Key Insights

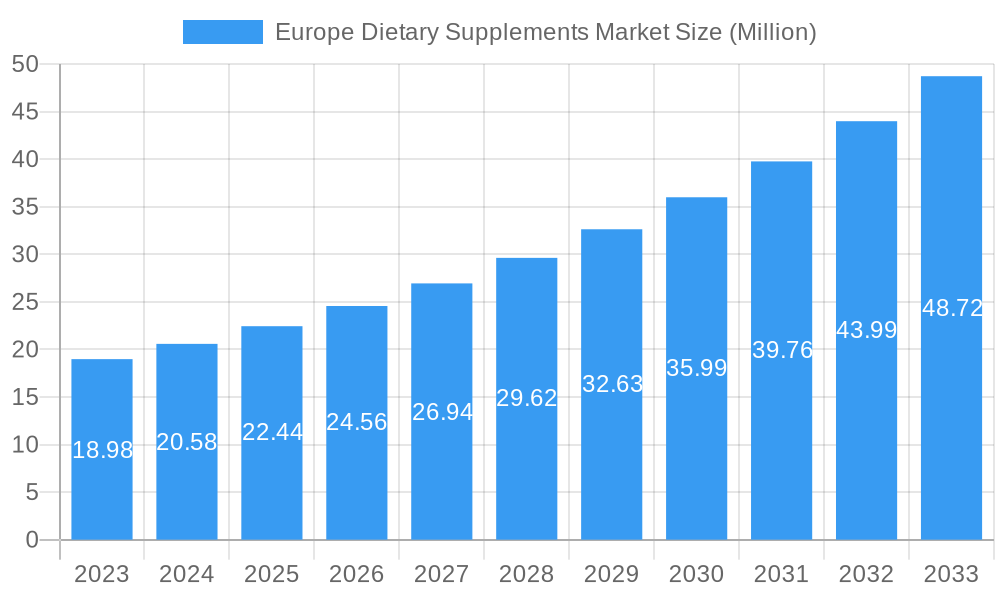

The European dietary supplements market is poised for significant expansion, projected to reach approximately USD 21.64 million in 2025 and grow at a Compound Annual Growth Rate (CAGR) of 9.01% through 2033. This robust growth is fueled by a confluence of factors, including increasing consumer awareness of preventative healthcare, a growing aging population seeking to maintain vitality and manage age-related health concerns, and a rising demand for natural and plant-based formulations. Consumers are becoming more proactive in their health management, viewing dietary supplements as essential tools for immune support, energy enhancement, and overall well-being. The market's segmentation reflects this demand, with Vitamins and Minerals, Proteins and Amino Acids, and Herbal Supplements emerging as key product categories. The increasing prevalence of lifestyle-related health issues, such as stress and fatigue, further stimulates the adoption of supplements that offer targeted solutions. Furthermore, the expanding online retail landscape is democratizing access to a wider array of products, making dietary supplements more accessible to a broader consumer base across Europe.

Europe Dietary Supplements Market Market Size (In Million)

Key market drivers underpinning this growth include a strong emphasis on wellness and fitness trends, where consumers are actively seeking solutions to improve their physical and mental health. The rising disposable income in many European nations allows consumers to allocate more resources towards health and nutrition. Conversely, stringent regulatory frameworks surrounding product claims and ingredient sourcing present a notable restraint, requiring manufacturers to maintain high standards of quality and efficacy. Emerging trends showcase a heightened interest in personalized nutrition, with consumers seeking supplements tailored to their specific genetic predispositions, lifestyle choices, and health goals. Probiotics and specialty supplements addressing gut health and cognitive function are also gaining significant traction. Distribution channels are diversifying, with online platforms and pharmacies playing increasingly crucial roles, offering convenience and expert advice to consumers navigating the complex dietary supplement landscape.

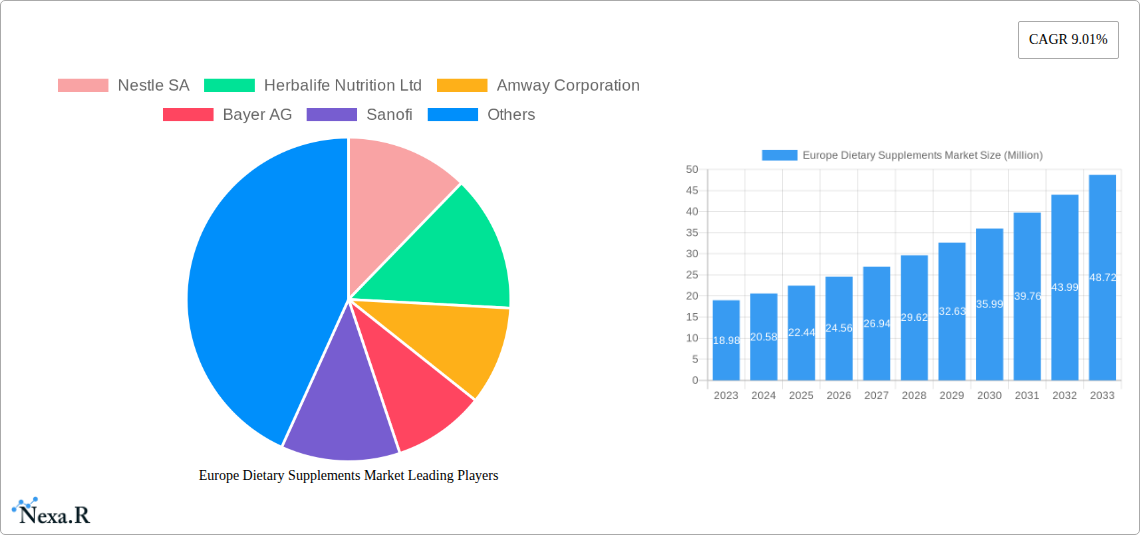

Europe Dietary Supplements Market Company Market Share

Unlock critical insights into the burgeoning Europe dietary supplements market with our in-depth report. This comprehensive analysis provides a detailed examination of market dynamics, growth trends, regional dominance, product landscapes, key players, and future opportunities, equipping industry professionals with the data needed to navigate this dynamic sector. The report covers vitamins and minerals, herbal supplements, proteins, probiotics, and more, across pharmacies, supermarkets, and online channels.

Europe Dietary Supplements Market Market Dynamics & Structure

The Europe dietary supplements market is characterized by a moderately concentrated structure, with key players like Nestle SA, Herbalife Nutrition Ltd, Amway Corporation, Bayer AG, Sanofi, Glaxosmithkline PLC, Perrigo Plc, Procter & Gamble Company, Biogaia AB, and Pileje SAS holding significant market shares. Technological innovation is a primary driver, with advancements in bioavailability, ingredient sourcing, and personalized nutrition fueling product development. Regulatory frameworks, such as those set by the European Food Safety Authority (EFSA), play a crucial role in shaping product claims and ingredient approvals, influencing market entry and product differentiation. Competitive product substitutes, including functional foods and fortified beverages, pose a growing challenge. End-user demographics are shifting towards a more health-conscious and aging population seeking preventative healthcare solutions, driving demand for vitamins and minerals, and herbal supplements. Mergers and acquisitions (M&A) activity, though not extensively documented in public records for this sector, is anticipated to increase as larger companies seek to expand their portfolios and market reach. Limited public quantitative data on M&A deal volumes makes precise quantification challenging, but anecdotal evidence suggests strategic acquisitions of smaller, innovative brands are occurring. Innovation barriers include stringent regulatory approval processes and the need for extensive clinical trials to substantiate health claims.

Europe Dietary Supplements Market Growth Trends & Insights

The Europe dietary supplements market has experienced robust growth throughout the historical period (2019-2024), driven by an escalating consumer focus on health and wellness, coupled with an aging population. The market is projected to witness significant expansion from a base year of 2025 through the forecast period of 2025–2033. This growth trajectory is underpinned by increasing awareness of the preventative benefits of supplements in managing chronic diseases and boosting overall immunity, particularly amplified by global health events. Adoption rates for various supplement categories, from vitamins and minerals to probiotics and specialized herbal supplements, are on an upward trend across key European nations. Technological disruptions, including advancements in fermentation processes for probiotics and sustainable sourcing of botanicals, are enhancing product efficacy and appeal. Consumer behavior shifts are pivotal, with a growing preference for natural, plant-based, and scientifically backed ingredients. The demand for personalized nutrition solutions, tailored to individual genetic makeup and lifestyle, is emerging as a significant growth accelerator. Market penetration for dietary supplements in Europe, estimated at xx% in the base year 2025, is expected to climb steadily. The Compound Annual Growth Rate (CAGR) for the Europe dietary supplements market is projected to be a healthy xx% during the forecast period. This sustained growth is further propelled by an increase in disposable incomes and a proactive approach to healthcare among European consumers. Online channels are rapidly gaining traction, offering convenience and a wider product selection, contributing significantly to market expansion. The market size evolution is characterized by consistent year-on-year increases, reflecting the deepening integration of dietary supplements into mainstream health routines. Key trends include the rise of specialized supplements targeting specific health concerns like cognitive function, joint health, and gut health, further diversifying the market.

Dominant Regions, Countries, or Segments in Europe Dietary Supplements Market

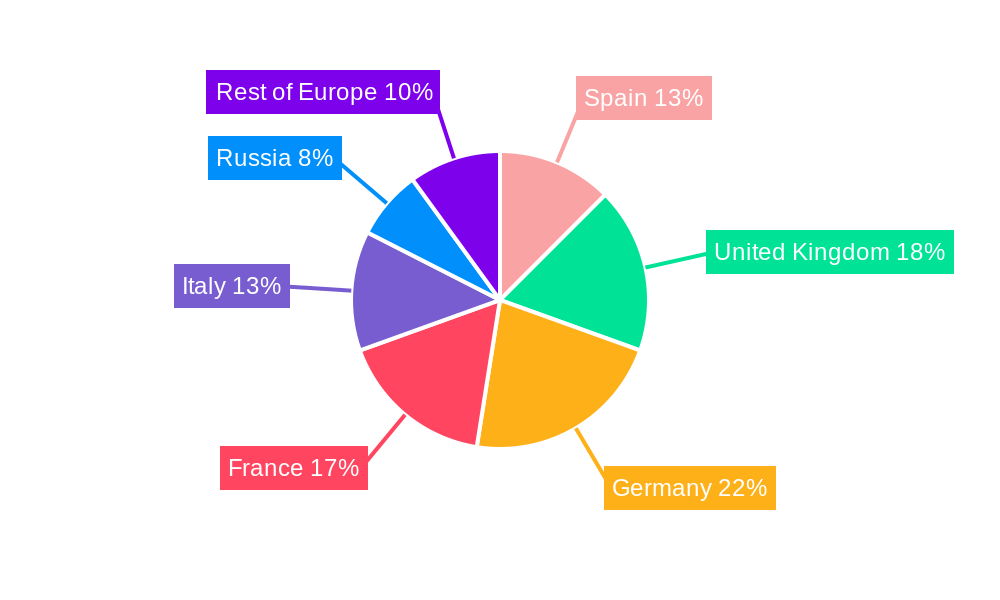

Within the Europe dietary supplements market, Western European countries, particularly Germany, the United Kingdom, and France, currently dominate the market. This regional dominance is attributed to several factors, including higher disposable incomes, advanced healthcare infrastructure, greater consumer awareness regarding health and wellness, and more established regulatory frameworks that facilitate market entry for reputable brands. Germany, in particular, often leads in terms of market value due to its large population and a strong tradition of natural and herbal medicine. The Vitamins and Minerals segment is the most dominant type of dietary supplement, consistently holding the largest market share due to their broad appeal for general health maintenance and disease prevention.

Dominant Segments:

- Type: Vitamins and Minerals (estimated xx% market share), Herbal Supplements, Proteins and Amino Acids, Probiotics.

- Distribution Channel: Pharmacies and Drug Stores (historically dominant, retaining significant share), Online Channels (experiencing rapid growth), Supermarkets and Hypermarkets.

Key Drivers of Dominance:

- Economic Policies: Favorable economic conditions in Western Europe support higher consumer spending on health and wellness products.

- Healthcare Infrastructure: Well-developed healthcare systems often promote the preventative role of supplements.

- Consumer Awareness: High levels of health consciousness and proactive health management among the population.

- Regulatory Maturity: Established regulatory pathways in key countries allow for smoother product launches and clearer marketing claims.

- E-commerce Penetration: The robust growth of online channels in countries like the UK and Germany is making supplements more accessible.

The Online Channels segment within distribution is showing the most aggressive growth, driven by convenience, wider product availability, and competitive pricing. Countries like the UK, with its high internet penetration and strong e-commerce culture, are leading this shift. While Pharmacies and Drug Stores remain crucial for credibility and expert advice, the ease of purchase online is undeniable. In terms of specific product types, the demand for Probiotics is surging due to increasing consumer understanding of the gut-brain axis and overall microbiome health.

Europe Dietary Supplements Market Product Landscape

The Europe dietary supplements market is characterized by a dynamic product landscape featuring continuous innovation in formulations and delivery systems. Key product innovations include enhanced bioavailability of nutrients through encapsulation technologies and the development of synergistic ingredient blends targeting specific health outcomes. Applications range from general wellness and immune support to specialized areas like cognitive function, sports nutrition, and gut health. Performance metrics are increasingly being evaluated based on scientific validation of ingredients and documented efficacy. Unique selling propositions often revolve around natural sourcing, organic certifications, and allergen-free formulations. Technological advancements are also seen in personalized supplement packs and subscription-based models. The market is witnessing a rise in multi-ingredient formulations designed for targeted benefits, such as stress relief or improved sleep quality.

Key Drivers, Barriers & Challenges in Europe Dietary Supplements Market

Key Drivers: The Europe dietary supplements market is propelled by a confluence of factors, including an aging population seeking to maintain health and vitality, increasing consumer awareness regarding preventative healthcare and the role of nutrition, and a growing demand for natural and plant-based products. Technological advancements in ingredient formulation and bioavailability also serve as significant growth catalysts. Furthermore, the endorsement of supplements by healthcare professionals and growing disposable incomes contribute to market expansion.

Barriers & Challenges: Despite the positive outlook, the market faces several challenges. Stringent and evolving regulatory frameworks across different European countries can create complexities for product approval and marketing claims. Consumer skepticism regarding the efficacy of certain supplements and concerns about product quality and safety necessitate robust scientific backing and transparent labeling. Intense market competition, with a proliferation of brands and private labels, can lead to price pressures and a need for strong brand differentiation. Supply chain disruptions and the sourcing of high-quality raw materials also present operational hurdles. The challenge of clearly communicating health benefits without making unsubstantiated claims is a constant regulatory concern.

Emerging Opportunities in Europe Dietary Supplements Market

Emerging opportunities within the Europe dietary supplements market lie in the growing demand for personalized nutrition solutions, driven by advancements in genetic testing and wearable technology. The increasing popularity of plant-based and vegan supplements presents a significant untapped market segment. Furthermore, the focus on mental wellness and cognitive enhancement supplements is rapidly expanding, driven by rising stress levels and a desire for improved brain function. Opportunities also exist in developing science-backed supplements for specific life stages, such as pregnancy or elder care, and in leveraging e-commerce platforms for direct-to-consumer sales and subscription models to enhance customer loyalty and reach. The development of novel delivery systems, like gummies and dissolvable tablets, caters to evolving consumer preferences for convenience and palatability.

Growth Accelerators in the Europe Dietary Supplements Market Industry

Several growth accelerators are poised to propel the Europe dietary supplements market forward. Technological breakthroughs in ingredient encapsulation and delivery systems, leading to improved nutrient absorption and efficacy, are key. Strategic partnerships between supplement manufacturers and healthcare providers or influencers can significantly enhance brand credibility and market penetration. Expansion into emerging European markets with growing health consciousness offers substantial growth potential. Furthermore, innovative marketing campaigns that emphasize scientific evidence and natural ingredients, coupled with the increasing acceptance of dietary supplements as a proactive approach to health management, will continue to drive market expansion. The rising trend of functional foods and beverages incorporating beneficial supplements also acts as an indirect growth accelerator.

Key Players Shaping the Europe Dietary Supplements Market Market

- Nestle SA

- Herbalife Nutrition Ltd

- Amway Corporation

- Bayer AG

- Sanofi

- Glaxosmithkline PLC

- Perrigo Plc

- Procter & Gamble Company

- Biogaia AB

- Pileje SAS

Notable Milestones in Europe Dietary Supplements Market Sector

- March 2023: Amway launched its new Nutrilite Omega, featuring Advanced Omega from sustainably sourced fish oil, following its Friend of the Sea certification for nutraceutical products globally, including Europe.

- June 2022: Bayer introduced Berocca Immuno Effervescent Tablets, a nutritional supplement for immunity, fortified with ten essential vitamins and minerals including zinc, copper, iron, selenium, and vitamins D, C, A, B6, B9, and B12.

- May 2021: Nature's Bounty initiated a significant marketing campaign across the United Kingdom and Ireland, aiming to redefine its brand positioning by emphasizing accessible, natural nutrition and high-quality, natural ingredients.

In-Depth Europe Dietary Supplements Market Market Outlook

The Europe dietary supplements market is projected for continued strong growth, driven by evolving consumer health consciousness and an aging demographic. The market's future is characterized by an increasing emphasis on science-backed efficacy, personalized nutrition, and sustainable sourcing. Growth accelerators include innovations in delivery systems and ingredient bioavailability, alongside strategic market expansion and partnerships. The shift towards online distribution channels and the growing demand for natural and plant-based alternatives will further shape market dynamics. Industry players are expected to focus on product differentiation through clear health benefit claims supported by robust scientific evidence. The overall outlook suggests a dynamic and expanding market, with significant opportunities for companies that can effectively cater to the evolving needs and preferences of health-conscious European consumers.

Europe Dietary Supplements Market Segmentation

-

1. Type

- 1.1. Vitamins and Minerals

- 1.2. Enzymes

- 1.3. Herbal Supplements

- 1.4. Proteins and Amino Acids

- 1.5. Fatty Acids

- 1.6. Probiotics

- 1.7. Other Types

-

2. Distribution Channel

- 2.1. Pharmacies and Drug Stores

- 2.2. Supermarkets and Hypermarkets

- 2.3. Online Channels

- 2.4. Other Distribution Channels

Europe Dietary Supplements Market Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. Germany

- 4. France

- 5. Italy

- 6. Russia

- 7. Rest of Europe

Europe Dietary Supplements Market Regional Market Share

Geographic Coverage of Europe Dietary Supplements Market

Europe Dietary Supplements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer Spending on Preventive Healthcare Products; Weight-loss Dietary Supplements Capturing the Market

- 3.3. Market Restrains

- 3.3.1. Escalating Functional Food Consumption; An Environment of Austere Regulations

- 3.4. Market Trends

- 3.4.1. Escalating Consumer Investment in Preventive Healthcare Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Dietary Supplements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Vitamins and Minerals

- 5.1.2. Enzymes

- 5.1.3. Herbal Supplements

- 5.1.4. Proteins and Amino Acids

- 5.1.5. Fatty Acids

- 5.1.6. Probiotics

- 5.1.7. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Pharmacies and Drug Stores

- 5.2.2. Supermarkets and Hypermarkets

- 5.2.3. Online Channels

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.3.2. United Kingdom

- 5.3.3. Germany

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Spain Europe Dietary Supplements Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Vitamins and Minerals

- 6.1.2. Enzymes

- 6.1.3. Herbal Supplements

- 6.1.4. Proteins and Amino Acids

- 6.1.5. Fatty Acids

- 6.1.6. Probiotics

- 6.1.7. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Pharmacies and Drug Stores

- 6.2.2. Supermarkets and Hypermarkets

- 6.2.3. Online Channels

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Dietary Supplements Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Vitamins and Minerals

- 7.1.2. Enzymes

- 7.1.3. Herbal Supplements

- 7.1.4. Proteins and Amino Acids

- 7.1.5. Fatty Acids

- 7.1.6. Probiotics

- 7.1.7. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Pharmacies and Drug Stores

- 7.2.2. Supermarkets and Hypermarkets

- 7.2.3. Online Channels

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Germany Europe Dietary Supplements Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Vitamins and Minerals

- 8.1.2. Enzymes

- 8.1.3. Herbal Supplements

- 8.1.4. Proteins and Amino Acids

- 8.1.5. Fatty Acids

- 8.1.6. Probiotics

- 8.1.7. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Pharmacies and Drug Stores

- 8.2.2. Supermarkets and Hypermarkets

- 8.2.3. Online Channels

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. France Europe Dietary Supplements Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Vitamins and Minerals

- 9.1.2. Enzymes

- 9.1.3. Herbal Supplements

- 9.1.4. Proteins and Amino Acids

- 9.1.5. Fatty Acids

- 9.1.6. Probiotics

- 9.1.7. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Pharmacies and Drug Stores

- 9.2.2. Supermarkets and Hypermarkets

- 9.2.3. Online Channels

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Italy Europe Dietary Supplements Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Vitamins and Minerals

- 10.1.2. Enzymes

- 10.1.3. Herbal Supplements

- 10.1.4. Proteins and Amino Acids

- 10.1.5. Fatty Acids

- 10.1.6. Probiotics

- 10.1.7. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Pharmacies and Drug Stores

- 10.2.2. Supermarkets and Hypermarkets

- 10.2.3. Online Channels

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Russia Europe Dietary Supplements Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Vitamins and Minerals

- 11.1.2. Enzymes

- 11.1.3. Herbal Supplements

- 11.1.4. Proteins and Amino Acids

- 11.1.5. Fatty Acids

- 11.1.6. Probiotics

- 11.1.7. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Pharmacies and Drug Stores

- 11.2.2. Supermarkets and Hypermarkets

- 11.2.3. Online Channels

- 11.2.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Dietary Supplements Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Vitamins and Minerals

- 12.1.2. Enzymes

- 12.1.3. Herbal Supplements

- 12.1.4. Proteins and Amino Acids

- 12.1.5. Fatty Acids

- 12.1.6. Probiotics

- 12.1.7. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Pharmacies and Drug Stores

- 12.2.2. Supermarkets and Hypermarkets

- 12.2.3. Online Channels

- 12.2.4. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Nestle SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Herbalife Nutrition Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Amway Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Bayer AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Sanofi

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Glaxosmithkline PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Perrigo Plc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Procter & Gamble Company

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Biogaia AB*List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Pileje SAS

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Nestle SA

List of Figures

- Figure 1: Europe Dietary Supplements Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Dietary Supplements Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Dietary Supplements Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Dietary Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Dietary Supplements Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Dietary Supplements Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Europe Dietary Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Dietary Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Europe Dietary Supplements Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Europe Dietary Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 9: Europe Dietary Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Europe Dietary Supplements Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Europe Dietary Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Europe Dietary Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Europe Dietary Supplements Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Europe Dietary Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Europe Dietary Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Dietary Supplements Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Europe Dietary Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Europe Dietary Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Europe Dietary Supplements Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Europe Dietary Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 21: Europe Dietary Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Europe Dietary Supplements Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Europe Dietary Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: Europe Dietary Supplements Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Dietary Supplements Market?

The projected CAGR is approximately 9.01%.

2. Which companies are prominent players in the Europe Dietary Supplements Market?

Key companies in the market include Nestle SA, Herbalife Nutrition Ltd, Amway Corporation, Bayer AG, Sanofi, Glaxosmithkline PLC, Perrigo Plc, Procter & Gamble Company, Biogaia AB*List Not Exhaustive, Pileje SAS.

3. What are the main segments of the Europe Dietary Supplements Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.64 Million as of 2022.

5. What are some drivers contributing to market growth?

Consumer Spending on Preventive Healthcare Products; Weight-loss Dietary Supplements Capturing the Market.

6. What are the notable trends driving market growth?

Escalating Consumer Investment in Preventive Healthcare Products.

7. Are there any restraints impacting market growth?

Escalating Functional Food Consumption; An Environment of Austere Regulations.

8. Can you provide examples of recent developments in the market?

March 2023: Amway launched a new Nutrilite Omega, and Advanced Omega offers omega-3s from sustainably sourced fish oil after receiving certification from Friend of the Sea for nutraceutical products globally, including Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Dietary Supplements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Dietary Supplements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Dietary Supplements Market?

To stay informed about further developments, trends, and reports in the Europe Dietary Supplements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence