Key Insights

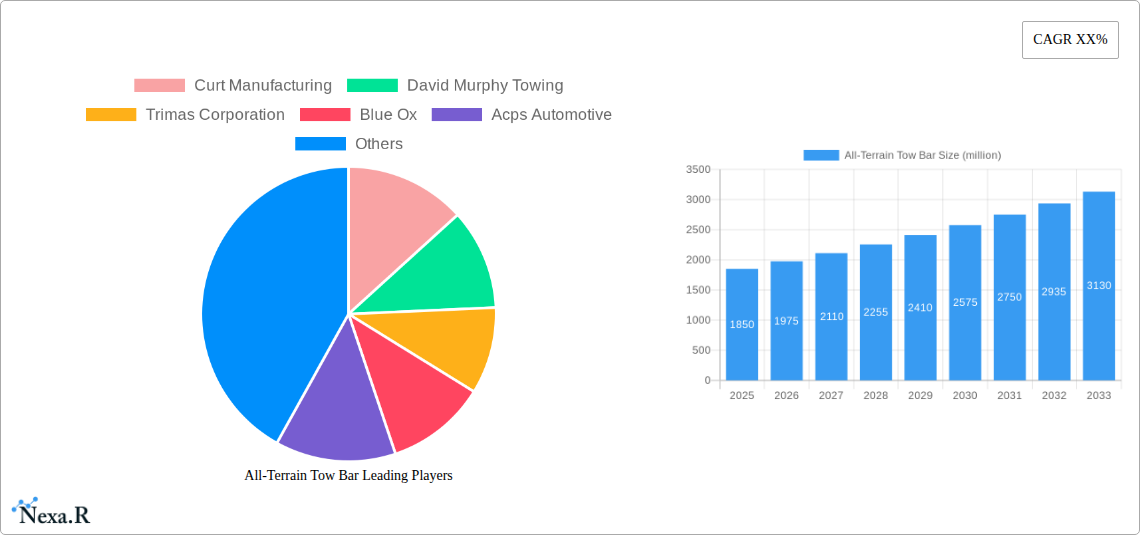

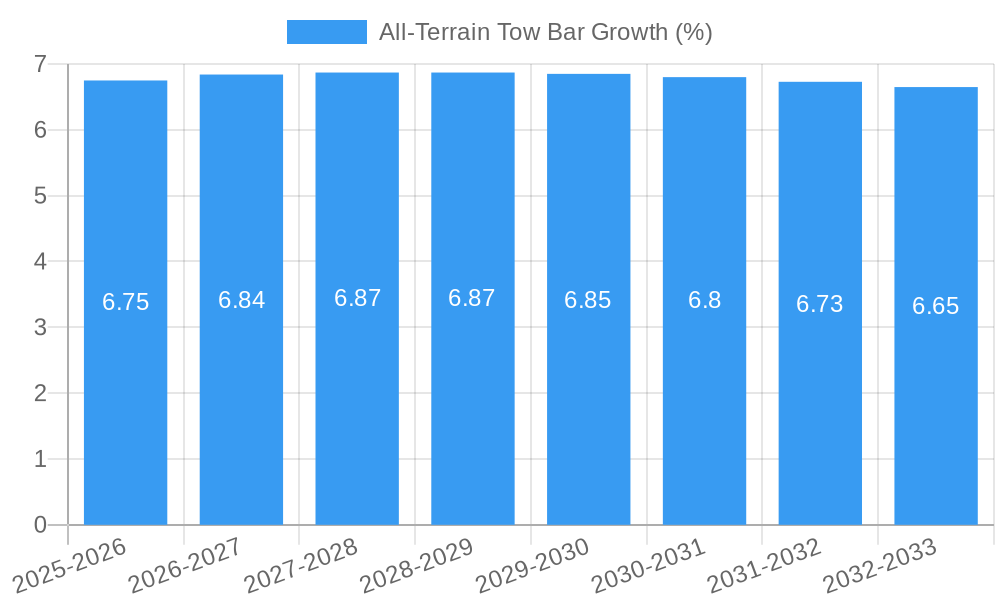

The global All-Terrain Tow Bar market is projected to experience robust growth, estimated at a substantial market size of $1,850 million in 2025. This expansion is fueled by a Compound Annual Growth Rate (CAGR) of 6.5% over the forecast period of 2025-2033, indicating a dynamic and expanding industry. The value unit is in millions, signifying significant financial transaction volume. Key growth drivers include the escalating demand for recreational vehicles (RVs) and the increasing popularity of outdoor adventures, such as camping and off-roading, which necessitate reliable towing solutions. Furthermore, the expanding commercial vehicle segment, particularly in logistics and transportation, contributes to the market's upward trajectory. Advancements in tow bar technology, focusing on enhanced safety, durability, and ease of use, alongside the adoption of lightweight materials like aluminum, are also pivotal in driving market adoption. The increasing disposable income and a growing desire for travel and exploration are further augmenting the demand for these essential automotive accessories.

The market is characterized by a clear segmentation across various applications and types. In terms of application, Passenger Cars represent a significant share due to the growing trend of towing personal recreational equipment like trailers and boats. Commercial Vehicles, encompassing trucks and vans used for hauling goods and specialized equipment, also present a substantial market segment. By type, both Steel and Aluminum tow bars cater to different consumer needs, with aluminum gaining traction due to its lighter weight and corrosion resistance, crucial for all-terrain use. Restraints, such as the high initial cost of advanced tow bar systems and fluctuating raw material prices, are present but are being mitigated by technological innovations and increasing consumer awareness of the long-term benefits. Leading companies like Curt Manufacturing, Blue Ox, and Horizon Global are actively innovating and expanding their product portfolios to capture market share, driving competition and fostering consumer choice within this growing all-terrain tow bar landscape.

All-Terrain Tow Bar Market: Comprehensive Analysis and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the global All-Terrain Tow Bar market, providing critical insights for industry stakeholders. Covering historical trends, current dynamics, and future projections, this report is essential for strategic planning and investment decisions within the towing and automotive accessory sectors. The study encompasses a detailed examination of market structure, growth trajectories, regional dominance, product innovation, key drivers, barriers, and emerging opportunities. We delve into the parent and child market segments, analyzing the influence of passenger car and commercial vehicle applications, as well as the impact of steel and aluminum tow bar types.

All-Terrain Tow Bar Market Dynamics & Structure

The global All-Terrain Tow Bar market exhibits a moderately concentrated structure, with key players like Curt Manufacturing, Blue Ox, and Horizon Global holding significant market share. Technological innovation is a primary driver, fueled by advancements in materials science, design for enhanced durability, and the integration of smart features. Regulatory frameworks, particularly concerning vehicle safety and towing capacity standards across different regions, play a crucial role in shaping product development and market entry. Competitive product substitutes, such as gooseneck hitches and fifth-wheel hitches for heavier loads, pose a challenge, but the versatility and ease of use of all-terrain tow bars ensure their continued demand. End-user demographics are shifting towards a growing segment of recreational vehicle (RV) owners and adventure enthusiasts who require robust towing solutions for varied terrains. Mergers and acquisitions (M&A) trends are moderately active, with companies seeking to expand their product portfolios and geographical reach.

- Market Concentration: Moderately Concentrated, with top 5 players holding approximately 55% of the market share in 2025.

- Technological Innovation Drivers: Lightweight materials, corrosion resistance, enhanced safety locking mechanisms, and modular designs.

- Regulatory Frameworks: Increasing stringency in safety standards (e.g., NHTSA in the US, UNECE regulations in Europe).

- Competitive Product Substitutes: Gooseneck hitches, fifth-wheel hitches, and specialized trailer hitches.

- End-User Demographics: Growing RV ownership, off-road enthusiasts, and commercial fleets requiring flexible towing.

- M&A Trends: Companies are acquiring smaller innovators to gain access to new technologies and markets. M&A deal volume is projected to be around 5-7 significant transactions annually from 2025-2033.

All-Terrain Tow Bar Growth Trends & Insights

The global All-Terrain Tow Bar market is poised for robust growth, driven by an increasing demand for versatile and durable towing solutions. The market size is projected to expand from an estimated $1,250 million in 2025 to $2,100 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.8%. Adoption rates are accelerating, particularly in North America and Europe, where outdoor recreation and RV travel are popular. Technological disruptions are leading to the development of lighter, stronger, and more corrosion-resistant tow bars made from advanced steel alloys and aluminum composites. Consumer behavior is shifting towards individuals and families seeking to extend their adventures, requiring reliable equipment for towing a variety of vehicles and trailers across diverse terrains, from paved roads to off-road trails. The increasing popularity of adventure vehicles and off-road SUVs further bolsters demand. The market penetration of all-terrain tow bars is expected to grow from an estimated 25% of the total tow bar market in 2025 to over 35% by 2033.

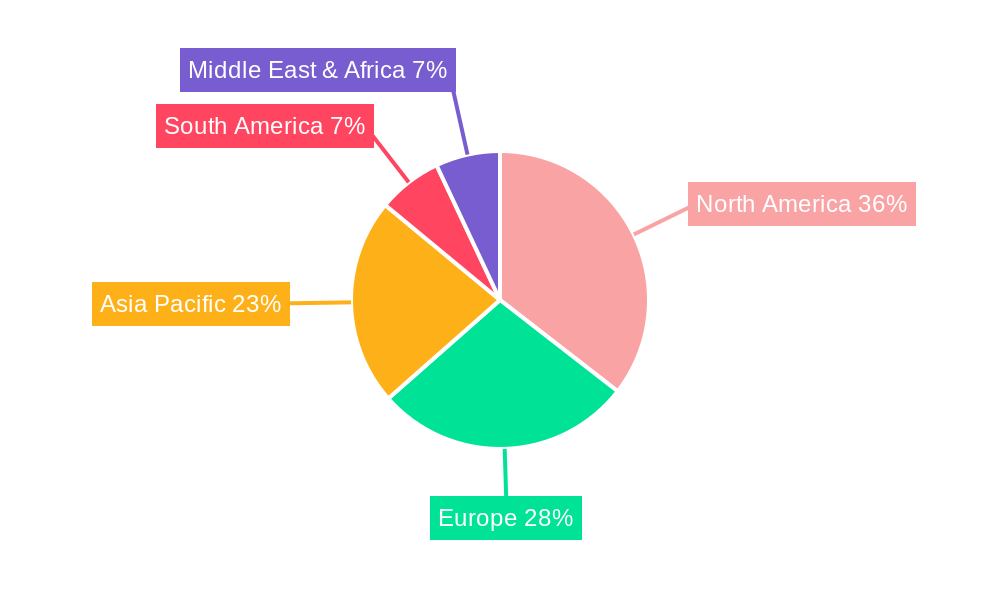

Dominant Regions, Countries, or Segments in All-Terrain Tow Bar

North America, particularly the United States, stands as the dominant region in the All-Terrain Tow Bar market, driven by a strong culture of outdoor recreation, a high prevalence of RV ownership, and a vast network of off-road trails. The Application: Passenger Car segment is the primary driver of market growth within this region, as a significant number of passenger vehicles are equipped with tow bars for recreational purposes, such as towing small campers, utility trailers, and personal watercraft. The Type: Steel tow bars continue to hold a substantial market share due to their perceived robustness and cost-effectiveness, though Type: Aluminum is gaining traction due to its lightweight properties and corrosion resistance, appealing to a segment of the market focused on fuel efficiency and reduced vehicle strain.

- Dominant Region: North America (specifically the United States)

- Key Drivers in North America:

- High disposable income and strong propensity for outdoor recreation.

- Extensive network of national parks and off-road trails.

- Large and growing RV and camper van market.

- Availability of diverse vehicle models equipped for towing.

- Favorable economic policies supporting recreational vehicle sales and accessory purchases.

- Dominant Application Segment: Passenger Car

- Dominant Type Segment: Steel (though Aluminum is a growing segment)

- Market Share in North America (2025): Estimated at 60% of the global market.

- Growth Potential: Continued expansion driven by an increasing number of first-time RV buyers and a rising interest in adventure travel. The demand for robust, all-terrain compatible tow bars for SUVs and trucks further solidifies its dominance.

All-Terrain Tow Bar Product Landscape

Innovations in the All-Terrain Tow Bar sector are focused on enhancing durability, ease of use, and safety. Manufacturers are developing lightweight yet exceptionally strong tow bars using high-grade steel alloys and advanced aluminum composites. Product designs are evolving to offer quick-connect and quick-disconnect mechanisms, reducing setup time for users. Enhanced safety features, such as self-latching systems and integrated security locks, are becoming standard. Performance metrics are being optimized for superior load-bearing capacity and resistance to extreme environmental conditions, ensuring reliable towing across various terrains. Unique selling propositions often revolve around patented locking mechanisms, modular designs for adaptable use, and extensive testing for off-road conditions.

Key Drivers, Barriers & Challenges in All-Terrain Tow Bar

Key Drivers:

- Growing Popularity of Outdoor Recreation: Increased demand for RVs, campers, and adventure vehicles fuels the need for robust towing solutions.

- Technological Advancements: Development of lighter, stronger, and more corrosion-resistant materials and designs.

- Versatility and Ease of Use: All-terrain tow bars cater to a wide range of vehicles and towing needs across diverse environments.

- Favorable Economic Conditions: Rising disposable incomes and a willingness to invest in recreational equipment.

Key Barriers & Challenges:

- High Initial Cost: Premium materials and advanced designs can lead to higher price points compared to standard tow bars.

- Regulatory Compliance: Navigating varying safety standards and homologation requirements across different countries.

- Competition from Specialized Hitches: For very heavy-duty or specific towing applications, alternatives like gooseneck hitches may be preferred.

- Supply Chain Disruptions: Fluctuations in raw material prices (steel, aluminum) and global logistics can impact production costs and availability. The global supply chain disruption index is estimated at 7.5 in 2025, impacting material procurement.

Emerging Opportunities in All-Terrain Tow Bar

Emerging opportunities lie in the development of smart tow bars integrated with GPS tracking and diagnostic sensors, providing real-time towing data and enhanced security. Untapped markets in developing economies with a growing middle class and increasing interest in recreational travel present significant potential. The integration of tow bars with electric vehicle (EV) platforms, considering factors like battery drain and towing capacity, is a nascent but growing area. Furthermore, the customization of tow bar solutions for specific vehicle models and towing scenarios, catering to niche adventure markets, offers lucrative avenues for growth.

Growth Accelerators in the All-Terrain Tow Bar Industry

Growth in the All-Terrain Tow Bar industry will be significantly accelerated by ongoing technological breakthroughs in material science, leading to lighter and more durable products. Strategic partnerships between tow bar manufacturers and vehicle OEMs (Original Equipment Manufacturers) to offer integrated towing solutions will expand market reach. Furthermore, aggressive market expansion strategies into emerging economies with a burgeoning interest in outdoor adventure and recreational vehicle ownership will act as major catalysts for long-term growth. The increasing adoption of e-commerce platforms for direct-to-consumer sales will also streamline accessibility and boost adoption rates.

Key Players Shaping the All-Terrain Tow Bar Market

- Curt Manufacturing

- David Murphy Towing

- Trimas Corporation

- Blue Ox

- Acps Automotive

- Horizon Global

- Brink Group

- Hayman Reese

- Mccabe Towbars

- North Shore Towbars

- PCT Automotive

Notable Milestones in All-Terrain Tow Bar Sector

- 2020, Q3: Curt Manufacturing launches its innovative XTRA-Duty tow bar series, enhancing strength and durability for extreme off-road use.

- 2021, Q1: Blue Ox introduces its redesigned Acadia tow bar, focusing on lighter weight and improved ease of use for passenger vehicles.

- 2022, Q4: Horizon Global expands its tow bar product line through strategic acquisitions, broadening its market presence.

- 2023, Q2: Trimas Corporation invests heavily in R&D for advanced material applications in its tow bar offerings.

- 2024, Q1: The industry sees increased focus on regulatory compliance following updated safety standards in North America and Europe.

In-Depth All-Terrain Tow Bar Market Outlook

The future outlook for the All-Terrain Tow Bar market is exceptionally bright, driven by sustained growth in outdoor recreation and the continuous evolution of vehicle technology. Growth accelerators such as advanced material development, strategic OEM collaborations, and expansion into untapped global markets will propel the industry forward. The increasing integration of smart technologies and a focus on eco-friendly manufacturing processes will further define the market's trajectory. Strategic opportunities for differentiation lie in offering enhanced user experience, superior product performance, and comprehensive customer support, ensuring continued dominance in the versatile towing solutions segment. The market is projected to see sustained growth of 6.8% CAGR from 2025-2033.

All-Terrain Tow Bar Segmentation

-

1. Application

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Types

- 2.1. Steel

- 2.2. Aluminum

All-Terrain Tow Bar Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

All-Terrain Tow Bar REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global All-Terrain Tow Bar Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Steel

- 5.2.2. Aluminum

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America All-Terrain Tow Bar Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Passenger Car

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Steel

- 6.2.2. Aluminum

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America All-Terrain Tow Bar Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Passenger Car

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Steel

- 7.2.2. Aluminum

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe All-Terrain Tow Bar Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Passenger Car

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Steel

- 8.2.2. Aluminum

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa All-Terrain Tow Bar Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Passenger Car

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Steel

- 9.2.2. Aluminum

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific All-Terrain Tow Bar Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Passenger Car

- 10.1.2. Commercial Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Steel

- 10.2.2. Aluminum

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Curt Manufacturing

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 David Murphy Towing

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Trimas Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Blue Ox

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Acps Automotive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Horizon Global

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Brink Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hayman Reese

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mccabe Towbars

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 North Shore Towbars

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PCT Automotive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Curt Manufacturing

List of Figures

- Figure 1: Global All-Terrain Tow Bar Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America All-Terrain Tow Bar Revenue (million), by Application 2024 & 2032

- Figure 3: North America All-Terrain Tow Bar Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America All-Terrain Tow Bar Revenue (million), by Types 2024 & 2032

- Figure 5: North America All-Terrain Tow Bar Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America All-Terrain Tow Bar Revenue (million), by Country 2024 & 2032

- Figure 7: North America All-Terrain Tow Bar Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America All-Terrain Tow Bar Revenue (million), by Application 2024 & 2032

- Figure 9: South America All-Terrain Tow Bar Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America All-Terrain Tow Bar Revenue (million), by Types 2024 & 2032

- Figure 11: South America All-Terrain Tow Bar Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America All-Terrain Tow Bar Revenue (million), by Country 2024 & 2032

- Figure 13: South America All-Terrain Tow Bar Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe All-Terrain Tow Bar Revenue (million), by Application 2024 & 2032

- Figure 15: Europe All-Terrain Tow Bar Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe All-Terrain Tow Bar Revenue (million), by Types 2024 & 2032

- Figure 17: Europe All-Terrain Tow Bar Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe All-Terrain Tow Bar Revenue (million), by Country 2024 & 2032

- Figure 19: Europe All-Terrain Tow Bar Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa All-Terrain Tow Bar Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa All-Terrain Tow Bar Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa All-Terrain Tow Bar Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa All-Terrain Tow Bar Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa All-Terrain Tow Bar Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa All-Terrain Tow Bar Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific All-Terrain Tow Bar Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific All-Terrain Tow Bar Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific All-Terrain Tow Bar Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific All-Terrain Tow Bar Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific All-Terrain Tow Bar Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific All-Terrain Tow Bar Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global All-Terrain Tow Bar Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global All-Terrain Tow Bar Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global All-Terrain Tow Bar Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global All-Terrain Tow Bar Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global All-Terrain Tow Bar Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global All-Terrain Tow Bar Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global All-Terrain Tow Bar Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global All-Terrain Tow Bar Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global All-Terrain Tow Bar Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global All-Terrain Tow Bar Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global All-Terrain Tow Bar Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global All-Terrain Tow Bar Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global All-Terrain Tow Bar Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global All-Terrain Tow Bar Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global All-Terrain Tow Bar Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global All-Terrain Tow Bar Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global All-Terrain Tow Bar Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global All-Terrain Tow Bar Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global All-Terrain Tow Bar Revenue million Forecast, by Country 2019 & 2032

- Table 41: China All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific All-Terrain Tow Bar Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the All-Terrain Tow Bar?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the All-Terrain Tow Bar?

Key companies in the market include Curt Manufacturing, David Murphy Towing, Trimas Corporation, Blue Ox, Acps Automotive, Horizon Global, Brink Group, Hayman Reese, Mccabe Towbars, North Shore Towbars, PCT Automotive.

3. What are the main segments of the All-Terrain Tow Bar?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "All-Terrain Tow Bar," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the All-Terrain Tow Bar report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the All-Terrain Tow Bar?

To stay informed about further developments, trends, and reports in the All-Terrain Tow Bar, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence