Key Insights

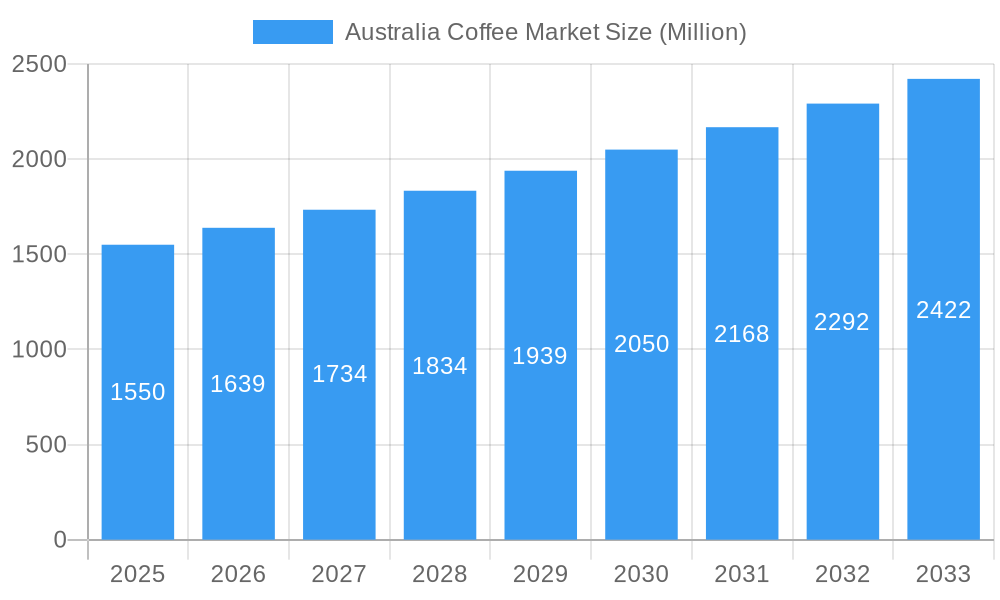

The Australian coffee market is poised for robust expansion, projected to reach an estimated value of AUD 1.55 billion by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 5.73% anticipated through 2033. This sustained growth is fueled by several key drivers, including the increasing consumer preference for premium and specialty coffee experiences, a growing awareness of coffee origins and ethical sourcing, and the continuous innovation in brewing methods and product offerings. The Australian palate has become increasingly sophisticated, driving demand for whole bean and ground coffee that offers superior flavour profiles. Furthermore, the convenience offered by instant coffee and the burgeoning popularity of single-serve coffee pods and capsules are catering to busy lifestyles, significantly contributing to market penetration across various consumer segments. Evolving consumer habits, influenced by global trends and a desire for café-quality coffee at home, are central to this upward trajectory. The market is also benefiting from the burgeoning café culture and the increasing accessibility of diverse coffee products through multiple retail avenues.

Australia Coffee Market Market Size (In Billion)

This dynamic market landscape is characterized by evolving consumer preferences and significant investments from both established global players and innovative local roasters. Key industry players such as Nestle SA, JAB Holding Company, and Illycaffè SpA are actively shaping the market through strategic product launches, mergers, and acquisitions, while local Australian brands like Vittoria Coffee Pty Ltd and St Ali Pty Ltd are carving out significant niches with their commitment to quality and unique flavour profiles. The distribution channels are also witnessing a transformation, with online retail stores experiencing remarkable growth, complementing traditional channels like hypermarkets, supermarkets, and convenience stores. While the market is optimistic, potential restraints such as fluctuating raw material prices and increasing competition could pose challenges. However, the prevailing trend of consumers seeking unique, high-quality coffee experiences, coupled with the industry's adaptability, suggests a promising future for the Australian coffee market, with a strong emphasis on sustainability and artisanal production expected to gain further traction.

Australia Coffee Market Company Market Share

Australia Coffee Market: Comprehensive Report & Future Outlook (2019-2033)

This in-depth report offers a detailed analysis of the Australia coffee market, providing critical insights into market dynamics, growth trends, competitive landscape, and future opportunities. Examining segments such as Whole Bean, Ground Coffee, Instant Coffee, and Coffee Pods & Capsules, and distribution channels including Hypermarkets/Supermarkets, Convenience/Grocery Stores, and Online Retail Stores, this report is an indispensable resource for stakeholders seeking to navigate this dynamic sector. The study spans the historical period 2019-2024, with a base year of 2025 and a comprehensive forecast extending to 2033. Values are presented in Million units.

Australia Coffee Market Market Dynamics & Structure

The Australian coffee market is characterized by a moderately concentrated competitive landscape, with established multinational corporations and a growing number of independent roasters vying for market share. Technological innovation is a significant driver, particularly in the specialty coffee segment, with advancements in brewing technology and bean sourcing techniques constantly emerging. Regulatory frameworks, while generally supportive of business, can influence aspects like food safety standards and import/export regulations for green coffee beans. Competitive product substitutes include tea and other hot beverages, though coffee's cultural entrenchment limits their direct impact. End-user demographics reveal a growing appreciation for premium and ethically sourced coffee among millennials and Gen Z, influencing demand for diverse product offerings. Merger and acquisition (M&A) trends are present, though less pronounced than in other global markets, indicating a focus on organic growth and strategic partnerships for larger players.

- Market Concentration: Dominated by a few key players, with increasing fragmentation in the specialty and independent roaster segments.

- Technological Innovation: Driven by advanced brewing equipment, sustainable packaging, and direct-to-consumer (DTC) e-commerce platforms.

- Regulatory Landscape: Focus on food safety, labelling, and fair trade practices.

- End-User Demographics: Shifting towards health-conscious, ethically aware consumers seeking premium coffee experiences.

- M&A Trends: Strategic acquisitions by larger entities to expand product portfolios or gain market access, alongside smaller, localized deals.

Australia Coffee Market Growth Trends & Insights

The Australian coffee market is poised for robust growth, driven by a confluence of evolving consumer preferences, technological advancements, and a maturing café culture that extends into at-home consumption. Market size is projected to expand significantly over the forecast period, fueled by increasing disposable incomes and a strong desire for premium and convenient coffee solutions. Adoption rates for innovative coffee formats, such as coffee pods and capsules, continue to rise, offering consumers speed and consistency without compromising taste. Technological disruptions are primarily seen in the proliferation of smart coffee machines and subscription services, simplifying the at-home brewing experience. Consumer behavior shifts are marked by a growing demand for ethically sourced and sustainable coffee, prompting brands to emphasize their supply chain transparency and environmental commitments. The rise of the "third wave" coffee movement has educated consumers, leading to a greater appreciation for single-origin beans, unique roast profiles, and diverse brewing methods, thus driving up demand for higher-quality products. Furthermore, the increasing integration of coffee consumption into daily routines, from morning rituals to social gatherings, underpins consistent market penetration. The market's trajectory is also influenced by the health and wellness trend, with consumers seeking coffee products with perceived health benefits, such as those with added functional ingredients or those positioned as healthier alternatives. The penetration of online retail stores has also democratized access to a wider variety of coffee beans and brewing equipment, further stimulating market growth and empowering niche brands to reach a broader audience. The overall CAGR is estimated to be around 5-7% for the forecast period.

Dominant Regions, Countries, or Segments in Australia Coffee Market

The Hypermarkets/Supermarkets distribution channel currently stands as the dominant force within the Australian coffee market, commanding a substantial market share due to their extensive reach and accessibility to a broad consumer base. This segment benefits from high foot traffic and the ability to offer a wide array of coffee products, from mainstream brands to private labels, catering to diverse price points and consumer needs. The convenience of one-stop shopping further solidifies its leading position.

- Hypermarkets/Supermarkets:

- Market Share Dominance: Consistently holds the largest share due to widespread presence and diverse product offerings.

- Consumer Accessibility: Offers a one-stop-shop experience, attracting a wide demographic.

- Promotional Power: Leverages in-store promotions and loyalty programs to drive sales.

- Product Variety: Stocks a comprehensive range of coffee types, from instant to whole bean, and various brands.

While Hypermarkets/Supermarkets lead in volume, Online Retail Stores are emerging as a significant growth driver, particularly for specialty coffee brands and direct-to-consumer models. The convenience of online ordering, coupled with the ability to discover niche products and subscription services, is attracting a growing segment of tech-savvy consumers. This channel offers unparalleled choice and allows for targeted marketing and personalized recommendations.

- Online Retail Stores:

- Rapid Growth Trajectory: Experiencing the highest growth rate due to increasing e-commerce adoption.

- Niche Product Accessibility: Enables consumers to discover and purchase specialty and artisanal coffee.

- Direct-to-Consumer (DTC) Models: Facilitates stronger brand-consumer relationships and subscription services.

- Convenience and Choice: Offers 24/7 accessibility and a vast selection of products.

The Whole Bean segment within Product Type is also exhibiting strong momentum, driven by the increasing consumer interest in home brewing and the artisanal coffee movement. Consumers are investing in grinders and brewing equipment to replicate café-quality coffee at home, valuing the freshness and control over the brewing process that whole beans provide.

- Whole Bean Coffee:

- Premiumization Trend: Aligns with consumer desire for higher quality and craft coffee experiences.

- Home Brewing Enthusiasts: Appeals to consumers investing in home coffee setups.

- Freshness and Flavor Control: Offers superior taste and aroma compared to pre-ground options.

- Specialty Coffee Demand: Directly benefits from the growth of the specialty coffee sector.

Australia Coffee Market Product Landscape

Product innovation in the Australian coffee market is dynamic, with a focus on enhancing consumer experience and convenience. Coffee pods and capsules continue to lead in technological advancements, offering advanced flavor profiles and rapid brewing with minimal effort, appealing to busy lifestyles. Whole bean offerings are seeing innovation in roast profiles and single-origin sourcing, emphasizing traceability and unique flavor notes. Ground coffee segments are benefiting from advanced grinding and packaging technologies that preserve freshness. The performance metrics are gauged by consumer preference for convenience, taste, and ethical sourcing, with brands increasingly highlighting their sustainability initiatives and unique flavor propositions, such as aromatic notes of flowers, cocoa, and wood in specialty blends.

Key Drivers, Barriers & Challenges in Australia Coffee Market

Key Drivers:

- Growing Coffee Culture: Increasing appreciation for specialty coffee and home brewing.

- Convenience Demand: Rise of instant coffee and convenient formats like pods and capsules.

- Disposable Income: Higher purchasing power for premium coffee products.

- Technological Advancements: Innovations in brewing technology and e-commerce.

- Health and Wellness Trends: Demand for functional coffees and ethically sourced options.

Barriers & Challenges:

- Supply Chain Volatility: Fluctuations in green coffee bean prices and availability due to climate and geopolitical factors.

- Intense Competition: A saturated market with numerous domestic and international players.

- Price Sensitivity: Some consumer segments remain highly price-conscious.

- Regulatory Compliance: Navigating food safety standards and import regulations.

- Sustainability Pressures: Increasing consumer and regulatory demands for eco-friendly practices.

Emerging Opportunities in Australia Coffee Market

Emerging opportunities lie in the continued growth of the specialty and artisanal coffee segment, with a focus on single-origin beans, unique processing methods, and transparent sourcing. Plant-based coffee creamers and alternatives are gaining traction, catering to health-conscious and ethically minded consumers. The expansion of subscription-based coffee services offers recurring revenue streams and fosters brand loyalty. Furthermore, the development of functional coffees, infused with ingredients like adaptogens or probiotics, presents a niche but growing market driven by wellness trends.

Growth Accelerators in the Australia Coffee Market Industry

Long-term growth in the Australian coffee market is being accelerated by several key factors. The ongoing premiumization trend, where consumers are willing to pay more for higher quality and unique coffee experiences, is a significant catalyst. Strategic partnerships, such as the collaboration between Nutella and Lavazza, are creating novel product offerings and expanding market reach through cross-promotional activities. The increasing adoption of sustainable sourcing and production methods not only appeals to conscious consumers but also future-proofs supply chains against environmental risks. Furthermore, the continuous innovation in at-home brewing technologies, making sophisticated brewing more accessible and convenient, fuels consistent demand for premium coffee beans and grounds.

Key Players Shaping the Australia Coffee Market Market

- JAB Holding Company

- Nestle SA

- FreshFood Services Pty Ltd

- DC Roasters Pty Ltd

- Vittoria Coffee Pty Ltd

- Sensory Lab Australia Pty Ltd

- Illycaffè SpA

- St Ali Pty Ltd

- Republica Coffee Pty Ltd

- Luigi Lavazza SpA

Notable Milestones in Australia Coffee Market Sector

- May 2024: Nutella partnered with Lavazza to launch Nutella & Lavazza’s biscuits and coffee ‘Perfect Match.’ Lavazza also offers the Espresso Barista coffee range, which uses beans from Central and South America, Africa, and Asia and has aromatic notes of flowers, cocoa, and wood.

- April 2024: Nescafe and Arnott teamed up to launch another Tim Tam-inspired drink, the Nescafe White Choc Mocha. The company states that the new flavors combine creamy coffee with the white chocolate taste of Tim Tam biscuits.

- February 2024: L’OR Espresso entered a new global partnership with Ferrari. The collaboration sees L’OR Espresso embark on a new chapter alongside Ferrari in the FIA World Endurance Championship (WEC).

In-Depth Australia Coffee Market Market Outlook

The Australia coffee market is set for sustained expansion, driven by an insatiable consumer appetite for quality and convenience. The continued rise of specialty coffee, coupled with innovative product development in segments like coffee pods and capsules, will ensure consistent market penetration. Growth accelerators include strategic brand collaborations, such as the Nutella and Lavazza partnership, which expand consumer touchpoints and create novel product experiences. Furthermore, the increasing emphasis on sustainability throughout the supply chain will not only meet evolving consumer demands but also bolster brand reputation and long-term market viability. The forecast period is expected to witness a dynamic interplay of established players and emerging artisanal brands, fostering a competitive yet innovative environment that promises significant value creation.

Australia Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole Bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

- 1.4. Coffee Pods and Capsules

-

2. Distribution Channel

- 2.1. Hypermarkets/ Supermarkets

- 2.2. Convenience/Grocery Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Australia Coffee Market Segmentation By Geography

- 1. Australia

Australia Coffee Market Regional Market Share

Geographic Coverage of Australia Coffee Market

Australia Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 There is a growing trend towards specialty coffee

- 3.2.2 with consumers increasingly seeking out single-origin beans

- 3.2.3 artisanal roasting

- 3.2.4 and unique flavor profiles. The rise of independent cafés and micro-roasters has fueled this trend.

- 3.3. Market Restrains

- 3.3.1 The Australian coffee market is highly competitive

- 3.3.2 with numerous local and international players. This can lead to price wars and challenges for new entrants trying to establish a foothold.

- 3.4. Market Trends

- 3.4.1 The demand for fair-trade

- 3.4.2 organic

- 3.4.3 and sustainably sourced coffee is on the rise. Consumers are increasingly looking for products that align with their environmental and social values.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Coffee Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole Bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.1.4. Coffee Pods and Capsules

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/ Supermarkets

- 5.2.2. Convenience/Grocery Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JAB Holding Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FreshFood Services Pty Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DC Roasters Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vittoria Coffee Pty Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sensory Lab Australia Pty Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Illycaffè SpA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 St Ali Pty Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Republica Coffee Pty Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Luigi Lavazza SpA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JAB Holding Company

List of Figures

- Figure 1: Australia Coffee Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Coffee Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Coffee Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Australia Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Australia Coffee Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Coffee Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Australia Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Australia Coffee Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Coffee Market?

The projected CAGR is approximately 5.73%.

2. Which companies are prominent players in the Australia Coffee Market?

Key companies in the market include JAB Holding Company, Nestle SA, FreshFood Services Pty Ltd, DC Roasters Pty Ltd, Vittoria Coffee Pty Ltd, Sensory Lab Australia Pty Ltd, Illycaffè SpA, St Ali Pty Ltd, Republica Coffee Pty Ltd, Luigi Lavazza SpA.

3. What are the main segments of the Australia Coffee Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.55 Million as of 2022.

5. What are some drivers contributing to market growth?

There is a growing trend towards specialty coffee. with consumers increasingly seeking out single-origin beans. artisanal roasting. and unique flavor profiles. The rise of independent cafés and micro-roasters has fueled this trend..

6. What are the notable trends driving market growth?

The demand for fair-trade. organic. and sustainably sourced coffee is on the rise. Consumers are increasingly looking for products that align with their environmental and social values..

7. Are there any restraints impacting market growth?

The Australian coffee market is highly competitive. with numerous local and international players. This can lead to price wars and challenges for new entrants trying to establish a foothold..

8. Can you provide examples of recent developments in the market?

May 2024: Nutella partnered with Lavazza to launch Nutella & Lavazza’s biscuits and coffee ‘Perfect Match.’ Lavazza also offers the Espresso Barista coffee range, which uses beans from Central and South America, Africa, and Asia and has aromatic notes of flowers, cocoa, and wood.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Coffee Market?

To stay informed about further developments, trends, and reports in the Australia Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence