Key Insights

The South American weight management market, including meal replacements, beverages, and supplements, is poised for significant expansion. Projected at a Compound Annual Growth Rate (CAGR) of 8.3%, the market is valued at $163.13 billion in the base year of 2024 and is expected to grow substantially through 2033. Key drivers include escalating consumer health awareness, rising obesity rates, and a growing demand for convenient, effective weight management solutions. Diverse product availability across channels like hypermarkets, convenience stores, and particularly robust online retail, further fuels this growth. Brazil and Argentina are identified as major market contributors. Potential challenges include regulatory considerations for supplements and economic volatility impacting consumer expenditure. The competitive environment features global leaders such as Nestlé and Herbalife, alongside specialized brands. The market is segmented by product type and distribution channel, with online retail anticipated to be a dominant growth area due to increasing internet access and home delivery preferences.

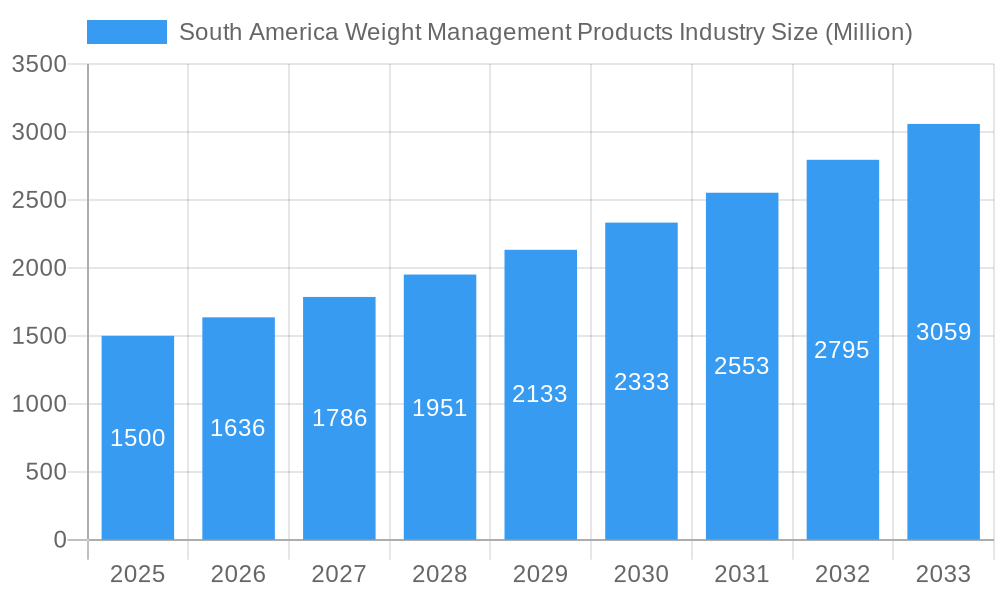

South America Weight Management Products Industry Market Size (In Billion)

The forecast period, 2025-2033, indicates sustained market growth driven by product innovation focusing on natural ingredients, personalized solutions, and superior efficacy. Strategic marketing and branding will be critical for market penetration in this competitive landscape. The ongoing trend towards healthier lifestyles and preventative healthcare will support long-term market expansion. Companies will likely prioritize research and development to address consumer concerns regarding safety, efficacy, and sustainability.

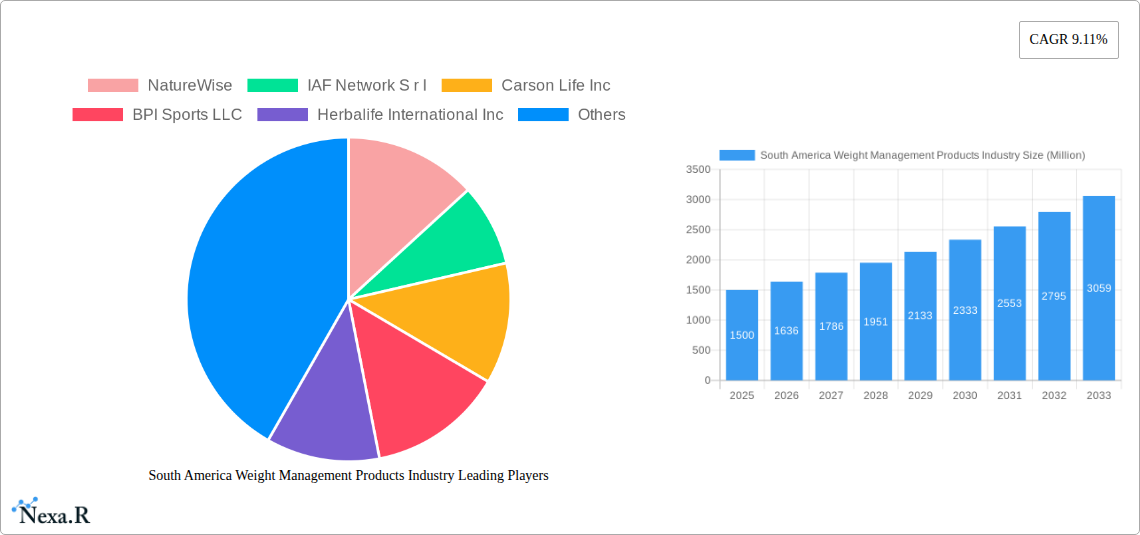

South America Weight Management Products Industry Company Market Share

South America Weight Management Products Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America weight management products industry, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the year 2025. It segments the market by product type (Meal Replacements, Beverages, Supplements) and distribution channel (Hypermarkets/Supermarkets, Convenience Stores, Online Retail Stores, Other Distribution Channels), offering granular insights for strategic decision-making. The report is essential for industry professionals, investors, and anyone seeking a detailed understanding of this dynamic market.

South America Weight Management Products Industry Market Dynamics & Structure

The South American weight management products market is characterized by moderate concentration, with several large multinational corporations alongside numerous regional and local players. Market growth is driven by rising health consciousness, increasing obesity rates, and growing adoption of convenient weight management solutions. Technological innovations, such as personalized nutrition plans and advanced supplement formulations, are key drivers. Regulatory frameworks regarding labeling and ingredient safety vary across countries, presenting both challenges and opportunities. Competitive substitutes include traditional dieting methods and medical interventions. The end-user demographic is broad, spanning various age groups and socioeconomic strata, with a strong focus on the urban middle class. M&A activity has been notable, with strategic acquisitions aimed at expanding product portfolios and market reach (e.g., Nestlé's acquisition of Puravida).

- Market Concentration: Moderately concentrated, with a xx% market share held by the top 5 players in 2025.

- Technological Innovation: Strong emphasis on personalized nutrition, digital health solutions, and advanced ingredient formulations.

- Regulatory Framework: Varies across countries, impacting product labeling, ingredient approvals, and marketing claims.

- Competitive Substitutes: Traditional dieting, medical weight loss procedures, and alternative health approaches.

- End-User Demographics: Primarily urban middle-class consumers, with increasing adoption across various age groups.

- M&A Activity: xx deals recorded between 2019-2024, indicating strategic consolidation within the industry.

South America Weight Management Products Industry Growth Trends & Insights

The South American weight management products market experienced significant growth between 2019 and 2024, driven by factors such as rising disposable incomes, increased health awareness, and the growing prevalence of obesity and related health issues. The market size is estimated to reach xx million units in 2025, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. Technological disruptions, particularly in digital health and personalized nutrition, are accelerating market penetration. Consumer behavior is shifting towards more convenient and science-backed solutions, fueling demand for ready-to-consume products and supplements with proven efficacy. Online retail channels are experiencing rapid growth, driven by increased internet penetration and consumer preference for e-commerce. The adoption rate of weight management products is expected to increase further, driven by rising awareness campaigns and increasing accessibility.

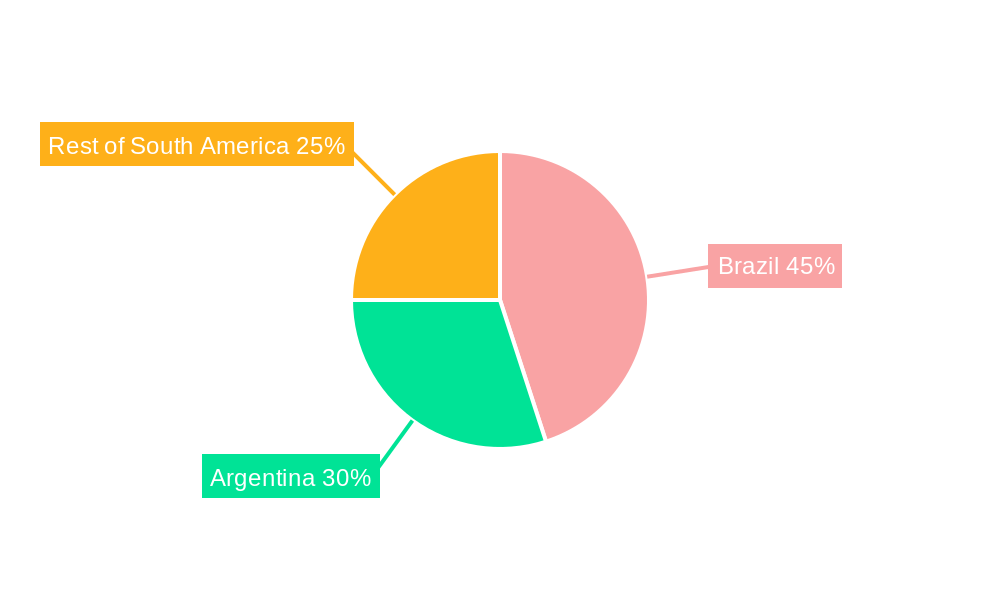

Dominant Regions, Countries, or Segments in South America Weight Management Products Industry

Brazil is the dominant market in South America for weight management products, driven by a large population, high obesity rates, and strong consumer spending on health and wellness products. Within Brazil, urban centers show higher adoption rates due to greater awareness and access to products. The Supplements segment holds the largest market share by type, followed by meal replacements and beverages. Online retail stores are experiencing the fastest growth in terms of distribution channels, driven by convenience and broader product availability.

- Key Drivers in Brazil: High obesity rates, rising disposable incomes, and growing health consciousness.

- Key Drivers in Supplements Segment: Perceived efficacy, convenience, and the wide range of available options.

- Key Drivers in Online Retail: Enhanced convenience, wider product selection, and competitive pricing.

South America Weight Management Products Industry Product Landscape

The South American weight management product landscape is diverse, encompassing meal replacements, beverages, and supplements with varying formulations and functionalities. Innovation focuses on personalized nutrition, natural ingredients, and scientifically-backed formulations. Many products emphasize convenience and taste, catering to consumer preferences. Key innovations include the use of novel ingredients, such as the prickly pear cactus fiber featured in a Herbalife product, and technologically advanced delivery systems. The market also shows a trend towards functional foods and beverages that incorporate weight management benefits.

Key Drivers, Barriers & Challenges in South America Weight Management Products Industry

Key Drivers:

- Rising obesity and related health concerns.

- Growing health consciousness and demand for wellness solutions.

- Increasing disposable incomes in key markets.

- Technological advancements in personalized nutrition.

- Expanding e-commerce channels.

Key Challenges and Restraints:

- Regulatory hurdles and variations in labeling requirements across countries.

- Price sensitivity and affordability concerns among certain segments of the population.

- Competition from traditional dieting methods and medical interventions.

- Supply chain disruptions and volatility in raw material prices.

- Counterfeit products and quality control issues.

Emerging Opportunities in South America Weight Management Products Industry

Significant growth potential exists in untapped markets within South America, specifically in rural areas with increasing access to information and distribution channels. The market presents an opportunity for specialized products targeting niche demographics (e.g., athletes, specific age groups). Innovation in natural and organic weight management solutions, personalized nutrition plans through digital platforms, and functional foods with proven health benefits present strong opportunities.

Growth Accelerators in the South America Weight Management Products Industry

Long-term growth will be accelerated by strategic partnerships between industry players and healthcare providers, expansion into underserved markets through e-commerce, and advancements in personalized nutrition based on genetic information and lifestyle factors. Further technological breakthroughs in supplement formulations and delivery systems will also be key drivers, alongside the continued rise in health consciousness and preventative healthcare among consumers.

Key Players Shaping the South America Weight Management Products Market

- NatureWise

- IAF Network S r l

- Carson Life Inc

- BPI Sports LLC

- Herbalife International Inc

- Nestle SA

- The Hut com Limited (Myprotein)

- Ultimate Nutrition inc

- N V Perricone LLC

- California Medical Weight Management LLC

Notable Milestones in South America Weight Management Products Industry Sector

- May 2022: Nestlé Health Science acquires Puravida in Brazil, expanding its presence in the dietary supplements market.

- July 2022: Herbalife launches a new weight management product featuring prickly pear cactus fiber, backed by clinical trials.

- April 2023: Herbalife unveils 106 innovative wellness products globally, including in Brazil, focusing on various aspects of well-being including weight management.

In-Depth South America Weight Management Products Industry Market Outlook

The South American weight management products market is poised for robust growth in the coming years, fueled by sustained increases in health consciousness, rising disposable incomes, and the continuing penetration of e-commerce. Strategic opportunities lie in developing innovative, science-backed products, expanding into less-penetrated regions, and leveraging digital technologies to provide personalized nutrition guidance. The focus on natural ingredients and sustainable practices will be crucial for success. The market offers substantial potential for both established players and new entrants focused on innovation and consumer-centric approaches.

South America Weight Management Products Industry Segmentation

-

1. Type

- 1.1. Meal

- 1.2. Beverage

- 1.3. Supplements

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of the South America

South America Weight Management Products Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of the South America

South America Weight Management Products Industry Regional Market Share

Geographic Coverage of South America Weight Management Products Industry

South America Weight Management Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Obesity; Growing Number of Fitness Enthusiasts or Health-Conscious Consumers

- 3.3. Market Restrains

- 3.3.1. Penetration of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Rising Obesity Incidence and Weight Consciousness

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Weight Management Products Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Meal

- 5.1.2. Beverage

- 5.1.3. Supplements

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of the South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of the South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Weight Management Products Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Meal

- 6.1.2. Beverage

- 6.1.3. Supplements

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarkets/Supermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of the South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Weight Management Products Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Meal

- 7.1.2. Beverage

- 7.1.3. Supplements

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarkets/Supermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of the South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of the South America South America Weight Management Products Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Meal

- 8.1.2. Beverage

- 8.1.3. Supplements

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarkets/Supermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of the South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 NatureWise

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 IAF Network S r l

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Carson Life Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 BPI Sports LLC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Herbalife International Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Nestle SA*List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 The Hut com Limited (Myprotein)

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Ultimate Nutrition inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 N V Perricone LLC

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 California Medical Weight Management LLC

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 NatureWise

List of Figures

- Figure 1: South America Weight Management Products Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Weight Management Products Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Weight Management Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South America Weight Management Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: South America Weight Management Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Weight Management Products Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South America Weight Management Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: South America Weight Management Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: South America Weight Management Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: South America Weight Management Products Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: South America Weight Management Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: South America Weight Management Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: South America Weight Management Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South America Weight Management Products Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South America Weight Management Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: South America Weight Management Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: South America Weight Management Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Weight Management Products Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Weight Management Products Industry?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the South America Weight Management Products Industry?

Key companies in the market include NatureWise, IAF Network S r l, Carson Life Inc, BPI Sports LLC, Herbalife International Inc, Nestle SA*List Not Exhaustive, The Hut com Limited (Myprotein), Ultimate Nutrition inc, N V Perricone LLC, California Medical Weight Management LLC.

3. What are the main segments of the South America Weight Management Products Industry?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 163.13 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Obesity; Growing Number of Fitness Enthusiasts or Health-Conscious Consumers.

6. What are the notable trends driving market growth?

Rising Obesity Incidence and Weight Consciousness.

7. Are there any restraints impacting market growth?

Penetration of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

April 2023: Herbalife unveiled 106 innovative Wellness Products on a global scale, catering to a diverse audience spanning 95 markets where the company maintains a strong presence, including Brazil. These new product additions are strategically designed to address various facets of well-being, including nutrient supplementation, weight management, digestion, and other essential segments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Weight Management Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Weight Management Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Weight Management Products Industry?

To stay informed about further developments, trends, and reports in the South America Weight Management Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence