Key Insights

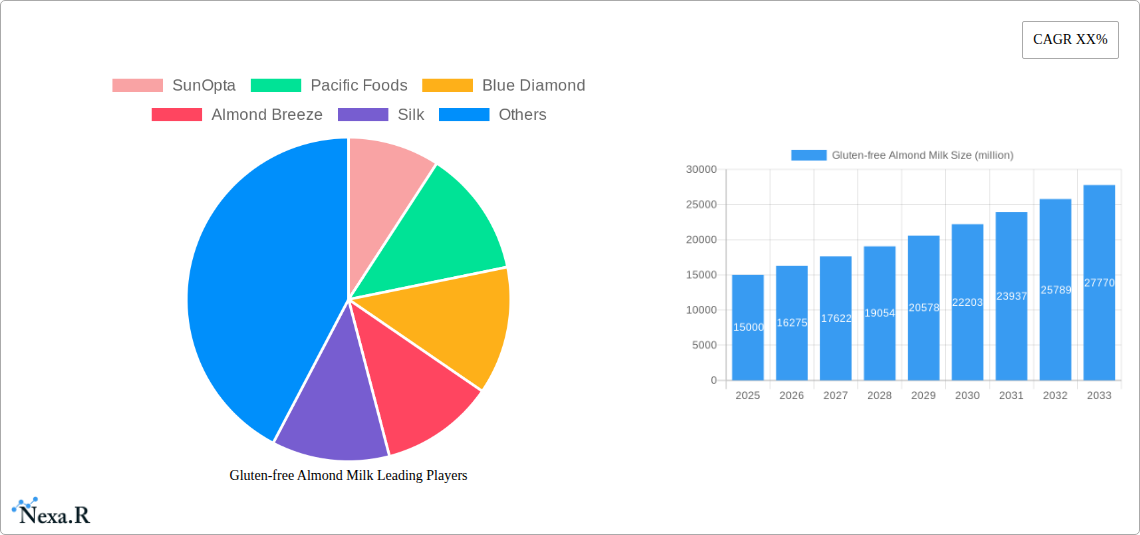

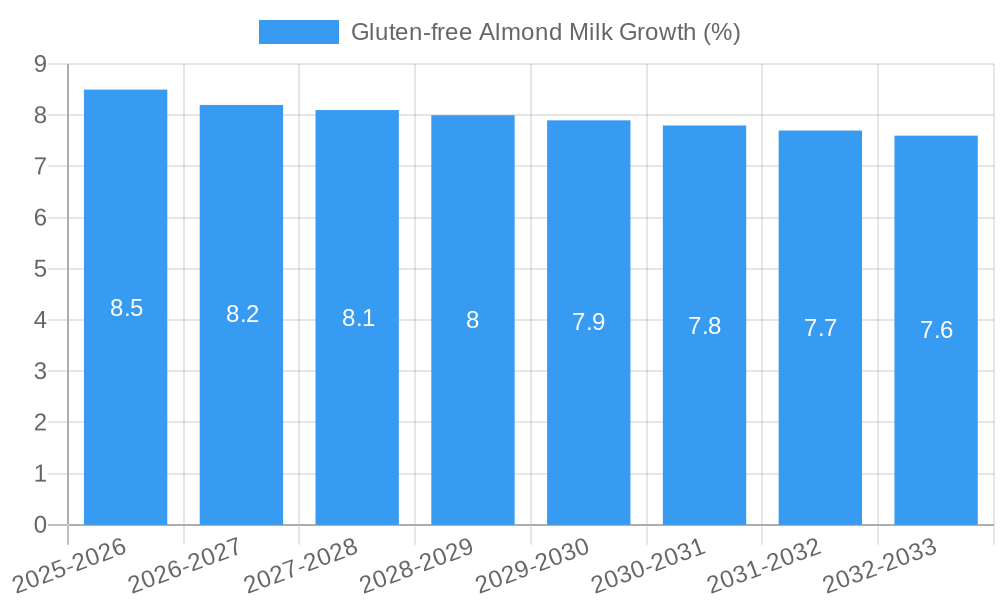

The global gluten-free almond milk market is experiencing robust expansion, driven by increasing health consciousness, a rising prevalence of lactose intolerance and celiac disease, and a growing consumer preference for plant-based alternatives. The market, valued at an estimated $15,000 million in 2025, is projected to witness a compound annual growth rate (CAGR) of approximately 8.5% during the forecast period of 2025-2033. This growth is fueled by the versatility of almond milk, its perceived health benefits including lower cholesterol and calorie content compared to dairy milk, and continuous product innovation by key players. The demand is further bolstered by the "free-from" trend, where consumers actively seek products free from gluten, dairy, and other common allergens. This trend is particularly strong in developed economies but is rapidly gaining traction in emerging markets as awareness and accessibility increase.

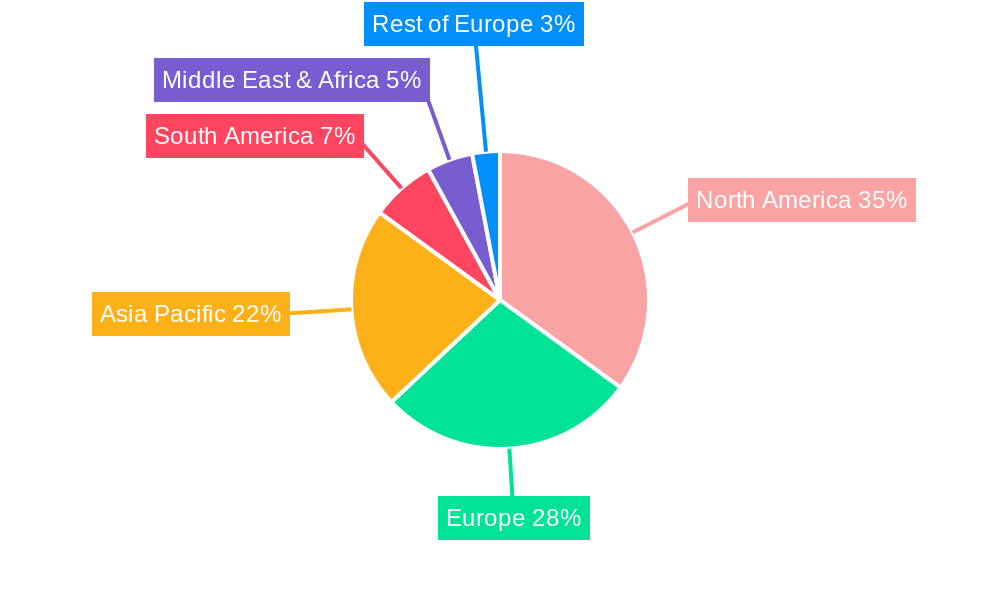

The market is segmented into "Drink Directly" and "Indirect Processing" applications, with "Drink Directly" holding a dominant share due to its convenience. In terms of packaging, both rigid and flexible packaging segments are significant, catering to different consumer needs for shelf life and portability. Geographically, North America currently leads the market, supported by a well-established plant-based beverage industry and high consumer adoption rates. However, the Asia Pacific region is anticipated to exhibit the fastest growth, driven by a burgeoning middle class, increasing disposable incomes, and a growing awareness of Western dietary trends and health benefits. Restrains such as the higher cost of almond milk compared to conventional dairy milk and potential environmental concerns related to almond cultivation are being addressed through technological advancements and sustainable sourcing practices, further solidifying the market's upward trajectory.

This in-depth report provides a panoramic view of the global Gluten-Free Almond Milk market, meticulously analyzing its dynamics, growth trajectories, and future potential. Spanning from historical trends (2019-2024) to forward-looking projections (2025-2033), this study is an indispensable resource for industry professionals, investors, and stakeholders seeking to understand market intricacies, identify growth avenues, and navigate competitive landscapes. We delve into critical market segments, application-wise analysis, packaging innovations, and the overarching influence of consumer behavior and regulatory shifts.

Gluten-free Almond Milk Market Dynamics & Structure

The global Gluten-Free Almond Milk market exhibits a moderately consolidated structure, with a few dominant players and a significant number of regional and niche manufacturers. Technological innovation is a key driver, particularly in enhancing almond milk's texture, shelf-life, and flavor profiles, alongside the development of more sustainable sourcing and production methods. Regulatory frameworks are evolving, with increasing emphasis on clear labeling for allergens and nutritional content, impacting product development and market access. Competitive product substitutes are plentiful, ranging from other plant-based milks (soy, oat, coconut) to dairy milk, creating a dynamic competitive environment. End-user demographics are shifting, with a growing segment of health-conscious consumers, individuals with lactose intolerance or gluten sensitivities, and vegans driving demand. Mergers and acquisitions (M&A) activity, while not at an extreme level, is present as larger companies seek to expand their plant-based portfolios and gain market share.

- Market Concentration: Dominated by key players, but with room for smaller innovators.

- Technological Innovation Drivers: Improved taste, texture, fortification, and sustainable sourcing.

- Regulatory Frameworks: Focus on allergen labeling, nutritional transparency, and plant-based claims.

- Competitive Product Substitutes: Dairy milk, soy milk, oat milk, coconut milk, cashew milk.

- End-User Demographics: Health-conscious, lactose-intolerant, gluten-sensitive, vegan consumers.

- M&A Trends: Strategic acquisitions to expand product offerings and market reach.

Gluten-free Almond Milk Growth Trends & Insights

The Gluten-Free Almond Milk market is poised for robust growth, driven by a confluence of escalating consumer health awareness, a rising prevalence of dietary restrictions, and the expanding appeal of plant-based alternatives. Market size evolution is projected to witness a significant upward trajectory. The adoption rates of gluten-free almond milk are accelerating across developed and emerging economies, propelled by greater product availability and a broader understanding of its benefits. Technological disruptions, such as advancements in almond cultivation, extraction processes, and formulation science, are continually enhancing product quality and affordability. Consumer behavior shifts are paramount; there's a discernible move away from traditional dairy products towards plant-based options for perceived health benefits, ethical considerations, and environmental sustainability. This paradigm shift is further amplified by the increasing awareness and diagnosis of celiac disease and gluten intolerance, creating a dedicated and growing consumer base. The CAGR for the forecast period is estimated to be robust, reflecting sustained demand. Market penetration is expected to deepen, not only in established markets but also in regions where plant-based diets are gaining traction. Innovations in fortified almond milk, offering enhanced nutritional profiles (e.g., added calcium, Vitamin D, B12), are also contributing to increased consumption and market expansion. The market's growth is a testament to its ability to adapt and cater to evolving consumer needs and preferences, solidifying its position as a leading plant-based beverage.

Dominant Regions, Countries, or Segments in Gluten-free Almond Milk

The Application: Drink Directly segment is the dominant force driving market growth in the Gluten-Free Almond Milk industry. This segment's leadership is primarily attributed to the inherent convenience and widespread consumer preference for ready-to-drink beverages. As consumers increasingly prioritize on-the-go consumption and seek quick, nutritious options, almond milk consumed directly emerges as a top choice. This is further fueled by its appeal as a healthier alternative to sugary drinks and its suitability for various dietary needs. The Indirect Processing segment, while significant, trails behind as the direct consumption trend takes precedence.

North America, particularly the United States, currently represents the leading region in the Gluten-Free Almond Milk market. This dominance is underpinned by several factors, including a highly health-conscious consumer base, a strong awareness of gluten intolerance and celiac disease, and a well-established infrastructure for plant-based product distribution. High disposable incomes and a proactive approach to dietary trends further bolster the market in this region.

Within the Types: Rigid Packaging segment, carton-based and PET bottles hold a significant market share. The preference for rigid packaging is driven by its ability to ensure product integrity, extend shelf life, and provide a premium perceived value, which is crucial for brand differentiation in a competitive market.

- Leading Application: Drink Directly, due to convenience and widespread consumer appeal.

- Dominant Region: North America (specifically the United States), owing to health consciousness and dietary trend adoption.

- Key Drivers in Dominant Region: High disposable income, awareness of gluten sensitivity, robust distribution networks.

- Dominant Packaging Type: Rigid Packaging (cartons, PET bottles) for product preservation and premium appeal.

- Growth Potential: Significant opportunities exist in emerging markets in Asia-Pacific and Latin America as awareness and adoption of plant-based diets increase.

Gluten-free Almond Milk Product Landscape

The Gluten-Free Almond Milk product landscape is characterized by continuous innovation focused on enhancing taste, texture, and nutritional value. Manufacturers are developing unsweetened varieties, flavored options (vanilla, chocolate), and fortified versions with essential vitamins and minerals like calcium and Vitamin D to appeal to a wider consumer base. Innovations also extend to improved mouthfeel and reduced separation. Unique selling propositions often revolve around sustainability, organic sourcing, and allergen-free claims. Technological advancements in extraction and filtration are crucial for creating smoother, creamier textures that closely mimic dairy milk, thereby improving consumer acceptance and widening application possibilities.

Key Drivers, Barriers & Challenges in Gluten-free Almond Milk

The Gluten-Free Almond Milk market is propelled by several key drivers. Increasing consumer awareness of health and wellness, coupled with a rising incidence of lactose intolerance and gluten sensitivities, fuels demand. The growing vegan and flexitarian population, driven by ethical and environmental concerns, also contributes significantly. Furthermore, product innovation, including the development of enhanced nutritional profiles and improved taste, broadens consumer appeal.

- Technological Drivers: Advancements in processing for better taste and texture, fortification techniques.

- Economic Drivers: Growing disposable incomes, increasing affordability of plant-based alternatives.

- Policy-Driven Factors: Clearer labeling regulations benefiting allergen-conscious consumers.

Key challenges and restraints include the high cost of almond cultivation and water usage concerns, which can impact pricing and sustainability perceptions. Competition from other plant-based milk alternatives and traditional dairy milk remains intense. Supply chain volatility and potential shortages of raw almonds can affect availability and pricing. Regulatory hurdles related to labeling claims and production standards can also pose challenges.

- Supply Chain Issues: Volatility in almond availability and pricing.

- Regulatory Hurdles: Stringent labeling requirements and evolving standards.

- Competitive Pressures: Intense competition from other plant-based and dairy beverages.

- Environmental Concerns: Water usage in almond cultivation.

Emerging Opportunities in Gluten-free Almond Milk

Emerging opportunities in the Gluten-Free Almond Milk market lie in the expansion of unsweetened and low-sugar variants to cater to the growing health-conscious segment. Untapped markets in Asia-Pacific and Latin America present significant growth potential as awareness of plant-based diets and dietary restrictions rises. Innovative applications, such as almond milk bases for dairy-free yogurts, cheeses, and desserts, offer new avenues for market penetration. Evolving consumer preferences for minimalist ingredient lists and sustainable packaging also present opportunities for brands that prioritize these aspects.

Growth Accelerators in the Gluten-free Almond Milk Industry

Catalysts driving long-term growth in the Gluten-Free Almond Milk industry include significant advancements in almond processing technologies that enhance taste, texture, and shelf-life, making the product more appealing to a broader consumer base. Strategic partnerships between almond milk producers and food manufacturers are expanding the product's integration into various food categories, thereby increasing consumption occasions. Market expansion strategies, particularly focusing on emerging economies where the demand for plant-based alternatives is nascent but growing rapidly, are crucial growth accelerators. Furthermore, continuous product diversification, such as the introduction of specialized formulations for specific dietary needs or enhanced nutritional benefits, will continue to fuel market expansion.

Key Players Shaping the Gluten-free Almond Milk Market

- SunOpta

- Pacific Foods

- Blue Diamond

- Almond Breeze

- Silk

- Milk Lab

- Isola Bio

- The Bridge

- Kite Hill

- Califia Farms

- Zen

- Kirkland

Notable Milestones in Gluten-free Almond Milk Sector

- 2019: Increased consumer demand for plant-based alternatives leads to expanded product lines and distribution for major players.

- 2020: Focus on fortified almond milk grows, with new products offering enhanced Vitamin D and Calcium.

- 2021: Innovations in processing technologies improve the taste and texture of almond milk, making it more competitive with dairy.

- 2022: Growing awareness of environmental sustainability drives demand for almond milk sourced from sustainable farms.

- 2023: Several companies launch unsweetened and low-sugar almond milk varieties in response to health trends.

- 2024: Increased M&A activity as larger food conglomerates seek to strengthen their plant-based portfolios.

In-Depth Gluten-free Almond Milk Market Outlook

The future outlook for the Gluten-Free Almond Milk market is exceptionally positive, driven by sustained consumer preference for healthier, plant-based, and allergen-friendly options. Growth accelerators such as ongoing product innovation, the expansion of product applications beyond beverages, and the increasing penetration into emerging markets will solidify its market position. Strategic alliances and a continued focus on sustainability and nutritional enhancement will further fuel this upward trajectory, presenting lucrative opportunities for market participants.

Gluten-free Almond Milk Segmentation

-

1. Application

- 1.1. Drink Directly

- 1.2. Indirect Processing

-

2. Types

- 2.1. Rigid Packaging

- 2.2. Flexible Packaging

Gluten-free Almond Milk Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Gluten-free Almond Milk REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gluten-free Almond Milk Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Drink Directly

- 5.1.2. Indirect Processing

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Rigid Packaging

- 5.2.2. Flexible Packaging

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Gluten-free Almond Milk Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Drink Directly

- 6.1.2. Indirect Processing

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Rigid Packaging

- 6.2.2. Flexible Packaging

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Gluten-free Almond Milk Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Drink Directly

- 7.1.2. Indirect Processing

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Rigid Packaging

- 7.2.2. Flexible Packaging

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Gluten-free Almond Milk Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Drink Directly

- 8.1.2. Indirect Processing

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Rigid Packaging

- 8.2.2. Flexible Packaging

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Gluten-free Almond Milk Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Drink Directly

- 9.1.2. Indirect Processing

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Rigid Packaging

- 9.2.2. Flexible Packaging

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Gluten-free Almond Milk Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Drink Directly

- 10.1.2. Indirect Processing

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Rigid Packaging

- 10.2.2. Flexible Packaging

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 SunOpta

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pacific Foods

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Blue Diamond

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Almond Breeze

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Silk

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Milk Lab

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Isola Bio

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Bridge

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kite Hill

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Califia Farms

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zen

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Kirkland

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 SunOpta

List of Figures

- Figure 1: Global Gluten-free Almond Milk Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Gluten-free Almond Milk Revenue (million), by Application 2024 & 2032

- Figure 3: North America Gluten-free Almond Milk Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Gluten-free Almond Milk Revenue (million), by Types 2024 & 2032

- Figure 5: North America Gluten-free Almond Milk Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Gluten-free Almond Milk Revenue (million), by Country 2024 & 2032

- Figure 7: North America Gluten-free Almond Milk Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Gluten-free Almond Milk Revenue (million), by Application 2024 & 2032

- Figure 9: South America Gluten-free Almond Milk Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Gluten-free Almond Milk Revenue (million), by Types 2024 & 2032

- Figure 11: South America Gluten-free Almond Milk Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Gluten-free Almond Milk Revenue (million), by Country 2024 & 2032

- Figure 13: South America Gluten-free Almond Milk Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Gluten-free Almond Milk Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Gluten-free Almond Milk Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Gluten-free Almond Milk Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Gluten-free Almond Milk Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Gluten-free Almond Milk Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Gluten-free Almond Milk Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Gluten-free Almond Milk Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Gluten-free Almond Milk Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Gluten-free Almond Milk Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Gluten-free Almond Milk Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Gluten-free Almond Milk Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Gluten-free Almond Milk Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Gluten-free Almond Milk Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Gluten-free Almond Milk Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Gluten-free Almond Milk Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Gluten-free Almond Milk Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Gluten-free Almond Milk Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Gluten-free Almond Milk Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Gluten-free Almond Milk Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Gluten-free Almond Milk Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Gluten-free Almond Milk Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Gluten-free Almond Milk Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Gluten-free Almond Milk Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Gluten-free Almond Milk Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Gluten-free Almond Milk Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Gluten-free Almond Milk Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Gluten-free Almond Milk Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Gluten-free Almond Milk Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Gluten-free Almond Milk Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Gluten-free Almond Milk Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Gluten-free Almond Milk Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Gluten-free Almond Milk Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Gluten-free Almond Milk Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Gluten-free Almond Milk Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Gluten-free Almond Milk Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Gluten-free Almond Milk Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Gluten-free Almond Milk Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Gluten-free Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gluten-free Almond Milk?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Gluten-free Almond Milk?

Key companies in the market include SunOpta, Pacific Foods, Blue Diamond, Almond Breeze, Silk, Milk Lab, Isola Bio, The Bridge, Kite Hill, Califia Farms, Zen, Kirkland.

3. What are the main segments of the Gluten-free Almond Milk?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gluten-free Almond Milk," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gluten-free Almond Milk report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gluten-free Almond Milk?

To stay informed about further developments, trends, and reports in the Gluten-free Almond Milk, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence