Key Insights

The Egyptian food sweetener market is poised for significant expansion, projecting a market size of approximately USD 746 million in 2024, driven by a CAGR of 5.2% over the forecast period. This robust growth is underpinned by a confluence of factors, including the rising demand for reduced-calorie and sugar-free options, increasing health consciousness among consumers, and the expanding food and beverage processing industry within Egypt. The increasing prevalence of lifestyle diseases such as diabetes and obesity is further propelling the adoption of alternative sweeteners. Key market drivers include growing disposable incomes, a burgeoning young population with evolving dietary preferences, and government initiatives aimed at promoting healthier food consumption. The market is segmented into various product types, with Sucrose (Common Sugar) holding a substantial share, followed by Starch Sweeteners and Sugar Alcohols, and High-intensity Sweeteners (HIS). Applications are diverse, spanning Dairy, Bakery, Soups, Sauces, and Dressings, Confectionery, Beverages, and Other Applications, reflecting the widespread integration of sweeteners across the food industry. Leading companies like Ingredion, Tate & Lyle PLC, Cargill Inc., and DuPont are actively participating in this dynamic market, introducing innovative products and expanding their reach.

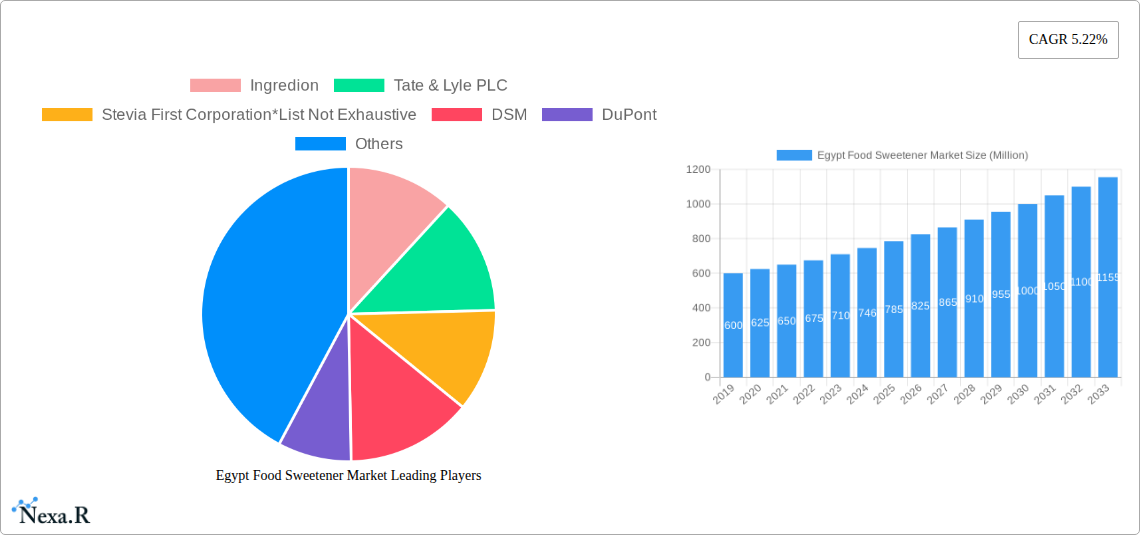

Egypt Food Sweetener Market Market Size (In Million)

The growth trajectory of the Egyptian food sweetener market is also influenced by evolving consumer trends. There is a discernible shift towards natural and naturally derived sweeteners, such as Stevia, which offers a healthier alternative to traditional sugar. However, the market also faces certain restraints, including the fluctuating prices of raw materials and the potential for stringent regulatory frameworks concerning food additives and sweeteners. Despite these challenges, the overall outlook remains highly positive. The increasing adoption of innovative ingredients and production technologies by market players is expected to further fuel market expansion. The strong presence of key players and a growing consumer base seeking healthier food choices position Egypt as a promising market for food sweeteners, with continued innovation and strategic investments likely to shape its future landscape.

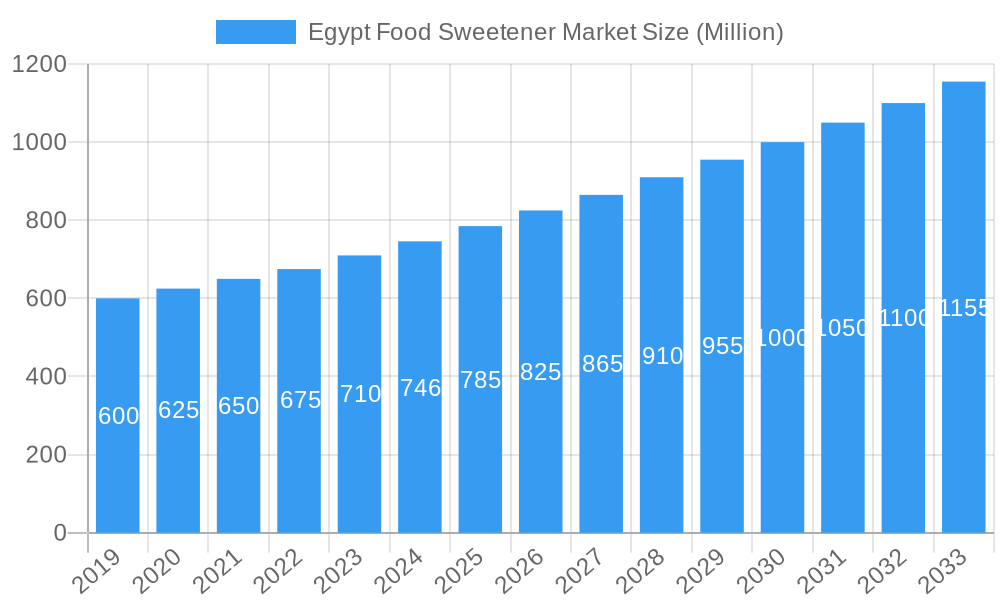

Egypt Food Sweetener Market Company Market Share

Egypt Food Sweetener Market: Comprehensive Report Analysis 2019–2033

This in-depth report provides a detailed analysis of the Egypt Food Sweetener Market, encompassing a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025. The forecast period extends from 2025 to 2033, with historical data covering 2019–2024. We delve into critical market dynamics, growth trends, dominant segments, product landscape, key drivers, emerging opportunities, and the strategic moves of major players, offering actionable insights for industry stakeholders.

Egypt Food Sweetener Market Market Dynamics & Structure

The Egypt Food Sweetener Market exhibits a moderately concentrated structure, with a few prominent global players holding significant market share, alongside a growing number of local manufacturers. Technological innovation is a key driver, particularly in the development of healthier, low-calorie alternatives and advanced processing techniques for existing sweeteners. Regulatory frameworks are evolving to promote food safety and encourage the adoption of healthier ingredients, impacting product development and market access. Competitive product substitutes are abundant, ranging from traditional sucrose to emerging high-intensity sweeteners (HIS), driving a constant need for differentiation and cost-effectiveness. End-user demographics are shifting towards health-conscious consumers, influencing demand for sugar reduction and natural sweeteners. Mergers and acquisitions (M&A) trends are notable, with strategic acquisitions aimed at expanding product portfolios and market reach, particularly in the high-growth HIS segment. For instance, the acquisition of Stevia First Corporation by Ingredion in 2023 highlights this trend, signaling a move towards natural, plant-based solutions. The overall market concentration is approximately 60% held by the top five players, with a steady increase in M&A deal volumes over the past five years, indicating a consolidation phase. Innovation barriers include high R&D costs and the need for extensive regulatory approvals for novel sweeteners.

Egypt Food Sweetener Market Growth Trends & Insights

The Egypt Food Sweetener Market is projected to witness substantial growth, driven by evolving consumer preferences and a growing awareness of health-related issues. The market size is expected to grow from an estimated XX million units in 2025 to XX million units by 2033, reflecting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. Adoption rates for low-calorie and natural sweeteners are accelerating, fueled by government initiatives promoting healthier food choices and an increasing prevalence of lifestyle diseases such as diabetes and obesity. Technological disruptions, including advancements in extraction and purification methods for natural sweeteners like stevia and erythritol, are making these alternatives more accessible and cost-effective, thereby widening their market penetration.

Consumer behavior shifts are playing a pivotal role. The demand for "sugar-free" and "reduced-sugar" products is no longer a niche trend but a mainstream expectation. This is compelling food and beverage manufacturers to reformulate their products, thereby increasing their reliance on a diverse range of sweeteners beyond traditional sucrose. The beverage sector, in particular, is a significant adopter of low-calorie sweeteners, driven by a strong consumer push for healthier drink options. The bakery and confectionery segments are also witnessing a transformation, with manufacturers exploring innovative ways to reduce sugar content without compromising taste and texture.

Furthermore, the increasing disposable income in Egypt is leading to a greater expenditure on processed foods and beverages, indirectly boosting the sweetener market. The young and growing population segment is also a key demographic influencing purchasing decisions, with a greater openness to trying new food products and ingredients, including healthier sweetener options. The regulatory landscape, while sometimes posing challenges, is also acting as a catalyst by encouraging healthier product formulations. For instance, potential sugar taxes or stricter labeling requirements can incentivize manufacturers to reduce sugar and opt for alternative sweeteners. This dynamic interplay of consumer demand, technological advancements, and regulatory influences paints a positive growth trajectory for the Egypt Food Sweetener Market.

Dominant Regions, Countries, or Segments in Egypt Food Sweetener Market

Within the broader Egypt Food Sweetener Market, specific segments and applications are demonstrating remarkable dominance and driving overall growth. From a Product Type perspective, High-intensity Sweeteners (HIS) are emerging as a leading segment, projected to capture a significant market share. This dominance is attributed to their superior sweetening power in small quantities, making them ideal for sugar reduction strategies without affecting calorie counts. Sucrose (Common Sugar), while historically dominant, is experiencing a slowdown in growth due to health concerns and is being gradually replaced by alternatives in many applications. Starch sweeteners and sugar alcohols, such as sorbitol and xylitol, also hold a considerable share, particularly in baked goods and sugar-free confectionery, offering a different taste profile and functional benefits.

In terms of Application, the Beverages segment stands out as the largest and fastest-growing consumer of food sweeteners. The persistent global trend towards healthier beverage options, including diet sodas, low-calorie juices, and functional drinks, directly translates into increased demand for HIS and other sugar substitutes. The Confectionery sector also represents a substantial market, with manufacturers actively seeking to reduce sugar content in chocolates, candies, and chewing gum to cater to health-conscious consumers and avoid potential regulatory pressures. The Bakery segment is another key driver, with sweeteners being crucial for taste, texture, and shelf-life in a wide array of products, including cakes, biscuits, and bread.

Dominance within these segments is fueled by several factors. Economic policies promoting food industry development and investment in manufacturing infrastructure are crucial. For instance, government initiatives aimed at boosting local production of food ingredients, including sweeteners, can significantly impact market dynamics. Furthermore, the presence of a well-established food processing industry in Egypt, particularly in urban centers, creates a ready demand for these ingredients. The high population density and growing middle class in major cities like Cairo and Alexandria also contribute to the concentrated demand for a diverse range of food products.

Market share within the HIS segment is increasingly being captured by ingredients like aspartame, sucralose, acesulfame potassium, and natural sweeteners like stevia glycosides. The growth potential for HIS remains exceptionally high as formulation challenges are overcome and consumer acceptance grows. For the Beverages segment, the market share is estimated to be around 35%, followed by Confectionery at 25%, and Bakery at 20%. The continued innovation in product development and the strategic marketing efforts by major players are key to maintaining and expanding this dominance.

Egypt Food Sweetener Market Product Landscape

The Egypt Food Sweetener Market product landscape is characterized by a dynamic evolution driven by innovation and consumer demand for healthier alternatives. Sucrose, or common sugar, remains a fundamental product, but its market share is gradually being eroded by a growing array of alternatives. Starch sweeteners and sugar alcohols, such as maltitol and erythritol, are gaining traction due to their functional properties and lower glycemic impact. The most significant transformation is observed in the High-Intensity Sweeteners (HIS) category, which includes both artificial sweeteners like sucralose and aspartame, and natural, zero-calorie options such as stevia and monk fruit extracts. These HIS offer superior sweetening power per unit, enabling significant sugar reduction in food and beverage formulations without compromising taste. Product innovations are focused on enhancing taste profiles, improving solubility, and ensuring stability across various food matrices. For instance, advanced purification techniques for stevia are yielding less bitter-tasting extracts, making them more palatable for a wider range of applications.

Key Drivers, Barriers & Challenges in Egypt Food Sweetener Market

The Egypt Food Sweetener Market is propelled by several key drivers. A primary force is the increasing consumer awareness regarding health and wellness, leading to a higher demand for sugar-reduced and sugar-free products. This trend is further amplified by the rising prevalence of lifestyle diseases such as diabetes and obesity. Government initiatives promoting healthier food consumption and potential future regulations on sugar content also act as significant drivers. Technological advancements in sweetener production, particularly for natural and low-calorie alternatives, are making them more accessible and cost-effective, fostering wider adoption.

However, the market faces several barriers and challenges. High research and development costs associated with novel sweetener innovation can be a significant hurdle. Stringent regulatory approval processes for new food ingredients in Egypt can also delay market entry. Price volatility of raw materials, particularly for natural sweeteners, can impact production costs and final product pricing. Furthermore, the established consumer preference for traditional sucrose in certain applications presents a challenge for widespread adoption of alternatives. Supply chain disruptions and the need for specialized handling and storage for certain sweeteners can also pose logistical difficulties. Competitive pressures from existing substitutes and the constant need for product differentiation also add to the market's complexity.

Emerging Opportunities in Egypt Food Sweetener Market

Emerging opportunities in the Egypt Food Sweetener Market are ripe for exploitation, driven by evolving consumer preferences and untapped market potential. The growing demand for natural and clean-label sweeteners presents a significant avenue for growth, especially for plant-derived options like stevia and monk fruit. Manufacturers that can offer sustainably sourced and minimally processed natural sweeteners are poised to capture market share. Furthermore, the "better-for-you" trend is extending beyond sugar reduction to encompass broader health benefits, creating opportunities for functional sweeteners that offer additional advantages, such as prebiotic properties or improved gut health. The expanded use of sweeteners in savory applications, beyond traditional confectionery and beverages, such as in sauces, dressings, and processed meats, represents a nascent but promising growth area. Innovative sugar-reduction solutions for the dairy industry, including yogurts and ice creams, also offer considerable potential.

Growth Accelerators in the Egypt Food Sweetener Market Industry

Several key catalysts are accelerating growth within the Egypt Food Sweetener Market industry. Technological breakthroughs in extraction, purification, and blending of sweeteners are continuously enhancing their quality, functionality, and cost-effectiveness. For instance, advancements in stevia glycoside extraction are yielding higher purity and less bitter profiles, increasing its acceptability in a wider range of products. Strategic partnerships and collaborations between sweetener manufacturers and food and beverage companies are crucial for co-developing innovative products and expanding market reach. These partnerships facilitate quicker product launches and ensure that sweetener solutions meet specific formulation needs. Furthermore, market expansion strategies by key players, including investments in local production facilities and robust distribution networks, are vital for catering to the growing Egyptian demand and improving accessibility across the country. The continuous R&D focus on developing sweeteners with enhanced taste profiles and functionalities is also a significant growth accelerator.

Key Players Shaping the Egypt Food Sweetener Market Market

- Ingredion

- Tate & Lyle PLC

- Stevia First Corporation

- DSM

- DuPont

- Cargill Inc

- JK Sucralose Inc

Notable Milestones in Egypt Food Sweetener Market Sector

- 2023: Acquisition of Stevia First Corporation by Ingredion, strengthening Ingredion's portfolio of natural, plant-based sweeteners and expanding its market presence in the region.

- 2022: Launch of a new low-calorie sweetener by Tate & Lyle PLC, offering an innovative solution for sugar reduction in various food and beverage applications.

- 2021: Expansion of Cargill's sweetener production facility in Alexandria, Egypt, enhancing its manufacturing capacity and supply chain efficiency to meet growing regional demand.

In-Depth Egypt Food Sweetener Market Market Outlook

The Egypt Food Sweetener Market is poised for sustained and robust growth in the coming years, driven by a confluence of favorable market conditions and strategic initiatives. The anticipated expansion of the market is underpinned by the ongoing consumer-driven shift towards healthier dietary choices, a demographic dividend with a young and health-conscious population, and increasing disposable incomes. Growth accelerators such as ongoing technological advancements in sweetener innovation, particularly in the realm of natural and high-intensity sweeteners, will continue to unlock new application possibilities and improve cost-effectiveness. Strategic partnerships between ingredient suppliers and food manufacturers will be instrumental in driving product reformulations and market penetration. Furthermore, potential supportive government policies aimed at public health and food product innovation will create a conducive environment for market expansion. The outlook suggests a dynamic landscape where innovation, consumer trends, and strategic investments will collectively shape a promising future for the Egypt Food Sweetener Market.

Egypt Food Sweetener Market Segmentation

-

1. Product Type

- 1.1. Sucrose (Common Sugar)

- 1.2. Starch Sweeteners and Sugar Alcohols

- 1.3. High-intensity Sweeteners (HIS)

-

2. Application

- 2.1. Dairy

- 2.2. Bakery

- 2.3. Soups, Sauces, and Dressings

- 2.4. Confectionery

- 2.5. Beverages

- 2.6. Other Applications

Egypt Food Sweetener Market Segmentation By Geography

- 1. Egypt

Egypt Food Sweetener Market Regional Market Share

Geographic Coverage of Egypt Food Sweetener Market

Egypt Food Sweetener Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmented demand for Natural Sweeteners; Rising Consumer Inclination Toward Clean Label and Organic Stevia

- 3.3. Market Restrains

- 3.3.1. Side Effects and Challenges with Stevia

- 3.4. Market Trends

- 3.4.1. Increasing Demand for High-intensity Sweeteners (HIS) in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Food Sweetener Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Sucrose (Common Sugar)

- 5.1.2. Starch Sweeteners and Sugar Alcohols

- 5.1.3. High-intensity Sweeteners (HIS)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy

- 5.2.2. Bakery

- 5.2.3. Soups, Sauces, and Dressings

- 5.2.4. Confectionery

- 5.2.5. Beverages

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ingredion

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tate & Lyle PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Stevia First Corporation*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DSM

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DuPont

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cargill Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JK Sucralose Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Ingredion

List of Figures

- Figure 1: Egypt Food Sweetener Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Egypt Food Sweetener Market Share (%) by Company 2025

List of Tables

- Table 1: Egypt Food Sweetener Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Egypt Food Sweetener Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Egypt Food Sweetener Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Egypt Food Sweetener Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Egypt Food Sweetener Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Egypt Food Sweetener Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Food Sweetener Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Egypt Food Sweetener Market?

Key companies in the market include Ingredion, Tate & Lyle PLC, Stevia First Corporation*List Not Exhaustive, DSM, DuPont, Cargill Inc, JK Sucralose Inc.

3. What are the main segments of the Egypt Food Sweetener Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Augmented demand for Natural Sweeteners; Rising Consumer Inclination Toward Clean Label and Organic Stevia.

6. What are the notable trends driving market growth?

Increasing Demand for High-intensity Sweeteners (HIS) in the Country.

7. Are there any restraints impacting market growth?

Side Effects and Challenges with Stevia.

8. Can you provide examples of recent developments in the market?

1. Acquisition of Stevia First Corporation by Ingredion in 2023 2. Launch of new low-calorie sweetener by Tate & Lyle in 2022 3. Expansion of Cargill's sweetener production facility in Alexandria in 2021

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Food Sweetener Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Food Sweetener Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Food Sweetener Market?

To stay informed about further developments, trends, and reports in the Egypt Food Sweetener Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence