Key Insights

The United Kingdom's Casein and Caseinates market is projected for substantial growth, reaching an estimated market size of $3 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 6.4%. This expansion is fueled by increasing consumer demand for high-protein products in sectors including animal feed, sports nutrition, and personal care and cosmetics, leveraging caseinates' nutritional and functional properties. The food and beverage industry, encompassing bakery, confectionery, dairy, and ready-to-eat/cook products, also sees significant adoption for enhanced texture, stability, and nutritional value. Growing awareness of health and wellness, particularly in infant and elderly nutrition, further sustains demand for specialized casein-based products.

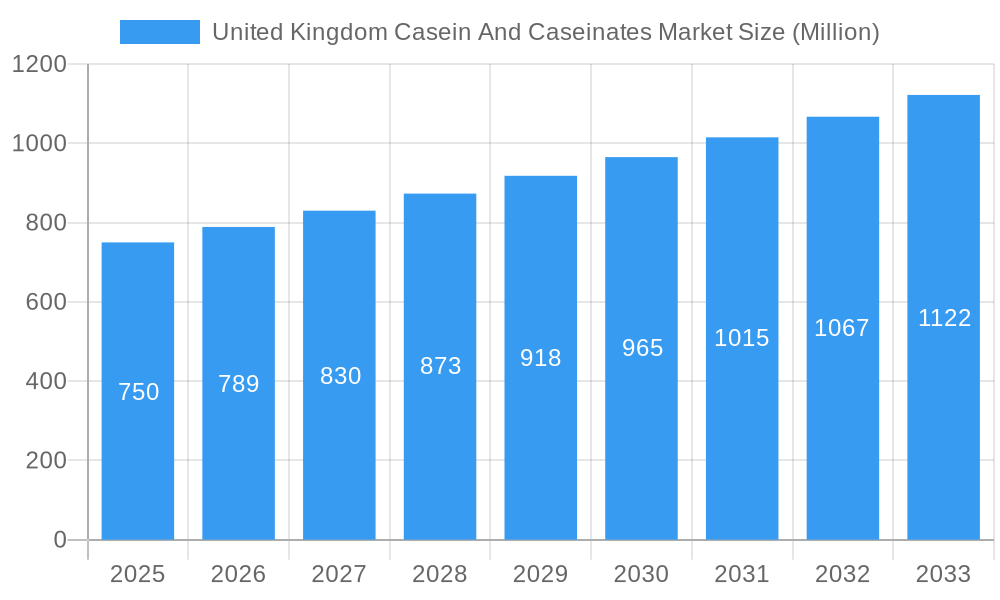

United Kingdom Casein And Caseinates Market Market Size (In Billion)

Market challenges include fluctuating raw material costs and intense competition from established players. However, the overarching drivers of rising protein consumption, advancements in processing technology, and the inherent versatility of casein and caseinates are expected to propel the market forward. The UK's developed food processing industry and health-conscious consumer base present significant opportunities for innovation and market penetration within the broader European landscape.

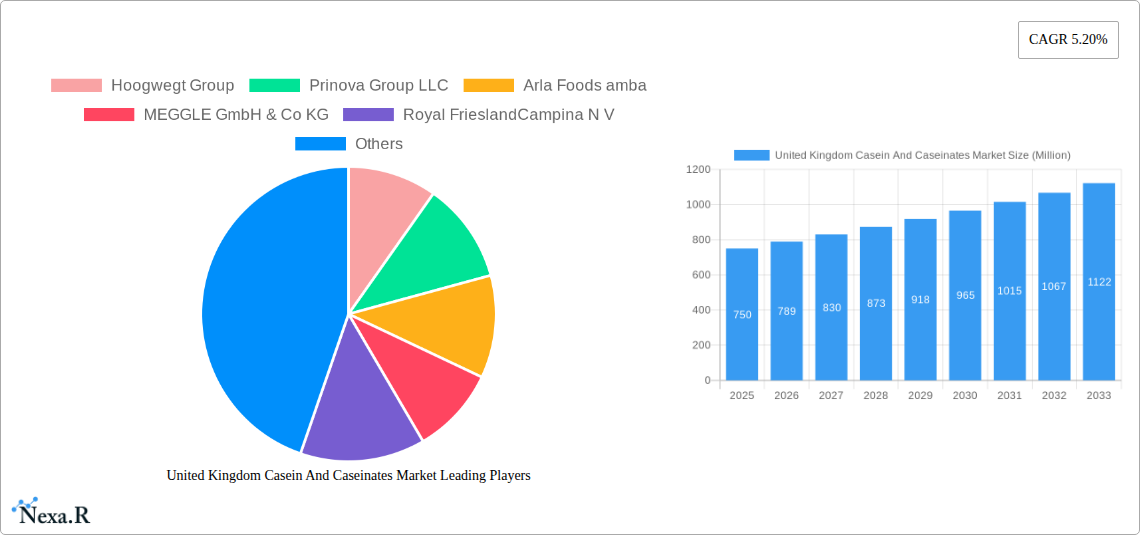

United Kingdom Casein And Caseinates Market Company Market Share

This comprehensive report analyzes the United Kingdom casein and caseinates market, offering critical insights into market dynamics, growth trends, regional performance, and the competitive environment. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast extending to 2033, this study provides data-driven market projections. Key segments examined include animal feed, personal care and cosmetics, food and beverages (segmented into bakery, confectionery, dairy and dairy alternatives, RTE/RTC food, and snacks), and supplements (including infant nutrition, elderly and medical nutrition, and sports nutrition). This report is essential for industry professionals seeking to understand the current state and future potential of the UK casein and caseinates industry.

United Kingdom Casein And Caseinates Market Market Dynamics & Structure

The United Kingdom casein and caseinates market exhibits a moderate to high concentration, with key players like Hoogwegt Group, Prinova Group LLC, Arla Foods amba, MEGGLE GmbH & Co KG, Royal FrieslandCampina N V, LAÏTA, Erie Foods International Inc, Lactoprot Deutschland GmbH, Fonterra Co-operative Group Limited, and Agrial Group dominating production and supply. Technological innovation is a significant driver, with ongoing advancements in processing techniques enhancing the purity and functionality of casein and caseinates for diverse applications. Regulatory frameworks, primarily driven by food safety standards and labeling requirements, influence product development and market entry. Competitive product substitutes, such as plant-based proteins, pose a growing challenge, necessitating continuous innovation and cost optimization. End-user demographics are shifting, with an increasing demand for high-protein products in food and beverages and a burgeoning market for specialized nutritional supplements. Mergers and acquisitions (M&A) trends, while not extensively documented in terms of volume, are crucial for market consolidation and expansion. For instance, the acquisition of Innova Flavors by Carbery Group in May 2021 highlights strategic moves to enhance product portfolios and market reach. Innovation barriers include the capital-intensive nature of specialized processing equipment and stringent quality control protocols.

- Market Concentration: Moderate to High, with a few key global and regional players holding significant market share.

- Technological Innovation Drivers: Improved extraction and purification methods, development of functional casein derivatives, and novel applications in specialized nutrition.

- Regulatory Frameworks: Strict adherence to UK and EU food safety regulations (e.g., FSA guidelines), Good Manufacturing Practices (GMP), and allergen labeling.

- Competitive Product Substitutes: Rise of plant-based protein alternatives (soy, pea, rice) impacting the dairy protein market share.

- End-User Demographics: Growing health-conscious consumer base, aging population requiring specialized nutrition, and increasing demand for performance-enhancing sports supplements.

- M&A Trends: Strategic acquisitions to gain market share, expand product offerings, and enhance vertical integration.

- Innovation Barriers: High R&D costs, complex regulatory approvals for novel ingredients, and consumer perception challenges regarding dairy products.

United Kingdom Casein And Caseinates Market Growth Trends & Insights

The United Kingdom casein and caseinates market is poised for robust growth, driven by evolving consumer preferences and expanding applications across various sectors. The market size is projected to witness a significant upward trajectory, with an estimated Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2025 to 2033. This growth is fueled by increasing consumer awareness of the nutritional benefits of casein and its derivatives, particularly in protein fortification of foods and beverages. The adoption rate for caseinates in functional foods and performance nutrition products is accelerating, reflecting a broader trend towards health and wellness. Technological disruptions, such as advancements in protein extraction and modification, are enabling the development of novel casein-based ingredients with tailored functionalities, enhancing their appeal in the food and beverage industry, especially in dairy and dairy alternative products, bakery, and confectionery. Consumer behavior shifts towards convenient, healthy, and protein-rich options are directly benefiting the demand for casein and caseinates. For instance, the burgeoning supplements market, particularly in baby food and infant formula, elderly nutrition and medical nutrition, and sport/performance nutrition, is a substantial growth engine. The market penetration of casein-based products in these segments is expected to increase significantly as manufacturers leverage casein's superior amino acid profile and digestibility. The RTE/RTC food products and snacks categories are also witnessing an uptake in casein fortification to meet the demand for convenient, protein-rich meal solutions and on-the-go snacks. The intrinsic properties of casein, such as its slow digestion rate providing sustained amino acid release, make it a preferred choice for specific applications within the supplements sector. The overall market evolution is characterized by a strong emphasis on product differentiation, quality, and catering to niche dietary requirements.

Dominant Regions, Countries, or Segments in United Kingdom Casein And Caseinates Market

Within the United Kingdom casein and caseinates market, the Food and Beverages segment stands out as the dominant growth driver, with substantial contributions from its sub-segments. Specifically, Dairy and Dairy Alternative Products are experiencing exceptional growth due to the continued popularity of traditional dairy items and the rising demand for innovative dairy-alternative beverages and products fortified with caseinates. The nutritional profile of casein makes it an ideal ingredient for enhancing the protein content and textural properties of these items. Following closely, the Supplements segment, particularly Baby Food and Infant Formula, represents another critical area of dominance. The stringent nutritional requirements for infant formula necessitate high-quality protein sources, making casein a preferred choice due to its resemblance to human milk proteins and its excellent digestibility. The growth in Sport/Performance Nutrition is also a significant factor, driven by an increasing number of health-conscious individuals and athletes seeking protein supplements for muscle recovery and growth.

- Food and Beverages Segment Dominance:

- Dairy and Dairy Alternative Products: High demand for protein-enriched yogurts, cheeses, milk drinks, and plant-based alternatives incorporating caseinates for improved texture and nutritional value.

- Bakery: Caseinates are utilized to improve dough stability, enhance crust browning, and increase the protein content of bread, pastries, and cakes.

- Confectionery: Used in the production of nougats, caramels, and chocolates for texture modification and protein enrichment.

- RTE/RTC Food Products & Snacks: Growing incorporation into ready-to-eat meals and protein bars to offer convenient, nutritious options.

- Supplements Segment Growth:

- Baby Food and Infant Formula: Essential for providing a balanced nutritional profile for infants, mimicking the casein to whey ratio in breast milk. Estimated to constitute XX% of the infant formula market share for caseinates.

- Elderly Nutrition and Medical Nutrition: Vital for maintaining muscle mass and aiding recovery in elderly individuals and patients with specific medical needs.

- Sport/Performance Nutrition: Widely used in protein powders, shakes, and bars to support muscle synthesis and recovery in athletes and fitness enthusiasts. This sub-segment is projected to grow at a CAGR of XX% through 2033.

- Personal Care and Cosmetics: Emerging applications in skincare and haircare products due to casein's moisturizing and film-forming properties, though this segment remains smaller in market share compared to food and supplements.

- Animal Feed: A consistent but less dynamic segment, where caseinates are used as high-quality protein supplements for young animals, particularly in calf milk replacers.

The economic policies supporting dairy production and innovation within the UK, coupled with robust supply chain infrastructure, further bolster the dominance of these segments.

United Kingdom Casein And Caseinates Market Product Landscape

The product landscape of the United Kingdom casein and caseinates market is characterized by innovation focused on enhancing functional properties and meeting specific end-user needs. Key products include acid casein, rennet casein, and various caseinates such as sodium caseinate, calcium caseinate, and potassium caseinate. Innovations are centered around improving solubility, emulsification, gelling, and nutritional bioavailability. For instance, advancements in microfiltration and ultrafiltration technologies allow for the production of highly purified casein and caseinates with tailored functional attributes. Applications range from creating stable emulsions in processed foods and beverages to providing slow-release protein benefits in sports nutrition. Performance metrics such as protein content, moisture levels, ash content, and specific functional characteristics (e.g., water-holding capacity, viscosity) are crucial for product differentiation and market acceptance. Unique selling propositions often revolve around the source of the milk, the processing methodology, and the specific functional benefits offered for niche applications.

Key Drivers, Barriers & Challenges in United Kingdom Casein And Caseinates Market

Key Drivers:

- Growing Demand for Protein-Rich Products: Increasing consumer awareness of the health benefits of protein consumption fuels demand across food, beverage, and supplement sectors.

- Advancements in Food Technology: Innovations in processing and formulation allow for wider applications of casein and caseinates in functional foods and improved product textures.

- Rising Popularity of Sports Nutrition: The expanding sports and fitness industry drives the demand for performance-enhancing protein supplements, where casein's slow-release properties are highly valued.

- Demand for Infant Nutrition: High nutritional requirements for baby food and infant formula make casein and its derivatives essential ingredients.

- Premiumization of Food Products: The trend towards premium, high-quality ingredients in food manufacturing supports the use of caseinates for enhanced nutritional and textural properties.

Key Barriers & Challenges:

- Competition from Plant-Based Proteins: The growing vegan and flexitarian movement presents a significant challenge with the increasing availability and acceptance of plant-based protein alternatives.

- Price Volatility of Raw Milk: Fluctuations in milk prices can impact the production costs and profitability of casein and caseinates, affecting their competitiveness.

- Regulatory Scrutiny and Labeling Requirements: Stringent food safety regulations and evolving labeling laws require continuous compliance and can pose hurdles for new product introductions.

- Consumer Perceptions and Allergies: Concerns about dairy allergies and lactose intolerance can limit consumption for certain consumer groups.

- Supply Chain Disruptions: Global events and logistical challenges can affect the availability and timely delivery of raw materials and finished products. The market faces an estimated supply chain efficiency challenge that could impact delivery timelines by up to 15% in adverse conditions.

Emerging Opportunities in United Kingdom Casein And Caseinates Market

Emerging opportunities in the United Kingdom casein and caseinates market lie in the development of specialized functional ingredients for niche applications. There is significant potential in expanding the use of caseinates in medical nutrition for wound healing and muscle recovery in hospital settings, leveraging their high digestibility and specific amino acid profiles. The trend towards sustainable and clean-label products presents an opportunity for transparent sourcing and production processes. Furthermore, innovation in encapsulating caseinates for controlled release in supplements and functional foods could unlock new product formats and enhanced efficacy. The growing demand for fortified dairy alternatives also offers a pathway for increased casein incorporation, providing superior nutritional and textural profiles compared to current offerings.

Growth Accelerators in the United Kingdom Casein And Caseinates Market Industry

Long-term growth in the United Kingdom casein and caseinates market is being accelerated by several key catalysts. Technological breakthroughs in enzymatic modification and hydrolyzing techniques are creating novel casein-based ingredients with enhanced functionality and digestibility, opening doors for premium applications. Strategic partnerships between dairy processors and ingredient manufacturers are fostering innovation and market penetration. Furthermore, the increasing global demand for high-quality protein sources, driven by health and wellness trends, provides a sustained impetus for market expansion. The development of specialized casein derivatives for pharmaceutical and nutraceutical applications, beyond traditional food and feed uses, represents a significant growth accelerator, promising higher value-added products.

Key Players Shaping the United Kingdom Casein And Caseinates Market Market

- Hoogwegt Group

- Prinova Group LLC

- Arla Foods amba

- MEGGLE GmbH & Co KG

- Royal FrieslandCampina N V

- LAÏTA

- Erie Foods International Inc

- Lactoprot Deutschland GmbH

- Fonterra Co-operative Group Limited

- Agrial Group

Notable Milestones in United Kingdom Casein And Caseinates Market Sector

- May 2022: Fonterra introduced an innovative online dairy platform designed to simplify the process of selecting dairy ingredients, ranging from milk powder to specialty dairy proteins, for its customers.

- February 2022: Arla Foods Ingredients unveiled its cutting-edge milk fractionation technology aimed at assisting infant formula manufacturers. This technology provides numerous advantages for the production of organic products, such as an uninterrupted supply sourced from high-quality milk.

- May 2021: Carbery Group acquired Innova Flavors from Griffith Foods Worldwide for an undisclosed amount.

In-Depth United Kingdom Casein And Caseinates Market Market Outlook

The United Kingdom casein and caseinates market is projected to witness substantial growth driven by an confluence of factors including surging consumer demand for protein-fortified products, continuous technological advancements in dairy processing, and the expanding applications in the health and nutrition sectors. The market's future outlook is intrinsically linked to its ability to innovate and adapt to evolving consumer preferences, particularly the growing interest in plant-based alternatives. Strategic initiatives focusing on product differentiation, such as the development of specialized casein peptides for targeted health benefits and the optimization of caseinates for improved textural properties in dairy and dairy-alternative products, will be crucial. The sustained growth in infant nutrition and sports supplements, coupled with emerging opportunities in medical nutrition, solidifies a positive long-term market trajectory. Investment in sustainable sourcing and production methods will also be a key factor in maintaining market competitiveness and consumer trust. The market is expected to reach an estimated xx Million units by 2033.

United Kingdom Casein And Caseinates Market Segmentation

-

1. End-User

- 1.1. Animal Feed

- 1.2. Personal Care and Cosmetics

-

1.3. Food and Beverages

- 1.3.1. Bakery

- 1.3.2. Confectionery

- 1.3.3. Dairy and Dairy Alternative Products

- 1.3.4. RTE/RTC Food Products

- 1.3.5. Snacks

-

1.4. Supplements

- 1.4.1. Baby Food and Infant Formula

- 1.4.2. Elderly Nutrition and Medical Nutrition

- 1.4.3. Sport/Performance Nutrition

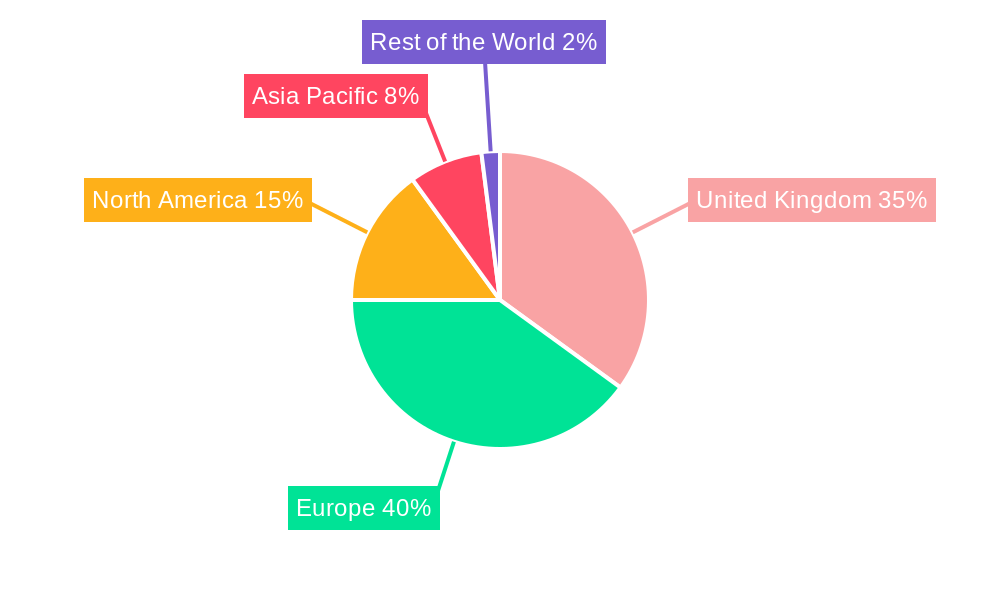

United Kingdom Casein And Caseinates Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Casein And Caseinates Market Regional Market Share

Geographic Coverage of United Kingdom Casein And Caseinates Market

United Kingdom Casein And Caseinates Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Application of Casein and Caseinates in Protein-rich Food Products; Increasing Demand for Infant Formula

- 3.3. Market Restrains

- 3.3.1. Increasing Market Penetration of Milk Protein Alternatives

- 3.4. Market Trends

- 3.4.1. Increasing Demand For Protein-rich Food Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Casein And Caseinates Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Animal Feed

- 5.1.2. Personal Care and Cosmetics

- 5.1.3. Food and Beverages

- 5.1.3.1. Bakery

- 5.1.3.2. Confectionery

- 5.1.3.3. Dairy and Dairy Alternative Products

- 5.1.3.4. RTE/RTC Food Products

- 5.1.3.5. Snacks

- 5.1.4. Supplements

- 5.1.4.1. Baby Food and Infant Formula

- 5.1.4.2. Elderly Nutrition and Medical Nutrition

- 5.1.4.3. Sport/Performance Nutrition

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hoogwegt Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Prinova Group LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arla Foods amba

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MEGGLE GmbH & Co KG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Royal FrieslandCampina N V

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LAÏTA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Erie Foods International Inc *List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lactoprot Deutschland GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fonterra Co-operative Group Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Agrial Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hoogwegt Group

List of Figures

- Figure 1: United Kingdom Casein And Caseinates Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Casein And Caseinates Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Casein And Caseinates Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 2: United Kingdom Casein And Caseinates Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: United Kingdom Casein And Caseinates Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: United Kingdom Casein And Caseinates Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Casein And Caseinates Market?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the United Kingdom Casein And Caseinates Market?

Key companies in the market include Hoogwegt Group, Prinova Group LLC, Arla Foods amba, MEGGLE GmbH & Co KG, Royal FrieslandCampina N V, LAÏTA, Erie Foods International Inc *List Not Exhaustive, Lactoprot Deutschland GmbH, Fonterra Co-operative Group Limited, Agrial Group.

3. What are the main segments of the United Kingdom Casein And Caseinates Market?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Application of Casein and Caseinates in Protein-rich Food Products; Increasing Demand for Infant Formula.

6. What are the notable trends driving market growth?

Increasing Demand For Protein-rich Food Products.

7. Are there any restraints impacting market growth?

Increasing Market Penetration of Milk Protein Alternatives.

8. Can you provide examples of recent developments in the market?

May 2022: Fonterra introduced an innovative online dairy platform designed to simplify the process of selecting dairy ingredients, ranging from milk powder to specialty dairy proteins, for its customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Casein And Caseinates Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Casein And Caseinates Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Casein And Caseinates Market?

To stay informed about further developments, trends, and reports in the United Kingdom Casein And Caseinates Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence