Key Insights

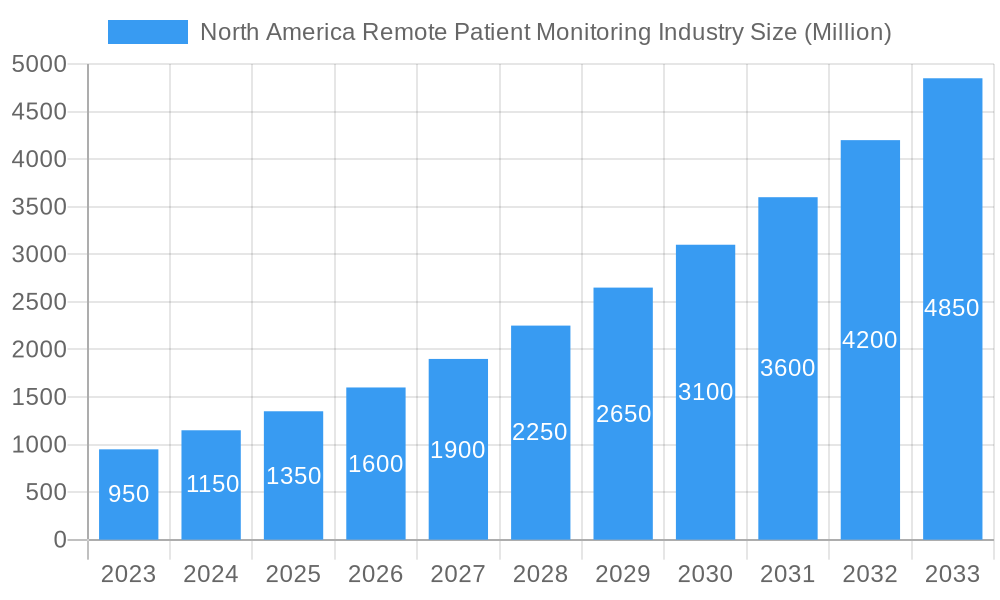

The North American Remote Patient Monitoring (RPM) market is poised for substantial expansion, projected to reach a market size of $1.50 billion. This robust growth is fueled by a remarkable Compound Annual Growth Rate (CAGR) of 18.83% from 2025 to 2033, indicating a dynamic and rapidly evolving sector. Several key drivers are propelling this surge, including the increasing prevalence of chronic diseases such as cardiovascular ailments and diabetes, which necessitate continuous health oversight. Furthermore, the growing adoption of home healthcare solutions and the rising demand for personalized and convenient healthcare services are significant contributors. The technological advancements in devices like advanced heart monitors, sophisticated breath monitors, and versatile multi-parameter monitors are enhancing diagnostic accuracy and patient comfort, thereby driving market penetration. The shift towards value-based care models also emphasizes the importance of RPM in improving patient outcomes and reducing healthcare costs, further bolstering market growth.

North America Remote Patient Monitoring Industry Market Size (In Million)

The North American RPM market segmentation reveals diverse opportunities across various device types, applications, and end-user settings. Heart monitors and multi-parameter monitors are anticipated to capture significant market share due to their broad applicability in managing chronic conditions. In terms of applications, cardiovascular diseases and diabetes treatment are expected to be leading segments, reflecting the high incidence rates of these conditions in the region. The increasing preference for home care settings, driven by patient convenience and the desire to reduce hospital readmissions, presents a substantial growth avenue for RPM solutions. While the market is experiencing strong tailwinds, potential restraints such as data security concerns, stringent regulatory frameworks, and the initial cost of device implementation could pose challenges. However, ongoing innovation in secure data transmission and interoperability, coupled with increasing government initiatives to promote telehealth, is expected to mitigate these restraints and sustain the upward trajectory of the North American RPM market.

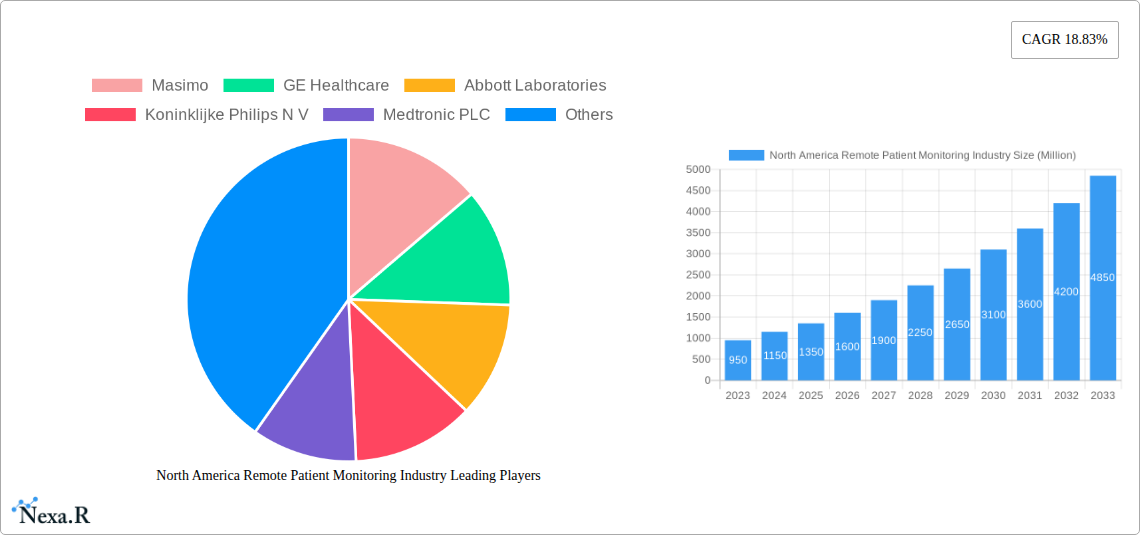

North America Remote Patient Monitoring Industry Company Market Share

Here's the SEO-optimized report description for the North America Remote Patient Monitoring Industry:

North America Remote Patient Monitoring Industry Market Dynamics & Structure

The North America Remote Patient Monitoring (RPM) industry is characterized by a dynamic market structure driven by escalating demand for continuous health oversight and proactive disease management. Market concentration is moderately fragmented, with key players like Masimo, GE Healthcare, Abbott Laboratories, Koninklijke Philips N.V., Medtronic PLC, Smiths Medical Inc., Boston Scientific Corporation, Welch Allyn Inc., and Dragerwerk AG vying for market share. Technological innovation is a primary driver, fueled by advancements in wearable sensors, AI-driven analytics, and secure data transmission. Regulatory frameworks, particularly those from the FDA in the United States and Health Canada, are evolving to accommodate and encourage RPM adoption, influencing market access and product development. Competitive product substitutes exist, ranging from traditional in-person consultations to less sophisticated health tracking devices, but the precision and data richness of RPM solutions offer a distinct advantage. End-user demographics are shifting towards an aging population with chronic conditions and a growing interest in personalized health management, significantly impacting the demand for home care settings. Mergers and acquisitions (M&A) activity is on the rise as companies seek to expand their portfolios, gain technological expertise, and broaden their market reach, indicating a maturing and consolidating industry.

- Market Concentration: Moderately fragmented with significant contributions from both large corporations and specialized technology providers.

- Technological Innovation Drivers: AI/ML, IoT, advanced biosensors, cloud computing, cybersecurity.

- Regulatory Frameworks: FDA clearances, HIPAA compliance, reimbursement policies by Medicare and private insurers are crucial.

- Competitive Product Substitutes: Traditional telehealth, basic fitness trackers, in-person clinical visits.

- End-User Demographics: Increasing prevalence of chronic diseases (cardiovascular, diabetes), aging population, tech-savvy consumers seeking convenience.

- M&A Trends: Consolidation for technology acquisition, market expansion, and service integration.

North America Remote Patient Monitoring Industry Growth Trends & Insights

The North America Remote Patient Monitoring (RPM) industry is projected for robust growth, driven by a confluence of factors that are reshaping healthcare delivery and patient engagement. Market size evolution is a key indicator, with the sector experiencing a significant expansion due to the increasing adoption of RPM solutions across various healthcare settings. The shift towards value-based care models and the growing need to manage chronic diseases efficiently are primary adoption rate boosters. Technological disruptions, including the miniaturization of sensors, enhanced data analytics, and improved connectivity through 5G, are continuously enhancing the capabilities and accessibility of RPM devices. Consumer behavior shifts are also pivotal; patients are increasingly comfortable with remote health monitoring and seek the convenience and proactive management it offers.

The market penetration of RPM is steadily increasing, moving beyond early adopters to mainstream healthcare providers and patients. This growth is further propelled by the ongoing demand for solutions that can reduce hospital readmissions, improve patient outcomes, and lower overall healthcare costs. The COVID-19 pandemic acted as a significant catalyst, accelerating the acceptance and implementation of telehealth and remote monitoring services out of necessity, a trend that has largely persisted. The integration of RPM with electronic health records (EHRs) and other health IT infrastructure is becoming seamless, enhancing data interoperability and clinical decision-making. The evolving reimbursement landscape, with expanded coverage for RPM services, is also a critical growth enabler. For instance, the Centers for Medicare & Medicaid Services (CMS) has consistently updated its policies to support RPM, recognizing its value in improving care access and quality.

The expansion of remote patient monitoring encompasses a wide array of applications, from managing cardiovascular conditions to monitoring diabetes and sleep disorders. The development of sophisticated algorithms for data interpretation allows for early detection of critical health events, enabling timely intervention. This proactive approach is particularly beneficial for elderly patients and those with limited mobility, who may otherwise struggle to access regular medical care. The market is also witnessing a rise in direct-to-consumer RPM devices, catering to the growing wellness and fitness monitoring segment. As technology becomes more affordable and user-friendly, the adoption of RPM solutions is expected to reach new heights, solidifying its position as a cornerstone of modern healthcare.

Dominant Regions, Countries, or Segments in North America Remote Patient Monitoring Industry

Within the North America Remote Patient Monitoring (RPM) industry, the United States stands out as the dominant country, driving a significant portion of market growth due to its advanced healthcare infrastructure, substantial healthcare spending, and progressive regulatory environment that supports technological innovation and reimbursement for RPM services. The country's large, aging population, coupled with a high prevalence of chronic diseases such as cardiovascular diseases, diabetes, and respiratory illnesses, creates an immense demand for continuous health monitoring solutions. Furthermore, the robust presence of leading RPM technology developers and healthcare providers headquartered in the U.S. fosters a competitive landscape that propels innovation and market expansion.

Among the device types, Heart Monitors are a leading segment, reflecting the high burden of cardiovascular diseases in North America. These devices, including ECG monitors, blood pressure monitors, and pulse oximeters, are crucial for managing conditions like heart failure, arrhythmias, and hypertension. The ability of these monitors to provide real-time data allows clinicians to proactively intervene, preventing acute events and reducing hospitalizations. Multi-Parameter Monitors are also gaining significant traction as they offer comprehensive physiological data collection, providing a holistic view of a patient's health status.

In terms of applications, Cardiovascular Diseases management is a primary driver, directly correlating with the dominance of heart monitors. However, Diabetes Treatment is a rapidly growing application, with continuous glucose monitors (CGMs) and integrated insulin delivery systems becoming integral to diabetes care. The increasing incidence of Type 2 diabetes and the emphasis on effective glycemic control are fueling this segment's expansion.

The Home Care Settings end-user segment is experiencing the most substantial growth. This is a direct consequence of the desire for convenience, the increasing preference for aging in place, and the proven cost-effectiveness of RPM in reducing hospital visits. The ability to monitor patients comfortably in their own environment, coupled with caregiver involvement, makes home-based RPM a highly attractive option. The ongoing advancements in user-friendly devices and secure data platforms are further accelerating the adoption in this segment. Economic policies supporting telehealth and remote care, along with the development of robust broadband infrastructure, are critical supporting factors for the dominance of these segments and geographical regions.

North America Remote Patient Monitoring Industry Product Landscape

The North America Remote Patient Monitoring (RPM) industry is characterized by a diverse and rapidly evolving product landscape. Innovations are centered on developing more compact, wearable, and user-friendly devices that capture a wider range of physiological data with increased accuracy. Key product categories include advanced heart monitors (e.g., wearable ECGs, continuous blood pressure cuffs), sophisticated breath monitors (e.g., smart inhalers, respiratory rate sensors), and versatile multi-parameter monitors capable of tracking vital signs like temperature, oxygen saturation, and activity levels. Hematology monitors are also emerging for in-home diagnostic capabilities. The focus is on seamless integration with mobile applications and cloud-based platforms, enabling real-time data transmission, analysis, and alerts for healthcare providers. Unique selling propositions often revolve around extended battery life, non-invasive monitoring, and AI-powered insights that predict health deteriorations.

Key Drivers, Barriers & Challenges in North America Remote Patient Monitoring Industry

Key Drivers:

- Increasing Prevalence of Chronic Diseases: Growing incidence of conditions like cardiovascular diseases, diabetes, and respiratory ailments necessitates continuous monitoring.

- Technological Advancements: Miniaturization of sensors, AI-driven analytics, improved connectivity (5G), and cloud computing enhance RPM capabilities.

- Shift Towards Value-Based Healthcare: RPM aids in improving patient outcomes and reducing healthcare costs, aligning with value-based care models.

- Growing Demand for Home Healthcare: Aging population and preference for remote care drive adoption in home settings.

- Favorable Reimbursement Policies: Expanding coverage by government and private payers incentivizes RPM adoption.

Barriers & Challenges:

- Data Security and Privacy Concerns: Protecting sensitive patient data from cyber threats is paramount and requires robust cybersecurity measures.

- Interoperability Issues: Integrating RPM data seamlessly with existing EHR systems can be complex and costly.

- Regulatory Hurdles: Navigating evolving regulatory landscapes and ensuring compliance with standards can be time-consuming.

- User Adoption and Training: Ensuring patients and caregivers are comfortable and proficient in using RPM devices and platforms.

- Initial Implementation Costs: The upfront investment in devices, software, and infrastructure can be a barrier for some providers and patients.

- Connectivity Limitations: Reliable internet access is essential, posing a challenge in certain rural or underserved areas.

Emerging Opportunities in North America Remote Patient Monitoring Industry

Emerging opportunities in the North America Remote Patient Monitoring (RPM) industry lie in the untapped potential of specialized chronic disease management programs, particularly for conditions beyond cardiovascular and diabetes. The development of integrated RPM solutions for mental health monitoring and post-operative recovery presents significant growth avenues. Furthermore, the increasing focus on preventative health and wellness is creating a demand for consumer-grade RPM devices that offer sophisticated insights into fitness, sleep, and stress management. The expansion of RPM into remote clinical trials, enabling more diverse participant recruitment and real-time data collection, also represents a promising frontier. The integration of AI and machine learning for predictive analytics, offering early warnings for potential health crises, will further unlock new applications and enhance the value proposition of RPM.

Growth Accelerators in the North America Remote Patient Monitoring Industry Industry

Several catalysts are accelerating the long-term growth of the North America Remote Patient Monitoring (RPM) industry. Foremost among these are continuous technological breakthroughs in sensor accuracy, miniaturization, and power efficiency, making devices more unobtrusive and user-friendly. Strategic partnerships between healthcare providers, technology companies, and pharmaceutical firms are crucial for developing comprehensive RPM ecosystems that cater to specific disease management needs. Market expansion strategies, including the increasing penetration of RPM into underserved rural and remote areas, are broadening the reach of remote care. The development of robust reimbursement frameworks that adequately compensate providers for RPM services also acts as a significant growth accelerator, encouraging wider adoption and investment in the sector.

Key Players Shaping the North America Remote Patient Monitoring Industry Market

- Masimo

- GE Healthcare

- Abbott Laboratories

- Koninklijke Philips N V

- Medtronic PLC

- Smiths Medical Inc

- Boston Scientific Corporation

- Welch Allyn Inc

- Dragerwerk AG

Notable Milestones in North America Remote Patient Monitoring Industry Sector

- 2019: Increased FDA approvals for new RPM devices, signaling a growing acceptance of the technology.

- 2020: Significant surge in RPM adoption driven by the COVID-19 pandemic, accelerating digital health initiatives.

- 2021: Expansion of Medicare reimbursement codes for remote patient monitoring services, boosting provider adoption.

- 2022: Major acquisitions and partnerships focused on integrating AI and data analytics into RPM platforms.

- 2023: Introduction of more sophisticated wearable sensors enabling continuous, multi-parameter monitoring.

- 2024: Growing emphasis on cybersecurity for RPM systems to ensure patient data protection.

In-Depth North America Remote Patient Monitoring Industry Market Outlook

The North America Remote Patient Monitoring (RPM) industry is poised for sustained and accelerated growth, driven by foundational shifts in healthcare delivery and patient expectations. The confluence of an aging population, a high burden of chronic diseases, and continuous technological innovation forms a powerful growth engine. Future market potential is immense, fueled by the increasing integration of RPM into mainstream clinical workflows, supported by evolving reimbursement policies and a growing understanding of its cost-effectiveness and clinical efficacy. Strategic opportunities lie in developing personalized RPM solutions for niche disease states, enhancing AI-driven predictive analytics, and expanding access to remote care in underserved regions. The industry's trajectory points towards a future where remote patient monitoring is not just a supplementary tool but an integral component of comprehensive healthcare.

North America Remote Patient Monitoring Industry Segmentation

-

1. Type of Device

- 1.1. Heart Monitors

- 1.2. Breath Monitors

- 1.3. Hematology Monitors

- 1.4. Multi-Parameter Monitors

- 1.5. Other Types of Devices

-

2. Application

- 2.1. Cancer Treatment

- 2.2. Cardiovascular Diseases

- 2.3. Diabetes Treatment

- 2.4. Sleep Disorder

- 2.5. Weight Management and Fitness Monitoring

- 2.6. Other Applications

-

3. End User

- 3.1. Home Care Settings

- 3.2. Hospital/Clinics

- 3.3. Others

-

4. Geography

-

4.1. North America

- 4.1.1. United States

- 4.1.2. Canada

- 4.1.3. Mexico

-

4.1. North America

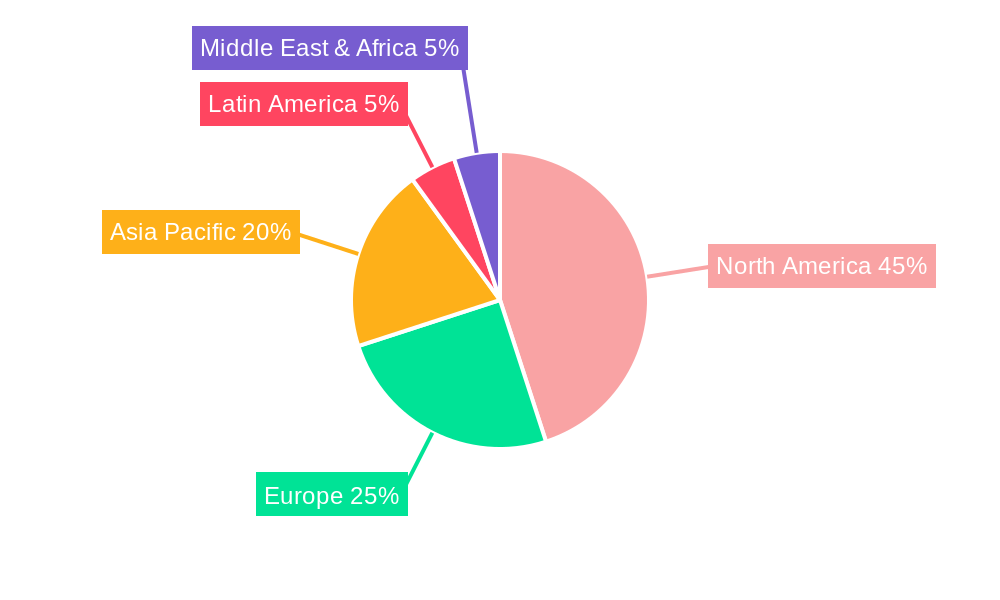

North America Remote Patient Monitoring Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Remote Patient Monitoring Industry Regional Market Share

Geographic Coverage of North America Remote Patient Monitoring Industry

North America Remote Patient Monitoring Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Incidences of Chronic Diseases due to Lifestyle Changes; Increase in the Aging Population; Growing Demand for Home-based Monitoring Devices

- 3.3. Market Restrains

- 3.3.1. ; Resistance from the Healthcare Industry Professionals Toward the Adoption of Patient Monitoring Systems; Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Heart Monitors are Expected to Witness a Rapid Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Remote Patient Monitoring Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Heart Monitors

- 5.1.2. Breath Monitors

- 5.1.3. Hematology Monitors

- 5.1.4. Multi-Parameter Monitors

- 5.1.5. Other Types of Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cancer Treatment

- 5.2.2. Cardiovascular Diseases

- 5.2.3. Diabetes Treatment

- 5.2.4. Sleep Disorder

- 5.2.5. Weight Management and Fitness Monitoring

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Home Care Settings

- 5.3.2. Hospital/Clinics

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. North America

- 5.4.1.1. United States

- 5.4.1.2. Canada

- 5.4.1.3. Mexico

- 5.4.1. North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Masimo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GE Healthcare

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Abbott Laboratories

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Koninklijke Philips N V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medtronic PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Smiths Medical Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Boston Scientific Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Welch Allyn Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dragerwerk AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Masimo

List of Figures

- Figure 1: North America Remote Patient Monitoring Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Remote Patient Monitoring Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Remote Patient Monitoring Industry Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 2: North America Remote Patient Monitoring Industry Volume K Unit Forecast, by Type of Device 2020 & 2033

- Table 3: North America Remote Patient Monitoring Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: North America Remote Patient Monitoring Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: North America Remote Patient Monitoring Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: North America Remote Patient Monitoring Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: North America Remote Patient Monitoring Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Remote Patient Monitoring Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 9: North America Remote Patient Monitoring Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 10: North America Remote Patient Monitoring Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: North America Remote Patient Monitoring Industry Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 12: North America Remote Patient Monitoring Industry Volume K Unit Forecast, by Type of Device 2020 & 2033

- Table 13: North America Remote Patient Monitoring Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: North America Remote Patient Monitoring Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: North America Remote Patient Monitoring Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 16: North America Remote Patient Monitoring Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 17: North America Remote Patient Monitoring Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: North America Remote Patient Monitoring Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: North America Remote Patient Monitoring Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: North America Remote Patient Monitoring Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: United States North America Remote Patient Monitoring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United States North America Remote Patient Monitoring Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Canada North America Remote Patient Monitoring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Canada North America Remote Patient Monitoring Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Mexico North America Remote Patient Monitoring Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Mexico North America Remote Patient Monitoring Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Remote Patient Monitoring Industry?

The projected CAGR is approximately 18.83%.

2. Which companies are prominent players in the North America Remote Patient Monitoring Industry?

Key companies in the market include Masimo, GE Healthcare, Abbott Laboratories, Koninklijke Philips N V, Medtronic PLC, Smiths Medical Inc, Boston Scientific Corporation, Welch Allyn Inc , Dragerwerk AG.

3. What are the main segments of the North America Remote Patient Monitoring Industry?

The market segments include Type of Device, Application, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.50 Million as of 2022.

5. What are some drivers contributing to market growth?

; Rising Incidences of Chronic Diseases due to Lifestyle Changes; Increase in the Aging Population; Growing Demand for Home-based Monitoring Devices.

6. What are the notable trends driving market growth?

Heart Monitors are Expected to Witness a Rapid Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

; Resistance from the Healthcare Industry Professionals Toward the Adoption of Patient Monitoring Systems; Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Remote Patient Monitoring Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Remote Patient Monitoring Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Remote Patient Monitoring Industry?

To stay informed about further developments, trends, and reports in the North America Remote Patient Monitoring Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence