Key Insights

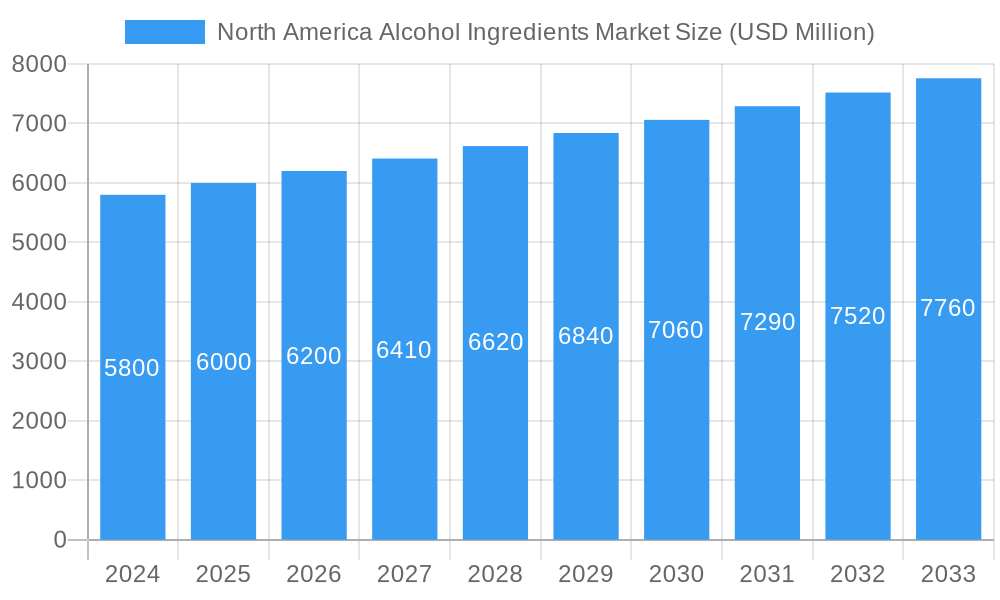

The North American alcohol ingredients market is poised for robust growth, driven by evolving consumer preferences for premium and diverse alcoholic beverages, alongside an increasing demand for natural and functional ingredients. The market, valued at approximately USD 5.8 billion in 2024, is projected to expand at a Compound Annual Growth Rate (CAGR) of 3.5% from 2025 to 2033. Key growth drivers include the rising popularity of craft beers and artisanal spirits, which necessitate specialized yeasts and unique flavorings. Furthermore, a growing consumer awareness regarding health and wellness is boosting the demand for naturally derived colorants and flavors, moving away from artificial additives. This shift is also influencing the wine sector, where consumers are increasingly seeking wines with specific flavor profiles achieved through carefully selected enzymes and fermentation aids.

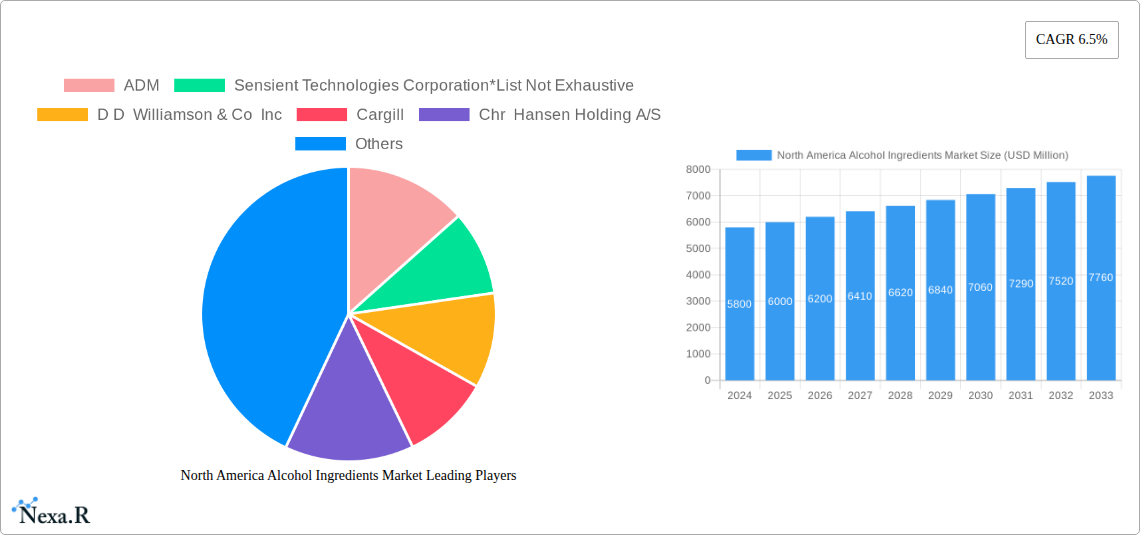

North America Alcohol Ingredients Market Market Size (In Billion)

The market's expansion is further propelled by innovation in beverage production and a dynamic landscape of ingredient suppliers. Companies like ADM, DSM, and Kerry Group are actively investing in research and development to offer novel solutions that cater to these changing demands. While the market shows strong upward momentum, certain restraints, such as fluctuating raw material prices and stringent regulatory landscapes for food and beverage additives in some regions, may pose challenges. However, the overarching trend of premiumization and the continuous quest for novel taste experiences in alcoholic beverages, coupled with an emphasis on sustainability and natural sourcing, are expected to outweigh these limitations, ensuring a healthy growth trajectory for the North American alcohol ingredients market over the forecast period.

North America Alcohol Ingredients Market Company Market Share

Gain a strategic advantage in the dynamic North American alcohol ingredients market with this in-depth report. Covering critical segments like Yeast, Enzymes, Colorants, Flavors & Salts, and their application across Beer, Spirits, and Wine, this analysis provides actionable insights for industry professionals. Our comprehensive study spans from 2019 to 2033, with a base year of 2025, offering a robust historical perspective and precise forecasts. We delve into the market's intricate dynamics, growth trajectories, regional dominance, product innovation, key drivers, emerging opportunities, and the influential players shaping its future. Navigate the evolving landscape of alcohol ingredients, beverage additives, brewing ingredients, distillery ingredients, and winemaking ingredients with data-driven intelligence.

North America Alcohol Ingredients Market Market Dynamics & Structure

The North America alcohol ingredients market, valued at approximately $6.5 billion in 2025, exhibits a moderate to high level of concentration, with a few key players dominating significant market shares. Technological innovation remains a primary driver, with advancements in fermentation processes, natural extraction techniques for flavors and colors, and enzyme development continually reshaping ingredient performance and application. Regulatory frameworks, particularly those pertaining to food safety, labeling, and the use of natural vs. synthetic ingredients, play a crucial role in shaping market entry and product development. Competitive product substitutes are prevalent, especially in the colorants and flavors segments, where natural alternatives are increasingly sought after. End-user demographics are shifting, with a growing demand for premium, craft, and low-alcohol beverages influencing ingredient choices. Mergers and acquisitions (M&A) are a notable trend, with companies consolidating to enhance their product portfolios, expand geographical reach, and gain a competitive edge. For instance, the M&A volume has seen an upward trend, with an estimated 3-5 significant deals annually in the past three years, averaging deal values in the $50-$150 million range. Barriers to innovation include the lengthy R&D cycles for novel ingredients and the stringent testing required for regulatory approval.

- Market Concentration: Dominated by a mix of large multinational corporations and specialized ingredient providers.

- Technological Innovation: Focus on natural sourcing, sustainable production, enhanced shelf-life, and improved sensory profiles.

- Regulatory Frameworks: Strict adherence to FDA, Health Canada, and other regional food safety and labeling regulations.

- Competitive Substitutes: Rise of natural colors and flavors replacing synthetic alternatives; impact of functional ingredients in beverage formulation.

- End-User Demographics: Growing preference for craft beers, artisanal spirits, and premium wines influencing ingredient demand.

- M&A Trends: Strategic acquisitions to broaden portfolios, gain market access, and secure intellectual property.

North America Alcohol Ingredients Market Growth Trends & Insights

The North America alcohol ingredients market is poised for sustained growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.8% between 2025 and 2033, reaching an estimated market size of $10.2 billion by 2033. This growth is underpinned by evolving consumer preferences and technological advancements that are revolutionizing the way alcoholic beverages are produced and consumed. The increasing demand for craft beverages, characterized by unique flavor profiles and artisanal production methods, is a significant catalyst. Consumers are actively seeking beverages with natural ingredients, leading to a surge in the adoption of natural colorants and flavors. This shift from synthetic to natural alternatives is a key disruption, encouraging ingredient manufacturers to invest heavily in research and development for plant-based and naturally derived options. Enzyme technology is also playing an increasingly vital role, enabling more efficient fermentation, improved yield, and the creation of distinct sensory characteristics in beer, spirits, and wine. The market penetration of specialized ingredients, such as those contributing to mouthfeel, aroma enhancement, and clarity, is steadily increasing as beverage producers aim to differentiate their offerings.

Furthermore, consumer behavior shifts towards healthier consumption patterns, including a growing interest in low-alcohol and no-alcohol options, are indirectly impacting the alcohol ingredients market by driving innovation in flavor masking and sensory enhancement for these emerging beverage categories. The proliferation of online sales channels and direct-to-consumer models has also created new avenues for niche ingredient suppliers to reach a broader audience. The overall market size evolution reflects a robust demand driven by both established beverage categories and emerging trends. Adoption rates for novel ingredients are accelerating, facilitated by clearer regulatory pathways and growing confidence in their performance and safety. Technological disruptions, such as advancements in precision fermentation and the use of AI in flavor development, are expected to further propel market growth by offering more tailored and efficient ingredient solutions. The dynamic interplay of these factors paints a picture of a vibrant and expanding market, ripe with opportunities for innovation and strategic investment.

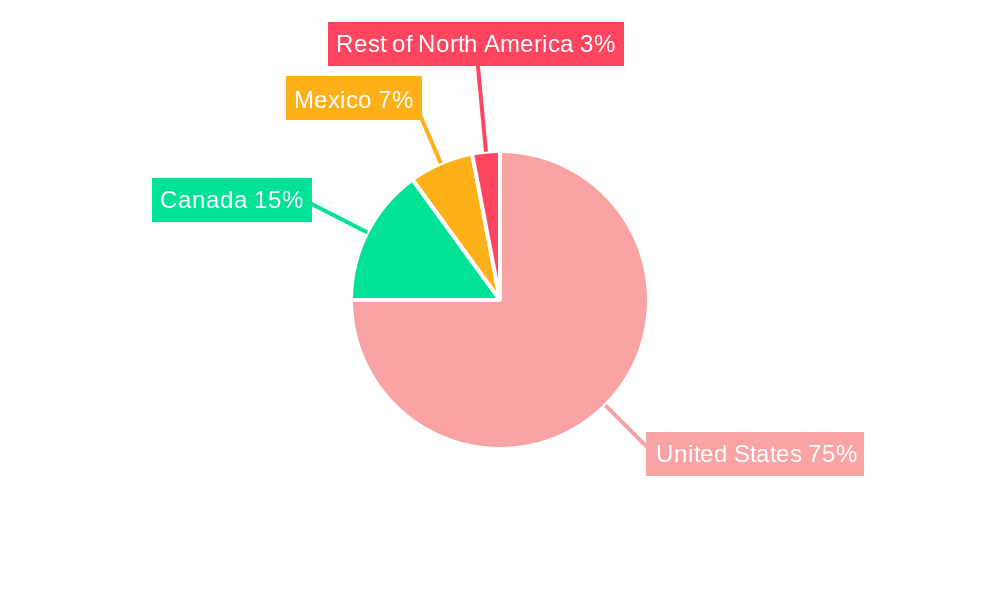

Dominant Regions, Countries, or Segments in North America Alcohol Ingredients Market

The United States stands as the dominant force within the North America alcohol ingredients market, representing an estimated 65% of the total market value in 2025, projected to reach $4.2 billion. This dominance is attributed to its vast consumer base, the maturity and scale of its beverage industry, and significant investment in research and development. The country's robust brewing and distilling sectors, coupled with a sophisticated winemaking industry, create a substantial and consistent demand for a wide array of alcohol ingredients. Furthermore, the strong consumer preference for premium and craft alcoholic beverages in the U.S. fuels demand for high-quality, specialized ingredients that enhance flavor, aroma, and visual appeal. Economic policies that support innovation and the ease of doing business further bolster the U.S.'s leading position.

Among the ingredient types, Flavors & Salts emerged as the largest segment, accounting for an estimated 35% of the market in 2025, valued at approximately $2.3 billion. This segment's growth is driven by the continuous innovation in creating novel taste experiences for spirits, the expanding market for flavored beers and wines, and the demand for natural flavor enhancers. The Beer segment, representing around 45% of the beverage type market share in 2025, valued at $2.9 billion, is another significant driver, propelled by the enduring popularity of craft brewing and the ongoing introduction of new beer styles that require diverse yeast strains, enzymes, and flavorings.

Canada and Mexico, while smaller, represent significant growth markets. Canada, with its mature beer and spirits market and increasing interest in wine, is projected to grow at a CAGR of 5.5%, reaching an estimated $1.3 billion by 2033. Mexico's burgeoning spirits industry, particularly tequila and mezcal, alongside its growing beer production, positions it as a key market with a projected CAGR of 6.2%, estimated to reach $0.9 billion by 2033. The "Rest of North America" category, encompassing smaller economies and niche markets, offers unique opportunities for specialized ingredients.

- Dominant Country: United States due to its large market size and strong beverage industry.

- Leading Ingredient Type: Flavors & Salts, driven by innovation and consumer demand for unique taste profiles.

- Leading Beverage Type: Beer, fueled by the persistent popularity of craft brewing.

- Key Growth Markets: Canada and Mexico, exhibiting substantial growth potential in their respective beverage sectors.

- Growth Drivers: Consumer preference for craft and premium beverages, demand for natural ingredients, and technological advancements in ingredient production.

North America Alcohol Ingredients Market Product Landscape

The product landscape of the North America alcohol ingredients market is characterized by a dynamic evolution driven by innovation and consumer demand. Manufacturers are increasingly focusing on natural and sustainably sourced ingredients. In the Yeast segment, advancements in strain development for specific fermentation characteristics, such as enhanced aroma profiles and higher alcohol yields, are prevalent. The Enzymes sector is witnessing innovation in developing enzymes for more efficient starch conversion, protein stabilization, and flavor modification in brewing and distilling. For Colorants, there's a strong trend towards natural extracts from fruits, vegetables, and botanicals, offering vibrant hues without synthetic additives. The Flavors & Salts segment is a hotbed of innovation, with an explosion of natural flavorings derived from botanicals, fruits, and spices, catering to the demand for unique and complex taste experiences in spirits, flavored beers, and wines. Performance metrics are increasingly emphasizing sensory attributes, stability, and the "clean label" appeal of ingredients.

Key Drivers, Barriers & Challenges in North America Alcohol Ingredients Market

The North America alcohol ingredients market is propelled by several key drivers, including the escalating consumer demand for craft and premium beverages, which necessitates specialized and high-quality ingredients. The ongoing trend towards natural and clean-label products is a significant force, pushing manufacturers to develop plant-based and naturally derived ingredients. Technological advancements in fermentation and extraction techniques are enabling the creation of novel flavors and functional properties.

However, the market also faces significant barriers and challenges. Stringent regulatory compliance, particularly concerning novel ingredients and labeling, can slow down product launches and increase development costs. Supply chain volatility, influenced by factors like agricultural yields and geopolitical events, can impact the availability and cost of raw materials. Intense competition, especially in established segments like flavors and colors, requires continuous innovation and cost-efficiency.

Key Drivers:

- Rising demand for craft and premium alcoholic beverages.

- Growing consumer preference for natural and clean-label ingredients.

- Technological advancements in ingredient production and application.

- Expansion of the spirits and wine markets.

Barriers & Challenges:

- Complex and evolving regulatory landscape.

- Supply chain disruptions and raw material price fluctuations.

- Intense competition and pricing pressures.

- High R&D costs for developing novel ingredients.

Emerging Opportunities in North America Alcohol Ingredients Market

Emerging opportunities in the North America alcohol ingredients market lie in the growing demand for low-alcohol and no-alcohol (NA) beverage alternatives, which requires innovative flavor masking and sensory enhancement ingredients. The increasing interest in functional beverages, incorporating ingredients that offer health benefits, presents another avenue for growth. Sustainable sourcing and production of ingredients, aligning with environmental consciousness, are becoming a significant differentiator. Untapped markets within specific niche beverage categories, such as hard seltzers and ready-to-drink (RTD) cocktails, continue to offer substantial potential for specialized ingredient suppliers.

Growth Accelerators in the North America Alcohol Ingredients Market Industry

Several catalysts are accelerating long-term growth in the North America alcohol ingredients market. Technological breakthroughs in precision fermentation and biotechnological production of flavors and enzymes offer more efficient and sustainable ingredient creation. Strategic partnerships between ingredient suppliers and beverage manufacturers are crucial for co-developing innovative products that meet evolving consumer demands. Market expansion strategies, including penetrating emerging demographic segments and geographical regions, are also key growth accelerators. The continued focus on product differentiation through unique flavor profiles and functional benefits will further fuel market expansion.

Key Players Shaping the North America Alcohol Ingredients Market Market

- ADM

- Sensient Technologies Corporation

- D D Williamson & Co Inc

- Cargill

- Chr Hansen Holding A/S

- DSM

- Kerry Group

- Dohler Group SE

- Tate & Lyle

- Symrise

Notable Milestones in North America Alcohol Ingredients Market Sector

- 2022/Q3: Chr Hansen Holding A/S launches a new range of natural colors derived from sustainable sources, enhancing its portfolio for craft beverage producers.

- 2023/Q1: ADM expands its enzyme production capacity to meet growing demand for brewing and distilling applications.

- 2023/Q4: Sensient Technologies Corporation announces a strategic acquisition to bolster its natural flavor ingredients for the spirits market.

- 2024/Q2: Kerry Group introduces innovative yeast strains that offer improved fermentation efficiency and distinct aroma profiles for craft beer.

- 2024/Q3: DSM invests in R&D for novel yeast derivatives aimed at enhancing mouthfeel and body in low-alcohol beverages.

In-Depth North America Alcohol Ingredients Market Market Outlook

The outlook for the North America alcohol ingredients market remains exceptionally strong, driven by enduring consumer trends and continuous innovation. Growth accelerators such as advancements in biotechnology for producing novel flavors and enzymes, coupled with a persistent demand for natural and sustainable ingredients, will shape the market's trajectory. Strategic partnerships between ingredient manufacturers and beverage producers will be pivotal in introducing innovative products tailored to evolving palates and market niches. The expansion into low- and no-alcohol segments and the growing popularity of RTD beverages present significant strategic opportunities for ingredient suppliers to capture new market share. The market is set for sustained expansion, offering lucrative prospects for companies that can adapt to consumer preferences and leverage technological advancements.

North America Alcohol Ingredients Market Segmentation

-

1. Ingredient Type

- 1.1. Yeast

- 1.2. Enzymes

- 1.3. Colorants

- 1.4. Flavors & Salts

-

2. Beverage Type

- 2.1. Beer

- 2.2. Spirits

- 2.3. Wine

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Alcohol Ingredients Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Alcohol Ingredients Market Regional Market Share

Geographic Coverage of North America Alcohol Ingredients Market

North America Alcohol Ingredients Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidence of Obesity and Cadiovascular Diseases; Growing Trend of Veganism Drives the Market

- 3.3. Market Restrains

- 3.3.1. Associated Allergies With Plant Proteins

- 3.4. Market Trends

- 3.4.1. Growing Preference for Craft Spirits in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Alcohol Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 5.1.1. Yeast

- 5.1.2. Enzymes

- 5.1.3. Colorants

- 5.1.4. Flavors & Salts

- 5.2. Market Analysis, Insights and Forecast - by Beverage Type

- 5.2.1. Beer

- 5.2.2. Spirits

- 5.2.3. Wine

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6. United States North America Alcohol Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6.1.1. Yeast

- 6.1.2. Enzymes

- 6.1.3. Colorants

- 6.1.4. Flavors & Salts

- 6.2. Market Analysis, Insights and Forecast - by Beverage Type

- 6.2.1. Beer

- 6.2.2. Spirits

- 6.2.3. Wine

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7. Canada North America Alcohol Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7.1.1. Yeast

- 7.1.2. Enzymes

- 7.1.3. Colorants

- 7.1.4. Flavors & Salts

- 7.2. Market Analysis, Insights and Forecast - by Beverage Type

- 7.2.1. Beer

- 7.2.2. Spirits

- 7.2.3. Wine

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8. Mexico North America Alcohol Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8.1.1. Yeast

- 8.1.2. Enzymes

- 8.1.3. Colorants

- 8.1.4. Flavors & Salts

- 8.2. Market Analysis, Insights and Forecast - by Beverage Type

- 8.2.1. Beer

- 8.2.2. Spirits

- 8.2.3. Wine

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9. Rest of North America North America Alcohol Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9.1.1. Yeast

- 9.1.2. Enzymes

- 9.1.3. Colorants

- 9.1.4. Flavors & Salts

- 9.2. Market Analysis, Insights and Forecast - by Beverage Type

- 9.2.1. Beer

- 9.2.2. Spirits

- 9.2.3. Wine

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ADM

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sensient Technologies Corporation*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 D D Williamson & Co Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Cargill

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Chr Hansen Holding A/S

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 DSM

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kerry Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Dohler Group SE

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Tate & Lyle

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Symrise

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 ADM

List of Figures

- Figure 1: North America Alcohol Ingredients Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Alcohol Ingredients Market Share (%) by Company 2025

List of Tables

- Table 1: North America Alcohol Ingredients Market Revenue undefined Forecast, by Ingredient Type 2020 & 2033

- Table 2: North America Alcohol Ingredients Market Volume K Tons Forecast, by Ingredient Type 2020 & 2033

- Table 3: North America Alcohol Ingredients Market Revenue undefined Forecast, by Beverage Type 2020 & 2033

- Table 4: North America Alcohol Ingredients Market Volume K Tons Forecast, by Beverage Type 2020 & 2033

- Table 5: North America Alcohol Ingredients Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: North America Alcohol Ingredients Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: North America Alcohol Ingredients Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: North America Alcohol Ingredients Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: North America Alcohol Ingredients Market Revenue undefined Forecast, by Ingredient Type 2020 & 2033

- Table 10: North America Alcohol Ingredients Market Volume K Tons Forecast, by Ingredient Type 2020 & 2033

- Table 11: North America Alcohol Ingredients Market Revenue undefined Forecast, by Beverage Type 2020 & 2033

- Table 12: North America Alcohol Ingredients Market Volume K Tons Forecast, by Beverage Type 2020 & 2033

- Table 13: North America Alcohol Ingredients Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: North America Alcohol Ingredients Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: North America Alcohol Ingredients Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: North America Alcohol Ingredients Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: North America Alcohol Ingredients Market Revenue undefined Forecast, by Ingredient Type 2020 & 2033

- Table 18: North America Alcohol Ingredients Market Volume K Tons Forecast, by Ingredient Type 2020 & 2033

- Table 19: North America Alcohol Ingredients Market Revenue undefined Forecast, by Beverage Type 2020 & 2033

- Table 20: North America Alcohol Ingredients Market Volume K Tons Forecast, by Beverage Type 2020 & 2033

- Table 21: North America Alcohol Ingredients Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: North America Alcohol Ingredients Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: North America Alcohol Ingredients Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: North America Alcohol Ingredients Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: North America Alcohol Ingredients Market Revenue undefined Forecast, by Ingredient Type 2020 & 2033

- Table 26: North America Alcohol Ingredients Market Volume K Tons Forecast, by Ingredient Type 2020 & 2033

- Table 27: North America Alcohol Ingredients Market Revenue undefined Forecast, by Beverage Type 2020 & 2033

- Table 28: North America Alcohol Ingredients Market Volume K Tons Forecast, by Beverage Type 2020 & 2033

- Table 29: North America Alcohol Ingredients Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: North America Alcohol Ingredients Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: North America Alcohol Ingredients Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: North America Alcohol Ingredients Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: North America Alcohol Ingredients Market Revenue undefined Forecast, by Ingredient Type 2020 & 2033

- Table 34: North America Alcohol Ingredients Market Volume K Tons Forecast, by Ingredient Type 2020 & 2033

- Table 35: North America Alcohol Ingredients Market Revenue undefined Forecast, by Beverage Type 2020 & 2033

- Table 36: North America Alcohol Ingredients Market Volume K Tons Forecast, by Beverage Type 2020 & 2033

- Table 37: North America Alcohol Ingredients Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: North America Alcohol Ingredients Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 39: North America Alcohol Ingredients Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: North America Alcohol Ingredients Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Alcohol Ingredients Market?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the North America Alcohol Ingredients Market?

Key companies in the market include ADM, Sensient Technologies Corporation*List Not Exhaustive, D D Williamson & Co Inc, Cargill, Chr Hansen Holding A/S, DSM, Kerry Group, Dohler Group SE, Tate & Lyle , Symrise.

3. What are the main segments of the North America Alcohol Ingredients Market?

The market segments include Ingredient Type, Beverage Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidence of Obesity and Cadiovascular Diseases; Growing Trend of Veganism Drives the Market.

6. What are the notable trends driving market growth?

Growing Preference for Craft Spirits in the Region.

7. Are there any restraints impacting market growth?

Associated Allergies With Plant Proteins.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Alcohol Ingredients Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Alcohol Ingredients Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Alcohol Ingredients Market?

To stay informed about further developments, trends, and reports in the North America Alcohol Ingredients Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence