Key Insights

The Canadian water enhancers market is projected for significant expansion, anticipating a Compound Annual Growth Rate (CAGR) of 9.6%. This growth is propelled by heightened consumer interest in healthier beverage choices and a greater understanding of the importance of adequate hydration. The market is forecast to reach an estimated size of $2.1 billion by 2025. Key drivers include the increasing concern over chronic diseases linked to high sugar intake from conventional beverages, leading consumers towards low-calorie and sugar-free alternatives. The convenience and adaptability of water enhancers, enabling consumers to customize their hydration, are also major contributors to their popularity. The prevailing health and wellness trend, coupled with continuous product innovation from major players such as Nestle SA, PepsiCo INC, and The Coca-Cola Company, is expected to further stimulate market growth. Consumers are increasingly prioritizing natural ingredients and functional benefits in their drinks, creating opportunities for brands that align with these evolving preferences.

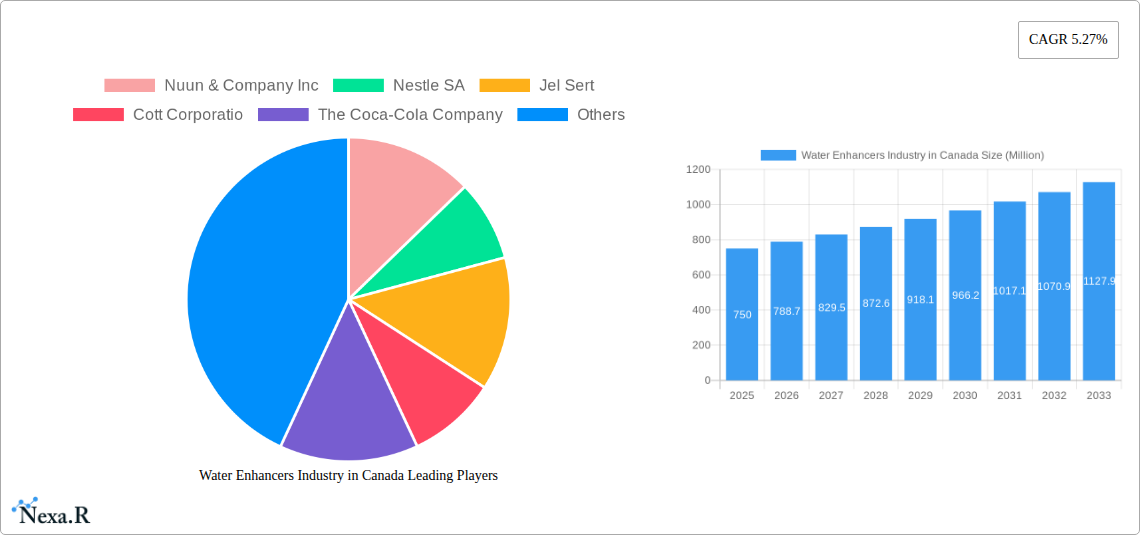

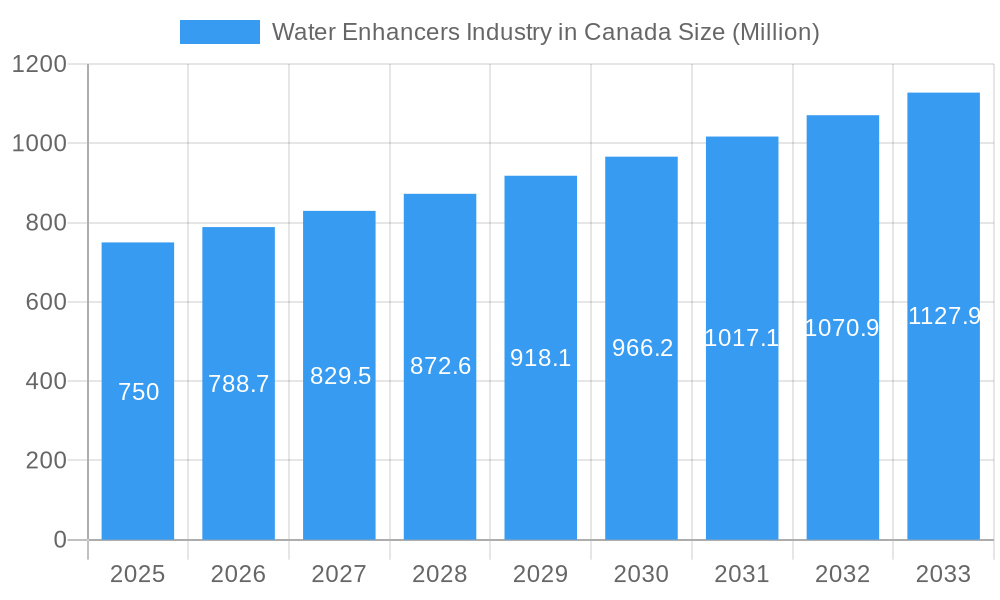

Water Enhancers Industry in Canada Market Size (In Billion)

The Canadian water enhancers market features a vibrant competitive environment and diverse sales channels. Pharmacies & Health Stores are expected to lead in sales, leveraging consumer trust and their focus on health-oriented products. Online channels, however, are experiencing the most rapid growth, reflecting the broader e-commerce shift and the ease of direct-to-consumer purchasing. Hypermarkets/Supermarkets and Convenience Stores will also remain vital for broad accessibility. Potential challenges include possible regulatory scrutiny over artificial ingredients and volatility in raw material costs. Nevertheless, the market's inherent expansion potential, supported by a strong emphasis on healthy lifestyles and innovative product development, indicates a promising future for water enhancers in Canada. Success will hinge on companies' ability to adapt to consumer demands for natural and functional ingredients, alongside effective marketing strategies across various distribution platforms.

Water Enhancers Industry in Canada Company Market Share

This comprehensive report delivers an in-depth analysis of the Canadian Water Enhancers Market, providing critical insights into market dynamics, growth forecasts, and competitive strategies. Spanning the period from 2025 to 2033, with 2025 as the base year, this research is an essential tool for industry professionals, investors, and stakeholders keen on understanding the evolving Canadian market for liquid water enhancers, powdered water enhancers, and water flavoring drops.

Water Enhancers Industry in Canada Market Dynamics & Structure

The Water Enhancers Industry in Canada is characterized by a moderately concentrated market, with key players such as Nestle SA, The Coca-Cola Company, and PepsiCo INC holding significant sway. Technological innovation, particularly in the development of novel natural sweeteners and functional ingredients, is a primary driver. Regulatory frameworks surrounding food additives and health claims influence product development and marketing strategies. Competitive product substitutes include traditional beverages like juices and sodas, as well as other health-focused alternatives. End-user demographics are broad, encompassing health-conscious consumers, busy professionals, and families seeking healthier hydration options. Mergers & Acquisitions (M&A) trends, while not historically rampant, are anticipated to see an uptick as larger corporations aim to consolidate their presence in the rapidly growing functional beverage sector.

- Market Concentration: Dominated by a few large multinational corporations and a growing number of specialized brands.

- Technological Innovation: Focus on natural ingredients, zero-calorie options, and added functional benefits (vitamins, electrolytes).

- Regulatory Frameworks: Adherence to Health Canada guidelines for ingredients and labeling.

- Competitive Substitutes: Traditional juices, sodas, and other ready-to-drink beverages.

- End-User Demographics: Growing appeal among Millennials and Gen Z for convenient and customizable beverage solutions.

- M&A Trends: Potential for consolidation as market share expands.

Water Enhancers Industry in Canada Growth Trends & Insights

The Water Enhancers Industry in Canada is poised for robust expansion, driven by increasing consumer demand for healthier and more engaging hydration alternatives. Leveraging market intelligence and extensive research, this report forecasts a significant market size evolution, with adoption rates steadily climbing as awareness of the benefits of enhanced water consumption grows. Technological disruptions, such as advancements in microencapsulation for flavor delivery and the integration of plant-based ingredients, are shaping the product landscape. Consumer behavior shifts, notably the move away from sugar-sweetened beverages and the preference for personalized nutrition, are directly fueling the growth of this segment. The CAGR for the Canadian water enhancers market is projected to be substantial, indicating strong market penetration and a widening consumer base.

- Market Size Evolution: Consistent year-on-year growth driven by consumer preferences.

- Adoption Rates: Increasing across various age groups and lifestyle segments.

- Technological Disruptions: Innovations in natural sweeteners, functional ingredients, and sustainable packaging.

- Consumer Behavior Shifts: Decline in sugary drink consumption, rise in demand for zero-calorie and functional beverages.

- Market Penetration: Expected to deepen significantly over the forecast period.

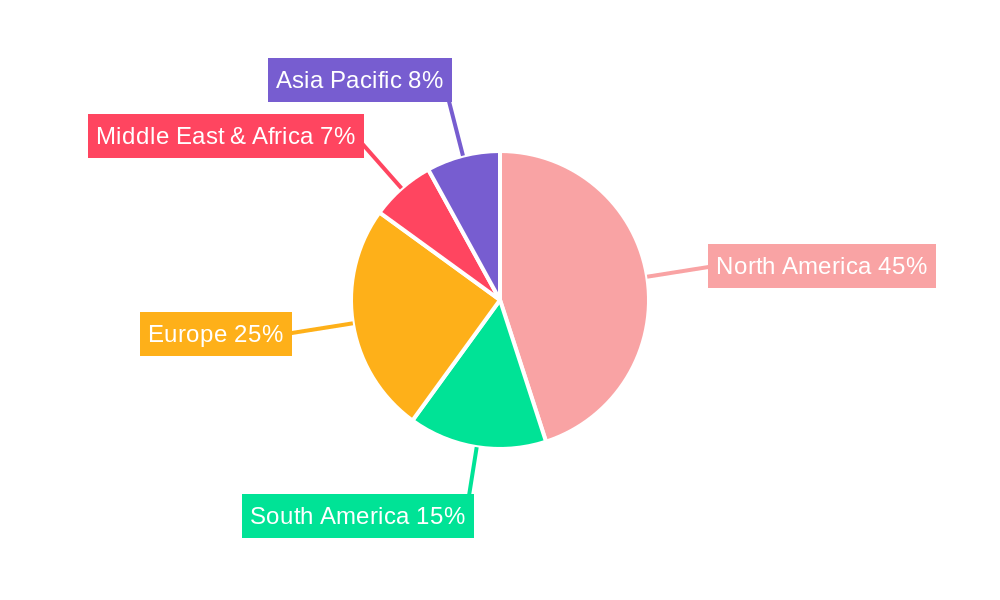

Dominant Regions, Countries, or Segments in Water Enhancers Industry in Canada

Within the Canadian Water Enhancers Industry, Online Channels are emerging as a dominant force, alongside established retail formats. The convenience and accessibility offered by e-commerce platforms, coupled with targeted digital marketing strategies, are accelerating growth. Hypermarkets/Supermarkets remain crucial for broad consumer reach, offering a wide selection and impulse purchase opportunities. Pharmacies & Health Stores cater to a segment focused on wellness and functional benefits, while Convenience Stores serve the on-the-go consumer. The growth in online sales is propelled by factors such as expanded product availability, competitive pricing, and the ability for consumers to easily discover new brands and flavors. Economic policies promoting healthy lifestyles and increasing disposable incomes further bolster the market.

- Online Channels: Rapidly expanding due to convenience, wider product selection, and targeted promotions.

- Hypermarkets/Supermarkets: Key for mass market penetration and brand visibility.

- Pharmacies & Health Stores: Serving health-conscious consumers seeking functional benefits.

- Convenience Stores: Catering to immediate consumption needs and impulse purchases.

- Key Drivers: Digital marketing, ease of access, competitive pricing, and growing health consciousness.

Water Enhancers Industry in Canada Product Landscape

The Canadian Water Enhancers Industry is characterized by a dynamic product landscape focused on innovation and consumer appeal. Product innovations range from zero-calorie, natural sweetener-based formulations to those fortified with vitamins, electrolytes, and antioxidants. Liquid water enhancers, powdered sachets, and dissolvable tablets are the primary formats, each offering unique selling propositions in terms of convenience and portability. Performance metrics revolve around flavor intensity, solubility, shelf-life, and nutritional benefits. Technological advancements in flavor encapsulation and natural ingredient sourcing are continuously enhancing the efficacy and desirability of these products.

Key Drivers, Barriers & Challenges in Water Enhancers Industry in Canada

Key Drivers: The primary forces propelling the Water Enhancers Industry in Canada include the growing consumer preference for sugar-free and low-calorie beverage options, increasing awareness of the health benefits associated with adequate hydration, and the convenience and portability offered by water enhancers. Technological advancements in natural flavorings and sweeteners are also significant drivers.

Barriers & Challenges: Key challenges include intense competition from established beverage giants and alternative hydration methods. Supply chain disruptions, though improving, can impact product availability. Regulatory hurdles related to health claims and ingredient transparency can also pose challenges. Negative perceptions surrounding artificial sweeteners, if prevalent in certain formulations, can also act as a restraint.

Emerging Opportunities in Water Enhancers Industry in Canada

Emerging opportunities in the Canadian Water Enhancers Industry lie in the untapped potential of functional water enhancers offering specific health benefits, such as enhanced immunity or cognitive support. The growing demand for plant-based and organic ingredients presents a significant niche. Innovations in sustainable and eco-friendly packaging solutions will also resonate with environmentally conscious consumers. Furthermore, expanding into untapped geographic regions within Canada and developing unique flavor profiles catering to diverse palates represent lucrative avenues for growth.

Growth Accelerators in the Water Enhancers Industry in Canada Industry

Catalysts driving long-term growth in the Canadian Water Enhancers Industry include continued technological breakthroughs in natural ingredient formulation and flavor delivery systems. Strategic partnerships between water enhancer brands and fitness or wellness influencers can significantly boost market reach and consumer engagement. Furthermore, market expansion strategies focused on increasing accessibility in underserved regions and through diverse distribution channels, such as vending machines and corporate wellness programs, will be crucial for sustained expansion.

Key Players Shaping the Water Enhancers Industry in Canada Market

- Nuun & Company Inc

- Nestle SA

- Jel Sert

- Cott Corporation

- The Coca-Cola Company

- PepsiCo INC

- Loblaw Inc

- Wisdom Natural Brands

- Kraft Heinz Company

Notable Milestones in Water Enhancers Industry in Canada Sector

- 2019: Increased consumer focus on low-sugar alternatives drives market growth.

- 2020: Product innovation leans towards natural ingredients and added vitamins.

- 2021: Online sales of water enhancers experience a significant surge.

- 2022: New product launches emphasizing electrolyte replenishment gain traction.

- 2023: Growing demand for plant-based and organic water enhancer options.

- 2024: Continued expansion of functional water enhancer categories.

In-Depth Water Enhancers Industry in Canada Market Outlook

The outlook for the Water Enhancers Industry in Canada remains exceptionally positive, fueled by sustained consumer interest in health and wellness. Growth accelerators such as the ongoing innovation in natural and functional ingredients, coupled with the expansion of online retail, are expected to propel the market forward. Strategic opportunities for market penetration lie in catering to niche consumer segments with specialized health benefits and in embracing sustainable packaging solutions. The Canadian market is well-positioned for continued expansion, driven by evolving consumer preferences and a supportive industry ecosystem.

Water Enhancers Industry in Canada Segmentation

-

1. Distribution Channel

- 1.1. Pharmacies & Health Stores

- 1.2. Convenience Stores

- 1.3. Hypermarkets/Supermarkets

- 1.4. Online Channels

- 1.5. Other distribution channels

Water Enhancers Industry in Canada Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Water Enhancers Industry in Canada Regional Market Share

Geographic Coverage of Water Enhancers Industry in Canada

Water Enhancers Industry in Canada REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sports Participation; Increasing Awareness about Health and Fitness

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Overconsumption of Products

- 3.4. Market Trends

- 3.4.1. The Popularization of Functional Beverages is Likely to Foster the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Water Enhancers Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Pharmacies & Health Stores

- 5.1.2. Convenience Stores

- 5.1.3. Hypermarkets/Supermarkets

- 5.1.4. Online Channels

- 5.1.5. Other distribution channels

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. North America Water Enhancers Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.1.1. Pharmacies & Health Stores

- 6.1.2. Convenience Stores

- 6.1.3. Hypermarkets/Supermarkets

- 6.1.4. Online Channels

- 6.1.5. Other distribution channels

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7. South America Water Enhancers Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.1.1. Pharmacies & Health Stores

- 7.1.2. Convenience Stores

- 7.1.3. Hypermarkets/Supermarkets

- 7.1.4. Online Channels

- 7.1.5. Other distribution channels

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8. Europe Water Enhancers Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.1.1. Pharmacies & Health Stores

- 8.1.2. Convenience Stores

- 8.1.3. Hypermarkets/Supermarkets

- 8.1.4. Online Channels

- 8.1.5. Other distribution channels

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9. Middle East & Africa Water Enhancers Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.1.1. Pharmacies & Health Stores

- 9.1.2. Convenience Stores

- 9.1.3. Hypermarkets/Supermarkets

- 9.1.4. Online Channels

- 9.1.5. Other distribution channels

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10. Asia Pacific Water Enhancers Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.1.1. Pharmacies & Health Stores

- 10.1.2. Convenience Stores

- 10.1.3. Hypermarkets/Supermarkets

- 10.1.4. Online Channels

- 10.1.5. Other distribution channels

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nuun & Company Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nestle SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Jel Sert

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cott Corporatio

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Coca-Cola Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PepsiCo INC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Loblaw Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Wisdom Natural Brands

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kraft Heinz Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Nuun & Company Inc

List of Figures

- Figure 1: Global Water Enhancers Industry in Canada Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Water Enhancers Industry in Canada Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 3: North America Water Enhancers Industry in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 4: North America Water Enhancers Industry in Canada Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Water Enhancers Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Water Enhancers Industry in Canada Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 7: South America Water Enhancers Industry in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: South America Water Enhancers Industry in Canada Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Water Enhancers Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Water Enhancers Industry in Canada Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: Europe Water Enhancers Industry in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Water Enhancers Industry in Canada Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Water Enhancers Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Water Enhancers Industry in Canada Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 15: Middle East & Africa Water Enhancers Industry in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Middle East & Africa Water Enhancers Industry in Canada Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa Water Enhancers Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Water Enhancers Industry in Canada Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 19: Asia Pacific Water Enhancers Industry in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 20: Asia Pacific Water Enhancers Industry in Canada Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Water Enhancers Industry in Canada Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Water Enhancers Industry in Canada Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 2: Global Water Enhancers Industry in Canada Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Water Enhancers Industry in Canada Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Water Enhancers Industry in Canada Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Water Enhancers Industry in Canada Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 9: Global Water Enhancers Industry in Canada Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Water Enhancers Industry in Canada Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Water Enhancers Industry in Canada Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Water Enhancers Industry in Canada Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Water Enhancers Industry in Canada Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Water Enhancers Industry in Canada Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 33: Global Water Enhancers Industry in Canada Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Water Enhancers Industry in Canada Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Water Enhancers Industry in Canada?

The projected CAGR is approximately 9.6%.

2. Which companies are prominent players in the Water Enhancers Industry in Canada?

Key companies in the market include Nuun & Company Inc, Nestle SA, Jel Sert, Cott Corporatio, The Coca-Cola Company, PepsiCo INC, Loblaw Inc, Wisdom Natural Brands, Kraft Heinz Company.

3. What are the main segments of the Water Enhancers Industry in Canada?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sports Participation; Increasing Awareness about Health and Fitness.

6. What are the notable trends driving market growth?

The Popularization of Functional Beverages is Likely to Foster the Market Growth.

7. Are there any restraints impacting market growth?

Adverse Effects of Overconsumption of Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Water Enhancers Industry in Canada," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Water Enhancers Industry in Canada report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Water Enhancers Industry in Canada?

To stay informed about further developments, trends, and reports in the Water Enhancers Industry in Canada, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence