Key Insights

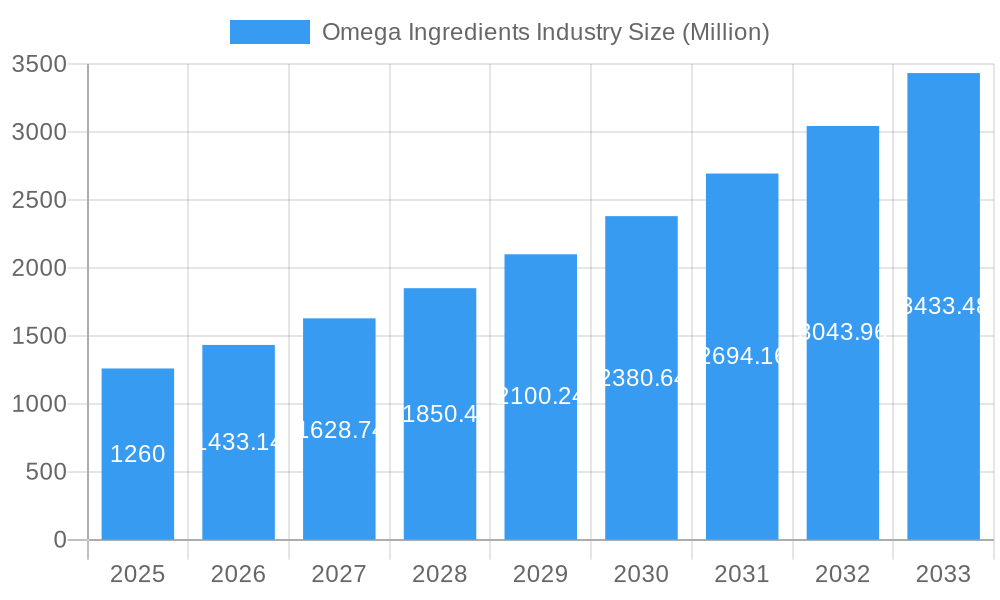

The global Omega Ingredients market is experiencing robust expansion, with a projected market size of USD 1.26 billion in 2025, poised for significant growth. This surge is fueled by an impressive Compound Annual Growth Rate (CAGR) of 13.79% throughout the forecast period of 2025-2033. Key drivers of this market include the escalating consumer awareness regarding the health benefits of omega fatty acids, particularly their role in cardiovascular health, brain function, and anti-inflammatory properties. The increasing demand for dietary supplements and functional foods and beverages fortified with omega ingredients, such as omega-3 and omega-6 fatty acids, is a primary growth catalyst. Furthermore, the pharmaceutical industry's interest in omega ingredients for therapeutic applications and the growing pet food sector seeking premium, health-enhancing additives are contributing to this upward trajectory. Emerging economies are also playing a crucial role, driven by increasing disposable incomes and a growing preference for health-conscious products.

Omega Ingredients Industry Market Size (In Billion)

The market is characterized by diverse segments, with Concentrates, Algal Oil, Cod Liver Oil, and Krill Oil emerging as prominent types, catering to a wide array of applications. Functional Food and Beverage and Dietary Supplements dominate the application landscape, reflecting consumer lifestyle trends. Infant Nutrition and Pharmaceutical segments are also witnessing substantial development, underscoring the critical role of omega ingredients across different life stages and health needs. While the market exhibits strong growth potential, certain restraints such as volatile raw material prices, stringent regulatory frameworks for health claims, and consumer perception challenges for certain ingredient sources need to be navigated. However, ongoing research and development into novel omega ingredient sources and improved extraction technologies are expected to mitigate these challenges, paving the way for sustained market expansion and innovation.

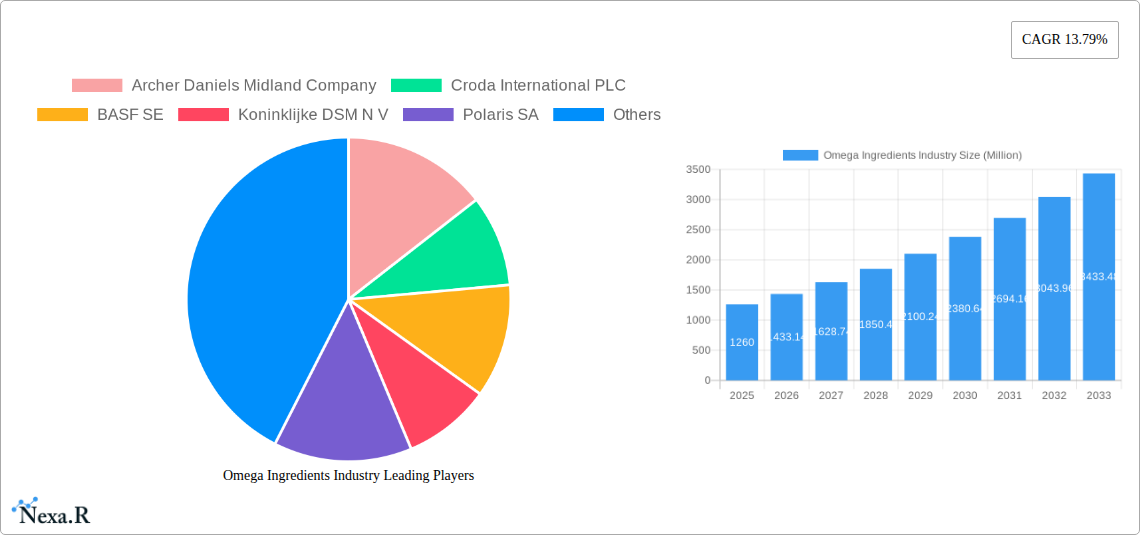

Omega Ingredients Industry Company Market Share

This in-depth report provides a critical analysis of the global Omega Ingredients Market, offering a detailed examination of its current state, historical performance, and projected trajectory through 2033. We delve into the intricate market dynamics, growth drivers, segmentation, and the competitive landscape, equipping industry professionals with actionable insights for strategic decision-making. The report covers key segments including Concentrates, Algal Oil, Cod Liver Oil, Krill Oil, Menhaden Oil, Refined Tuna Oil, Anchovy Oil, and Other Oil Types, alongside vital applications such as Functional Food and Beverage, Dietary Supplements, Infant Nutrition, Pet food and Feed, Pharmaceutical, and Clinical Nutrition.

Omega Ingredients Industry Market Dynamics & Structure

The Omega Ingredients Market exhibits a moderate concentration, characterized by the presence of large multinational corporations and specialized niche players. Technological innovation is a significant driver, with ongoing advancements in extraction, purification, and encapsulation technologies enhancing product quality and bioavailability. Stringent regulatory frameworks governing food safety and health claims for omega-3 fatty acids in various regions influence market entry and product development. Competitive product substitutes, particularly plant-based omega-3 sources, are gaining traction, posing a challenge to traditional marine-derived ingredients. End-user demographics are shifting, with increasing consumer awareness of the health benefits of omega-3s, particularly EPA and DHA, driving demand across all age groups. Merger and acquisition (M&A) trends are evident as companies seek to expand their product portfolios, gain market share, and leverage vertical integration.

- Market Concentration: Characterized by a mix of large players and smaller innovators.

- Technological Drivers: Advancements in extraction, purification, and encapsulation.

- Regulatory Frameworks: Impacting product claims and market access.

- Competitive Substitutes: Rise of plant-based omega-3 alternatives.

- End-User Demographics: Growing health consciousness across age groups.

- M&A Trends: Strategic acquisitions to enhance portfolios and market reach.

Omega Ingredients Industry Growth Trends & Insights

The global Omega Ingredients Market is poised for robust growth, driven by escalating consumer awareness of the indispensable role of omega-3 fatty acids in overall health and well-being. The market size is projected to witness a substantial expansion, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This growth is fueled by increasing adoption rates across diverse applications, from dietary supplements and functional foods to infant nutrition and animal feed. Technological disruptions, such as the development of more sustainable and efficient extraction methods, are not only improving product efficacy but also addressing environmental concerns. Consumer behavior shifts are pivotal, with a growing preference for natural, high-purity, and ethically sourced omega-3 ingredients. The demand for customized omega-3 formulations tailored to specific health needs and life stages is also on the rise, further accelerating market penetration. The Omega Ingredients Market is benefiting from extensive research validating the benefits of EPA and DHA for cardiovascular health, cognitive function, and inflammatory response management.

Dominant Regions, Countries, or Segments in Omega Ingredients Industry

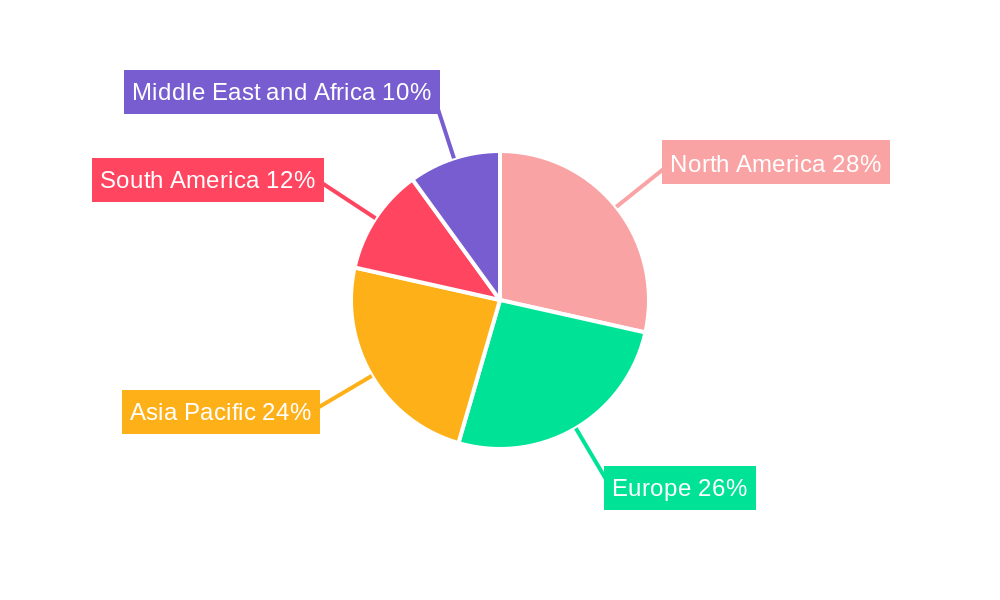

The Dietary Supplements segment is anticipated to emerge as the dominant force in the global Omega Ingredients Market, driven by a confluence of factors including heightened consumer health consciousness, the proactive pursuit of preventative healthcare, and the widespread availability of omega-3 fortified products. North America, specifically the United States, is expected to lead regional market growth due to a well-established dietary supplement industry, high disposable incomes, and a strong emphasis on health and wellness. The region's robust regulatory environment also fosters consumer trust in the quality and efficacy of omega-3 ingredients. Asia Pacific is identified as a high-growth region, spurred by increasing awareness of the health benefits of omega-3s, rising disposable incomes, and a burgeoning middle class embracing healthier lifestyles. Investments in research and development are significantly contributing to the expansion of the Algal Oil segment, driven by its sustainable sourcing and vegan appeal, catering to a growing vegetarian and vegan population.

- Dominant Segment: Dietary Supplements, propelled by health-conscious consumers and preventative healthcare trends.

- Leading Region: North America (particularly the USA) due to a mature supplement market and high health awareness.

- High-Growth Region: Asia Pacific, owing to rising incomes and increasing health consciousness.

- Emerging Segment Growth: Algal Oil, supported by sustainability and vegan trends.

Omega Ingredients Industry Product Landscape

The Omega Ingredients Market is witnessing continuous product innovation focused on enhancing purity, bioavailability, and sustainability. Companies are developing advanced Concentrates with higher concentrations of EPA and DHA, catering to specific therapeutic applications. Algal Oil is gaining significant traction as a sustainable and vegan alternative, offering a pure source of omega-3s free from marine contaminants. Innovations in encapsulation technologies, such as microencapsulation and liposomal delivery, are improving the stability and absorption of omega-3 fatty acids. These advancements ensure that end products, ranging from dietary supplements to fortified foods and infant formulas, deliver maximum health benefits with improved palatability and shelf-life.

Key Drivers, Barriers & Challenges in Omega Ingredients Industry

Key Drivers:

- Growing Health Awareness: Increasing consumer understanding of omega-3 benefits for cardiovascular, cognitive, and inflammatory health.

- Demand for Functional Foods & Supplements: Integration of omega-3s into everyday products and the booming dietary supplement industry.

- Technological Advancements: Improved extraction, purification, and delivery systems enhancing product quality and efficacy.

- Rising Disposable Incomes: Enabling consumers in emerging economies to invest more in health and wellness products.

- Positive Scientific Research: Continuous validation of omega-3 health benefits driving market demand.

Barriers & Challenges:

- Supply Chain Volatility: Dependence on marine resources can lead to fluctuations in availability and price.

- Regulatory Hurdles: Stringent regulations for health claims and product approvals in different regions.

- Competition from Substitutes: Increasing availability and acceptance of plant-based omega-3 alternatives.

- Consumer Perceptions: Concerns regarding the taste and odor of some omega-3 ingredients.

- Sustainability Concerns: Environmental impact of fishing practices and sourcing of marine-based omega-3s.

Emerging Opportunities in Omega Ingredients Industry

Emerging opportunities within the Omega Ingredients Market lie in the expansion of Algal Oil production, addressing the growing demand for vegan and sustainable omega-3 sources. The development of specialized omega-3 formulations for targeted health applications, such as cognitive enhancement for aging populations or immune support, presents significant potential. Furthermore, the untapped market for omega-3 enrichment in functional pet food and animal feed is gaining momentum, driven by pet owners' increasing focus on their pets' health. Innovative applications in the pharmaceutical sector, exploring omega-3s for disease management beyond cardiovascular health, also represent a promising avenue for growth.

Growth Accelerators in the Omega Ingredients Industry Industry

Long-term growth in the Omega Ingredients Market will be significantly accelerated by continued investment in research and development to uncover novel health benefits of omega-3s, particularly EPA and DHA, for a wider range of conditions. Strategic partnerships between ingredient suppliers and end-product manufacturers will drive innovation and market penetration. The development of more sustainable and traceable sourcing methods for marine-based omega-3s will bolster consumer confidence and appeal. Expansion into emerging markets with growing disposable incomes and increasing health consciousness will unlock new revenue streams. Furthermore, advancements in biotechnology, enabling the cultivation of omega-3-rich microalgae on a larger scale, will ensure a more stable and sustainable supply chain.

Key Players Shaping the Omega Ingredients Market

- Archer Daniels Midland Company

- Croda International PLC

- BASF SE

- Koninklijke DSM N V

- Polaris SA

- Aker BioMarine

- Corbion N V

- Omega Protein Corporation

- Cargill Inc

- Pelagia AS

Notable Milestones in Omega Ingredients Industry Sector

- October 2021: GC Rieber VivoMega announced plans to expand production facilities and storage tanks to accommodate more ingredients in the upcoming years.

- September 2021: KD Pharma Group introduced Alga3, a sustainable, vegan omega-3 solution, offering customizable EPA and DHA ratios.

- May 2021: AlgaeCytes Limited announced plans to build its first commercial plant in Dessau, Saxon-Anhalt, Germany, operated by its subsidiary AlgaeCytes Germany GmbH.

In-Depth Omega Ingredients Industry Market Outlook

The Omega Ingredients Market is projected for substantial future growth, driven by sustained consumer demand for health and wellness products. Key accelerators include ongoing scientific validation of omega-3 benefits, leading to broader applications in pharmaceuticals and clinical nutrition. The continued shift towards plant-based and sustainable ingredients, particularly Algal Oil, will redefine market offerings. Strategic collaborations and technological breakthroughs in production and delivery systems will enhance product efficacy and accessibility, solidifying the market's trajectory. This outlook indicates a dynamic and evolving landscape, ripe with opportunities for innovation and expansion within the global Omega Ingredients Market.

Omega Ingredients Industry Segmentation

-

1. Type

- 1.1. Concentrates

- 1.2. Algal Oil

- 1.3. Cod Liver Oil

- 1.4. Krill Oil

- 1.5. Menhaden Oil

- 1.6. Refined Tuna Oil

- 1.7. Anchovy Oil

- 1.8. Others Oil Types

-

2. Application

- 2.1. Functional Food and Beverage

- 2.2. Dietary Supplements

- 2.3. Infant Nutrition

- 2.4. Pet food and Feed

- 2.5. Pharmaceutical

- 2.6. Clinical Nutrition

Omega Ingredients Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Omega Ingredients Industry Regional Market Share

Geographic Coverage of Omega Ingredients Industry

Omega Ingredients Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth

- 3.4. Market Trends

- 3.4.1. Immense Growth in Concentrated Forms of Algal Omega-3 Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Omega Ingredients Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Concentrates

- 5.1.2. Algal Oil

- 5.1.3. Cod Liver Oil

- 5.1.4. Krill Oil

- 5.1.5. Menhaden Oil

- 5.1.6. Refined Tuna Oil

- 5.1.7. Anchovy Oil

- 5.1.8. Others Oil Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Functional Food and Beverage

- 5.2.2. Dietary Supplements

- 5.2.3. Infant Nutrition

- 5.2.4. Pet food and Feed

- 5.2.5. Pharmaceutical

- 5.2.6. Clinical Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Omega Ingredients Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Concentrates

- 6.1.2. Algal Oil

- 6.1.3. Cod Liver Oil

- 6.1.4. Krill Oil

- 6.1.5. Menhaden Oil

- 6.1.6. Refined Tuna Oil

- 6.1.7. Anchovy Oil

- 6.1.8. Others Oil Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Functional Food and Beverage

- 6.2.2. Dietary Supplements

- 6.2.3. Infant Nutrition

- 6.2.4. Pet food and Feed

- 6.2.5. Pharmaceutical

- 6.2.6. Clinical Nutrition

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Omega Ingredients Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Concentrates

- 7.1.2. Algal Oil

- 7.1.3. Cod Liver Oil

- 7.1.4. Krill Oil

- 7.1.5. Menhaden Oil

- 7.1.6. Refined Tuna Oil

- 7.1.7. Anchovy Oil

- 7.1.8. Others Oil Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Functional Food and Beverage

- 7.2.2. Dietary Supplements

- 7.2.3. Infant Nutrition

- 7.2.4. Pet food and Feed

- 7.2.5. Pharmaceutical

- 7.2.6. Clinical Nutrition

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Omega Ingredients Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Concentrates

- 8.1.2. Algal Oil

- 8.1.3. Cod Liver Oil

- 8.1.4. Krill Oil

- 8.1.5. Menhaden Oil

- 8.1.6. Refined Tuna Oil

- 8.1.7. Anchovy Oil

- 8.1.8. Others Oil Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Functional Food and Beverage

- 8.2.2. Dietary Supplements

- 8.2.3. Infant Nutrition

- 8.2.4. Pet food and Feed

- 8.2.5. Pharmaceutical

- 8.2.6. Clinical Nutrition

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Omega Ingredients Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Concentrates

- 9.1.2. Algal Oil

- 9.1.3. Cod Liver Oil

- 9.1.4. Krill Oil

- 9.1.5. Menhaden Oil

- 9.1.6. Refined Tuna Oil

- 9.1.7. Anchovy Oil

- 9.1.8. Others Oil Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Functional Food and Beverage

- 9.2.2. Dietary Supplements

- 9.2.3. Infant Nutrition

- 9.2.4. Pet food and Feed

- 9.2.5. Pharmaceutical

- 9.2.6. Clinical Nutrition

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Omega Ingredients Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Concentrates

- 10.1.2. Algal Oil

- 10.1.3. Cod Liver Oil

- 10.1.4. Krill Oil

- 10.1.5. Menhaden Oil

- 10.1.6. Refined Tuna Oil

- 10.1.7. Anchovy Oil

- 10.1.8. Others Oil Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Functional Food and Beverage

- 10.2.2. Dietary Supplements

- 10.2.3. Infant Nutrition

- 10.2.4. Pet food and Feed

- 10.2.5. Pharmaceutical

- 10.2.6. Clinical Nutrition

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Archer Daniels Midland Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Croda International PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BASF SE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Koninklijke DSM N V

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Polaris SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aker BioMarine*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Corbion N V

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Omega Protein Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cargill Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pelagia AS

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Archer Daniels Midland Company

List of Figures

- Figure 1: Global Omega Ingredients Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Omega Ingredients Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Omega Ingredients Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Omega Ingredients Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Omega Ingredients Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Omega Ingredients Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Omega Ingredients Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Omega Ingredients Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Omega Ingredients Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Omega Ingredients Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Omega Ingredients Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Omega Ingredients Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Omega Ingredients Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Omega Ingredients Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Omega Ingredients Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Omega Ingredients Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Omega Ingredients Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Omega Ingredients Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Omega Ingredients Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Omega Ingredients Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Omega Ingredients Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Omega Ingredients Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Omega Ingredients Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Omega Ingredients Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Omega Ingredients Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Omega Ingredients Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Omega Ingredients Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Omega Ingredients Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Omega Ingredients Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Omega Ingredients Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Omega Ingredients Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Omega Ingredients Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Omega Ingredients Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Omega Ingredients Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Omega Ingredients Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Omega Ingredients Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Omega Ingredients Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Omega Ingredients Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Omega Ingredients Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Omega Ingredients Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Germany Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Spain Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Russia Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Omega Ingredients Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Omega Ingredients Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Omega Ingredients Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Omega Ingredients Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global Omega Ingredients Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Omega Ingredients Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Omega Ingredients Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Omega Ingredients Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 37: Global Omega Ingredients Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 38: United Arab Emirates Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: South Africa Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Omega Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Omega Ingredients Industry?

The projected CAGR is approximately 13.79%.

2. Which companies are prominent players in the Omega Ingredients Industry?

Key companies in the market include Archer Daniels Midland Company, Croda International PLC, BASF SE, Koninklijke DSM N V, Polaris SA, Aker BioMarine*List Not Exhaustive, Corbion N V, Omega Protein Corporation, Cargill Inc, Pelagia AS.

3. What are the main segments of the Omega Ingredients Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.26 Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth.

6. What are the notable trends driving market growth?

Immense Growth in Concentrated Forms of Algal Omega-3 Ingredients.

7. Are there any restraints impacting market growth?

Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth.

8. Can you provide examples of recent developments in the market?

In October 2021, Omega-3 concentrates supplier GC Rieber VivoMega announced its plans to expand production facilities and storage tanks to accommodate more ingredients in the upcoming years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Omega Ingredients Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Omega Ingredients Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Omega Ingredients Industry?

To stay informed about further developments, trends, and reports in the Omega Ingredients Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence