Key Insights

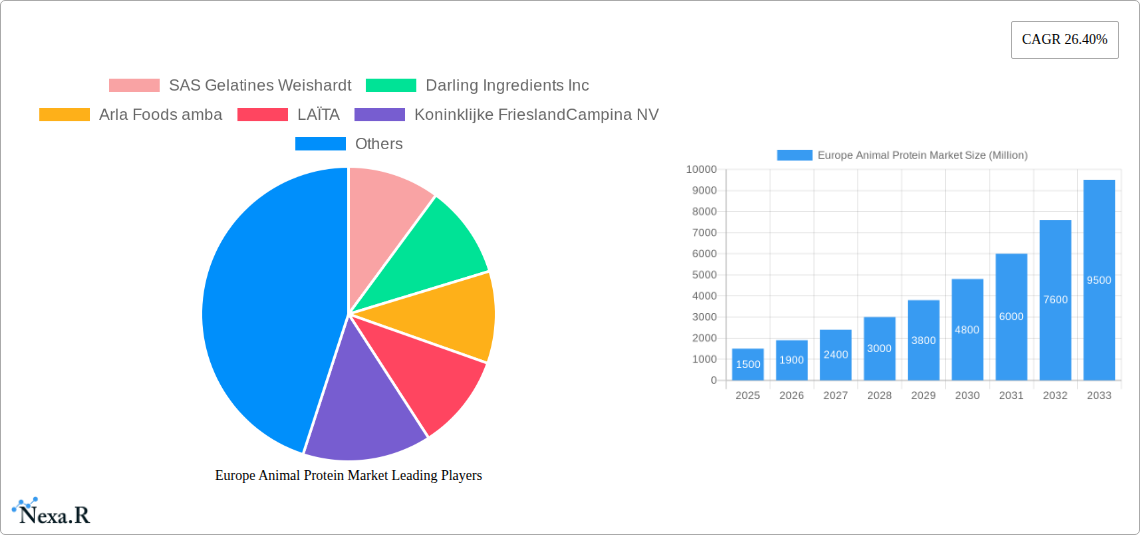

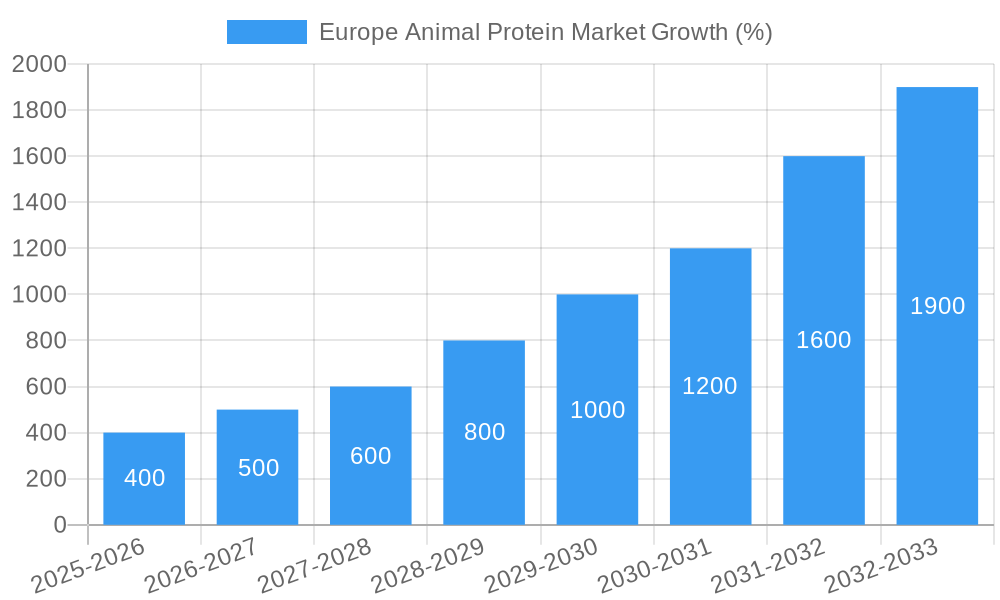

The European animal protein market, valued at approximately €XX million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 26.40% from 2025 to 2033. This significant expansion is driven by several key factors. The rising demand for animal feed, fueled by the growing global population and increasing consumption of meat and dairy products, is a primary driver. Furthermore, the burgeoning food and beverage industry, particularly in processed foods and functional foods incorporating animal-based protein sources, significantly contributes to market growth. Specific trends include the increasing adoption of sustainable and ethical sourcing practices within the animal protein supply chain, leading to higher demand for responsibly produced ingredients. Innovation in protein extraction and processing technologies is also boosting market expansion, offering improved product quality and efficiency. However, challenges remain, including fluctuating raw material prices, stringent regulations regarding animal welfare and food safety, and concerns about the environmental impact of animal agriculture. These restraints could potentially temper market growth to some degree, but the overall positive trajectory is expected to continue.

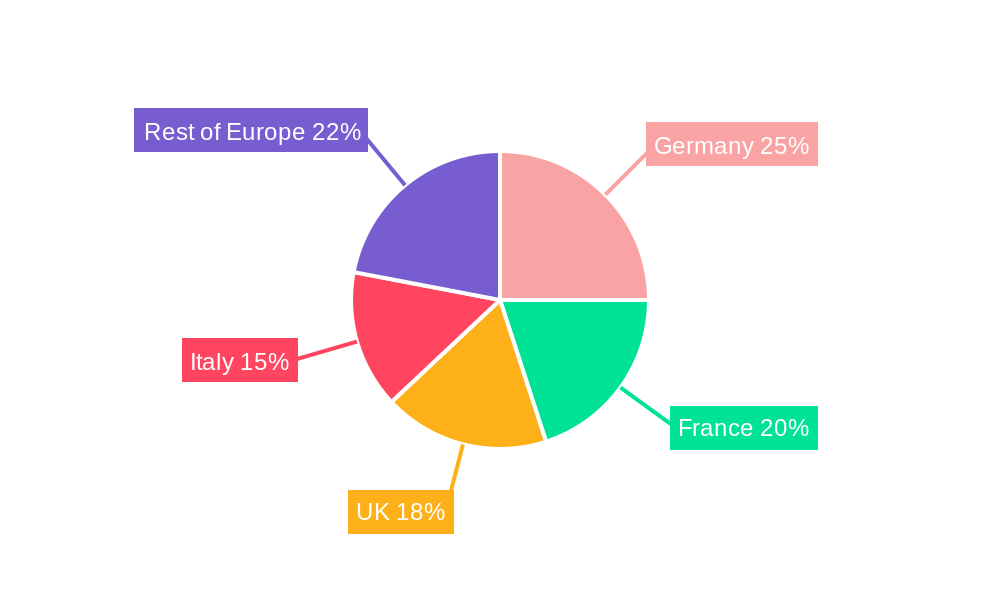

The market segmentation reveals a diverse landscape. Whey protein, casein and caseinates, and collagen dominate the protein type segment, reflecting their widespread applications across various industries. The animal feed end-user segment represents a significant portion of market demand, followed by the food and beverage sector. Geographically, Germany, France, the United Kingdom, and Italy are major contributors to the European market, exhibiting robust growth due to high consumption levels and strong processing industries. Key players like Arla Foods amba, Lactalis Group, and FrieslandCampina are shaping the market dynamics through innovation, strategic partnerships, and investments in expanding production capabilities. The forecast period (2025-2033) promises continued expansion as the European animal protein market responds to evolving consumer preferences and industry trends. Further expansion is expected from emerging protein sources such as insect protein, although currently holding a smaller market share.

Europe Animal Protein Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe animal protein market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by protein type (Casein and Caseinates, Collagen, Egg Protein, Gelatin, Insect Protein, Milk Protein, Whey Protein, Other Animal Protein) and end-user (Animal Feed, Food and Beverages), allowing for a granular understanding of market performance across various segments. The market size is presented in Million units.

Europe Animal Protein Market Dynamics & Structure

This section analyzes the market concentration, technological innovation drivers, regulatory frameworks, competitive product substitutes, end-user demographics, and M&A trends within the European animal protein market. The European animal protein market is characterized by a moderately concentrated structure, with a few large players holding significant market share. Technological innovation, particularly in sustainable and alternative protein sources, is a key driver, although challenges remain in scaling up production and ensuring consumer acceptance. Stringent regulatory frameworks concerning food safety and labeling impact market operations and product development. Competitive substitutes, including plant-based proteins, exert pressure on market growth. The aging population and increasing health consciousness are shaping end-user demographics. M&A activity, as seen in recent years, continues to reshape the market landscape.

- Market Concentration: xx% controlled by top 5 players (2024).

- Technological Innovation: Focus on sustainable production methods and alternative protein sources (e.g., insect protein). Innovation barriers include high R&D costs and regulatory hurdles.

- Regulatory Framework: EU regulations on food safety and labeling significantly impact market operations.

- Competitive Substitutes: Plant-based proteins pose a growing competitive threat.

- End-User Demographics: Aging population driving demand for functional foods and dietary supplements.

- M&A Activity: xx M&A deals recorded between 2019-2024, with a value of xx Million.

Europe Animal Protein Market Growth Trends & Insights

The European animal protein market experienced significant growth between 2019 and 2024, driven by factors such as increasing consumer demand for protein-rich foods, expanding food and beverage applications, and growth in the animal feed industry. The market is expected to continue its growth trajectory during the forecast period (2025-2033), although at a potentially moderated pace compared to the historical period, influenced by factors such as economic conditions and shifts in consumer preferences toward more sustainable and ethically sourced products. Technological disruptions, like advancements in protein extraction and processing, are expected to drive efficiency and product innovation. Consumer behavior shifts towards health and wellness are fueling demand for specific protein types.

- Market Size (Million Units): 2019: xx; 2024: xx; 2025: xx; 2033: xx

- CAGR (2019-2024): xx%

- CAGR (2025-2033): xx%

- Market Penetration: xx% in key segments by 2033.

Dominant Regions, Countries, or Segments in Europe Animal Protein Market

Germany, France, and the UK are the leading countries in the European animal protein market, driven by high population density, strong economies, and established food processing industries. Within the protein type segment, Whey Protein and Casein and Caseinates dominate due to wide applications in the food and beverage sector. The Animal Feed segment holds a larger market share than Food and Beverages, reflecting the significant use of animal protein in livestock farming.

- Leading Regions: Western Europe (Germany, France, UK)

- Dominant Protein Types: Whey Protein, Casein and Caseinates

- Largest End-User Segment: Animal Feed

- Key Drivers: Strong food processing industries, high consumer spending, and substantial livestock farming.

Europe Animal Protein Market Product Landscape

The European animal protein market offers a diverse range of products catering to various end-user needs. Innovations focus on enhancing product functionalities (e.g., improved solubility, digestibility) and addressing consumer demand for clean-label and natural ingredients. Technological advancements include optimized extraction methods and innovative formulations for improved shelf-life and nutritional value. Unique selling propositions revolve around specific functionalities (e.g., enhanced protein content, improved texture), sourcing (e.g., sustainable, organic), and production methods (e.g., cold filtration).

Key Drivers, Barriers & Challenges in Europe Animal Protein Market

Key Drivers: Increasing consumer demand for protein-rich foods, growth of the health and wellness sector, and the development of new food and beverage applications. Government support for sustainable agriculture and alternative protein sources further accelerates growth.

Key Challenges and Restraints: Fluctuations in raw material prices, stringent regulatory requirements, and competition from plant-based protein alternatives present significant challenges. Supply chain disruptions due to geopolitical factors can impact production and distribution, while consumer perception of ethical and sustainable sourcing is paramount.

Emerging Opportunities in Europe Animal Protein Market

Emerging opportunities exist in the development and adoption of insect protein, which is gaining traction as a sustainable and environmentally friendly alternative. Expansion into niche markets, such as functional foods and sports nutrition, presents significant growth potential. Customized protein solutions tailored to specific dietary needs and preferences, alongside increasing consumer awareness about the importance of protein in maintaining good health, fuels market growth.

Growth Accelerators in the Europe Animal Protein Market Industry

Technological advancements in protein extraction and processing, along with strategic partnerships between ingredient suppliers and food manufacturers, are key growth accelerators. Market expansion into new geographical regions and product diversification into high-value segments, such as functional foods and nutraceuticals, are important growth strategies. The increasing adoption of sustainable and ethical sourcing practices enhances market growth.

Key Players Shaping the Europe Animal Protein Market Market

- SAS Gelatines Weishardt

- Darling Ingredients Inc

- Arla Foods amba

- LAÏTA

- Koninklijke FrieslandCampina NV

- Lactoprot Deutschland GmbH

- Groupe LACTALIS

- Agrial Enterprise

- Ÿnsect

Notable Milestones in Europe Animal Protein Market Sector

- February 2021: Lactalis Ingredients launched a new Pronativ Native Micellar Casein, marketed as a pure and natural protein, extracted via cold filtration.

- April 2021: Ÿnsect acquired Protifarm, expanding its insect protein production capabilities.

- November 2021: Lactalis Ingredients launched high-protein product concepts using Pronativ® Native Micellar Casein and Pronativ® Native Whey Protein (shakes and puddings).

In-Depth Europe Animal Protein Market Market Outlook

The future of the European animal protein market looks promising, driven by continued innovation in protein sources and processing technologies. Opportunities exist in tapping into emerging markets, developing novel applications, and creating sustainable production systems to address growing consumer demand for healthy, ethical, and environmentally responsible protein sources. Strategic partnerships and investments in research and development will play a crucial role in shaping the future of this dynamic market.

Europe Animal Protein Market Segmentation

-

1. Protein Type

- 1.1. Casein and Caseinates

- 1.2. Collagen

- 1.3. Egg Protein

- 1.4. Gelatin

- 1.5. Insect Protein

- 1.6. Milk Protein

- 1.7. Whey Protein

- 1.8. Other Animal Protein

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Confectionery

- 2.2.1.5. Dairy and Dairy Alternative Products

- 2.2.1.6. RTE/RTC Food Products

- 2.2.1.7. Snacks

-

2.2.1. By Sub End User

- 2.3. Personal Care and Cosmetics

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

Europe Animal Protein Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Animal Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 5.1.1. Casein and Caseinates

- 5.1.2. Collagen

- 5.1.3. Egg Protein

- 5.1.4. Gelatin

- 5.1.5. Insect Protein

- 5.1.6. Milk Protein

- 5.1.7. Whey Protein

- 5.1.8. Other Animal Protein

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Confectionery

- 5.2.2.1.5. Dairy and Dairy Alternative Products

- 5.2.2.1.6. RTE/RTC Food Products

- 5.2.2.1.7. Snacks

- 5.2.2.1. By Sub End User

- 5.2.3. Personal Care and Cosmetics

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 6. Germany Europe Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 SAS Gelatines Weishardt

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Darling Ingredients Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Arla Foods amba

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 LAÏTA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Koninklijke FrieslandCampina NV

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Lactoprot Deutschland GmbH

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Groupe LACTALIS

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Agrial Enterprise

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Ÿnsec

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 SAS Gelatines Weishardt

List of Figures

- Figure 1: Europe Animal Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Animal Protein Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Animal Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Animal Protein Market Revenue Million Forecast, by Protein Type 2019 & 2032

- Table 3: Europe Animal Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Europe Animal Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Animal Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Animal Protein Market Revenue Million Forecast, by Protein Type 2019 & 2032

- Table 14: Europe Animal Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Europe Animal Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Animal Protein Market?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the Europe Animal Protein Market?

Key companies in the market include SAS Gelatines Weishardt, Darling Ingredients Inc, Arla Foods amba, LAÏTA, Koninklijke FrieslandCampina NV, Lactoprot Deutschland GmbH, Groupe LACTALIS, Agrial Enterprise, Ÿnsec.

3. What are the main segments of the Europe Animal Protein Market?

The market segments include Protein Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

November 2021: Lactalis Ingredients launched new high-protein product concepts using Pronativ® Native Micellar Casein and Pronativ® Native Whey Protein. Some of the derived concepts are high-protein shakes and high-protein pudding.April 2021: Ÿnsect acquired Protifarm, one of the leading insect protein producers for human applications. The joint offering accelerated its manufacturing capabilities with a third production site, strengthening Ÿnsect’s position in the global insect protein market.February 2021: Lactalis Ingredients launched a new Pronativ Native Micellar Casein, marketed as a pure and natural protein. It uses a cold filtration method to extract whey directly from milk without adding additives or chemicals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Animal Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Animal Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Animal Protein Market?

To stay informed about further developments, trends, and reports in the Europe Animal Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence