Key Insights

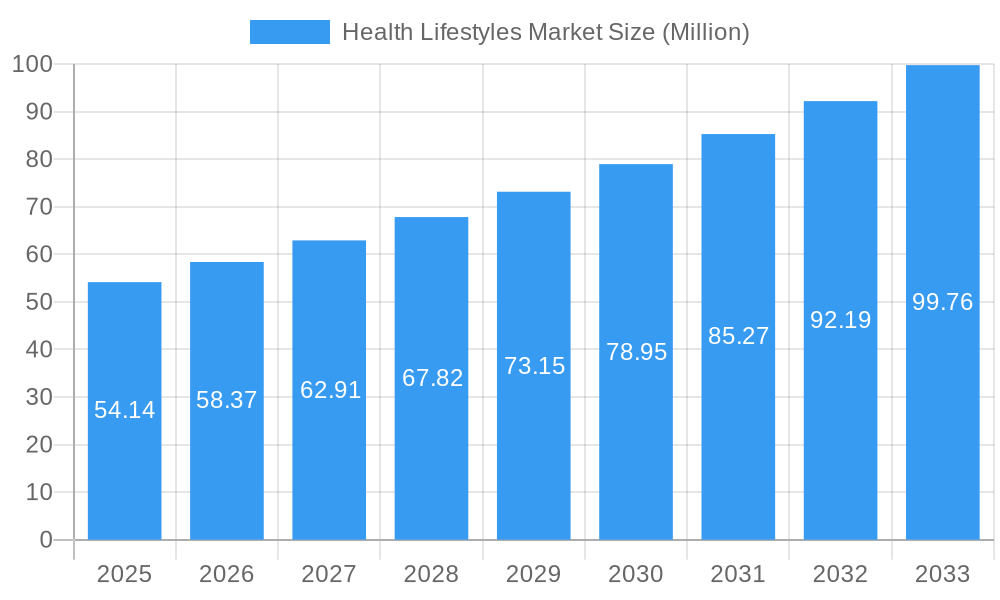

The global Health Lifestyles Market is poised for significant expansion, projected to reach USD 54.14 Million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.75% during the forecast period of 2025-2033. This growth is fueled by a confluence of evolving consumer priorities, increasing awareness of preventive healthcare, and a rising disposable income across key regions. Consumers are increasingly investing in products and services that support well-being, leading to a surge in demand for a diverse range of health-focused offerings. The market is witnessing a pronounced shift towards proactive health management, with individuals seeking to enhance their overall quality of life through better nutrition, physical activity, and mental well-being. This burgeoning demand is further amplified by innovative product development and expanding distribution channels, making health-conscious choices more accessible than ever before.

Health Lifestyles Market Market Size (In Million)

The market's dynamism is also shaped by a variety of factors, including the growing prevalence of lifestyle-related diseases, the aging global population, and the escalating adoption of digital health solutions. Key market drivers include the increasing consumer focus on preventive healthcare measures, advancements in nutritional science, and the growing demand for personalized health and wellness solutions. Trends such as the rise of functional foods and beverages, the popularity of plant-based diets, and the integration of technology in health tracking are further propelling market growth. While the market is experiencing a healthy upward trajectory, potential restraints such as stringent regulatory frameworks for health products and the high cost of some specialized supplements could pose challenges. The competitive landscape is characterized by the presence of major global players and a host of emerging companies, all vying for market share through product innovation, strategic partnerships, and extensive distribution networks across diverse segments like heart health, bone and joint health, digestive health, and brain health supplements, available in various forms including powders and capsules through channels like supermarkets, pharmacies, and online retail.

Health Lifestyles Market Company Market Share

Health Lifestyles Market: Comprehensive Report & Analysis 2019-2033

This in-depth report provides a definitive analysis of the global Health Lifestyles Market, a rapidly expanding sector driven by increasing consumer awareness of preventative health and well-being. Covering the historical period of 2019-2024, base year 2025, and forecast period 2025-2033, this report offers critical insights into market dynamics, growth trends, dominant regions, product landscape, key players, and future opportunities. We dissect parent and child market segments with unparalleled detail, leveraging high-traffic keywords to ensure maximum visibility for industry professionals seeking strategic intelligence on the nutritional supplements market, wellness products market, and dietary supplements industry.

Health Lifestyles Market Market Dynamics & Structure

The Health Lifestyles Market is characterized by a moderate to high degree of market concentration, with several large, established players vying for significant market share alongside a growing number of agile, niche manufacturers. Technological innovation is a primary driver, with continuous advancements in ingredient sourcing, formulation efficacy, and delivery systems, particularly in areas like personalized nutrition and bioavailability. Regulatory frameworks, while varying across regions, generally favor the proliferation of health supplements, though stringent quality control and labeling requirements act as both enablers and potential barriers. Competitive product substitutes exist in the form of functional foods, specialized beverages, and over-the-counter pharmaceuticals, but supplements offer targeted, concentrated benefits. End-user demographics are increasingly broad, encompassing millennials and Gen Z increasingly focused on proactive health, alongside older demographics prioritizing age-related wellness. Mergers & Acquisitions (M&A) trends indicate consolidation among larger entities seeking to expand their portfolios and market reach, alongside strategic acquisitions of innovative startups.

- Market Concentration: Dominated by key players like Nestle SA, Otsuka Holdings Inc., Amway Corporation, Herbalife Nutrition Limited, and Abbott Laboratories.

- Technological Innovation: Focus on novel ingredient research, advanced extraction methods, and scientifically backed formulations.

- Regulatory Landscape: Evolving regulations for dietary supplements, emphasizing safety and efficacy.

- Competitive Landscape: Competition from functional foods and health and wellness products.

- End-User Demographics: Growing demand from younger demographics for preventative health solutions.

- M&A Activity: Strategic acquisitions to enhance product portfolios and market penetration.

Health Lifestyles Market Growth Trends & Insights

The Health Lifestyles Market is poised for significant expansion, driven by a confluence of socioeconomic and technological advancements. The global market size is projected to witness robust growth, fueled by an escalating emphasis on preventative healthcare and a proactive approach to well-being. Adoption rates for health supplements are increasing across all age groups, spurred by greater accessibility and a wider understanding of the benefits associated with specific ingredients. Technological disruptions, such as advancements in biotechnology and nutrigenomics, are enabling the development of highly targeted and personalized health solutions, further accelerating market penetration. Consumer behavior shifts are profoundly influencing this market; there is a pronounced move towards natural and organic products, a demand for transparency in ingredient sourcing, and a growing preference for convenient, on-the-go consumption formats. The rise of e-commerce has also democratized access to a vast array of health and wellness products, empowering consumers to make informed choices. The perceived value proposition of vitamins and dietary supplements is shifting from mere deficiency correction to comprehensive health optimization. This evolving consumer mindset, coupled with rising disposable incomes in emerging economies, creates a fertile ground for sustained growth. The estimated market size in 2025 is projected to be in the range of hundreds of billions of dollars, with a Compound Annual Growth Rate (CAGR) estimated to be between 7% and 9% over the forecast period. This upward trajectory is supported by ongoing research and development into the efficacy of various health supplements for a myriad of conditions, from cognitive health to immune support.

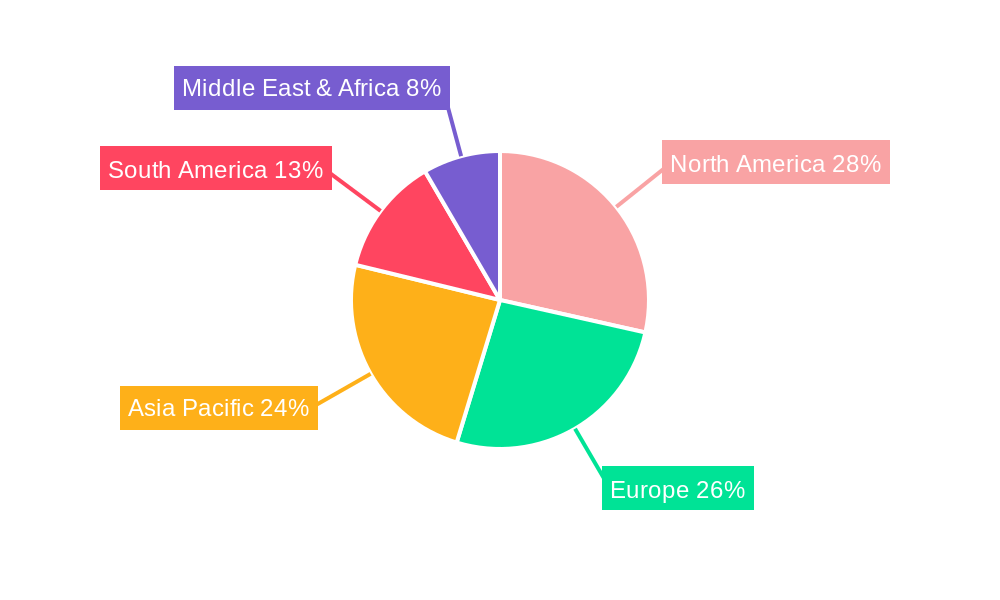

Dominant Regions, Countries, or Segments in Health Lifestyles Market

The Health Lifestyles Market's dominance is currently observed across several key regions and segments, driven by a complex interplay of economic policies, consumer behavior, and infrastructural development. North America, particularly the United States, has historically been a frontrunner, characterized by high consumer disposable income, a well-established healthcare infrastructure, and a deeply ingrained culture of health consciousness. This region exhibits a strong demand for a wide array of supplements, including heart health supplements, bone and joint health supplements, and digestive health supplements. The extensive presence of major retailers like supermarkets/hypermarkets and specialized pharmacies & drug stores, coupled with the robust growth of online retail stores, ensures widespread accessibility.

In Europe, countries like Germany and the UK are significant contributors, with a growing emphasis on natural and organic products and a strong regulatory framework that fosters consumer trust. Asia Pacific, however, is emerging as the fastest-growing region, propelled by rising middle-class populations, increasing health awareness, and a burgeoning interest in traditional herbal remedies now being integrated into modern supplement formulations. Countries like China and India are witnessing an unprecedented surge in demand for nutritional supplements and wellness products, driven by government initiatives promoting public health and the increasing influence of digital marketing.

From a product type perspective, Heart Health Supplements and Bone and Joint Health supplements represent substantial market segments due to the increasing prevalence of cardiovascular diseases and age-related joint issues, respectively. The Brain Health Supplements segment is also experiencing rapid growth as cognitive function becomes a key concern for aging populations and individuals seeking enhanced mental performance. In terms of form, Capsules remain a dominant format due to convenience and ease of consumption, though powders are gaining traction for their versatility in formulations and targeted delivery. Online Retail Stores are rapidly becoming a pivotal distribution channel, surpassing traditional brick-and-mortar outlets in many markets, offering consumers a wider selection, competitive pricing, and the convenience of home delivery. The market share within these dominant segments is substantial, with North America holding an estimated 35-40% of the global market, followed by Europe at approximately 25-30%, and Asia Pacific showing a CAGR of over 10%.

Health Lifestyles Market Product Landscape

The Health Lifestyles Market is characterized by a dynamic product landscape marked by constant innovation and a focus on efficacy and consumer convenience. Leading companies are investing heavily in research and development to introduce novel formulations that address specific health concerns. Innovations in ingredient sourcing, such as the use of bioavailable forms of vitamins and minerals and the incorporation of novel plant-based extracts, are differentiating products. Applications span a wide spectrum, from improving cardiovascular health and bolstering the immune system to enhancing cognitive function and supporting skeletal integrity. Performance metrics are increasingly scrutinized, with a focus on scientifically validated efficacy and safety profiles. Unique selling propositions often revolve around scientifically proven ingredients, patented formulations, and certifications from recognized health organizations. Technological advancements in encapsulation techniques, controlled-release mechanisms, and the development of ingestible technologies are further enhancing product performance and consumer appeal in the health supplements market.

Key Drivers, Barriers & Challenges in Health Lifestyles Market

Key Drivers:

- Rising Health Consciousness: Growing consumer awareness of preventative healthcare and the role of nutrition in overall well-being is a primary growth driver.

- Aging Global Population: The increasing proportion of the elderly population is fueling demand for supplements targeting age-related health concerns like bone health, joint health, and cognitive function.

- Prevalence of Chronic Diseases: The rising incidence of lifestyle-related chronic diseases such as cardiovascular issues, diabetes, and obesity drives demand for supplements that can help manage or mitigate these conditions.

- Technological Advancements: Innovations in ingredient research, formulation technology, and delivery systems are leading to more effective and targeted health solutions.

- Expanding Online Retail: The convenience and accessibility of online platforms have significantly broadened the market reach for health supplements.

Barriers & Challenges:

- Regulatory Hurdles: Stringent and evolving regulatory landscapes across different countries can pose challenges for product approvals, marketing claims, and international market entry.

- Misinformation and Skepticism: The proliferation of unsubstantiated health claims and a general sense of skepticism among some consumers can hinder market growth.

- Price Sensitivity: While demand is high, price can be a barrier for some segments of the population, especially in emerging economies.

- Supply Chain Disruptions: Geopolitical factors, natural disasters, and global health crises can disrupt the supply chain for raw materials and finished products.

- Intense Competition: The market is highly competitive, with numerous players vying for consumer attention, leading to pressure on pricing and profitability. The global market size for dietary supplements is estimated to reach hundreds of billions of units in the coming years, indicating significant competitive pressure.

Emerging Opportunities in Health Lifestyles Market

Emerging opportunities in the Health Lifestyles Market are primarily centered around personalized nutrition, the integration of technology, and the growing demand for sustainable and ethically sourced products. The rise of nutrigenomics presents a significant opportunity for companies to develop customized supplement regimens based on individual genetic profiles, dietary habits, and lifestyle factors. The incorporation of wearable technology and AI-powered health apps allows for real-time health monitoring and data-driven recommendations, creating a demand for personalized supplement solutions that can be seamlessly integrated into these platforms. Furthermore, the increasing consumer preference for natural, organic, and plant-based ingredients, coupled with a strong emphasis on environmental sustainability and ethical sourcing, opens doors for specialized brands that can cater to these values. Untapped markets in developing economies, with their growing middle class and increasing health awareness, represent substantial growth potential. The development of novel delivery systems, such as advanced gummies, dissolvable strips, and functional beverages, also presents opportunities to enhance consumer engagement and product differentiation in the wellness products market.

Growth Accelerators in the Health Lifestyles Market Industry

Several key catalysts are accelerating the growth of the Health Lifestyles Market. Technological breakthroughs in biotechnology and advanced extraction methods are enabling the development of more potent and bioavailable ingredients, thereby enhancing product efficacy. Strategic partnerships between supplement manufacturers, healthcare providers, and technology companies are fostering innovation and expanding market reach. For instance, collaborations focused on developing evidence-based nutritional supplements for specific health conditions are proving highly effective. Market expansion strategies, including targeted marketing campaigns to younger demographics and increasing product availability in emerging economies, are significant growth accelerators. The continuous influx of venture capital into health and wellness startups also fuels innovation and rapid expansion within the industry. Furthermore, the growing body of scientific research validating the benefits of various dietary supplements is building consumer confidence and driving greater adoption rates.

Key Players Shaping the Health Lifestyles Market Market

- Nestle SA

- Otsuka Holdings Inc.

- Amway Corporation

- Mega Lifesciences

- Herbalife Nutrition Limited

- Bayer AG

- NOW Health Group Inc.

- Nordic Naturals

- Abbott Laboratories

- Swanson Health Products

Notable Milestones in Health Lifestyles Market Sector

- July 2022: Infinitus, a leading Chinese herbal health company, introduced Li Mai Jain supplements, formulated to strengthen bones and joints.

- February 2022: Amway India launched its Nutrilite nutritional supplements in trendy and convenient formats like gummies and mouth-dissolving jelly strips, supporting immune and bone health.

- January 2020: Herbalife Nutrition launched Beta Heart under the heart health segment, specifically designed to maintain cholesterol levels.

In-Depth Health Lifestyles Market Market Outlook

The future outlook for the Health Lifestyles Market remains exceptionally promising, driven by enduring global trends in health consciousness and preventative care. Growth accelerators like personalized nutrition, fueled by advancements in genetic and biometric data, will redefine product offerings and consumer engagement. Strategic partnerships between supplement innovators and digital health platforms are poised to create seamless, integrated wellness ecosystems. Furthermore, the increasing demand for sustainable and transparently sourced ingredients will continue to shape product development and brand positioning. The market is expected to witness significant expansion in emerging economies as disposable incomes rise and health awareness becomes more prevalent. Overall, the Health Lifestyles Market is on a robust growth trajectory, presenting substantial opportunities for companies that can adapt to evolving consumer preferences and leverage technological advancements to deliver effective and trusted health solutions.

Health Lifestyles Market Segmentation

-

1. Product Type

- 1.1. Heart Health Supplements

- 1.2. Bone and Joint Health supplements

- 1.3. Digestive Health Supplements

- 1.4. Brain Health Supplements

- 1.5. Other Supplements

-

2. Form

- 2.1. Powder

- 2.2. Capsules

- 2.3. Others

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Pharmacies & Drug Stores

- 3.3. Online Retail Stores

- 3.4. Other Distribution Channel

Health Lifestyles Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Health Lifestyles Market Regional Market Share

Geographic Coverage of Health Lifestyles Market

Health Lifestyles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1. Growing Demand for Preventive Health Care Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Health Lifestyles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Heart Health Supplements

- 5.1.2. Bone and Joint Health supplements

- 5.1.3. Digestive Health Supplements

- 5.1.4. Brain Health Supplements

- 5.1.5. Other Supplements

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Powder

- 5.2.2. Capsules

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Pharmacies & Drug Stores

- 5.3.3. Online Retail Stores

- 5.3.4. Other Distribution Channel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East

- 5.4.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Health Lifestyles Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Heart Health Supplements

- 6.1.2. Bone and Joint Health supplements

- 6.1.3. Digestive Health Supplements

- 6.1.4. Brain Health Supplements

- 6.1.5. Other Supplements

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Powder

- 6.2.2. Capsules

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Pharmacies & Drug Stores

- 6.3.3. Online Retail Stores

- 6.3.4. Other Distribution Channel

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Health Lifestyles Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Heart Health Supplements

- 7.1.2. Bone and Joint Health supplements

- 7.1.3. Digestive Health Supplements

- 7.1.4. Brain Health Supplements

- 7.1.5. Other Supplements

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Powder

- 7.2.2. Capsules

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Pharmacies & Drug Stores

- 7.3.3. Online Retail Stores

- 7.3.4. Other Distribution Channel

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Health Lifestyles Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Heart Health Supplements

- 8.1.2. Bone and Joint Health supplements

- 8.1.3. Digestive Health Supplements

- 8.1.4. Brain Health Supplements

- 8.1.5. Other Supplements

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Powder

- 8.2.2. Capsules

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Pharmacies & Drug Stores

- 8.3.3. Online Retail Stores

- 8.3.4. Other Distribution Channel

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Health Lifestyles Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Heart Health Supplements

- 9.1.2. Bone and Joint Health supplements

- 9.1.3. Digestive Health Supplements

- 9.1.4. Brain Health Supplements

- 9.1.5. Other Supplements

- 9.2. Market Analysis, Insights and Forecast - by Form

- 9.2.1. Powder

- 9.2.2. Capsules

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/Hypermarkets

- 9.3.2. Pharmacies & Drug Stores

- 9.3.3. Online Retail Stores

- 9.3.4. Other Distribution Channel

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East Health Lifestyles Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Heart Health Supplements

- 10.1.2. Bone and Joint Health supplements

- 10.1.3. Digestive Health Supplements

- 10.1.4. Brain Health Supplements

- 10.1.5. Other Supplements

- 10.2. Market Analysis, Insights and Forecast - by Form

- 10.2.1. Powder

- 10.2.2. Capsules

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarkets/Hypermarkets

- 10.3.2. Pharmacies & Drug Stores

- 10.3.3. Online Retail Stores

- 10.3.4. Other Distribution Channel

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Saudi Arabia Health Lifestyles Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Heart Health Supplements

- 11.1.2. Bone and Joint Health supplements

- 11.1.3. Digestive Health Supplements

- 11.1.4. Brain Health Supplements

- 11.1.5. Other Supplements

- 11.2. Market Analysis, Insights and Forecast - by Form

- 11.2.1. Powder

- 11.2.2. Capsules

- 11.2.3. Others

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Supermarkets/Hypermarkets

- 11.3.2. Pharmacies & Drug Stores

- 11.3.3. Online Retail Stores

- 11.3.4. Other Distribution Channel

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Nestle SA

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Otsuka Holdings inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Amway Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Mega Lifesciences

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Herbalife Nutrition Limited

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Bayer AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 NOW Health Group Inc*List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Nordic Naturals

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Abbott Laboratories

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Swanson Health Products

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Nestle SA

List of Figures

- Figure 1: Global Health Lifestyles Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Health Lifestyles Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Health Lifestyles Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Health Lifestyles Market Revenue (Million), by Form 2025 & 2033

- Figure 5: North America Health Lifestyles Market Revenue Share (%), by Form 2025 & 2033

- Figure 6: North America Health Lifestyles Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Health Lifestyles Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Health Lifestyles Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Health Lifestyles Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Health Lifestyles Market Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Health Lifestyles Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Health Lifestyles Market Revenue (Million), by Form 2025 & 2033

- Figure 13: Europe Health Lifestyles Market Revenue Share (%), by Form 2025 & 2033

- Figure 14: Europe Health Lifestyles Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: Europe Health Lifestyles Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Health Lifestyles Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Health Lifestyles Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Health Lifestyles Market Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Health Lifestyles Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Health Lifestyles Market Revenue (Million), by Form 2025 & 2033

- Figure 21: Asia Pacific Health Lifestyles Market Revenue Share (%), by Form 2025 & 2033

- Figure 22: Asia Pacific Health Lifestyles Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Health Lifestyles Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Health Lifestyles Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Health Lifestyles Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Health Lifestyles Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: South America Health Lifestyles Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Health Lifestyles Market Revenue (Million), by Form 2025 & 2033

- Figure 29: South America Health Lifestyles Market Revenue Share (%), by Form 2025 & 2033

- Figure 30: South America Health Lifestyles Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: South America Health Lifestyles Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: South America Health Lifestyles Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Health Lifestyles Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Health Lifestyles Market Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Middle East Health Lifestyles Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Middle East Health Lifestyles Market Revenue (Million), by Form 2025 & 2033

- Figure 37: Middle East Health Lifestyles Market Revenue Share (%), by Form 2025 & 2033

- Figure 38: Middle East Health Lifestyles Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Middle East Health Lifestyles Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East Health Lifestyles Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East Health Lifestyles Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Saudi Arabia Health Lifestyles Market Revenue (Million), by Product Type 2025 & 2033

- Figure 43: Saudi Arabia Health Lifestyles Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Saudi Arabia Health Lifestyles Market Revenue (Million), by Form 2025 & 2033

- Figure 45: Saudi Arabia Health Lifestyles Market Revenue Share (%), by Form 2025 & 2033

- Figure 46: Saudi Arabia Health Lifestyles Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 47: Saudi Arabia Health Lifestyles Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: Saudi Arabia Health Lifestyles Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Saudi Arabia Health Lifestyles Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Health Lifestyles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Health Lifestyles Market Revenue Million Forecast, by Form 2020 & 2033

- Table 3: Global Health Lifestyles Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Health Lifestyles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Health Lifestyles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Health Lifestyles Market Revenue Million Forecast, by Form 2020 & 2033

- Table 7: Global Health Lifestyles Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Health Lifestyles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Health Lifestyles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Health Lifestyles Market Revenue Million Forecast, by Form 2020 & 2033

- Table 15: Global Health Lifestyles Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Health Lifestyles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Germany Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: France Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Italy Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Russia Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Health Lifestyles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 25: Global Health Lifestyles Market Revenue Million Forecast, by Form 2020 & 2033

- Table 26: Global Health Lifestyles Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global Health Lifestyles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: China Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Japan Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: India Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Australia Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Health Lifestyles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: Global Health Lifestyles Market Revenue Million Forecast, by Form 2020 & 2033

- Table 35: Global Health Lifestyles Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 36: Global Health Lifestyles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Health Lifestyles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 41: Global Health Lifestyles Market Revenue Million Forecast, by Form 2020 & 2033

- Table 42: Global Health Lifestyles Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global Health Lifestyles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Health Lifestyles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 45: Global Health Lifestyles Market Revenue Million Forecast, by Form 2020 & 2033

- Table 46: Global Health Lifestyles Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 47: Global Health Lifestyles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: South Africa Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: Rest of Middle East Health Lifestyles Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Health Lifestyles Market?

The projected CAGR is approximately 7.75%.

2. Which companies are prominent players in the Health Lifestyles Market?

Key companies in the market include Nestle SA, Otsuka Holdings inc, Amway Corporation, Mega Lifesciences, Herbalife Nutrition Limited, Bayer AG, NOW Health Group Inc*List Not Exhaustive, Nordic Naturals, Abbott Laboratories, Swanson Health Products.

3. What are the main segments of the Health Lifestyles Market?

The market segments include Product Type, Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 54.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

Growing Demand for Preventive Health Care Products.

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

In July 2022, Infinitus, a leading Chinese herbal health company introduced Li Mai Jain supplements which are formulated to strengthen the bones and joints.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Health Lifestyles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Health Lifestyles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Health Lifestyles Market?

To stay informed about further developments, trends, and reports in the Health Lifestyles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence