Key Insights

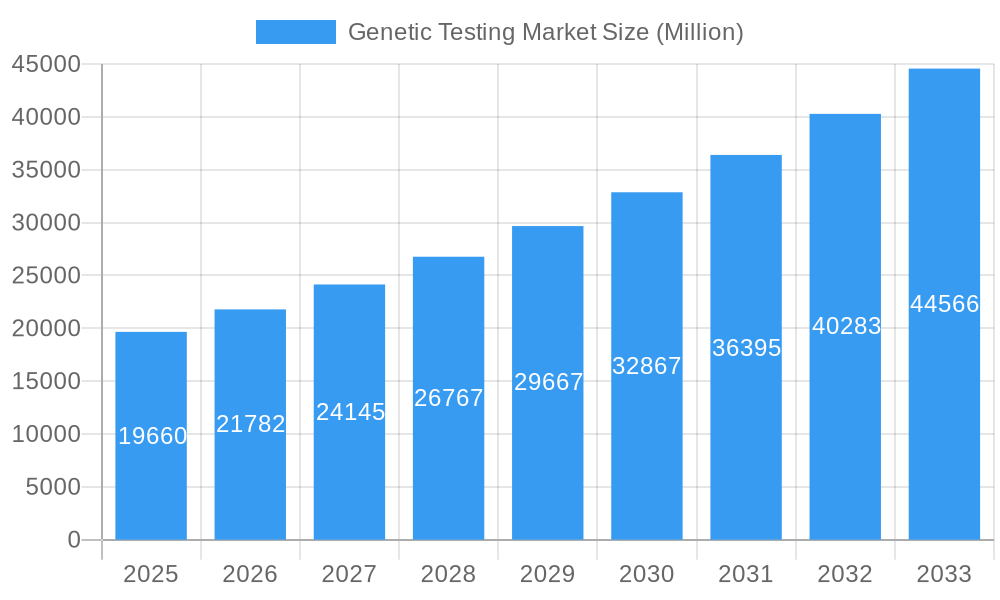

The global genetic testing market is experiencing robust expansion, projected to reach USD 19.66 billion in 2025 with a compelling Compound Annual Growth Rate (CAGR) of 10.81% extending through 2033. This significant growth is fueled by an increasing understanding of genetic predispositions to various diseases, advancements in diagnostic technologies, and a rising demand for personalized medicine. Carrier testing and diagnostic testing are emerging as dominant segments, driven by their critical role in early disease detection and management. The growing prevalence of chronic conditions such as cancer and rare diseases, coupled with the widespread adoption of prenatal and newborn screening programs, further propels market expansion. Molecular testing, in particular, is revolutionizing the field with its precision and efficiency in identifying genetic variations.

Genetic Testing Market Market Size (In Billion)

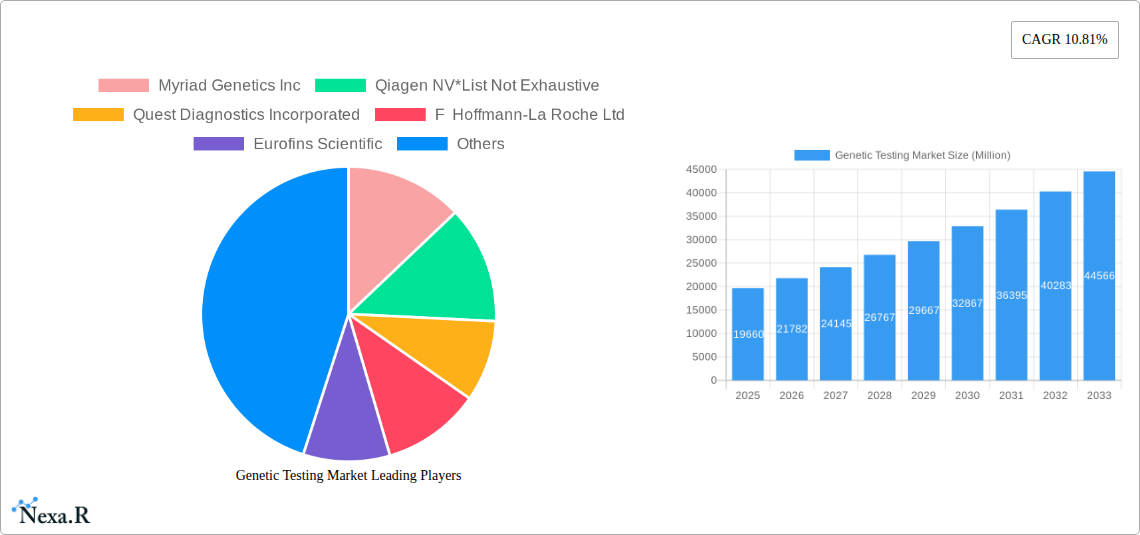

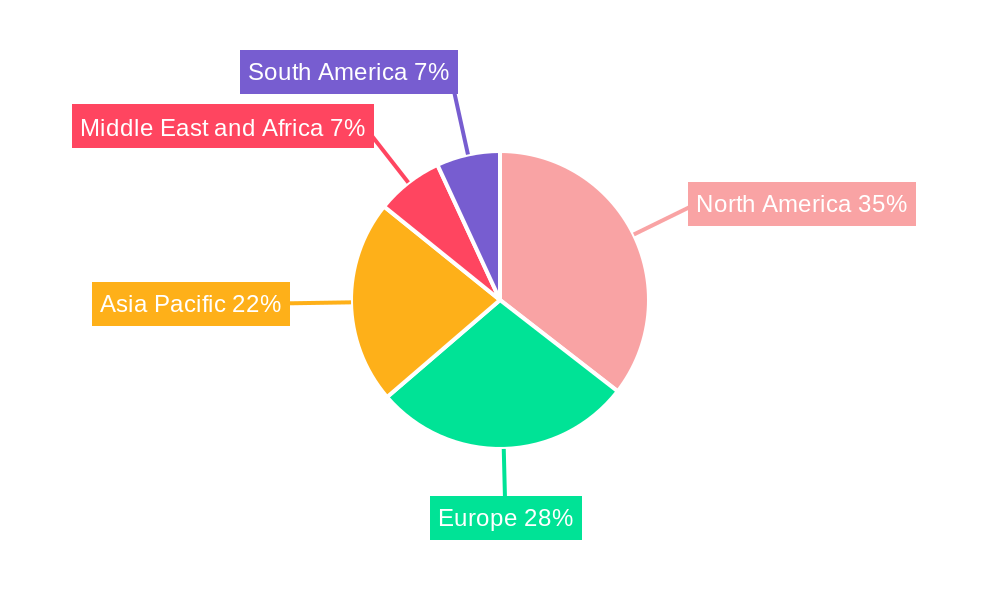

Geographically, North America currently leads the market, owing to a high prevalence of chronic diseases, early adoption of advanced genetic technologies, and substantial investments in research and development by leading companies like Myriad Genetics Inc. and Quest Diagnostics Incorporated. Europe and the Asia Pacific region are also exhibiting strong growth trajectories, driven by increasing healthcare expenditure, expanding awareness of genetic disorders, and supportive government initiatives aimed at promoting genetic research and diagnostics. Key players such as Qiagen NV, F Hoffmann-La Roche Ltd, and Illumina Inc. are actively investing in innovation and strategic collaborations to expand their product portfolios and geographical reach. However, challenges such as high testing costs, lack of skilled personnel in certain regions, and ethical concerns surrounding genetic data privacy may pose moderate restraints to market growth in specific segments.

Genetic Testing Market Company Market Share

Comprehensive Genetic Testing Market Report: Unlocking Future Health and Precision Medicine

This in-depth report provides a strategic analysis of the global Genetic Testing Market, offering critical insights for stakeholders navigating this rapidly evolving sector. With a forecast period extending to 2033, our research delves into market dynamics, growth trends, regional dominance, product innovations, and the key players shaping the future of genomic diagnostics. This report is an indispensable resource for understanding the market's trajectory, driven by advancements in molecular diagnostics, personalized medicine, and the increasing prevalence of genetic disorders.

Genetic Testing Market Market Dynamics & Structure

The global Genetic Testing Market exhibits a dynamic and increasingly consolidated structure, fueled by continuous technological innovation and a burgeoning demand for personalized healthcare solutions. Key drivers include advancements in DNA sequencing technologies, increasing awareness of genetic predispositions to diseases, and supportive governmental initiatives aimed at promoting early disease detection. The market is characterized by intense competition among established players and agile innovators, with a notable trend towards strategic mergers and acquisitions (M&A) to expand product portfolios and market reach. Regulatory frameworks, while sometimes posing challenges, also provide a foundation for standardized testing and data integrity. Substitutes, such as traditional diagnostic methods, are gradually being outpaced by the precision and efficiency of genetic testing. End-user demographics are broadening beyond research institutions to include healthcare providers, direct-to-consumer markets, and specialized diagnostic laboratories.

- Market Concentration: Dominated by a mix of large pharmaceutical and biotechnology firms and specialized genetic testing companies.

- Technological Innovation Drivers: Advancements in next-generation sequencing (NGS), CRISPR technology, and bioinformatics are critical.

- Regulatory Frameworks: FDA approvals, CLIA certifications, and data privacy regulations (e.g., GDPR, HIPAA) significantly influence market entry and operations.

- Competitive Product Substitutes: Traditional diagnostic tests, while still relevant, are facing increasing competition from genetic testing for specific conditions.

- End-User Demographics: Expanding to include healthcare systems, pharmaceutical companies for drug development, and a growing direct-to-consumer segment.

- M&A Trends: Active consolidation to achieve economies of scale, acquire specialized expertise, and broaden service offerings. The historical period saw approximately 15-20 significant M&A deals annually, with deal values ranging from tens of millions to billions of dollars.

Genetic Testing Market Growth Trends & Insights

The Genetic Testing Market is poised for robust expansion, projected to reach significant valuations by 2033. This growth is underpinned by a confluence of factors including rising global healthcare expenditure, an aging population susceptible to chronic genetic conditions, and a paradigm shift towards preventative and personalized medicine. The increasing adoption of carrier testing, new-born screening, and predictive and presymptomatic testing is a testament to the growing understanding of genetic insights' value. Technological disruptions, such as the miniaturization of sequencing equipment and the development of more affordable molecular testing platforms, are accelerating market penetration. Consumer behavior is also evolving, with a greater willingness to embrace genetic information for health management and family planning. Diagnostic testing for prevalent diseases like cancer and rare diseases continues to be a major revenue driver, with significant investment in research and development for novel genetic markers and therapeutic targets.

The market is experiencing an impressive Compound Annual Growth Rate (CAGR) of approximately 10-12% over the forecast period. By 2025, the global genetic testing market is estimated to be valued at over $20,000 million. The increasing incidence of genetic disorders, coupled with enhanced diagnostic capabilities, is significantly boosting the adoption of various testing types. For instance, prenatal testing is witnessing a surge due to heightened awareness of fetal health and the availability of non-invasive prenatal testing (NIPT) methods.

Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) in analyzing vast genomic datasets is unlocking new frontiers in disease prediction and drug discovery, further accelerating market growth. The rise of direct-to-consumer (DTC) genetic testing, while facing some regulatory scrutiny, is also contributing to increased consumer engagement with their genetic health. The growing preference for personalized treatment plans, particularly in oncology, is a substantial tailwind for the cancer genetic testing segment. The market penetration of advanced genetic testing services is expected to rise from approximately 30% in 2024 to over 60% by 2033 in developed economies.

Dominant Regions, Countries, or Segments in Genetic Testing Market

The Genetic Testing Market's dominance is largely attributed to regions and segments that have heavily invested in healthcare infrastructure, research and development, and possess favorable regulatory environments. North America, particularly the United States, has consistently led the market due to its advanced healthcare system, high disposable incomes, and significant presence of key market players and research institutions. The region’s strong emphasis on personalized medicine and a proactive approach to adopting novel diagnostic technologies are critical growth accelerators.

In terms of segments, Diagnostic Testing for a wide array of diseases, especially Cancer and Rare Diseases, represents the most dominant category. The rising incidence of these conditions, coupled with the critical need for accurate and early diagnosis for effective treatment, drives substantial demand. The molecular testing technology segment is also a significant contributor to market growth, offering higher sensitivity and specificity compared to traditional methods.

- Dominant Region: North America, driven by the USA, holds a substantial market share, estimated at over 35% in the base year 2025.

- Key Drivers in North America: High R&D spending, strong reimbursement policies for genetic testing, widespread adoption of advanced healthcare technologies, and a large patient pool for chronic diseases.

- Dominant Segment (Type): Diagnostic Testing is the largest segment, expected to account for over 30% of the market revenue in 2025.

- Drivers: Increasing prevalence of genetic disorders, demand for early and accurate diagnosis, and advancements in diagnostic technologies.

- Dominant Segment (Disease): Cancer genetic testing is a major revenue generator, driven by the need for targeted therapies and personalized treatment plans.

- Drivers: High cancer incidence rates, advancements in oncology research, and the efficacy of genetic profiling in treatment selection.

- Dominant Segment (Technology): Molecular Testing is the leading technology, offering precise detection of genetic variations.

- Drivers: Superior accuracy, ability to detect a wide range of genetic mutations, and decreasing costs of sequencing.

Genetic Testing Market Product Landscape

The product landscape of the Genetic Testing Market is characterized by continuous innovation aimed at enhancing diagnostic accuracy, expanding test menus, and improving user experience. Companies are focused on developing multiplex assays that can simultaneously detect multiple genetic markers, thereby increasing efficiency and reducing costs. Innovations in sequencing platforms, such as the integration of AI for faster data analysis and interpretation, are crucial. Furthermore, the development of point-of-care genetic testing devices is emerging as a significant trend, promising to bring diagnostic capabilities closer to patients.

Key Drivers, Barriers & Challenges in Genetic Testing Market

The Genetic Testing Market is propelled by several key drivers, including the escalating demand for personalized medicine, the growing understanding of genetic factors in disease etiology, and advancements in genomic sequencing technologies. Supportive government initiatives and increasing R&D investments further accelerate market growth. The economic viability of genetic testing, especially for routine screenings and diagnostics, is also a significant driver.

However, the market faces several barriers and challenges. High costs associated with certain advanced genetic tests can be a restraint in some regions, particularly in developing economies. Regulatory hurdles and the need for stringent data privacy and security measures can slow down product development and market entry. The lack of awareness among a significant portion of the population about the benefits of genetic testing and interpretation of results can also pose a challenge. Ethical considerations surrounding genetic information and potential misuse also require careful navigation.

- Key Drivers:

- Advancements in NGS and CRISPR technologies.

- Increasing prevalence of chronic and rare diseases.

- Growing adoption of personalized and precision medicine.

- Government initiatives and funding for genetic research.

- Key Barriers & Challenges:

- High cost of certain genetic tests.

- Complex regulatory landscape and data privacy concerns.

- Limited awareness and understanding among the general population.

- Ethical considerations and potential for genetic discrimination.

- Shortage of skilled genetic counselors and bioinformaticians.

Emerging Opportunities in Genetic Testing Market

Emerging opportunities in the Genetic Testing Market lie in the expansion of direct-to-consumer (DTC) genetic testing for wellness and ancestry, coupled with a growing demand for pharmacogenomics to personalize drug prescriptions. The increasing focus on rare disease diagnostics and the development of liquid biopsy technologies for non-invasive cancer screening present significant untapped potential. Furthermore, the integration of genetic data with other health information, such as electronic health records (EHRs), opens avenues for more comprehensive health insights and predictive modeling. The growing market for companion diagnostics in targeted therapy is another key area for growth.

Growth Accelerators in the Genetic Testing Market Industry

Long-term growth in the Genetic Testing Market will be significantly accelerated by breakthroughs in gene editing technologies and the development of more cost-effective genomic sequencing solutions. Strategic partnerships between diagnostic companies, pharmaceutical firms, and research institutions will foster innovation and expand market reach. The expansion of genetic testing services into emerging economies, driven by improving healthcare infrastructure and increasing awareness, will be a crucial growth catalyst. Furthermore, the increasing utility of genetic testing in areas like infectious disease surveillance and agricultural biotechnology offers diversified growth avenues.

Key Players Shaping the Genetic Testing Market Market

- Myriad Genetics Inc

- Qiagen NV

- Quest Diagnostics Incorporated

- F Hoffmann-La Roche Ltd

- Eurofins Scientific

- Abbott Laboratories

- DiaSorin Spa (Luminex Corporation)

- BioRad Laboratories Inc

- Danaher Corporation

- 23&Me Inc

- PerkinElmer Inc

- Illumina Inc

Notable Milestones in Genetic Testing Market Sector

- June 2022: Prenetics Group Limited introduced ColoClear by Circle, a novel, non-invasive at-home screening test for detecting early signs of colorectal cancer.

- March 2022: Illumina launched a cancer test in Europe that checks for a wide range of tumor genes in one tissue sample, aiding in the matching of rare disease patients with treatment options.

In-Depth Genetic Testing Market Market Outlook

The future of the Genetic Testing Market is exceptionally promising, driven by the relentless pursuit of precision medicine and proactive healthcare. Growth accelerators such as advancements in AI for genomic data analysis, the increasing affordability of whole-genome sequencing, and the expanding role of companion diagnostics will solidify its position. Strategic opportunities lie in developing user-friendly platforms for broader consumer access and forging collaborations for large-scale genomic studies. The market is set to witness transformative innovations that will redefine disease prevention, diagnosis, and treatment, ultimately contributing to improved global health outcomes.

Genetic Testing Market Segmentation

-

1. Type

- 1.1. Carrier Testing

- 1.2. Diagnostic Testing

- 1.3. New-born Screening

- 1.4. Predictive and Presymptomatic Testing

- 1.5. Prenatal Testing

- 1.6. Other Types

-

2. Disease

- 2.1. Alzheimer's Disease

- 2.2. Cancer

- 2.3. Cystic Fibrosis

- 2.4. Sickle Cell Anemia

- 2.5. Duchenne Muscular Dystrophy

- 2.6. Thalassemia

- 2.7. Huntington's Disease

- 2.8. Rare Diseases

- 2.9. Other Diseases

-

3. Technology

- 3.1. Cytogenetic Testing

- 3.2. Biochemical Testing

- 3.3. Molecular Testing

Genetic Testing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Genetic Testing Market Regional Market Share

Geographic Coverage of Genetic Testing Market

Genetic Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Emphasis on Early Disease Detection and Prevention; Growing Demand for Personalized Medicine; Increasing Application of Genetic Testing in Oncology

- 3.3. Market Restrains

- 3.3.1. High Costs of Genetic Testing; Social and Ethical Implications of Genetic Testing

- 3.4. Market Trends

- 3.4.1. Cancer is Expected to Witness Strong Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Genetic Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Carrier Testing

- 5.1.2. Diagnostic Testing

- 5.1.3. New-born Screening

- 5.1.4. Predictive and Presymptomatic Testing

- 5.1.5. Prenatal Testing

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Disease

- 5.2.1. Alzheimer's Disease

- 5.2.2. Cancer

- 5.2.3. Cystic Fibrosis

- 5.2.4. Sickle Cell Anemia

- 5.2.5. Duchenne Muscular Dystrophy

- 5.2.6. Thalassemia

- 5.2.7. Huntington's Disease

- 5.2.8. Rare Diseases

- 5.2.9. Other Diseases

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Cytogenetic Testing

- 5.3.2. Biochemical Testing

- 5.3.3. Molecular Testing

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Genetic Testing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Carrier Testing

- 6.1.2. Diagnostic Testing

- 6.1.3. New-born Screening

- 6.1.4. Predictive and Presymptomatic Testing

- 6.1.5. Prenatal Testing

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Disease

- 6.2.1. Alzheimer's Disease

- 6.2.2. Cancer

- 6.2.3. Cystic Fibrosis

- 6.2.4. Sickle Cell Anemia

- 6.2.5. Duchenne Muscular Dystrophy

- 6.2.6. Thalassemia

- 6.2.7. Huntington's Disease

- 6.2.8. Rare Diseases

- 6.2.9. Other Diseases

- 6.3. Market Analysis, Insights and Forecast - by Technology

- 6.3.1. Cytogenetic Testing

- 6.3.2. Biochemical Testing

- 6.3.3. Molecular Testing

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Genetic Testing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Carrier Testing

- 7.1.2. Diagnostic Testing

- 7.1.3. New-born Screening

- 7.1.4. Predictive and Presymptomatic Testing

- 7.1.5. Prenatal Testing

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Disease

- 7.2.1. Alzheimer's Disease

- 7.2.2. Cancer

- 7.2.3. Cystic Fibrosis

- 7.2.4. Sickle Cell Anemia

- 7.2.5. Duchenne Muscular Dystrophy

- 7.2.6. Thalassemia

- 7.2.7. Huntington's Disease

- 7.2.8. Rare Diseases

- 7.2.9. Other Diseases

- 7.3. Market Analysis, Insights and Forecast - by Technology

- 7.3.1. Cytogenetic Testing

- 7.3.2. Biochemical Testing

- 7.3.3. Molecular Testing

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Genetic Testing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Carrier Testing

- 8.1.2. Diagnostic Testing

- 8.1.3. New-born Screening

- 8.1.4. Predictive and Presymptomatic Testing

- 8.1.5. Prenatal Testing

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Disease

- 8.2.1. Alzheimer's Disease

- 8.2.2. Cancer

- 8.2.3. Cystic Fibrosis

- 8.2.4. Sickle Cell Anemia

- 8.2.5. Duchenne Muscular Dystrophy

- 8.2.6. Thalassemia

- 8.2.7. Huntington's Disease

- 8.2.8. Rare Diseases

- 8.2.9. Other Diseases

- 8.3. Market Analysis, Insights and Forecast - by Technology

- 8.3.1. Cytogenetic Testing

- 8.3.2. Biochemical Testing

- 8.3.3. Molecular Testing

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Genetic Testing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Carrier Testing

- 9.1.2. Diagnostic Testing

- 9.1.3. New-born Screening

- 9.1.4. Predictive and Presymptomatic Testing

- 9.1.5. Prenatal Testing

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Disease

- 9.2.1. Alzheimer's Disease

- 9.2.2. Cancer

- 9.2.3. Cystic Fibrosis

- 9.2.4. Sickle Cell Anemia

- 9.2.5. Duchenne Muscular Dystrophy

- 9.2.6. Thalassemia

- 9.2.7. Huntington's Disease

- 9.2.8. Rare Diseases

- 9.2.9. Other Diseases

- 9.3. Market Analysis, Insights and Forecast - by Technology

- 9.3.1. Cytogenetic Testing

- 9.3.2. Biochemical Testing

- 9.3.3. Molecular Testing

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Genetic Testing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Carrier Testing

- 10.1.2. Diagnostic Testing

- 10.1.3. New-born Screening

- 10.1.4. Predictive and Presymptomatic Testing

- 10.1.5. Prenatal Testing

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Disease

- 10.2.1. Alzheimer's Disease

- 10.2.2. Cancer

- 10.2.3. Cystic Fibrosis

- 10.2.4. Sickle Cell Anemia

- 10.2.5. Duchenne Muscular Dystrophy

- 10.2.6. Thalassemia

- 10.2.7. Huntington's Disease

- 10.2.8. Rare Diseases

- 10.2.9. Other Diseases

- 10.3. Market Analysis, Insights and Forecast - by Technology

- 10.3.1. Cytogenetic Testing

- 10.3.2. Biochemical Testing

- 10.3.3. Molecular Testing

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Myriad Genetics Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Qiagen NV*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Quest Diagnostics Incorporated

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 F Hoffmann-La Roche Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eurofins Scientific

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Abbott Laboratories

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DiaSorin Spa (Luminex Corporation)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BioRad Laboratories Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Danaher Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 23&Me Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PerkinElmer Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Illumina Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Myriad Genetics Inc

List of Figures

- Figure 1: Global Genetic Testing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Genetic Testing Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Genetic Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Genetic Testing Market Revenue (Million), by Disease 2025 & 2033

- Figure 5: North America Genetic Testing Market Revenue Share (%), by Disease 2025 & 2033

- Figure 6: North America Genetic Testing Market Revenue (Million), by Technology 2025 & 2033

- Figure 7: North America Genetic Testing Market Revenue Share (%), by Technology 2025 & 2033

- Figure 8: North America Genetic Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Genetic Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Genetic Testing Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Genetic Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Genetic Testing Market Revenue (Million), by Disease 2025 & 2033

- Figure 13: Europe Genetic Testing Market Revenue Share (%), by Disease 2025 & 2033

- Figure 14: Europe Genetic Testing Market Revenue (Million), by Technology 2025 & 2033

- Figure 15: Europe Genetic Testing Market Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Europe Genetic Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Genetic Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Genetic Testing Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Genetic Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Genetic Testing Market Revenue (Million), by Disease 2025 & 2033

- Figure 21: Asia Pacific Genetic Testing Market Revenue Share (%), by Disease 2025 & 2033

- Figure 22: Asia Pacific Genetic Testing Market Revenue (Million), by Technology 2025 & 2033

- Figure 23: Asia Pacific Genetic Testing Market Revenue Share (%), by Technology 2025 & 2033

- Figure 24: Asia Pacific Genetic Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Genetic Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Genetic Testing Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Genetic Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Genetic Testing Market Revenue (Million), by Disease 2025 & 2033

- Figure 29: Middle East and Africa Genetic Testing Market Revenue Share (%), by Disease 2025 & 2033

- Figure 30: Middle East and Africa Genetic Testing Market Revenue (Million), by Technology 2025 & 2033

- Figure 31: Middle East and Africa Genetic Testing Market Revenue Share (%), by Technology 2025 & 2033

- Figure 32: Middle East and Africa Genetic Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Genetic Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Genetic Testing Market Revenue (Million), by Type 2025 & 2033

- Figure 35: South America Genetic Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: South America Genetic Testing Market Revenue (Million), by Disease 2025 & 2033

- Figure 37: South America Genetic Testing Market Revenue Share (%), by Disease 2025 & 2033

- Figure 38: South America Genetic Testing Market Revenue (Million), by Technology 2025 & 2033

- Figure 39: South America Genetic Testing Market Revenue Share (%), by Technology 2025 & 2033

- Figure 40: South America Genetic Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Genetic Testing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Genetic Testing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Genetic Testing Market Revenue Million Forecast, by Disease 2020 & 2033

- Table 3: Global Genetic Testing Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Global Genetic Testing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Genetic Testing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Genetic Testing Market Revenue Million Forecast, by Disease 2020 & 2033

- Table 7: Global Genetic Testing Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 8: Global Genetic Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Genetic Testing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Genetic Testing Market Revenue Million Forecast, by Disease 2020 & 2033

- Table 14: Global Genetic Testing Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 15: Global Genetic Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Genetic Testing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Genetic Testing Market Revenue Million Forecast, by Disease 2020 & 2033

- Table 24: Global Genetic Testing Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 25: Global Genetic Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Genetic Testing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Genetic Testing Market Revenue Million Forecast, by Disease 2020 & 2033

- Table 34: Global Genetic Testing Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 35: Global Genetic Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: GCC Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Genetic Testing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 40: Global Genetic Testing Market Revenue Million Forecast, by Disease 2020 & 2033

- Table 41: Global Genetic Testing Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 42: Global Genetic Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Brazil Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Argentina Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Genetic Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Genetic Testing Market?

The projected CAGR is approximately 10.81%.

2. Which companies are prominent players in the Genetic Testing Market?

Key companies in the market include Myriad Genetics Inc, Qiagen NV*List Not Exhaustive, Quest Diagnostics Incorporated, F Hoffmann-La Roche Ltd, Eurofins Scientific, Abbott Laboratories, DiaSorin Spa (Luminex Corporation), BioRad Laboratories Inc, Danaher Corporation, 23&Me Inc, PerkinElmer Inc, Illumina Inc.

3. What are the main segments of the Genetic Testing Market?

The market segments include Type, Disease, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Emphasis on Early Disease Detection and Prevention; Growing Demand for Personalized Medicine; Increasing Application of Genetic Testing in Oncology.

6. What are the notable trends driving market growth?

Cancer is Expected to Witness Strong Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

High Costs of Genetic Testing; Social and Ethical Implications of Genetic Testing.

8. Can you provide examples of recent developments in the market?

June 2022: Prenetics Group Limited, one of the leaders in genomic and diagnostic testing, introduced a novel, non-invasive at-home screening test, ColoClear by Circle (ColoClear), for detecting early signs of colorectal cancer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Genetic Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Genetic Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Genetic Testing Market?

To stay informed about further developments, trends, and reports in the Genetic Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence