Key Insights

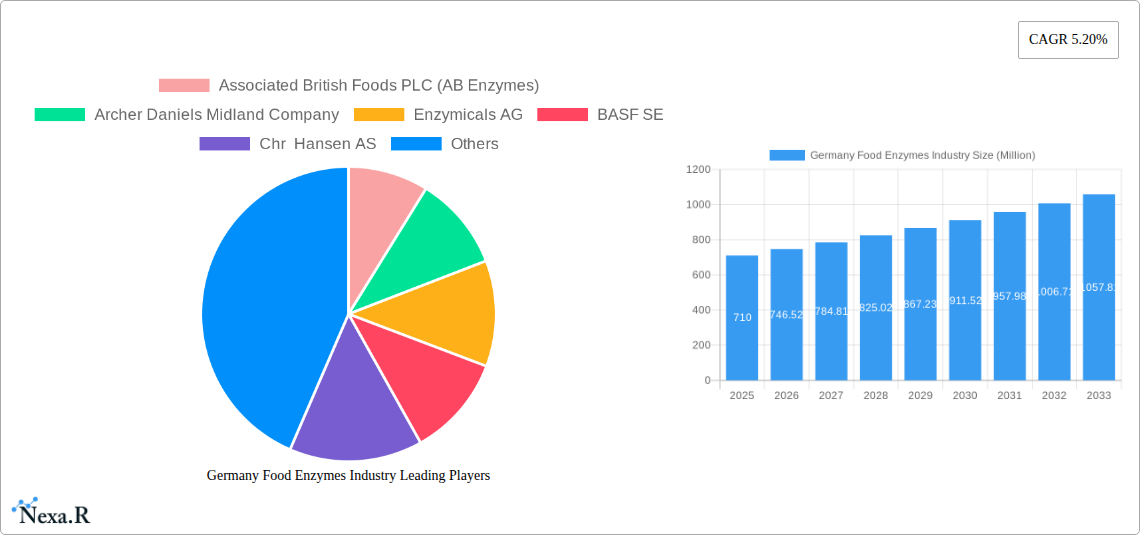

The German food enzymes market, a significant segment of the broader European food and beverage industry, is projected to experience steady growth over the forecast period (2025-2033). With a 2025 market size estimated at €710 million (based on the provided overall market size and considering Germany's significant share of the European food processing sector), the market is driven by several key factors. Increasing consumer demand for processed foods with improved texture, taste, and shelf life fuels the demand for food enzymes. The rising adoption of enzyme-based solutions in bakery, confectionery, and dairy applications, particularly within Germany's robust food manufacturing sector, is a significant contributor to this growth. Furthermore, the growing focus on natural and clean-label ingredients is driving the demand for food enzymes derived from natural sources, presenting a lucrative opportunity for manufacturers. Stringent regulations regarding food safety and quality in Germany also necessitate the use of enzymes for enhanced processing and preservation, contributing to the market expansion. Competition amongst major players like Associated British Foods PLC (AB Enzymes), Archer Daniels Midland Company, and Chr. Hansen AS is likely to intensify, driving innovation and pricing strategies.

However, the market might face certain challenges. Fluctuations in raw material prices and potential regulatory changes could influence market growth. Maintaining sustainable sourcing practices and ensuring the cost-effectiveness of enzyme solutions remain crucial for market players. The overall growth trajectory, however, remains positive, with advancements in enzyme technology and increasing applications expected to offset potential restraints. The market's segmentation by application (bakery, confectionery, dairy, meat, etc.) allows companies to target specific niches and develop tailored enzyme solutions for various food processing needs. The presence of established players and emerging companies highlights the dynamic nature and competitive landscape of this market segment in Germany. Continued research and development in enzyme technology will be key to unlocking further market potential and meeting evolving consumer demands for high-quality, functional foods.

Germany Food Enzymes Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Germany food enzymes industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. It leverages extensive market research and data analysis to deliver a thorough understanding of market dynamics, growth trends, and key players. The report examines the parent market (food processing industry in Germany) and its child market (food enzymes) providing a granular view of market segmentation (By Application: Bakery, Confectionery, Dairy and Frozen Desserts, Meat, Poultry, and Seafood Products, Beverages, Other Applications) and competitive landscape.

Germany Food Enzymes Industry Market Dynamics & Structure

The German food enzymes market is characterized by a moderately concentrated structure with key players holding significant market share. The market is driven by technological advancements in enzyme production, increasing demand for natural and clean-label food products, and stringent regulations regarding food safety. Competitive pressures stem from both established multinational corporations and smaller specialized enzyme producers. The market also sees considerable influence from mergers and acquisitions (M&A) activity, with larger players consolidating their market position through strategic acquisitions of smaller companies. Innovation is a key driver, but challenges exist in terms of R&D costs and regulatory hurdles. Substitute products, such as traditional processing methods, pose a competitive threat, especially in price-sensitive segments.

- Market Concentration: The top five players hold approximately xx% of the market share in 2025.

- Technological Innovation: Focus on enzyme engineering and improved production processes to enhance efficiency and efficacy.

- Regulatory Framework: Stringent food safety regulations influence the type of enzymes used and manufacturing processes.

- Competitive Substitutes: Traditional processing methods and chemically synthesized ingredients pose a competitive challenge.

- End-User Demographics: Shifting consumer preferences towards natural and healthier food products drive demand for food enzymes.

- M&A Trends: A moderate level of M&A activity observed in the period 2019-2024, with xx deals recorded.

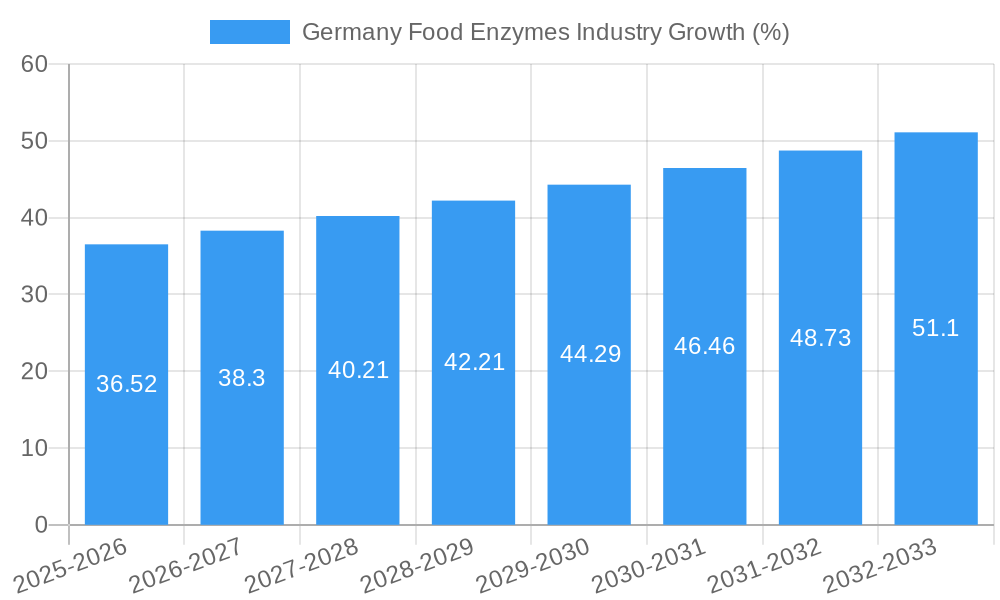

Germany Food Enzymes Industry Growth Trends & Insights

The German food enzymes market has exhibited steady growth in the historical period (2019-2024), driven by factors such as increasing demand for processed foods, the growing preference for clean-label products, and ongoing innovation in enzyme technology. The market is expected to continue its growth trajectory throughout the forecast period (2025-2033), with a projected Compound Annual Growth Rate (CAGR) of xx% during this time. This growth will be fueled by factors such as increased consumer awareness of health and wellness, and the expanding use of enzymes in various food applications. Technological advancements in enzyme production, such as the development of more efficient and cost-effective production methods, will further drive market growth. Consumer behavior is shifting towards more convenient, ready-to-eat foods, supporting increased demand for food enzymes in these product segments. Market penetration of food enzymes remains relatively high in established segments, but there's still potential for growth in emerging applications.

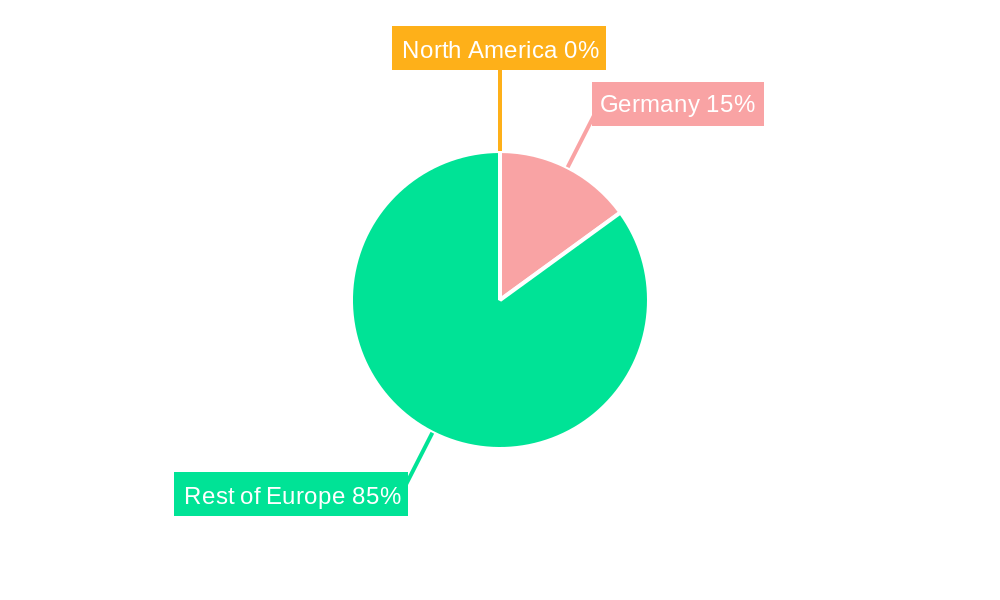

Dominant Regions, Countries, or Segments in Germany Food Enzymes Industry

The Bakery segment currently holds the largest market share within the German food enzymes market, owing to the high consumption of baked goods and the widespread adoption of enzymes for improving bread quality, texture, and shelf life. Dairy and Frozen Desserts is another significant segment, driven by the use of enzymes in cheese making and ice cream production. The strong performance of these segments is attributed to several factors, including:

- Strong domestic consumption of bakery and dairy products.

- Established infrastructure supporting food processing industries.

- Favorable economic conditions and disposable income levels.

- Growing demand for functional foods and clean-label products.

Other applications, such as meat processing, beverages, and confectionery also exhibit notable growth potentials, fueled by increasing demand for processed meat products, novel beverage types, and innovative confectionery items.

Germany Food Enzymes Industry Product Landscape

The German food enzymes market offers a diverse range of products tailored to different food applications. Recent innovations focus on improving enzyme stability, efficiency, and specificity, leading to enhanced product quality, reduced processing costs, and improved sustainability. Many companies are developing enzymes with enhanced functionalities, catering to specific needs of different food manufacturers. These innovations include enzymes with enhanced thermostability, pH stability, and activity levels, enabling their application across broader processing conditions. Unique selling propositions increasingly include sustainability aspects, such as reduced energy consumption and waste generation during food production.

Key Drivers, Barriers & Challenges in Germany Food Enzymes Industry

Key Drivers:

- Increasing demand for natural food ingredients.

- Growing consumer preference for clean-label products.

- Technological advancements in enzyme production and application.

- Stringent food safety regulations driving innovation.

Key Challenges:

- Fluctuations in raw material prices affecting production costs.

- Stringent regulatory approvals and compliance requirements.

- Competition from substitute ingredients and traditional processing methods.

- Potential supply chain disruptions impacting availability.

Emerging Opportunities in Germany Food Enzymes Industry

Emerging opportunities lie in the development of novel enzymes for niche applications, such as plant-based protein processing and functional food formulations. Growing demand for gluten-free and allergen-free products creates opportunities for enzymes to improve the quality and texture of these food items. Further exploration of enzyme applications in fermented foods and personalized nutrition offers substantial growth potential. Utilizing enzymes to promote sustainable food production processes and reduce waste is also gaining traction, creating new business avenues.

Growth Accelerators in the Germany Food Enzymes Industry Industry

Long-term growth will be fueled by ongoing research and development in enzyme technology, leading to the discovery of more efficient and effective enzymes. Strategic partnerships between enzyme producers and food manufacturers will accelerate innovation and market penetration. Expansion into new food applications, such as plant-based meat alternatives and novel beverage formulations, will also contribute to market growth. Government initiatives promoting sustainable food production may positively impact the market.

Key Players Shaping the Germany Food Enzymes Industry Market

- Associated British Foods PLC (AB Enzymes)

- Archer Daniels Midland Company

- Enzymicals AG

- BASF SE

- Chr Hansen AS

- DuPont

- SternEnzym GmbH & Co K

- Koninklijke DSM NV

Notable Milestones in Germany Food Enzymes Industry Sector

- 2021: Launch of a novel enzyme for improved bread dough processing by BASF SE.

- 2022: Acquisition of a smaller enzyme producer by Associated British Foods PLC (AB Enzymes).

- 2023: Introduction of a new range of enzymes for dairy applications by Chr. Hansen AS.

- 2024: Publication of new research highlighting the benefits of enzymes in sustainable food production. (Specific details would need to be researched for accuracy)

In-Depth Germany Food Enzymes Industry Market Outlook

The German food enzymes market is poised for significant growth over the next decade, driven by a confluence of factors, including the growing demand for processed foods, increasing consumer awareness of health and wellness, and ongoing innovation in enzyme technology. Strategic partnerships and investments in research and development will play a crucial role in shaping the market's trajectory. The market is expected to witness further consolidation through M&A activity, and the expansion of enzyme applications into new food categories will create new growth opportunities.

Germany Food Enzymes Industry Segmentation

-

1. Application

- 1.1. Bakery

- 1.2. Confectionery

- 1.3. Dairy and Frozen Desserts

- 1.4. Meat, Poultry, and Seafood Products

- 1.5. Beverages

- 1.6. Other Applications

Germany Food Enzymes Industry Segmentation By Geography

- 1. Germany

Germany Food Enzymes Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. Increasing Application in the Bakery Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Food Enzymes Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Bakery

- 5.1.2. Confectionery

- 5.1.3. Dairy and Frozen Desserts

- 5.1.4. Meat, Poultry, and Seafood Products

- 5.1.5. Beverages

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Germany Germany Food Enzymes Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Germany Food Enzymes Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Germany Food Enzymes Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Germany Food Enzymes Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Germany Food Enzymes Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Europe Germany Food Enzymes Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Associated British Foods PLC (AB Enzymes)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Archer Daniels Midland Company

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Enzymicals AG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 BASF SE

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Chr Hansen AS

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 DuPont

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 SternEnzym GmbH & Co K

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Koninklijke DSM NV

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Associated British Foods PLC (AB Enzymes)

List of Figures

- Figure 1: Germany Food Enzymes Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Food Enzymes Industry Share (%) by Company 2024

List of Tables

- Table 1: Germany Food Enzymes Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Food Enzymes Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Germany Food Enzymes Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Germany Food Enzymes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Germany Food Enzymes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Germany Food Enzymes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Germany Food Enzymes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Germany Food Enzymes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Germany Food Enzymes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Europe Germany Food Enzymes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Germany Food Enzymes Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 12: Germany Food Enzymes Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Food Enzymes Industry?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Germany Food Enzymes Industry?

Key companies in the market include Associated British Foods PLC (AB Enzymes), Archer Daniels Midland Company, Enzymicals AG, BASF SE, Chr Hansen AS, DuPont, SternEnzym GmbH & Co K, Koninklijke DSM NV.

3. What are the main segments of the Germany Food Enzymes Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 710 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

Increasing Application in the Bakery Sector.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Food Enzymes Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Food Enzymes Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Food Enzymes Industry?

To stay informed about further developments, trends, and reports in the Germany Food Enzymes Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence