Key Insights

The Russian food colorants market is poised for significant expansion, projected to reach an estimated USD 4.7 billion by 2024, exhibiting a robust Compound Annual Growth Rate (CAGR) of 6% during the forecast period of 2025-2033. This growth is primarily propelled by the escalating consumer demand for visually appealing and natural food products. Key drivers include the increasing adoption of food colorants in the expanding beverages, dairy, bakery, and confectionery sectors within Russia. The rising disposable incomes and evolving consumer preferences towards premium and aesthetically pleasing food items are further fueling market penetration. Furthermore, the growing awareness and preference for natural food colorants derived from plant-based sources, driven by health and wellness trends, are shaping the product landscape and contributing to market dynamism. The synthetic segment, while still significant, is witnessing a shift towards natural alternatives due to regulatory pressures and consumer demand for cleaner labels.

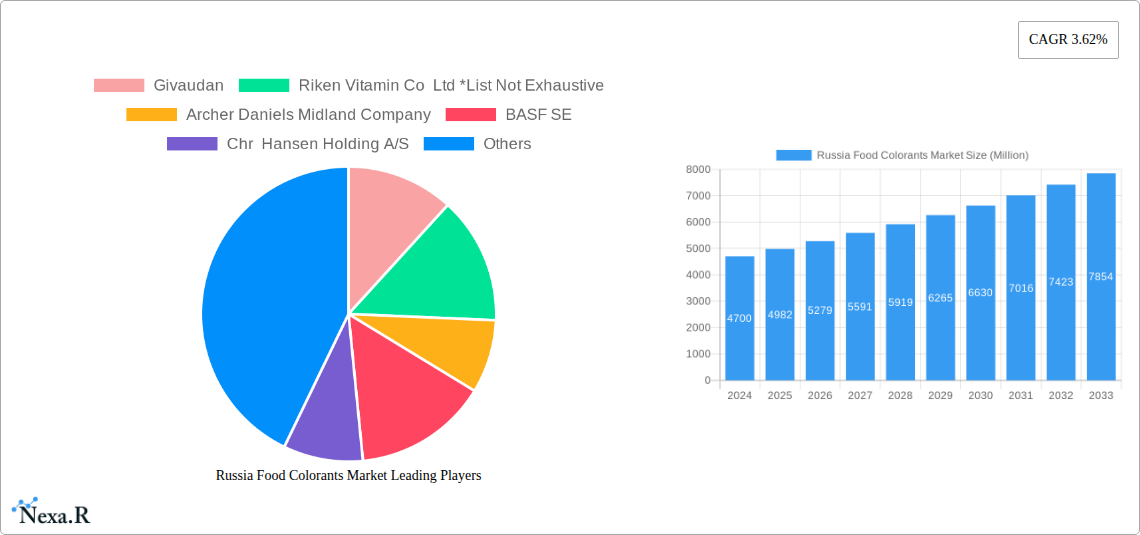

Russia Food Colorants Market Market Size (In Billion)

Despite the promising growth trajectory, the Russian food colorants market faces certain restraints. Stringent regulatory frameworks and evolving labeling requirements concerning synthetic food colors can pose challenges for manufacturers. Fluctuations in raw material prices, particularly for natural colorants, can impact profit margins and supply chain stability. However, the market is actively navigating these challenges through innovation and strategic collaborations. The trend towards diversification of product portfolios, with an emphasis on vibrant and stable natural colorants, is a key strategic focus for major players. The competitive landscape is characterized by the presence of both global giants like Givaudan and Archer Daniels Midland Company, alongside local players, fostering innovation and a diverse range of offerings across synthetic and natural colorant segments for applications spanning beverages, dairy, bakery, meat and poultry, and confectionery.

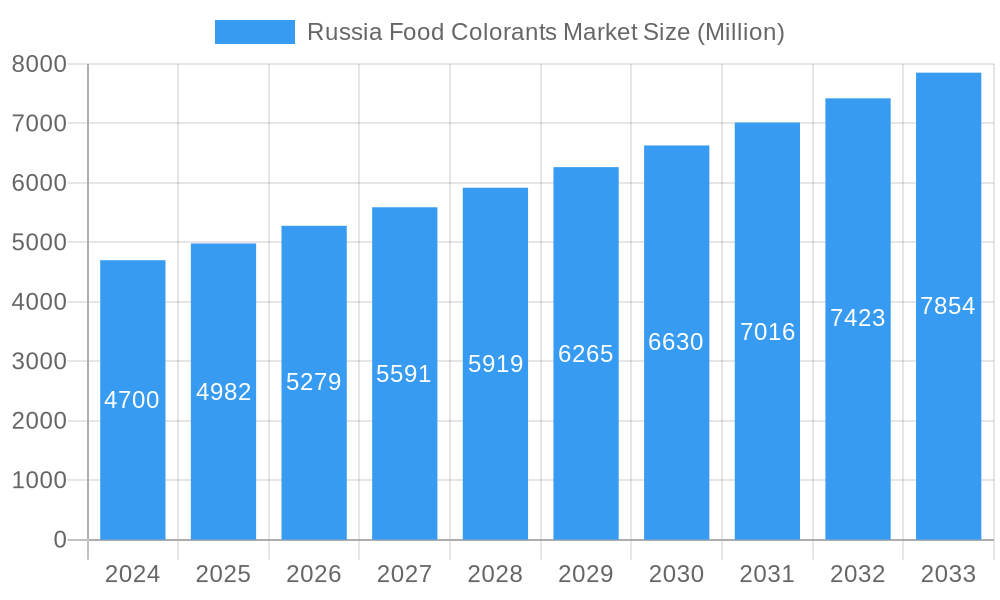

Russia Food Colorants Market Company Market Share

This comprehensive report delves into the dynamic Russia food colorants market, offering an in-depth analysis of its evolution, key drivers, and future trajectory. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025–2033, this report equips industry professionals with critical insights for strategic decision-making. Explore the market's intricate structure, the impact of natural food colorants, the burgeoning demand for synthetic food colors, and their applications across diverse food and beverage segments like dairy products, bakery goods, confectionery, meat and poultry, and other essential food categories.

Russia Food Colorants Market Market Dynamics & Structure

The Russia food colorants market exhibits a moderate concentration, with key players like Givaudan, Archer Daniels Midland Company, and BASF SE holding significant positions. Technological innovation is a primary driver, particularly the advancement in extraction and stabilization techniques for natural food colorants, enhancing their performance and shelf-life. Regulatory frameworks, including food safety standards and labeling requirements for both synthetic food colors and their natural counterparts, significantly shape market entry and product development. Competitive product substitutes, such as the increasing consumer preference for clean-label ingredients, are pushing manufacturers to invest in R&D for vibrant and stable natural alternatives. End-user demographics are shifting, with a growing health-conscious consumer base demanding transparency and natural ingredients, impacting the demand for specific food colorant types. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their product portfolios and geographic reach within the Russian food industry.

- Market Concentration: Moderate, with a few dominant players and several niche manufacturers.

- Technological Innovation: Focus on improving stability, cost-effectiveness, and vibrant hues for natural food colorants.

- Regulatory Frameworks: Stringent food safety regulations and evolving labeling laws influence product formulation and market access.

- Competitive Product Substitutes: Growing demand for natural and clean-label solutions impacting synthetic colorant market share.

- End-User Demographics: Rising consumer awareness of health and ingredient origins driving preference for natural food colorants.

- M&A Trends: Strategic acquisitions to broaden product offerings and strengthen market presence.

Russia Food Colorants Market Growth Trends & Insights

The Russia food colorants market is poised for substantial growth, projected to reach an estimated $1.5 billion in 2025. This expansion is underpinned by a rising adoption rate of both synthetic and natural food colorants across various food and beverage applications. Technological disruptions, including advancements in microencapsulation and enzymatic modification of color compounds, are enabling the creation of more stable and vibrant colorants, catering to stringent processing requirements in bakery, dairy, and confectionery products. Consumer behavior shifts towards healthier and more natural food options are a significant catalyst, driving the demand for natural food colorants derived from sources like fruits, vegetables, and insects. This trend is particularly evident in the beverages and dairy sectors, where visually appealing and "clean label" products are gaining traction. The market penetration of specialized colorants, such as those offering heat and light stability, is also increasing, facilitating their use in processed foods like meat and poultry products. The overall market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.2% during the forecast period. This sustained growth reflects the increasing sophistication of food manufacturing in Russia and the evolving palate of its consumers who demand both visual appeal and ingredient integrity.

Dominant Regions, Countries, or Segments in Russia Food Colorants Market

Within the Russia food colorants market, the natural food colorants segment is emerging as the dominant force, driven by profound shifts in consumer preferences and stringent regulatory pressures favoring healthier ingredients. This segment is projected to account for approximately 55% of the total market share by 2025, with an estimated market size of $825 million. Key drivers for this dominance include the growing health consciousness among Russian consumers, who are increasingly scrutinizing ingredient lists and actively seeking products free from artificial additives. This trend is particularly pronounced in urban centers and among younger demographics, who are more influenced by global food trends and sustainability concerns.

- Natural Food Colorants Dominance: Fueled by consumer demand for clean labels and health benefits.

- Beverages Application: Leading segment for natural colorants due to demand for visually appealing and "natural" drinks. Expected market size of $250 million in 2025.

- Dairy Application: Growing adoption of natural colorants for yogurts, cheeses, and dairy-based desserts. Estimated market size of $200 million in 2025.

- Bakery Application: Increasing use of natural colorants in bread, cakes, and pastries, driven by consumer perception of healthier options. Estimated market size of $180 million in 2025.

- Confectionery Application: While synthetic colors have traditionally dominated, there's a growing demand for natural alternatives in candies and chocolates. Estimated market size of $150 million in 2025.

- Meat and Poultry Application: Emerging opportunities for natural colorants to enhance the visual appeal of processed meats. Estimated market size of $75 million in 2025.

- Economic Policies: Government initiatives promoting domestic production of agricultural products and natural ingredients indirectly support the natural food colorants market.

- Infrastructure Development: Improved supply chains for sourcing and processing natural raw materials contribute to market growth.

Russia Food Colorants Market Product Landscape

The Russia food colorants market is witnessing a surge in product innovation, with a strong emphasis on developing highly stable and vibrant natural food colorants. Companies are investing in advanced extraction techniques, such as supercritical fluid extraction and enzymatic processing, to yield richer hues and improved functionality from plant-based sources like anthocyanins, carotenoids, and curcuminoids. These advancements are crucial for their application in demanding food matrices like dairy products, bakery, and confectionery, where heat, light, and pH stability are paramount. Unique selling propositions often revolve around natural origin, allergen-free formulations, and enhanced sensory appeal, aligning with evolving consumer preferences for clean-label products. Technological breakthroughs in microencapsulation are also enhancing the performance of both natural and synthetic colorants, offering controlled release and improved dispersibility in various food applications.

Key Drivers, Barriers & Challenges in Russia Food Colorants Market

The Russia food colorants market is propelled by several key drivers, including the escalating consumer demand for natural and clean-label products, coupled with increasing awareness of the potential health implications of artificial additives. Technological advancements in extraction and stabilization of natural colorants are making them more viable and cost-effective alternatives to synthetics. Furthermore, a growing middle class with higher disposable incomes is willing to pay a premium for visually appealing and health-conscious food options.

Conversely, the market faces significant barriers and challenges. The higher cost of some natural food colorants compared to their synthetic counterparts can be a restraint for price-sensitive manufacturers. Supply chain volatility and the potential for seasonal variations in the availability of natural raw materials pose logistical challenges. Stringent regulatory approval processes for new food colorants and evolving labeling requirements can also create hurdles for market entry and product development. Intense competition within the synthetic segment, offering a wide range of shades at competitive prices, also presents a challenge for natural alternatives.

Emerging Opportunities in Russia Food Colorants Market

Emerging opportunities in the Russia food colorants market lie in the development of novel, highly stable natural colorants derived from underutilized plant and insect sources, catering to the growing demand for unique shades and functionalities. The expansion of the plant-based food industry presents a significant avenue, requiring natural coloring solutions that mimic traditional meat and dairy products. Furthermore, exploring innovative applications of colorants in functional foods and beverages, such as those fortified with vitamins or probiotics, offers untapped potential. The increasing consumer interest in traceable and sustainably sourced ingredients also creates an opportunity for market players to differentiate themselves through transparent supply chains.

Growth Accelerators in the Russia Food Colorants Market Industry

Several growth accelerators are poised to significantly impact the Russia food colorants market. Technological breakthroughs in fermentation-based production of natural colorants promise scalability and cost-efficiency, addressing a key barrier. Strategic partnerships between food manufacturers and specialized food colorant suppliers will foster co-innovation and tailor-made solutions for specific product applications. The increasing focus on research and development for colorants that withstand harsh processing conditions will expand their application into a wider range of food products. Moreover, market expansion strategies targeting underserved regions within Russia and leveraging e-commerce platforms to reach a broader consumer base will further fuel growth.

Key Players Shaping the Russia Food Colorants Market Market

- Givaudan

- Riken Vitamin Co Ltd

- Archer Daniels Midland Company

- BASF SE

- Chr Hansen Holding A/S

- GNT Group B V

- Sensient Technologies Corporation

- Eco Resource

Notable Milestones in Russia Food Colorants Market Sector

- 2021: Launch of a new range of heat-stable anthocyanin-based colors by a leading global supplier, enhancing their application in bakery and confectionery.

- 2022: Increased investment by major food manufacturers in R&D for natural colorants to meet growing consumer demand for clean-label products.

- 2023 (Early): Introduction of advanced microencapsulation technology for improved dispersibility and stability of carotenes in beverage applications.

- 2023 (Mid): Regulatory updates clarifying labeling requirements for natural food colorants, providing greater clarity for manufacturers.

- 2023 (Late): Acquisition of a specialized natural food colorant producer by a major ingredient supplier to expand its portfolio.

- 2024 (Ongoing): Growing interest in insect-derived colorants, such as carmine, as a vibrant natural alternative.

In-Depth Russia Food Colorants Market Market Outlook

The Russia food colorants market is set for robust expansion, driven by the sustained consumer pivot towards natural and healthier food options. Growth accelerators, including technological advancements in the production and stabilization of natural food colorants, alongside strategic collaborations between ingredient suppliers and food manufacturers, will be instrumental. The market's outlook is further brightened by opportunities in the burgeoning plant-based food sector and innovative applications in functional foods. Anticipate continued investment in R&D to develop colorants that meet increasingly stringent processing requirements and consumer expectations for both visual appeal and ingredient integrity, solidifying its growth trajectory.

Russia Food Colorants Market Segmentation

-

1. Type

- 1.1. Synthetic

- 1.2. Natural

-

2. Application

- 2.1. Beverages

- 2.2. Dairy

- 2.3. Bakery

- 2.4. Meat and Poultry

- 2.5. Confectionery

- 2.6. Others

Russia Food Colorants Market Segmentation By Geography

- 1. Russia

Russia Food Colorants Market Regional Market Share

Geographic Coverage of Russia Food Colorants Market

Russia Food Colorants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health Consciousness among consumer

- 3.3. Market Restrains

- 3.3.1. High Cost of natural Ingredients

- 3.4. Market Trends

- 3.4.1. High Import of Food Colorants

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Food Colorants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Synthetic

- 5.1.2. Natural

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beverages

- 5.2.2. Dairy

- 5.2.3. Bakery

- 5.2.4. Meat and Poultry

- 5.2.5. Confectionery

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Givaudan

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Riken Vitamin Co Ltd *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Archer Daniels Midland Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BASF SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chr Hansen Holding A/S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GNT Group B V

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sensient Technologies Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eco Resource

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Givaudan

List of Figures

- Figure 1: Russia Food Colorants Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Russia Food Colorants Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Food Colorants Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Russia Food Colorants Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Russia Food Colorants Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Russia Food Colorants Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Russia Food Colorants Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Russia Food Colorants Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Food Colorants Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Russia Food Colorants Market?

Key companies in the market include Givaudan, Riken Vitamin Co Ltd *List Not Exhaustive, Archer Daniels Midland Company, BASF SE, Chr Hansen Holding A/S, GNT Group B V, Sensient Technologies Corporation, Eco Resource.

3. What are the main segments of the Russia Food Colorants Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Health Consciousness among consumer.

6. What are the notable trends driving market growth?

High Import of Food Colorants.

7. Are there any restraints impacting market growth?

High Cost of natural Ingredients.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Food Colorants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Food Colorants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Food Colorants Market?

To stay informed about further developments, trends, and reports in the Russia Food Colorants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence