Key Insights

China's plant-based food and beverage sector is set for significant expansion, projected to reach a market size of $64.14 billion by 2025, exhibiting a compound annual growth rate (CAGR) of 12.5% from the base year of 2025. This growth is largely propelled by heightened consumer awareness of health advantages, environmental sustainability, and ethical considerations surrounding conventional animal products. Rising disposable incomes among the expanding middle class, coupled with a demand for innovative culinary experiences, are also key contributing factors. The market is characterized by rapid diversification, with plant-based meat alternatives, notably Textured Vegetable Protein (TVP), and dairy-free beverages such as soy and almond milk, at the forefront. Tofu and tempeh are also gaining popularity, appealing to consumers seeking healthier protein options. Enhanced accessibility of plant-based products through supermarkets, hypermarkets, and expanding online retail further fuels market penetration. Both emerging brands and established food corporations are actively investing in product development and market reach to address the escalating demand for plant-centric diets.

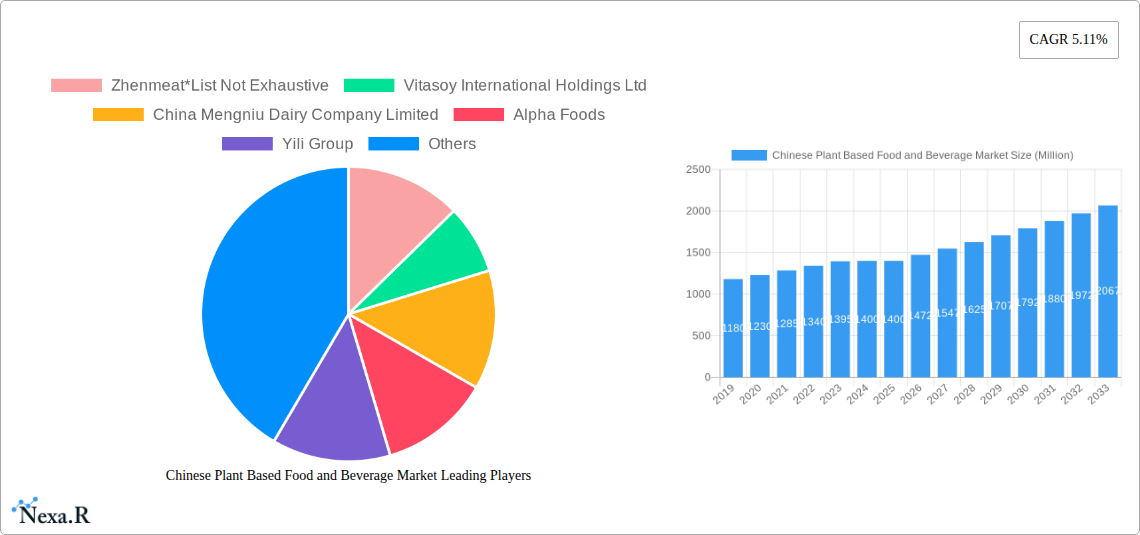

Chinese Plant Based Food and Beverage Market Market Size (In Billion)

Future market evolution will be shaped by technological advancements in food science, improving the taste, texture, and nutritional value of plant-based alternatives, thereby broadening consumer appeal. The diversification of product ranges beyond staple items, including non-dairy ice cream, cheese, and yogurt, indicates a maturing market capable of satisfying diverse dietary needs and lifestyle choices. While strong consumer interest and a supportive innovation ecosystem are advantageous, potential challenges like price competitiveness against conventional products and the ongoing need for consumer education on the benefits and versatility of plant-based foods necessitate strategic focus. Nevertheless, the prevailing global shift towards healthier, more sustainable dietary choices in China suggests a highly promising trajectory for the plant-based food and beverage industry.

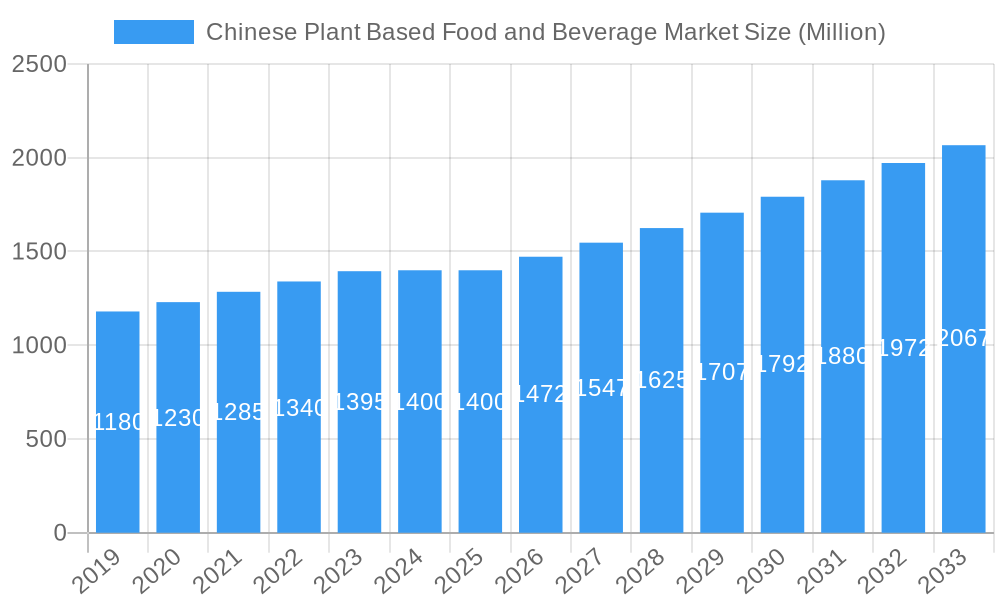

Chinese Plant Based Food and Beverage Market Company Market Share

Unlocking the Future: Chinese Plant Based Food and Beverage Market Report (2019–2033)

This comprehensive report delves into the dynamic Chinese plant based food and beverage market, offering an in-depth analysis of its growth trajectory, key drivers, and emerging opportunities from 2019 to 2033. With a base year of 2025, the report provides an estimated outlook for the same year and forecasts market evolution through 2033, detailing historical trends from 2019-2024. This essential resource equips industry professionals with actionable insights into market size, segmentation, competitive landscape, and consumer preferences. Explore the burgeoning demand for vegan food China, meat alternatives China, and dairy alternatives China as this market solidifies its position as a global powerhouse.

Chinese Plant Based Food and Beverage Market Market Dynamics & Structure

The Chinese plant-based food and beverage market is characterized by an evolving competitive landscape, marked by both established dairy and meat conglomerates and agile new entrants. Market concentration is gradually shifting, with increasing fragmentation as numerous startups vie for market share, driven by significant venture capital investment. Technological innovation remains a primary driver, focusing on improving taste, texture, and nutritional profiles of plant-based products to rival conventional counterparts. Regulatory frameworks are becoming more defined, with growing government support for sustainable food systems and public health initiatives indirectly benefiting the plant-based sector. Competitive product substitutes are abundant, ranging from traditional soy-based products to novel protein sources. End-user demographics are expanding beyond strict vegans and vegetarians to include flexitarians and health-conscious consumers, particularly younger generations. Merger and acquisition (M&A) trends are on the rise as larger companies seek to integrate plant-based offerings and smaller innovators aim for wider distribution and R&D capabilities.

- Market Concentration: Moderate and evolving, with increasing competition from new entrants.

- Technological Innovation: Focus on taste, texture, nutritional equivalence, and cost reduction.

- Regulatory Frameworks: Growing support for sustainability and health-focused food policies.

- Competitive Product Substitutes: Traditional (Tofu, Soy Milk) and novel (pea protein, oat milk).

- End-User Demographics: Expanding from niche vegan/vegetarian to mainstream flexitarian and health-conscious consumers.

- M&A Trends: Increasing strategic acquisitions and partnerships to gain market access and expertise.

Chinese Plant Based Food and Beverage Market Growth Trends & Insights

The Chinese plant-based food and beverage market is experiencing an unprecedented surge in growth, fueled by a confluence of factors including rising health consciousness, environmental concerns, and a desire for novel culinary experiences. Market size evolution indicates a robust upward trajectory, with plant based milk China and plant based meat China leading the charge. Adoption rates are accelerating as consumers become more aware of the benefits of plant-derived diets. Technological disruptions are continuously enhancing the palatability and accessibility of plant-based options, effectively bridging the gap with traditional animal-derived products. Consumer behavior shifts are profound, with a growing segment of the population actively seeking out vegan products China and reducing their meat and dairy consumption.

The market is projected to witness a significant Compound Annual Growth Rate (CAGR) over the forecast period (2025-2033), reflecting sustained consumer interest and industry innovation. Market penetration is steadily increasing, moving beyond major urban centers to smaller cities and even rural areas, albeit at varying paces. The demand for plant based protein China is a key indicator of this growth, as consumers look for healthier and more sustainable protein sources. This expansion is further supported by the increasing availability of diverse product types, from innovative meat substitutes like those offered by Zhenmeat to a wide array of dairy alternatives from established players like Vitasoy International Holdings Ltd and Yili Group. The rise of online retail channels has also democratized access to these products, making them readily available to a broader consumer base. The perceived health benefits, coupled with a growing awareness of the environmental impact of traditional animal agriculture, are powerful motivators driving this market's impressive expansion. The continuous introduction of new product formulations and the ongoing efforts by companies like Oatly Group AB and Beyond Meat to localize their offerings are critical in sustaining this momentum and capturing a larger share of the Chinese food and beverage landscape. The market’s dynamic nature ensures that innovation will remain paramount, with a constant drive to create products that not only meet but exceed consumer expectations in terms of taste, nutrition, and ethical appeal.

Dominant Regions, Countries, or Segments in Chinese Plant Based Food and Beverage Market

The Chinese plant-based food and beverage market exhibits a clear dominance of specific regions and product segments, reflecting concentrated consumer demand and strategic industry focus. Tier 1 cities, including Shanghai, Beijing, and Guangzhou, consistently emerge as the leading regions due to higher disposable incomes, greater awareness of global food trends, and a well-developed retail infrastructure that supports premium and niche products. These urban centers are at the forefront of adopting meat substitutes China and dairy alternatives China, driven by a growing health-conscious and environmentally aware populace.

Within product types, Dairy Alternative Beverages represent a significant and dominant segment. This leadership is primarily attributed to the long-standing popularity of soy milk and the rapid rise of oat milk, almond milk, and other plant-based milks. Companies like Vitasoy International Holdings Ltd and China Mengniu Dairy Company Limited have historically strong positions in the dairy sector and have successfully pivoted to capture a substantial share of the dairy alternatives market. Meat Substitutes are another rapidly growing and increasingly dominant segment, propelled by global brands like Unilever PLC (The Vegetarian Butcher) and Beyond Meat making significant inroads, alongside innovative domestic players such as Starfield Food Science and Technology. The demand for Textured Vegetable Protein (TVP) and tofu continues to be strong, forming the backbone of traditional vegetarian diets, while newer forms of plant-based meats are gaining traction for their versatility and resemblance to animal products.

Distribution channels play a crucial role in segment dominance. Online Retail Channels have become a pivotal driver, particularly for reaching younger demographics and facilitating wider product availability across the country. E-commerce platforms allow for the efficient distribution of specialized plant based products China, overcoming logistical challenges in reaching consumers in less accessible areas. Supermarkets and Hypermarkets also hold significant sway, providing broad consumer access and visibility for established brands. Convenience stores are increasingly stocking plant-based options, catering to impulse purchases and the on-the-go lifestyle of urban consumers.

- Dominant Regions: Tier 1 cities (Shanghai, Beijing, Guangzhou) due to higher disposable income and trend adoption.

- Dominant Product Type (Beverages): Dairy Alternative Beverages (Soy Milk, Oat Milk, Almond Milk) driven by established brands and evolving consumer preferences.

- Dominant Product Type (Food): Meat Substitutes, with strong growth in both traditional (TVP, Tofu) and novel plant-based meats.

- Dominant Distribution Channel: Online Retail Channels, facilitating broad reach and accessibility, followed by Supermarkets/Hypermarkets.

- Key Drivers of Dominance: Consumer health consciousness, environmental awareness, growing disposable incomes, and advanced retail infrastructure.

Chinese Plant Based Food and Beverage Market Product Landscape

The Chinese plant-based food and beverage market is characterized by a dynamic and rapidly evolving product landscape. Innovations are centered around mimicking the taste, texture, and culinary versatility of traditional animal products, thereby appealing to a broader consumer base. Key product categories include a diverse range of meat substitutes like textured vegetable protein (TVP), tofu, and increasingly sophisticated alternatives developed by companies such as Zhenmeat and Beyond Meat. The dairy alternative beverages segment is robust, featuring soy milk, almond milk, and the rapidly growing oat milk market, with brands like Vitasoy and Oatly leading. Non-dairy ice cream, cheese, and yogurt are also gaining traction, offering consumers more choices for plant-based indulgence and everyday consumption. These products often leverage advanced food science technologies to enhance nutritional profiles and sensory experiences, making them highly competitive in the marketplace.

Key Drivers, Barriers & Challenges in Chinese Plant Based Food and Beverage Market

Key Drivers:

The Chinese plant-based food and beverage market is propelled by a confluence of powerful drivers. Rising health awareness among consumers, seeking healthier diets and preventative healthcare, is a primary catalyst. Growing environmental consciousness and a desire for sustainable food choices are also significant motivators, aligning with global trends. The increasing adoption of flexitarianism, where consumers reduce but do not eliminate meat and dairy, expands the potential market beyond strict vegetarians. Government support for sustainable agriculture and food security initiatives indirectly benefits the plant-based sector. Furthermore, technological advancements in food science are creating more palatable and accessible plant-based alternatives, closing the gap with conventional products.

Barriers & Challenges:

Despite the robust growth, the market faces several barriers and challenges. Perceived taste and texture differences compared to traditional meat and dairy products remain a significant hurdle for some consumers. The relatively higher price point of many plant-based products compared to their conventional counterparts can limit affordability for a broader segment of the population. Supply chain complexities and the need for specialized processing and cold chain logistics can pose challenges for manufacturers and distributors. Regulatory clarity and standards for plant-based products are still evolving, which can create uncertainty. Intense competition from established food and beverage giants and a crowded startup ecosystem also presents challenges for market differentiation and sustained growth.

Emerging Opportunities in Chinese Plant Based Food and Beverage Market

Emerging opportunities in the Chinese plant-based food and beverage market are vast and ripe for exploration. The increasing demand for innovative protein sources beyond soy presents significant potential for companies exploring pea, fava bean, and algae-based ingredients. The development of plant-based convenience foods and ready-to-eat meals tailored to Chinese culinary preferences offers a substantial growth avenue, catering to busy urban lifestyles. Expansion into less saturated geographical regions beyond Tier 1 cities presents an untapped market with growing potential. Furthermore, opportunities lie in developing plant-based functional foods and beverages that offer specific health benefits, such as enhanced gut health or immune support, appealing to a more health-conscious demographic. Partnerships with traditional food businesses looking to diversify their portfolios also represent a valuable avenue for growth.

Growth Accelerators in the Chinese Plant Based Food and Beverage Market Industry

Several growth accelerators are poised to fuel the long-term expansion of the Chinese plant-based food and beverage industry. Continuous technological breakthroughs in ingredient processing and product formulation will be crucial in enhancing the sensory attributes and nutritional value of plant-based offerings, making them more appealing to mainstream consumers. Strategic partnerships between international plant-based pioneers and local Chinese food manufacturers are vital for navigating cultural nuances, adapting products to local tastes, and leveraging existing distribution networks. Market expansion strategies targeting secondary and tertiary cities, where awareness and adoption are still nascent, will unlock significant new consumer bases. The increasing influence of social media and health influencers in promoting plant-based lifestyles will further accelerate consumer adoption and demand. Investment in R&D for developing cost-effective production methods will be instrumental in driving down prices and increasing accessibility.

Key Players Shaping the Chinese Plant Based Food and Beverage Market Market

- Zhenmeat

- Vitasoy International Holdings Ltd

- China Mengniu Dairy Company Limited

- Alpha Foods

- Yili Group

- Unilever PLC (The Vegetarian Butcher)

- Oatly Group AB

- Beyond Meat

- Green Monday Group (Omnipork)

- Qishan Foods

- Starfield Food Science and Technology

Notable Milestones in Chinese Plant Based Food and Beverage Market Sector

- May 2022: Beyond Meat expanded its presence in China through a new partnership with convenience store Lawson, stocking two plant-based lunch boxes in over 2,300 Lawson stores nationwide.

- June 2021: LIVEKINDLY Collective launched two new vegan meat brands, Giggling Pig and Happy Chicken, in China, offering seven products including dumplings and seasoned mince to cater to local culinary preferences.

- January 2021: Thailand-based Sesamilk Foods announced its strategic expansion plans targeting China and Taiwan, aiming to significantly increase its export business from 30% to 80% by 2022-2023.

In-Depth Chinese Plant Based Food and Beverage Market Market Outlook

The outlook for the Chinese plant-based food and beverage market is exceptionally promising, characterized by sustained high growth driven by evolving consumer preferences and supportive industry trends. Key growth accelerators, including ongoing technological innovations in taste and texture, alongside strategic market expansion into less saturated regions, will continue to drive adoption. The increasing integration of plant-based options into mainstream diets, propelled by a growing understanding of their health and environmental benefits, positions the market for significant long-term expansion. Opportunities for product diversification, particularly in convenient meal solutions and functional foods, are expected to be readily seized by agile market players. Strategic collaborations between domestic and international entities will further enhance market penetration and product localization, solidifying China's position as a leading global market for plant-based alternatives.

Chinese Plant Based Food and Beverage Market Segmentation

-

1. Product Type

-

1.1. Meat Substitutes

- 1.1.1. Textured Vegetable Protein

- 1.1.2. Tofu

- 1.1.3. Tempeh

- 1.1.4. Others

-

1.2. Dairy Alternative Beverages

- 1.2.1. Soy Milk

- 1.2.2. Almond Milk

- 1.2.3. Other Dairy Alternative Beverages

- 1.3. Non-dairy Ice Cream

- 1.4. Non-dairy Cheese

- 1.5. Non-dairy Yogurt

-

1.1. Meat Substitutes

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Convinience Sores

- 2.3. Online Retail Channels

- 2.4. Other Distribution Channels

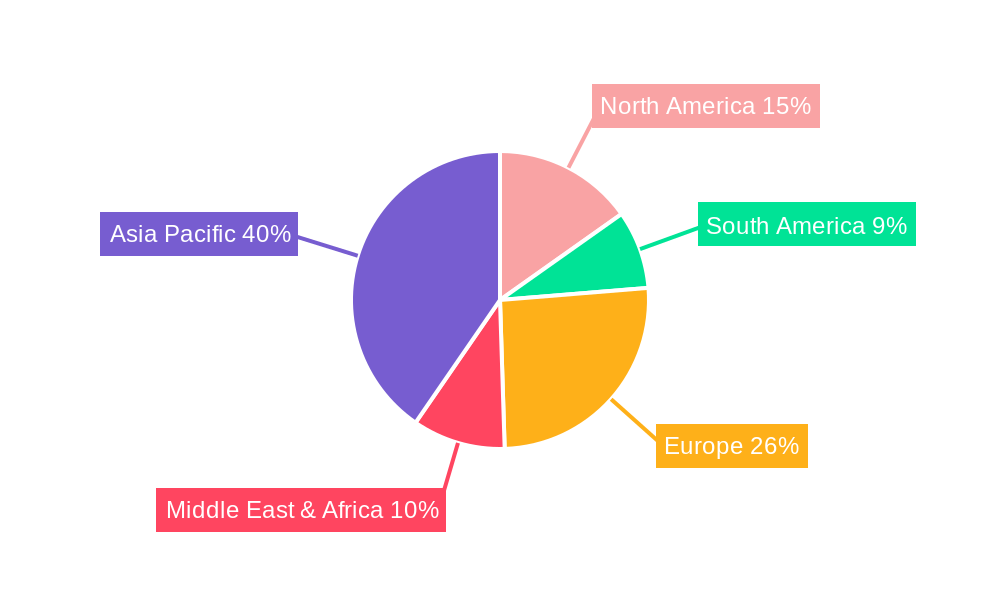

Chinese Plant Based Food and Beverage Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Chinese Plant Based Food and Beverage Market Regional Market Share

Geographic Coverage of Chinese Plant Based Food and Beverage Market

Chinese Plant Based Food and Beverage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products

- 3.3. Market Restrains

- 3.3.1. Presence of Preservatives in Ready Meals may Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Popularity of Vegan Diet in China

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chinese Plant Based Food and Beverage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Meat Substitutes

- 5.1.1.1. Textured Vegetable Protein

- 5.1.1.2. Tofu

- 5.1.1.3. Tempeh

- 5.1.1.4. Others

- 5.1.2. Dairy Alternative Beverages

- 5.1.2.1. Soy Milk

- 5.1.2.2. Almond Milk

- 5.1.2.3. Other Dairy Alternative Beverages

- 5.1.3. Non-dairy Ice Cream

- 5.1.4. Non-dairy Cheese

- 5.1.5. Non-dairy Yogurt

- 5.1.1. Meat Substitutes

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Convinience Sores

- 5.2.3. Online Retail Channels

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Chinese Plant Based Food and Beverage Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Meat Substitutes

- 6.1.1.1. Textured Vegetable Protein

- 6.1.1.2. Tofu

- 6.1.1.3. Tempeh

- 6.1.1.4. Others

- 6.1.2. Dairy Alternative Beverages

- 6.1.2.1. Soy Milk

- 6.1.2.2. Almond Milk

- 6.1.2.3. Other Dairy Alternative Beverages

- 6.1.3. Non-dairy Ice Cream

- 6.1.4. Non-dairy Cheese

- 6.1.5. Non-dairy Yogurt

- 6.1.1. Meat Substitutes

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/ Hypermarkets

- 6.2.2. Convinience Sores

- 6.2.3. Online Retail Channels

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Chinese Plant Based Food and Beverage Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Meat Substitutes

- 7.1.1.1. Textured Vegetable Protein

- 7.1.1.2. Tofu

- 7.1.1.3. Tempeh

- 7.1.1.4. Others

- 7.1.2. Dairy Alternative Beverages

- 7.1.2.1. Soy Milk

- 7.1.2.2. Almond Milk

- 7.1.2.3. Other Dairy Alternative Beverages

- 7.1.3. Non-dairy Ice Cream

- 7.1.4. Non-dairy Cheese

- 7.1.5. Non-dairy Yogurt

- 7.1.1. Meat Substitutes

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/ Hypermarkets

- 7.2.2. Convinience Sores

- 7.2.3. Online Retail Channels

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Chinese Plant Based Food and Beverage Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Meat Substitutes

- 8.1.1.1. Textured Vegetable Protein

- 8.1.1.2. Tofu

- 8.1.1.3. Tempeh

- 8.1.1.4. Others

- 8.1.2. Dairy Alternative Beverages

- 8.1.2.1. Soy Milk

- 8.1.2.2. Almond Milk

- 8.1.2.3. Other Dairy Alternative Beverages

- 8.1.3. Non-dairy Ice Cream

- 8.1.4. Non-dairy Cheese

- 8.1.5. Non-dairy Yogurt

- 8.1.1. Meat Substitutes

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/ Hypermarkets

- 8.2.2. Convinience Sores

- 8.2.3. Online Retail Channels

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Chinese Plant Based Food and Beverage Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Meat Substitutes

- 9.1.1.1. Textured Vegetable Protein

- 9.1.1.2. Tofu

- 9.1.1.3. Tempeh

- 9.1.1.4. Others

- 9.1.2. Dairy Alternative Beverages

- 9.1.2.1. Soy Milk

- 9.1.2.2. Almond Milk

- 9.1.2.3. Other Dairy Alternative Beverages

- 9.1.3. Non-dairy Ice Cream

- 9.1.4. Non-dairy Cheese

- 9.1.5. Non-dairy Yogurt

- 9.1.1. Meat Substitutes

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/ Hypermarkets

- 9.2.2. Convinience Sores

- 9.2.3. Online Retail Channels

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Chinese Plant Based Food and Beverage Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Meat Substitutes

- 10.1.1.1. Textured Vegetable Protein

- 10.1.1.2. Tofu

- 10.1.1.3. Tempeh

- 10.1.1.4. Others

- 10.1.2. Dairy Alternative Beverages

- 10.1.2.1. Soy Milk

- 10.1.2.2. Almond Milk

- 10.1.2.3. Other Dairy Alternative Beverages

- 10.1.3. Non-dairy Ice Cream

- 10.1.4. Non-dairy Cheese

- 10.1.5. Non-dairy Yogurt

- 10.1.1. Meat Substitutes

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/ Hypermarkets

- 10.2.2. Convinience Sores

- 10.2.3. Online Retail Channels

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Zhenmeat*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vitasoy International Holdings Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 China Mengniu Dairy Company Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alpha Foods

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yili Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Unilever PLC (The Vegetarian Butcher)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Oatly Group AB

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Beyond Meat

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Green Monday Group (Omnipork)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Qishan Foods

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Starfield Food Science and Technology

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Zhenmeat*List Not Exhaustive

List of Figures

- Figure 1: Global Chinese Plant Based Food and Beverage Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Chinese Plant Based Food and Beverage Market Volume Breakdown (Liters, %) by Region 2025 & 2033

- Figure 3: North America Chinese Plant Based Food and Beverage Market Revenue (billion), by Product Type 2025 & 2033

- Figure 4: North America Chinese Plant Based Food and Beverage Market Volume (Liters), by Product Type 2025 & 2033

- Figure 5: North America Chinese Plant Based Food and Beverage Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Chinese Plant Based Food and Beverage Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Chinese Plant Based Food and Beverage Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 8: North America Chinese Plant Based Food and Beverage Market Volume (Liters), by Distribution Channel 2025 & 2033

- Figure 9: North America Chinese Plant Based Food and Beverage Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Chinese Plant Based Food and Beverage Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Chinese Plant Based Food and Beverage Market Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Chinese Plant Based Food and Beverage Market Volume (Liters), by Country 2025 & 2033

- Figure 13: North America Chinese Plant Based Food and Beverage Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Chinese Plant Based Food and Beverage Market Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Chinese Plant Based Food and Beverage Market Revenue (billion), by Product Type 2025 & 2033

- Figure 16: South America Chinese Plant Based Food and Beverage Market Volume (Liters), by Product Type 2025 & 2033

- Figure 17: South America Chinese Plant Based Food and Beverage Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: South America Chinese Plant Based Food and Beverage Market Volume Share (%), by Product Type 2025 & 2033

- Figure 19: South America Chinese Plant Based Food and Beverage Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 20: South America Chinese Plant Based Food and Beverage Market Volume (Liters), by Distribution Channel 2025 & 2033

- Figure 21: South America Chinese Plant Based Food and Beverage Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: South America Chinese Plant Based Food and Beverage Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: South America Chinese Plant Based Food and Beverage Market Revenue (billion), by Country 2025 & 2033

- Figure 24: South America Chinese Plant Based Food and Beverage Market Volume (Liters), by Country 2025 & 2033

- Figure 25: South America Chinese Plant Based Food and Beverage Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Chinese Plant Based Food and Beverage Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Chinese Plant Based Food and Beverage Market Revenue (billion), by Product Type 2025 & 2033

- Figure 28: Europe Chinese Plant Based Food and Beverage Market Volume (Liters), by Product Type 2025 & 2033

- Figure 29: Europe Chinese Plant Based Food and Beverage Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Europe Chinese Plant Based Food and Beverage Market Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Europe Chinese Plant Based Food and Beverage Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 32: Europe Chinese Plant Based Food and Beverage Market Volume (Liters), by Distribution Channel 2025 & 2033

- Figure 33: Europe Chinese Plant Based Food and Beverage Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Europe Chinese Plant Based Food and Beverage Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Europe Chinese Plant Based Food and Beverage Market Revenue (billion), by Country 2025 & 2033

- Figure 36: Europe Chinese Plant Based Food and Beverage Market Volume (Liters), by Country 2025 & 2033

- Figure 37: Europe Chinese Plant Based Food and Beverage Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Chinese Plant Based Food and Beverage Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Chinese Plant Based Food and Beverage Market Revenue (billion), by Product Type 2025 & 2033

- Figure 40: Middle East & Africa Chinese Plant Based Food and Beverage Market Volume (Liters), by Product Type 2025 & 2033

- Figure 41: Middle East & Africa Chinese Plant Based Food and Beverage Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: Middle East & Africa Chinese Plant Based Food and Beverage Market Volume Share (%), by Product Type 2025 & 2033

- Figure 43: Middle East & Africa Chinese Plant Based Food and Beverage Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 44: Middle East & Africa Chinese Plant Based Food and Beverage Market Volume (Liters), by Distribution Channel 2025 & 2033

- Figure 45: Middle East & Africa Chinese Plant Based Food and Beverage Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Middle East & Africa Chinese Plant Based Food and Beverage Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Middle East & Africa Chinese Plant Based Food and Beverage Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Middle East & Africa Chinese Plant Based Food and Beverage Market Volume (Liters), by Country 2025 & 2033

- Figure 49: Middle East & Africa Chinese Plant Based Food and Beverage Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Chinese Plant Based Food and Beverage Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Chinese Plant Based Food and Beverage Market Revenue (billion), by Product Type 2025 & 2033

- Figure 52: Asia Pacific Chinese Plant Based Food and Beverage Market Volume (Liters), by Product Type 2025 & 2033

- Figure 53: Asia Pacific Chinese Plant Based Food and Beverage Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Asia Pacific Chinese Plant Based Food and Beverage Market Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Asia Pacific Chinese Plant Based Food and Beverage Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 56: Asia Pacific Chinese Plant Based Food and Beverage Market Volume (Liters), by Distribution Channel 2025 & 2033

- Figure 57: Asia Pacific Chinese Plant Based Food and Beverage Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Asia Pacific Chinese Plant Based Food and Beverage Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Asia Pacific Chinese Plant Based Food and Beverage Market Revenue (billion), by Country 2025 & 2033

- Figure 60: Asia Pacific Chinese Plant Based Food and Beverage Market Volume (Liters), by Country 2025 & 2033

- Figure 61: Asia Pacific Chinese Plant Based Food and Beverage Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Chinese Plant Based Food and Beverage Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Chinese Plant Based Food and Beverage Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Chinese Plant Based Food and Beverage Market Volume Liters Forecast, by Product Type 2020 & 2033

- Table 3: Global Chinese Plant Based Food and Beverage Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Chinese Plant Based Food and Beverage Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Chinese Plant Based Food and Beverage Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Chinese Plant Based Food and Beverage Market Volume Liters Forecast, by Region 2020 & 2033

- Table 7: Global Chinese Plant Based Food and Beverage Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global Chinese Plant Based Food and Beverage Market Volume Liters Forecast, by Product Type 2020 & 2033

- Table 9: Global Chinese Plant Based Food and Beverage Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Chinese Plant Based Food and Beverage Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Chinese Plant Based Food and Beverage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Chinese Plant Based Food and Beverage Market Volume Liters Forecast, by Country 2020 & 2033

- Table 13: United States Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 15: Canada Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 17: Mexico Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 19: Global Chinese Plant Based Food and Beverage Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Global Chinese Plant Based Food and Beverage Market Volume Liters Forecast, by Product Type 2020 & 2033

- Table 21: Global Chinese Plant Based Food and Beverage Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Chinese Plant Based Food and Beverage Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Chinese Plant Based Food and Beverage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Chinese Plant Based Food and Beverage Market Volume Liters Forecast, by Country 2020 & 2033

- Table 25: Brazil Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Brazil Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 27: Argentina Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Argentina Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 31: Global Chinese Plant Based Food and Beverage Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 32: Global Chinese Plant Based Food and Beverage Market Volume Liters Forecast, by Product Type 2020 & 2033

- Table 33: Global Chinese Plant Based Food and Beverage Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Chinese Plant Based Food and Beverage Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Chinese Plant Based Food and Beverage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global Chinese Plant Based Food and Beverage Market Volume Liters Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 39: Germany Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Germany Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 41: France Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: France Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 43: Italy Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Italy Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 45: Spain Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Spain Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 47: Russia Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Russia Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 49: Benelux Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Benelux Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 51: Nordics Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Nordics Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 55: Global Chinese Plant Based Food and Beverage Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 56: Global Chinese Plant Based Food and Beverage Market Volume Liters Forecast, by Product Type 2020 & 2033

- Table 57: Global Chinese Plant Based Food and Beverage Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 58: Global Chinese Plant Based Food and Beverage Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global Chinese Plant Based Food and Beverage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Chinese Plant Based Food and Beverage Market Volume Liters Forecast, by Country 2020 & 2033

- Table 61: Turkey Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Turkey Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 63: Israel Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Israel Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 65: GCC Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: GCC Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 67: North Africa Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: North Africa Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 69: South Africa Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: South Africa Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 73: Global Chinese Plant Based Food and Beverage Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 74: Global Chinese Plant Based Food and Beverage Market Volume Liters Forecast, by Product Type 2020 & 2033

- Table 75: Global Chinese Plant Based Food and Beverage Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 76: Global Chinese Plant Based Food and Beverage Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 77: Global Chinese Plant Based Food and Beverage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 78: Global Chinese Plant Based Food and Beverage Market Volume Liters Forecast, by Country 2020 & 2033

- Table 79: China Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: China Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 81: India Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: India Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 83: Japan Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 84: Japan Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 85: South Korea Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: South Korea Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 89: Oceania Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 90: Oceania Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Chinese Plant Based Food and Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Chinese Plant Based Food and Beverage Market Volume (Liters) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chinese Plant Based Food and Beverage Market?

The projected CAGR is approximately 12.5%.

2. Which companies are prominent players in the Chinese Plant Based Food and Beverage Market?

Key companies in the market include Zhenmeat*List Not Exhaustive, Vitasoy International Holdings Ltd, China Mengniu Dairy Company Limited, Alpha Foods, Yili Group, Unilever PLC (The Vegetarian Butcher), Oatly Group AB, Beyond Meat, Green Monday Group (Omnipork), Qishan Foods, Starfield Food Science and Technology.

3. What are the main segments of the Chinese Plant Based Food and Beverage Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 64.14 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products.

6. What are the notable trends driving market growth?

Growing Popularity of Vegan Diet in China.

7. Are there any restraints impacting market growth?

Presence of Preservatives in Ready Meals may Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

In May 2022, one of the prominent plant-based meat suppliers Beyond Meat expanded in China following a new partnership with Chinese convenience shop Lawson. In accordance with the deal, two plant-based lunch boxes were supplied to more than 2,300 Lawson stores across the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Liters.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chinese Plant Based Food and Beverage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chinese Plant Based Food and Beverage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chinese Plant Based Food and Beverage Market?

To stay informed about further developments, trends, and reports in the Chinese Plant Based Food and Beverage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence