Key Insights

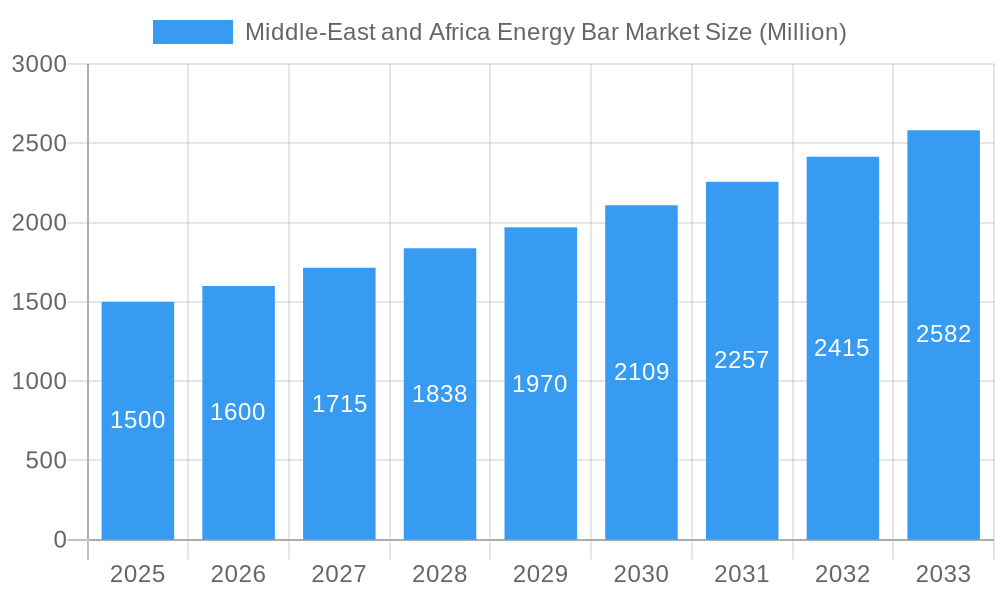

The Middle East and Africa (MEA) energy bar market is projected for robust growth, driven by increasing health consciousness, rising disposable incomes, and a demand for convenient, on-the-go nutrition. With a market size of $5.6 billion in the base year 2025 and a Compound Annual Growth Rate (CAGR) of 4.7%, the market is expected to exceed $5.6 billion by 2033. This expansion is supported by evolving consumer lifestyles and a surge in sports and fitness activities, increasing the demand for nutrient-rich snacks. Key growth factors include the availability of diverse formulations (e.g., gluten-free, vegan, low-sugar) and the adoption of energy bars as meal replacements or supplements for active individuals.

Middle-East and Africa Energy Bar Market Market Size (In Billion)

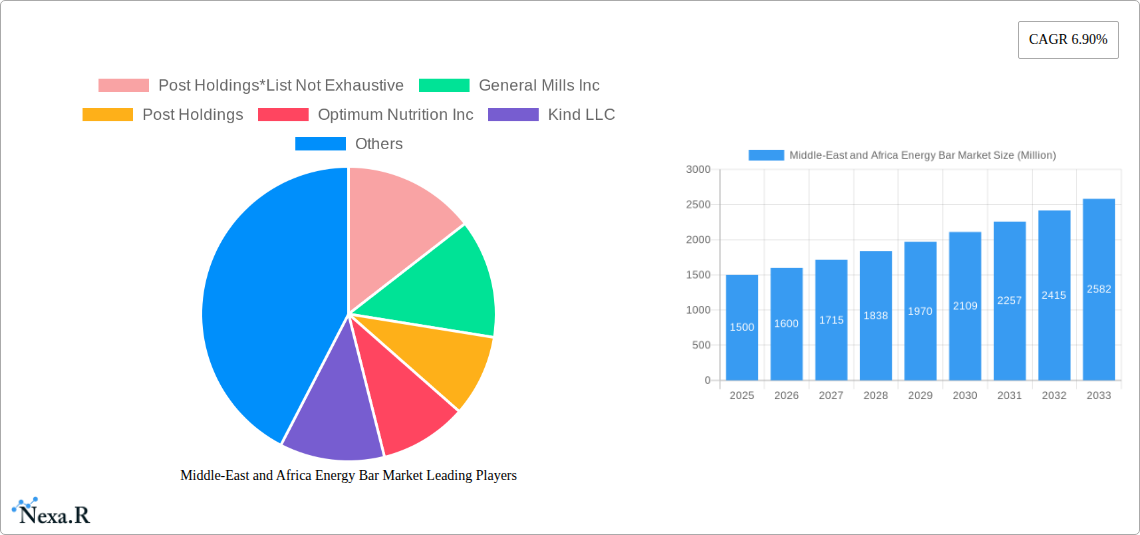

The MEA energy bar market features evolving distribution channels and a dynamic competitive landscape. While supermarkets and hypermarkets lead in product variety, online retail is rapidly expanding, especially in urban centers like Saudi Arabia and the UAE. Pharmacies and drug stores also contribute by promoting energy bars as healthy snack alternatives. Key players, including Post Holdings, General Mills Inc., Optimum Nutrition Inc., and Kind LLC, are innovating product offerings and expanding their regional presence to capture market share. The competitive environment emphasizes product differentiation through premium ingredients, unique flavors, and targeted nutritional benefits, while addressing price sensitivity and competition from other snack categories through value-added propositions and strategic marketing.

Middle-East and Africa Energy Bar Market Company Market Share

This report provides an in-depth analysis of the MEA Energy Bar Market, detailing market dynamics, growth trends, and future opportunities. Covering the period from 2019 to 2033, with 2025 as the base year, the report forecasts market evolution and identifies key strategic advantages. The market's expansion is fueled by rising health consciousness, demand for portable nutrition, and a growing middle-class population. The report examines market structure, key players, and segmentation across various distribution channels, including Supermarkets/Hypermarkets, Convenience Stores, Pharmacies & Drug Stores, and Online Retail. It offers insights into parent market influence and child market specifics to capitalize on emerging trends and gain a competitive edge.

Middle-East and Africa Energy Bar Market Market Dynamics & Structure

The Middle-East and Africa energy bar market exhibits a moderately concentrated structure, with a mix of established global players and emerging local manufacturers vying for market share. Technological innovation is a key driver, with companies focusing on developing bars with enhanced nutritional profiles, natural ingredients, and specialized formulations for athletes, busy professionals, and health-conscious individuals. Regulatory frameworks, while evolving across different MEA countries, are increasingly scrutinizing product labeling, health claims, and ingredient sourcing, impacting product development and marketing strategies. Competitive product substitutes include traditional snacks, confectionery, and other functional food products, necessitating continuous innovation and differentiated offerings. End-user demographics are diverse, encompassing a growing urban population with disposable income, a surge in fitness enthusiasts, and a rising demand for on-the-go healthy options. Mergers and acquisitions (M&A) activity, though currently at a nascent stage, is expected to gain momentum as larger entities seek to expand their regional footprint and acquire innovative local brands. For instance, the market is witnessing a trend towards smaller, agile companies being acquired by larger corporations to leverage their distribution networks and product portfolios. Barriers to entry include established brand loyalty, high initial investment costs for manufacturing and distribution, and navigating complex import/export regulations across different countries.

- Market Concentration: Moderate, with a blend of multinational corporations and local players.

- Technological Innovation Drivers: Focus on natural ingredients, functional benefits (e.g., protein, fiber), and personalized nutrition.

- Regulatory Frameworks: Evolving standards for food safety, labeling, and health claims are critical for market entry.

- Competitive Product Substitutes: Confectionery, traditional snacks, and other functional food and beverage options.

- End-User Demographics: Growing middle class, fitness enthusiasts, urban professionals, and health-conscious consumers.

- M&A Trends: Anticipated increase in strategic acquisitions to expand market reach and acquire innovative product lines.

- Market Share Insights (Illustrative): Leading players hold approximately 30-40% of the market share.

- M&A Deal Volumes (Illustrative): Expected to see 5-8 significant deals in the forecast period.

Middle-East and Africa Energy Bar Market Growth Trends & Insights

The Middle-East and Africa energy bar market is on an upward trajectory, projected to witness robust growth throughout the forecast period. The market size is expected to expand significantly, driven by increasing consumer awareness regarding health and wellness, coupled with the demand for convenient, portable nutrition solutions. Adoption rates for energy bars are accelerating, particularly in urban centers where fast-paced lifestyles necessitate quick and nutritious snack options. Technological disruptions are playing a pivotal role, with advancements in food processing and ingredient sourcing enabling the development of healthier, more appealing energy bars. Consumers are increasingly seeking products with natural ingredients, lower sugar content, and functional benefits such as added protein, vitamins, and prebiotics. This shift in consumer behavior, from prioritizing taste and price to valuing health and nutritional content, is a major catalyst for market expansion.

The CAGR for the MEA energy bar market is estimated to be approximately XX% from 2019 to 2033, indicating a strong and sustained growth phase. Market penetration is currently in its growth stage, with considerable room for expansion, especially in less developed economies within the region. The rise of e-commerce platforms has also significantly contributed to market growth by enhancing accessibility and offering a wider variety of products to consumers. Online retail stores are becoming increasingly popular channels for purchasing energy bars, catering to the convenience-seeking demographic. Furthermore, the increasing prevalence of sports and fitness activities across the MEA region is directly fueling the demand for specialized energy bars designed to enhance athletic performance and aid in recovery. This trend is supported by growing disposable incomes and a greater focus on active lifestyles.

The report also highlights the impact of evolving dietary trends, such as the increasing popularity of plant-based diets, which is spurring the development of vegan and plant-based energy bar options. Innovations in packaging, such as resealable and single-serving formats, are further enhancing product appeal and convenience. The growing awareness of the benefits of sustained energy release for improved productivity and well-being is also a key factor driving demand. As consumers become more informed about nutritional science, the demand for energy bars with transparent ingredient lists and scientifically backed benefits will continue to rise. This evolving consumer landscape presents a fertile ground for both established brands and new entrants to innovate and capture market share. The increasing influence of social media and health influencers is also contributing to greater product awareness and adoption rates.

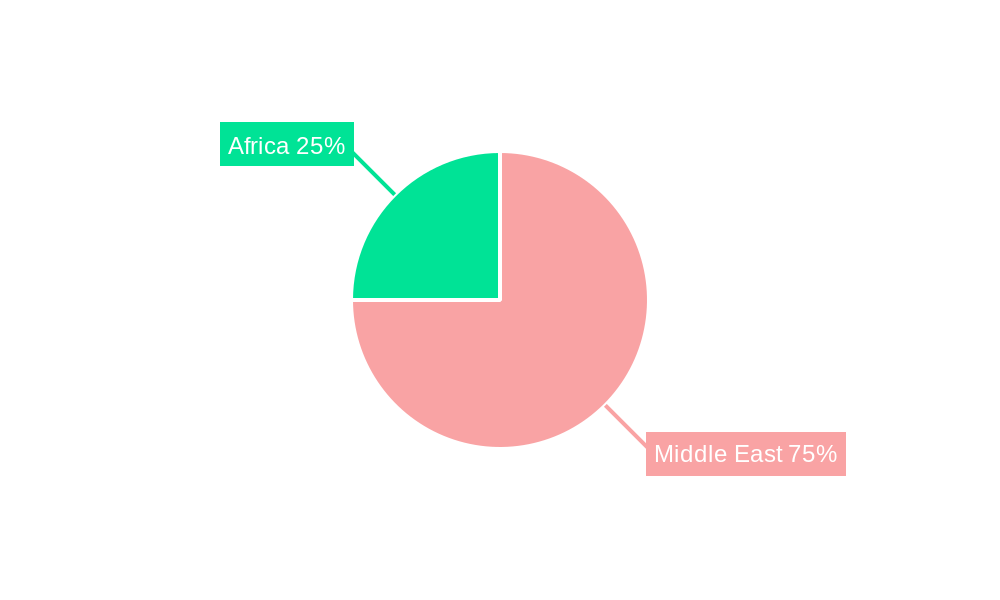

Dominant Regions, Countries, or Segments in Middle-East and Africa Energy Bar Market

The Supermarkets/Hypermarkets distribution channel is currently dominating the Middle-East and Africa energy bar market, driven by their extensive reach, product variety, and consumer trust. These retail giants offer a consolidated shopping experience, allowing consumers to access a wide array of energy bar brands and varieties under one roof. The strategic placement of energy bars in high-traffic areas within these stores, often near checkouts or in health food sections, further boosts visibility and impulse purchases. Economic policies that support large-scale retail development and incentivize foreign investment in the supermarket sector have been instrumental in the growth of this channel across key MEA countries.

- Dominance Factors for Supermarkets/Hypermarkets:

- Extensive Reach and Accessibility: Present in major urban and semi-urban areas across the region.

- Product Variety and Brand Availability: Offers consumers a broad selection of local and international brands.

- Consumer Trust and Familiarity: Established shopping destinations for a significant portion of the population.

- Promotional Activities and Shelf Space: Strategic placement and promotional campaigns drive sales.

- Economies of Scale: Ability to offer competitive pricing due to bulk purchasing.

While Supermarkets/Hypermarkets lead, Online Retail Stores are rapidly emerging as a significant growth driver. The proliferation of smartphones, improving internet penetration, and the increasing comfort of consumers with e-commerce transactions are propelling online sales. This channel offers unparalleled convenience, a wider selection, and often competitive pricing, attracting a younger, tech-savvy demographic. Countries like the UAE, Saudi Arabia, and Egypt are witnessing substantial growth in online grocery and health food sales, with energy bars being a popular category. The ability for online retailers to offer personalized recommendations and subscription services further enhances their appeal.

- Emerging Growth Drivers for Online Retail Stores:

- Convenience and 24/7 Accessibility: Consumers can shop anytime, anywhere.

- Wider Product Selection: Access to niche brands and international products not readily available in physical stores.

- Competitive Pricing and Discounts: Online platforms often offer attractive deals.

- Personalized Shopping Experiences: AI-driven recommendations and customized offers.

- Efficient Delivery Networks: Improving logistics and last-mile delivery services across urban areas.

Convenience Stores also play a crucial role, catering to impulse purchases and on-the-go consumption needs, particularly in busy urban environments and transportation hubs. Pharmacies & Drug Stores are gaining traction as consumers increasingly associate energy bars with health and wellness products, seeking options with specific nutritional benefits or catering to dietary needs. However, the infrastructure development and consumer habits in many parts of Africa are still heavily reliant on traditional retail and informal markets, which are encompassed under 'Other Distribution Channels' and represent a significant, albeit fragmented, market. The future growth will likely see a more balanced contribution from all channels as the MEA market matures and consumer preferences diversify.

Middle-East and Africa Energy Bar Market Product Landscape

The product landscape of the Middle-East and Africa energy bar market is characterized by increasing innovation aimed at meeting diverse consumer needs. Manufacturers are focusing on developing bars with natural sweeteners, organic ingredients, and functional additives like probiotics and adaptogens. Unique selling propositions include gluten-free, vegan, keto-friendly, and high-protein formulations catering to specific dietary trends and health goals. Technological advancements in extrusion and baking processes are enabling the creation of bars with improved texture and shelf life. The market is witnessing a rise in bars formulated for specific occasions, such as pre-workout, post-workout recovery, and general daily energy boosts, emphasizing performance and well-being.

Key Drivers, Barriers & Challenges in Middle-East and Africa Energy Bar Market

Key Drivers:

- Rising Health and Wellness Consciousness: Growing awareness of healthy eating habits and the need for nutritious on-the-go options.

- Increasing Disposable Incomes: Enhanced purchasing power in key MEA economies.

- Growth of Fitness and Sports Activities: Demand for performance-enhancing and recovery nutrition.

- Urbanization and Fast-Paced Lifestyles: Need for convenient and portable food solutions.

- Product Innovation and Diversification: Introduction of specialized and functional energy bars.

Barriers & Challenges:

- Price Sensitivity and Affordability: In some lower-income segments, energy bars can be perceived as a premium product.

- Complex Distribution Networks: Reaching diverse and sometimes remote regions can be challenging.

- Regulatory Variations: Navigating different food safety and labeling regulations across MEA countries.

- Intense Competition from Local Snacks: Established traditional snacks hold significant consumer loyalty.

- Supply Chain Volatility: Dependence on imported ingredients in some cases can lead to cost fluctuations.

- Consumer Education: Need to further educate consumers on the benefits and specific uses of energy bars.

Emerging Opportunities in Middle-East and Africa Energy Bar Market

Emerging opportunities lie in catering to the growing demand for plant-based and vegan energy bars, aligning with global dietary trends. Untapped markets within Africa present significant potential as economies develop and consumer awareness grows. Innovative applications, such as energy bars designed for specific professional groups (e.g., for pilots or truck drivers requiring sustained focus) or for children's active lifestyles, offer niche growth avenues. Evolving consumer preferences for ethically sourced and sustainable ingredients also present an opportunity for brands to differentiate themselves. The development of functional energy bars targeting specific health concerns, such as digestive health or immune support, will also drive market expansion.

Growth Accelerators in the Middle-East and Africa Energy Bar Market Industry

Long-term growth in the MEA energy bar market will be accelerated by strategic partnerships between local distributors and international manufacturers, facilitating wider market penetration. Technological breakthroughs in ingredient innovation, such as the development of novel protein sources or natural energy boosters, will drive product differentiation. Market expansion strategies focused on underserved regions within Africa and the Levant will unlock new consumer bases. The increasing adoption of direct-to-consumer (DTC) sales models, especially online, will allow brands to build stronger customer relationships and gather valuable market insights. Furthermore, government initiatives promoting healthy lifestyles and domestic food production can create a more favorable operating environment.

Key Players Shaping the Middle-East and Africa Energy Bar Market Market

- Post Holdings

- General Mills Inc

- Post Holdings

- Optimum Nutrition Inc

- Kind LLC

- MAX SPORT S R O

Notable Milestones in Middle-East and Africa Energy Bar Market Sector

- 2020 (Q2): Launch of a new line of high-protein, plant-based energy bars by a regional player targeting the fitness segment.

- 2021 (Q1): Major international brand expands its distribution network into several key African countries, significantly increasing product availability.

- 2022 (Q4): Significant M&A activity as a larger food conglomerate acquires a niche energy bar producer to leverage its innovative product portfolio.

- 2023 (Q3): Introduction of innovative, low-sugar energy bars with natural sweeteners by a leading manufacturer in response to growing health concerns.

- 2024 (Q1): Increased investment in online retail and direct-to-consumer (DTC) channels by several brands to enhance market reach and customer engagement.

In-Depth Middle-East and Africa Energy Bar Market Market Outlook

The MEA energy bar market is set for substantial future growth, propelled by escalating health consciousness and the demand for convenient nutrition. Future market potential is immense, particularly in emerging economies within Africa where penetration is still low. Strategic opportunities lie in leveraging e-commerce for wider reach, developing specialized products for diverse dietary needs, and focusing on sustainable and ethically sourced ingredients. The anticipated increase in M&A activity will consolidate the market and foster greater innovation. The report forecasts continued robust growth, driven by evolving consumer preferences and supportive economic development across the region, making it a compelling market for investment and strategic development.

Middle-East and Africa Energy Bar Market Segmentation

-

1. Distribution Channel

- 1.1. Supermarkets/Hypermarkets

- 1.2. Convenience Stores

- 1.3. Pharmacies & Drug Stores

- 1.4. Online Retail Stores

- 1.5. Other Distribution Channels

Middle-East and Africa Energy Bar Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle-East and Africa Energy Bar Market Regional Market Share

Geographic Coverage of Middle-East and Africa Energy Bar Market

Middle-East and Africa Energy Bar Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. EVOLVING FITNESS TRENDS AND INCREASING DEMAND FOR INDULGENT ENERGY BARS

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Energy Bar Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Supermarkets/Hypermarkets

- 5.1.2. Convenience Stores

- 5.1.3. Pharmacies & Drug Stores

- 5.1.4. Online Retail Stores

- 5.1.5. Other Distribution Channels

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Post Holdings*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 General Mills Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Post Holdings

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Optimum Nutrition Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kind LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MAX SPORT S R O

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Post Holdings*List Not Exhaustive

List of Figures

- Figure 1: Middle-East and Africa Energy Bar Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Energy Bar Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Energy Bar Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 2: Middle-East and Africa Energy Bar Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Middle-East and Africa Energy Bar Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Middle-East and Africa Energy Bar Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Saudi Arabia Middle-East and Africa Energy Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: United Arab Emirates Middle-East and Africa Energy Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Israel Middle-East and Africa Energy Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Qatar Middle-East and Africa Energy Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Kuwait Middle-East and Africa Energy Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Oman Middle-East and Africa Energy Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Bahrain Middle-East and Africa Energy Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Jordan Middle-East and Africa Energy Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Lebanon Middle-East and Africa Energy Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Energy Bar Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Middle-East and Africa Energy Bar Market?

Key companies in the market include Post Holdings*List Not Exhaustive, General Mills Inc, Post Holdings, Optimum Nutrition Inc, Kind LLC, MAX SPORT S R O.

3. What are the main segments of the Middle-East and Africa Energy Bar Market?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

EVOLVING FITNESS TRENDS AND INCREASING DEMAND FOR INDULGENT ENERGY BARS.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Energy Bar Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Energy Bar Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Energy Bar Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Energy Bar Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence