pea Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Europe Pea Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Europe Pea Protein Market Revenue Million Forecast, by Form 2020 & 2033

- Table 20: Europe Pea Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Europe Pea Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Europe Pea Protein Market Revenue Million Forecast, by Form 2020 & 2033

- Table 23: Europe Pea Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Europe Pea Protein Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pea Protein Market?

The projected CAGR is approximately 9.20%.

2. Which companies are prominent players in the Europe Pea Protein Market?

Key companies in the market include Cargill Incorporated, Roquette Freres SA, Archer Daniels Midland Company (ADM), International Flavors & Fragrances Inc, Ceresal Gmbh*List Not Exhaustive, Koninklijke DSM N V, Kerry Group PLC, Emsland Food GmbH, Cosucra Groupe Warcoing SA, Ingredion Incorporated.

3. What are the main segments of the Europe Pea Protein Market?

The market segments include Form, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 204.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Plant Based Alternatives; Expanding Application of Pea Protein Toward Food Fortification.

6. What are the notable trends driving market growth?

Growing Demand for Plant Based Alternatives.

7. Are there any restraints impacting market growth?

Low Awareness and Application of the Additive.

8. Can you provide examples of recent developments in the market?

February 2024: Roquette Freres SA launched four multi-functional pea proteins designed to improve taste, texture, and creativity in plant-based food and high-protein nutritional products. The four pea protein ingredients include NUTRALYS® Pea F853M (isolate), NUTRALYS® H85 (hydrolysate), NUTRALYS® T Pea 700FL (textured) and NUTRALYS® T Pea 700M (textured).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pea Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pea Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pea Protein Market?

To stay informed about further developments, trends, and reports in the Europe Pea Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence