Key Insights

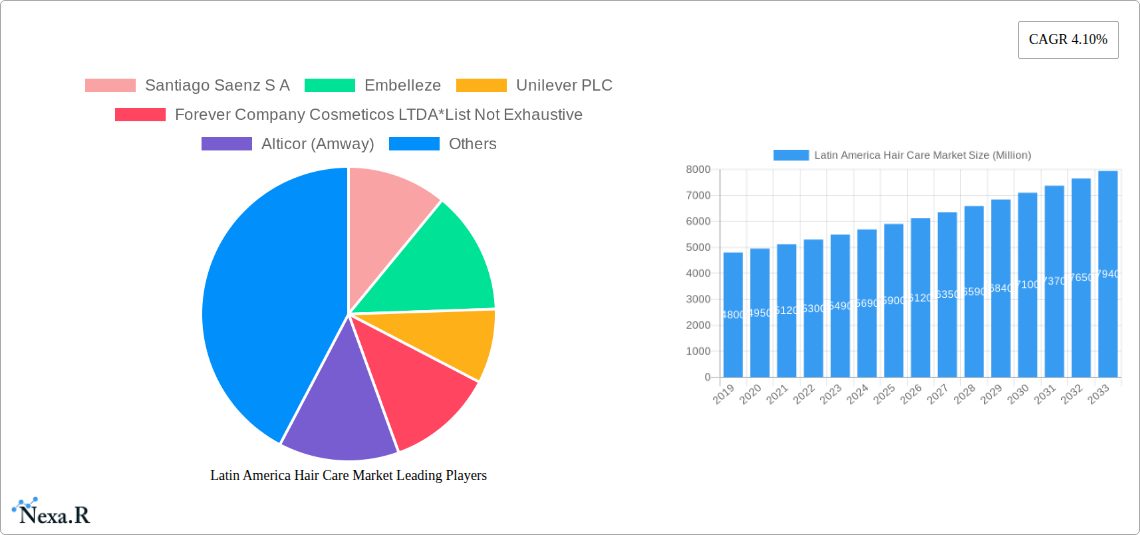

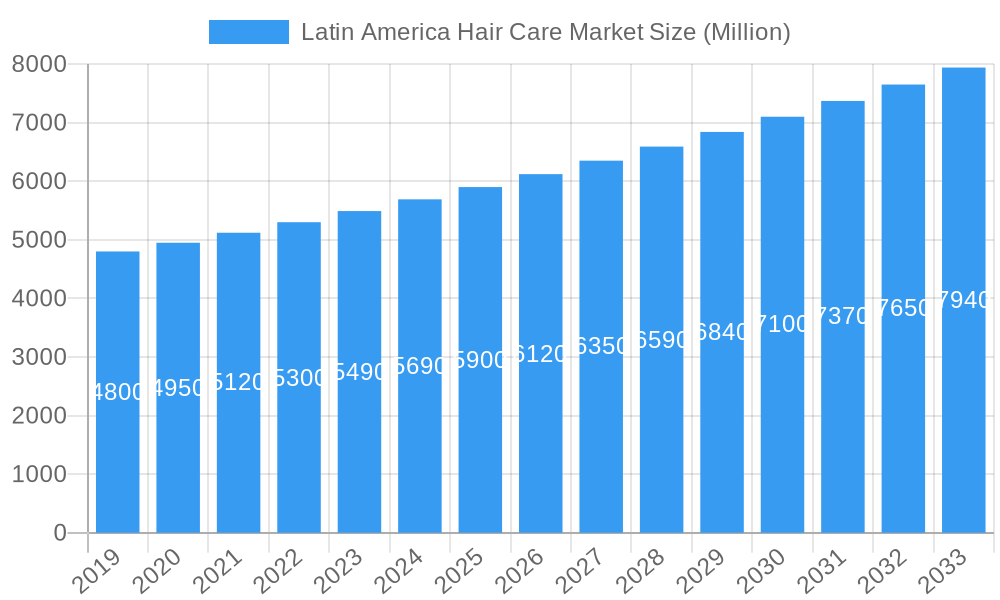

The Latin America Hair Care Market is projected for significant expansion, expected to reach 1636 million by 2025 and maintain a Compound Annual Growth Rate (CAGR) of 4.1% through 2033. Growth is driven by an expanding middle class, increasing disposable income, and a rising focus on personal grooming across the region. Key drivers include escalating demand for premium and specialized hair care solutions, such as anti-hair loss treatments and advanced styling products, aligning with evolving consumer preferences for at-home, salon-quality results. The pervasive influence of social media and beauty influencers is also shaping consumer choices, promoting innovative formulations. Furthermore, the burgeoning e-commerce sector in Latin America enhances product accessibility, accelerating market penetration and sales.

Latin America Hair Care Market Market Size (In Billion)

Market segmentation highlights a dynamic interplay between product categories and distribution channels. While shampoos and conditioners remain dominant, niche segments like hair loss treatments and specialized hair colorants are showing notable growth, indicating a consumer base seeking targeted solutions. Distribution channels are diversifying, with online retail experiencing exponential growth, catering to convenience-seeking consumers. Supermarkets and hypermarkets continue to be vital for mass-market reach, while pharmacies and drug stores are increasing in importance for specialized and therapeutic products. Major players, including Unilever PLC, L'Oreal S.A., and Procter & Gamble Company, are investing in product innovation and strategic marketing to capitalize on this competitive market.

Latin America Hair Care Market Company Market Share

This report offers an in-depth analysis of the Latin America Hair Care Market, providing critical insights into market size, growth trends, competitive landscape, and future opportunities. Covering the period 2019-2033, with a base year of 2025, this report is an essential resource for industry professionals navigating this dynamic market.

Study Period: 2019–2033 Base Year: 2025 Forecast Period: 2025–2033

Latin America Hair Care Market Market Dynamics & Structure

The Latin America Hair Care Market is characterized by a moderate to high market concentration, with key global players like Unilever PLC, L'Oreal S.A., and Procter & Gamble Company holding significant shares. However, the region also boasts a vibrant ecosystem of local and regional manufacturers, contributing to a diverse competitive landscape. Technological innovation is a key driver, with a growing emphasis on natural ingredients, sustainable packaging, and personalized hair care solutions. Regulatory frameworks, while evolving, generally support market growth, though compliance with varying local standards can present challenges. Competitive product substitutes range from home-brewed remedies to specialized professional treatments, influencing consumer choices. End-user demographics are diverse, with a growing middle class and an increasing demand for premium and efficacy-driven products. Mergers and acquisitions (M&A) activity, while not as intense as in more mature markets, is present, with companies seeking to expand their market reach and product portfolios. Market share of leading companies is estimated to be around xx% in 2025. The volume of M&A deals in the region is projected to be xx million units over the forecast period. Innovation barriers include high R&D costs and the need for localized product development to cater to diverse hair types and consumer preferences.

Latin America Hair Care Market Growth Trends & Insights

The Latin America Hair Care Market is poised for robust expansion, driven by increasing disposable incomes, a growing population, and a rising awareness of personal grooming and beauty trends. The market size evolution showcases a consistent upward trajectory, with an anticipated Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. Adoption rates for advanced hair care solutions, such as anti-hair loss treatments and specialized styling products, are steadily increasing as consumers become more informed and discerning. Technological disruptions, including the integration of AI for personalized recommendations and the development of innovative formulations utilizing biotechnology, are shaping product offerings. Consumer behavior shifts are evident, with a strong preference for natural, organic, and ethically sourced ingredients, alongside a growing demand for products that address specific hair concerns like damage repair and frizz control. Market penetration for premium hair care segments is expected to rise as economic conditions improve across various Latin American countries. The total market size is projected to reach USD xx billion by 2033.

Dominant Regions, Countries, or Segments in Latin America Hair Care Market

Brazil stands out as the dominant region in the Latin America Hair Care Market, owing to its large population, strong economic base, and established beauty industry. The country’s high consumption rate for personal care products, coupled with a significant demand for both mass-market and premium hair care items, solidifies its leading position. Within product types, Shampoo commands the largest market share, estimated at xx% in 2025, followed by Conditioner and Hair Colorants. This dominance is attributed to the daily usage of shampoos and conditioners as basic hair hygiene and care essentials. The increasing adoption of hair coloring for fashion and self-expression further fuels the growth of this segment.

In terms of distribution channels, Supermarkets/Hypermarkets represent the primary avenue for hair care product sales, capturing an estimated xx% of the market in 2025. This is due to their widespread accessibility, convenience, and the ability to offer a broad range of brands and price points. Online Retail Stores are rapidly gaining traction, projected to witness the highest growth rate over the forecast period, driven by the increasing internet penetration and the convenience of e-commerce.

Key drivers for Brazil’s dominance include favorable economic policies supporting the cosmetics industry, robust infrastructure enabling efficient distribution, and a deeply ingrained beauty culture. Market share for shampoo in Brazil is projected to be xx% of the total Latin American shampoo market by 2025. The growth potential in the Brazilian hair care market remains substantial, driven by continuous product innovation and evolving consumer preferences.

Latin America Hair Care Market Product Landscape

Product innovation in the Latin America Hair Care Market is characterized by a surge in formulations featuring natural and organic ingredients, catering to the growing consumer demand for sustainable and gentle products. Applications are diverse, ranging from everyday cleansing and conditioning to specialized treatments for hair loss, color protection, and intense repair. Performance metrics are increasingly being scrutinized by consumers, with a focus on efficacy, long-term hair health benefits, and sensory appeal. Unique selling propositions often revolve around regionally sourced ingredients, advanced scientific formulations, and cruelty-free and vegan certifications. Technological advancements are evident in the development of advanced delivery systems for active ingredients and the creation of personalized hair care solutions through diagnostic tools.

Key Drivers, Barriers & Challenges in Latin America Hair Care Market

Key Drivers:

- Growing disposable income and rising consumer spending on personal care.

- Increasing awareness of hair health and beauty trends across all demographics.

- Innovation in product formulations, with a focus on natural and sustainable ingredients.

- Expansion of online retail channels, enhancing accessibility and convenience.

- Influence of social media and beauty influencers driving product adoption.

Key Barriers & Challenges:

- Economic volatility and currency fluctuations impacting purchasing power in certain countries.

- Complex and varied regulatory landscapes across different Latin American nations.

- Logistical challenges and infrastructure gaps in remote areas, affecting supply chain efficiency.

- Intense competition from both global giants and agile local players.

- Price sensitivity among a significant portion of the consumer base.

Emerging Opportunities in Latin America Hair Care Market

Emerging opportunities in the Latin America Hair Care Market lie in the untapped potential of niche segments such as organic and vegan hair care, catering to the growing conscious consumer base. The increasing demand for anti-aging hair care products and specialized treatments for thinning hair presents a significant growth avenue. Furthermore, the development of salon-quality professional hair care products for at-home use, coupled with the expansion of subscription-based beauty boxes, offers innovative ways to reach and engage consumers. There is also a growing opportunity for brands that focus on inclusivity and cater to the diverse hair types and textures prevalent across the region.

Growth Accelerators in the Latin America Hair Care Market Industry

Long-term growth in the Latin America Hair Care Market is being significantly accelerated by technological breakthroughs in ingredient sourcing and formulation, leading to more effective and targeted hair solutions. Strategic partnerships between global manufacturers and local distributors are crucial for navigating regional market complexities and expanding reach. Furthermore, market expansion strategies, including the introduction of localized product lines and aggressive marketing campaigns tailored to specific cultural preferences, are proving highly effective. The increasing investment in R&D by key players, focusing on addressing specific regional hair concerns, will also act as a significant growth accelerator.

Key Players Shaping the Latin America Hair Care Market Market

- Santiago Saenz S A

- Embelleze

- Unilever PLC

- Forever Company Cosmeticos LTDA

- Alticor (Amway)

- L'Oreal S A

- Coty Inc

- Johnson & Johnson Services Inc

- Genomma Lab Internacional S A B de C V

- Henkel AG & Company KGaA

- Procter & Gamble Company

- Grupo Coala do Brasil

Notable Milestones in Latin America Hair Care Market Sector

- February 2023: Unilever plans to establish a new manufacturing facility in the Nuevo Leon region of Mexico, investing USD 400 million in the Latin American market over the next three years to manufacture beauty and personal care products.

- January 2021: Forever Liss, a brand of Forever Company Cosmeticos LTDA, launched a shampoo for hair wetting treatment, enriched with castor oil, coconut oil, and vitamin D, suitable for all hair types with a focus on oil control and healthy hair growth.

- September 2021: Grupo Coala do Brasil launched the cosmetics brand, Coala Beauty, offering repair and deep hydration for hair with potent natural actives like Shea Butter, Coconut Lipids, and Acai Extract, initially with 30 SKUs across nine lines.

In-Depth Latin America Hair Care Market Market Outlook

The future outlook for the Latin America Hair Care Market is exceptionally promising, fueled by sustained economic development, a burgeoning consumer base with evolving beauty aspirations, and continuous product innovation. Growth accelerators such as the increasing adoption of e-commerce platforms, the rising popularity of natural and sustainable ingredients, and strategic investments by leading companies in manufacturing and R&D will continue to propel the market forward. Opportunities abound for brands that can effectively cater to the diverse needs and preferences of the Latin American consumer, emphasizing efficacy, affordability, and ethical sourcing. The market is expected to witness significant expansion in specialized hair care segments, further solidifying its position as a key growth engine within the global beauty industry.

Latin America Hair Care Market Segmentation

-

1. Product Type

- 1.1. Shampoo

- 1.2. Conditioner

- 1.3. Hair Loss Treatment Products

- 1.4. Hair Colorants

- 1.5. Hair Styling Products

- 1.6. Perms and Relaxants

- 1.7. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarket/ Hypermarket

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Pharmacies/ Drug Stores

- 2.5. Online Retail Stores

- 2.6. Other Distribution Channels

Latin America Hair Care Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Hair Care Market Regional Market Share

Geographic Coverage of Latin America Hair Care Market

Latin America Hair Care Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovative Launches; Hair Concerns Among Consumers

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Consumer Expenditure Towards Natural Hair Care Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Hair Care Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Shampoo

- 5.1.2. Conditioner

- 5.1.3. Hair Loss Treatment Products

- 5.1.4. Hair Colorants

- 5.1.5. Hair Styling Products

- 5.1.6. Perms and Relaxants

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/ Hypermarket

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Pharmacies/ Drug Stores

- 5.2.5. Online Retail Stores

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Santiago Saenz S A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Embelleze

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Unilever PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Forever Company Cosmeticos LTDA*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alticor (Amway)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 L'Oreal S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Coty Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Johnson & Johnson Services Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Genomma Lab Internacional S A B de C V

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Henkel AG & Company KGaA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Procter & Gamble Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Grupo Coala do Brasil

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Santiago Saenz S A

List of Figures

- Figure 1: Latin America Hair Care Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Latin America Hair Care Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Hair Care Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Latin America Hair Care Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Latin America Hair Care Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Latin America Hair Care Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 5: Latin America Hair Care Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Latin America Hair Care Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Hair Care Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Hair Care Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Hair Care Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Hair Care Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Hair Care Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Hair Care Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Hair Care Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Hair Care Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Hair Care Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Hair Care Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Hair Care Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Latin America Hair Care Market?

Key companies in the market include Santiago Saenz S A, Embelleze, Unilever PLC, Forever Company Cosmeticos LTDA*List Not Exhaustive, Alticor (Amway), L'Oreal S A, Coty Inc, Johnson & Johnson Services Inc, Genomma Lab Internacional S A B de C V, Henkel AG & Company KGaA, Procter & Gamble Company, Grupo Coala do Brasil.

3. What are the main segments of the Latin America Hair Care Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1636 million as of 2022.

5. What are some drivers contributing to market growth?

Innovative Launches; Hair Concerns Among Consumers.

6. What are the notable trends driving market growth?

Increasing Consumer Expenditure Towards Natural Hair Care Products.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In February 2023, Unilever plans to establish a new manufacturing facility in the Nuevo Leon region of Mexico. The company plans to invest USD 400 million in the Latin American market over the next three years. The new facility manufactures beauty and personal care products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Hair Care Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Hair Care Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Hair Care Market?

To stay informed about further developments, trends, and reports in the Latin America Hair Care Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence