Key Insights

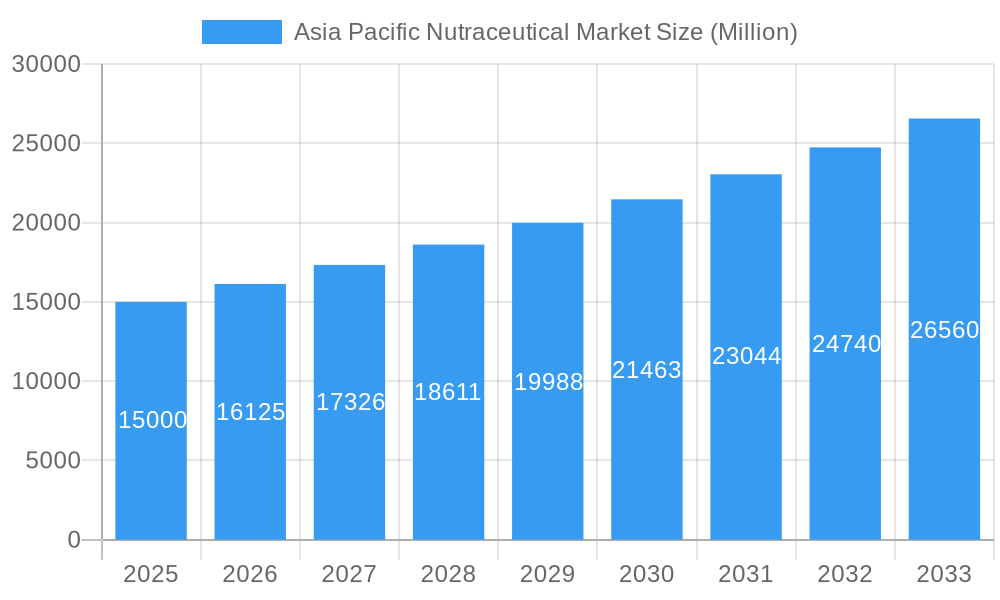

The Asia-Pacific nutraceutical market is poised for significant expansion, projecting a market size of $103 billion by 2025, with a compound annual growth rate (CAGR) of 7%. This growth is propelled by heightened consumer health consciousness, escalating disposable incomes, and an aging demographic across the region. Key drivers include the rising incidence of chronic diseases, increasing demand for preventive healthcare solutions, and a growing awareness of the health benefits associated with functional foods and dietary supplements. The market's expansion is further supported by the proliferation of nutraceuticals through diverse retail channels, encompassing supermarkets, specialty stores, online platforms, and pharmacies.

Asia Pacific Nutraceutical Market Market Size (In Billion)

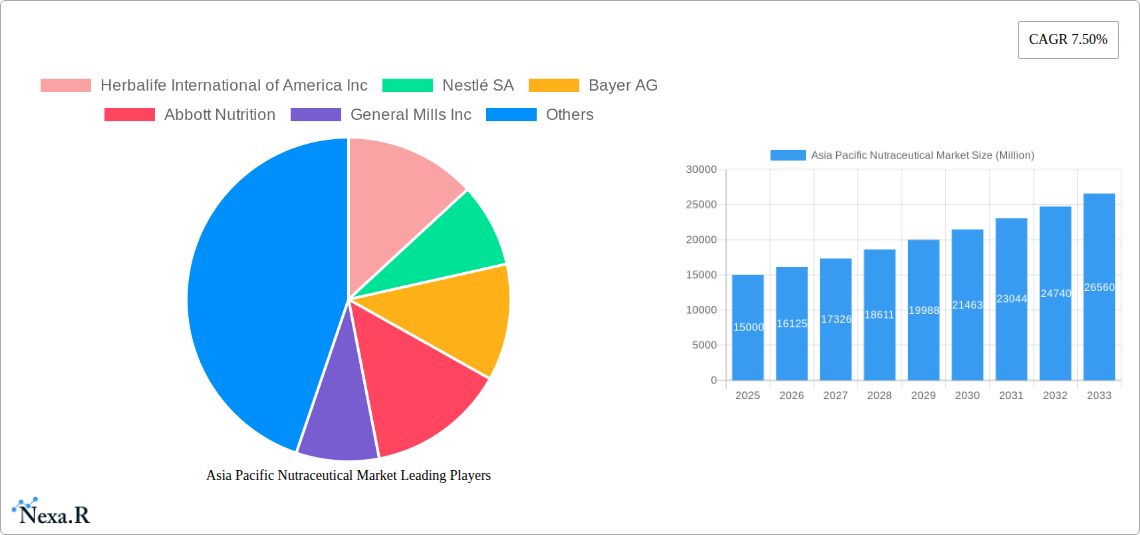

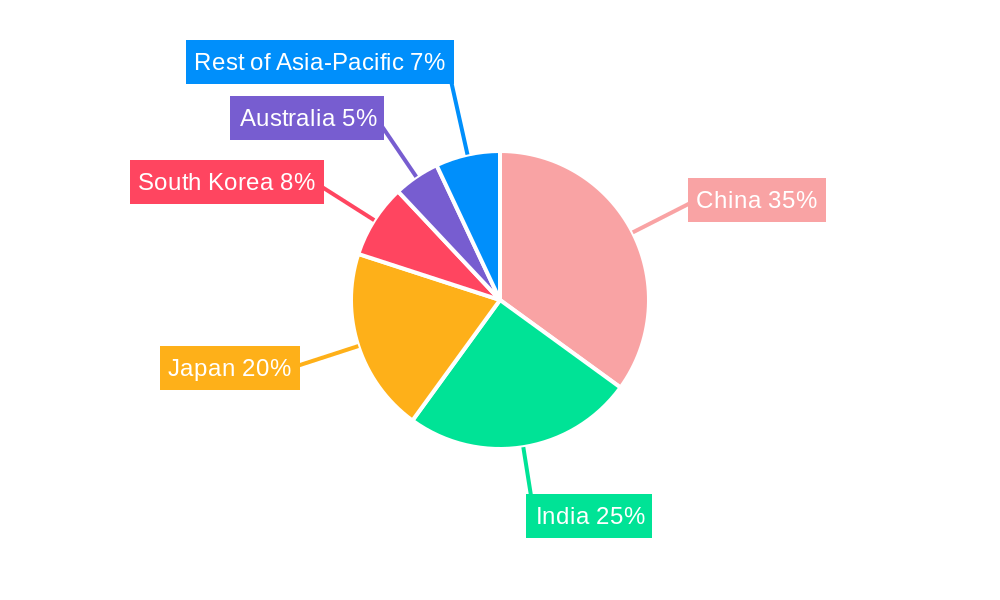

The market is segmented by product type, including functional beverages, dietary supplements, and other functional foods, alongside distribution channels that shape market accessibility and consumer engagement. Leading industry participants such as Nestlé, Herbalife, and Abbott Nutrition are capitalizing on their extensive distribution networks and strong brand recognition to secure substantial market shares. Nevertheless, regulatory complexities and varied consumer preferences across Asian markets present considerable challenges. Notable regional growth is anticipated in China and India, driven by expanding middle-class populations and assertive health awareness initiatives. Japan, with its ingrained health and wellness culture, constitutes a mature yet vital market segment.

Asia Pacific Nutraceutical Market Company Market Share

Navigating the diverse cultural preferences and regulatory frameworks is paramount for the success of nutraceutical enterprises. Consumer education is instrumental in fostering market adoption, highlighting product efficacy and safety. Future expansion will be significantly influenced by innovation in product development, particularly in personalized nutrition and convenient product formats. Intensified competition among established global corporations and emerging specialized firms will likely result in greater product variety and potentially more competitive pricing strategies. Strategic alliances and collaborations are anticipated to become increasingly crucial for market penetration and distribution within this dynamic and rapidly evolving sector.

Asia Pacific Nutraceutical Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia Pacific nutraceutical market, encompassing market dynamics, growth trends, dominant segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals seeking to navigate this dynamic market. The market size is projected to reach xx Million by 2033.

Asia Pacific Nutraceutical Market Dynamics & Structure

The Asia Pacific nutraceutical market is characterized by a moderately concentrated landscape, with key players such as Herbalife International of America Inc, Nestlé SA, and Bayer AG holding significant market share. Technological innovation, driven by advancements in formulation and delivery systems, is a key driver. However, stringent regulatory frameworks and the presence of competitive product substitutes pose challenges. The market is witnessing a rise in health-conscious consumers, particularly among younger demographics, fueling demand for functional foods and dietary supplements. Mergers and acquisitions (M&A) activity is prevalent, with xx M&A deals recorded in the last five years, signifying consolidation within the industry.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Focus on personalized nutrition, advanced delivery systems (e.g., liposomes), and natural ingredients.

- Regulatory Frameworks: Varying regulations across countries impact product approvals and labeling.

- Competitive Substitutes: Traditional pharmaceuticals and over-the-counter medications.

- End-User Demographics: Growing middle class, increasing health awareness, and aging population driving demand.

- M&A Trends: Consolidation through acquisitions and strategic partnerships.

Asia Pacific Nutraceutical Market Growth Trends & Insights

The Asia Pacific nutraceutical market has experienced robust growth over the historical period (2019-2024), with a CAGR of xx%. This growth is primarily attributed to rising disposable incomes, increasing health awareness, and the growing prevalence of chronic diseases. Technological disruptions, such as the introduction of personalized nutrition products and online retail channels, have further accelerated market expansion. Consumer behavior is shifting towards preventative healthcare, increasing the demand for functional foods and dietary supplements. Market penetration for functional beverages is estimated at xx% in 2025, projected to reach xx% by 2033.

The market is expected to continue its growth trajectory during the forecast period (2025-2033), driven by factors such as rising health consciousness, increasing disposable incomes, and the growing adoption of e-commerce.

Dominant Regions, Countries, or Segments in Asia Pacific Nutraceutical Market

China and India dominate the Asia Pacific nutraceutical market, driven by large populations, rising disposable incomes, and increasing health awareness. Within product types, dietary supplements hold the largest market share, followed by functional beverages. The supermarket/hypermarket distribution channel holds the largest market share.

- Key Drivers:

- China & India: Large populations, rising disposable incomes, and increasing health consciousness.

- Dietary Supplements: High demand for targeted health benefits.

- Supermarkets/Hypermarkets: Wide reach and established distribution networks.

- Dominance Factors: Large market size, high consumer spending, and established distribution infrastructure.

Asia Pacific Nutraceutical Market Product Landscape

The Asia Pacific nutraceutical market features a diverse product landscape, encompassing functional foods (e.g., fortified foods, functional beverages), dietary supplements (e.g., vitamins, minerals, probiotics), and other functional foods. Product innovation focuses on natural ingredients, enhanced bioavailability, and personalized formulations. Key selling propositions include health benefits, convenience, and taste. Technological advancements include the use of nanotechnology for enhanced nutrient absorption and personalized nutrition solutions based on genomic data.

Key Drivers, Barriers & Challenges in Asia Pacific Nutraceutical Market

Key Drivers:

- Rising health consciousness among consumers.

- Growing prevalence of chronic diseases.

- Increasing disposable incomes in developing economies.

- Technological advancements in product formulation and delivery.

Challenges & Restraints:

- Stringent regulatory requirements impacting product approvals.

- Concerns regarding product efficacy and safety.

- High competition among established and emerging players.

- Supply chain disruptions impacting ingredient availability and pricing. This resulted in a xx% increase in raw material costs in 2022.

Emerging Opportunities in Asia Pacific Nutraceutical Market

- Expanding into untapped markets within the region.

- Developing innovative products leveraging personalized nutrition and AI.

- Catering to evolving consumer preferences for natural and organic products.

- Leveraging e-commerce channels to expand market reach and accessibility.

Growth Accelerators in the Asia Pacific Nutraceutical Market Industry

Strategic partnerships between nutraceutical companies and healthcare providers are facilitating market expansion. Technological advancements, such as personalized nutrition solutions and innovative delivery systems, are driving product innovation and market growth. Government initiatives promoting health and wellness are creating a favorable regulatory environment.

Key Players Shaping the Asia Pacific Nutraceutical Market Market

- Herbalife International of America Inc

- Nestlé SA

- Bayer AG

- Abbott Nutrition

- General Mills Inc

- GlaxoSmithKline Plc

- PepsiCo Inc

- Pure Harvest Smart Farms Ltd

- Remedy Drinks

- The Kellogg's Company

- Alticor (Amway Corporation)

- List Not Exhaustive

Notable Milestones in Asia Pacific Nutraceutical Market Sector

- July 2021: Herbalife Nutrition of America Inc. launched high-protein iced coffee in Asia Pacific.

- July 2022: PureHarvest launched four new plant-based alt-milk products in Australia.

- October 2022: Remedy Drinks introduced Remedy K! CK, an all-natural clean energy drink in Australia.

In-Depth Asia Pacific Nutraceutical Market Market Outlook

The Asia Pacific nutraceutical market is poised for continued strong growth, driven by a confluence of factors including rising health awareness, increasing disposable incomes, and technological advancements. Strategic partnerships and expansion into untapped markets will be crucial for companies seeking to capitalize on this market potential. The focus on personalized nutrition and preventative healthcare will shape future innovation and market development.

Asia Pacific Nutraceutical Market Segmentation

-

1. Product Type

-

1.1. Functional Food

- 1.1.1. Cereals

- 1.1.2. Bakery and Confectionery

- 1.1.3. Dairy

- 1.1.4. Snacks

- 1.1.5. Other Functional Foods

-

1.2. Functional Beverages

- 1.2.1. Energy Drinks

- 1.2.2. Sports Drinks

- 1.2.3. Fortified Juice

- 1.2.4. Dairy and Dairy Alternative Beverages

-

1.3. Dietary Supplements

- 1.3.1. Vitamins

- 1.3.2. Minerals

- 1.3.3. Botanicals

- 1.3.4. Enzymes

- 1.3.5. Fatty Acids

- 1.3.6. Proteins

- 1.3.7. Other Dietary Supplements

-

1.1. Functional Food

-

2. Distribution Channel

- 2.1. Specialty Stores

- 2.2. Supermarkets/Hypermarkets,

- 2.3. Convenience Stores

- 2.4. Drug Stores/Pharmacies

- 2.5. Online Retail Stores

- 2.6. Other Distribution Channels

Asia Pacific Nutraceutical Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Nutraceutical Market Regional Market Share

Geographic Coverage of Asia Pacific Nutraceutical Market

Asia Pacific Nutraceutical Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Organic Ingredients in the Food Industry; Increasing Popularity of "Super Fruit" Ingredients in Functional Foods and Beverages

- 3.3. Market Restrains

- 3.3.1. Stringent Food Safety Regulations

- 3.4. Market Trends

- 3.4.1. Growing Consumption of Functional Food and Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Nutraceutical Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Functional Food

- 5.1.1.1. Cereals

- 5.1.1.2. Bakery and Confectionery

- 5.1.1.3. Dairy

- 5.1.1.4. Snacks

- 5.1.1.5. Other Functional Foods

- 5.1.2. Functional Beverages

- 5.1.2.1. Energy Drinks

- 5.1.2.2. Sports Drinks

- 5.1.2.3. Fortified Juice

- 5.1.2.4. Dairy and Dairy Alternative Beverages

- 5.1.3. Dietary Supplements

- 5.1.3.1. Vitamins

- 5.1.3.2. Minerals

- 5.1.3.3. Botanicals

- 5.1.3.4. Enzymes

- 5.1.3.5. Fatty Acids

- 5.1.3.6. Proteins

- 5.1.3.7. Other Dietary Supplements

- 5.1.1. Functional Food

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Specialty Stores

- 5.2.2. Supermarkets/Hypermarkets,

- 5.2.3. Convenience Stores

- 5.2.4. Drug Stores/Pharmacies

- 5.2.5. Online Retail Stores

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Herbalife International of America Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestlé SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bayer AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Abbott Nutrition

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Mills Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GlaxoSmithKline Plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PepsiCo Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pure Harvest Smart Farms Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Remedy Drinks

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Kellogg's Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Alticor (Amway Corporation)*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Herbalife International of America Inc

List of Figures

- Figure 1: Asia Pacific Nutraceutical Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Nutraceutical Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Nutraceutical Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Asia Pacific Nutraceutical Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asia Pacific Nutraceutical Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Nutraceutical Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Asia Pacific Nutraceutical Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Asia Pacific Nutraceutical Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Nutraceutical Market?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Asia Pacific Nutraceutical Market?

Key companies in the market include Herbalife International of America Inc, Nestlé SA, Bayer AG, Abbott Nutrition, General Mills Inc, GlaxoSmithKline Plc, PepsiCo Inc, Pure Harvest Smart Farms Ltd, Remedy Drinks, The Kellogg's Company, Alticor (Amway Corporation)*List Not Exhaustive.

3. What are the main segments of the Asia Pacific Nutraceutical Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 103 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Organic Ingredients in the Food Industry; Increasing Popularity of "Super Fruit" Ingredients in Functional Foods and Beverages.

6. What are the notable trends driving market growth?

Growing Consumption of Functional Food and Beverages.

7. Are there any restraints impacting market growth?

Stringent Food Safety Regulations.

8. Can you provide examples of recent developments in the market?

October 2022: Remedy Drinks introduced Remedy K! CK, an all-natural clean energy drink available at 7-Eleven stores across Australia. Remedy K! CK is available in three fruity flavors - blackberry, lemon-lime, and mango pineapple.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Nutraceutical Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Nutraceutical Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Nutraceutical Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Nutraceutical Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence