Key Insights

The South America draught beer market is forecasted to reach 46.51 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 5.6%. This growth is driven by evolving consumer preferences for premium and craft draught beer experiences, alongside rising disposable incomes in key markets like Brazil and Argentina. The "other beer types" segment, encompassing craft and specialty ales, is anticipated to gain significant traction as consumers explore diverse flavor profiles beyond traditional lagers. Expanding distribution networks, encompassing both online and offline retail channels, are crucial for accessibility, further supported by the continued dominance of on-trade establishments in driving draught beer consumption.

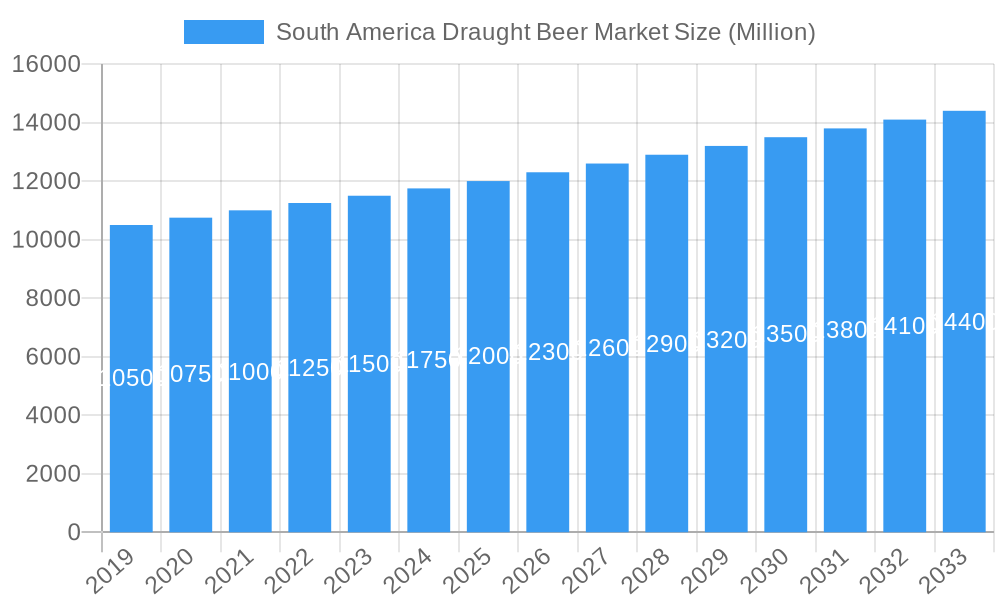

South America Draught Beer Market Market Size (In Billion)

Market momentum will be sustained by strategic investments from major players, including Anheuser-Busch InBev, Heineken N.V., and Carlsberg Group, focusing on expanding draught beer portfolios and regional marketing efforts. While robust demand drivers are present, potential restraints may arise from fluctuations in raw material costs and excise duties. However, the inherent social nature of draught beer consumption, coupled with the increasing popularity of beer festivals and brewery tours, is expected to counterbalance these challenges. Brazil and Argentina are central to market share competition, with the "Rest of South America" offering untapped growth potential as brewing culture diversifies.

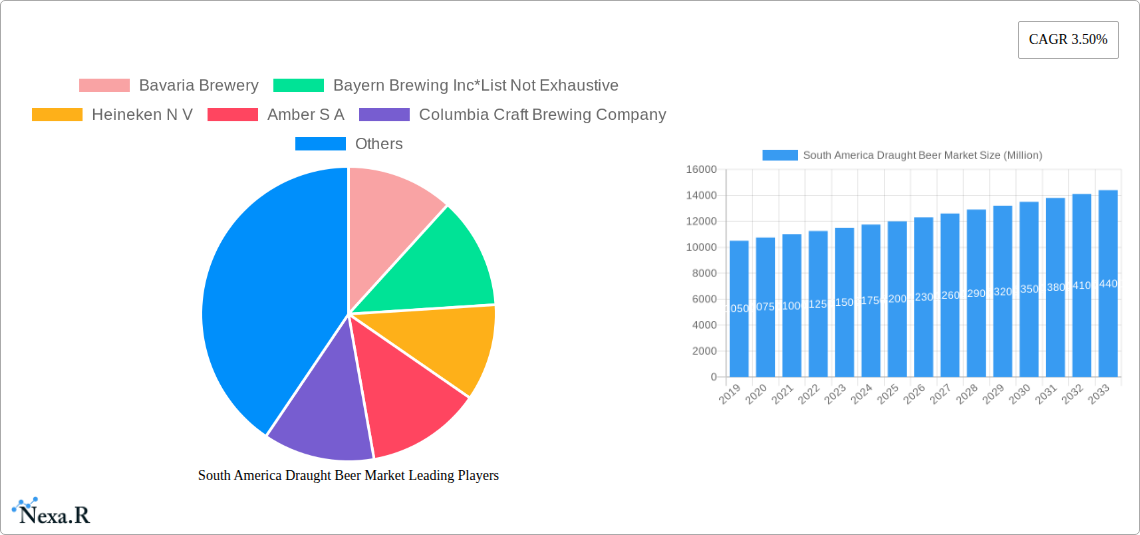

South America Draught Beer Market Company Market Share

South America Draught Beer Market: Comprehensive Report 2025-2033

This in-depth report provides a granular analysis of the South America draught beer market, offering unparalleled insights into market dynamics, growth trends, regional dominance, product innovation, and key player strategies. With a focus on quantitative data and qualitative analysis, this report is an indispensable resource for industry professionals, investors, and stakeholders seeking to navigate the evolving landscape of draught beer consumption and production across South America. The study encompasses the period from 2019 to 2033, with a base year of 2025 and a detailed forecast for 2025–2033, building upon historical data from 2019–2024. All values are presented in Million units.

South America Draught Beer Market Market Dynamics & Structure

The South America draught beer market is characterized by a moderately concentrated structure, with Anheuser-Bushch InBev, Bavaria Brewery, and Heineken N V holding significant market share. Technological innovation is primarily driven by advancements in brewing processes, fermentation techniques, and the introduction of novel beer styles. Regulatory frameworks vary across countries, influencing aspects like taxation, advertising, and distribution. Competitive product substitutes include bottled and canned beers, as well as other alcoholic beverages. End-user demographics show a growing preference for premium and craft draught beers, particularly among millennials and Gen Z. Mergers and acquisitions (M&A) activity has been strategic, aimed at consolidating market presence and expanding product portfolios.

- Market Concentration: Dominant players account for over 60% of the market share.

- Technological Innovation: Focus on automated brewing systems and quality control technologies.

- Regulatory Frameworks: Stringent labeling requirements and age restrictions in most countries.

- Competitive Substitutes: A growing craft segment challenges traditional offerings.

- End-User Demographics: Rising disposable incomes and a taste for premium experiences.

- M&A Trends: Acquisitions by larger breweries to gain access to regional craft brands and distribution networks.

South America Draught Beer Market Growth Trends & Insights

The South America draught beer market is poised for robust growth, driven by a confluence of factors including increasing disposable incomes, a burgeoning middle class, and a growing appreciation for premium and craft beer experiences. The market size is projected to witness a significant expansion, with an estimated CAGR of xx% during the forecast period. Adoption rates of draught beer, particularly in emerging urban centers and within the hospitality sector, are on the rise. Technological disruptions, such as the proliferation of home-brewing kits and advanced tap systems, are also influencing consumer behavior. This shift is further fueled by evolving consumer preferences, with a discernible move towards diverse beer styles beyond traditional lagers, and a greater emphasis on local sourcing and artisanal production. The convenience and perceived quality of draught beer in on-trade establishments continue to be a significant draw.

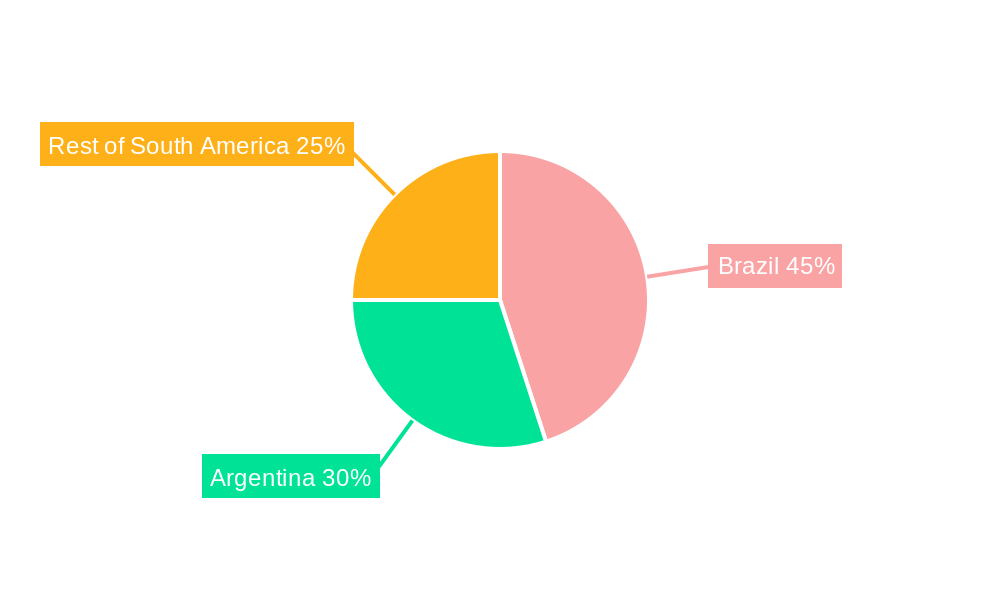

Dominant Regions, Countries, or Segments in South America Draught Beer Market

Brazil stands out as the most dominant region within the South America draught beer market, driven by its large population, robust economic activity, and a deeply ingrained beer culture. The country's substantial hospitality infrastructure, including a vast number of bars, restaurants, and event venues, consistently drives demand for draught beer. Within Brazil, the Lager product type commands the largest market share due to its widespread appeal and mass consumption.

- Dominant Region: Brazil.

- Key Drivers: High population density, significant economic output, strong tradition of beer consumption.

- Market Share: Brazil accounts for approximately xx% of the total South America draught beer market.

- Growth Potential: Continued urbanization and rising disposable incomes in secondary cities present further growth opportunities.

- Dominant Product Type: Lager.

- Dominance Factors: Broad consumer acceptance, established brand loyalty, affordability for mass market.

- Market Share within Brazil: Lagers constitute over xx% of draught beer sales in Brazil.

- Growth Drivers: Introduction of new lager variants and premium lagers catering to evolving tastes.

- Dominant Distribution Channel: On Trade Channel.

- Dominance Factors: Traditional consumption habits, social gatherings in bars and restaurants, perceived freshness of draught beer.

- Market Share: The On Trade Channel contributes over xx% to the overall draught beer market in Brazil.

- Growth Potential: Expansion of modern on-trade formats and experiential dining venues.

Argentina also presents a significant market, influenced by its European heritage and a growing appreciation for craft beers. The Rest of South America, encompassing countries like Colombia, Chile, and Peru, demonstrates emerging growth potential, driven by increasing tourism and a rising middle class adopting Westernized lifestyle trends. In terms of distribution, the On Trade Channel remains paramount across the region, given the social nature of beer consumption in South America. However, the Off Trade Channel, particularly online retail, is experiencing rapid growth, fueled by convenience and a wider product selection.

South America Draught Beer Market Product Landscape

The product landscape of the South America draught beer market is marked by a dynamic interplay between traditional offerings and innovative craft creations. Lagers, including pilsners and pale lagers, continue to dominate in volume, satisfying the mass market's preference for refreshing and approachable beers. However, the market is witnessing a surge in the popularity of Ale varieties, such as IPAs, stouts, and wheat beers, as consumers seek more complex flavor profiles and artisanal experiences. Companies are actively innovating with unique ingredients, fermentation techniques, and the introduction of limited edition brews. Performance metrics often revolve around ABV content, hop profiles, and the distinctiveness of flavor.

Key Drivers, Barriers & Challenges in South America Draught Beer Market

Key Drivers:

- Rising Disposable Incomes: Increased consumer spending power fuels demand for premium and leisure-related products like draught beer.

- Growing Tourism Sector: Influx of international tourists influences consumption patterns and introduces new preferences.

- Urbanization and Changing Lifestyles: Increased social gatherings in bars and restaurants drive on-trade draught beer consumption.

- Craft Beer Movement: Growing consumer interest in unique flavors, artisanal production, and local breweries.

- Economic Growth: Overall economic stability in key South American nations supports market expansion.

Barriers & Challenges:

- Economic Volatility: Fluctuations in currency exchange rates and inflation can impact consumer purchasing power and import costs.

- Regulatory Hurdles: Varying alcohol taxation policies and import regulations across different countries can complicate market entry and operations.

- Supply Chain Inefficiencies: Infrastructure limitations in some regions can lead to challenges in distribution and maintaining product freshness.

- Competition from Other Beverages: Strong competition from wine, spirits, and non-alcoholic options.

- Perishable Nature of Product: Draught beer requires careful handling and storage, increasing logistical complexity and potential for spoilage.

Emerging Opportunities in South America Draught Beer Market

Emerging opportunities in the South America draught beer market lie in the continued expansion of the craft beer segment, catering to an increasingly sophisticated palate. Untapped markets within smaller cities and rural areas present significant growth potential as disposable incomes rise. The development of innovative draught beer systems for home use and the increasing adoption of online retail for beer delivery are also key trends. Furthermore, the demand for low-alcohol and non-alcoholic draught beer options is an evolving preference that presents a niche but growing opportunity. Collaborations between breweries and the hospitality sector to create unique tasting experiences and beer pairings will also drive engagement.

Growth Accelerators in the South America Draught Beer Market Industry

The long-term growth of the South America draught beer market will be significantly accelerated by technological breakthroughs in brewing efficiency and quality control. Strategic partnerships between established beverage giants and smaller craft breweries will facilitate market penetration and product diversification. Furthermore, the expansion of e-commerce platforms specifically for alcoholic beverages will enhance accessibility and convenience for consumers. Governments' supportive policies towards the beverage industry, including potential tax incentives and streamlined import/export procedures, could also act as significant growth catalysts. The increasing focus on sustainability within the brewing process will also resonate with environmentally conscious consumers.

Key Players Shaping the South America Draught Beer Market Market

- Bavaria Brewery

- Bayern Brewing Inc

- Heineken N V

- Amber S A

- Columbia Craft Brewing Company

- Brahma

- Carlsberg Group

- Anheuser-Bushch InBev

- Novo Brazil Brewing Company

- Muller Inc

Notable Milestones in South America Draught Beer Market Sector

- May 2022: Compania Cervecerias Unidas (CCU) invested about USD 23 million to expand its beer production capacity in Argentina, aiming to strengthen its footprints across the region.

- November 2021: Novo Brazil Brewing Company launched its two limited editions of the beer collection called TRES, featuring 9.5% ABV and 1.7 oz of hops per gallon, including a triple-hazy and hoppy flavor.

- September 2021: River North Brewery launched its new Socorro Chile Lager beer, a light 5% ABV spicy lager, on the occasion of the annual Chile Beer day. The product is also available in pineapple jalapeno imperial Saison and Mayan chocolate imperial stout flavors.

In-Depth South America Draught Beer Market Market Outlook

The future outlook for the South America draught beer market is exceptionally promising, fueled by sustained economic growth, evolving consumer palates, and strategic industry investments. Growth accelerators such as increasing disposable incomes, the vibrant craft beer scene, and expanding tourism will continue to drive demand for diverse draught beer offerings. Strategic opportunities abound in leveraging e-commerce for wider distribution and exploring untapped regional markets. Companies that focus on product innovation, sustainability, and creating unique consumer experiences will be well-positioned to capture significant market share. The market is expected to witness a surge in premiumization and diversification of offerings, moving beyond traditional lagers to a broader spectrum of ales and specialty beers.

South America Draught Beer Market Segmentation

-

1. Product Type

- 1.1. Lager

- 1.2. Ale

- 1.3. Other Beer types

-

2. distribution channel

-

2.1. Off trade Channel

- 2.1.1. Online Retail Channel

- 2.1.2. Offline Retail Channel

- 2.2. On Trade Channel

-

2.1. Off trade Channel

-

3. Geography

-

3.1. South America

- 3.1.1. Brazil

- 3.1.2. Argentina

- 3.1.3. Rest of South America

-

3.1. South America

South America Draught Beer Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Rest of South America

South America Draught Beer Market Regional Market Share

Geographic Coverage of South America Draught Beer Market

South America Draught Beer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. Growing microbreweries leading to increased consumption.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Draught Beer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Lager

- 5.1.2. Ale

- 5.1.3. Other Beer types

- 5.2. Market Analysis, Insights and Forecast - by distribution channel

- 5.2.1. Off trade Channel

- 5.2.1.1. Online Retail Channel

- 5.2.1.2. Offline Retail Channel

- 5.2.2. On Trade Channel

- 5.2.1. Off trade Channel

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South America

- 5.3.1.1. Brazil

- 5.3.1.2. Argentina

- 5.3.1.3. Rest of South America

- 5.3.1. South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bavaria Brewery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayern Brewing Inc*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Heineken N V

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amber S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Columbia Craft Brewing Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Brahma

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Carlsberg Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Anheuser-Bushch InBev

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Novo Brazil Brewing Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Muller Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bavaria Brewery

List of Figures

- Figure 1: South America Draught Beer Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Draught Beer Market Share (%) by Company 2025

List of Tables

- Table 1: South America Draught Beer Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: South America Draught Beer Market Volume liter Forecast, by Product Type 2020 & 2033

- Table 3: South America Draught Beer Market Revenue billion Forecast, by distribution channel 2020 & 2033

- Table 4: South America Draught Beer Market Volume liter Forecast, by distribution channel 2020 & 2033

- Table 5: South America Draught Beer Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: South America Draught Beer Market Volume liter Forecast, by Geography 2020 & 2033

- Table 7: South America Draught Beer Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: South America Draught Beer Market Volume liter Forecast, by Region 2020 & 2033

- Table 9: South America Draught Beer Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: South America Draught Beer Market Volume liter Forecast, by Product Type 2020 & 2033

- Table 11: South America Draught Beer Market Revenue billion Forecast, by distribution channel 2020 & 2033

- Table 12: South America Draught Beer Market Volume liter Forecast, by distribution channel 2020 & 2033

- Table 13: South America Draught Beer Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: South America Draught Beer Market Volume liter Forecast, by Geography 2020 & 2033

- Table 15: South America Draught Beer Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: South America Draught Beer Market Volume liter Forecast, by Country 2020 & 2033

- Table 17: Brazil South America Draught Beer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Brazil South America Draught Beer Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 19: Argentina South America Draught Beer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina South America Draught Beer Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America South America Draught Beer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of South America South America Draught Beer Market Volume (liter ) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Draught Beer Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the South America Draught Beer Market?

Key companies in the market include Bavaria Brewery, Bayern Brewing Inc*List Not Exhaustive, Heineken N V, Amber S A, Columbia Craft Brewing Company, Brahma, Carlsberg Group, Anheuser-Bushch InBev, Novo Brazil Brewing Company, Muller Inc.

3. What are the main segments of the South America Draught Beer Market?

The market segments include Product Type, distribution channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 46.51 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

Growing microbreweries leading to increased consumption..

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

In May 2022, Compania Cervecerias Unidas (CCU) invested about USD 23 million to expand its beer production capacity in Argentina. The company aims to strengthen its footprints across the region with increasing production and logistic capacity to reach maximum consumers in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Draught Beer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Draught Beer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Draught Beer Market?

To stay informed about further developments, trends, and reports in the South America Draught Beer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence