Key Insights

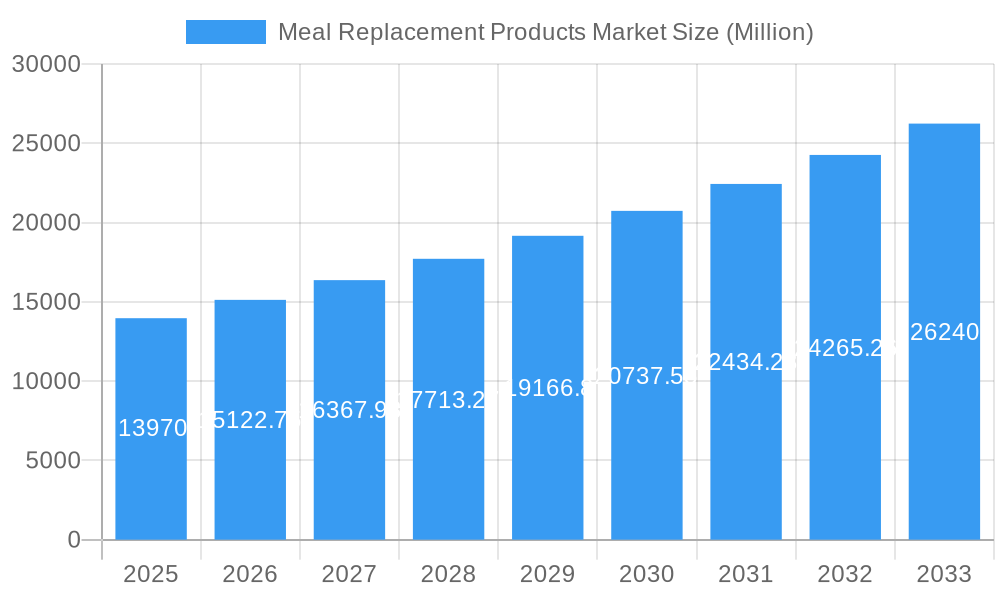

The global Meal Replacement Products Market is poised for substantial growth, projected to reach USD 13.97 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 8.26% from 2019 to 2033. This robust expansion is fueled by a growing consumer consciousness around health and wellness, a rising prevalence of lifestyle diseases, and the increasing demand for convenient and nutritionally balanced food options. Consumers are actively seeking solutions that simplify healthy eating amidst busy schedules, making meal replacement products a highly attractive choice. The market's dynamism is further shaped by evolving dietary preferences, including a surge in demand for plant-based and organic options, as well as a focus on personalized nutrition. Key drivers include greater awareness of weight management and the desire for functional foods that offer specific health benefits, such as improved digestion or enhanced energy levels.

Meal Replacement Products Market Market Size (In Billion)

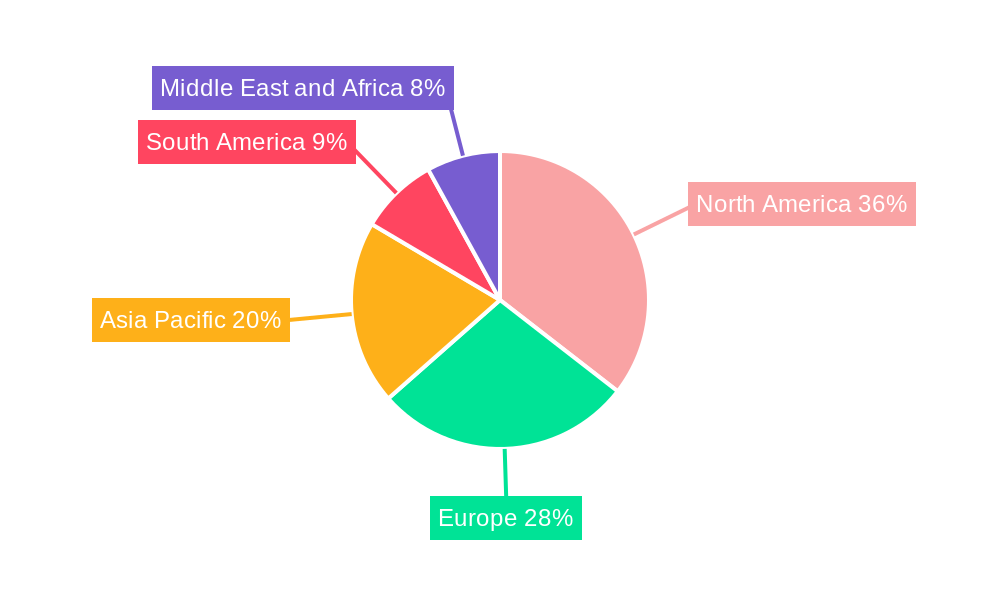

The market segmentation highlights diverse consumer needs and accessibility points. Ready-to-drink products are likely to dominate due to their ultimate convenience, followed by nutritional bars and powdered products, catering to different lifestyle preferences. Distribution channels are equally varied, with online retailers witnessing significant growth, mirroring broader e-commerce trends, alongside traditional channels like hypermarkets and supermarkets. Specialty stores are also playing a role in reaching niche consumer segments. Geographically, North America and Europe are expected to remain dominant markets, driven by higher disposable incomes and advanced healthcare awareness. However, the Asia Pacific region presents a significant growth opportunity, fueled by rapid urbanization, increasing disposable incomes, and a burgeoning middle class adopting Western dietary habits and health trends. Restraints may include consumer perception regarding the nutritional completeness of meal replacements compared to whole foods and potential regulatory hurdles in certain regions.

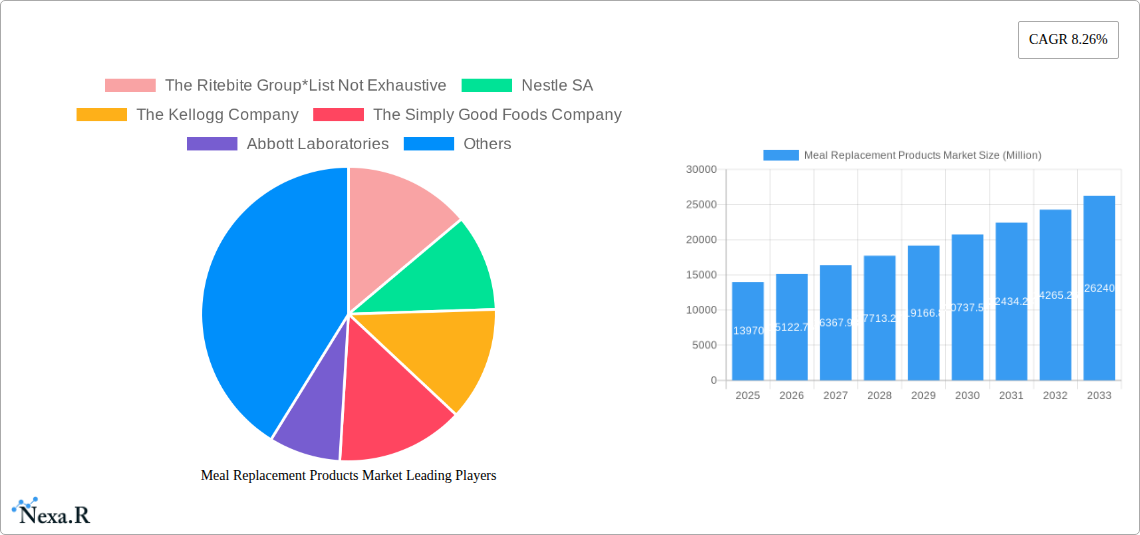

Meal Replacement Products Market Company Market Share

Here is a comprehensive, SEO-optimized report description for the Meal Replacement Products Market, designed for maximum visibility and engagement with industry professionals.

This in-depth meal replacement products market report provides a holistic analysis of the global market, projecting significant growth from 2019 to 2033, with a base year of 2025 and an extended forecast period of 2025-2033. The study covers a robust historical period from 2019-2024, offering invaluable insights into market dynamics, growth trends, and future opportunities. Discover the burgeoning demand for convenient, healthy nutritional solutions, driven by evolving consumer lifestyles and a growing emphasis on wellness. This report dissects the market by product type (Ready-to-drink Products, Nutritional Bars, Powdered Products, Other Product Types) and distribution channel (Convenience Stores, Hypermarkets/Supermarkets, Specialty Stores, Online Retailers, Other Distribution Channels), providing a granular understanding of market segmentation.

Meal Replacement Products Market Market Dynamics & Structure

The global meal replacement products market exhibits a moderate level of concentration, with a mix of large multinational corporations and emerging niche players vying for market share. Technological innovation is a significant driver, with continuous advancements in formulation, ingredient sourcing, and bioavailability enhancing product efficacy and appeal. Regulatory frameworks, primarily focused on food safety and nutritional claims, are evolving to accommodate the growing popularity of these products, particularly in regions like North America and Europe. Competitive product substitutes, ranging from traditional snacks to specialized dietary supplements, pose a constant challenge, necessitating ongoing product differentiation and value proposition enhancement. End-user demographics are increasingly diverse, encompassing busy professionals, fitness enthusiasts, individuals seeking weight management solutions, and aging populations requiring convenient nutrition. Mergers and acquisitions (M&A) are strategic tools for market consolidation and expansion, allowing companies to broaden their product portfolios and geographic reach. In the parent market of nutritional supplements and functional foods, meal replacements represent a dynamic and rapidly growing segment.

- Market Concentration: Moderately concentrated, with key players holding substantial shares but significant room for new entrants.

- Technological Innovation Drivers: Novel ingredient blends, improved palatability, plant-based formulations, and advanced delivery systems.

- Regulatory Frameworks: Stringent food safety standards and evolving labeling requirements across major markets.

- Competitive Product Substitutes: Protein bars, dietary supplements, ready-to-eat meals, and whole foods.

- End-User Demographics: Increasing adoption among health-conscious millennials, Gen Z, and the elderly population.

- M&A Trends: Strategic acquisitions aimed at expanding product lines, entering new markets, and leveraging synergistic technologies.

Meal Replacement Products Market Growth Trends & Insights

The meal replacement market size is poised for substantial expansion, propelled by escalating consumer demand for convenient, nutritionally balanced food options. The shift towards healthier lifestyles and increased awareness regarding the importance of controlled calorie intake are key adoption drivers. Technological disruptions, such as the development of plant-based protein alternatives and advanced nutrient delivery systems, are continuously reshaping the product landscape. Consumer behavior is evolving rapidly, with a growing preference for personalized nutrition, clean labels, and sustainable sourcing. This trend is further amplified by the accessibility of online retail channels, which provide a vast selection and convenient doorstep delivery. The CAGR for the meal replacement products market is projected to be robust throughout the forecast period. Market penetration is expected to rise significantly as awareness and product availability increase globally.

Dominant Regions, Countries, or Segments in Meal Replacement Products Market

North America, particularly the United States, currently dominates the meal replacement products market, driven by a high prevalence of health-conscious consumers, a well-established distribution network, and strong disposable incomes. Within this region, Ready-to-drink Products represent a significant segment, owing to their unparalleled convenience for on-the-go consumption. Online Retailers have emerged as a pivotal distribution channel, offering consumers a wide array of choices and competitive pricing, contributing to increased market penetration.

- Dominant Region: North America (driven by the US).

- Key Product Segment Driver: Ready-to-drink Products due to convenience.

- Pivotal Distribution Channel: Online Retailers facilitating accessibility and choice.

- Market Share: North America is estimated to hold XX% of the global market share in 2025.

- Growth Potential: Emerging economies in Asia-Pacific are showcasing considerable growth potential due to rising health consciousness and increasing urbanization.

- Economic Policies: Favorable government initiatives promoting healthy eating and wellness contribute to market expansion.

- Infrastructure: Well-developed retail and logistics infrastructure in developed regions supports market growth.

Meal Replacement Products Market Product Landscape

The meal replacement product landscape is characterized by a continuous stream of innovations aimed at enhancing nutritional profiles, improving taste, and catering to diverse dietary needs. Companies are investing heavily in research and development to create advanced formulations featuring complete protein sources, essential vitamins, minerals, and fiber. Unique selling propositions often revolve around plant-based ingredients, allergen-free options, and functional benefits such as enhanced energy or digestive support. Technological advancements in encapsulation and shelf-life extension further bolster product performance and market appeal.

Key Drivers, Barriers & Challenges in Meal Replacement Products Market

Key Drivers:

- Convenience: The fast-paced modern lifestyle drives demand for quick and easy meal solutions.

- Health & Wellness Trends: Growing consumer focus on healthy eating, weight management, and disease prevention.

- Product Innovation: Development of diverse flavors, formulations (e.g., plant-based, keto-friendly), and delivery formats.

- Rising Disposable Income: Increased purchasing power allows consumers to invest in premium health products.

Barriers & Challenges:

- Perception Issues: Some consumers still view meal replacements as artificial or lacking in whole-food benefits.

- Regulatory Hurdles: Stringent regulations regarding nutritional claims and product labeling can impact market entry and expansion.

- Supply Chain Disruptions: Volatility in raw material prices and availability can affect production costs and profitability.

- Intense Competition: The market is competitive, with numerous players offering a wide range of products.

Emerging Opportunities in Meal Replacement Products Market

Emerging opportunities in the meal replacement products market are centered around the growing demand for personalized nutrition solutions, catering to specific dietary requirements like gluten-free, vegan, and low-carb diets. The untapped potential in emerging economies, driven by increasing health awareness and disposable incomes, presents a significant avenue for growth. Innovative applications, such as meal replacements tailored for specific athletic performance or elderly nutritional needs, are gaining traction. Evolving consumer preferences for sustainable and ethically sourced ingredients also open doors for new product development and brand positioning.

Growth Accelerators in the Meal Replacement Products Market Industry

Long-term growth in the meal replacement products industry is being significantly accelerated by breakthroughs in nutritional science and ingredient technology. Strategic partnerships between food manufacturers, health and wellness influencers, and technology providers are creating new market avenues and enhancing consumer engagement. Market expansion strategies, including aggressive product launches in underserved geographic regions and targeted marketing campaigns, are also playing a crucial role. The increasing integration of digital platforms for direct-to-consumer sales and personalized nutrition guidance further fuels sustained growth.

Key Players Shaping the Meal Replacement Products Market Market

- The Ritebite Group

- Nestle SA

- The Kellogg Company

- The Simply Good Foods Company

- Abbott Laboratories

- Amway Corp (Alticor)

- Glanbia PLC

- The Kraft Heinz Company

- Herbalife Nutrition

- Bob's Red Mill Natural Foods

Notable Milestones in Meal Replacement Products Market Sector

- November 2022: Levana Nourishment introduced a line of plant-based meal replacement shakes in vanilla bean, mixed berry, and cocoa-coffee varieties, expanding the plant-based segment.

- March 2022: Southern Charm Nutrition opened its outlet in downtown Fairmont, focusing on loaded tea and coffee bombs, as well as full meal replacement shakes with high protein content (17-24g) and low calories (under 270 kcal).

- February 2021: United States-based Veji Holdings released Heal plant-based meal replacements, specifically targeting patients and athletes with vegan, gluten-free, non-GMO formulations aligned with Health Canada guidelines.

In-Depth Meal Replacement Products Market Market Outlook

The meal replacement products market is set for sustained and robust growth, driven by a confluence of factors that enhance future potential. The increasing global adoption of healthy living and the demand for convenient nutritional solutions are significant growth accelerators. Strategic opportunities lie in the expansion of product lines to cater to niche dietary requirements, such as specialized formulations for athletes, the elderly, or individuals with specific medical conditions. Furthermore, the burgeoning online retail sector and direct-to-consumer models offer lucrative avenues for market penetration and personalized consumer engagement. The continuous evolution of ingredient technology and the emphasis on sustainable sourcing will further shape the market's trajectory, presenting a dynamic landscape for innovation and profitability.

Meal Replacement Products Market Segmentation

-

1. Product Type

- 1.1. Ready-to-drink Products

- 1.2. Nutritional Bars

- 1.3. Powdered Products

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. Convenience Stores

- 2.2. Hypermarkets/Supermarkets

- 2.3. Specialty Stores

- 2.4. Online Retailers

- 2.5. Other Distribution Channels

Meal Replacement Products Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Italy

- 2.4. Spain

- 2.5. France

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Meal Replacement Products Market Regional Market Share

Geographic Coverage of Meal Replacement Products Market

Meal Replacement Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for healthy alternative food products; Advancements in vitamin infusion into food products

- 3.3. Market Restrains

- 3.3.1. Expensive pricing of vitamin-infused food products

- 3.4. Market Trends

- 3.4.1. Rising Demand for Convenient and Small-portion Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Meal Replacement Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Ready-to-drink Products

- 5.1.2. Nutritional Bars

- 5.1.3. Powdered Products

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Stores

- 5.2.2. Hypermarkets/Supermarkets

- 5.2.3. Specialty Stores

- 5.2.4. Online Retailers

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Meal Replacement Products Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Ready-to-drink Products

- 6.1.2. Nutritional Bars

- 6.1.3. Powdered Products

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Convenience Stores

- 6.2.2. Hypermarkets/Supermarkets

- 6.2.3. Specialty Stores

- 6.2.4. Online Retailers

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Meal Replacement Products Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Ready-to-drink Products

- 7.1.2. Nutritional Bars

- 7.1.3. Powdered Products

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Convenience Stores

- 7.2.2. Hypermarkets/Supermarkets

- 7.2.3. Specialty Stores

- 7.2.4. Online Retailers

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Meal Replacement Products Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Ready-to-drink Products

- 8.1.2. Nutritional Bars

- 8.1.3. Powdered Products

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Convenience Stores

- 8.2.2. Hypermarkets/Supermarkets

- 8.2.3. Specialty Stores

- 8.2.4. Online Retailers

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Meal Replacement Products Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Ready-to-drink Products

- 9.1.2. Nutritional Bars

- 9.1.3. Powdered Products

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Convenience Stores

- 9.2.2. Hypermarkets/Supermarkets

- 9.2.3. Specialty Stores

- 9.2.4. Online Retailers

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Meal Replacement Products Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Ready-to-drink Products

- 10.1.2. Nutritional Bars

- 10.1.3. Powdered Products

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Convenience Stores

- 10.2.2. Hypermarkets/Supermarkets

- 10.2.3. Specialty Stores

- 10.2.4. Online Retailers

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The Ritebite Group*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nestle SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Kellogg Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Simply Good Foods Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Abbott Laboratories

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Amway Corp (Alticor)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Glanbia PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Kraft Heinz Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Herbalife Nutrition

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bob's Red Mill Natural Foods

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 The Ritebite Group*List Not Exhaustive

List of Figures

- Figure 1: Global Meal Replacement Products Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Meal Replacement Products Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Meal Replacement Products Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Meal Replacement Products Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Meal Replacement Products Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Meal Replacement Products Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Meal Replacement Products Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Meal Replacement Products Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Meal Replacement Products Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Meal Replacement Products Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Meal Replacement Products Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Meal Replacement Products Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Meal Replacement Products Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Meal Replacement Products Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Meal Replacement Products Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Meal Replacement Products Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Meal Replacement Products Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Meal Replacement Products Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Meal Replacement Products Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Meal Replacement Products Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: South America Meal Replacement Products Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Meal Replacement Products Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Meal Replacement Products Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Meal Replacement Products Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Meal Replacement Products Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Meal Replacement Products Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Meal Replacement Products Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Meal Replacement Products Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Meal Replacement Products Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Meal Replacement Products Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Meal Replacement Products Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Meal Replacement Products Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Meal Replacement Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Meal Replacement Products Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Meal Replacement Products Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Meal Replacement Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Meal Replacement Products Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Meal Replacement Products Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Meal Replacement Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Meal Replacement Products Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Russia Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Meal Replacement Products Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Global Meal Replacement Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Meal Replacement Products Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Meal Replacement Products Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 30: Global Meal Replacement Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Meal Replacement Products Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Meal Replacement Products Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 36: Global Meal Replacement Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Meal Replacement Products Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: United Arab Emirates Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Meal Replacement Products Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Meal Replacement Products Market?

The projected CAGR is approximately 8.26%.

2. Which companies are prominent players in the Meal Replacement Products Market?

Key companies in the market include The Ritebite Group*List Not Exhaustive, Nestle SA, The Kellogg Company, The Simply Good Foods Company, Abbott Laboratories, Amway Corp (Alticor), Glanbia PLC, The Kraft Heinz Company, Herbalife Nutrition, Bob's Red Mill Natural Foods.

3. What are the main segments of the Meal Replacement Products Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for healthy alternative food products; Advancements in vitamin infusion into food products.

6. What are the notable trends driving market growth?

Rising Demand for Convenient and Small-portion Food.

7. Are there any restraints impacting market growth?

Expensive pricing of vitamin-infused food products.

8. Can you provide examples of recent developments in the market?

November 2022: Levana Nourishment introduced a line of plant-based meal replacement shakes in vanilla bean, mixed berry, and cocoa-coffee varieties.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Meal Replacement Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Meal Replacement Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Meal Replacement Products Market?

To stay informed about further developments, trends, and reports in the Meal Replacement Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence