Key Insights

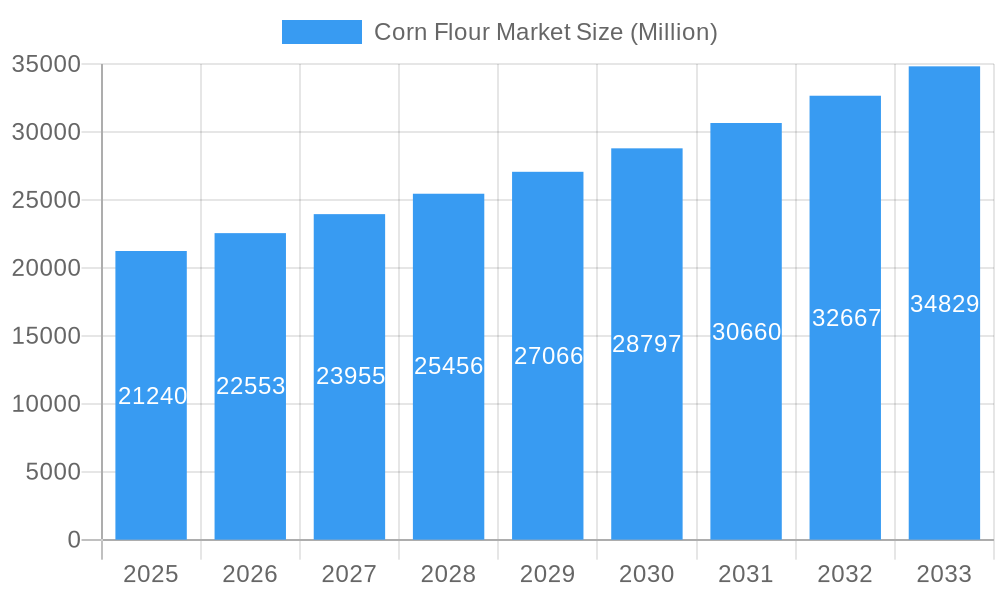

The global Corn Flour Market is poised for robust expansion, projected to reach USD 21.24 billion in 2025 and grow at a substantial Compound Annual Growth Rate (CAGR) of 6.11% through 2033. This significant market size underscores the widespread utility and increasing demand for corn flour across diverse industries. A primary driver for this growth is the escalating demand from the food and beverage sector, fueled by its versatility as a thickening agent, binder, and bulking ingredient in a vast array of consumer products, including baked goods, snacks, and sauces. Furthermore, the burgeoning animal feed industry, where corn flour serves as a crucial energy source and digestible component for livestock, is a key contributor to market dynamism. The pharmaceutical industry also represents a growing segment, leveraging corn flour's properties in tablet manufacturing and as an excipient.

Corn Flour Market Market Size (In Billion)

The market's upward trajectory is further supported by a confluence of trends. Innovations in modified starches are expanding their applications and improving their functional properties, making them more attractive for specialized uses. The increasing consumer preference for natural and clean-label ingredients also favors corn flour, a widely recognized and accepted ingredient. However, the market is not without its challenges. Fluctuations in corn prices, influenced by agricultural yields and global supply-demand dynamics, can impact profitability and market stability. Additionally, the development and adoption of alternative starches derived from other crops like tapioca or potato, while currently smaller in scale, could present competitive pressure in certain niche applications. Despite these restraints, the sustained demand from core sectors and the ongoing exploration of new applications suggest a promising future for the corn flour market.

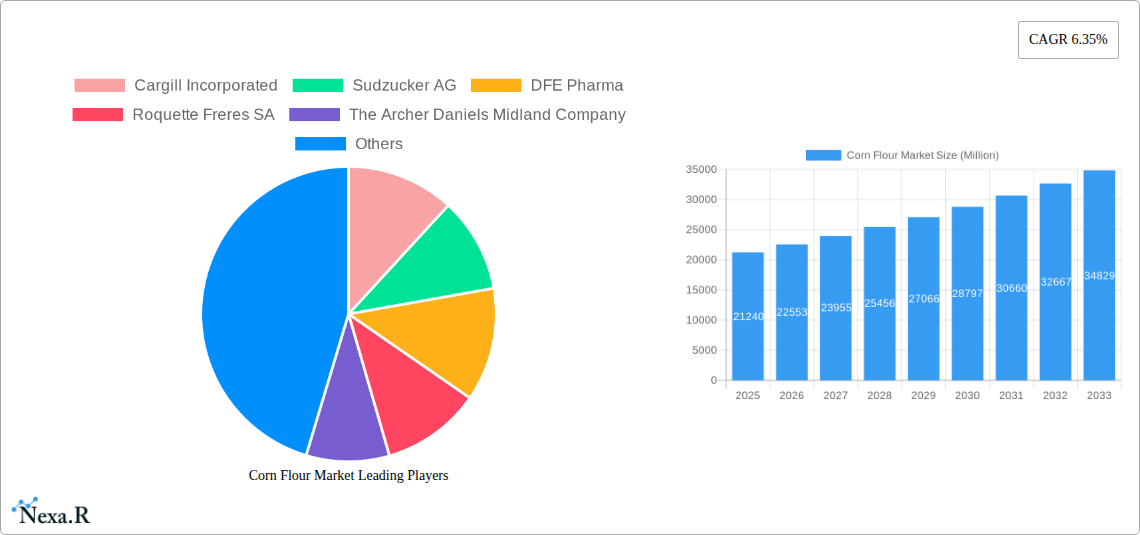

Corn Flour Market Company Market Share

Unveiling the Corn Flour Market: A Comprehensive Report for Industry Leaders

This in-depth report offers a strategic analysis of the global Corn Flour Market, providing actionable insights for stakeholders navigating this dynamic sector. Spanning the historical period of 2019–2024, with a detailed forecast from 2025–2033 based on the estimated year of 2025, this research delves into market size, growth drivers, regional dominance, product innovation, and key players. Optimize your strategy with a deep understanding of market dynamics, technological advancements, and emerging opportunities in the global corn flour market, including the significant native corn starch market and the rapidly evolving modified corn starch market.

Corn Flour Market Market Dynamics & Structure

The Corn Flour Market exhibits a moderate to high concentration, driven by significant investments in R&D and a competitive landscape shaped by major global players. Technological innovation is a key differentiator, with advancements in starch modification and processing enhancing product functionality across diverse applications. Regulatory frameworks, particularly concerning food safety and agricultural subsidies, play a crucial role in shaping market access and operational costs. Competitive product substitutes, such as wheat flour and other starches, exert continuous pressure, necessitating continuous product development and cost-efficiency. End-user demographics are shifting, with increasing demand for natural, clean-label ingredients and specialized functional starches in both developed and emerging economies. Mergers and acquisitions (M&A) remain a significant trend, as larger companies consolidate to expand market reach, acquire innovative technologies, and achieve economies of scale. For instance, the ADM corn starch market presence is continually augmented through strategic expansions.

- Market Concentration: Dominated by a few key global players, with increasing consolidation through M&A.

- Technological Innovation: Focus on developing starches with enhanced functional properties (e.g., viscosity, stability, emulsification).

- Regulatory Frameworks: Stringent food safety standards and agricultural policies influence production and pricing.

- Competitive Landscape: Competition from alternative flours and starches necessitates product differentiation.

- End-User Demographics: Growing demand for natural ingredients, plant-based products, and specialized functional starches.

- M&A Trends: Strategic acquisitions to enhance product portfolios, expand geographical reach, and gain market share.

Corn Flour Market Growth Trends & Insights

The global corn flour market is poised for robust expansion, projected to reach $XX billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately X.X% during the forecast period. This growth is underpinned by a confluence of escalating demand from the food and beverage industry, where corn flour serves as a crucial thickener, binder, and texturizer, and its expanding applications in animal feed, pharmaceuticals, and industrial sectors like paper and textiles. The increasing consumer preference for gluten-free alternatives, a segment where corn flour excels, is a significant market penetration driver. Technological disruptions, including enzymatic modifications and advanced processing techniques, are enhancing the functionality and value proposition of corn flour derivatives, leading to higher adoption rates for specialized starches like modified corn starch in innovative food formulations. Consumer behavior shifts towards health-conscious eating and the demand for convenient, ready-to-eat food products further propel the market. The base year of 2025 represents a critical inflection point, with significant growth anticipated.

- Market Size Evolution: Significant growth projected from $XX billion in 2019 to an estimated $XX billion by 2033.

- CAGR: Expected to grow at a CAGR of approximately X.X% between 2025 and 2033.

- Adoption Rates: Steadily increasing, particularly for specialized and modified corn starches in high-value applications.

- Technological Disruptions: Innovations in processing and modification enhance product functionality and expand application scope.

- Consumer Behavior Shifts: Growing demand for gluten-free, natural, and functional ingredients.

- Market Penetration: Deepening penetration in the food and beverage sector and significant inroads into industrial applications.

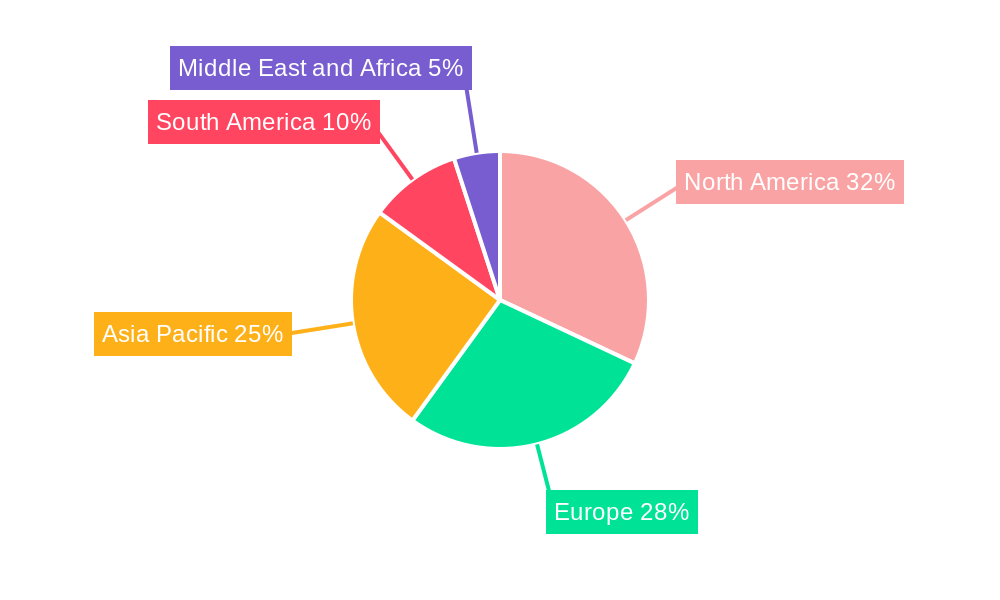

Dominant Regions, Countries, or Segments in Corn Flour Market

The Food and Beverage segment stands as the dominant force within the global Corn Flour Market, accounting for an estimated XX% of the total market share in 2025 and projected to maintain its leading position throughout the forecast period. This dominance is fueled by corn flour's indispensable role as a versatile ingredient in a vast array of food products, including baked goods, snacks, soups, sauces, confectionery, and breakfast cereals. The increasing global population, coupled with rising disposable incomes in emerging economies, directly translates to higher per capita consumption of processed and convenience foods, thereby bolstering demand for corn flour. North America and Europe currently lead in consumption due to well-established food processing industries and a high consumer preference for corn-based products. However, the Asia-Pacific region is emerging as a high-growth area, driven by rapid urbanization, evolving dietary habits, and a burgeoning food manufacturing sector. Within the Type segment, both Native Starch and Modified Starch are critical, with modified starches gaining significant traction due to their tailored functionalities that enhance texture, stability, and shelf-life in various food applications.

- Dominant Application Segment: Food and Beverage, comprising an estimated XX% market share in 2025.

- Key Drivers in Food & Beverage: Versatility as a thickener, binder, stabilizer, and texturizer; growing demand for processed and convenience foods.

- Regional Dominance: North America and Europe currently lead, with Asia-Pacific exhibiting the highest growth potential.

- Segmental Growth: Robust demand for both Native Starch and Modified Starch, with the latter experiencing accelerated adoption for functional benefits.

- Economic Policies & Infrastructure: Supportive agricultural policies and well-developed food processing infrastructure in key regions contribute to market dominance.

- Market Share & Growth Potential: Food and Beverage segment expected to maintain its leading market share and exhibit consistent growth.

Corn Flour Market Product Landscape

The Corn Flour Market is characterized by continuous product innovation, driven by the demand for enhanced functionality and specific application needs. Innovations range from the development of high-purity native starches for sensitive pharmaceutical applications to sophisticated modified starches designed to impart unique textural properties and stability in baked goods, dairy products, and savory snacks. Companies are focusing on creating starches with improved viscosity, freeze-thaw stability, and emulsification capabilities. Technological advancements in enzymatic and chemical modification processes allow for tailored functionalities, catering to evolving consumer preferences for clean labels and natural ingredients. Performance metrics such as particle size distribution, gelatinization temperature, and solubility are key differentiators, influencing product selection across various industries. The report details these advancements and their impact on market competitiveness.

Key Drivers, Barriers & Challenges in Corn Flour Market

Key Drivers:

- Growing Demand from Food & Beverage Sector: Increasing consumption of processed foods, snacks, and convenience items worldwide.

- Versatility and Cost-Effectiveness: Corn flour's broad applicability and relatively low cost make it an attractive ingredient.

- Gluten-Free Trend: Rising consumer preference for gluten-free alternatives, with corn flour being a primary substitute.

- Industrial Applications: Expanding use in paper, textile, and pharmaceutical industries for various functional purposes.

- Technological Advancements: Development of modified starches with enhanced functionalities and specialized properties.

Barriers & Challenges:

- Price Volatility of Raw Materials: Fluctuations in corn prices due to weather patterns, agricultural policies, and global demand.

- Competition from Substitutes: Availability and competitive pricing of other starches and flours (e.g., tapioca, potato, wheat).

- Regulatory Hurdles: Stringent food safety regulations and labeling requirements in different regions.

- Supply Chain Disruptions: Potential for disruptions due to geopolitical events, transportation issues, and natural disasters.

- Development of Novel Ingredients: Emergence of new ingredients that could potentially replace corn flour in certain applications.

Emerging Opportunities in Corn Flour Market

Emerging opportunities in the Corn Flour Market lie in the burgeoning demand for plant-based and sustainable ingredients. The development of specialty corn flours with enhanced nutritional profiles, such as increased protein or fiber content, presents a significant avenue for growth. Furthermore, the expansion of the nutraceutical sector offers prospects for corn-based excipients and ingredients with specific health benefits, as demonstrated by DFE Pharma's recent product launches. Untapped markets in developing regions, where food processing infrastructure is rapidly expanding, also represent considerable potential. Innovative applications in biodegradable plastics and bio-based chemicals are further diversifying the market's scope.

Growth Accelerators in the Corn Flour Market Industry

Long-term growth in the Corn Flour Market is being accelerated by significant technological breakthroughs in starch modification, enabling the creation of starches with highly tailored functionalities for niche applications. Strategic partnerships between corn producers, ingredient manufacturers, and end-product companies are fostering innovation and market penetration. Furthermore, market expansion strategies by key players, including investments in new production facilities and geographic diversification, are crucial growth catalysts. The increasing focus on sustainability and circular economy principles within the agricultural and food industries is also driving demand for corn-based products and innovative solutions.

Key Players Shaping the Corn Flour Market Market

- Cargill Incorporated

- Sudzucker AG

- DFE Pharma

- Roquette Freres SA

- The Archer Daniels Midland Company

- Tate & Lyle PLC

- Egyptian Corn Starch Company

- AGRANA Beteiligungs AG

- Associated British Foods PLC

- Ingredion Incorporated

Notable Milestones in Corn Flour Market Sector

- May 2022: ADM invested in its starch manufacturing plant to increase production capacity, expanding its site in Marshall, MN, to cater to growing demand.

- January 2022: DFE Pharma launched three starch-based excipients – Nutroféli ST100 (native maize starch), Nutroféli ST200 (partially pre-gelatinized maize starch), and Nutroféli ST300 (fully gelatinized maize starch) – bolstering its nutraceutical portfolio.

- March 2021: The United States Grains Council collaborated with an Egyptian corn starch company to enhance operational efficiency and plant profitability.

In-Depth Corn Flour Market Market Outlook

The future of the Corn Flour Market is bright, driven by sustained demand from the food and beverage industry and promising growth in industrial and pharmaceutical applications. Strategic investments in research and development, particularly in the realm of modified starches with enhanced functionalities, will continue to be a key growth accelerator. Emerging markets in Asia-Pacific and Latin America offer significant untapped potential for expansion. The increasing consumer focus on health, wellness, and sustainable sourcing will also shape product development and market strategies. Companies that can effectively leverage technological innovation, forge strategic alliances, and adapt to evolving consumer preferences are well-positioned for significant growth in the coming years.

Corn Flour Market Segmentation

-

1. Type

- 1.1. Native Starch

- 1.2. Modified Starch

-

2. Application

- 2.1. Food and Beverage

- 2.2. Animal Feed

- 2.3. Pharmaceuticals

- 2.4. Textile

- 2.5. Paper and Corrugated

- 2.6. Other Applications

Corn Flour Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Corn Flour Market Regional Market Share

Geographic Coverage of Corn Flour Market

Corn Flour Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Increase in Demand for Clean-label Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Corn Flour Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Native Starch

- 5.1.2. Modified Starch

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.2. Animal Feed

- 5.2.3. Pharmaceuticals

- 5.2.4. Textile

- 5.2.5. Paper and Corrugated

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Corn Flour Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Native Starch

- 6.1.2. Modified Starch

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverage

- 6.2.2. Animal Feed

- 6.2.3. Pharmaceuticals

- 6.2.4. Textile

- 6.2.5. Paper and Corrugated

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Corn Flour Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Native Starch

- 7.1.2. Modified Starch

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverage

- 7.2.2. Animal Feed

- 7.2.3. Pharmaceuticals

- 7.2.4. Textile

- 7.2.5. Paper and Corrugated

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Corn Flour Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Native Starch

- 8.1.2. Modified Starch

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverage

- 8.2.2. Animal Feed

- 8.2.3. Pharmaceuticals

- 8.2.4. Textile

- 8.2.5. Paper and Corrugated

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Corn Flour Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Native Starch

- 9.1.2. Modified Starch

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverage

- 9.2.2. Animal Feed

- 9.2.3. Pharmaceuticals

- 9.2.4. Textile

- 9.2.5. Paper and Corrugated

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Corn Flour Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Native Starch

- 10.1.2. Modified Starch

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food and Beverage

- 10.2.2. Animal Feed

- 10.2.3. Pharmaceuticals

- 10.2.4. Textile

- 10.2.5. Paper and Corrugated

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cargill Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sudzucker AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DFE Pharma

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Roquette Freres SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Archer Daniels Midland Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tate & Lyle PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Egyptian Corn Starch Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AGRANA Beteiligungs AG*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Associated British Foods PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ingredion Incorporated

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Cargill Incorporated

List of Figures

- Figure 1: Global Corn Flour Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Corn Flour Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Corn Flour Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Corn Flour Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Corn Flour Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Corn Flour Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Corn Flour Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Corn Flour Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Corn Flour Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Corn Flour Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Corn Flour Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Corn Flour Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Corn Flour Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Corn Flour Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Corn Flour Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Corn Flour Market Revenue (undefined), by Application 2025 & 2033

- Figure 17: Asia Pacific Corn Flour Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Corn Flour Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Corn Flour Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Corn Flour Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: South America Corn Flour Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Corn Flour Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: South America Corn Flour Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Corn Flour Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Corn Flour Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Corn Flour Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa Corn Flour Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Corn Flour Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East and Africa Corn Flour Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Corn Flour Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Corn Flour Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Corn Flour Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Corn Flour Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Corn Flour Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Corn Flour Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Corn Flour Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Corn Flour Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Corn Flour Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global Corn Flour Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 13: Global Corn Flour Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Germany Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: France Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Russia Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global Corn Flour Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global Corn Flour Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Global Corn Flour Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: India Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: China Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Japan Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Australia Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Corn Flour Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 30: Global Corn Flour Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 31: Global Corn Flour Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Brazil Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Argentina Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Global Corn Flour Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 36: Global Corn Flour Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 37: Global Corn Flour Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 38: South Africa Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Corn Flour Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Corn Flour Market?

The projected CAGR is approximately 6.11%.

2. Which companies are prominent players in the Corn Flour Market?

Key companies in the market include Cargill Incorporated, Sudzucker AG, DFE Pharma, Roquette Freres SA, The Archer Daniels Midland Company, Tate & Lyle PLC, Egyptian Corn Starch Company, AGRANA Beteiligungs AG*List Not Exhaustive, Associated British Foods PLC, Ingredion Incorporated.

3. What are the main segments of the Corn Flour Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Increase in Demand for Clean-label Ingredients.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

May 2022: ADM invested in the facility of the starch manufacturing plant to increase its production capacity. To cater to the growing demand, the company has decided to expand its site in Marshall, MN.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Corn Flour Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Corn Flour Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Corn Flour Market?

To stay informed about further developments, trends, and reports in the Corn Flour Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence