Key Insights

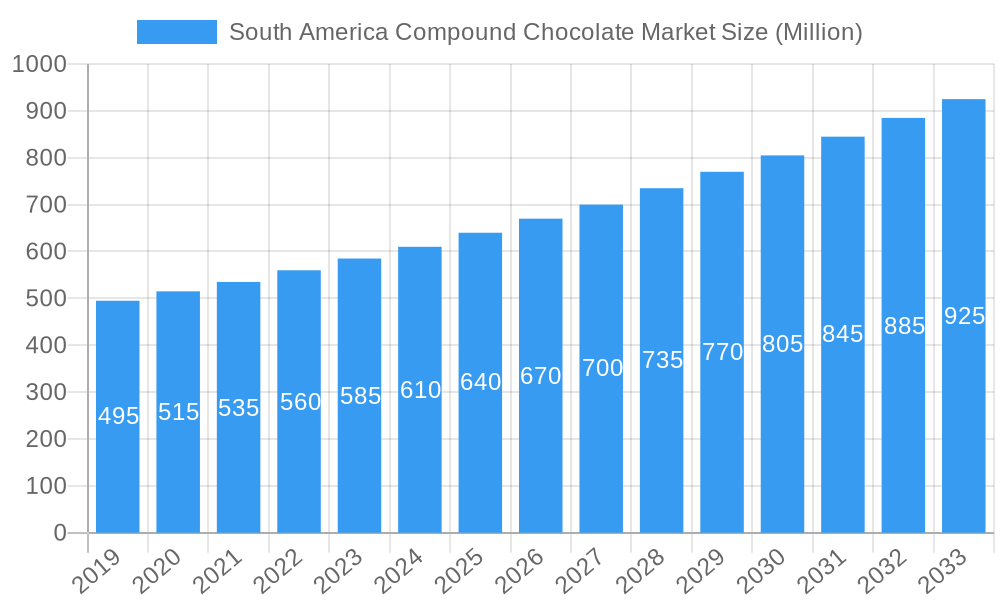

The South America Compound Chocolate Market is projected for substantial growth, with an estimated market size of $1.87 billion by 2025. The market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 5.64% through 2033. This growth is propelled by rising consumer demand for premium and convenient confectionery, alongside increasing use of compound chocolate in bakery and ice cream sectors. Its cost-effectiveness and ease of integration into various food products drive widespread adoption. Expanding middle classes and emerging economies in South America further support market penetration. Key trends include the development of artisanal compound chocolate and innovative flavor profiles, catering to evolving consumer preferences and the popularity of ready-to-eat snacks.

South America Compound Chocolate Market Market Size (In Billion)

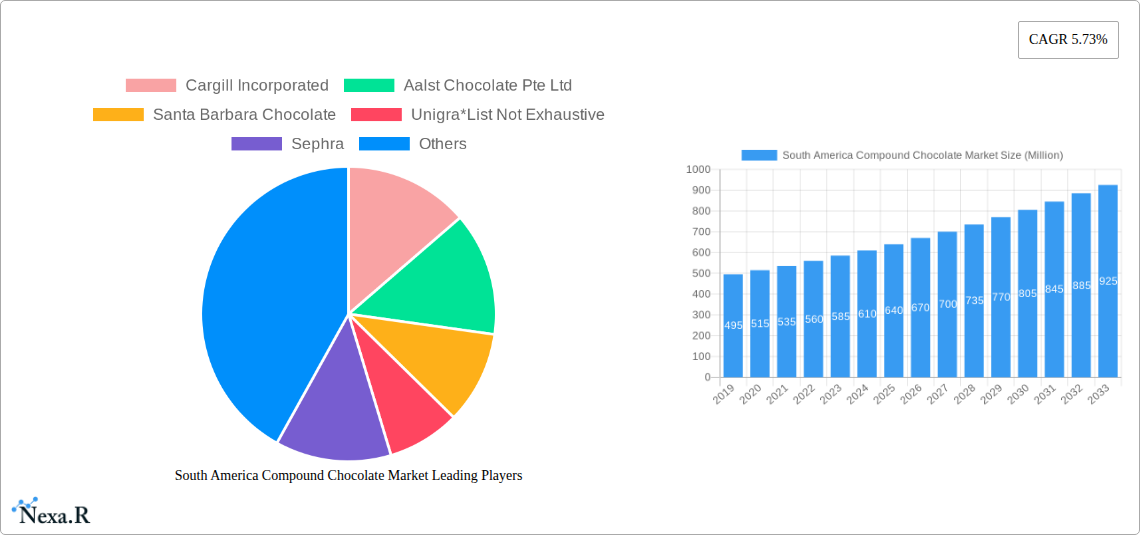

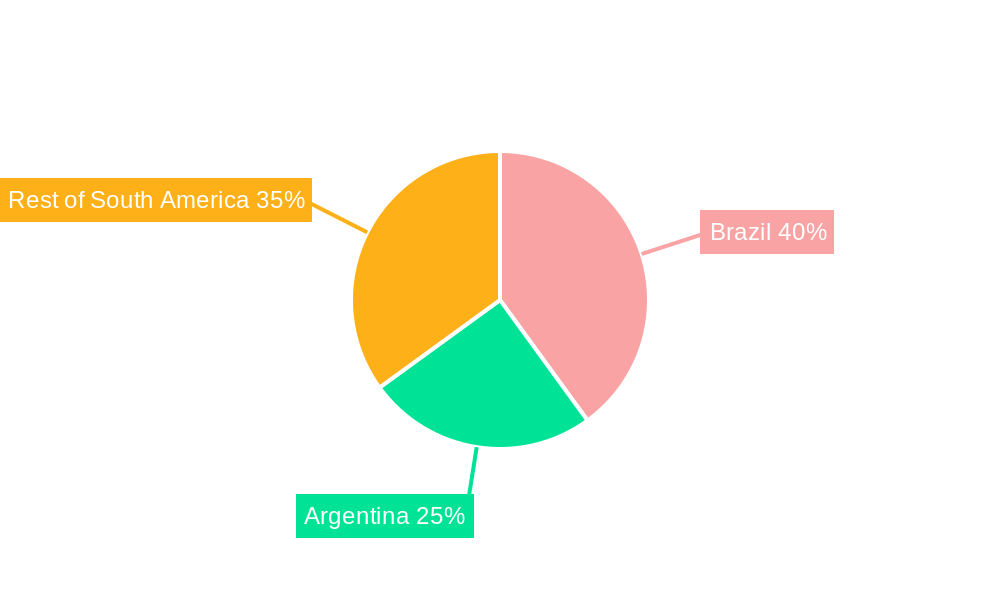

Market restraints include raw material price volatility, impacting profitability and pricing strategies. Intense competition necessitates product differentiation, quality enhancement, and cost optimization. Segmentation analysis indicates strong performance in "Dark" and "Milk" flavor categories, with "Chocolate Chips/Drops/Chunks" and "Chocolate Slab" being significant product types. "Bakery" and "Confectionery" are dominant application sectors, followed by "Ice Cream and Frozen Desserts." Brazil is expected to lead market value, with Argentina and other South American nations contributing to expansion. Key players like The Barry Callebaut Group, Cargill Incorporated, and Blommer Chocolate Company are influential through their product offerings and strategic initiatives.

South America Compound Chocolate Market Company Market Share

This comprehensive report offers critical insights into the South America Compound Chocolate Market, analyzing market dynamics, growth drivers, regional trends, product segmentation, emerging opportunities, and competitive strategies. The study covers the period from 2019 to 2033, with a base year of 2025. The South America Compound Chocolate Market, projected to reach a significant valuation, is driven by evolving consumer tastes, advancements in chocolate manufacturing technology, and a robust confectionery and bakery industry.

South America Compound Chocolate Market Dynamics & Structure

The South America Compound Chocolate Market exhibits a moderately consolidated structure, with a few key players holding significant market share while a broader base of smaller manufacturers caters to niche demands. Technological innovation is a primary driver, with advancements in processing techniques and ingredient formulations enabling the creation of diverse compound chocolate products with enhanced functionalities and sensory appeal. Regulatory frameworks, though varied across the region, are increasingly focused on food safety standards and labeling, influencing product development and market access. Competitive product substitutes, such as confectionery coatings made from vegetable fats, present a constant challenge, necessitating continuous innovation and differentiation by compound chocolate manufacturers. End-user demographics reveal a growing demand for premium and indulgence-oriented products, particularly among urban populations, alongside an increasing preference for sugar-free and plant-based options. Mergers and acquisitions (M&A) trends, while not overtly dominant, are strategically employed by larger entities to expand their product portfolios, gain market access in specific geographies, or acquire innovative technologies. For instance, recent M&A activities have focused on integrating smaller, agile manufacturers with unique product offerings or expanding distribution networks into underserved markets. The overall market concentration is influenced by factors such as economies of scale in production, brand recognition, and the ability to secure stable raw material supplies, particularly cocoa and vegetable oils. Innovation barriers include the high cost of research and development for novel formulations and the complex regulatory approval processes in some South American countries.

South America Compound Chocolate Market Growth Trends & Insights

The South America Compound Chocolate Market is experiencing robust growth, fueled by a confluence of macroeconomic factors and shifting consumer behaviors. The market size is estimated to reach $XXX million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This expansion is underpinned by increasing disposable incomes across key South American economies, leading to higher per capita spending on confectionery and bakery products, where compound chocolate plays a vital role. The adoption rate of compound chocolate in various applications, from artisanal bakeries to large-scale industrial confectioneries, is steadily rising. Technological disruptions, such as advancements in tempering technologies, the development of specialized emulsifiers, and the increasing use of automation in production lines, are enhancing the efficiency and versatility of compound chocolate manufacturing. These innovations allow for the creation of products with improved melt profiles, gloss, and texture, directly catering to the sophisticated demands of both industrial and retail consumers.

Consumer behavior shifts are playing a pivotal role. There's a noticeable trend towards convenience foods and ready-to-eat snacks, where compound chocolate offers a cost-effective and versatile ingredient. Furthermore, a growing awareness of health and wellness is driving demand for compound chocolates with reduced sugar content, healthier fat profiles, and inclusions of functional ingredients. This has spurred innovation in the "Other Flavors" and "Other Products" segments, with manufacturers exploring novel flavor combinations and formats. The "Confectionery" and "Bakery" application segments continue to be the primary growth engines, driven by the enduring popularity of chocolate-based treats and baked goods. The market penetration of compound chocolate in emerging economies within South America is also on an upward trajectory, as manufacturers expand their reach and introduce products tailored to local tastes and price points. The forecast period anticipates continued growth, driven by sustained economic development, ongoing product innovation, and a deepening understanding of consumer preferences across the diverse South American landscape.

Dominant Regions, Countries, or Segments in South America Compound Chocolate Market

Within the South America Compound Chocolate Market, Brazil stands out as the dominant force, consistently leading in consumption and production. Its large population, robust industrial base in food processing, and significant agricultural output contribute to its leading position. Brazil's strong confectionery and bakery sectors, coupled with a growing middle class, create a substantial demand for a wide range of compound chocolate products. Economic policies that support agricultural processing and manufacturing, along with well-established infrastructure for distribution, further bolster Brazil's market leadership.

In terms of Flavor, Milk compound chocolate holds the largest market share, owing to its widespread appeal and versatility in various confectionery and bakery applications. However, Dark compound chocolate is experiencing notable growth, driven by increasing consumer preference for richer, more intense flavors and the perceived health benefits associated with cocoa content. "Other Flavors," including those with fruit, caramel, or coffee infusions, are also gaining traction as manufacturers innovate to meet evolving consumer tastes.

From a Product perspective, Chocolate Coatings represent the largest segment. Their application in enrobing confectionery items, baked goods, and ice cream products makes them indispensable for many food manufacturers. Chocolate Chips/Drops/Chunks also command a significant share, favored by the baking industry for their ease of use and ability to deliver consistent chocolate distribution in cookies, cakes, and muffins.

The Application segment is heavily influenced by the Confectionery and Bakery industries. These sectors are the primary consumers of compound chocolate, utilizing it in a vast array of products ranging from everyday candy bars to elaborate pastries. The Ice Cream and Frozen Desserts segment is also a significant contributor to market growth, with compound chocolate being used for variegates, inclusions, and coatings.

The "Rest of South America," encompassing countries like Colombia, Chile, and Peru, presents substantial growth potential. These regions are witnessing increasing industrialization, urbanization, and rising disposable incomes, which are translating into a growing demand for processed food products, including those incorporating compound chocolate. Infrastructure development and supportive government initiatives aimed at boosting the food manufacturing sector in these countries are key drivers of their expanding market share.

South America Compound Chocolate Market Product Landscape

The South America Compound Chocolate Market's product landscape is characterized by continuous innovation aimed at enhancing both functionality and sensory appeal. Manufacturers are actively developing advanced compound chocolate formulations that offer superior melt resistance, allowing for easier handling and extended shelf life in warmer climates. Innovations in emulsification technologies and the strategic use of specific vegetable fats contribute to achieving desired textures and mouthfeel. Applications extend beyond traditional confectionery and bakery, with growing use in ice cream coatings, frozen dessert inclusions, and even as a base for savory applications in some culinary contexts. Performance metrics such as gloss, snap, and ease of tempering are key differentiators, driving the development of specialized products for specific industrial needs. Unique selling propositions often lie in customizable flavor profiles, color variations, and the incorporation of functional ingredients, catering to niche market demands and health-conscious consumers.

Key Drivers, Barriers & Challenges in South America Compound Chocolate Market

Key Drivers:

- Growing Confectionery and Bakery Industries: The sustained growth of these sectors across South America directly fuels the demand for compound chocolate as a versatile and cost-effective ingredient.

- Increasing Disposable Incomes: Rising economic prosperity in many South American nations leads to increased consumer spending on indulgence products, including those made with compound chocolate.

- Technological Advancements: Innovations in processing, formulation, and ingredient sourcing are leading to improved quality, functionality, and cost-efficiency of compound chocolates.

- Demand for Affordable Indulgence: Compound chocolate offers a more budget-friendly alternative to true chocolate, making premium-like experiences accessible to a broader consumer base.

Key Barriers & Challenges:

- Volatility in Raw Material Prices: Fluctuations in the prices of key ingredients like vegetable oils and cocoa derivatives can impact profit margins and pricing strategies.

- Stringent Food Regulations: Varying and evolving food safety and labeling regulations across different South American countries can pose compliance challenges and increase operational costs.

- Competition from True Chocolate: While compound chocolate offers cost advantages, it faces competition from premium true chocolate products, particularly in higher-end market segments.

- Supply Chain Disruptions: Geopolitical factors, logistical complexities, and climate-related issues can disrupt the supply chain for essential raw materials, impacting production schedules and costs.

Emerging Opportunities in South America Compound Chocolate Market

Emerging opportunities in the South America Compound Chocolate Market lie in the growing demand for healthier alternatives and specialized functional ingredients. The rising health consciousness among consumers presents a significant avenue for innovation in sugar-free, low-fat, and plant-based compound chocolates. The "Other Flavors" segment is ripe for exploration, with opportunities to introduce unique local flavors and exotic fruit infusions that cater to regional palates. Furthermore, the expansion of e-commerce platforms provides a direct channel for manufacturers to reach a wider consumer base, particularly for artisanal and niche compound chocolate products. The increasing use of compound chocolate in non-traditional applications, such as gourmet cooking ingredients and specialized food service products, also presents untapped market potential.

Growth Accelerators in the South America Compound Chocolate Market Industry

Several catalysts are accelerating the long-term growth of the South America Compound Chocolate Market. Technological breakthroughs in ingredient science are enabling the creation of compound chocolates with enhanced nutritional profiles and improved sensory attributes, meeting the evolving demands of health-conscious consumers. Strategic partnerships between compound chocolate manufacturers and ingredient suppliers are fostering innovation in sourcing and product development, leading to more sustainable and cost-effective solutions. Furthermore, market expansion strategies by leading companies, focusing on underserved regions within South America and developing localized product offerings, are driving increased penetration and consumption. The growing trend of premiumization within the mass market, where consumers seek better quality at affordable prices, directly benefits compound chocolate producers.

Key Players Shaping the South America Compound Chocolate Market Market

- Cargill Incorporated

- Aalst Chocolate Pte Ltd

- Santa Barbara Chocolate

- Unigra

- Sephra

- Blommer Chocolate Company

- The Barry Callebaut Group

- Puratos NV

Notable Milestones in South America Compound Chocolate Market Sector

- 2021/08: Launch of a new range of dairy-free compound chocolates by a major player, catering to the growing vegan and lactose-intolerant consumer base.

- 2022/03: Investment in advanced processing technology by a key manufacturer to improve the melt profile and gloss of their chocolate coatings.

- 2022/11: Strategic acquisition of a regional specialty ingredient supplier to enhance the innovation capabilities in flavor development.

- 2023/05: Introduction of a sustainable sourcing initiative for key raw materials, addressing growing consumer demand for ethically produced ingredients.

- 2023/10: Expansion of production capacity by a leading company to meet the increasing demand from the confectionery sector in emerging South American markets.

- 2024/01: Development of a low-glycemic index compound chocolate formulation, targeting the health-conscious consumer segment.

In-Depth South America Compound Chocolate Market Market Outlook

The outlook for the South America Compound Chocolate Market remains highly positive, driven by persistent growth accelerators. Continued technological innovation in product development, focusing on healthier formulations and unique flavor profiles, will be crucial. Strategic partnerships and market expansion initiatives, particularly into growing economies within the "Rest of South America," are expected to unlock new revenue streams. The market's ability to adapt to evolving consumer preferences for both indulgence and wellness will dictate its long-term trajectory. Opportunities for market leaders lie in leveraging their scale for cost efficiencies while simultaneously fostering agility to respond to niche demands and emerging trends. The South America Compound Chocolate Market is poised for sustained growth, presenting significant strategic opportunities for stakeholders who can effectively navigate its dynamic landscape.

South America Compound Chocolate Market Segmentation

-

1. Flavor

- 1.1. Dark

- 1.2. Milk

- 1.3. White

- 1.4. Other Flavors

-

2. Product

- 2.1. Chocolate Chips/Drops/Chunks

- 2.2. Chocolate Slab

- 2.3. Chocolate Coatings

- 2.4. Other Products

-

3. Application

- 3.1. Compound Chocolates

- 3.2. Bakery

- 3.3. Confectionery

- 3.4. Ice Cream and Frozen Desserts

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

South America Compound Chocolate Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Compound Chocolate Market Regional Market Share

Geographic Coverage of South America Compound Chocolate Market

South America Compound Chocolate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Versatile Application of Compound Chocolate in Bakery & Confectionery Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Compound Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Flavor

- 5.1.1. Dark

- 5.1.2. Milk

- 5.1.3. White

- 5.1.4. Other Flavors

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Chocolate Chips/Drops/Chunks

- 5.2.2. Chocolate Slab

- 5.2.3. Chocolate Coatings

- 5.2.4. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Compound Chocolates

- 5.3.2. Bakery

- 5.3.3. Confectionery

- 5.3.4. Ice Cream and Frozen Desserts

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Flavor

- 6. Brazil South America Compound Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Flavor

- 6.1.1. Dark

- 6.1.2. Milk

- 6.1.3. White

- 6.1.4. Other Flavors

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Chocolate Chips/Drops/Chunks

- 6.2.2. Chocolate Slab

- 6.2.3. Chocolate Coatings

- 6.2.4. Other Products

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Compound Chocolates

- 6.3.2. Bakery

- 6.3.3. Confectionery

- 6.3.4. Ice Cream and Frozen Desserts

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Flavor

- 7. Argentina South America Compound Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Flavor

- 7.1.1. Dark

- 7.1.2. Milk

- 7.1.3. White

- 7.1.4. Other Flavors

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Chocolate Chips/Drops/Chunks

- 7.2.2. Chocolate Slab

- 7.2.3. Chocolate Coatings

- 7.2.4. Other Products

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Compound Chocolates

- 7.3.2. Bakery

- 7.3.3. Confectionery

- 7.3.4. Ice Cream and Frozen Desserts

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Flavor

- 8. Rest of South America South America Compound Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Flavor

- 8.1.1. Dark

- 8.1.2. Milk

- 8.1.3. White

- 8.1.4. Other Flavors

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Chocolate Chips/Drops/Chunks

- 8.2.2. Chocolate Slab

- 8.2.3. Chocolate Coatings

- 8.2.4. Other Products

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Compound Chocolates

- 8.3.2. Bakery

- 8.3.3. Confectionery

- 8.3.4. Ice Cream and Frozen Desserts

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Flavor

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Cargill Incorporated

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Aalst Chocolate Pte Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Santa Barbara Chocolate

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Unigra*List Not Exhaustive

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Sephra

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Blommer Chocolate Company

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 The Barry Callebaut Group

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Puratos NV

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Cargill Incorporated

List of Figures

- Figure 1: South America Compound Chocolate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Compound Chocolate Market Share (%) by Company 2025

List of Tables

- Table 1: South America Compound Chocolate Market Revenue billion Forecast, by Flavor 2020 & 2033

- Table 2: South America Compound Chocolate Market Revenue billion Forecast, by Product 2020 & 2033

- Table 3: South America Compound Chocolate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: South America Compound Chocolate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: South America Compound Chocolate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: South America Compound Chocolate Market Revenue billion Forecast, by Flavor 2020 & 2033

- Table 7: South America Compound Chocolate Market Revenue billion Forecast, by Product 2020 & 2033

- Table 8: South America Compound Chocolate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: South America Compound Chocolate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: South America Compound Chocolate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: South America Compound Chocolate Market Revenue billion Forecast, by Flavor 2020 & 2033

- Table 12: South America Compound Chocolate Market Revenue billion Forecast, by Product 2020 & 2033

- Table 13: South America Compound Chocolate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: South America Compound Chocolate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: South America Compound Chocolate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: South America Compound Chocolate Market Revenue billion Forecast, by Flavor 2020 & 2033

- Table 17: South America Compound Chocolate Market Revenue billion Forecast, by Product 2020 & 2033

- Table 18: South America Compound Chocolate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: South America Compound Chocolate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: South America Compound Chocolate Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Compound Chocolate Market?

The projected CAGR is approximately 5.64%.

2. Which companies are prominent players in the South America Compound Chocolate Market?

Key companies in the market include Cargill Incorporated, Aalst Chocolate Pte Ltd, Santa Barbara Chocolate, Unigra*List Not Exhaustive, Sephra, Blommer Chocolate Company, The Barry Callebaut Group, Puratos NV.

3. What are the main segments of the South America Compound Chocolate Market?

The market segments include Flavor, Product, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.87 billion as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Versatile Application of Compound Chocolate in Bakery & Confectionery Segment.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Compound Chocolate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Compound Chocolate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Compound Chocolate Market?

To stay informed about further developments, trends, and reports in the South America Compound Chocolate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence