Key Insights

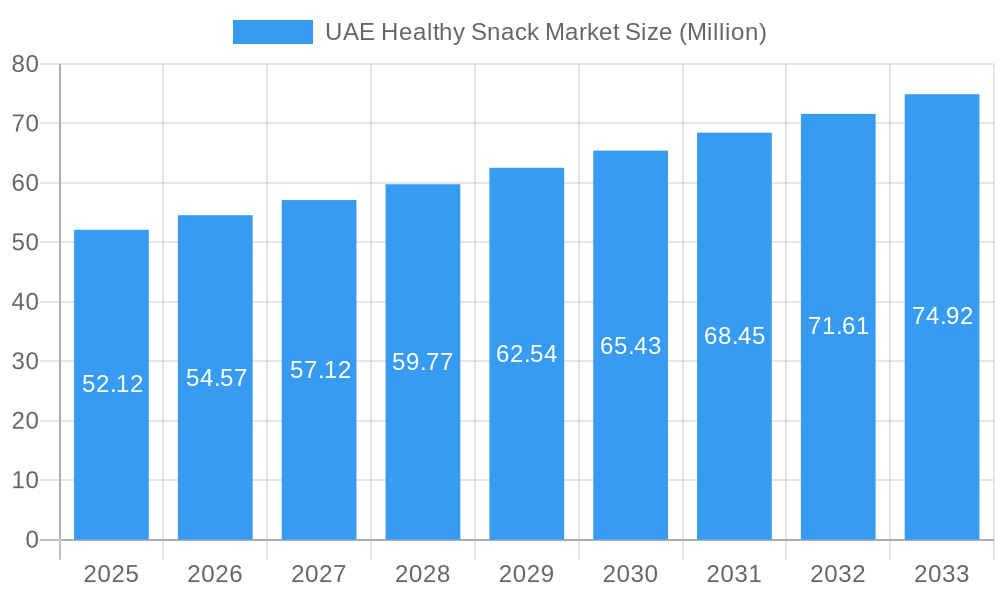

The UAE healthy snack market is poised for robust growth, projected to reach an estimated USD 52.12 million in 2025. This expansion is driven by a confluence of factors, including increasing consumer awareness regarding health and wellness, a growing preference for convenient yet nutritious food options, and a rising disposable income within the region. The market's upward trajectory is further supported by a healthy CAGR of 4.66%, indicating sustained expansion throughout the forecast period. Key product segments like Cereal Bars, particularly Granola/Muesli Bars, and Energy Bars are expected to witness significant demand. This surge is fueled by busy lifestyles and the demand for on-the-go nutrition. Distribution channels are also evolving, with online retail stores gaining substantial traction alongside traditional supermarkets and hypermarkets, reflecting changing consumer purchasing habits and the increasing digitalization of commerce in the UAE.

UAE Healthy Snack Market Market Size (In Million)

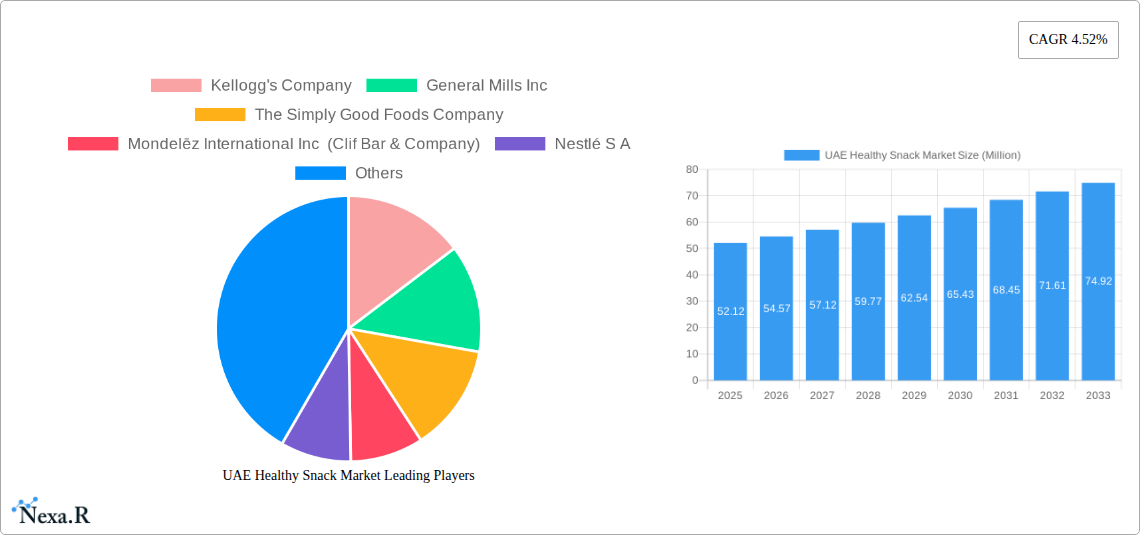

The competitive landscape features established global players such as Kellogg's Company, General Mills Inc., and Nestlé S.A., alongside specialized healthy snack brands. These companies are actively innovating and launching new products to cater to the evolving tastes and dietary needs of UAE consumers, including options for specific diets like keto or vegan. Emerging trends also point towards a greater emphasis on natural ingredients, reduced sugar content, and functional benefits like added protein or fiber. Restraints to market growth, such as the price sensitivity of some consumer segments and the potential for intense competition, are being addressed through product differentiation and strategic marketing initiatives. The market is expected to see continued investment in product development and wider accessibility through diverse distribution networks to capitalize on the positive growth outlook.

UAE Healthy Snack Market Company Market Share

Here is a comprehensive and SEO-optimized report description for the UAE Healthy Snack Market, designed to maximize visibility and engage industry professionals.

This in-depth report provides a definitive analysis of the UAE Healthy Snack Market, offering critical insights into its current landscape and future trajectory. Covering the period from 2019 to 2033, with a detailed focus on the base year 2025 and the forecast period 2025-2033, this study is an indispensable resource for stakeholders seeking to understand market dynamics, growth drivers, and emerging opportunities within the region's burgeoning healthy snacking sector. We delve into parent and child market segments, providing a holistic view of the competitive environment.

UAE Healthy Snack Market Market Dynamics & Structure

The UAE Healthy Snack Market is characterized by a dynamic and evolving landscape, driven by increasing health consciousness and a growing demand for convenient, nutritious options. Market concentration is moderate, with a mix of global giants and regional players vying for market share. Technological innovation is a key driver, with companies continuously introducing new formulations and product types to cater to diverse dietary needs and preferences, including gluten-free, vegan, and high-protein options. Regulatory frameworks are becoming more defined, emphasizing clear labeling and nutritional information, which influences product development and marketing strategies. Competitive product substitutes range from traditional snacks to newer, health-focused alternatives, necessitating continuous innovation from market participants. End-user demographics are broad, encompassing health-conscious millennials, active professionals, and families seeking healthier choices for children. Merger and acquisition (M&A) trends indicate strategic consolidation and expansion efforts as companies aim to strengthen their market presence and product portfolios. In 2023, for instance, M&A activity in the broader food and beverage sector within the UAE signals a proactive approach towards capturing niche market segments.

- Market Concentration: Moderate, with a blend of multinational corporations and local enterprises.

- Technological Innovation: Driven by demand for diverse dietary needs (e.g., vegan, keto, high-protein).

- Regulatory Frameworks: Evolving to ensure consumer safety and transparency in labeling.

- Competitive Product Substitutes: Wide array from traditional snacks to specialized health foods.

- End-User Demographics: Broad appeal across age groups and lifestyle segments.

- M&A Trends: Strategic acquisitions for portfolio expansion and market penetration.

UAE Healthy Snack Market Growth Trends & Insights

The UAE Healthy Snack Market is poised for substantial growth, projected to witness a robust Compound Annual Growth Rate (CAGR) over the forecast period. This expansion is fueled by a paradigm shift in consumer behavior towards proactive health management and the rising disposable incomes that enable greater spending on premium and health-oriented food products. Market size evolution indicates a consistent upward trend, driven by increasing awareness of the detrimental effects of unhealthy eating habits and the accessibility of a wider variety of healthy snack options. Adoption rates for innovative product formats, such as functional bars and protein-enriched snacks, are steadily climbing as consumers become more discerning about their nutritional intake. Technological disruptions, including advancements in ingredient sourcing and processing, are enabling the development of more appealing and effective healthy snacks. For example, innovations in plant-based ingredients have significantly expanded the vegan healthy snack segment. Consumer behavior shifts are evident in the growing preference for snacks that offer specific health benefits, such as sustained energy release, digestive support, or muscle recovery. The market penetration of niche healthy snack categories, like sugar-free or organic options, is also on an upward trajectory, reflecting a maturing and sophisticated consumer base. The overall market is expected to reach a value of approximately $650 million units by 2033, with a CAGR of over 7.5% from the base year of 2025.

Dominant Regions, Countries, or Segments in UAE Healthy Snack Market

Within the UAE Healthy Snack Market, Product Type: Energy Bars is emerging as a dominant segment, driven by the region's active lifestyle and a growing emphasis on fitness and performance. This segment is further propelled by the increasing popularity of protein bars and functional energy bars catering to athletes, gym-goers, and busy professionals seeking sustained energy and recovery. Supermarkets/Hypermarkets continue to be the primary distribution channel, accounting for approximately 45% of the market share due to their extensive reach and diverse product offerings. However, Online Retail Stores are exhibiting the fastest growth rate, projected to capture a significant market share of over 20% by 2033, fueled by the convenience and wider product availability offered through e-commerce platforms.

Dominant Product Type Segment: Energy Bars (including Protein Bars and Functional Energy Bars)

- Key Drivers: Growing fitness culture, demand for performance-enhancing snacks, convenience for on-the-go consumption.

- Market Share (Estimated Base Year 2025): ~35% of the total healthy snack market.

- Growth Potential: High, with continuous innovation in flavors and functional ingredients.

Leading Distribution Channel: Supermarket/Hypermarket

- Key Drivers: Extensive reach, one-stop shopping convenience, prime product placement.

- Market Share (Estimated Base Year 2025): ~45%.

- Growth Trajectory: Steady growth, though pace might be outpaced by online channels.

Fastest Growing Distribution Channel: Online Retail Stores

- Key Drivers: E-commerce adoption, convenience, wider product selection, direct-to-consumer models.

- Market Share (Projected 2033): ~20%.

- Growth Potential: Exponential, driven by digital transformation and changing shopping habits.

The Emirate of Dubai stands out as the leading geographical segment within the UAE, accounting for over 50% of the healthy snack market. This dominance is attributed to its cosmopolitan population, high expatriate influx, strong tourism sector, and a progressive government focus on health and wellness initiatives. Dubai's advanced retail infrastructure, coupled with a high concentration of fitness centers and healthy lifestyle establishments, creates a fertile ground for the expansion of the healthy snack market. Abu Dhabi follows as another significant contributor, with a growing emphasis on health awareness and the development of sports and leisure facilities. The expansion of specialty stores and the increasing presence of international healthy food brands further bolster the market in these key emirates.

UAE Healthy Snack Market Product Landscape

The UAE Healthy Snack Market product landscape is marked by a surge in innovation focused on meeting diverse dietary needs and enhancing nutritional profiles. Key developments include the introduction of protein-enriched bars, vegan and gluten-free options, and snacks fortified with functional ingredients like probiotics and prebiotics. Manufacturers are emphasizing clean labels with natural ingredients and reduced sugar content. For instance, the "Date Bar with Collagen" launched by Nature Foodtech exemplifies this trend, combining a popular local ingredient with a sought-after functional benefit. Product performance is increasingly measured by nutritional value, taste, and convenience, with brands like Grenade and Oreo collaborating on high-protein, low-sugar offerings that resonate with health-conscious consumers.

Key Drivers, Barriers & Challenges in UAE Healthy Snack Market

Key Drivers:

- Rising Health Consciousness: Growing awareness of the link between diet and well-being is a primary propellant.

- Convenience & On-the-Go Culture: The fast-paced lifestyle in the UAE fuels demand for portable, ready-to-eat healthy snacks.

- Government Initiatives: Proactive health and wellness campaigns promoted by the UAE government encourage healthy eating habits.

- Product Innovation: Continuous introduction of new flavors, formulations (e.g., plant-based, high-protein), and functional benefits.

Barriers & Challenges:

- Price Sensitivity: Premium pricing of some healthy snacks can be a barrier for a segment of the population.

- Intense Competition: The market is becoming increasingly crowded with both local and international brands, leading to price pressures.

- Supply Chain Complexities: Sourcing of specialized ingredients and maintaining consistent product quality across a wide distribution network can be challenging.

- Consumer Education Gaps: While awareness is growing, some consumers may still lack a full understanding of the benefits of specific healthy ingredients or product categories.

Emerging Opportunities in UAE Healthy Snack Market

Emerging opportunities in the UAE Healthy Snack Market lie in the expansion of personalized nutrition solutions and the development of allergen-friendly product lines. The growing trend of subscription-based healthy snack boxes and the increasing demand for ethically sourced and sustainable products present significant untapped potential. Furthermore, catering to specific dietary lifestyles beyond vegan and gluten-free, such as keto and paleo diets, is a promising avenue. The integration of smart packaging that provides detailed nutritional information and storage recommendations also represents an innovative approach to enhance consumer engagement and product differentiation.

Growth Accelerators in the UAE Healthy Snack Market Industry

Technological breakthroughs in food science, particularly in developing plant-based alternatives and sugar substitutes, are significant growth accelerators. Strategic partnerships between local distributors and international healthy snack brands are also crucial for market expansion, facilitating wider product availability and market penetration. The increasing investment in marketing and consumer education campaigns by key players, highlighting the tangible health benefits of their products, further fuels market growth. Furthermore, the continued development of e-commerce infrastructure and last-mile delivery services simplifies accessibility, acting as a powerful catalyst for sustained growth.

Key Players Shaping the UAE Healthy Snack Market Market

- Kellogg's Company

- General Mills Inc

- The Simply Good Foods Company

- Mondelēz International Inc (Clif Bar & Company)

- Nestlé S A

- PepsiCo Inc

- Natural Balance Foods

- Mars Incorporated

- Rise Bar

- Associated British Foods PLC

- Glanbia PLC

- TNF Middle East

- Nature Foodtech

Notable Milestones in UAE Healthy Snack Market Sector

- April 2023: Atkins announced the launch of its new bar flavors, including Atkins Endulge Almond Craze Bar, Atkins Chocolate Caramel Pretzel Snack Bar, and Atkins Crunchalicious Bar.

- February 2023: Nature Foodtech launched "Date Bar with Collagen" at Gulfood, utilizing UAE-sourced dates and offering flavors like semi-sweet chocolate, cookies and cream, and strawberry.

- January 2023: Grenade and Oreo collaborated on a co-branded protein bar containing 21g of protein and 1g of sugar.

- December 2022: Mars, Inc. (Snickers) launched Snickers Hi Protein bars, offering 20g of protein with familiar Snickers ingredients.

- April 2022: Quest launched mini versions of its protein bars, including new flavors like chocolate chip cookie dough and cookies & cream, made available through online retail channels in UAE.

- October 2021: TNF launched its vegan and vegetarian fruit bar in the UAE, made with 100% fresh pulp and available in strawberry, apricot, and raspberry variants.

- August 2021: Emirates Snack Foods (ESF) partnered with Hershey to expand Hershey's snack portfolio in the region.

In-Depth UAE Healthy Snack Market Market Outlook

The UAE Healthy Snack Market Outlook is exceptionally positive, with continued growth driven by evolving consumer preferences for health, wellness, and convenience. Key growth accelerators include the expanding range of functional ingredients, the increasing adoption of plant-based diets, and the sophisticated digital infrastructure supporting online retail. Strategic partnerships and product innovations focused on catering to specific dietary needs will further solidify the market's expansion. The report forecasts sustained momentum, with opportunities for new market entrants and established players to capture significant market share by aligning their offerings with the dynamic demands of the health-conscious UAE consumer. The market is expected to reach a value of approximately $850 million units by 2033.

UAE Healthy Snack Market Segmentation

-

1. Product Type

-

1.1. Cereal Bars

- 1.1.1. Granola/Muesli Bars

- 1.1.2. Other Cereal Bars

- 1.2. Energy Bars

- 1.3. Other Snack Bars

-

1.1. Cereal Bars

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Convenience/Grocery Store

- 2.3. Specialty Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

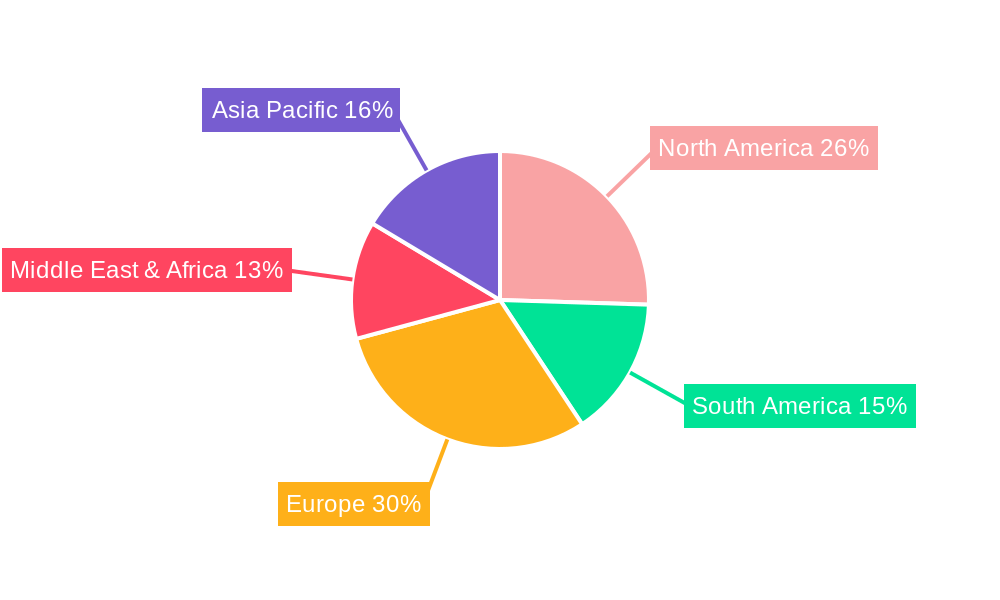

UAE Healthy Snack Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Healthy Snack Market Regional Market Share

Geographic Coverage of UAE Healthy Snack Market

UAE Healthy Snack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Surge in Popularity of Snack Bars as Meal Replacement

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Healthy Snack Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cereal Bars

- 5.1.1.1. Granola/Muesli Bars

- 5.1.1.2. Other Cereal Bars

- 5.1.2. Energy Bars

- 5.1.3. Other Snack Bars

- 5.1.1. Cereal Bars

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Convenience/Grocery Store

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America UAE Healthy Snack Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cereal Bars

- 6.1.1.1. Granola/Muesli Bars

- 6.1.1.2. Other Cereal Bars

- 6.1.2. Energy Bars

- 6.1.3. Other Snack Bars

- 6.1.1. Cereal Bars

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarket/Hypermarket

- 6.2.2. Convenience/Grocery Store

- 6.2.3. Specialty Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America UAE Healthy Snack Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cereal Bars

- 7.1.1.1. Granola/Muesli Bars

- 7.1.1.2. Other Cereal Bars

- 7.1.2. Energy Bars

- 7.1.3. Other Snack Bars

- 7.1.1. Cereal Bars

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarket/Hypermarket

- 7.2.2. Convenience/Grocery Store

- 7.2.3. Specialty Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe UAE Healthy Snack Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cereal Bars

- 8.1.1.1. Granola/Muesli Bars

- 8.1.1.2. Other Cereal Bars

- 8.1.2. Energy Bars

- 8.1.3. Other Snack Bars

- 8.1.1. Cereal Bars

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarket/Hypermarket

- 8.2.2. Convenience/Grocery Store

- 8.2.3. Specialty Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa UAE Healthy Snack Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Cereal Bars

- 9.1.1.1. Granola/Muesli Bars

- 9.1.1.2. Other Cereal Bars

- 9.1.2. Energy Bars

- 9.1.3. Other Snack Bars

- 9.1.1. Cereal Bars

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarket/Hypermarket

- 9.2.2. Convenience/Grocery Store

- 9.2.3. Specialty Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific UAE Healthy Snack Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Cereal Bars

- 10.1.1.1. Granola/Muesli Bars

- 10.1.1.2. Other Cereal Bars

- 10.1.2. Energy Bars

- 10.1.3. Other Snack Bars

- 10.1.1. Cereal Bars

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarket/Hypermarket

- 10.2.2. Convenience/Grocery Store

- 10.2.3. Specialty Stores

- 10.2.4. Online Retail Stores

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kellogg's Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 General Mills Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Simply Good Foods Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mondelēz International Inc (Clif Bar & Company)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nestlé S A

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PepsiCo Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Natural Balance Foods

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mars Incorporated

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rise Bar

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Associated British Foods PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Glanbia PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 TNF Middle East

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Nature Foodtech*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Kellogg's Company

List of Figures

- Figure 1: Global UAE Healthy Snack Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America UAE Healthy Snack Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America UAE Healthy Snack Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America UAE Healthy Snack Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: North America UAE Healthy Snack Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America UAE Healthy Snack Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America UAE Healthy Snack Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America UAE Healthy Snack Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: South America UAE Healthy Snack Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: South America UAE Healthy Snack Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 11: South America UAE Healthy Snack Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America UAE Healthy Snack Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America UAE Healthy Snack Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe UAE Healthy Snack Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Europe UAE Healthy Snack Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe UAE Healthy Snack Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 17: Europe UAE Healthy Snack Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe UAE Healthy Snack Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe UAE Healthy Snack Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa UAE Healthy Snack Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: Middle East & Africa UAE Healthy Snack Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East & Africa UAE Healthy Snack Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa UAE Healthy Snack Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa UAE Healthy Snack Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa UAE Healthy Snack Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific UAE Healthy Snack Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Asia Pacific UAE Healthy Snack Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific UAE Healthy Snack Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific UAE Healthy Snack Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific UAE Healthy Snack Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific UAE Healthy Snack Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Healthy Snack Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global UAE Healthy Snack Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global UAE Healthy Snack Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global UAE Healthy Snack Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global UAE Healthy Snack Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global UAE Healthy Snack Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global UAE Healthy Snack Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 11: Global UAE Healthy Snack Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global UAE Healthy Snack Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global UAE Healthy Snack Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 17: Global UAE Healthy Snack Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global UAE Healthy Snack Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global UAE Healthy Snack Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 29: Global UAE Healthy Snack Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global UAE Healthy Snack Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global UAE Healthy Snack Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 38: Global UAE Healthy Snack Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global UAE Healthy Snack Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific UAE Healthy Snack Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Healthy Snack Market?

The projected CAGR is approximately 4.66%.

2. Which companies are prominent players in the UAE Healthy Snack Market?

Key companies in the market include Kellogg's Company, General Mills Inc, The Simply Good Foods Company, Mondelēz International Inc (Clif Bar & Company), Nestlé S A, PepsiCo Inc, Natural Balance Foods, Mars Incorporated, Rise Bar, Associated British Foods PLC, Glanbia PLC, TNF Middle East, Nature Foodtech*List Not Exhaustive.

3. What are the main segments of the UAE Healthy Snack Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Surge in Popularity of Snack Bars as Meal Replacement.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

April 2023: Atkins announced the launch of its new bar flavors. Atkins' new bar product launch includes Atkins Endulge Almond Craze Bar, Atkins Chocolate Caramel Pretzel Snack Bar, and Atkins Crunchalicious Bar.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Healthy Snack Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Healthy Snack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Healthy Snack Market?

To stay informed about further developments, trends, and reports in the UAE Healthy Snack Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence