Key Insights

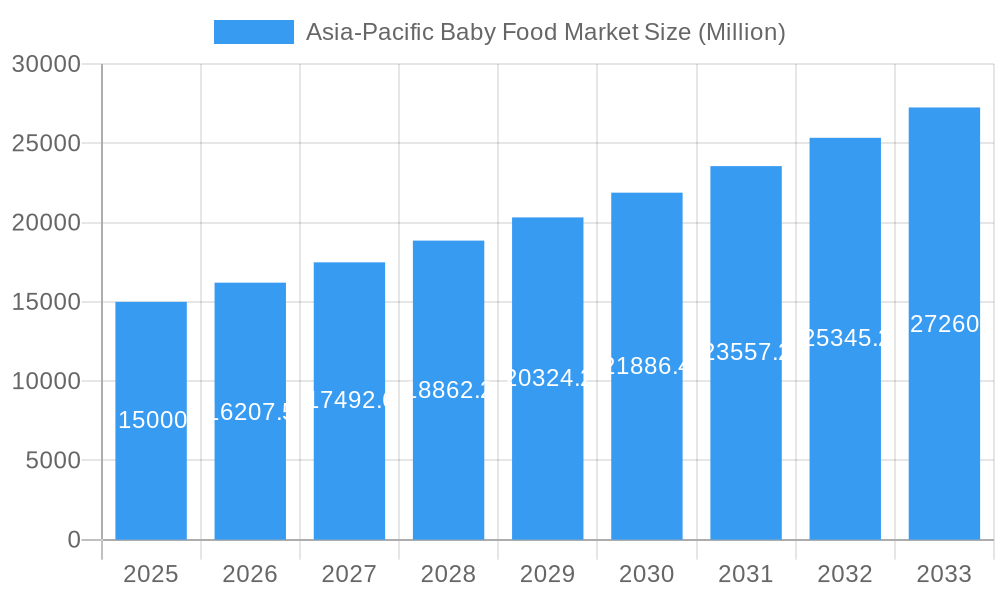

The Asia-Pacific baby food market is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 7.6% from the base year 2025. The market size is estimated at $77.13 billion, driven by increasing disposable incomes, urbanization, and a heightened focus on early childhood nutrition. Emerging economies like China and India are key contributors, with parents increasingly prioritizing premium, organic, and specialized infant nutrition. The market is segmented by product type (milk formula, dried baby food, prepared baby food) and distribution channel, with online retail emerging as a rapidly growing segment. Key players include global brands such as Nestle and Abbott Laboratories, alongside specialized regional providers, highlighting a dynamic and competitive landscape focused on product innovation and broader market reach.

Asia-Pacific Baby Food Market Market Size (In Billion)

Asia-Pacific Baby Food Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific baby food market, encompassing market dynamics, growth trends, regional performance, product landscape, and key players. The report covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering valuable insights for industry professionals, investors, and stakeholders. The market is segmented by distribution channel (hypermarkets/supermarkets, drugstores/pharmacies, convenience stores, online retail stores, other) and product type (milk formula, dried baby food, prepared baby food, other). The total market size is projected to reach xx Million units by 2033.

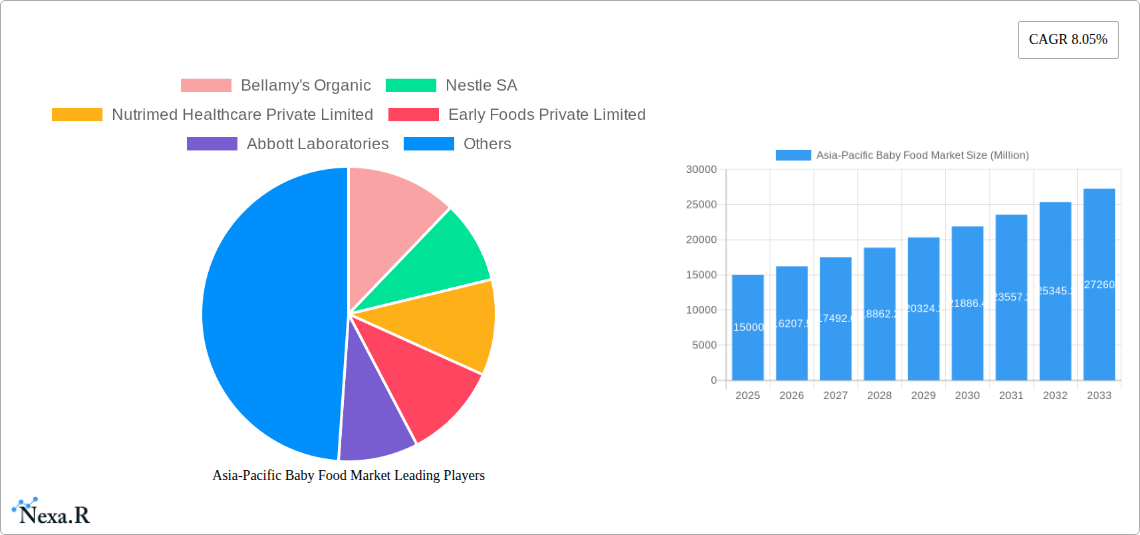

Asia-Pacific Baby Food Market Company Market Share

Asia-Pacific Baby Food Market Dynamics & Structure

The Asia-Pacific baby food market is characterized by a moderately concentrated landscape with several multinational corporations and regional players competing for market share. Technological innovation, particularly in areas like product formulation and packaging, is a key driver. Stringent regulatory frameworks concerning food safety and labeling influence product development and marketing strategies. The market also faces competition from homemade baby food and alternative nutritional choices. End-user demographics, including rising disposable incomes and changing parental preferences, significantly influence market growth. The past five years have seen a moderate level of mergers and acquisitions (M&A) activity, primarily focused on expanding product portfolios and geographic reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on organic, natural, and specialized formulas; innovative packaging for convenience and safety.

- Regulatory Framework: Stringent regulations concerning food safety, labeling, and marketing claims.

- Competitive Substitutes: Homemade baby food, alternative feeding methods.

- End-User Demographics: Rising middle class, increasing urbanization, and changing dietary preferences driving demand.

- M&A Trends: xx M&A deals recorded between 2019 and 2024, primarily focused on expanding product lines and market access.

Asia-Pacific Baby Food Market Growth Trends & Insights

The Asia-Pacific baby food market has witnessed significant growth over the past five years, driven by factors such as rising disposable incomes, increasing urbanization, and a growing preference for convenient and nutritious baby food products. The market size expanded from xx Million units in 2019 to xx Million units in 2024, exhibiting a CAGR of xx%. This growth is expected to continue in the forecast period, with a projected CAGR of xx% from 2025 to 2033. Technological advancements, such as the introduction of innovative formulations and packaging, have further propelled market expansion. A shift towards healthier and organic baby food products is also evident, driven by increasing health consciousness among parents.

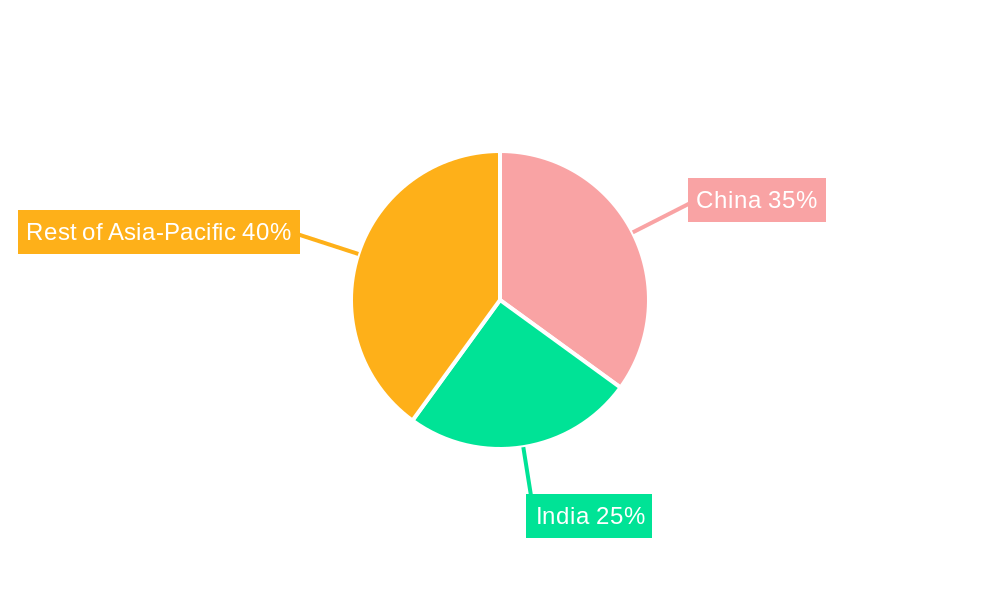

Dominant Regions, Countries, or Segments in Asia-Pacific Baby Food Market

China and India are the dominant markets within the Asia-Pacific region, contributing a significant share to the overall market size. Within distribution channels, hypermarkets/supermarkets maintain the largest share, driven by their extensive reach and consumer preference. Milk formula remains the dominant product type, accounting for xx% of the market share.

- Key Drivers in China & India: Rapid economic growth, rising disposable incomes, expanding middle class, and increasing awareness of the importance of nutrition in early childhood development.

- Hypermarkets/Supermarkets Dominance: Extensive reach, established distribution networks, and consumer familiarity contribute to their leading position.

- Milk Formula's Leading Share: High demand for nutritional benefits and convenience, with continued innovation in product formulations driving growth.

Asia-Pacific Baby Food Market Product Landscape

The Asia-Pacific baby food market offers a diverse range of products, catering to various dietary needs and preferences. Innovation focuses on organic and specialized formulas tailored to specific developmental stages and health conditions. Products often highlight features such as enhanced nutritional value, natural ingredients, and convenient packaging formats. Technological advancements continue to improve product safety, shelf life, and nutritional content.

Key Drivers, Barriers & Challenges in Asia-Pacific Baby Food Market

Key Drivers:

- Rising disposable incomes and increasing urbanization across the region.

- Growing awareness of nutrition's importance in early childhood development.

- Increasing preference for convenience and ready-to-eat baby food products.

- Technological advancements in product formulation and packaging.

Challenges & Restraints:

- Intense competition from both established multinational corporations and local players.

- Stringent regulatory requirements impacting production costs and time to market.

- Fluctuating raw material prices impacting profitability.

- Supply chain disruptions affecting product availability and distribution. These disruptions reduced the market size by an estimated xx Million units in 2022.

Emerging Opportunities in Asia-Pacific Baby Food Market

- Growing demand for organic and specialized baby food products catering to specific dietary needs and allergies.

- Expansion into rural and underserved markets with limited access to nutritious baby food.

- Development of innovative products using advanced technologies, such as probiotics and prebiotics, to improve gut health and immunity.

- Adoption of e-commerce platforms for convenient online purchasing and direct-to-consumer sales.

Growth Accelerators in the Asia-Pacific Baby Food Market Industry

Long-term growth in the Asia-Pacific baby food market will be driven by sustained economic growth in key markets, increasing health consciousness among parents, technological advancements leading to improved product offerings, and strategic partnerships between manufacturers and retailers to improve distribution and reach. Government initiatives promoting healthy eating habits among infants and young children will also play a crucial role.

Key Players Shaping the Asia-Pacific Baby Food Market Market

- Bellamy's Organic

- Nestle SA

- Nutrimed Healthcare Private Limited

- Early Foods Private Limited

- Abbott Laboratories

- Wholsum Foods Pvt Ltd (Slurrp Farm)

- Danone SA

- Sun-Maid Growers of California (Plum Organic)

- PZ Cussons plc (Rafferty's Garden)

- Max Biocare

- List Not Exhaustive

Notable Milestones in Asia-Pacific Baby Food Sector

- November 2022: Nestle launched Cerelac Homestyle Daging Sayur in Indonesia.

- July 2022: Rafferty's Garden (PZ Cussons) released Vegemite Cheesy Bread Sticks in Australia.

- August 2021: Max Biocare expanded its Little Étoile infant and toddler formula range in Australia.

In-Depth Asia-Pacific Baby Food Market Outlook

The Asia-Pacific baby food market is poised for continued growth, driven by the factors outlined above. Strategic opportunities exist for companies to expand their product portfolios, invest in research and development of innovative products, and leverage e-commerce channels to reach a wider consumer base. Focusing on organic, specialized, and convenient products will be key to capturing market share in this dynamic and rapidly evolving market. Further penetration into underserved regions and utilizing effective marketing strategies targeted at increasingly health-conscious parents will be crucial for long-term success.

Asia-Pacific Baby Food Market Segmentation

-

1. Type

- 1.1. Milk Formula

- 1.2. Dried Baby Food

- 1.3. Prepared Baby Food

- 1.4. Other Types

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Drugstores/Pharmacies Stores

- 2.3. Convenience Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

Asia-Pacific Baby Food Market Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. Australia

- 5. Rest of Asia Pacific

Asia-Pacific Baby Food Market Regional Market Share

Geographic Coverage of Asia-Pacific Baby Food Market

Asia-Pacific Baby Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Popularity of Single-Origin Coffee; Product Differentiation and Marketing Strategies

- 3.3. Market Restrains

- 3.3.1. Presence of Substitutes Hampering Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Awareness Among People and Working Women

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Milk Formula

- 5.1.2. Dried Baby Food

- 5.1.3. Prepared Baby Food

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Drugstores/Pharmacies Stores

- 5.2.3. Convenience Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. India

- 5.3.2. China

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.4.2. China

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. India Asia-Pacific Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Milk Formula

- 6.1.2. Dried Baby Food

- 6.1.3. Prepared Baby Food

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarkets/Supermarkets

- 6.2.2. Drugstores/Pharmacies Stores

- 6.2.3. Convenience Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. India

- 6.3.2. China

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. China Asia-Pacific Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Milk Formula

- 7.1.2. Dried Baby Food

- 7.1.3. Prepared Baby Food

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarkets/Supermarkets

- 7.2.2. Drugstores/Pharmacies Stores

- 7.2.3. Convenience Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. India

- 7.3.2. China

- 7.3.3. Japan

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Milk Formula

- 8.1.2. Dried Baby Food

- 8.1.3. Prepared Baby Food

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarkets/Supermarkets

- 8.2.2. Drugstores/Pharmacies Stores

- 8.2.3. Convenience Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. India

- 8.3.2. China

- 8.3.3. Japan

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia-Pacific Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Milk Formula

- 9.1.2. Dried Baby Food

- 9.1.3. Prepared Baby Food

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hypermarkets/Supermarkets

- 9.2.2. Drugstores/Pharmacies Stores

- 9.2.3. Convenience Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. India

- 9.3.2. China

- 9.3.3. Japan

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia-Pacific Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Milk Formula

- 10.1.2. Dried Baby Food

- 10.1.3. Prepared Baby Food

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Hypermarkets/Supermarkets

- 10.2.2. Drugstores/Pharmacies Stores

- 10.2.3. Convenience Stores

- 10.2.4. Online Retail Stores

- 10.2.5. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. India

- 10.3.2. China

- 10.3.3. Japan

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bellamy's Organic

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nestle SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nutrimed Healthcare Private Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Early Foods Private Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Abbott Laboratories

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wholsum Foods Pvt Ltd (Slurrp Farm)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Danone SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sun-Maid Growers of California (Plum Organic)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PZ Cussons plc (Rafferty's Garden)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Max Biocare*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bellamy's Organic

List of Figures

- Figure 1: Asia-Pacific Baby Food Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Baby Food Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Baby Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Baby Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asia-Pacific Baby Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Baby Food Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Baby Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Baby Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Asia-Pacific Baby Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Baby Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Baby Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Baby Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Asia-Pacific Baby Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Baby Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Baby Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Asia-Pacific Baby Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Asia-Pacific Baby Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Baby Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Baby Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Asia-Pacific Baby Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Asia-Pacific Baby Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Baby Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Baby Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Asia-Pacific Baby Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Asia-Pacific Baby Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Baby Food Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Baby Food Market?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the Asia-Pacific Baby Food Market?

Key companies in the market include Bellamy's Organic, Nestle SA, Nutrimed Healthcare Private Limited, Early Foods Private Limited, Abbott Laboratories, Wholsum Foods Pvt Ltd (Slurrp Farm), Danone SA, Sun-Maid Growers of California (Plum Organic), PZ Cussons plc (Rafferty's Garden), Max Biocare*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Baby Food Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 77.13 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Single-Origin Coffee; Product Differentiation and Marketing Strategies.

6. What are the notable trends driving market growth?

Increasing Awareness Among People and Working Women.

7. Are there any restraints impacting market growth?

Presence of Substitutes Hampering Market Growth.

8. Can you provide examples of recent developments in the market?

In November 2022, Nestle Cerelac Homestyle for babies introduced a new variant, meat and vegetable (Daging Sayur), in Indonesia to introduce babies to the goodness of vegetables and meat. Cerelac Homestyle is rich in iron and comes with 10 vitamins and five minerals to combat anemia, which affects babies aged 1-6.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Baby Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Baby Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Baby Food Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Baby Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence