Key Insights

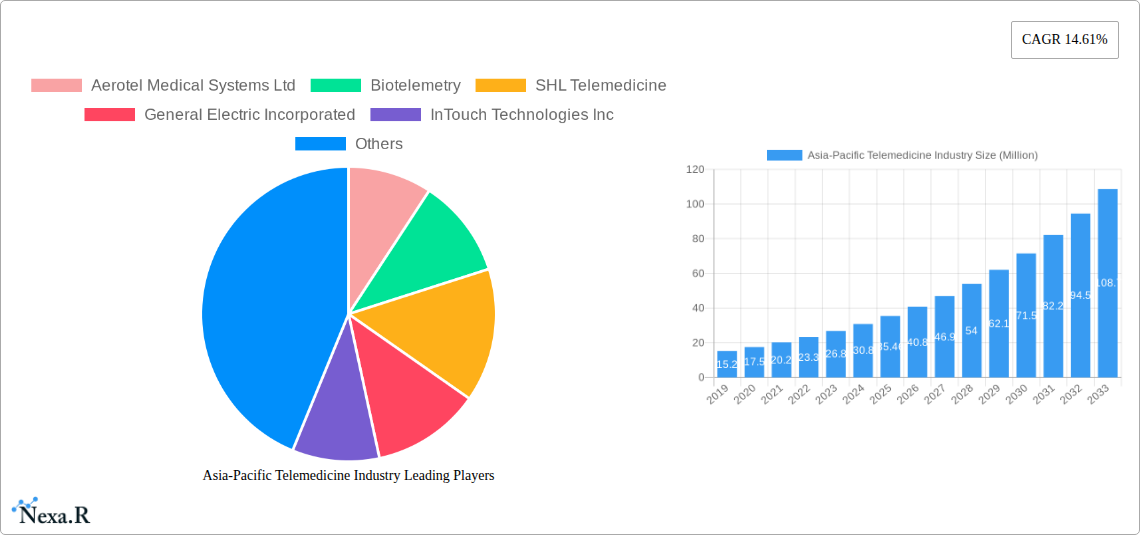

The Asia-Pacific telemedicine market is poised for substantial expansion, projected to reach a significant market size of approximately USD 35.46 million, driven by a robust Compound Annual Growth Rate (CAGR) of 14.61%. This remarkable growth is fueled by several key drivers including increasing digital health adoption, rising prevalence of chronic diseases, and the growing need for accessible and affordable healthcare solutions across the region. The COVID-19 pandemic acted as a significant catalyst, accelerating the adoption of virtual care services and highlighting their importance in ensuring healthcare continuity. Technological advancements in areas like artificial intelligence (AI), machine learning (ML), and the widespread availability of high-speed internet and mobile devices are further bolstering market growth. The "Telehomes" and "mHealth" segments are expected to witness particularly strong adoption as individuals embrace remote health monitoring and consultations.

Asia-Pacific Telemedicine Industry Market Size (In Million)

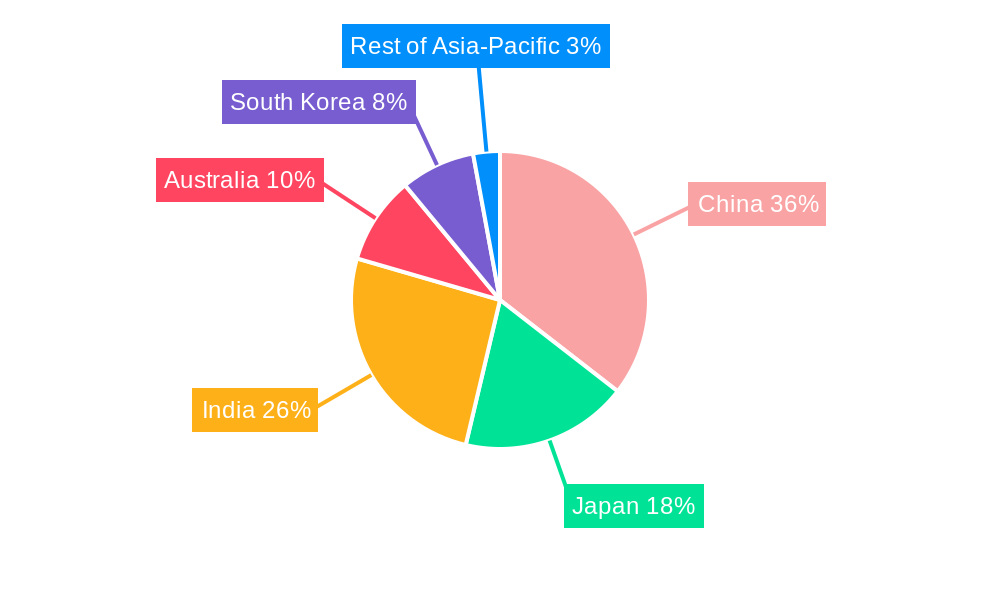

The market's expansion will be further supported by the increasing demand for specialized telehealth services such as Telecardiology, Teleradiology, and Telepsychiatry. While the "Products" segment, particularly software and hardware, will remain crucial, the "Services" segment is anticipated to grow at a faster pace, reflecting the shift towards outcome-based healthcare delivery. Cloud-based delivery models are also set to dominate due to their scalability and cost-effectiveness. Geographically, China and India are expected to be major growth engines, owing to their large populations and increasing healthcare infrastructure development. However, Japan and South Korea will also contribute significantly, driven by their advanced technological infrastructure and aging demographics. Emerging restraints include data privacy concerns, regulatory hurdles in some sub-regions, and the need for greater digital literacy among both patients and healthcare providers, though these are being actively addressed through policy reforms and educational initiatives.

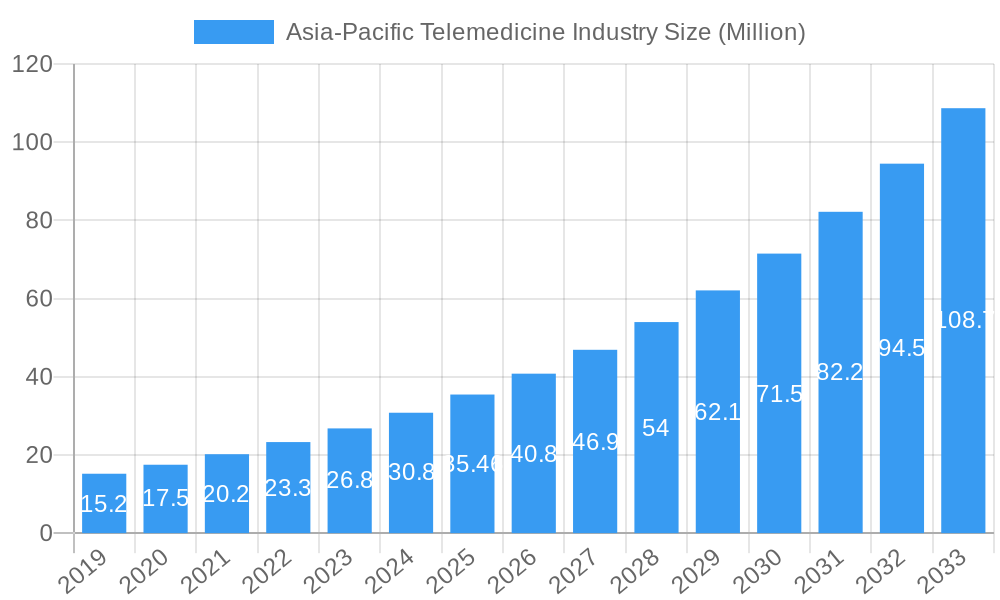

Asia-Pacific Telemedicine Industry Company Market Share

Asia-Pacific Telemedicine Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019–2033)

Unlock unparalleled insights into the burgeoning Asia-Pacific telemedicine market with this comprehensive report. Spanning from 2019 to 2033, with a deep dive into the 2025 base year and an extensive forecast period of 2025–2033, this report offers a strategic roadmap for stakeholders navigating this dynamic landscape. We meticulously analyze parent and child market segments, providing actionable intelligence on market share, growth drivers, and competitive strategies. Discover the impact of telehealth adoption, remote patient monitoring, mHealth solutions, and digital health transformation across key geographies like China, Japan, and India. With an estimated market size of $XX,XXX Million in 2025, this report is essential for understanding telemedicine market size, telemedicine growth rate, and future telemedicine trends in one of the world's fastest-growing healthcare regions.

Asia-Pacific Telemedicine Industry Market Dynamics & Structure

The Asia-Pacific telemedicine industry is characterized by a moderately concentrated market, driven by significant technological innovation and evolving regulatory frameworks. The increasing adoption of remote patient monitoring and mHealth apps is a primary driver, fueled by a growing demand for accessible and affordable healthcare solutions across diverse demographics. Key technological innovations revolve around AI-powered diagnostics, improved connectivity, and user-friendly interfaces for both patients and healthcare providers. Regulatory bodies are progressively adapting to telemedicine, establishing guidelines that foster growth while ensuring patient safety and data privacy. Competitive product substitutes, while present in traditional healthcare delivery, are increasingly being displaced by the convenience and efficiency of telemedicine. End-user demographics reveal a strong uptake among the elderly population, individuals in rural or underserved areas, and younger, tech-savvy demographics seeking on-demand health services. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger players acquiring innovative startups to expand their service portfolios and market reach. The market is projected to witness a significant number of strategic alliances and partnerships aimed at enhancing service integration and geographic expansion.

- Market Concentration: Moderately concentrated with key players focusing on strategic partnerships and acquisitions.

- Technological Innovation: Driven by AI in diagnostics, advanced connectivity, and user experience enhancements.

- Regulatory Frameworks: Evolving to support telemedicine growth while maintaining compliance and patient safety standards.

- Competitive Substitutes: Traditional healthcare models are increasingly challenged by the agility of telemedicine.

- End-User Demographics: Broad adoption across elderly populations, rural communities, and tech-savvy individuals.

- M&A Trends: Active M&A landscape indicating consolidation and strategic portfolio expansion.

Asia-Pacific Telemedicine Industry Growth Trends & Insights

The Asia-Pacific telemedicine market is poised for substantial expansion, driven by a confluence of factors that are reshaping healthcare delivery across the region. From an estimated market size of $XX,XXX Million in 2025, the market is projected to witness a robust Compound Annual Growth Rate (CAGR) of XX.X% over the forecast period of 2025–2033, reaching an impressive $XX,XXX Million by 2033. This remarkable growth is underpinned by escalating telehealth adoption rates, particularly in densely populated and geographically diverse nations. The COVID-19 pandemic served as a significant catalyst, accelerating the acceptance and integration of telemedicine services into mainstream healthcare, with adoption rates expected to continue their upward trajectory. Technological disruptions, including the widespread availability of high-speed internet, advanced mobile devices, and sophisticated remote patient monitoring technologies, are fundamental to this growth. These advancements enable seamless virtual consultations, remote data collection, and personalized health management. Consumer behavior is also undergoing a significant shift; patients are increasingly prioritizing convenience, accessibility, and proactive health management, making telemedicine an attractive alternative to traditional in-person visits. The rise of mHealth solutions further empowers individuals to manage their health on the go, contributing to higher engagement and improved health outcomes. Furthermore, government initiatives and investments aimed at improving healthcare infrastructure and digital health capabilities are creating a fertile ground for telemedicine’s continued proliferation. The integration of AI and machine learning in telemedicine platforms is also a key trend, enhancing diagnostic accuracy, personalizing treatment plans, and optimizing operational efficiency for healthcare providers. The increasing prevalence of chronic diseases across the Asia-Pacific region necessitates continuous monitoring and management, which telemedicine is ideally positioned to provide.

Dominant Regions, Countries, or Segments in Asia-Pacific Telemedicine Industry

Within the dynamic Asia-Pacific telemedicine industry, China stands out as the dominant country, consistently leading in market share and growth potential. This dominance is driven by a multifaceted interplay of factors, including a vast population, significant government investment in digital health infrastructure, and a rapidly advancing technological ecosystem. China’s proactive approach to embracing innovative healthcare solutions, coupled with a large base of smartphone users and widespread internet penetration, creates an ideal environment for the widespread adoption of telemedicine services. The country’s commitment to improving healthcare access for its vast rural population through digital means further bolsters its leadership position.

Among the various segments, mHealth (mobile health) is emerging as the most influential and fastest-growing child market. This segment's rapid expansion is directly linked to the ubiquitous nature of mobile devices in the Asia-Pacific region. mHealth encompasses a wide array of applications, from fitness trackers and wellness apps to sophisticated platforms for chronic disease management and remote patient monitoring. Its inherent flexibility and accessibility allow it to transcend geographical barriers, making healthcare services readily available to a broader population.

Cloud-based Delivery for telemedicine services is also a critical growth enabler, offering scalability, cost-effectiveness, and enhanced accessibility for healthcare providers and patients alike. This mode of delivery supports the seamless integration of various telemedicine applications and facilitates data sharing across different healthcare entities.

Key drivers contributing to the dominance of China and the rise of mHealth include:

- Economic Policies and Investments: Significant government funding allocated to digital health initiatives and infrastructure development. China's "Healthy China 2030" initiative, for instance, emphasizes the integration of digital technologies into healthcare.

- Infrastructure Development: Widespread availability of high-speed internet, 5G networks, and a robust ecosystem of technology providers.

- Consumer Behavior Shifts: Increasing patient demand for convenient, accessible, and personalized healthcare solutions, driving the adoption of mHealth apps and telehealth consultations.

- Regulatory Support: Evolving regulatory frameworks that are increasingly supportive of telemedicine adoption, while ensuring data security and privacy.

- Technological Advancements: Rapid innovation in AI, IoT, and wearable technology, enabling sophisticated remote monitoring and diagnostic capabilities.

The market share in China is estimated to be approximately XX% of the total Asia-Pacific telemedicine market in 2025, with mHealth projected to capture XX% of the overall telemedicine component market by 2033. The growth potential within these dominant segments is substantial, fueled by continuous innovation and an expanding user base.

Asia-Pacific Telemedicine Industry Product Landscape

The Asia-Pacific telemedicine product landscape is characterized by a surge in innovative solutions designed to enhance remote patient care and streamline healthcare delivery. Hardware innovations include advanced wearable biosensors for continuous health monitoring, sophisticated diagnostic devices for remote use, and high-definition video conferencing equipment tailored for medical consultations. Software advancements are equally significant, featuring AI-powered diagnostic algorithms, intuitive patient management platforms, secure data integration tools, and comprehensive telehealth software suites. "Other Products" encompass a range of complementary offerings such as specialized medical equipment for home use and digital therapeutics. Unique selling propositions often lie in the integration of these components, offering end-to-end solutions that improve patient outcomes and operational efficiency. For instance, integrated hardware and software solutions that provide real-time data analysis and personalized alerts for chronic disease management are gaining traction. Technological advancements are focused on increasing accuracy, enhancing user-friendliness for both clinicians and patients, and ensuring robust data security and interoperability across diverse healthcare systems.

Key Drivers, Barriers & Challenges in Asia-Pacific Telemedicine Industry

Key Drivers:

The Asia-Pacific telemedicine industry is propelled by several significant drivers. Technological advancements, particularly in AI, IoT, and high-speed connectivity, are foundational, enabling more sophisticated remote diagnostics and monitoring. Government initiatives and supportive policies aimed at improving healthcare access and efficiency across the region play a crucial role. The increasing prevalence of chronic diseases necessitates continuous and accessible patient management solutions. Furthermore, a growing consumer demand for convenience, affordability, and proactive health management is a major catalyst for telemedicine adoption. Strategic partnerships between technology providers and healthcare institutions are also instrumental in expanding service reach and integrating telemedicine into existing healthcare ecosystems.

Barriers & Challenges:

Despite the positive growth trajectory, the industry faces considerable barriers and challenges. Regulatory fragmentation across different countries within the Asia-Pacific region can create complexities for cross-border service delivery. Data privacy and security concerns remain paramount, requiring robust cybersecurity measures and clear regulatory guidelines. The initial cost of implementing advanced telemedicine infrastructure and the need for digital literacy among both healthcare providers and patients can pose significant hurdles. Interoperability issues between different healthcare IT systems can also impede seamless data exchange. Additionally, reimbursement policies for telemedicine services can be inconsistent, affecting the financial viability of some providers. Supply chain disruptions for essential hardware components can impact deployment timelines and availability.

Emerging Opportunities in Asia-Pacific Telemedicine Industry

Emerging opportunities in the Asia-Pacific telemedicine industry are vast and multifaceted. The untapped potential in underserved rural and remote areas across countries like India and Southeast Asian nations presents significant growth avenues. Innovative applications of AI in telemedicine, such as predictive diagnostics and personalized treatment recommendations, are poised to revolutionize patient care. The increasing demand for specialized sub-segments like telepsychiatry and teledermatology, driven by a growing awareness and a shortage of specialists, offers fertile ground for focused service providers. Evolving consumer preferences towards preventative healthcare and wellness programs are creating opportunities for integrated mHealth platforms that combine monitoring, coaching, and virtual consultations. The expansion of corporate wellness programs leveraging telemedicine for employee health management is another burgeoning area.

Growth Accelerators in the Asia-Pacific Telemedicine Industry Industry

Several key growth accelerators are poised to drive the long-term expansion of the Asia-Pacific telemedicine industry. Continued technological breakthroughs in areas such as advanced analytics for remote patient monitoring, extended reality (AR/VR) for remote surgical training and patient education, and the increasing affordability and capability of mobile health devices will significantly enhance service offerings. Strategic partnerships between global technology giants and local healthcare providers are crucial for market penetration and tailoring solutions to specific regional needs. Furthermore, government-driven initiatives to digitize healthcare records and implement national telehealth frameworks will create a more cohesive and accessible ecosystem. Market expansion strategies focusing on emerging economies within the Asia-Pacific region, coupled with innovative business models that address affordability and accessibility, will also act as significant growth catalysts. The development of robust cybersecurity frameworks will foster greater trust and confidence among users, further accelerating adoption.

Key Players Shaping the Asia-Pacific Telemedicine Industry Market

- Aerotel Medical Systems Ltd

- Biotelemetry

- SHL Telemedicine

- General Electric Incorporated

- InTouch Technologies Inc

- Medtronic PLC

- Cerner Corporation

- AMD Global Telemedicine Inc

- Koninklijke Philips NV

- Resideo Technologies Inc

- Allscripts Healthcare Solutions Inc

Notable Milestones in Asia-Pacific Telemedicine Industry Sector

- 2020: Significant surge in telehealth adoption across the region due to the COVID-19 pandemic, leading to the rapid scaling of existing services and the launch of new virtual care platforms.

- 2021: Governments in countries like Japan and South Korea released updated guidelines and reimbursement frameworks to support the sustainable growth of telemedicine services.

- 2021: Major technology companies began investing heavily in AI-powered diagnostic tools and remote patient monitoring hardware for the Asia-Pacific market.

- 2022: Several key players, including Philips and Medtronic, expanded their product portfolios with integrated telehealth solutions for chronic disease management in markets like India and China.

- 2023: Increased focus on cybersecurity and data privacy as regulatory bodies started enforcing stricter compliance measures for digital health services.

- 2024: Introduction of advanced mHealth applications offering personalized wellness programs and integration with wearable devices, indicating a shift towards proactive health management.

In-Depth Asia-Pacific Telemedicine Industry Market Outlook

The future outlook for the Asia-Pacific telemedicine industry is exceptionally promising, driven by sustained technological innovation, increasing healthcare infrastructure investment, and a fundamental shift in consumer demand towards more accessible and convenient healthcare. Growth accelerators such as the continued integration of AI for enhanced diagnostics and personalized medicine, the expansion of 5G networks for seamless connectivity, and the development of user-friendly mHealth applications will continue to fuel market expansion. Strategic partnerships and collaborations will be pivotal in navigating diverse regulatory landscapes and effectively reaching underserved populations. The industry is set to witness a greater emphasis on value-based care models, where telemedicine plays a crucial role in improving patient outcomes while managing costs. Untapped markets within the region, particularly in developing economies, offer significant opportunities for tailored telemedicine solutions. The evolution of consumer preferences towards preventative health and digital wellness further solidifies the long-term growth trajectory of the telemedicine sector in the Asia-Pacific region.

Asia-Pacific Telemedicine Industry Segmentation

-

1. Type

- 1.1. Telehospitals

- 1.2. Telehomes

- 1.3. mHealth (mobile health)

-

2. Component

-

2.1. Products

- 2.1.1. Hardware

- 2.1.2. Software

- 2.1.3. Other Products

-

2.2. Services

- 2.2.1. Telepathology

- 2.2.2. Telecardiology

- 2.2.3. Teleradiology

- 2.2.4. Teledermatology

- 2.2.5. Telepsychiatry

- 2.2.6. Other Services

-

2.1. Products

-

3. Mode of Delivery

- 3.1. On-premise Delivery

- 3.2. Cloud-based Delivery

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

- 4.5. South Korea

- 4.6. Rest of Asia-Pacific

Asia-Pacific Telemedicine Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. South Korea

- 6. Rest of Asia Pacific

Asia-Pacific Telemedicine Industry Regional Market Share

Geographic Coverage of Asia-Pacific Telemedicine Industry

Asia-Pacific Telemedicine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Healthcare Expenditure; Technological Innovations; Increasing Remote Patient Monitoring; Growing Burden of Chronic Diseases

- 3.3. Market Restrains

- 3.3.1. Legal and Reimbursement Issues; High Initial Capital Requirements and Lack of Physician Support

- 3.4. Market Trends

- 3.4.1. mHealth Segment is Expected to Witness Rapid Growth Rate in the Asia-Pacific Telemedicine Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Telemedicine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Telehospitals

- 5.1.2. Telehomes

- 5.1.3. mHealth (mobile health)

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Products

- 5.2.1.1. Hardware

- 5.2.1.2. Software

- 5.2.1.3. Other Products

- 5.2.2. Services

- 5.2.2.1. Telepathology

- 5.2.2.2. Telecardiology

- 5.2.2.3. Teleradiology

- 5.2.2.4. Teledermatology

- 5.2.2.5. Telepsychiatry

- 5.2.2.6. Other Services

- 5.2.1. Products

- 5.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 5.3.1. On-premise Delivery

- 5.3.2. Cloud-based Delivery

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. South Korea

- 5.4.6. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Australia

- 5.5.5. South Korea

- 5.5.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Telemedicine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Telehospitals

- 6.1.2. Telehomes

- 6.1.3. mHealth (mobile health)

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Products

- 6.2.1.1. Hardware

- 6.2.1.2. Software

- 6.2.1.3. Other Products

- 6.2.2. Services

- 6.2.2.1. Telepathology

- 6.2.2.2. Telecardiology

- 6.2.2.3. Teleradiology

- 6.2.2.4. Teledermatology

- 6.2.2.5. Telepsychiatry

- 6.2.2.6. Other Services

- 6.2.1. Products

- 6.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 6.3.1. On-premise Delivery

- 6.3.2. Cloud-based Delivery

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Australia

- 6.4.5. South Korea

- 6.4.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Japan Asia-Pacific Telemedicine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Telehospitals

- 7.1.2. Telehomes

- 7.1.3. mHealth (mobile health)

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Products

- 7.2.1.1. Hardware

- 7.2.1.2. Software

- 7.2.1.3. Other Products

- 7.2.2. Services

- 7.2.2.1. Telepathology

- 7.2.2.2. Telecardiology

- 7.2.2.3. Teleradiology

- 7.2.2.4. Teledermatology

- 7.2.2.5. Telepsychiatry

- 7.2.2.6. Other Services

- 7.2.1. Products

- 7.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 7.3.1. On-premise Delivery

- 7.3.2. Cloud-based Delivery

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Australia

- 7.4.5. South Korea

- 7.4.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. India Asia-Pacific Telemedicine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Telehospitals

- 8.1.2. Telehomes

- 8.1.3. mHealth (mobile health)

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Products

- 8.2.1.1. Hardware

- 8.2.1.2. Software

- 8.2.1.3. Other Products

- 8.2.2. Services

- 8.2.2.1. Telepathology

- 8.2.2.2. Telecardiology

- 8.2.2.3. Teleradiology

- 8.2.2.4. Teledermatology

- 8.2.2.5. Telepsychiatry

- 8.2.2.6. Other Services

- 8.2.1. Products

- 8.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 8.3.1. On-premise Delivery

- 8.3.2. Cloud-based Delivery

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Australia

- 8.4.5. South Korea

- 8.4.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia-Pacific Telemedicine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Telehospitals

- 9.1.2. Telehomes

- 9.1.3. mHealth (mobile health)

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Products

- 9.2.1.1. Hardware

- 9.2.1.2. Software

- 9.2.1.3. Other Products

- 9.2.2. Services

- 9.2.2.1. Telepathology

- 9.2.2.2. Telecardiology

- 9.2.2.3. Teleradiology

- 9.2.2.4. Teledermatology

- 9.2.2.5. Telepsychiatry

- 9.2.2.6. Other Services

- 9.2.1. Products

- 9.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 9.3.1. On-premise Delivery

- 9.3.2. Cloud-based Delivery

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Australia

- 9.4.5. South Korea

- 9.4.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South Korea Asia-Pacific Telemedicine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Telehospitals

- 10.1.2. Telehomes

- 10.1.3. mHealth (mobile health)

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Products

- 10.2.1.1. Hardware

- 10.2.1.2. Software

- 10.2.1.3. Other Products

- 10.2.2. Services

- 10.2.2.1. Telepathology

- 10.2.2.2. Telecardiology

- 10.2.2.3. Teleradiology

- 10.2.2.4. Teledermatology

- 10.2.2.5. Telepsychiatry

- 10.2.2.6. Other Services

- 10.2.1. Products

- 10.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 10.3.1. On-premise Delivery

- 10.3.2. Cloud-based Delivery

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. India

- 10.4.4. Australia

- 10.4.5. South Korea

- 10.4.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Asia Pacific Asia-Pacific Telemedicine Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Telehospitals

- 11.1.2. Telehomes

- 11.1.3. mHealth (mobile health)

- 11.2. Market Analysis, Insights and Forecast - by Component

- 11.2.1. Products

- 11.2.1.1. Hardware

- 11.2.1.2. Software

- 11.2.1.3. Other Products

- 11.2.2. Services

- 11.2.2.1. Telepathology

- 11.2.2.2. Telecardiology

- 11.2.2.3. Teleradiology

- 11.2.2.4. Teledermatology

- 11.2.2.5. Telepsychiatry

- 11.2.2.6. Other Services

- 11.2.1. Products

- 11.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 11.3.1. On-premise Delivery

- 11.3.2. Cloud-based Delivery

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. China

- 11.4.2. Japan

- 11.4.3. India

- 11.4.4. Australia

- 11.4.5. South Korea

- 11.4.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Aerotel Medical Systems Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Biotelemetry

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 SHL Telemedicine

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 General Electric Incorporated

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 InTouch Technologies Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Medtronic PLC

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Cerner Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 AMD Global Telemedicine Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Koninklijke Philips NV

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Resideo Technologies Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Allscripts Healthcare Solutions Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Aerotel Medical Systems Ltd

List of Figures

- Figure 1: Asia-Pacific Telemedicine Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Telemedicine Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 4: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Component 2020 & 2033

- Table 5: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Mode of Delivery 2020 & 2033

- Table 6: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Mode of Delivery 2020 & 2033

- Table 7: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 13: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 14: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Component 2020 & 2033

- Table 15: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Mode of Delivery 2020 & 2033

- Table 16: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Mode of Delivery 2020 & 2033

- Table 17: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 23: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 24: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Component 2020 & 2033

- Table 25: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Mode of Delivery 2020 & 2033

- Table 26: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Mode of Delivery 2020 & 2033

- Table 27: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 33: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 34: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Component 2020 & 2033

- Table 35: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Mode of Delivery 2020 & 2033

- Table 36: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Mode of Delivery 2020 & 2033

- Table 37: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 43: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 44: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Component 2020 & 2033

- Table 45: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Mode of Delivery 2020 & 2033

- Table 46: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Mode of Delivery 2020 & 2033

- Table 47: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 48: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 49: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 52: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 53: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 54: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Component 2020 & 2033

- Table 55: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Mode of Delivery 2020 & 2033

- Table 56: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Mode of Delivery 2020 & 2033

- Table 57: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 58: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 59: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 62: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 63: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 64: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Component 2020 & 2033

- Table 65: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Mode of Delivery 2020 & 2033

- Table 66: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Mode of Delivery 2020 & 2033

- Table 67: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 68: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 69: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Telemedicine Industry?

The projected CAGR is approximately 14.61%.

2. Which companies are prominent players in the Asia-Pacific Telemedicine Industry?

Key companies in the market include Aerotel Medical Systems Ltd, Biotelemetry, SHL Telemedicine, General Electric Incorporated, InTouch Technologies Inc, Medtronic PLC, Cerner Corporation, AMD Global Telemedicine Inc, Koninklijke Philips NV, Resideo Technologies Inc, Allscripts Healthcare Solutions Inc.

3. What are the main segments of the Asia-Pacific Telemedicine Industry?

The market segments include Type, Component, Mode of Delivery, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Healthcare Expenditure; Technological Innovations; Increasing Remote Patient Monitoring; Growing Burden of Chronic Diseases.

6. What are the notable trends driving market growth?

mHealth Segment is Expected to Witness Rapid Growth Rate in the Asia-Pacific Telemedicine Market.

7. Are there any restraints impacting market growth?

Legal and Reimbursement Issues; High Initial Capital Requirements and Lack of Physician Support.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Telemedicine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Telemedicine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Telemedicine Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Telemedicine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence