Key Insights

The global catheter securement device market is set for significant expansion, projected to reach $1.29 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.4%. This growth is propelled by the rising incidence of chronic diseases, an expanding elderly population requiring long-term medical care, and an increasing volume of surgical procedures worldwide. Technological advancements in securement devices, emphasizing patient comfort, infection risk reduction, and improved usability for healthcare providers, are also key contributors. The growing trend of home healthcare further drives demand, as these devices are essential for managing patients outside hospital settings. Arterial and central venous catheter securement devices are anticipated to see strong demand due to their vital role in critical care and post-operative patient management.

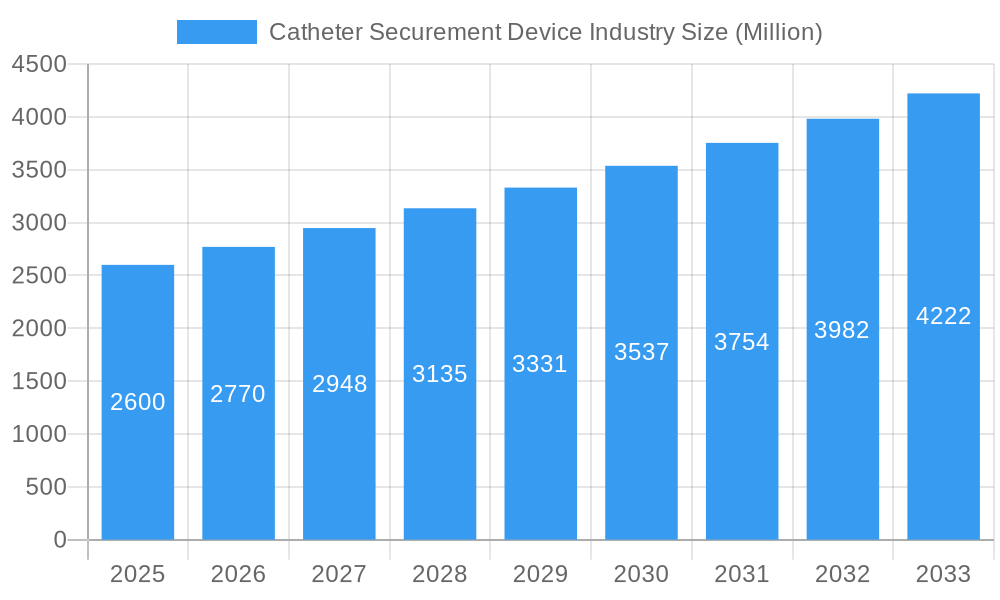

Catheter Securement Device Industry Market Size (In Billion)

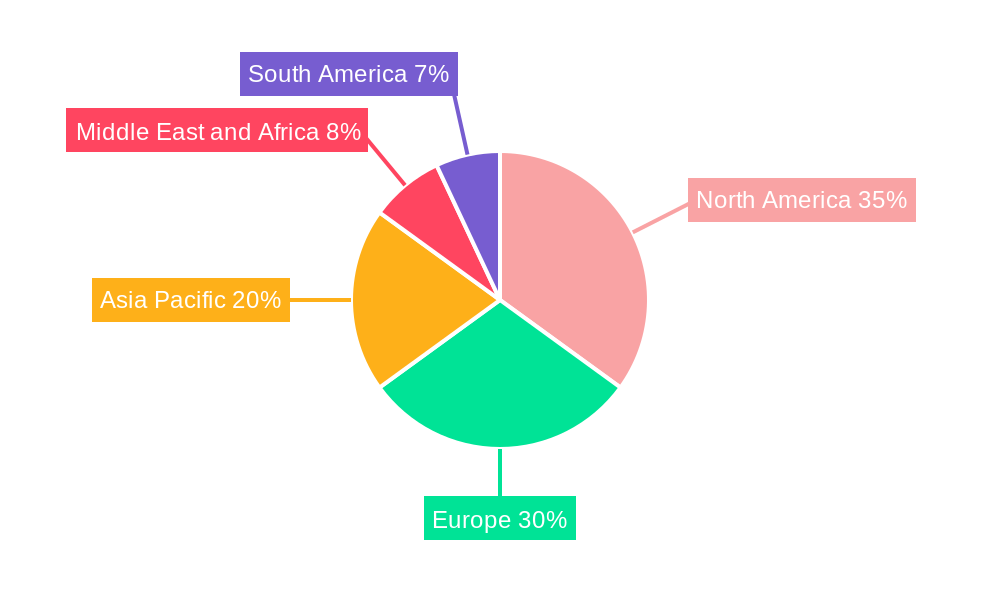

While the market exhibits a positive trajectory, certain factors may present challenges. Stringent regulatory approvals for medical devices and an intensified focus on infection control protocols can impact market entry and product innovation. Additionally, the availability of alternative securement solutions and potential pricing pressures from leading companies could moderate growth in specific segments. Nevertheless, the persistent necessity for patient safety and effective catheter management in healthcare globally guarantees continued market advancement. North America is expected to dominate the market, supported by its developed healthcare infrastructure and high adoption of novel medical technologies, with Europe following closely. The Asia Pacific region offers substantial growth potential due to its rapidly developing healthcare sector and increasing medical tourism.

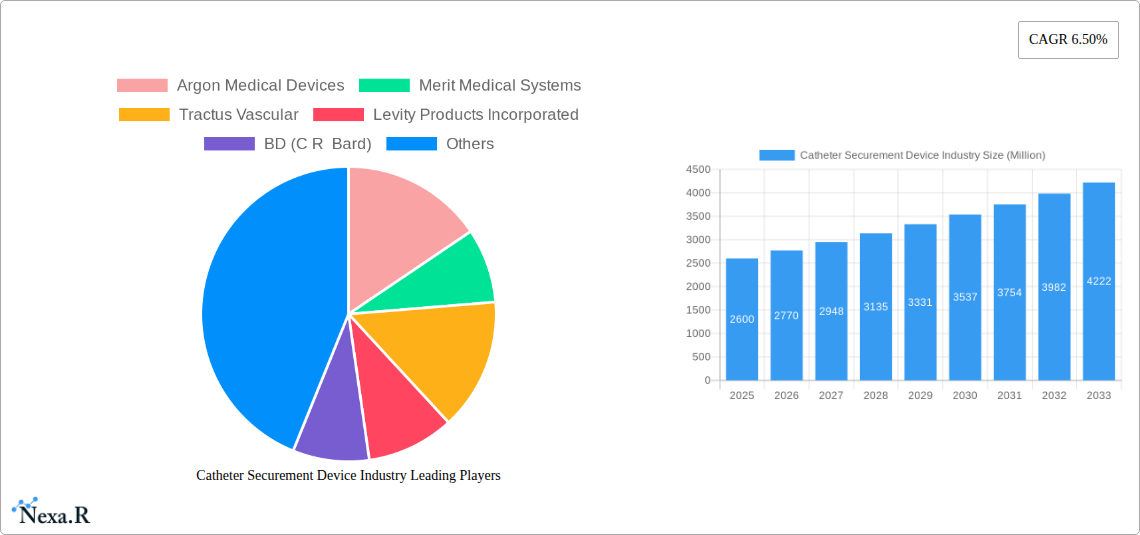

Catheter Securement Device Industry Company Market Share

Catheter Securement Device Industry: Comprehensive Market Analysis (2019-2033)

This in-depth report provides a definitive analysis of the global Catheter Securement Device market, a critical segment within the medical device industry. Covering the historical period from 2019 to 2024, the base year of 2025, and extending to a comprehensive forecast period of 2025–2033, this report offers unparalleled insights for industry professionals. We delve into the intricate dynamics, growth trajectories, and future potential of catheter stabilization solutions, essential for patient care and infection prevention.

Key Market Segments:

- Product: Arterial Securement Devices, Central Venous Catheter Securement Devices, Peripheral Securement Devices, Urinary Catheters Securement Devices, Chest Drainage Tube Securement Devices, Other Securement Devices.

- End-User: Hospitals, Home care Settings, Other End-Users.

- Parent Markets: Medical Devices, Patient Safety Solutions, Infection Control Devices.

- Child Markets: Catheter Management Devices, Wound Care Accessories.

High-Traffic Keywords Integrated: Catheter Securement Devices, Catheter Stabilization Devices, Medical Securement Devices, Vascular Securement Devices, Central Line Securement, Urinary Catheter Securement, Hospital Acquired Infections (HAIs), Patient Safety, Medical Innovations, Healthcare Market Trends.

Catheter Securement Device Industry Market Dynamics & Structure

The Catheter Securement Device market exhibits a moderately concentrated structure, driven by a blend of established global players and emerging innovators. Technological advancements in materials science and adhesive technologies are paramount, propelling the development of more secure, patient-friendly, and infection-resistant devices. Regulatory frameworks, particularly those focused on patient safety and infection prevention by bodies like the FDA and EMA, significantly influence product development and market entry strategies. Competitive product substitutes, such as traditional taping methods, are gradually being phased out due to their inherent limitations in providing consistent and reliable securement. The increasing prevalence of chronic diseases and invasive procedures, coupled with an aging global population, fuels the demand across various end-user segments, with hospitals representing the largest consumers. Mergers and acquisitions (M&A) are notable trends, with larger companies acquiring smaller innovators to expand their product portfolios and market reach.

- Market Concentration: Moderate, with key players holding significant shares.

- Technological Innovation Drivers: Advanced adhesives, antimicrobial coatings, bio-compatible materials, user-friendly designs.

- Regulatory Frameworks: FDA clearance, CE marking, ISO standards for medical devices.

- Competitive Product Substitutes: Traditional taping, sutures (for specific applications).

- End-User Demographics: Growing demand from hospitals, increasing adoption in home care settings.

- M&A Trends: Strategic acquisitions to gain market share and technological expertise.

Catheter Securement Device Industry Growth Trends & Insights

The Catheter Securement Device market is poised for robust growth, driven by an escalating awareness of hospital-acquired infections (HAIs) and the critical role of securement in preventing them. The global market size for catheter securement devices is projected to reach an estimated USD 3,500 Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.2% from the base year of 2025. This growth is underpinned by increasing patient populations requiring invasive procedures, such as central venous catheters and urinary catheters, and a corresponding rise in their utilization. Adoption rates are being significantly influenced by healthcare policies promoting patient safety and cost containment strategies aimed at reducing the burden of HAIs. Technological disruptions are continuously improving product efficacy, with innovations focusing on enhanced adhesion, reduced skin irritation, and integrated antimicrobial properties. Consumer behavior shifts, primarily within healthcare institutions, are favoring evidence-based solutions that demonstrably improve patient outcomes and reduce complications. The market penetration of advanced securement devices is expected to deepen as healthcare providers prioritize investments in technologies that mitigate risks and enhance procedural efficiency. The increasing volume of surgical procedures and the rising number of patients managed in home care settings further contribute to the expanding market for these essential devices, projecting a market value of USD 2,100 Million units in 2025.

Dominant Regions, Countries, or Segments in Catheter Securement Device Industry

North America currently dominates the global Catheter Securement Device market, driven by its advanced healthcare infrastructure, high patient awareness regarding HAIs, and substantial government investments in healthcare technology and patient safety initiatives. The United States, in particular, represents a significant market due to the high volume of invasive medical procedures performed annually and the stringent regulatory environment that encourages the adoption of advanced medical devices. Economic policies supporting innovation and reimbursement frameworks that favor evidence-based patient safety solutions further bolster its leadership.

Within the product segments, Central Venous Catheter Securement Devices are a leading driver of market growth. This is directly attributable to the increasing incidence of central line-associated bloodstream infections (CLABSIs), which represent a major concern in hospital settings. The demand for effective securement solutions to prevent catheter migration and dislodgement in critically ill patients is substantial.

In terms of end-users, Hospitals remain the primary segment, accounting for the largest market share due to the high concentration of procedures requiring catheterization and the robust infection control protocols implemented. However, Home care Settings are emerging as a significant growth area. This is propelled by the aging global population, the increasing trend of home-based patient care, and advancements in portable medical devices, all of which necessitate the safe and secure management of catheters outside traditional hospital environments.

- Dominant Region: North America, with the United States as a key market.

- Key Drivers: Advanced healthcare infrastructure, high patient safety awareness, government support for medical technology, robust reimbursement policies.

- Dominant Product Segment: Central Venous Catheter Securement Devices.

- Key Drivers: High prevalence of CLABSIs, critical need for preventing catheter migration, increased use of central venous catheters in intensive care.

- Dominant End-User Segment: Hospitals.

- Key Drivers: High volume of invasive procedures, stringent infection control protocols, focus on reducing HAIs.

- Emerging Growth End-User Segment: Home care Settings.

- Key Drivers: Aging population, shift towards home-based care, advancements in portable medical technology.

Catheter Securement Device Industry Product Landscape

The product landscape of the Catheter Securement Device industry is characterized by continuous innovation focused on enhancing patient comfort, procedural efficiency, and infection prevention. Key advancements include the development of hypoallergenic adhesives that minimize skin irritation and allergic reactions, antimicrobial coatings that actively combat microbial colonization on the device and surrounding skin, and sophisticated locking mechanisms that provide superior catheter stability, preventing dislodgement and kinking. Designs are increasingly user-centric, featuring easy application and removal processes for healthcare professionals and improved flexibility for patient mobility. Performance metrics are evaluated based on adhesion strength, duration of wear, biocompatibility, and effectiveness in preventing catheter-related complications.

Key Drivers, Barriers & Challenges in Catheter Securement Device Industry

Key Drivers:

- Increasing prevalence of Hospital-Acquired Infections (HAIs): A primary driver, pushing for robust infection control measures, including effective catheter securement.

- Growing number of invasive procedures: Surgeries, chemotherapy, and chronic disease management necessitate the use of catheters, directly increasing demand for securement devices.

- Technological advancements: Innovations in adhesives, materials, and design enhance product efficacy and patient comfort.

- Aging global population: Older individuals are more prone to chronic conditions requiring long-term catheterization.

- Home healthcare growth: The shift towards home-based care increases demand for reliable securement solutions outside of clinical settings.

Barriers & Challenges:

- Cost sensitivity in some healthcare systems: Budget constraints can sometimes limit the adoption of premium, advanced securement devices.

- Regulatory hurdles and lengthy approval processes: Obtaining clearance for new devices can be time-consuming and expensive.

- Competition from established, lower-cost alternatives: Traditional taping methods, though less effective, can remain a competitive option in price-sensitive markets.

- Limited awareness or training for optimal use: Inconsistent understanding of best practices for securement can impact device effectiveness.

- Supply chain disruptions: Global events can impact the availability and cost of raw materials and finished products.

Emerging Opportunities in Catheter Securement Device Industry

Emerging opportunities in the Catheter Securement Device industry lie in the development of intelligent, connected securement devices that can monitor catheter position and alert healthcare providers to potential dislodgement. The expansion of antimicrobial technologies, beyond basic coatings to actively targeted antimicrobial release, presents a significant avenue. Untapped markets in developing economies with rapidly growing healthcare sectors and increasing access to medical technologies also offer substantial potential. Furthermore, the increasing demand for specialized securement devices for niche applications, such as pediatric care or specialized surgical procedures, represents a growing opportunity for tailored product development.

Growth Accelerators in the Catheter Securement Device Industry Industry

The Catheter Securement Device industry is experiencing growth acceleration through strategic partnerships and collaborations between medical device manufacturers and healthcare institutions to conduct clinical trials and validate the efficacy of new securement technologies. Technological breakthroughs in biomaterials, leading to devices with superior biocompatibility and extended wear times, are crucial growth accelerators. Market expansion strategies, including targeted marketing campaigns in emerging economies and the development of cost-effective solutions for price-sensitive markets, are also propelling growth. The increasing focus by regulatory bodies on mandating best practices for catheter securement further incentivizes innovation and adoption, acting as a significant catalyst.

Key Players Shaping the Catheter Securement Device Industry Market

Argon Medical Devices Merit Medical Systems Tractus Vascular Levity Products Incorporated BD (C R Bard) 3M Baxter ConvaTec Group PLC Medtronic PLC TIDI Products LLC B Braun SE Medline Industries Inc CATHETRIX

Notable Milestones in Catheter Securement Device Industry Sector

- April 2022: Bedal and Gulf Medical Co. Ltd. (GMC) signed a distribution agreement for Saudi Arabia and Bahrain. The Bedal products will be distributed by GMC in the Saudi Arabian and Bahraini markets, representing a major part of the market for the usage of catheter stabilization devices in the Gulf region.

- March 2022: Tractus Vascular reported the first human use of its Tractus Crossing Support Catheter.

In-Depth Catheter Securement Device Industry Market Outlook

The Catheter Securement Device market outlook remains exceptionally positive, fueled by the persistent need for effective infection control and patient safety in healthcare settings worldwide. The projected growth is driven by an ongoing commitment to reducing hospital-acquired infections and the continuous evolution of medical technologies. Strategic investments in research and development by leading companies are expected to yield next-generation securement devices with enhanced functionalities. Market expansion into underserved regions and the growing adoption in home healthcare settings are key opportunities that will shape the future landscape, ensuring continued robust growth and a sustained demand for these critical medical devices.

Catheter Securement Device Industry Segmentation

-

1. Product

- 1.1. Arterial Securement Devices

- 1.2. Central Venous Catheter Securement Devices

- 1.3. Peripheral Securement Devices

- 1.4. Urinary Catheters Securement Devices

- 1.5. Chest Drainage Tube Securement Devices

- 1.6. Other Securement Devices

-

2. End-User

- 2.1. Hospitals

- 2.2. Home care Settings

- 2.3. Other End-Users

Catheter Securement Device Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. France

- 2.2. Germany

- 2.3. United Kingdom

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Catheter Securement Device Industry Regional Market Share

Geographic Coverage of Catheter Securement Device Industry

Catheter Securement Device Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The increasing number of surgical procedures worldwide contributes to the demand for catheter securement devices. Catheters are commonly used in various surgeries

- 3.2.2 necessitating effective securement solutions

- 3.3. Market Restrains

- 3.3.1 Budget constraints in healthcare facilities can limit the adoption of advanced catheter securement devices. Hospitals may prioritize cost-effective solutions

- 3.3.2 potentially impacting the market for premium products

- 3.4. Market Trends

- 3.4.1. There is a growing trend toward the use of disposable catheter securement devices due to concerns about infection control and convenience. Single-use products help minimize the risk of contamination and ensure patient safety

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Catheter Securement Device Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Arterial Securement Devices

- 5.1.2. Central Venous Catheter Securement Devices

- 5.1.3. Peripheral Securement Devices

- 5.1.4. Urinary Catheters Securement Devices

- 5.1.5. Chest Drainage Tube Securement Devices

- 5.1.6. Other Securement Devices

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Hospitals

- 5.2.2. Home care Settings

- 5.2.3. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Catheter Securement Device Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Arterial Securement Devices

- 6.1.2. Central Venous Catheter Securement Devices

- 6.1.3. Peripheral Securement Devices

- 6.1.4. Urinary Catheters Securement Devices

- 6.1.5. Chest Drainage Tube Securement Devices

- 6.1.6. Other Securement Devices

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Hospitals

- 6.2.2. Home care Settings

- 6.2.3. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Catheter Securement Device Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Arterial Securement Devices

- 7.1.2. Central Venous Catheter Securement Devices

- 7.1.3. Peripheral Securement Devices

- 7.1.4. Urinary Catheters Securement Devices

- 7.1.5. Chest Drainage Tube Securement Devices

- 7.1.6. Other Securement Devices

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Hospitals

- 7.2.2. Home care Settings

- 7.2.3. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Catheter Securement Device Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Arterial Securement Devices

- 8.1.2. Central Venous Catheter Securement Devices

- 8.1.3. Peripheral Securement Devices

- 8.1.4. Urinary Catheters Securement Devices

- 8.1.5. Chest Drainage Tube Securement Devices

- 8.1.6. Other Securement Devices

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Hospitals

- 8.2.2. Home care Settings

- 8.2.3. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Catheter Securement Device Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Arterial Securement Devices

- 9.1.2. Central Venous Catheter Securement Devices

- 9.1.3. Peripheral Securement Devices

- 9.1.4. Urinary Catheters Securement Devices

- 9.1.5. Chest Drainage Tube Securement Devices

- 9.1.6. Other Securement Devices

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Hospitals

- 9.2.2. Home care Settings

- 9.2.3. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Catheter Securement Device Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Arterial Securement Devices

- 10.1.2. Central Venous Catheter Securement Devices

- 10.1.3. Peripheral Securement Devices

- 10.1.4. Urinary Catheters Securement Devices

- 10.1.5. Chest Drainage Tube Securement Devices

- 10.1.6. Other Securement Devices

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Hospitals

- 10.2.2. Home care Settings

- 10.2.3. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Argon Medical Devices

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Merit Medical Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tractus Vascular

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Levity Products Incorporated

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BD (C R Bard)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 3M

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Baxter

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ConvaTec Group PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Medtronic PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TIDI Products LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 B Braun SE

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Medline Industries Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 CATHETRIX

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Argon Medical Devices

List of Figures

- Figure 1: Global Catheter Securement Device Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Catheter Securement Device Industry Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Catheter Securement Device Industry Revenue (billion), by Product 2025 & 2033

- Figure 4: North America Catheter Securement Device Industry Volume (K Units), by Product 2025 & 2033

- Figure 5: North America Catheter Securement Device Industry Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Catheter Securement Device Industry Volume Share (%), by Product 2025 & 2033

- Figure 7: North America Catheter Securement Device Industry Revenue (billion), by End-User 2025 & 2033

- Figure 8: North America Catheter Securement Device Industry Volume (K Units), by End-User 2025 & 2033

- Figure 9: North America Catheter Securement Device Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America Catheter Securement Device Industry Volume Share (%), by End-User 2025 & 2033

- Figure 11: North America Catheter Securement Device Industry Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Catheter Securement Device Industry Volume (K Units), by Country 2025 & 2033

- Figure 13: North America Catheter Securement Device Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Catheter Securement Device Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Catheter Securement Device Industry Revenue (billion), by Product 2025 & 2033

- Figure 16: Europe Catheter Securement Device Industry Volume (K Units), by Product 2025 & 2033

- Figure 17: Europe Catheter Securement Device Industry Revenue Share (%), by Product 2025 & 2033

- Figure 18: Europe Catheter Securement Device Industry Volume Share (%), by Product 2025 & 2033

- Figure 19: Europe Catheter Securement Device Industry Revenue (billion), by End-User 2025 & 2033

- Figure 20: Europe Catheter Securement Device Industry Volume (K Units), by End-User 2025 & 2033

- Figure 21: Europe Catheter Securement Device Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 22: Europe Catheter Securement Device Industry Volume Share (%), by End-User 2025 & 2033

- Figure 23: Europe Catheter Securement Device Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Catheter Securement Device Industry Volume (K Units), by Country 2025 & 2033

- Figure 25: Europe Catheter Securement Device Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Catheter Securement Device Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Catheter Securement Device Industry Revenue (billion), by Product 2025 & 2033

- Figure 28: Asia Pacific Catheter Securement Device Industry Volume (K Units), by Product 2025 & 2033

- Figure 29: Asia Pacific Catheter Securement Device Industry Revenue Share (%), by Product 2025 & 2033

- Figure 30: Asia Pacific Catheter Securement Device Industry Volume Share (%), by Product 2025 & 2033

- Figure 31: Asia Pacific Catheter Securement Device Industry Revenue (billion), by End-User 2025 & 2033

- Figure 32: Asia Pacific Catheter Securement Device Industry Volume (K Units), by End-User 2025 & 2033

- Figure 33: Asia Pacific Catheter Securement Device Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 34: Asia Pacific Catheter Securement Device Industry Volume Share (%), by End-User 2025 & 2033

- Figure 35: Asia Pacific Catheter Securement Device Industry Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Catheter Securement Device Industry Volume (K Units), by Country 2025 & 2033

- Figure 37: Asia Pacific Catheter Securement Device Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Catheter Securement Device Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Catheter Securement Device Industry Revenue (billion), by Product 2025 & 2033

- Figure 40: Middle East and Africa Catheter Securement Device Industry Volume (K Units), by Product 2025 & 2033

- Figure 41: Middle East and Africa Catheter Securement Device Industry Revenue Share (%), by Product 2025 & 2033

- Figure 42: Middle East and Africa Catheter Securement Device Industry Volume Share (%), by Product 2025 & 2033

- Figure 43: Middle East and Africa Catheter Securement Device Industry Revenue (billion), by End-User 2025 & 2033

- Figure 44: Middle East and Africa Catheter Securement Device Industry Volume (K Units), by End-User 2025 & 2033

- Figure 45: Middle East and Africa Catheter Securement Device Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 46: Middle East and Africa Catheter Securement Device Industry Volume Share (%), by End-User 2025 & 2033

- Figure 47: Middle East and Africa Catheter Securement Device Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Middle East and Africa Catheter Securement Device Industry Volume (K Units), by Country 2025 & 2033

- Figure 49: Middle East and Africa Catheter Securement Device Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Catheter Securement Device Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Catheter Securement Device Industry Revenue (billion), by Product 2025 & 2033

- Figure 52: South America Catheter Securement Device Industry Volume (K Units), by Product 2025 & 2033

- Figure 53: South America Catheter Securement Device Industry Revenue Share (%), by Product 2025 & 2033

- Figure 54: South America Catheter Securement Device Industry Volume Share (%), by Product 2025 & 2033

- Figure 55: South America Catheter Securement Device Industry Revenue (billion), by End-User 2025 & 2033

- Figure 56: South America Catheter Securement Device Industry Volume (K Units), by End-User 2025 & 2033

- Figure 57: South America Catheter Securement Device Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 58: South America Catheter Securement Device Industry Volume Share (%), by End-User 2025 & 2033

- Figure 59: South America Catheter Securement Device Industry Revenue (billion), by Country 2025 & 2033

- Figure 60: South America Catheter Securement Device Industry Volume (K Units), by Country 2025 & 2033

- Figure 61: South America Catheter Securement Device Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Catheter Securement Device Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Catheter Securement Device Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Catheter Securement Device Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 3: Global Catheter Securement Device Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Global Catheter Securement Device Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 5: Global Catheter Securement Device Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Catheter Securement Device Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global Catheter Securement Device Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 8: Global Catheter Securement Device Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 9: Global Catheter Securement Device Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 10: Global Catheter Securement Device Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 11: Global Catheter Securement Device Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Catheter Securement Device Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Global Catheter Securement Device Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 20: Global Catheter Securement Device Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 21: Global Catheter Securement Device Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 22: Global Catheter Securement Device Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 23: Global Catheter Securement Device Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Catheter Securement Device Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 25: France Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: France Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 27: Germany Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: United Kingdom Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Italy Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Italy Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 33: Spain Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Spain Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Global Catheter Securement Device Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 38: Global Catheter Securement Device Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 39: Global Catheter Securement Device Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 40: Global Catheter Securement Device Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 41: Global Catheter Securement Device Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Global Catheter Securement Device Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 43: China Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: China Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 45: Japan Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Japan Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 47: India Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: India Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 49: Australia Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Australia Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: South Korea Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: South Korea Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Global Catheter Securement Device Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 56: Global Catheter Securement Device Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 57: Global Catheter Securement Device Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 58: Global Catheter Securement Device Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 59: Global Catheter Securement Device Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Catheter Securement Device Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 61: GCC Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: GCC Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: South Africa Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: South Africa Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 67: Global Catheter Securement Device Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 68: Global Catheter Securement Device Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 69: Global Catheter Securement Device Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 70: Global Catheter Securement Device Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 71: Global Catheter Securement Device Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 72: Global Catheter Securement Device Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 73: Brazil Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: Brazil Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 75: Argentina Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Argentina Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Catheter Securement Device Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Catheter Securement Device Industry Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Catheter Securement Device Industry?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Catheter Securement Device Industry?

Key companies in the market include Argon Medical Devices, Merit Medical Systems, Tractus Vascular, Levity Products Incorporated, BD (C R Bard), 3M, Baxter, ConvaTec Group PLC, Medtronic PLC, TIDI Products LLC, B Braun SE, Medline Industries Inc, CATHETRIX.

3. What are the main segments of the Catheter Securement Device Industry?

The market segments include Product, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.29 billion as of 2022.

5. What are some drivers contributing to market growth?

The increasing number of surgical procedures worldwide contributes to the demand for catheter securement devices. Catheters are commonly used in various surgeries. necessitating effective securement solutions.

6. What are the notable trends driving market growth?

There is a growing trend toward the use of disposable catheter securement devices due to concerns about infection control and convenience. Single-use products help minimize the risk of contamination and ensure patient safety.

7. Are there any restraints impacting market growth?

Budget constraints in healthcare facilities can limit the adoption of advanced catheter securement devices. Hospitals may prioritize cost-effective solutions. potentially impacting the market for premium products.

8. Can you provide examples of recent developments in the market?

April 2022: Bedal and Gulf Medical Co. Ltd. (GMC) signed a distribution agreement for Saudi Arabia and Bahrain. The Bedal products will be distributed by GMC in the Saudi Arabian and Bahraini markets, representing a major part of the market for the usage of catheter stabilization devices in the Gulf region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Catheter Securement Device Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Catheter Securement Device Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Catheter Securement Device Industry?

To stay informed about further developments, trends, and reports in the Catheter Securement Device Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence