Key Insights

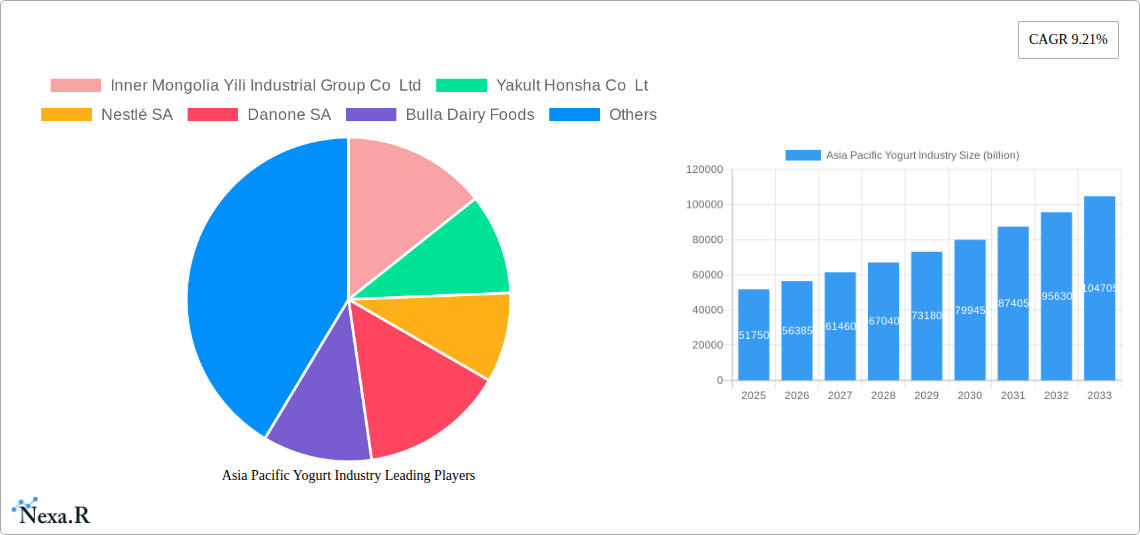

The Asia Pacific yogurt market is poised for significant expansion, projected to reach a USD 51.75 billion valuation by 2025, with a robust Compound Annual Growth Rate (CAGR) of 9.21% expected to propel it through 2033. This growth is primarily fueled by evolving consumer preferences towards healthier food options and the increasing availability of diverse yogurt products, including both flavored and unflavored varieties. The growing health consciousness across the region, particularly in emerging economies, is driving demand for probiotic-rich and nutrient-dense foods like yogurt. Furthermore, the expansion of modern retail channels, such as supermarkets, hypermarkets, and a burgeoning online retail sector, is making yogurt more accessible to a wider consumer base. Innovative product development, including the introduction of novel flavors, functional yogurts, and convenient packaging formats, is also a key contributor to market dynamism, catering to the sophisticated palates and on-the-go lifestyles of urban populations.

Asia Pacific Yogurt Industry Market Size (In Billion)

The market's upward trajectory is further supported by strategic initiatives from leading companies like Inner Mongolia Yili Industrial Group Co Ltd, Nestlé SA, and Danone SA, who are actively investing in product innovation, market penetration, and expanding their distribution networks across key Asia Pacific nations such as China, India, and Southeast Asian countries. The increasing disposable incomes and a growing middle class in these regions are translating into higher consumer spending on premium and specialized dairy products. While the market benefits from strong drivers, potential restraints such as fluctuating raw material prices and intense competition from other dairy and non-dairy alternatives need to be carefully managed by industry players. The dominant distribution channels are expected to be off-trade, with convenience stores and online retail showing particularly strong growth, reflecting changing shopping habits and the demand for immediate accessibility and variety.

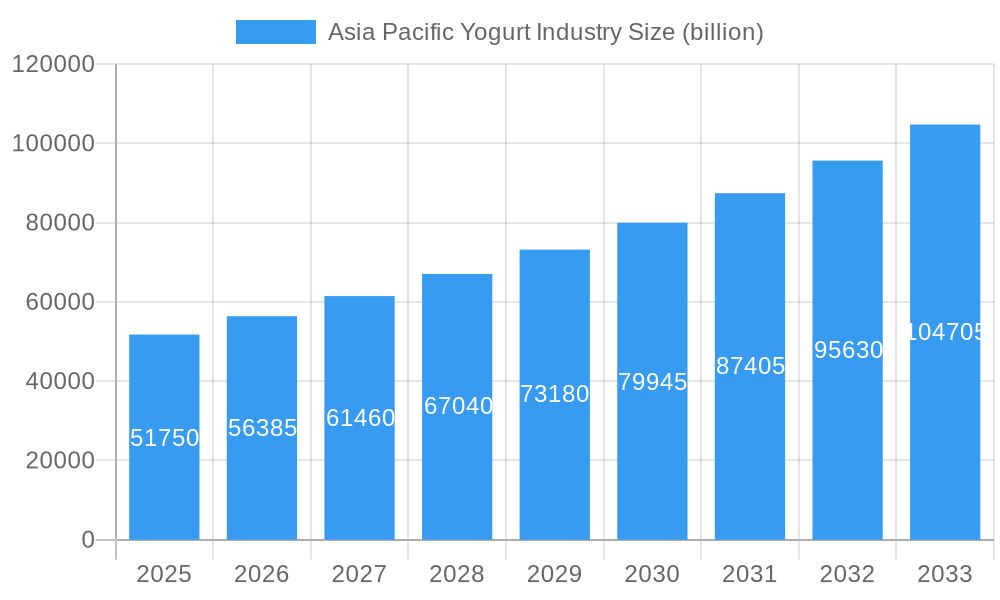

Asia Pacific Yogurt Industry Company Market Share

Asia Pacific Yogurt Industry Market Research Report: Growth, Trends, and Forecast (2019-2033)

This comprehensive report offers an in-depth analysis of the Asia Pacific Yogurt Industry, providing critical insights into market dynamics, growth trends, competitive landscape, and future outlook. Covering the historical period (2019-2024), base year (2025), estimated year (2025), and forecast period (2025-2033), this research is an indispensable resource for stakeholders seeking to capitalize on the burgeoning opportunities within this dynamic market. Delve into parent and child market analyses to understand intricate market segmentation and uncover new avenues for growth.

Asia Pacific Yogurt Industry Market Dynamics & Structure

The Asia Pacific yogurt market is characterized by a moderately concentrated structure, with a few key global players and a growing number of regional and local manufacturers vying for market share. Technological innovation remains a significant driver, particularly in developing novel probiotic strains, enhanced nutritional profiles, and sustainable packaging solutions. Regulatory frameworks, varying across countries, influence product safety, labeling, and ingredient standards, creating both opportunities and challenges for market entrants. Competitive product substitutes, such as other fermented dairy products and plant-based alternatives, pose a constant threat, necessitating continuous product differentiation and marketing efforts. End-user demographics are increasingly health-conscious, driving demand for functional yogurts, low-sugar options, and those with added health benefits. Mergers and acquisitions (M&A) are a recurring trend, with larger companies acquiring smaller, innovative firms to expand their product portfolios and geographical reach.

- Market Concentration: Dominated by global players like Nestlé SA and Danone SA, alongside strong regional contenders such as Inner Mongolia Yili Industrial Group Co Ltd and China Mengniu Dairy Company Ltd.

- Technological Innovation: Focus on probiotics, prebiotics, protein fortification, and plant-based yogurt alternatives.

- Regulatory Frameworks: Stringent food safety standards and evolving labeling requirements across different APAC nations.

- Competitive Substitutes: Intense competition from kefir, other fermented drinks, and a rising tide of dairy-free alternatives.

- End-User Demographics: Growing demand from health-conscious millennials and Gen Z consumers seeking functional and natural products.

- M&A Trends: Strategic acquisitions to enhance market penetration, technological capabilities, and product diversification.

Asia Pacific Yogurt Industry Growth Trends & Insights

The Asia Pacific yogurt industry is poised for substantial growth, propelled by an evolving consumer landscape and increasing disposable incomes across the region. The market size is projected to witness a robust expansion, fueled by rising awareness of the health benefits associated with yogurt consumption, including improved gut health and nutrient intake. Adoption rates for both traditional and innovative yogurt products are steadily increasing, particularly in emerging economies within Southeast Asia and South Asia. Technological disruptions, such as advancements in cold chain logistics and e-commerce platforms, are enhancing product accessibility and expanding the reach of yogurt manufacturers. Consumer behavior shifts are evident, with a growing preference for premium, natural, and functional yogurts. This includes a demand for products fortified with vitamins, minerals, and probiotics, as well as a significant interest in plant-based yogurt alternatives. The escalating demand for convenient and healthy on-the-go snacking options further contributes to market penetration.

- Market Size Evolution: The market is expected to grow significantly, driven by increasing health consciousness and rising per capita income.

- Adoption Rates: Higher adoption of yogurt as a staple in daily diets, especially in developing economies.

- Technological Disruptions: Enhanced manufacturing processes and sophisticated distribution networks are improving availability.

- Consumer Behavior Shifts: A pronounced move towards healthier, functional, and customized yogurt options.

- CAGR: The market is anticipated to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period.

- Market Penetration: Deepening penetration across urban and semi-urban populations, with increasing rural reach.

Dominant Regions, Countries, or Segments in Asia Pacific Yogurt Industry

China stands out as the dominant region in the Asia Pacific yogurt industry, driven by its vast population, rapidly growing middle class, and increasing consumer focus on health and wellness. The country's robust economic growth, coupled with significant investments in dairy processing infrastructure, has propelled the market forward. Flavored yogurt is the leading product type, appealing to a broad consumer base with its diverse taste profiles. Within the distribution channel, Off-Trade significantly dominates, with Online Retail emerging as a particularly high-growth sub-channel, facilitated by the widespread adoption of e-commerce and a growing preference for convenient home delivery of groceries. Supermarkets and Hypermarkets also hold a substantial share within the off-trade segment, offering wider product selection and promotional activities.

- Dominant Country: China leads the Asia Pacific yogurt market due to its large consumer base and increasing disposable income.

- Leading Product Type: Flavored Yogurt accounts for the largest market share, driven by diverse consumer preferences and innovation in taste profiles.

- Dominant Distribution Channel: Off-Trade channels are paramount, with Online Retail experiencing rapid expansion.

- Key Drivers in China:

- Economic Policies: Supportive government policies for the dairy sector and increasing consumer spending power.

- Infrastructure: Advanced cold chain logistics and a well-developed retail network.

- Consumer Preferences: Growing demand for healthier food options and a preference for convenience.

- Growth Potential of Online Retail: The digital shift in grocery shopping significantly boosts online yogurt sales, offering wider reach and convenience.

- Market Share: Flavored yogurt holds an estimated xx% of the total market share within product types.

- Online Retail Dominance: Online Retail is projected to grow at a CAGR of xx% within the Off-Trade segment.

Asia Pacific Yogurt Industry Product Landscape

The Asia Pacific yogurt market is characterized by a vibrant product landscape featuring continuous innovation in flavors, formulations, and functionalities. Beyond traditional plain and fruit-flavored yogurts, there's a surge in demand for Greek-style yogurts, skyrs, and yogurts fortified with probiotics, prebiotics, and protein. The emphasis on natural ingredients, reduced sugar content, and allergen-free options is a significant trend. Unique selling propositions often revolve around specific health benefits, such as improved digestion, enhanced immunity, or added nutritional value for specific demographics like children and the elderly. Technological advancements in fermentation processes and ingredient blending are enabling the creation of novel textures and taste experiences.

Key Drivers, Barriers & Challenges in Asia Pacific Yogurt Industry

Key Drivers:

- Growing Health Consciousness: Consumers are increasingly seeking yogurt for its perceived health benefits, including gut health and nutritional value.

- Rising Disposable Incomes: Improved living standards across the Asia Pacific region are leading to increased consumer spending on premium and healthy food products.

- Product Innovation: Continuous development of new flavors, functional ingredients (probiotics, protein), and convenient packaging formats.

- Expanding Distribution Networks: Enhanced cold chain logistics and the growth of online retail are improving product accessibility.

Barriers & Challenges:

- Supply Chain Inefficiencies: Maintaining a consistent cold chain across vast and varied geographical regions can be challenging.

- Raw Material Price Volatility: Fluctuations in milk prices can impact production costs and profitability.

- Intense Competition: The market faces competition from established global brands, local players, and substitute products.

- Regulatory Compliance: Navigating diverse food safety regulations and labeling requirements across different countries.

- Consumer Perception of Sugar Content: Growing concern regarding sugar in flavored yogurts may hinder growth in certain segments.

Emerging Opportunities in Asia Pacific Yogurt Industry

Emerging opportunities within the Asia Pacific yogurt industry lie in the burgeoning demand for specialized and functional yogurts. This includes a significant potential for plant-based yogurt alternatives, catering to the growing vegan and lactose-intolerant population. Untapped markets in developing Southeast Asian countries present substantial growth prospects. Innovative applications, such as yogurt-based beverages with added adaptogens or superfoods, and the development of personalized nutrition solutions based on individual gut microbiome profiles, are also promising avenues. The increasing popularity of direct-to-consumer models and subscription services for niche yogurt products offers further avenues for expansion.

Growth Accelerators in the Asia Pacific Yogurt Industry Industry

Long-term growth in the Asia Pacific yogurt industry will be significantly accelerated by continued technological breakthroughs in fermentation and ingredient technology, enabling the creation of highly targeted functional benefits. Strategic partnerships between dairy producers and technology firms focused on areas like AI-driven personalized nutrition and advanced supply chain management will be crucial. Market expansion strategies targeting rural and semi-urban areas, coupled with innovative marketing campaigns that highlight the health and wellness benefits of yogurt, will drive deeper penetration. The increasing focus on sustainability throughout the value chain, from sourcing to packaging, will also become a key growth differentiator.

Key Players Shaping the Asia Pacific Yogurt Industry Market

Inner Mongolia Yili Industrial Group Co Ltd Yakult Honsha Co Lt Nestlé SA Danone SA Bulla Dairy Foods Meiji Dairies Corporation Gujarat Co-operative Milk Marketing Federation Ltd FAGE International SA China Mengniu Dairy Company Ltd

Notable Milestones in Asia Pacific Yogurt Industry Sector

- July 2022: Amul announced an investment of USD 60 million to build a new dairy plant in Rajkot to expand its production capabilities across milk, yogurt, and buttermilk products.

- September 2021: Bulla Dairy Foods launched its Australian Style Yogurt in 100g cups through food service distributors.

- July 2021: Miss Fresh partnered with China Mengniu Dairy to offer the full range of Mengniu's 70 high-quality dairy products to bring more nutritious and healthy choices to the MissFresh app and WeChat Mini Program users.

In-Depth Asia Pacific Yogurt Industry Market Outlook

The Asia Pacific yogurt market presents a highly promising future, characterized by sustained growth driven by evolving consumer preferences for health and wellness. The market outlook is particularly strong for functional yogurts offering specific health benefits, plant-based alternatives, and premium, artisanal products. Continued investment in research and development to enhance nutritional profiles and explore novel ingredients will be pivotal. Strategic collaborations and expansions into underserved geographies will unlock significant untapped potential. The industry's ability to adapt to changing consumer demands for convenience and sustainability will be key to its long-term success and market leadership.

Asia Pacific Yogurt Industry Segmentation

-

1. Product Type

- 1.1. Flavored Yogurt

- 1.2. Unflavored Yogurt

-

2. Distribution Channel

-

2.1. Off-Trade

-

2.1.1. By Sub Distribution Channels

- 2.1.1.1. Convenience Stores

- 2.1.1.2. Online Retail

- 2.1.1.3. Specialist Retailers

- 2.1.1.4. Supermarkets and Hypermarkets

- 2.1.1.5. Others (Warehouse clubs, gas stations, etc.)

-

2.1.1. By Sub Distribution Channels

- 2.2. On-Trade

-

2.1. Off-Trade

Asia Pacific Yogurt Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Yogurt Industry Regional Market Share

Geographic Coverage of Asia Pacific Yogurt Industry

Asia Pacific Yogurt Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Supplement Nutrition; Growing Casein Application in Processed Food Products

- 3.3. Market Restrains

- 3.3.1. Competition from Vegan/Plant-based Protein Powders

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Yogurt Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Flavored Yogurt

- 5.1.2. Unflavored Yogurt

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. By Sub Distribution Channels

- 5.2.1.1.1. Convenience Stores

- 5.2.1.1.2. Online Retail

- 5.2.1.1.3. Specialist Retailers

- 5.2.1.1.4. Supermarkets and Hypermarkets

- 5.2.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.1.1. By Sub Distribution Channels

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Inner Mongolia Yili Industrial Group Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yakult Honsha Co Lt

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nestlé SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Danone SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bulla Dairy Foods

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Meiji Dairies Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gujarat Co-operative Milk Marketing Federation Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FAGE International SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China Mengniu Dairy Company Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Inner Mongolia Yili Industrial Group Co Ltd

List of Figures

- Figure 1: Asia Pacific Yogurt Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Yogurt Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Yogurt Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Asia Pacific Yogurt Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asia Pacific Yogurt Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Yogurt Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Asia Pacific Yogurt Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Asia Pacific Yogurt Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Yogurt Industry?

The projected CAGR is approximately 9.21%.

2. Which companies are prominent players in the Asia Pacific Yogurt Industry?

Key companies in the market include Inner Mongolia Yili Industrial Group Co Ltd, Yakult Honsha Co Lt, Nestlé SA, Danone SA, Bulla Dairy Foods, Meiji Dairies Corporation, Gujarat Co-operative Milk Marketing Federation Ltd, FAGE International SA, China Mengniu Dairy Company Ltd.

3. What are the main segments of the Asia Pacific Yogurt Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 51.75 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Supplement Nutrition; Growing Casein Application in Processed Food Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition from Vegan/Plant-based Protein Powders.

8. Can you provide examples of recent developments in the market?

July 2022: Amul announced an investment of USD 60 million to build a new dairy plant in Rajkot to expand its production capabilities across milk, yogurt, and buttermilk products.September 2021: Bulla Dairy Foods launched its Australian Style Yogurt in 100g cups through food service distributors.July 2021: Miss Fresh partnered with China Mengniu Dairy to offer the full range of Mengniu's 70 high-quality dairy products to bring more nutritious and healthy choices to the MissFresh app and WeChat Mini Program users.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Yogurt Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Yogurt Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Yogurt Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Yogurt Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence