Key Insights

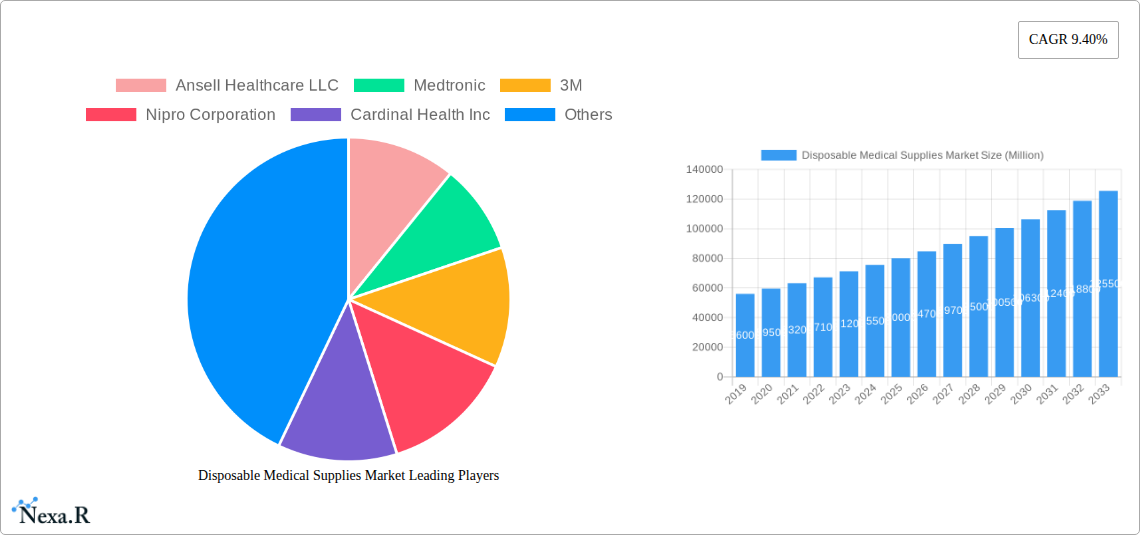

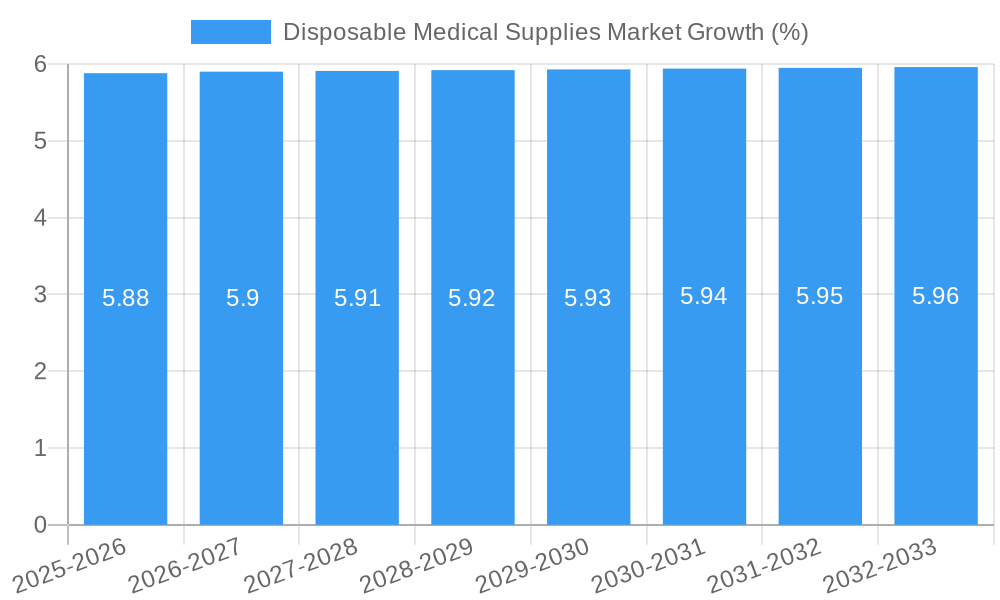

The global Disposable Medical Supplies Market is poised for robust expansion, projected to reach a significant market size of approximately $85,000 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 9.40% anticipated to continue through 2033. This dynamic growth is fueled by a confluence of factors, notably the escalating prevalence of chronic diseases, an aging global population, and a heightened focus on infection control and prevention in healthcare settings. The increasing demand for single-use medical products, driven by their ability to minimize the risk of cross-contamination and enhance patient safety, is a primary accelerator. Furthermore, advancements in material science and manufacturing technologies are leading to the development of more cost-effective, efficient, and user-friendly disposable medical supplies, further stimulating market penetration. The shift towards outpatient care and the expansion of healthcare infrastructure in emerging economies are also contributing significantly to this upward trajectory.

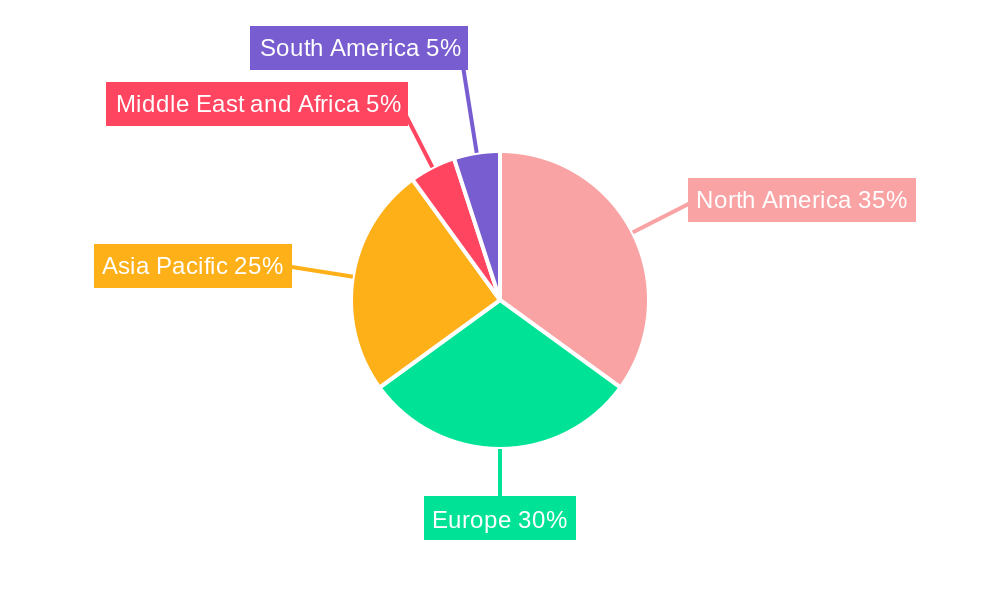

Key segments driving this market include indispensable items such as gloves, masks, and needles & syringes, which witness continuous high demand across all healthcare verticals. Procedure kits and trays are also gaining traction as they streamline clinical workflows and ensure better resource management. Hospitals and clinics represent the largest end-user segment, owing to their extensive consumption of disposable medical supplies. However, ambulatory surgery centers are emerging as a rapidly growing segment, reflecting the increasing trend of same-day surgical procedures. Geographically, North America is expected to maintain its leadership position due to advanced healthcare infrastructure and high healthcare expenditure. Asia Pacific, driven by a large population base and increasing healthcare access, is projected to exhibit the fastest growth rate. Restraints such as stringent regulatory approvals for new products and the growing emphasis on waste management and environmental sustainability of disposable products present challenges that market players will need to navigate strategically through innovation and responsible product lifecycle management.

Disposable Medical Supplies Market: Comprehensive Industry Analysis (2019-2033)

This in-depth report provides a thorough analysis of the global Disposable Medical Supplies Market, covering market dynamics, growth trends, regional dominance, product landscape, key players, and emerging opportunities. With a study period spanning from 2019 to 2033, including a base and estimated year of 2025, and a forecast period of 2025-2033, this report leverages the latest data and expert insights to offer actionable intelligence for stakeholders. The market is segmented by product type and end-user, with detailed examination of parent and child markets to ensure comprehensive coverage. Keywords: disposable medical supplies, medical disposables, healthcare consumables, surgical gloves, face masks, syringes, needles, drapes and gowns, procedure kits, hospitals, clinics, ambulatory surgery centers, medical device market.

Disposable Medical Supplies Market Market Dynamics & Structure

The Disposable Medical Supplies Market is characterized by a moderate level of market concentration, with key players like Medtronic, 3M, Cardinal Health Inc., and McKesson Corporation holding significant shares. Technological innovation remains a crucial driver, particularly in developing advanced materials for wound care, infection control, and enhanced patient comfort. Regulatory frameworks, such as those from the FDA and EMA, significantly influence product development and market entry, demanding stringent quality and safety standards. Competitive product substitutes exist, especially in areas like reusable medical equipment, but the convenience and infection control benefits of disposables often outweigh these alternatives. End-user demographics are evolving, with an increasing aging population and a rise in chronic diseases driving demand for disposable medical products. Merger and acquisition (M&A) trends are active, as larger companies seek to consolidate market share and expand their product portfolios. For instance, the acquisition of Medline Industries Inc. by Carlyle and Hellman & Friedman underscores this trend. Barriers to innovation include the high cost of research and development, lengthy approval processes, and the need to demonstrate clear clinical efficacy and cost-effectiveness.

- Market Concentration: Moderate, with a few dominant players and a fragmented landscape of smaller manufacturers.

- Technological Innovation Drivers: Advanced materials, smart disposables, antimicrobial coatings, sustainable manufacturing.

- Regulatory Frameworks: FDA, EMA, ISO standards, impacting product safety, efficacy, and labeling.

- Competitive Product Substitutes: Reusable medical instruments, sterilization technologies.

- End-User Demographics: Aging population, rising prevalence of chronic diseases, growing demand for home healthcare.

- M&A Trends: Consolidation for market share expansion and portfolio diversification.

- Innovation Barriers: R&D costs, regulatory hurdles, clinical validation requirements.

Disposable Medical Supplies Market Growth Trends & Insights

The Disposable Medical Supplies Market is poised for robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. This expansion is fueled by several intersecting trends. The increasing global prevalence of infectious diseases and the heightened awareness surrounding infection control measures, amplified by recent pandemics, have significantly boosted the demand for disposable masks, gloves, and gowns. Furthermore, the expanding healthcare infrastructure, particularly in emerging economies, coupled with a growing volume of surgical procedures and diagnostic tests, directly translates into a higher consumption of medical disposables. Advances in material science are leading to the development of more sophisticated and specialized disposable products, such as advanced wound dressings and ergonomic syringes, enhancing patient outcomes and user experience. Consumer behavior is also shifting, with a greater preference for single-use items in clinical settings due to perceived safety and hygiene benefits. The integration of digital technologies into disposable medical devices, although nascent, presents a future avenue for growth and differentiation. Market penetration for basic disposable medical supplies is already high in developed regions, with growth largely driven by an increase in procedural volumes and product innovation, while emerging markets offer significant untapped potential due to expanding healthcare access and improving disposable incomes.

Dominant Regions, Countries, or Segments in Disposable Medical Supplies Market

North America currently holds a dominant position in the Disposable Medical Supplies Market, driven by its well-established healthcare infrastructure, high disposable incomes, and a strong emphasis on patient safety and infection control. The United States, in particular, is a leading contributor to this dominance. This leadership is sustained by a high volume of medical procedures, including elective surgeries and routine diagnostics, which inherently require a substantial supply of disposable products. Furthermore, the presence of major healthcare institutions and a proactive approach to adopting new medical technologies contribute to the region's market leadership. Within the product segments, Gloves represent a significant and consistently high-demand category, encompassing surgical gloves, examination gloves, and specialty gloves, catering to a wide range of medical applications. In the end-user segment, Hospitals and Clinics collectively represent the largest consumer base for disposable medical supplies, accounting for a substantial portion of the market share. This is attributed to the continuous influx of patients, the extensive range of medical interventions performed, and the stringent hygiene protocols enforced in these settings.

- Leading Region: North America (primarily the United States).

- Key Dominance Factors in North America:

- Advanced healthcare infrastructure and high per capita healthcare spending.

- Strong regulatory oversight promoting product safety and quality.

- High prevalence of chronic diseases and an aging population.

- Significant adoption of advanced medical technologies.

- High volume of surgical and diagnostic procedures.

- Dominant Product Segment: Gloves (surgical, examination, specialty).

- Dominant End-User Segment: Hospitals and Clinics.

- Key Drivers in Dominant Segments:

- Gloves: Infection control mandates, rising surgical volumes, increased use in diagnostic procedures.

- Hospitals & Clinics: Continuous patient flow, diverse medical services, stringent hygiene standards, routine use of disposables in patient care.

- Growth Potential in Emerging Markets: Asia-Pacific is exhibiting rapid growth due to improving healthcare access and increasing healthcare expenditure.

Disposable Medical Supplies Market Product Landscape

The product landscape within the Disposable Medical Supplies Market is dynamic, characterized by continuous innovation focused on enhancing safety, efficiency, and patient comfort. Key advancements include the development of latex-free and powder-free gloves to mitigate allergic reactions, biodegradable materials for environmentally conscious products, and advanced sterilization techniques for critical medical disposables. Smart technologies are also being integrated, such as self-sealing wound dressings and integrated sensors for monitoring patient vitals. These innovations aim to reduce the risk of healthcare-associated infections (HAIs), improve procedural outcomes, and streamline workflows for healthcare professionals. Unique selling propositions often revolve around superior barrier protection, ergonomic design for extended wear, and enhanced biocompatibility. The focus is on providing reliable, single-use solutions that meet the evolving demands of modern healthcare.

Key Drivers, Barriers & Challenges in Disposable Medical Supplies Market

The Disposable Medical Supplies Market is propelled by several key drivers. The escalating global healthcare expenditure, coupled with an aging population and the increasing prevalence of chronic diseases, directly translates into a higher demand for medical consumables. Furthermore, stringent infection control protocols, especially amplified post-pandemic, have solidified the indispensable role of disposable medical supplies. Technological advancements leading to improved product performance and safety also act as significant growth catalysts.

Conversely, the market faces notable barriers and challenges. Fluctuations in raw material prices, particularly for plastics and polymers, can impact manufacturing costs and profit margins. Intense price competition among numerous manufacturers, especially for commoditized products like basic gloves and masks, can limit profitability. Regulatory hurdles and lengthy approval processes for new products add to development timelines and costs. Supply chain disruptions, as witnessed during global health crises, can lead to shortages and price volatility, posing a significant challenge to consistent availability.

- Key Drivers:

- Increasing global healthcare expenditure.

- Aging population and rising chronic disease burden.

- Stringent infection control mandates.

- Technological advancements in materials and design.

- Growth in minimally invasive procedures.

- Key Barriers & Challenges:

- Volatility in raw material prices.

- Intense price competition and commoditization.

- Stringent and evolving regulatory requirements.

- Supply chain vulnerabilities and disruptions.

- Environmental concerns regarding plastic waste disposal.

Emerging Opportunities in Disposable Medical Supplies Market

Emerging opportunities in the Disposable Medical Supplies Market are diverse and promising. The growing demand for home healthcare services presents a significant avenue for growth, requiring specialized disposable kits and consumables for patient monitoring and treatment in domestic settings. The increasing focus on sustainability is driving innovation in biodegradable and recyclable medical disposables, creating a niche market for eco-conscious manufacturers. Furthermore, the development of smart disposable medical devices, equipped with sensors for real-time data collection and transmission, offers potential for enhanced patient management and remote monitoring. Expansion into underserved emerging markets with improving healthcare infrastructure also represents a substantial growth opportunity, catering to the increasing need for basic and advanced medical disposables.

- Home Healthcare Market: Growing demand for specialized disposable kits and consumables.

- Sustainable Disposables: Innovation in biodegradable and recyclable medical supplies.

- Smart Disposable Medical Devices: Integration of sensors for data collection and remote monitoring.

- Emerging Markets: Untapped potential in regions with expanding healthcare access.

- Personalized Medicine: Development of customized disposable solutions for specific patient needs.

Growth Accelerators in the Disposable Medical Supplies Market Industry

Several growth accelerators are poised to significantly boost the Disposable Medical Supplies Market in the long term. Strategic partnerships and collaborations between medical device manufacturers and healthcare providers are crucial for understanding evolving clinical needs and co-developing innovative disposable solutions. The ongoing advancements in material science, leading to the creation of superior barrier properties, antimicrobial functionalities, and enhanced biocompatibility, will continue to drive product innovation and adoption. Furthermore, the expanding global healthcare infrastructure, particularly in developing nations, coupled with increasing government initiatives to improve healthcare access, will broaden the market for disposable medical supplies. The continued focus on preventing healthcare-associated infections (HAIs) will also remain a significant catalyst, reinforcing the demand for high-quality disposable products.

Key Players Shaping the Disposable Medical Supplies Market Market

- Ansell Healthcare LLC

- Medtronic

- 3M

- Nipro Corporation

- Cardinal Health Inc.

- Molnlycke Health Care AB

- Semperit AG Holding

- Medline Industries Inc (Carlyle and Hellman & Friedman)

- Owens & Minor

- McKesson Corporation

Notable Milestones in Disposable Medical Supplies Market Sector

- July 2022: Quipt Home Medical Corp. and Cardinal Health at-Home, a division of Cardinal Health, Inc., announced an agreement for Quipt to offer to sell disposable medical supplies, with Cardinal Health supplying and distributing them across the country.

- January 2022: Maskc launched the KF94 Face mask in the United States, featuring a four-layer construction comprising a non-woven external layer, two non-woven and meltblown central layers, and a soft inner layer designed for skin comfort.

In-Depth Disposable Medical Supplies Market Market Outlook

The Disposable Medical Supplies Market is projected to witness sustained and robust growth, driven by fundamental healthcare trends and continuous innovation. The increasing global demand for safe and effective patient care, coupled with the ongoing efforts to combat healthcare-associated infections, will continue to solidify the indispensable role of disposable medical products. Strategic investments in research and development, particularly in areas like sustainable materials and smart disposables, are expected to unlock new market segments and enhance competitive advantages. Furthermore, the expansion of healthcare access in emerging economies and the growing adoption of home-based care models present significant opportunities for market players to broaden their reach and impact. The market's outlook remains highly positive, indicating substantial potential for growth and profitability for stakeholders who can adapt to evolving demands and embrace technological advancements.

Disposable Medical Supplies Market Segmentation

-

1. Type

- 1.1. Gloves

- 1.2. Drapes and Gowns

- 1.3. Masks

- 1.4. Needles and Syringes

- 1.5. Procedure Kits and Trays

- 1.6. Other Types

-

2. End Users

- 2.1. Hospitals and Clinics

- 2.2. Ambulatory Surgery Center

- 2.3. Other End Users

Disposable Medical Supplies Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Disposable Medical Supplies Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Number of Surgical Procedures; Increase In Incidences of Hospital Acquired Infections (HAI) and Other Chronic Diseases; Growing Awareness Regarding the Importance of Maintaining Health and Hygiene

- 3.3. Market Restrains

- 3.3.1. Increase in Waste Produced Due to Disposable Products; Inadequate Reimbursement for Disposable Medical Supplies

- 3.4. Market Trends

- 3.4.1. The Masks Segment is Expected to Account for the Largest Market Share During the Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Disposable Medical Supplies Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Gloves

- 5.1.2. Drapes and Gowns

- 5.1.3. Masks

- 5.1.4. Needles and Syringes

- 5.1.5. Procedure Kits and Trays

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End Users

- 5.2.1. Hospitals and Clinics

- 5.2.2. Ambulatory Surgery Center

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Disposable Medical Supplies Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Gloves

- 6.1.2. Drapes and Gowns

- 6.1.3. Masks

- 6.1.4. Needles and Syringes

- 6.1.5. Procedure Kits and Trays

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End Users

- 6.2.1. Hospitals and Clinics

- 6.2.2. Ambulatory Surgery Center

- 6.2.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Disposable Medical Supplies Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Gloves

- 7.1.2. Drapes and Gowns

- 7.1.3. Masks

- 7.1.4. Needles and Syringes

- 7.1.5. Procedure Kits and Trays

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End Users

- 7.2.1. Hospitals and Clinics

- 7.2.2. Ambulatory Surgery Center

- 7.2.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Disposable Medical Supplies Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Gloves

- 8.1.2. Drapes and Gowns

- 8.1.3. Masks

- 8.1.4. Needles and Syringes

- 8.1.5. Procedure Kits and Trays

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End Users

- 8.2.1. Hospitals and Clinics

- 8.2.2. Ambulatory Surgery Center

- 8.2.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Disposable Medical Supplies Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Gloves

- 9.1.2. Drapes and Gowns

- 9.1.3. Masks

- 9.1.4. Needles and Syringes

- 9.1.5. Procedure Kits and Trays

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End Users

- 9.2.1. Hospitals and Clinics

- 9.2.2. Ambulatory Surgery Center

- 9.2.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Disposable Medical Supplies Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Gloves

- 10.1.2. Drapes and Gowns

- 10.1.3. Masks

- 10.1.4. Needles and Syringes

- 10.1.5. Procedure Kits and Trays

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End Users

- 10.2.1. Hospitals and Clinics

- 10.2.2. Ambulatory Surgery Center

- 10.2.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Disposable Medical Supplies Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Disposable Medical Supplies Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Disposable Medical Supplies Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Disposable Medical Supplies Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Disposable Medical Supplies Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Ansell Healthcare LLC

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Medtronic

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 3M

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Nipro Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Cardinal Health Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Molnlycke Health Care AB

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Semperit AG Holding

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Medline Industries Inc (Carlyle and Hellman & Friedman)

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Owens & Minor

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 McKesson Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Ansell Healthcare LLC

List of Figures

- Figure 1: Global Disposable Medical Supplies Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Disposable Medical Supplies Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Disposable Medical Supplies Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Disposable Medical Supplies Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Disposable Medical Supplies Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Disposable Medical Supplies Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Disposable Medical Supplies Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Disposable Medical Supplies Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Disposable Medical Supplies Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Disposable Medical Supplies Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Disposable Medical Supplies Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Disposable Medical Supplies Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Disposable Medical Supplies Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Disposable Medical Supplies Market Revenue (Million), by End Users 2024 & 2032

- Figure 15: North America Disposable Medical Supplies Market Revenue Share (%), by End Users 2024 & 2032

- Figure 16: North America Disposable Medical Supplies Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Disposable Medical Supplies Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Disposable Medical Supplies Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Disposable Medical Supplies Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Disposable Medical Supplies Market Revenue (Million), by End Users 2024 & 2032

- Figure 21: Europe Disposable Medical Supplies Market Revenue Share (%), by End Users 2024 & 2032

- Figure 22: Europe Disposable Medical Supplies Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Disposable Medical Supplies Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Disposable Medical Supplies Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific Disposable Medical Supplies Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific Disposable Medical Supplies Market Revenue (Million), by End Users 2024 & 2032

- Figure 27: Asia Pacific Disposable Medical Supplies Market Revenue Share (%), by End Users 2024 & 2032

- Figure 28: Asia Pacific Disposable Medical Supplies Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Disposable Medical Supplies Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Disposable Medical Supplies Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Middle East and Africa Disposable Medical Supplies Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Middle East and Africa Disposable Medical Supplies Market Revenue (Million), by End Users 2024 & 2032

- Figure 33: Middle East and Africa Disposable Medical Supplies Market Revenue Share (%), by End Users 2024 & 2032

- Figure 34: Middle East and Africa Disposable Medical Supplies Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Disposable Medical Supplies Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Disposable Medical Supplies Market Revenue (Million), by Type 2024 & 2032

- Figure 37: South America Disposable Medical Supplies Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: South America Disposable Medical Supplies Market Revenue (Million), by End Users 2024 & 2032

- Figure 39: South America Disposable Medical Supplies Market Revenue Share (%), by End Users 2024 & 2032

- Figure 40: South America Disposable Medical Supplies Market Revenue (Million), by Country 2024 & 2032

- Figure 41: South America Disposable Medical Supplies Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Disposable Medical Supplies Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Disposable Medical Supplies Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Disposable Medical Supplies Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 4: Global Disposable Medical Supplies Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Disposable Medical Supplies Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Disposable Medical Supplies Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Disposable Medical Supplies Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Disposable Medical Supplies Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: GCC Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Disposable Medical Supplies Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of South America Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Disposable Medical Supplies Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Global Disposable Medical Supplies Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 33: Global Disposable Medical Supplies Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Disposable Medical Supplies Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Global Disposable Medical Supplies Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 39: Global Disposable Medical Supplies Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Germany Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United Kingdom Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Disposable Medical Supplies Market Revenue Million Forecast, by Type 2019 & 2032

- Table 47: Global Disposable Medical Supplies Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 48: Global Disposable Medical Supplies Market Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: India Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Korea Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Disposable Medical Supplies Market Revenue Million Forecast, by Type 2019 & 2032

- Table 56: Global Disposable Medical Supplies Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 57: Global Disposable Medical Supplies Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: GCC Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: South Africa Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East and Africa Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Disposable Medical Supplies Market Revenue Million Forecast, by Type 2019 & 2032

- Table 62: Global Disposable Medical Supplies Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 63: Global Disposable Medical Supplies Market Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Brazil Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Argentina Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of South America Disposable Medical Supplies Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Disposable Medical Supplies Market?

The projected CAGR is approximately 9.40%.

2. Which companies are prominent players in the Disposable Medical Supplies Market?

Key companies in the market include Ansell Healthcare LLC, Medtronic, 3M, Nipro Corporation, Cardinal Health Inc, Molnlycke Health Care AB, Semperit AG Holding, Medline Industries Inc (Carlyle and Hellman & Friedman), Owens & Minor, McKesson Corporation.

3. What are the main segments of the Disposable Medical Supplies Market?

The market segments include Type, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Number of Surgical Procedures; Increase In Incidences of Hospital Acquired Infections (HAI) and Other Chronic Diseases; Growing Awareness Regarding the Importance of Maintaining Health and Hygiene.

6. What are the notable trends driving market growth?

The Masks Segment is Expected to Account for the Largest Market Share During the Forecast Period..

7. Are there any restraints impacting market growth?

Increase in Waste Produced Due to Disposable Products; Inadequate Reimbursement for Disposable Medical Supplies.

8. Can you provide examples of recent developments in the market?

In July 2022, Quipt Home Medical Corp. and Cardinal Health at-Home, a division of Cardinal Health, Inc., states that Quipt will offer to sell disposable medical supplies while Cardinal will supply and distribute them across the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Disposable Medical Supplies Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Disposable Medical Supplies Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Disposable Medical Supplies Market?

To stay informed about further developments, trends, and reports in the Disposable Medical Supplies Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence